January 2026

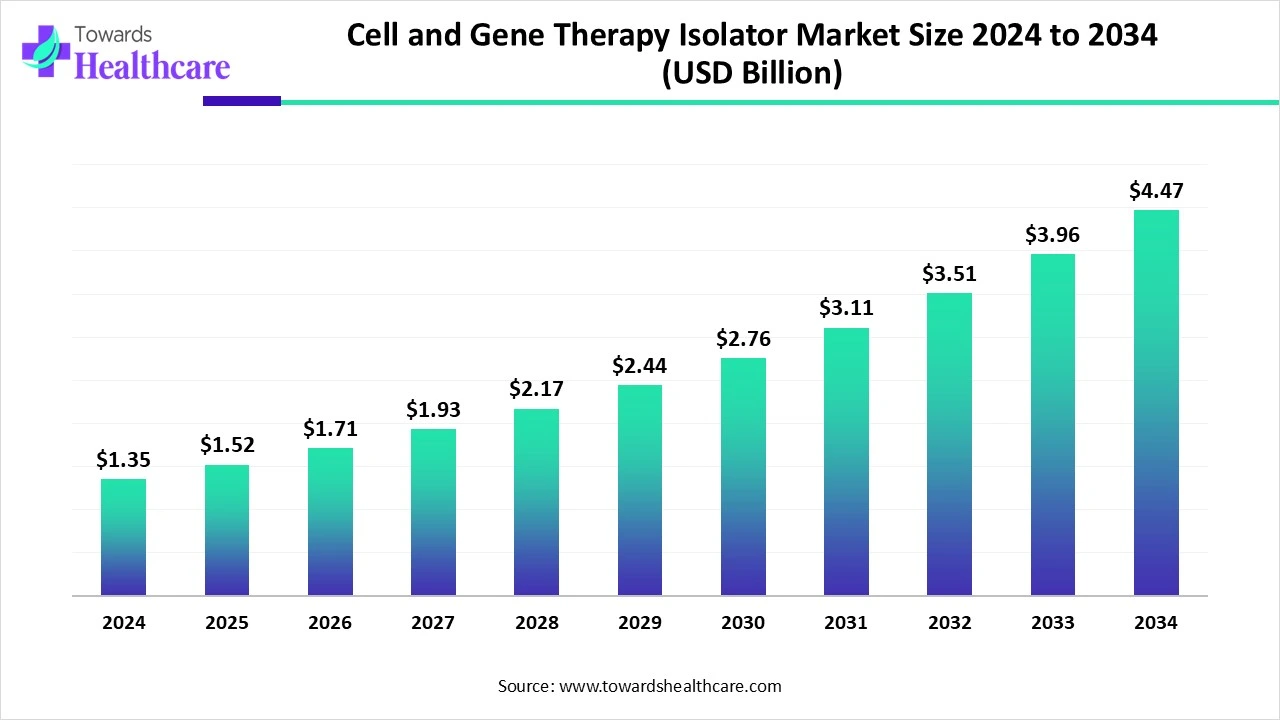

The global cell and gene therapy isolator market size is calculated at USD 1.35 billion in 2024, grew to USD 1.52 billion in 2025, and is projected to reach around USD 4.47 billion by 2034. The market is expanding at a CAGR of 12.54% between 2025 and 2034.

The cell and gene therapy isolator market is primarily driven by the increasing demand for personalized medicines and new product launches. Government and private organizations support the development of cell and gene therapy (CGT) through initiatives and funding. Prominent players collaborate to access advanced technologies and expand their product pipeline. The growing need for a sterilized manufacturing environment boosts the market. Artificial intelligence (AI) introduces automation in isolators, enhancing their efficiency. The future is promising, with the increasing number of clinical trials.

