January 2026

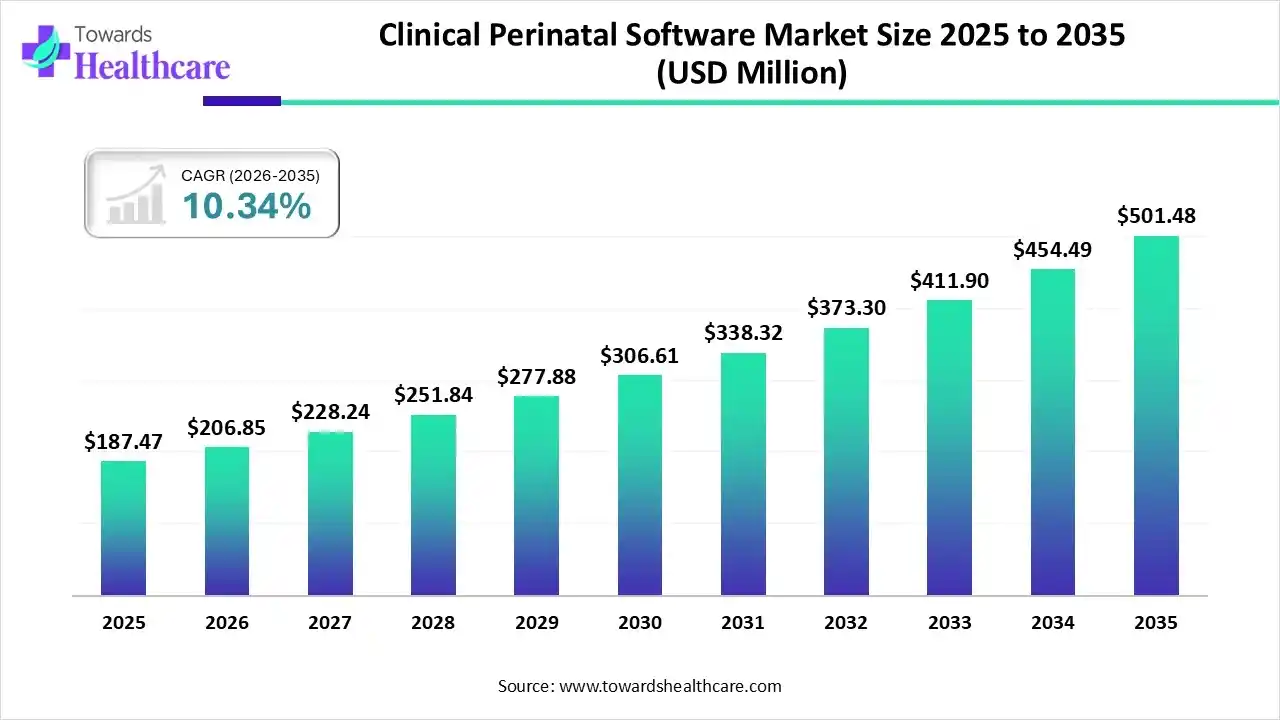

The clinical perinatal software market size was estimated at USD 187.47 million in 2025 and is predicted to increase from USD 206.85 million in 2026 to approximately USD 501.48 million by 2035, expanding at a CAGR of 10.34% from 2026 to 2035.

The clinical perinatal software market is significantly driven by the great need for integrated solutions that enhance neonatal and maternal care. The rising trends such as AI, predictive analytics, cloud-based deployment, remote patient monitoring, integrated solutions, and focus on interoperability are shaping this industry.

