Which are the Top Companies in the Fitness App Market

- MyFitnessPal, Inc.

- Google (Alphabet Inc.)

- Nike, Inc.

- Under Armour, Inc.

- Adidas AG

- ASICS Corporation

- Fitbit, Inc. (part of Google)

- Strava, Inc.

- Peloton Interactive, Inc.

- Noom, Inc.

- Calm

- Headspace Inc.

- Samsung Electronics Co., Ltd.

- Azumio, Inc.

- Sweat

- Freeletics GmbH

- Garmin Ltd.

- Sworkit Health

- Jefit, Inc.

- Polar Electro

Introduction

Growing consumer awareness of the benefits of a healthy lifestyle and rising smartphone, tablet, and wearable device usage have contributed to the expansion of the fitness app market. Additionally, the global fitness app market share has increased due to growing awareness of diet-related illnesses.

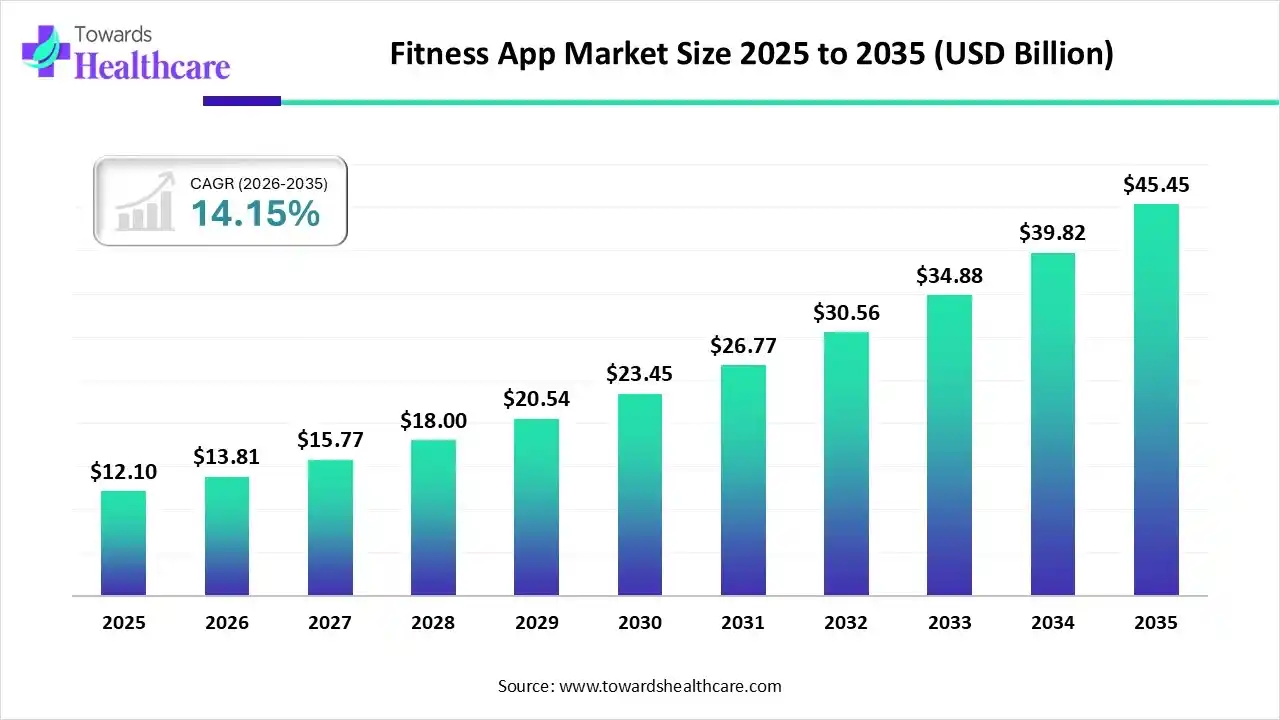

Market Growth

The global fitness app market size is calculated at US$ 12.1 billion in 2025, grew to US$ 13.81 billion in 2026, and is projected to reach around US$ 45.45 billion by 2035. The market is expanding at a CAGR of 14.15% between 2025 and 2034.