| Table | Scope |

| Market Size in 2025 | USD 1.52 Billion |

| Projected Market Size in 2034 | USD 4.47 Billion |

| CAGR (2025 - 2034) | 12.54% |

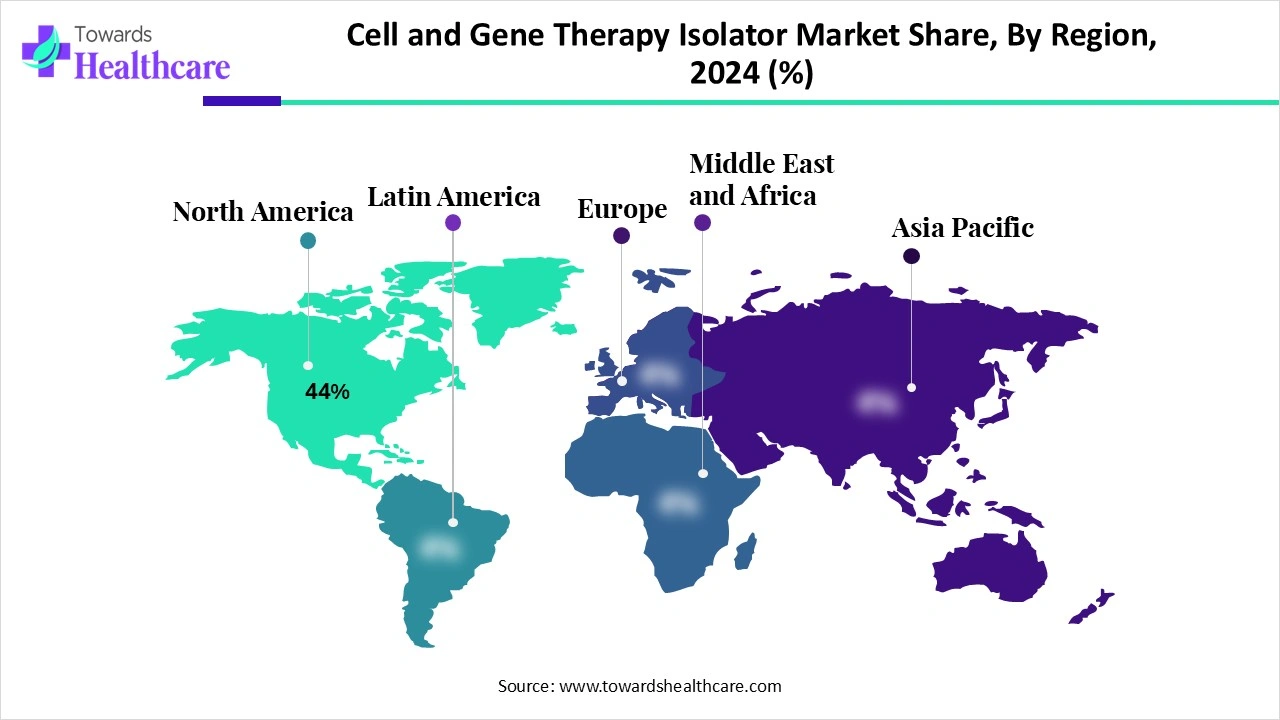

| Leading Region | North America 44% |

| Market Segmentation | By Application, By Therapeutic Area, By Technology/Type of Isolator, By End-User, By Region |

| Top Key Players | SKAN AG, Getinge AB, Azbil Telstar, Comecer (ATS Automation), Germfree Laboratories, Esco Aster, MBRAUN, Tema Sinergie, BioSpherix, Fedegari Group, Vanrx (Cytiva), WABO Isolator Systems, Tofflon Science and Technology, Nuaire Inc., Lancer (Getinge Group), Hosokawa Micron Ltd., Skanfog Technologies, Extract Technology (Wabash), Carlo Erba Group, ITECO Engineering |

The cell and gene therapy isolator market refers to a specialized controlled environment designed to provide sterile, contamination-free processing for advanced therapy medicinal products (ATMPs). They ensure product integrity and patient safety during the manufacturing of cell and gene therapy products. These isolators support operations such as aseptic filling, viral vector handling, stem cell culture, and personalized therapy preparation. With the surge in ATMP approvals, demand for isolators is accelerating, especially for automated, modular, and closed-system formats.

Increasing Collaboration: In April 2024, Multiply Labs announced a strategic partnership with GenScript Biotech Corporation to introduce automation in the cell isolation phase of cell therapy manufacturing. The collaboration was made to combine Multiply Labs’ cell therapy robotic cluster and GenScript’s GMP-grade CytoSinct 1000 cell isolation solution, enabling the isolation of 120 × 10^9 cells per hour.

