January 2026

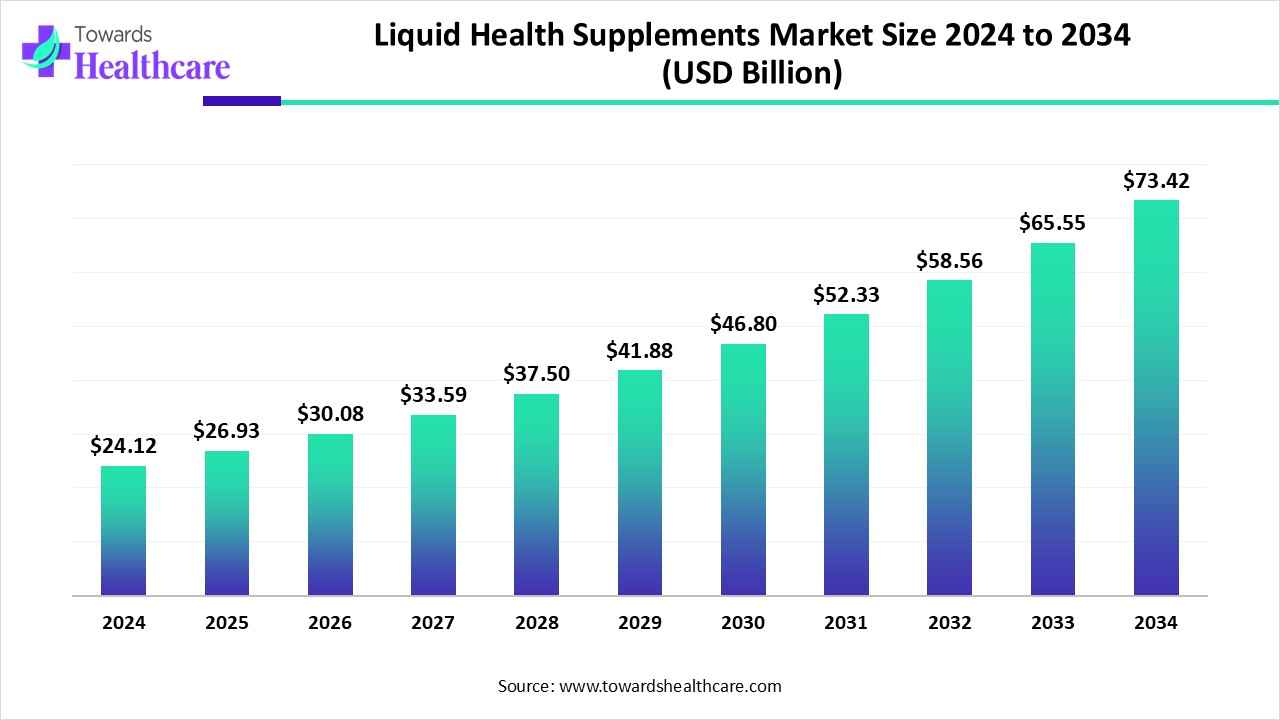

The global liquid health supplements market size is calculated at US$ 24.12 billion in 2024, grew to US$ 26.93 billion in 2025, and is projected to reach around US$ 73.42 billion by 2034. The market is expanding at a CAGR of 11.65% between 2025 and 2034.

Consumers' growing health concern is driving greater demand for liquid dietary supplements. These goods are seen as an easy approach to reach certain health objectives, such better immunity, more energy, or weight control. Formulations, flavours, and package designs are being innovated in the market to appeal to a wider range of consumers. Therefore, as businesses develop to satisfy changing customer needs for simple, health-focused nutritional solutions, the market for liquid dietary supplements is expected to grow further.