Top Vendors in the Fitness App Market & Their Offerings

1. MyFitnessPal, Inc. (Austin, Texas, USA)

-

Leading nutrition-tracking platform with an extensive food database.

-

Strong personalization features.

-

Recent focus: Advanced AI-powered meal logging and enhanced nutrition insights.

2. Google (Alphabet Inc.) – Mountain View, California, USA

-

Operates a core health-tracking ecosystem using Android’s scale.

-

Strong device interoperability across the Google ecosystem.

-

Recent focus: Expanded wearable integrations and improved Google Fit activity-metric accuracy.

3. Nike, Inc. (Beaverton, Oregon, USA)

-

Premium digital training brand driven by athlete-based programs.

-

Large and active global fitness community.

-

Recent focus: New performance-focused training series and upgraded Nike Training Club content.

4. Under Armour, Inc. (Baltimore, Maryland, USA)

-

Leader in performance analytics with strong connected-footwear data.

-

Well-established training ecosystem.

-

Recent focus: Enhanced MapMyFitness analytics and improved connected-footwear metrics.

5. Adidas AG (Herzogenaurach, Germany)

-

Sports heritage transformed into engaging, digital fitness experiences.

-

Known for strong community-focused fitness features.

-

Recent focus: Expanded adaptive running plans and more personalized digital coaching features.

Company Landscape

Peloton Interactive, Inc.

Company Overview:

- Mission: To use technology and design to connect the world through fitness, empowering people to be the best version of themselves anywhere, anytime.

- Vision: To be the largest and most engaging fitness platform in the world, with millions of Members.

Corporate Information:

Headquarters: New York, New York, USA | Year Founded: 2012 | Ownership Type: Publicly Traded (NASDAQ: PTON)

History and Background:

- Foundation: Started as a Kickstarter project, launching the first Bike in 2013, combining high-end stationary bikes with a connected tablet streaming live/on-demand classes.

- Early Growth: Established itself as a premium, at-home fitness brand, bypassing the traditional gym model.

- Pandemic Surge: Experienced explosive growth in 2020-2021 due to lockdowns, significantly expanding its subscriber base and hardware sales.

- Post-Pandemic Shift: Focused on streamlining operations, reducing costs, and expanding its software-only membership to tap into a broader market.

Key Milestones/Timeline:

- 2012: Company founded.

- 2014: Launched the first Peloton Bike.

- 2018: Launched the Peloton Tread.

- 2019 (Sept): Initial Public Offering (IPO) on NASDAQ.

- 2023 (May): Relaunched its App with three new tiers to drive broader subscription growth.

- 2025 (Oct): Announced the launch of AI-Powered Peloton IQ and the new Peloton Cross Training Series (Q4 FY25/Q1 FY26 development).

Business Overview:

- Core Model: Subscription-first model combining premium fitness hardware with proprietary, interactive content accessible via an all-access membership.

- Revenue Mix (Q1 FY25): Approximately 67% Subscription Revenue, 33% Connected Fitness Products Revenue.

- Subscriber Base (Q3 FY25): ~2.88 million Paid Connected Fitness Subscribers and ~573,000 Paid App Subscribers.

Business Segments/Divisions:

- Connected Fitness Products: Sale of hardware (Bikes, Treads, Row, Guide).

- Subscription: Monthly subscription revenue from All-Access (hardware owners) and App memberships (digital-only users).

Geographic Presence:

USA, UK, Canada, Germany, Australia, and Austria.

Key Offerings:

- Hardware: Peloton Bike/Bike+, Tread/Tread+, Row, and Guide.

- Content: Live and On-Demand classes (Cycling, Running, Strength, Yoga, Meditation, etc.) taught by world-class instructors.

- Software: Peloton App (multiple tiers including App Free, App One, and App+), community features, and metrics tracking.

End-Use Industries Served:

- Individual Consumers (At-Home Fitness)

- Commercial/Hospitality (Peloton Pro Series targeting gyms, hotels, corporate wellness).

Key Developments and Strategic Initiatives:

Mergers & Acquisitions: Not a primary strategy; focus is on organic platform growth.

