Revenue, 2025

12.1 Billion

Forecast, 2035

45.45 Billion

Fitness App Market Size, Dynamics with Growth and Key Players

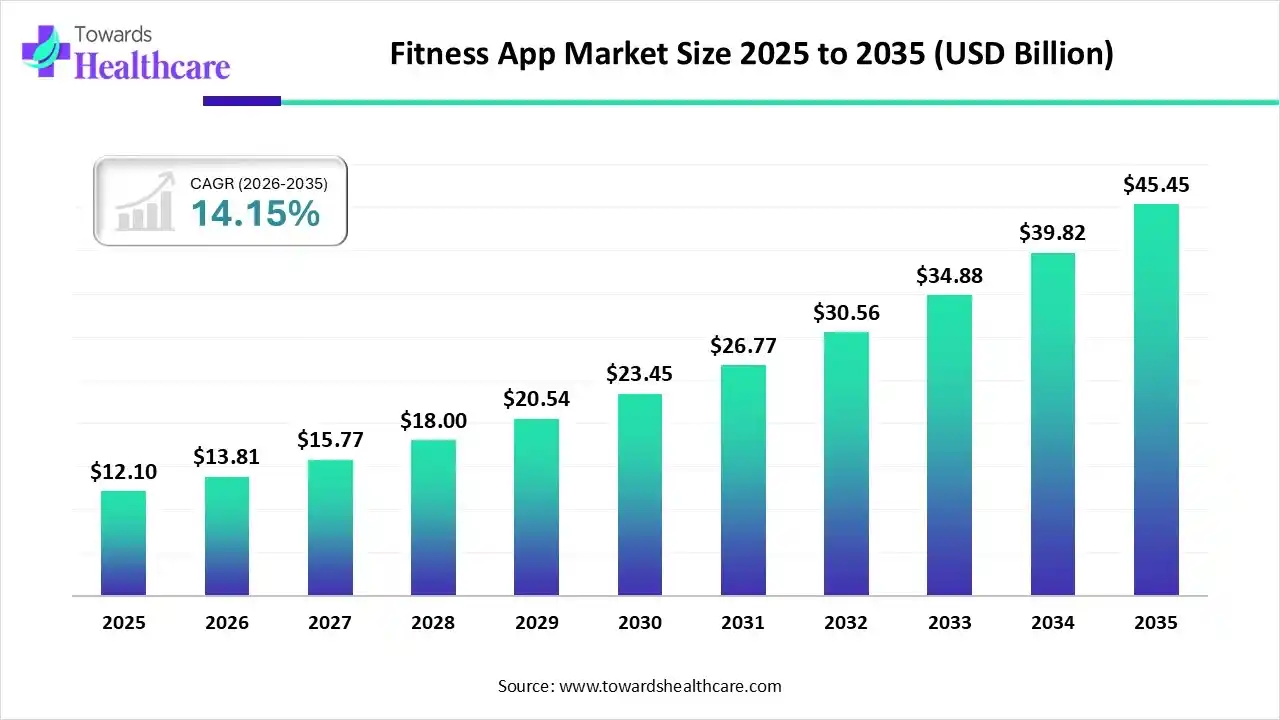

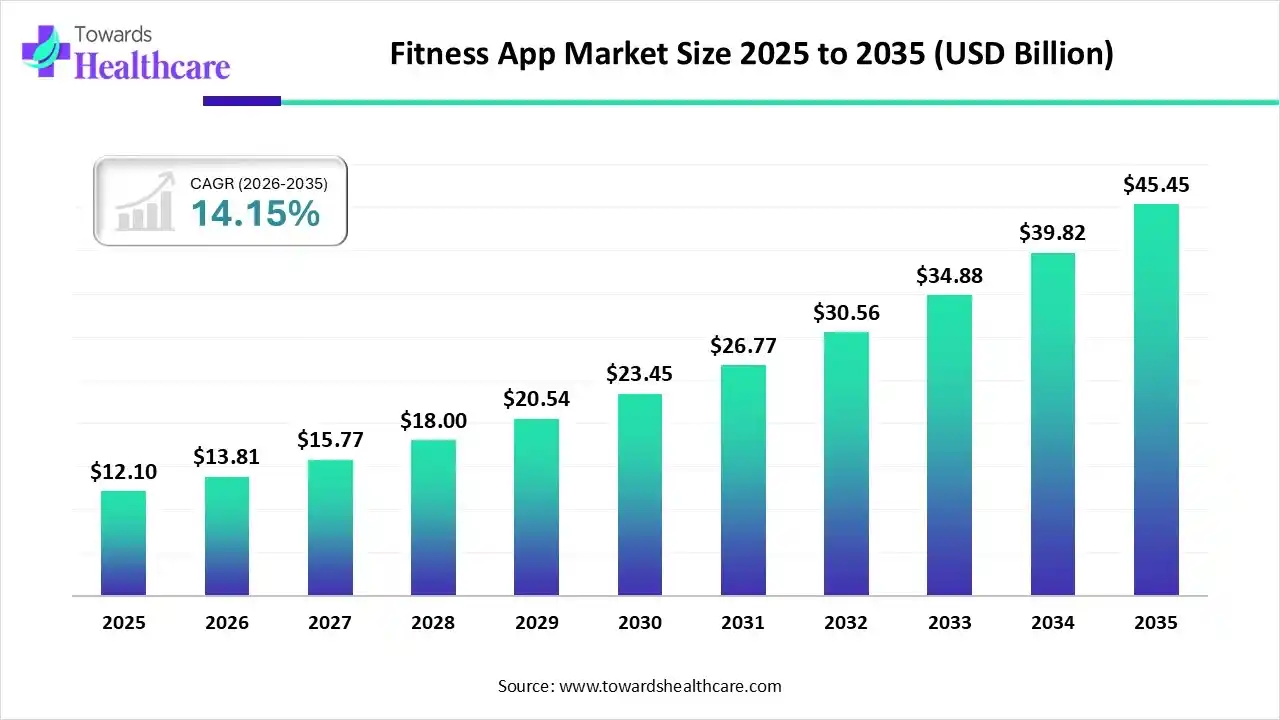

The global fitness app market size is calculated at US$ 12.1 billion in 2025, grew to US$ 13.81 billion in 2026, and is projected to reach around US$ 45.45 billion by 2035. The market is expanding at a CAGR of 14.15% between 2025 and 2034.

Key Takeaways

- Fitness App industry poised to reach USD 13.81 billion by 2026.

- Forecasted to grow to USD 45.45 billion by 2035.

- Expected to maintain a CAGR of 14.15% from 2026 to 2035.

- North America dominated the fitness app market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By type, the exercise & weight loss segment dominated the market in 2024.

- By type, the activity tracking segment is expected to grow at the fastest CAGR during the forecast period.

- By platform, the iOS segment dominated the market in 2024.

- By platform, the Android segment is expected to grow at the fastest CAGR during the forecast period.

- By devices, the smartphones segment dominated the fitness app market in 2024.

- By devices, the wearable devices segment is expected to grow at the fastest CAGR during the forecast period.

Executive Summary Table

| Key Elements |

Scope |

| Market Size in 2026 |

USD 13.81 Billion |

| Projected Market Size in 2035 |

USD 45.45 Billion |

| CAGR (2026 - 2035) |

14.15% |

| Leading Region |

North America |

| Market Segmentation |

By Type, By Platform, By Device, By Region |

| Top Key Players |

MyFitnessPal, Inc., Google (Alphabet Inc.), Nike, Inc., Under Armour, Inc., Adidas AG, ASICS Corporation, Fitbit, Inc. (part of Google), Strava, Inc., Peloton Interactive, Inc., Noom, Inc., Calm, Headspace Inc., Samsung Electronics Co., Ltd., Azumio, Inc., Sweat, Freeletics GmbH, Garmin Ltd., Sworkit Health, Jefit, Inc., Polar Electro |

Growing consumer awareness of the benefits of a healthy lifestyle and rising smartphone, tablet, and wearable device usage have contributed to the expansion of the fitness app market. Additionally, the global fitness app market share has increased due to growing awareness of diet-related illnesses.

How is the Fitness App Changing Healthcare?