| Table | Scope |

| Market Size in 2025 | USD 26.93 Billion |

| Projected Market Size in 2034 | USD 73.42 Billion |

| CAGR (2025-2034) | 11.65% |

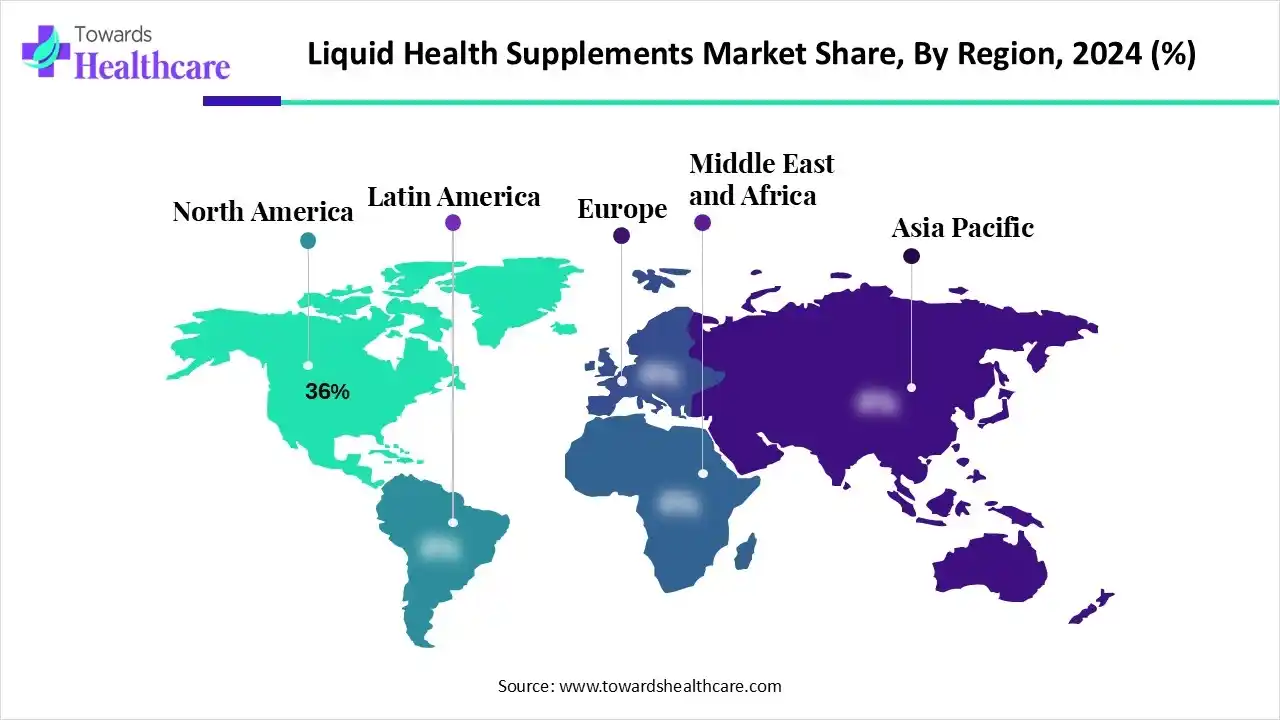

| Leading Region | North America by 36% |

| Market Segmentation |

By Product Type, By Function/Health Benefit, By Distribution Channel, By End User/Demographic, By Region |

| Top Key Players | Herbalife Nutrition Ltd., Amway Corporation (Nutrilite), Bayer AG (One A Day, Supradyn Liquids), Nestlé Health Science, The Bountiful Company (Nature’s Bounty, Solgar), Abbott Laboratories (Ensure, Pediasure Liquids), Pfizer Consumer Healthcare (Centrum Liquid), NOW Foods, Nature’s Way Products, LLC, Glanbia PLC (Optimum Nutrition, Isopure Liquids), Blackmores Limited, Unilever PLC (OLLY Nutrition, Liquid I.V.), Vital Proteins LLC (Nestlé-owned), Garden of Life (Mykind Organics, Liquid Multi), Swisse Wellness Pty Ltd., Hum Nutrition Inc., Ritual Inc. (Liquid prenatal and vitamin blends), Yakult Honsha Co., Ltd., HUMM Kombucha/GT’s Living Foods, Liquid Health Inc. |

The liquid health supplements market is driven by rising in the sports and fitness industry for health supplements in order to enhance sports performance. The market encompasses the production, formulation, and distribution of nutritional and functional supplements in liquid form, designed to support general health and wellness, and specific physiological functions such as immunity, digestion, bone health, and cognitive performance. These include vitamin and mineral tonics, herbal elixirs, protein and amino acid beverages, energy boosters, and probiotic or collagen-based liquid formulations. Growth is driven by increasing consumer preference for easy-to-swallow, fast-absorbing, and bioavailable formulations, coupled with the rise of personalized nutrition and demand for clean-label, plant-based ingredients.