Partnerships & Collaborations:

- 2025 (Nov): Official Fitness Partner of the FORMULA 1 HEINEKEN LAS VEGAS GRAND PRIX 2025.

- 2025 (Oct): Collaboration with Hospital for Special Surgery (HSS) to enhance injury prevention and recovery education content.

- 2023: Partnership with Lululemon for co-branded apparel and digital content.

Product Launches/Innovations:

- 2025 (Oct): Introduction of the Peloton Cross Training Series.

- 2023 (May): Relaunched Peloton App with three subscription tiers (App Free, App One, App+).

- Capacity Expansions/Investments: Continued investment in content production and the technology platform. Focus has shifted from manufacturing expansion to profitability and inventory reduction.

- Regulatory Approvals: Adherence to safety standards, including a voluntary recall and remediation program for the Tread+ in previous years.

- Distribution channel strategy: Direct-to-consumer (online and retail showrooms), third-party retail partnerships (e.g., Amazon, Dick's Sporting Goods).

Technological Capabilities/R&D Focus:

- 2025 (Oct): Announced AI-Powered Peloton IQ, a new technology platform for personalized experiences.

- Focus on Connected Fitness Technology, real-time metric tracking, and content delivery infrastructure.

- Core Technologies/Patents: Proprietary hardware and software integration; a large library of licensed music for workouts.

- Research & Development Infrastructure: Dedicated in-house hardware engineering, software development, and content production studios.

- Innovation Focus Areas: AI-driven personalization, seamless multi-device experience, expanding strength/off-equipment content, and commercial market penetration.

Competitive Positioning:

- Strengths & Differentiators: Highly engaged community; high-quality, exclusive content (live and on-demand); strong instructor brand presence; integrated hardware/software experience; high customer retention rate for Connected Fitness subscribers (1.2% net monthly churn in Q3 FY25).

- Market presence & ecosystem role: Dominant market leader in the at-home connected fitness category (reported 51% market share in this sub-segment in 2024). Plays a key role in defining premium home fitness.

SWOT Analysis:

- Strengths: Brand loyalty, high retention, vast content library, integrated ecosystem.

- Weaknesses: High hardware cost (barrier to entry), dependency on the premium segment, and inventory management challenges post-pandemic.

- Opportunities: Global expansion of App-only subscriptions, B2B/Commercial partnerships, integration of AI/personalization.

- Threats: Increasing competition from cheaper digital-only apps and tech giants (Apple, Google), economic headwinds affecting discretionary spending, and hardware manufacturing risks.

Recent News and Updates:

Press Releases:

- 2025 (Nov 6): Announced Q1 FY26 Financial Results, raising Full Year 2026 Adjusted EBITDA Guidance.

- 2025 (Oct 1): Launched AI-Powered Peloton IQ and the new Peloton Cross Training Series.

- Industry Recognitions/Awards: Specific recent awards not highlighted in search results, generally recognized for product innovation and content quality.

BetterMe

Company Overview:

- Mission: To help people live happier, healthier lives by making wellness simple, accessible, and inclusive.

- Focus: A holistic approach combining fitness, nutrition, and mental wellness (mindfulness).

Corporate Information:

- Headquarters: N/A (Globally distributed, often associated with Cyprus/Ukraine for development).

- Year Founded: 2016

- Ownership Type: Private Company

History and Background:

- Foundation: Established as a developer of user-friendly mobile health and fitness applications.

- Growth Driver: Utilized highly personalized digital content and aggressive performance marketing to quickly scale a massive global user base, focusing on accessible, no-equipment workouts.

- Expansion: Expanded from fitness to include nutrition (meal planning) and mental health (meditation, somatics).

Key Milestones/Timeline:

- 2016: Company founded, launch of first apps.

- 2024: Continued strong revenue performance, often ranking among the top-grossing health and fitness apps globally.

- 2025: Focus on integrating sophisticated mind-body practices like Somatics and developing highly personalized meal plans.

Business Overview:

- Core Model: Mobile application-based subscription model (freemium with paid subscription for full access to content, personalized plans, and coaching features).