The demand for digital wellness solutions, the increasing prevalence of lifestyle-related disorders, and growing health consciousness are driving robust growth in the global fitness app market. Over time, the popularity of fitness apps has increased in tandem with a growing awareness of the benefits of physical activity and leading a healthy lifestyle. In the global fitness industry, fitness apps have become popular, leading to new training behavior patterns.

Fitness App Market Outlook

- Global Expansion: The use of fitness apps is increasing worldwide due to smartphone adoption and health consciousness. The market is dominated by North America, but the fastest-growing region is Asia-Pacific. Significant user adoption is also occurring in Europe, Latin America, the Middle East, and Africa, indicating a global trend toward digital wellness solutions.

- Major Investors: Businesses like Google, Apple, and Adidas AG, as well as venture capital firms like Sequoia Capital, Kleiner Perkins, and Khosla Ventures, are major investors in the market.

- Startup Ecosystem: The startup ecosystem for the fitness app market is strong and expanding, with significant venture capital funding, particularly in the U.S. and India. Wearable integration, AI-driven personalization, and an emphasis on holistic wellness are driving market innovation and consolidation.

How is AI Useful in the Fitness App Market?

AI is changing the fitness sector by making companies more user-focused and efficient. AI improves user engagement, lowers attrition, and creates new opportunities through everything from virtual coaching and customized exercise regimens to predictive analytics and automated processes. By evaluating user data to spot possible health risks and offer early interventions, AI fitness apps will have a bigger impact on preventive healthcare.

Segmental Insights

Type Insights

Why Exercise & Weight Loss Dominated the Fitness App Market in 2024?

The exercise & weight loss segment accounted for the largest share of market revenue in 2024 due to the rising cases of obesity and diabetes. Mobile apps encourage a variety of tactics, such as social support and educational content, as well as self-monitoring of weight, exercise, and diet. According to the World Obesity Federation's World Obesity Atlas 2024, estimates for 2035 indicate that 1.53 billion people will suffer from obesity, and over 1.77 billion will be overweight. The WHO estimates that 44% of diabetes cases are caused by obesity, and by 2025, the number of people with obesity-related diabetes is predicted to double to 300 million.

Activity Tracking

The activity tracking segment is expected to grow at the fastest CAGR in the fitness app market during the forecast period. In order to promote healthy behaviors and provide public health interventions, technologies like fitness trackers and smartphone apps are essential. Running and cycling distances can be monitored by tracking apps. These apps can even track the user's swimming pool laps, calories burned, and other metrics when paired with wearable technology. Gamification elements could keep people motivated and committed to their objectives.

Diet & Nutrition

The diet & nutrition segment is expected to grow at a significant CAGR during the forecast period. Apps can be a useful tool for assessing and tracking diet-related health risk factors and eating habits. Apps can help people take control of their dietary decisions and give them autonomy. For people who prefer less face-to-face interaction with medical professionals, the ability to monitor food intake, set goals, and track progress in private may be appealing.

Platform Insights

Why did the iOS Segment Dominate in the Fitness App Market in 2024?

The iOS segment accounted for the largest share of market revenue in 2024. One of the most powerful and well-known companies in the world, Apple is credited with helping to popularize smartphones with the iPhone. Sales of iPhones accounted for 51% of Apple's $390.8 billion in revenue in 2024. The United States, Apple's home nation, has consistently seen the company's greatest success.

Android

The Android segment is expected to grow at the fastest CAGR in the fitness app market during the forecast period. With more than 3 billion active users across 190 countries, Android is the most widely used operating system worldwide. In most nations, Android is the most popular platform. It holds more than 85% of the market share in countries such as Brazil, India, Indonesia, Iran, and Turkey. Xiaomi and Oppo are the next biggest producers of Android smartphones, after Samsung.

Devices Insights

How Smartphones Dominated the Fitness App Market in 2024?

The smartphones segment accounted for the largest share of market revenue in 2024. The significance of mobile devices among internet-using gadgets has gradually grown. By the end of 2022, there were 6.6 billion smartphone subscriptions globally, and by 2026, that number is expected to more than double from 3.6 billion in 2016 to 7.5 billion.