Venture Capital Investment: In June 2025, Akadeum Life Sciences announced that it raised $20 million in funding. The funding was raised to scale commercial operations and support customers entering clinical trials. The company has developed a GMP-compliant product suite to advance next-generation cell therapies.

AI can revolutionize the market by facilitating the design of novel and customized CGT isolators based on manufacturers’ requirements. It enables real-time monitoring of the entire process and sends alerts to manufacturers about the process. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest sterility levels of microbes. AI-enabled predictive analytics detect potential errors in manufacturing, allowing manufacturers to make proactive decisions. AI and ML reduce human intervention in CGT isolators and enhance the efficiency and accuracy of manufacturing.

Demand for Personalized Medicines

The major growth factor for the cell and gene therapy isolator market is the rising demand for personalized medicines. Personalized medicines provide targeted treatment to patients with chronic, rare, and genetic disorders. CGT products are types of personalized medicines that cure a disease from its root cause. The cells and genes are either directly delivered into the body or are modified in the laboratory in vitro and then delivered. This enables researchers to modify the properties of CGT products to provide the desired response.

Limited Flexibility

Cell and gene isolators have limited flexibility and scalability due to complex and labor-intensive processes. Manufacturers can scale the production of CGT products up to a certain extent. This limits the large-scale manufacturing of CGTs with enhanced reproducibility.

What is the Future of the Cell and Gene Therapy Isolator Market?

The market future is promising, driven by the increasing number of clinical trials. The growing research and development activities facilitate the development of novel cell and gene therapies. Regulatory agencies necessitate the conduct of clinical trials before market approval. Researchers also assess expanded applications of existing CGT products. As of August 2025, 961 clinical trials related to CGT are registered on the clinicaltrials.gov website. The increasing number of clinical trials potentiate the need for CGTs, thereby increasing the use of isolators.

By application, the cell therapy manufacturing segment held a dominant presence in the market in 2024. This is due to the increasing demand for cell therapy products, including stem cells and CAR-T cells. Cell therapy can replace diseased cells, modulate cellular processes, and deliver therapeutic factors. Researchers have evaluated the success rates of cell therapies to treat various disorders. It is estimated that stem cell transplants have a success rate of 60-70% in blood cancers, while around 80% in autoimmune diseases. This increases confidence among healthcare professionals and patients, potentiating the need for cell therapy manufacturing.

By application, the viral vector production segment is expected to grow at the fastest CAGR in the market during the forecast period. Viral vectors are essential for delivering gene therapy products within the body. These vectors cause no harm to humans as they are inert and provide long-lasting effects. Researchers can specifically engineer viral vectors to transport corrective genes or modify existing ones. The manufacturing of viral vectors requires a constrained environment with high sterility, necessitating advanced isolators for their production.

By therapeutic area, the oncology segment held the largest revenue share of the market in 2024. The segmental growth is attributed to the increasing prevalence of cancer and the complications with conventional treatment. Conventional treatment fails to cure cancer completely and causes adverse effects. CGT products can not only cure cancer but also prevent recurrence. They are also developed and used to treat rare cancer types that are not possible through conventional methods.

By therapeutic area, the neurological disorders segment is expected to grow with the highest CAGR in the market during the studied years. Neurological disorders are major health concerns, especially among the geriatric population. The Alzheimer’s Association estimated that approximately 7.2 million Americans aged 65 years and above were living with the disease in 2025. Personalized medicines are required to cure various types of dementia and improve the quality of life of individuals.

By technology/type of isolator, the aseptic isolators segment contributed the biggest revenue share of the market in 2024. Aseptic isolators are preferred to avoid contamination within the product. They provide safe and efficient processing in ISO Class 5 conditions, maintaining high sterility. They are embedded with HEPA filters to maintain conditions within the chamber and provide a barrier for cross-contamination between the main chamber and the room.