| Key Elements | Scope |

| Market Size in 2026 | USD 206.85 Million |

| Projected Market Size in 2035 | USD 501.48 Million |

| CAGR (2026 - 2035) | 10.34% |

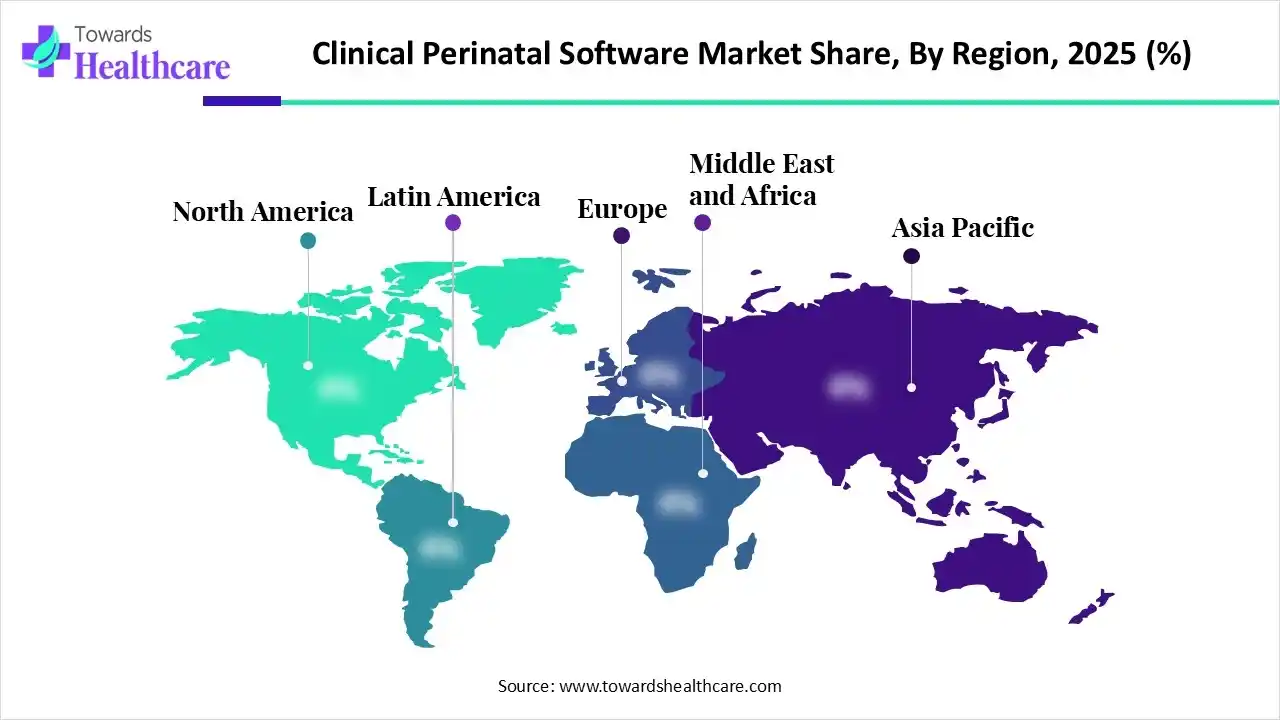

| Leading Region | North America |

| Market Segmentation | By Product, By Deployment Model, By Application, By End Use, By Region |

| Top Key Players | PeriGen, Inc., Koninklijke Philips N.V., GE HealthCare, Clinical Computer Systems, Inc., Epic Systems Corporation, Oracle Health, K2 Medical Systems Ltd., Trium Analysis Online GmbH, Huntleigh Healthcare Limited, EDAN Instruments, Inc. |

AI contributes to the expansion of the market through enhanced diagnostics and screening, predictive modelling and risk stratification, personalized management and monitoring, operational efficiency, and workflow integration. It helps in automated image analysis, anomaly detection, and genetic screening.

How does the Integrated Segment Dominate the Clinical Perinatal Software Market in 2025?

The integrated segment dominated the market in 2025, owing to the seamless workflow and data integration, enhanced clinical decision support, improved efficiency, and reduced error. These products support remote monitoring and telehealth, and ensure quality improvement and compliance. Integrated software solutions encompass patient documentation, fetal monitoring data services, reporting, and alerts.

Standalone:

The standalone segment is expected to grow at the fastest CAGR in the clinical perinatal software market during the forecast period due to the major roles of standalone perinatal software products, such as targeted functionality, cost-effectiveness, flexibility, and adaptability. The standalone software is suitable for smaller facilities like maternity clinics or smaller private practices. It is ideal for facilities with less complex infrastructure needs and low patient volumes.

What made On-Premise the Dominant Segment in the Clinical Perinatal Software Market in 2025?

The on-premise segment dominated the market in 2025, owing to the need for achieving maximum control over performance, data security, and customization. The on-premise model is important due to well-equipped IT infrastructure, stringent internal policies, and specific regulatory compliance needs. The on-premise models play a crucial role in healthcare organizations, like large hospitals and health systems.

Cloud-based:

The cloud-based segment is estimated to grow at the fastest rate in the clinical perinatal software market during the predicted timeframe due to enhanced accessibility, scalability, cost-efficiency, and advanced data analytics offered by cloud-based models. They facilitate improved collaboration and data sharing, and integration with advanced technologies. The cloud service providers offer advanced security features such as access controls. Robust encryption and compliance with healthcare regulations such as GDPR and HIPAA.

How did the Fetal Monitor Data Services Segment Dominate the Clinical Perinatal Software Market in 2025?

