Clinical Microbiology Market Size, Shares, Developments and Drivers

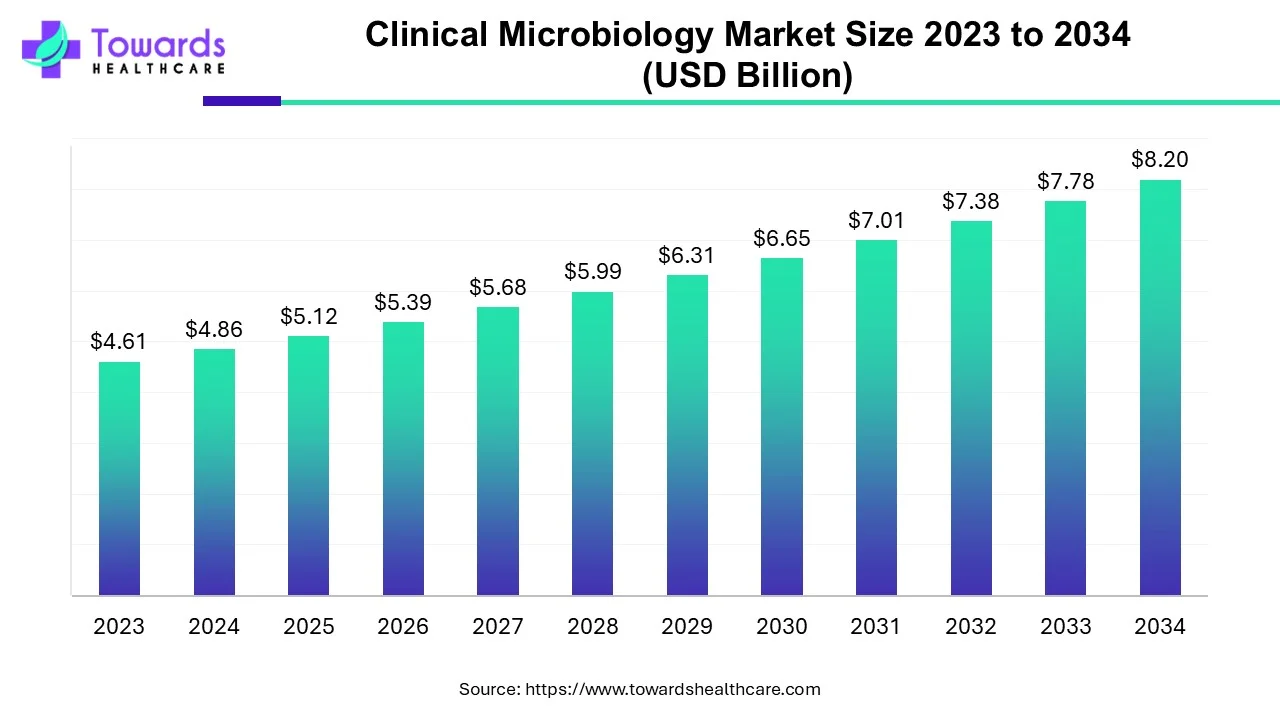

The global clinical microbiology market size is projected to reach USD 8.2 billion by 2034, growing from USD 5.12 billion in 2025, at a CAGR of 5.37% during the forecast period from 2025 to 2034.

Key Takeaways

- North America dominated the clinical microbiology market with the largest revenue share of 41% in 2023.

- Asia Pacific is estimated to grow at the fastest CAGR between 2024 and 2033.

- By instruments, the laboratory instruments segment held the largest market share in 2023.

- By disease area, the respiratory diseases segment led the market in 2023 and is anticipated to grow exponentially over the forecast period.

- By application, the pharmaceutical application segment had the largest revenue share of the market in 2023.

- By end-user, the hospitals and diagnostic centers dominated the market in 2023.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2024 | USD 4.86 Billion |

| Projected Market Size in 2034 | USD 8.2 Billion |

| CAGR (2025 - 2034) | 5.37% |

| Leading Region | North America |

| Market Segmentation | By Instruments, By Disease Area, By Application, By End-User and By Region |

| Top Key Players | Thermo Fisher Scientific Inc., GSK, BioMérieux, Danaher Corporation, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd, QIAGEN N.V., 3M, Bio-Rad Laboratories, Bruker Corporation, Hologic Inc., Abbott Laboratories, Merck KGaA, Diagnóstica Longwood SL, Agilent Technologies Inc., Memmert GmbH + Co.KG, Hardy Diagnostics, NEOGEN Corporation, T2 Biosystems Inc. |