- Revenue Generation: Driven by a large volume of paying digital subscribers globally.

Business Segments/Divisions:

- BetterMe: Health Coaching: Flagship app for holistic wellness (fitness, nutrition, mind).

- BetterMe: Yoga: Focused app for yoga and stretching.

- BetterMe: Mental Health: Dedicated app for sleep and meditation.

Geographic Presence:

Strong Global Presence (High engagement in North America, Europe, and Asia).

Key Offerings:

- Workout Plans: 1,500+ workouts for all levels (running, walking, bodyweight strength, HIIT).

- Nutrition: Customized meal plans, food tracking, recipe database.

- Mental Wellness: Guided meditations, sleep stories, Somatic exercises, and breathwork.

- Coaching: AI-driven personalization and digital coaching support.

End-Use Industries Served:

Individual Consumers (Digital Health and Wellness)

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Not a primary strategy; focus is on in-house development and strategic content partnerships.

- Partnerships & Collaborations: Focus is primarily on digital influencer marketing and content development rather than large corporate partnerships.

Product Launches/Innovations:

- 2025: Launched in-depth features for Somatic Movement and refined Customized Meal Planning to focus on holistic wellness and behavior change.

- Continuous updates to algorithms for personalized plan generation (Walking, Running, Weight Loss).

- Capacity Expansions/Investments: Investment in internal R&D for AI personalization and sophisticated content production.

- Regulatory Approvals: N/A (Operates as a consumer wellness platform, not a regulated medical device).

- Distribution channel strategy: App Stores (Apple App Store, Google Play Store) with heavy reliance on performance and social media marketing.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: AI/Machine Learning for personalized fitness and nutrition plan generation; complex behavioral change algorithms.

- Research & Development Infrastructure: Emphasis on data science, AI development, and psychology-informed content creation.

- Innovation Focus Areas: Behavior change psychology, Mind-Body connection (Somatic), and hyper-personalization of nutrition and fitness plans.

Competitive Positioning:

- Strengths & Differentiators: High accessibility (low-cost/subscription, no equipment needed), vast library of diverse content, strong focus on psychological and holistic wellness (Somatic, Mental Health).

- Market presence & ecosystem role: A global high-grossing app (top competitor in the exercise/weight loss and nutrition segments) known for its effective user acquisition and broad global reach.

SWOT Analysis:

- Strengths: Massive user base, high revenue generation, affordable price point, holistic health focus, strong marketing engine.

- Weaknesses: Reports of challenging subscription cancellation and billing issues from some users, content repetition in some plans, and less integration with high-end hardware than competitors.

- Opportunities: Further integration of mental wellness and clinical-grade health features, expansion in emerging markets.

- Threats: High user churn rates are common in app-only models, intense competition from free content and new entrants, increasing cost of user acquisition.

Recent News and Updates:

Press Releases:

- 2025 (Nov): Overview releases promoting new Somatic Pilates and Gentle Somatic Yoga sequences.

- 2025 (Sept): Detailed overview of the BetterMe Walking Plan and its research-backed benefits.

- Industry Recognitions/Awards: Frequently cited in top-grossing app lists for the Health & Fitness category.

Recent Developments in the Fitness App Market

- In May 2025, the Wall Street Journal stated that the fitness app Strava raised an undisclosed sum of new funding, including debt, to reach a $2.2 billion valuation. The company, which last raised capital in 2020 at a $1.5 billion valuation, will benefit greatly from the new agreement.

- In July 2025, ApClub, a fitness startup based in Bengaluru, raised ₹2 crore in its pre-seed funding round, which was spearheaded by Curefit Healthcare Pvt Ltd. PedalStart, a renowned start-up accelerator, and angel investors like Pranay Jivrajka strategically participated.

- In July 2025, the Palta-backed health tech company Zing Coach, which uses its AI-powered fitness app to lower rising rates of physical inactivity, announced today that it has raised a $10 million Series A funding round in debt and equity. With the funding, Zing Coach will be able to grow its workforce, penetrate new markets, and keep creating ground-breaking new features for its industry-leading AI-powered fitness app.

Collaborate with our experts to explore the Fitness App Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking