February 2026

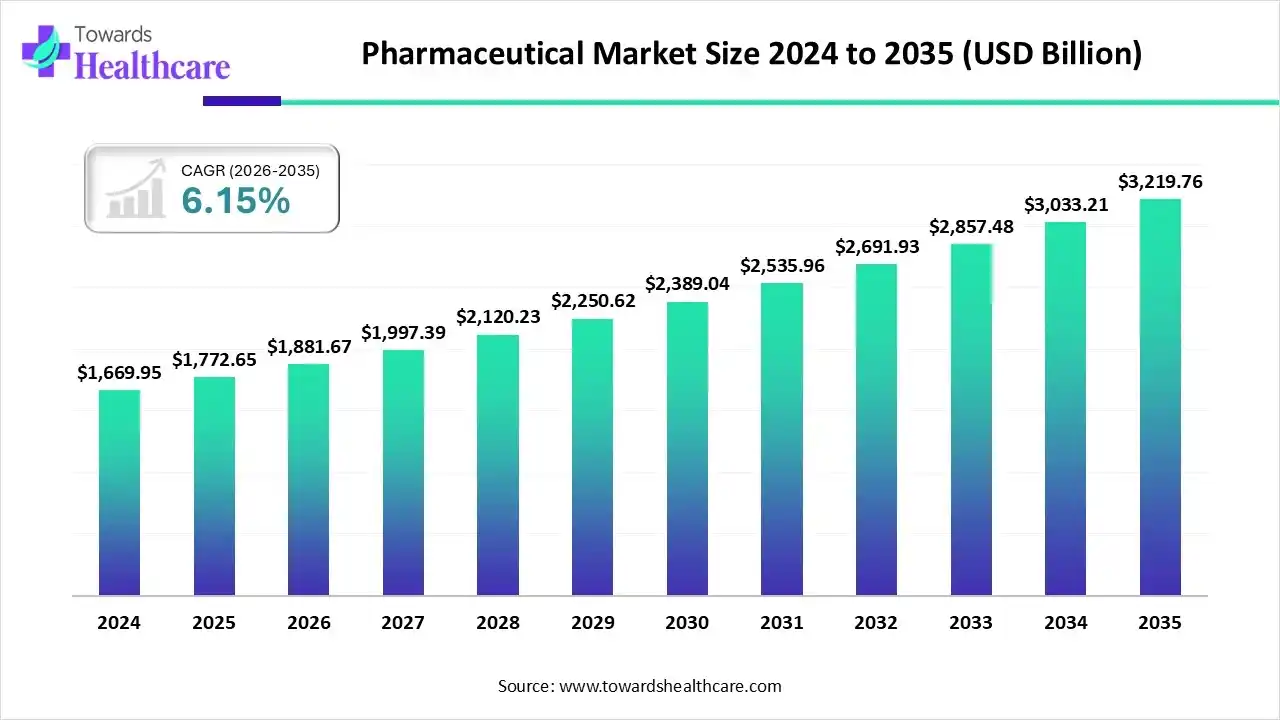

The pharmaceutical market size marked US$ 1772.65 billion in 2025 and is forecast to experience consistent growth, reaching US$ 1881.67 billion in 2026 and US$ 3219.76 billion by 2035 at a CAGR of 6.15%.