Industry at a Glance

The medical field that studies the prevention, treatment and cure of infectious illnesses is covered by the clinical microbiology market. A medical microbiologist investigates the properties of pathogens, including growth, infection, and route of transmission. Improved diagnosis accuracy and shorter turnaround times are the consequences of recent technology developments. Examples of developments are the advent of mass spectrometry for the proteomic identification of microorganisms and the automation of the processing and incubation of bacterial cultures. Over the past few decades, a number of components in the clinical microbiology laboratory have been automated. Automated blood culture equipment, automated platforms for assessing antibiotic resistance, automated nucleic acid extraction, and other automated innovations are examples of automation developments. This continuous adoption of technology, along with automation, is boosting the growth of the clinical microbiology market.

Strategic Initiatives

- In May 2025, specific blood biomarkers were identified in the study conducted at the Karolinska Institute, which are correlated to long COVID, specifically in patients suffering from severe respiratory symptoms.

- In April 2025, the Clinical Microbiology wing at Nandyal Government General Hospital (GGH), Andhra Pradesh, is providing round-the-clock hepatitis services during the whole week due to the spike in hepatitis B and hepatitis C virus cases.

- In April 2025, a pivotal platform for scientific exchange, a global academic conference, that is European Congress of Clinical Microbiology and Infectious Diseases (ESCMID Global 2025), was announced to take place in Vienna between April 11 to 15, 2025. It is considered the largest, most comprehensive, and influential global academic conference for clinical microbiology, infection control, and infectious diseases. Fifteen new clinical and preclinical research datasets were presented by Shanghai MicuRx Pharmaceutical Co., Ltd., which focused on Contezolid and MRX-5.

Market Dynamics

Technological Advancements Drives the Clinical Microbiology Market

With the advent of molecular biology methods and laboratory automation during the past ten years, clinical microbiology laboratories have seen significant changes. Faster diagnosis, more testing uniformity, and improved flexibility will be required in the future to handle emerging diseases and bioterrorism agents, among other infectious microorganism concerns.

AI is being incorporated into several areas of microbiology, including virology, parasitology, mycology and bacteriology. The successful use of AI in microbiology has been accelerated by the combination of AI with cutting-edge data-gathering tools, increased processing capacity, and international networks—typified by Big Data, Moore's Law, and the Internet. This combination is especially clear in the area of medication creation, where AI-powered methods are paving the way for the creation of cutting-edge antibiotics to battle organisms that are resistant to multiple drugs, a growing threat to world health.

Limited Capitalization in Developing Countries Restraint the Clinical Microbiology Market’s Growth

In poor nations, the primary cause of mortality is still infectious illnesses. There is no end in sight to the HIV epidemic, and the prevalence of tuberculosis (TB) is rising concurrently with it. Many sentinel hospitals have subpar microbiological laboratory capabilities. Microbiology tests are frequently unavailable due to prohibitive costs and questions about the cost-effectiveness of particular testing. Inadequate laboratory management and inadequate infrastructure have led to dangerous outcomes in the majority of developing nations. The creation of a molecular microbiology facility in a microbiology lab is yet dispersed.

Drones and Intra-site Pneumatic Transportation Systems are the Future

In order to bypass the time-consuming and carbon-intensive traditional ground transport techniques, two viable options for sample transfer between hospital units and microbiological laboratories in the future are drones and intra-site pneumatic transportation systems. The field of clinical microbiology has a lot of room to expand because of the potential applications of drones in epidemiology, infectious illnesses and clinical microbiology. Because of their remote location, lack of infrastructure, or lack of financial resources, those who may not otherwise benefit from adequate treatment may find that access to healthcare is increased because of drones. In the next five years, drone application in many medical fields is likely to be driven by significant cost reductions as compared to ground transportation, delivery speed and convenience, and the expanding drone industry.

Segment Highlights

Instruments Insights

By instruments, the laboratory instruments segment held the largest clinical microbiology market share in 2023 and is estimated to grow at the fastest growth rate during the forecast period. Sterilization, storage, and sample culture are all accomplished with a range of instruments and equipment used in microbiology labs. It is possible for microbiologists to operate in an enclosed area known as a biosafety cabinet, which keeps ambient bacteria and microbial samples apart. Scientific research is built on data that is accurate and trustworthy. With the use of laboratory equipment, scientists may regulate and work with variables to guarantee accurate observations and results. It would be challenging to derive reliable findings from tests without the proper equipment since they would be prone to mistakes and inconsistencies.