By technology/type of isolator, the bio-decontamination isolators segment is expected to expand rapidly in the market in the coming years. Isolators are decontaminated using a wide range of surface contact agents, such as hydrogen peroxide vapor, chlorine dioxide, ozone, or peracetic acid. It is the first and primary step before manufacturing CGT to get a log-6 Sterility Assurance Level (SAL). Isolators provide a sealed environment with automated decontamination cycles, simplifying the tasks of manufacturers.

By end-user, the pharmaceutical & biotechnology companies segment led the global market in 2024. This is due to the presence of favorable manufacturing infrastructure and the need to fulfill the demands of high-quality CGT products. They possess a suitable capital investment to adopt advanced manufacturing equipment. Pharma & biotech companies can purchase isolators of different sizes and capacities based on their research and manufacturing requirements. The increasing competition among companies encourages them to deliver innovative products on time.

By end-user, the contract development & manufacturing organizations (CDMOs) segment is expected to witness the fastest growth in the market over the forecast period. CDMOs have specialized infrastructure to manufacture a wide range of CGT products and provide relevant expertise. The increasing number of pharma & biotech startups potentiate the need for CDMOs as they do not have proper facilities for the development of CGTs. By collaborating with CDMOs, companies can focus on their core competencies, such as sales and marketing.

North America dominated the market share 44% in 2024. The presence of key players, increasing investments by government and private organizations, and favorable regulatory support are the major growth factors that contribute to the market in North America. The region has a favorable clinical trial infrastructure and state-of-the-art research and development facilities to develop innovative CGT products.

The U.S. is home to major biotech companies, such as Pfizer, Twist Bioscience, and Gilead Sciences, that develop innovative products. Out of the total 961 clinical trials, about 489 studies are reported in the U.S. The Food and Drug Administration (FDA) regulates the approval of CGT in the U.S. As of January 2025, 43 CGTs have been approved within the U.S.

As of June 2024, a total of 12 CGTs have been approved by Health Canada for various disorders. Around 36 clinical trials were registered on the clinicaltrials.gov website as of August 2025. Companies like Comecer, Miltenyi Biotec, and Optima Packaging Group provide high-quality CGT isolators to Canadian companies.

Asia-Pacific is expected to host the fastest-growing cell and gene therapy isolator market in the coming years. The availability of suitable manufacturing infrastructure and an affordable workforce encourages foreign players to set up their manufacturing facilities in Asia-Pacific countries. The rapidly expanding pharma & biotech sectors and increasing collaborations favor market growth. Government organizations launch initiatives to develop personalized medicines and provide funding.

The Chinese government has also lifted bans on foreign-invested enterprises (FIEs) engaging in CGT in selected free-trade zones. Geopolitical issues and financing difficulties in the West open doors for China related to the research and manufacturing of CGTs. According to GlobalData’s Pharmaceutical Intelligence Center report, China is emerging as a global leader in CGT trials.

The Indian government has launched the “Make in India” and “Atmanirbhar Bharat” to support the indigenous development of CGTs and other innovative therapeutics. The Indian pharma industry is focusing on developing biological entities, serving a large patient population. The first marketed therapy, CAR-T cell, was recently launched by IIT Bombay, in collaboration with Tata Memorial Center.

The research and development activities for CGT isolators refer to the design, testing, and improvement of isolators for the development and manufacturing of CGTs. Researchers focus on providing maximum protection for the operator during the manipulation operations.

Key Players: Comecer, Thermo Fisher Scientific, and Tailin

CGT isolators must comply with stringent current good manufacturing practices (cGMP) regulations to manufacture CGTs.

CGT isolators prevent contamination and provide an aseptic environment for CGT products. This provides patients with high-quality and high-purity CGTs.

Jon Ellis, CEO of Trenchant BioSystems, commented that the use of cell and gene therapy manufacturing practices to deliver therapies to large-scale patient populations in an affordable manner is possible. The company has developed a manufacturing platform to reduce manufacturing timelines to 2.5 days and costs by over 80%. It has selected Autolomous’ autoloMate as the most advanced CGT-specific digital platform to integrate digitalization.

By Application

By Therapeutic Area

By Technology/Type of Isolator

By End-User

By Region

January 2026

January 2026

January 2026

January 2026