The fetal monitor data services segment dominated the market in 2025, owing to the several benefits of clinical perinatal software, including real-time data acquisition, centralised surveillance, advanced data analysis, and integration with electronic health records. There is enhanced communication and collaboration, along with support for remote monitoring and telehealth. This software streamlines risk management and documentation.

Workflow Management:

The workflow management segment is anticipated to grow at a notable rate in the clinical perinatal software market during the upcoming period due to the urgent need for data integration, centralisation, real-time monitoring and surveillance, clinical decision support, and streamlined documentation and compliance. This software brings operational efficiency and ensures resource management. It also streamlines patient engagement and remote monitoring.

Why did the Hospitals/Clinics Segment dominate the Clinical Perinatal Software Market in 2025?

The hospitals/clinics segment dominated the market in 2025, owing to the increased focus on fetal and maternal monitoring, data integration and documentation, and clinical decision support systems. The hospitals or clinics prioritise workflow and practice management. They also adopt advanced solutions like telehealth and remote monitoring.

Maternity Clinics:

The maternity clinics segment is predicted to grow at a rapid rate in the clinical perinatal software market during the studied period due to more precise, proactive, and coordinated care provided by maternity clinics with the help of clinical perinatal software. These clinics focus on leveraging software capabilities to improve outcomes for every mother and baby. The software data helps clinics to comply with regulations, meet accreditation requirements, and redefine their care protocols.

North America dominated the market in 2025, owing to the rising demand for maternal health solutions and integration with existing healthcare IT. In October 2025, GE Healthcare launched a cloud-first application named CareIntellect for perinatal care to improve care delivery and keep patients healthy. The other major growth drivers for the North American clinical perinatal software market are commercial product launches, government support for digital health, and market dominance of private entities.

The U.S. market is growing due to the presence of the leading market players like GE Healthcare, Philips, and PeriGen, Inc. AI integration aims to achieve risk assessment, enhanced analytics, and fetal monitoring. The U.S. government focuses on the regulation of medical devices and health IT through the FDA and CMS agencies.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to increasing healthcare investments, adoption of healthcare IT solutions, and focus on patient-centric care. The government policies aim to raise the adoption of digital health in the Asian Pacific countries, such as India and China. The Asian Pacific clinical perinatal software market is driven by the increased maternal health awareness campaigns, rising healthcare expenditures, and government initiatives.

In September 2025, Philips collaborated with the Gates Foundation and research centres across the globe to achieve the goal of the World Health Organization (WHO) of improving maternal health. It aims to improve access to quality pregnancy care in rural communities.

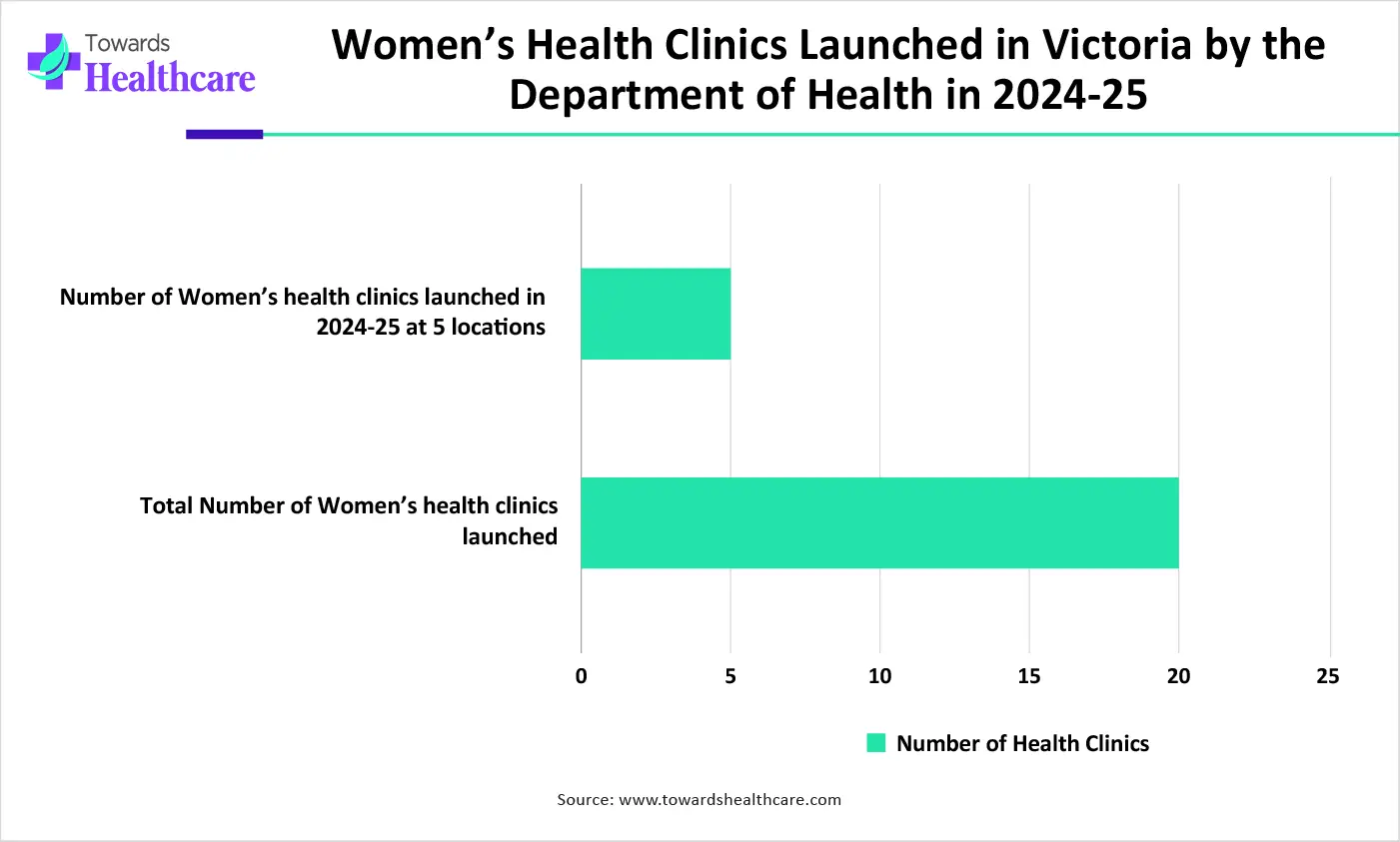

Europe is expected to grow at a notable rate in the market in 2025, led by a shift to cloud-based and telehealth solutions, and demand for data management. European countries like the United Kingdom have launched national initiatives to invest in general neonatal and maternal care advancements. They are adopting digital health solutions and clinical software from private vendors. The private companies are driving technological advancements like cloud-based platforms and AI-driven fetal monitoring, which are then adopted by clinics and hospitals across Europe.

The prominent German digital health initiatives are related to electronic patient files, digital health applications, strict cloud data needs, interoperability, and data use. There is a great emphasis on integrated solutions that manage fetal monitoring, workflow, and maternal health.

| Sr. No. | Name of the Company | Headquarter | Latest Update |

| 1 | PeriGen, Inc. | Cary, North Carolina | In February 2025, PeriGen, Inc. received FDA clearance for patterns 3.0, aiming to expand AI-powered fetal monitoring to 32 weeks. |

| 2 | Koninklijke Philips N.V. | Amsterdam, Netherlands | Philips focused on improving access to maternal care through AI-enabled ultrasound. |

| 3 | GE HealthCare | Chicago, Illinois, USA | In October 2025, GE HealthCare launched a cloud-first Software-as-a-Service (SaaS) application to streamline perinatal workflow. |

| 4 | Clinical Computer Systems, Inc. | Hoffman Estates, Illinois | Clinical Computer Systems, Inc., focused on advancing OBIX perinatal software. |

| 5 | Epic Systems Corporation | Verona, Wisconsin | In March 2025, Epic Systems Corporation demonstrated industry-leading capabilities in genomics, AI, and interoperability at the HIMSS Global Health Conference and Exhibition. |

| 6 | Oracle Health | Nashville, Tennessee | In October 2024, Oracle Health Data Intelligence released updates for healthcare organizations to drive operational efficiency, improve care quality, and boost financial performance. |

| 7 | K2 Medical Systems Ltd. | Midrand, Gauteng, South Africa | K2 Medical Systems Ltd. is embracing innovation through the Online K2 Fetal Monitoring Training Program in the Ministry of National Guard Health Affairs Hospitals. |

| 8 | Trium Analysis Online GmbH | Munich, Germany | Trium Analysis Online GmbH is leading with its integrated platform for activity monitoring and Trium CTG Online for fetal monitoring. |

| 9 | Huntleigh Healthcare Limited | Cardiff, United Kingdom | Huntleigh Healthcare Limited is advancing care in high-risk pregnancies. |

| 10 | EDAN Instruments, Inc. | Shenzhen, China | In November 2025, EDAN Instruments, Inc. presented its 30 years of innovation and global healthcare solutions at MEDICA 2025. |

By Product

By Deployment Model

By Application

By End Use

By Region

January 2026

January 2026

January 2026

January 2026