The nexus between artificial intelligence (AI) and the supplement sector has opened up intriguing new opportunities for consumers and healthcare professionals in recent years. Our approach to health and fitness is evolving as a result of AI's capacity to evaluate data and optimise supplement consumption as personalised wellness gains importance. AI in the healthcare sector is also speeding up the development of novel medicines and supplements. Additionally, virtual AI assistants are being employed to help clients on their health journeys by making suggestions based on user input, fitness objectives, and past supplement usage.

By product type, the vitamins & minerals liquids segment was dominant the liquid health supplements market in 2024, with an approximate 32% of share. Essential nutrients are micronutrients. While macronutrients are required in grammes per day for human nutrition, micronutrients are often required in amounts less than 100 milligrammes per day. About 5–6% of the total weight of the body is made up of minerals. Supplements can be beneficial, especially for elderly people and those who are malnourished.

By product type, the probiotic liquids & digestive health drinks segment is estimated to witness the highest growth during 2025-2034. Foods and drinks based on probiotics are seen as one of the future foods that will be more widely accepted by consumers among the new functional foods that are now on the market. Kefir, kombucha, and liquid yoghurt are examples of fermented drinks that contain probiotics and are well-known for their advantageous effects on human immune system function and gastrointestinal health.

By function/health benefit, the immunity & wellness support segment was dominant the liquid health supplements market in 2024, with an approximate 25% of share. Various dietary components that might enhance immune response are in high demand. Functional foods can control the immune system by suppressing inflammation and allergies and enhancing or inhibiting the immunological response, which gives the host defences against infection. The manufacturing of certain dietary ingredients, such as probiotics and prebiotics, is constantly growing in an effort to combat chronic illnesses including cancer, obesity, diabetes, cardiovascular disease, and non-alcoholic fatty liver disease (NAFLD).

By function/health benefit, the digestive & gut health segment is estimated to witness the highest growth during 2025-2034. The recognition of the gut microbiota's significance in both health and illness has led to a surge in interest in therapies that might alter the microbiota and its interactions with its host. Prebiotics and probiotics are the most widely used medications, aside from food, that are used to maintain a healthy microbiome or to restore equilibrium when it is thought that bacterial homeostasis has been disrupted in illness.

By distribution channel, the supermarkets & pharmacies segment was dominant the liquid health supplements market in 2024, with an approximate 35% of share. As more local pharmacies close their doors, more consumers are flocking to mass market merchandisers, mail order pharmacies, and supermarkets, all of which provide better customer service. The main aspects of the pharmacy customer experience that supermarkets and mass market retailers are significantly outperforming chain drug shops in include having enough employees, having faith in the pharmacist, being able to obtain prescriptions easily, and having prescriptions filled promptly.

By distribution channel, the online/e-commerce platforms segment is estimated to witness the highest growth during 2025-2034. These online marketplaces offer a wide selection of health solutions in one handy location, and they operate similarly to traditional e-commerce platforms, allowing customers to explore, compare, and buy items from different brands and vendors. To help customers select the finest items for their requirements, several of these platforms also offer product reviews, professional assistance, and even subscription services.

By end-user, the adults segment was dominant in the liquid health supplements market in 2024, with an approximate 45% share. Diet has an impact on how well the body functions and is crucial in preventing a number of illnesses. Adults have compromised nutrition and other bodily processes, therefore it's critical to think about dietary supplements now. In recent years, adult dietary supplement consumption has increased. Furthermore, in recent decades, there has been a notable acceleration of the global ageing process.

By end-user, the women segment is estimated to witness the highest growth during 2025-2034. In their lifetime, 73% of women over 65 will suffer from one or more musculoskeletal conditions, such as rheumatoid arthritis or osteoporosis. According to a Republic of Korea poll, over 64% of persons with long-term medical disorders use supplements, with a larger percentage of women using them.