| Metric | Details |

| Market Size in 2025 | USD 1772.65 Billion |

| Projected Market Size in 2035 | USD 3219.76 Billion |

| CAGR (2026 - 2035) | 6.15% |

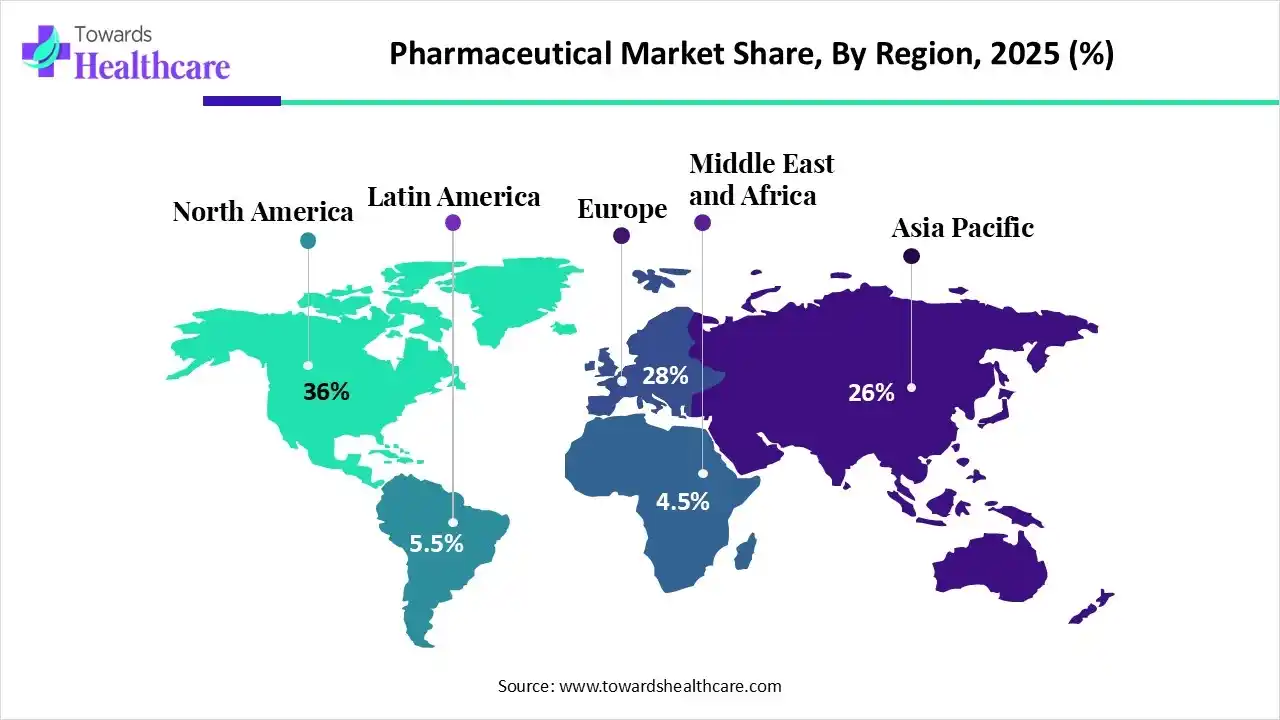

| Leading Region | North America by 36% |

| Market Segmentation | By Molecule Type, By Product, By Type, By Disease, By Route of Administration, By Formulation, By Age Group, By End-user, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd., Novartis AG, AbbVie Inc., Johnson & Johnson Services, Inc., Merck & Co., Inc., Pfizer Inc., Bristol-Myers Squibb Company, Sanofi, GSK plc, Takeda Pharmaceutical Company Limited |

Businesses that find, develop, produce, distribute, and sell pharmaceutical goods are referred to as pharmaceutical industries. One of the most tightly regulated industries, the pharmaceutical industry has consistently produced high-quality pharmaceutical goods for human use that have the intended pharmacotherapeutic effects for the treatment of a wide range of illnesses. As one of the most R&D-intensive businesses (15%–20% of US revenues go toward R&D operations), the pharmaceutical sector is renowned for its competitiveness, high employment, both directly and indirectly, innovation, and its rapidly expanding biologics and generics section.