Disease Area Insights

By disease area, the respiratory diseases segment dominated the clinical microbiology market in 2023 and is anticipated to grow exponentially over the forecast period. Respiratory illnesses are a frequent cause of disease and death worldwide. For optimal patient treatment, including the selection of antiviral or antibiotic medicine, effective infection control measures, and a reduced length of hospital stay, a prompt and accurate diagnosis of a respiratory tract infection is crucial. Furthermore, both microbiological and virological approaches must be used in laboratory diagnosis in order to be very informative concerning strain type, epidemiological surveillance, outbreak management and antibiotic susceptibility.

Application Insights

By application, the pharmaceutical application segment had the largest revenue share of the clinical microbiology market in 2023. A crucial part of guaranteeing the security and effectiveness of pharmaceuticals is clinical microbiology. This area of study focuses on microorganisms that are important to the pharmaceutical sector and includes the investigation of bacteria, viruses, fungi, and other microbes that may have an effect on the quality of pharmaceutical goods. Pharmaceutical microbiology's main objective is to stop and manage microbial contamination that occurs during the production, storage, and delivery of medications. Strict testing procedures are utilized to evaluate pharmaceutical formulations for sterility, stability, and general microbiological quality. By maintaining the standards of pharmaceutical goods, microbiological methods play a crucial role in pharmaceutical quality assurance and the protection of public health.

Tables & Figures

By_Type

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed Wing Drone | 129.30 | 158.01 | 192.97 | 235.50 | 287.24 | 350.14 | 426.57 | 519.43 | 632.17 | 769.00 | 935.03 |

| Rotor Wing Drone | 301.70 | 355.01 | 417.68 | 491.35 | 577.93 | 679.68 | 799.22 | 939.63 | 1104.55 | 1298.21 | 1525.57 |

By_Application

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Drug Transmission | 172.40 | 203.16 | 239.37 | 282.02 | 332.23 | 391.33 | 460.90 | 542.77 | 639.11 | 752.46 | 885.82 |

| Blood Transmission | 107.75 | 126.72 | 149.00 | 175.17 | 205.91 | 242.01 | 284.38 | 334.12 | 392.50 | 460.99 | 541.33 |

| Sample Transmission | 86.20 | 106.20 | 130.68 | 160.63 | 197.26 | 242.01 | 296.64 | 363.31 | 444.60 | 543.68 | 664.36 |

| Others | 64.65 | 76.95 | 91.60 | 109.03 | 129.78 | 154.47 | 183.87 | 218.86 | 260.51 | 310.08 | 369.09 |

By_Region

| Subsegment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| North America | 150.85 | 176.99 | 207.62 | 243.49 | 285.51 | 334.69 | 392.25 | 459.60 | 538.38 | 630.50 | 738.18 |

| Europe | 107.75 | 127.74 | 151.44 | 179.53 | 212.83 | 252.31 | 299.09 | 354.55 | 420.29 | 498.20 | 590.54 |

| Asia-Pacific | 86.20 | 106.71 | 131.90 | 162.81 | 200.72 | 247.16 | 304.00 | 373.52 | 458.49 | 562.28 | 688.97 |

| Latin America | 43.10 | 50.28 | 58.62 | 68.32 | 79.60 | 92.68 | 107.87 | 125.48 | 145.88 | 169.51 | 196.85 |

| Middle East & Africa | 43.10 | 51.30 | 61.06 | 72.69 | 86.52 | 102.98 | 122.58 | 145.91 | 173.67 | 206.72 | 246.06 |

Validation

| Subsegment | Total | By_Type_Sum | By_App_Sum | By_Reg_Sum |

|---|---|---|---|---|

| 2024 | 431.00 | 431.00 | 431.00 | 431.00 |

| 2025 | 513.02 | 513.02 | 513.03 | 513.02 |

| 2026 | 610.65 | 610.65 | 610.65 | 610.64 |

| 2027 | 726.85 | 726.85 | 726.85 | 726.84 |

| 2028 | 865.17 | 865.17 | 865.18 | 865.18 |

| 2029 | 1029.82 | 1029.82 | 1029.82 | 1029.82 |

| 2030 | 1225.79 | 1225.79 | 1225.79 | 1225.79 |

| 2031 | 1459.06 | 1459.06 | 1459.06 | 1459.06 |

| 2032 | 1736.72 | 1736.72 | 1736.72 | 1736.71 |

| 2033 | 2067.21 | 2067.21 | 2067.21 | 2067.21 |

| 2034 | 2460.60 | 2460.60 | 2460.60 | 2460.60 |

List of Figures & Tables

Make Every Move Strategic. Get Insights, Fully Customized

- On-Demand Metrics & KPIs

- Industry-Specific Dashboards

- Quick Turnaround, No Compromises