North America dominated the liquid health supplements market with a revenue of approximately 36% in 2024. A large portion of the population in North America suffers from obesity and lifestyle-related illnesses due to their eating habits and the availability of a number of processed and ready-to-eat meals that may not be optimal for their health. Nutraceuticals and food supplements are becoming more popular among consumers in the area, though, as a result of growing consumer knowledge of the advantages of dietary supplements, the ageing of the population, and the emergence of health and wellness trends.

The FDA protects public health by taking a variety of measures regarding dietary supplements. When a recall occurs that might pose a major or serious danger to the product's user or consumer, the FDA works with industry and our state partners to produce news releases and other public alerts.

For instance,

Asia Pacific is estimated to host the fastest-growing liquid health supplements market during the forecast period. The large number of patients with unmet medical needs is the reason behind this. Furthermore, the market for liquid dietary supplements in the Asia Pacific region would increase as a result of shifting eating patterns and lifestyles, as well as shifting preferences for food and beverages among the adolescent population and young people in the subcontinent. Aside from this, regional market trends will be driven by an increase in the purchasing power of the middle-class population and a rise in the amount of money spent by locals on wholesome diets.

The food sector is grabbing hold of the momentum and aggressively pursuing product approvals in response to the Chinese government's "Healthy China 2030 Plan" and customers' growing aspirations for health and wellbeing. China authorised more than 1,900 health foods in the first half of 2025. The opportunity for entering the rapidly expanding health food sector is enormous.

Europe is expected to grow at a significant CAGR in the liquid health supplements market during the forecast period. encouraged by increased knowledge of preventative nutrition, healthy ageing, and more stringent laws governing dietary supplements. Adoption is being fueled by the rising demand for natural and plant-based liquid supplements, particularly those containing botanical and herbal extracts. With customers choosing easy liquid solutions, the sports nutrition and weight management sectors also experience notable development in the region.

In 2025, sports nutrition retail value sales in the UK are anticipated to rise sharply in current currency thanks to consistent unit price rises and strong consumer demand, especially for protein-based products. According to the Voice of the Consumer: Health and Nutrition Survey conducted by Euromonitor International in February 2025, 30% of UK respondents said they exercised nearly every day, up from 28% in 2020.

From preliminary market research to final quality control and manufacturing, the research and development process for liquid health supplements entails a number of crucial steps. The main objective is to develop a product that is consumer-friendly, stable, safe, and effective.

Developing the formulation and preparing the final dosage, which includes batch manufacturing, quality control, filling, and packaging, are steps in the process of making a liquid health supplement. Important factors to take into account include masking off off-putting flavours and guaranteeing the stability, bioavailability, and regular dosage of the active ingredients.

Steps for patient support and services with regard to liquid health supplements include educating patients, making sure they are safe, and giving them usage advice, particularly in collaboration with medical professionals. By taking these precautions, patients can use supplements safely, comprehend their advantages, and reduce any risks.

Herbalife Nutrition Ltd.

Provides liquid supplements such as Niteworks powder mix and Herbal Aloe Concentrate. With the support of an international distributor network, they use a direct-selling model to offer meal replacement products and personalised nutrition.

Amway Corporation (Nutrilite)

Offers kids' liquid supplements like Nutrilite DHA Yummies Omega-3 Soft Drops. Their contribution is the "seed to supplement" method, which produces premium plant-based nutrients from certified organic farms.

Bayer AG (One A Day, Supradyn Liquids)

Provides scientifically supported liquid solutions for specific needs, such as Supradyn Naturals Calcium+ for bone health in India and Supradyn Mom's prenatal micronutrient drink. Additionally, One A Day sells liquid supplements.

Nestlé Health Science

Provides specific liquid nutritional solutions for medical conditions, such as Peptamen formulas for gastrointestinal problems and Resource High Protein drink. Their contributions centre on active lifestyles and patient nutrition based on research.

The Bountiful Company (Nature’s Bounty, Solgar)

Supplies a variety of vitamins, minerals, and other dietary products with an emphasis on quality and research, as well as liquid supplements like Nature's Bounty B-12 Sublingual Liquid.

By Product Type

By Function/Health Benefit

By Distribution Channel

By End User/Demographic

By Region

January 2026

January 2026

January 2026

January 2026