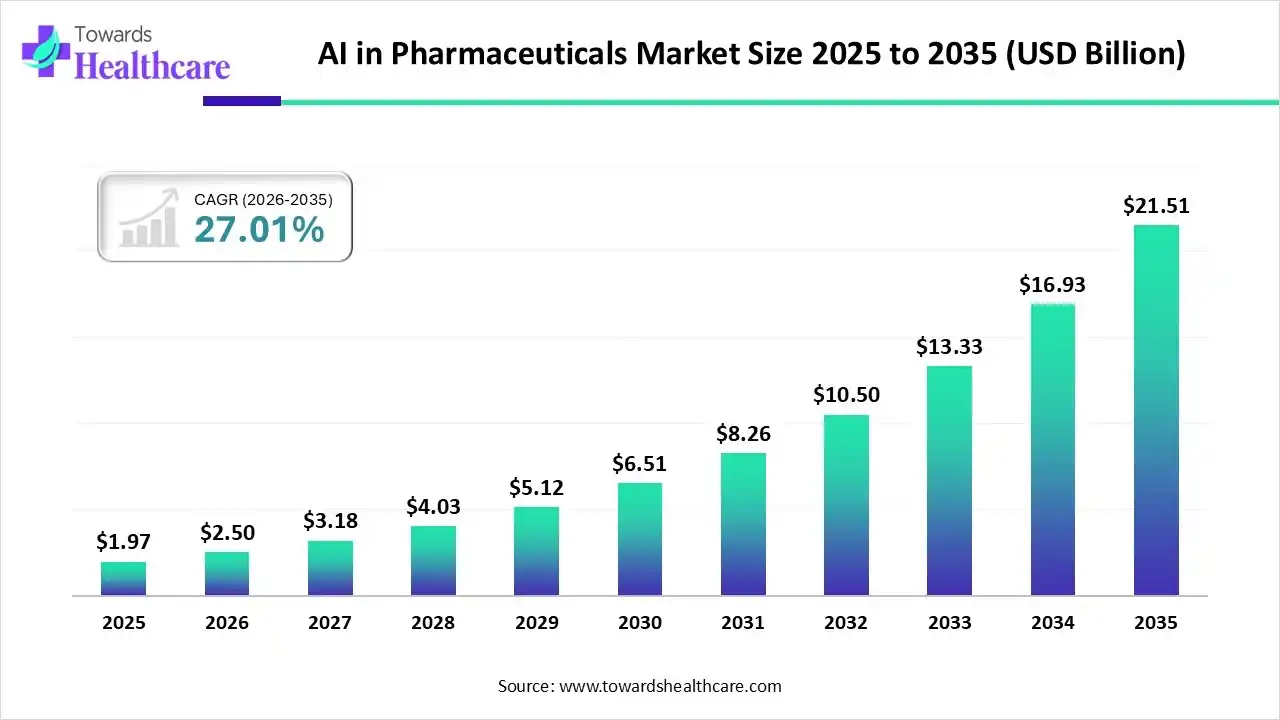

The AI in pharmaceuticals market encompasses the use of artificial intelligence (AI), machine learning (ML), and deep learning (DL) technologies throughout different stages of the pharmaceutical value chain including drug discovery, clinical trials, manufacturing, supply chain management, and commercialization. These technologies enable faster target identification, lower R&D costs, improved clinical trial design, optimized drug formulation, and better patient outcomes. Market growth is being driven by the increasing availability of biomedical data, supportive regulatory frameworks for AI-driven innovation, and collaborations between pharmaceutical companies and AI startups.

The global AI in pharmaceuticals market is valued at approximately US$ 1.97 billion in 2025, expected to grow to US$ 2.5 billion by 2026, and projected to reach around US$ 21.51 billion by 2035. This reflects a strong CAGR of 27.01% during the forecast period from 2026 to 2035.

With over 3,500 medications now in development, precision medicine will continue to be a major area of focus for pharmaceutical innovation. The field's future is hinted at by Germany's ambitious ambition to use whole-genome sequencing in regular healthcare, the emergence of mRNA vaccines, and next-generation treatments that use CRISPR technology.

There are many parties involved in the manufacturing, distribution, and shipping of pharmaceuticals, making the supply chain complicated and heavily regulated. Although it might be difficult, it is crucial to guarantee the quality and safety of pharmaceutical goods at every point in the supply chain.

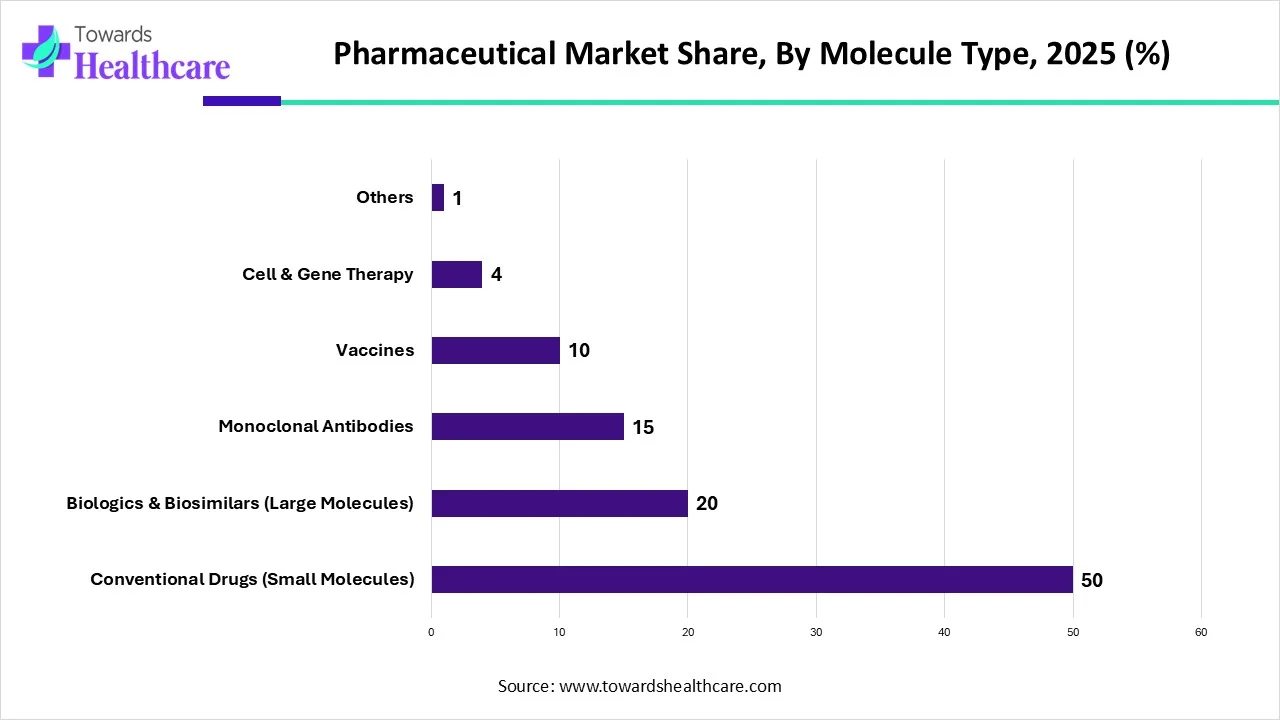

Which Molecule Type Segment Dominated the Pharmaceutical Market?

By molecule type, the conventional drugs segment held the largest share by 50% of the market. The nauseating powers are frequently destroyed, demolished, or suppressed by conventional medicine. Conventional medicine is characterized as a type of medicine that seeks to repress the causes of sickness, considers health as the absence of disease, diagnoses particular organ or tissue aberrations, and usually requires passive patient engagement in therapy.

Why Did the Branded Segment Dominate the Pharmaceutical Market?

By product, the branded segment held the dominant share by 70% of the market. Branded medications are the original goods that pharmaceutical companies create and sell. They must be approved by the Food and Drug Administration (FDA) and go through rigorous clinical testing. To recoup their high development expenses, pharmaceutical corporations usually keep a patent for 20 years.

By product, the generic segment is estimated to grow at the fastest rate during the forecast period. As consumers and payers look for methods to reduce healthcare expenses, the demand for generic medications is still rising globally. Under typical market settings, rising healthcare expenses would result in higher generic medicine prices due to the growing demand for these medications.

| Segmentations | Share 2025 (%) |

| Prescription | 75 |

| OTC | 25 |

How the Prescription Segment Dominated the Pharmaceutical Market?

By type, the prescription segment held the major share by 75% of the market. Generally speaking, prescription drugs are more effective than over-the-counter remedies. For this reason, medications need to be taken under a doctor's supervision to ensure their safe use.

By type, the OTC segment is anticipated to grow at the fastest CAGR during the predicted timeframe. Because OTC medications have low toxicity, the FDA has concluded that the advantages of using them exceed any potential risks or adverse effects. For self-diagnosed diseases, these drugs are similarly simple to use. They are well-labeled with usage instructions, cautions, and directions. Compared to prescription drugs, they are frequently less effective.

What Made Cancer the Dominant Segment in the Pharmaceutical Market?

By disease, the cancer segment dominated the market share by 30%. The market for pharmaceutical oncology is changing significantly despite the anticipated increase. Pharma firms involved in cancer are currently competing to use new digital platforms and data sources to better interact with patients, providers, and regulators.

How the Oral Segment Dominated the Pharmaceutical Market?

By route of administration, the oral segment secured the largest share by 50% of the market. The most popular method of medication delivery is oral since it is non-invasive, highly patient-complied with, economical, easy to use, and doesn't require any special sterile conditions.

By route of administration, the parenteral segment is estimated to grow at the fastest rate in the pharmaceutical market in 2023. Parenterally given medications have a quicker beginning of effect since they are absorbed more quickly than when taken orally. They have a stronger impact than oral drugs because they are digested differently and do not go through the digestive processes in the gastrointestinal tract.

Why Did the Tablets Segment Dominate the Pharmaceutical Market?

By formulation, the tablets segment was dominant in the market share by 45%. Benefits include stability, ease of packaging, shipping, and dispensing, as well as ease and economy in preparation. Patients value tablets for their convenience of use, compact size, and precise dosing.

By formulation, the sprays segment is expected to grow at the fastest rate during the forecast period. Pharmaceutical sprays are medications that are breathed in orally or through the nose. Sprays use atomization to transform a liquid or solid composition into a dynamic combination spread across a gas.

Which Age Group Segment Dominated the Pharmaceutical Market?

By age group, the adults segment dominated the market share by 70%. This group is the largest and consumes various pharmaceutical products for better health and to improve quality of life.

By age group, the children & adolescent segment is estimated to witness strong growth during the forecast period. This group is prone to health issues due to weak immunity and hormonal changes.

What Made Hospitals the Dominant Segment in the Pharmaceutical Market?

By end-user, the hospitals segment held the dominant share by 60% of the market. A large population visits hospitals for disease treatment, during which a lot of pharmaceuticals are used in the hospital.

By end-user, the clinics segment is expected to grow at the fastest growth rate during 2024-2034. For basic medication, people often visit clinics. Apart from this, specialty clinics are visited by patients for specialized treatment.

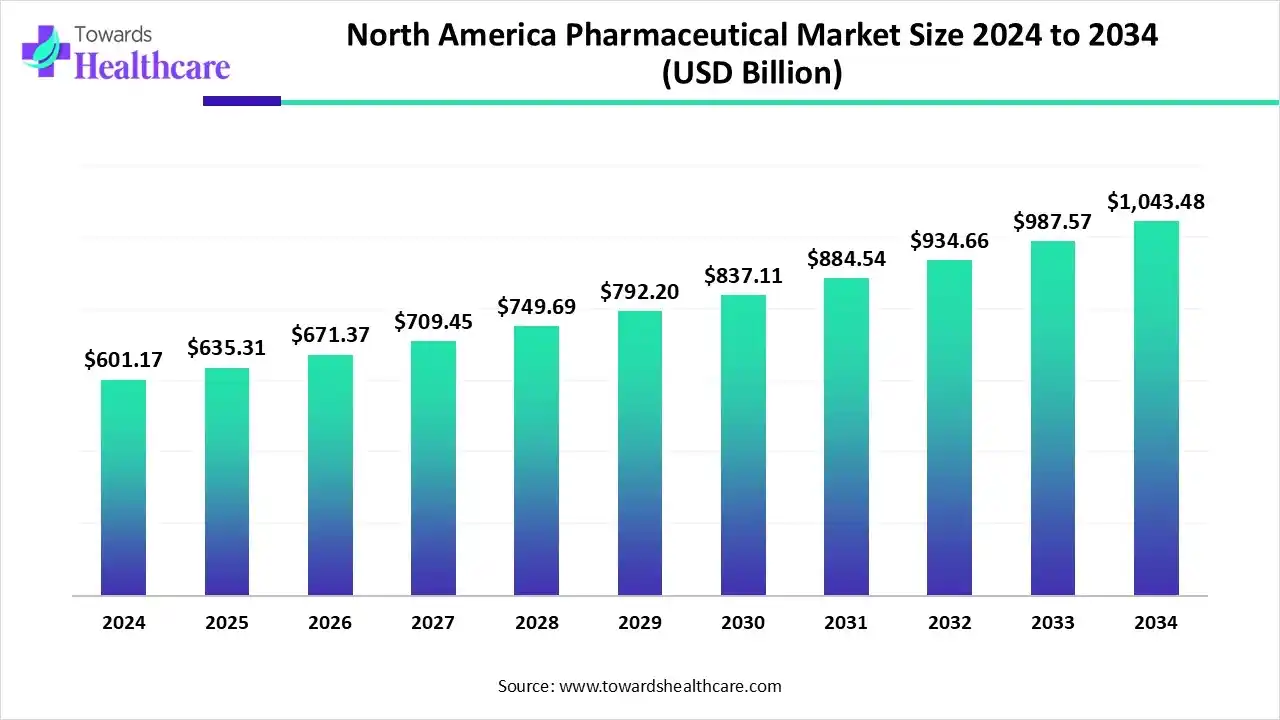

The North American pharmaceutical market is valued at US$ 601.17 billion in 2024 and is expected to grow to US$ 635.31 billion in 2025. It is projected to reach approximately US$ 1,043.48 billion by 2034, expanding at a CAGR of 5.67% from 2025 to 2034. North America dominated to pharma market share by 36% in 2025.

There are several reasons for this region's supremacy, including improvements in clinical trials and medication production in the US and Canada. Key companies are being prompted by these variables to create novel goods in the area, which is propelling market expansion. The region's growing number of medicinal approvals is another important element supporting the market's expansion.

The scale of the pharmaceutical industry in the United States is enormous.29 The markets in developing countries are comparatively more diverse, with groups with higher purchasing power investing more in innovation and those with lower purchasing power investing more in generics. With high healthcare spending per capita, aging populations, and sophisticated regulatory frameworks, industrialized nations in North America remain the top markets for pharmaceutical goods.

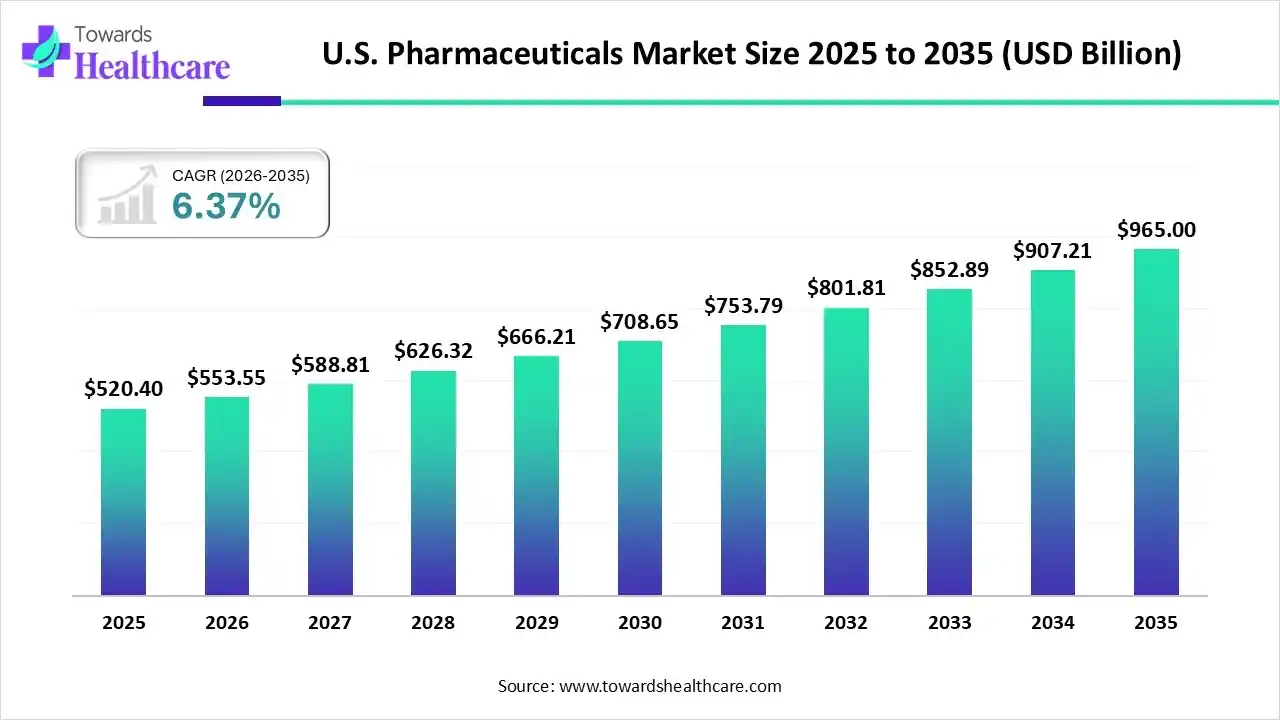

U.S. Pharmaceutical Market Growth

The U.S. pharmaceutical market size is calculated at USD 520.4 billion in 2025, grew to USD 553.55 billion in 2026, and is projected to reach around USD 965 billion by 2035. The market is expanding at a CAGR of 6.37% between 2026 and 2035.

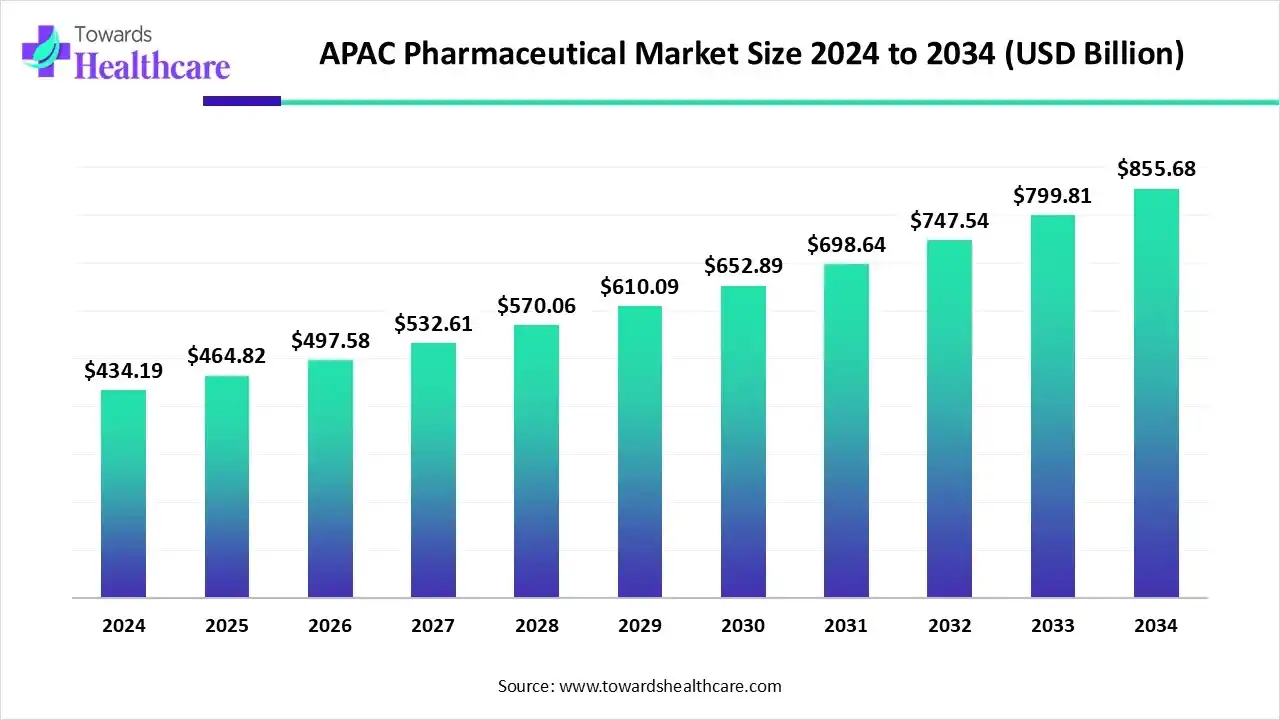

The APAC pharmaceutical market is valued at USD 434.19 billion in 2024 and is expected to grow to USD 464.82 billion in 2025. It is projected to reach approximately USD 855.68 billion by 2034, expanding at a CAGR of 7.02% from 2025 to 2034.

Demand for innovative items rises as people become more conscious of the treatment and management of illnesses. Furthermore, it is projected that the region's need for and accessibility to treatment choices would increase as a result of growing domestic firms' investments there and mergers with important players.

Indian Market Trends

The pharmaceutical sector in India is a major player in the worldwide pharmaceutical market. India sells pharmaceuticals to more than 200 nations, making it a major exporter. About 40% of the US's generic needs, more than 50% of Africa's generic needs, and about 25% of the UK's total drug supply come from India. India is also a major provider of DPT, BCG, and measles vaccinations, and it supplies around 60% of the world's vaccine orders. India supplies 70% of the vaccines used by the WHO (according to the essential immunization schedule).

For instance,

The Europe pharmaceutical market is valued at US$ 467.59 billion in 2024 and is expected to grow to US$ 494.63 billion in 2025. Looking ahead, the market is projected to reach approximately US$ 820.05 billion by 2034, expanding at a CAGR of 5.78% between 2025 and 2034.

The rising prevalence of various diseases in Europe is driving higher demand for diverse pharmaceutical products. This surge is boosting production and fueling research and development efforts, supported by both government funding and corporate investments. Additionally, companies are leveraging AI technologies to accelerate drug discovery and streamline clinical trials. Simultaneously, active product development, collaborations, and new launches are further propelling market growth.

The Pharmaceutical Industry: A Key Asset to the European Economy

The research-based pharmaceutical industry is one of Europe’s most valuable economic and scientific assets. Beyond its role in developing innovative medicines that enhance health and quality of life globally, it stands as one of the continent’s strongest high-technology sectors. Over the past two decades, the industry has demonstrated remarkable growth across production, trade, research and development (R&D), and employment solidifying its contribution to Europe’s economic resilience and healthcare leadership.

From 2000 to 2023, Europe’s pharmaceutical production value more than tripled, growing from €127.5 billion to an estimated €390 billion. Exports surged dramatically from €90.9 billion in 2000 to €680 billion in 2023, underscoring the sector’s global competitiveness. Imports also rose, reaching €480 billion in 2023, maintaining a robust trade surplus of about €200 billion.

Investment in R&D has been a cornerstone of this progress expanding from €17.8 billion in 2000 to €50 billion in 2023. Employment within the sector has similarly grown from 556,506 to approximately 900,000 workers, with a significant share dedicated to R&D activities (about 130,000 employees in 2023).

The total pharmaceutical market value at ex-factory prices climbed from €89.4 billion in 2000 to €290 billion in 2023, reflecting consistent market expansion. Meanwhile, statutory health insurance payments for pharmaceuticals (in ambulatory care only) also rose steadily, reaching €175 billion in 2023, indicating the growing importance of medicines in healthcare systems.

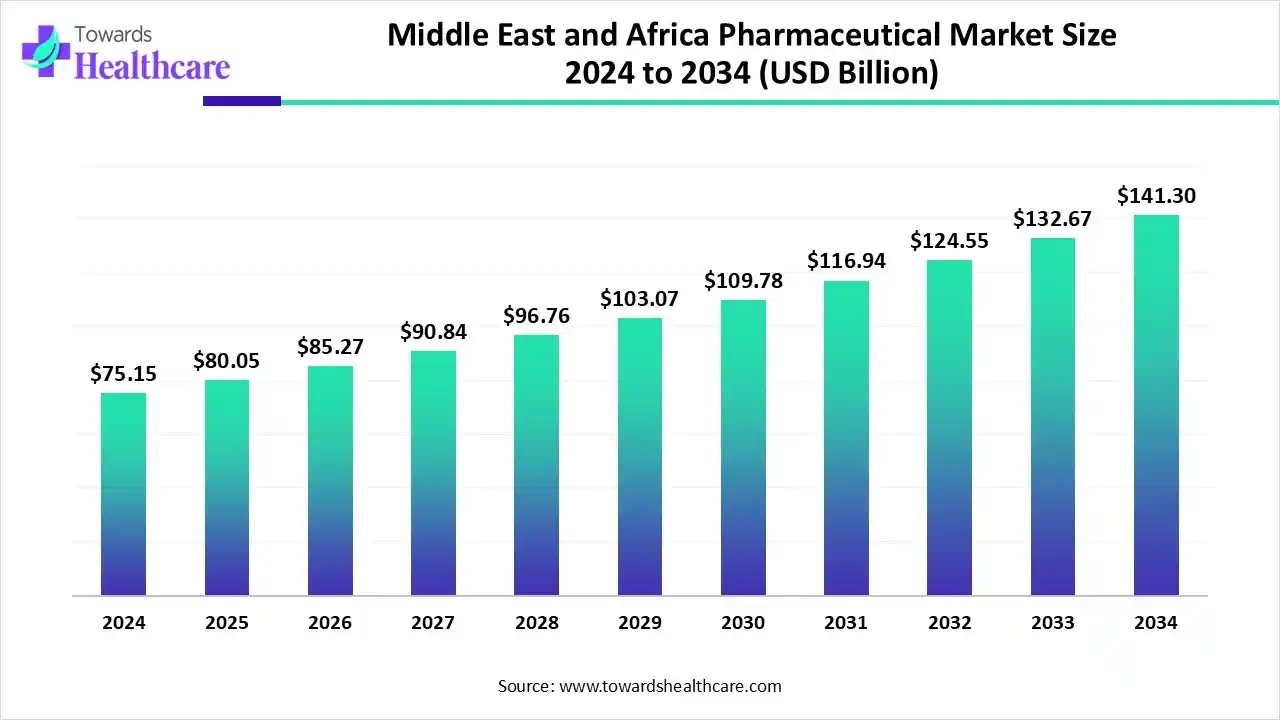

The Middle East and Africa pharmaceutical market was valued at US$ 75.15 billion in 2024 and is expected to reach US$ 80.05 billion in 2025. Looking ahead, it is projected to grow to approximately US$ 141.3 billion by 2034, reflecting a CAGR of 6.52% over the forecast period.

The Middle East and Africa pharmaceutical market is undergoing a transformation, fueled by a growing burden of chronic diseases, rising healthcare expenditure, and strong government support for local drug manufacturing and healthcare infrastructure. Key growth drivers include improved access to medicines, adoption of digital health technologies, and enhanced regulatory harmonization, highlighted by the establishment of the African Medicines Agency (AMA) for streamlined drug approvals. However, challenges persist, such as fragmented medicine regulations, heavy dependence on imported active pharmaceutical ingredients (APIs), and the widespread presence of substandard or falsified medicines, posing significant systemic risks.

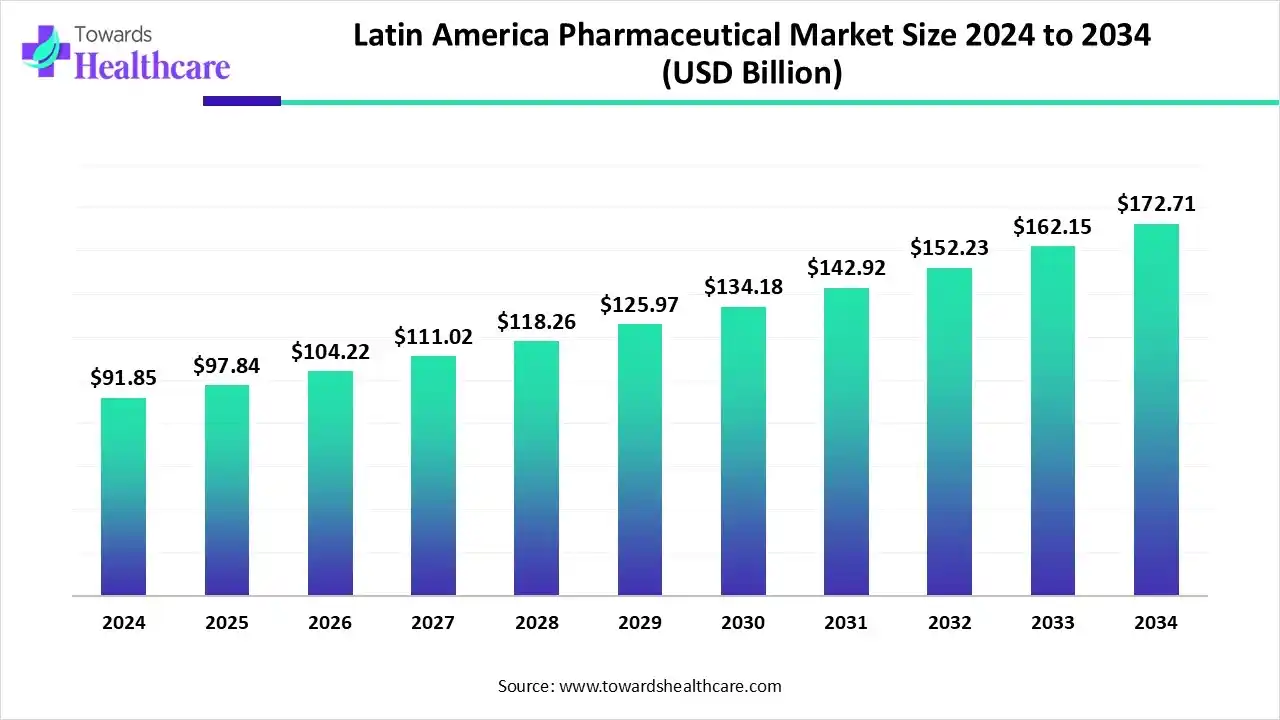

The Latin American pharmaceutical market was valued at approximately USD 91.85 billion in 2024 and is expected to grow to USD 97.84 billion in 2025. By 2034, the market is projected to reach USD 172.71 billion, reflecting a robust CAGR of 6.52% over the forecast period.

The Latin American pharmaceutical market is experiencing growth driven by rising demand for specialty drugs, broader health insurance coverage, and increased investment in healthcare infrastructure. Major markets such as Brazil, Mexico, and Argentina are fueling expansion through both local manufacturing and the import of innovative therapies. Furthermore, supportive government policies promoting affordable medicines, the growth of clinical research, and partnerships between domestic and international pharmaceutical companies are contributing to the region’s consistent market development.

R&D

Clinical Trials & Regulatory Approval

Distribution to Hospitals, Pharmacies

Patient Support & Services

Explore further to learn about the top players in the Pharmaceutical Market and their company profile at: https://www.towardshealthcare.com/companies/pharmaceutical-companies

Healthcare leaders gathered at Health Evolution's 2023 Connect to discuss important topics pertaining to the sector, including the pharmaceutical market's critical obstacles. Leaders urged CEOs to use new AI technologies, pointing out that recent developments in AI might significantly affect pharmaceutical research and innovation. In general, leaders stressed the need for creative leadership to adopt new pharmaceutical advances and develop mechanisms that would guarantee the accessibility and affordability of upcoming therapies.

By Molecule Type

By Product

By Type

By Disease

By Route of Administration

By Formulation

By Age Group

By End-user

By Region

February 2026

February 2026

February 2026

February 2026