Wearable Devices

The wearable devices segment is expected to grow at the fastest CAGR in the fitness app market during the forecast period. From simple fitness trackers to sophisticated medical devices that allow continuous health monitoring, wearable technology has advanced quickly. Wearable technology, such as wristbands, smartwatches, and earbuds, has already become very popular worldwide.

Regional Growth

- North America dominated the market in 2024 due to its sophisticated ecosystem.

- Asia Pacific is estimated to host the fastest-growing market during the forecast period.

- Europe is expected to grow at a significant CAGR in the market during the forecast period.

- South America is expected to grow significantly in the market during the forecast period.

- The Middle East and Africa are expected to grow at a lucrative CAGR in the market during the forecast period.

The Rising Health Awareness is Driving North America

North America dominated the fitness app market in 2024 due to its sophisticated ecosystem, rising health and fitness consciousness, and high smartphone penetration. With the widespread use of wearables like the Apple Watch, Fitbit, and Garmin, as well as fitness-focused apps like Peloton and Nike Training Club, the area benefits from a culture of fitness. High disposable income, growing innovation and product launches, and significant investments in healthcare mobile applications all contribute to the market's strength.

U.S. Obesity & Diabetes Fuel Fitness App Demand

Some of the major drivers of the fitness app market in the U.S. are chronic conditions such as diabetes and obesity, along with technological advancements in developing fitness devices and apps. The adult obesity rate in the United States was 37% in 2024–2025, a slight decrease from its peak in 2022, but still high, and 11.6% of the population (38.4 million) had diabetes, including 8.7 million who were undiagnosed. Obesity and diabetes continue to be serious health issues.

The Smartphone Surge: Unlocking the Asian Fitness Market

Asia Pacific is estimated to host the fastest-growing fitness app market during the forecast period. Growing health consciousness, growing smartphone adoption, and rising disposable incomes are some of the factors causing this. Fitness apps are becoming more and more popular in nations with younger populations, such as China and India, as they meet the growing need for easy, at-home exercise options. Numerous local developers are joining the market with applications designed to meet local fitness requirements, such as diets and customs like yoga and Tai Chi. Increasing investments in digital health infrastructure benefits the region as well.

Smartphones Propel China's Fitness App Growth

Fitness awareness and widespread smartphone use are the main drivers of the fitness app market in China. With over 975 million smartphone users as of late 2025 and an estimated 1.2 billion by 2029, China has the largest smartphone user base in the world. Smartphones have become an integral part of everyday life. As of June 2025, there were more than 1.12 billion internet users in China. As of June 2025, 322 million people in rural China were among the 161 million internet users who were 60 years of age or older. These groups' respective rates of internet penetration were 52% and 69.2%.

UK, Germany, France Lead European Fitness App Adoption

Europe is expected to grow at a significant CAGR in the fitness app market during the forecast period. With differing degrees of adoption and maturity among nations, the European market is diverse. In terms of market size and revenue, the Western European sub-regions, which include the UK, Germany, and France, are in the lead. Due to laws like the GDPR, which have made security a major concern for both consumers and app developers, the European market is characterized by a strong emphasis on data privacy.

Germany's Diabetes Rise Drives Fitness App Growth

The fitness app market in Germany is majorly driven by to rise in chronic conditions like diabetes. It is projected that there will be 10.4 million diabetics in Germany by 2050, up from 7.1 million in 2021. The International Diabetes Federation predicts that the prevalence of diabetes among Germans between the ages of 20 and 79 will stay mostly stable, with a minor decrease from 6.2 million in 2021 to 6.1 million in 2045. These findings suggest that older age groups are primarily responsible for the rise in diabetes cases.

Sweat and Smartphones: South Fitness Surge

South America is expected to grow significantly in the fitness app market during the forecast period. South America’s fitness apps expand as mobile access rises, reaching nearly 400 million with mobile internet. Diabetes and obesity pressures are growing regionally, prompting app-driven prevention and telehealth adoption. Governments and NGOs increasingly fund digital health pilots to boost activity.

Brazil’s Body: Running, Risks, Responses

Brazil’s fitness market scales alongside rising obesity measured at about 24.3 percent in 2023, driving demand for weight management apps. Smartphone penetration and community 'Academia da Saúde' programmes support digital exercise, prevention, and public health interventions and digital coaching uptake.

Health Hustle Across the Middle East and Africa

The Middle East and Africa are expected to grow at a lucrative CAGR in the fitness app market during the forecast period. The Middle East and Africa face escalating diabetes and obesity burdens, with the Eastern Mediterranean flagged among the highest global diabetes prevalence. Mobile health adoption accelerates as governments roll out digital strategies and community programmes to expand preventive care and fitness access.

GCC Moves: Challenge, Apps, Government Action

GCC nations show strong smartphone adoption and active promotion of movement through the Dubai Fitness Challenge and public health platforms. Saudi reports obesity near 23 percent, while regional studies highlight rising diabetes, driving widespread uptake of fitness apps and telehealth services.

Top Companies in the Fitness App Market

- MyFitnessPal, Inc.

- Google (Alphabet Inc.)

- Nike, Inc.

- Under Armour, Inc.

- Adidas AG

- ASICS Corporation

- Fitbit, Inc. (part of Google)

- Strava, Inc.

- Peloton Interactive, Inc.

- Noom, Inc.

- Calm

- Headspace Inc.

- Samsung Electronics Co., Ltd.

- Azumio, Inc.

- Sweat

- Freeletics GmbH

- Garmin Ltd.

- Sworkit Health

- Jefit, Inc.

- Polar Electro

Top Vendors in the Fitness App Market & Their Offerings

| Name |

Headquarters |

Market Position & Strength/Differentiation |

Recent Product Focus |

| MyFitnessPal, Inc. |

Austin, Texas, USA |

Leading nutrition-tracking platform with an extensive food database and strong personalization |

Advanced AI-powered meal logging and enhanced nutrition insights |

| Google (Alphabet Inc.) |

Mountain View, California, USA |

Core health-tracking ecosystem leveraging Android scale and deep device interoperability. |

Expanded wearable integrations and improved activity-metric accuracy in Google Fit |

| Nike, Inc. |

Beaverton, Oregon, USA |

Premium digital training brand with athlete-driven programs and a strong global community |

New performance-focused training series and upgraded Nike Training Club content |

| Under Armour, Inc. |

Baltimore, Maryland, USA |

Performance analytics leader with connected-footwear data and a strong training ecosystem |

Enhanced MapMyFitness analytics and upgraded connected-footwear metrics |

| Adidas AG |

Herzogenaurach, Germany |

Strong sports heritage translated into engaging digital fitness experiences. |

Expanded adaptive running plans and personalized digital coaching features |

Peloton Interactive, Inc.

Company Overview:

- Mission: To use technology and design to connect the world through fitness, empowering people to be the best version of themselves anywhere, anytime.

- Vision: To be the largest and most engaging fitness platform in the world, with millions of Members.

Corporate Information:

Headquarters: New York, New York, USA | Year Founded: 2012 | Ownership Type: Publicly Traded (NASDAQ: PTON)

History and Background:

- Foundation: Started as a Kickstarter project, launching the first Bike in 2013, combining high-end stationary bikes with a connected tablet streaming live/on-demand classes.

- Early Growth: Established itself as a premium, at-home fitness brand, bypassing the traditional gym model.

- Pandemic Surge: Experienced explosive growth in 2020-2021 due to lockdowns, significantly expanding its subscriber base and hardware sales.

- Post-Pandemic Shift: Focused on streamlining operations, reducing costs, and expanding its software-only membership to tap into a broader market.

Key Milestones/Timeline:

- 2012: Company founded.

- 2014: Launched the first Peloton Bike.

- 2018: Launched the Peloton Tread.

- 2019 (Sept): Initial Public Offering (IPO) on NASDAQ.

- 2023 (May): Relaunched its App with three new tiers to drive broader subscription growth.

- 2025 (Oct): Announced the launch of AI-Powered Peloton IQ and the new Peloton Cross Training Series (Q4 FY25/Q1 FY26 development).

Business Overview:

- Core Model: Subscription-first model combining premium fitness hardware with proprietary, interactive content accessible via an all-access membership.

- Revenue Mix (Q1 FY25): Approximately 67% Subscription Revenue, 33% Connected Fitness Products Revenue.

- Subscriber Base (Q3 FY25): ~2.88 million Paid Connected Fitness Subscribers and ~573,000 Paid App Subscribers.

Business Segments/Divisions:

- Connected Fitness Products: Sale of hardware (Bikes, Treads, Row, Guide).

- Subscription: Monthly subscription revenue from All-Access (hardware owners) and App memberships (digital-only users).

Geographic Presence:

USA, UK, Canada, Germany, Australia, and Austria.

Key Offerings:

- Hardware: Peloton Bike/Bike+, Tread/Tread+, Row, and Guide.

- Content: Live and On-Demand classes (Cycling, Running, Strength, Yoga, Meditation, etc.) taught by world-class instructors.

- Software: Peloton App (multiple tiers including App Free, App One, and App+), community features, and metrics tracking.

End-Use Industries Served:

- Individual Consumers (At-Home Fitness)

- Commercial/Hospitality (Peloton Pro Series targeting gyms, hotels, corporate wellness).

Key Developments and Strategic Initiatives:

Mergers & Acquisitions: Not a primary strategy; focus is on organic platform growth.

Partnerships & Collaborations:

- 2025 (Nov): Official Fitness Partner of the FORMULA 1 HEINEKEN LAS VEGAS GRAND PRIX 2025.

- 2025 (Oct): Collaboration with Hospital for Special Surgery (HSS) to enhance injury prevention and recovery education content.

- 2023: Partnership with Lululemon for co-branded apparel and digital content.

Product Launches/Innovations:

- 2025 (Oct): Introduction of the Peloton Cross Training Series.

- 2023 (May): Relaunched Peloton App with three subscription tiers (App Free, App One, App+).

- Capacity Expansions/Investments: Continued investment in content production and the technology platform. Focus has shifted from manufacturing expansion to profitability and inventory reduction.

- Regulatory Approvals: Adherence to safety standards, including a voluntary recall and remediation program for the Tread+ in previous years.

- Distribution channel strategy: Direct-to-consumer (online and retail showrooms), third-party retail partnerships (e.g., Amazon, Dick's Sporting Goods).

Technological Capabilities/R&D Focus:

- 2025 (Oct): Announced AI-Powered Peloton IQ, a new technology platform for personalized experiences.

- Focus on Connected Fitness Technology, real-time metric tracking, and content delivery infrastructure.

- Core Technologies/Patents: Proprietary hardware and software integration; a large library of licensed music for workouts.

- Research & Development Infrastructure: Dedicated in-house hardware engineering, software development, and content production studios.

- Innovation Focus Areas: AI-driven personalization, seamless multi-device experience, expanding strength/off-equipment content, and commercial market penetration.

Competitive Positioning:

- Strengths & Differentiators: Highly engaged community; high-quality, exclusive content (live and on-demand); strong instructor brand presence; integrated hardware/software experience; high customer retention rate for Connected Fitness subscribers (1.2% net monthly churn in Q3 FY25).

- Market presence & ecosystem role: Dominant market leader in the at-home connected fitness category (reported 51% market share in this sub-segment in 2024). Plays a key role in defining premium home fitness.

SWOT Analysis:

- Strengths: Brand loyalty, high retention, vast content library, integrated ecosystem.

- Weaknesses: High hardware cost (barrier to entry), dependency on the premium segment, and inventory management challenges post-pandemic.

- Opportunities: Global expansion of App-only subscriptions, B2B/Commercial partnerships, integration of AI/personalization.

- Threats: Increasing competition from cheaper digital-only apps and tech giants (Apple, Google), economic headwinds affecting discretionary spending, and hardware manufacturing risks.

Recent News and Updates:

Press Releases:

- 2025 (Nov 6): Announced Q1 FY26 Financial Results, raising Full Year 2026 Adjusted EBITDA Guidance.

- 2025 (Oct 1): Launched AI-Powered Peloton IQ and the new Peloton Cross Training Series.

- Industry Recognitions/Awards: Specific recent awards not highlighted in search results, generally recognized for product innovation and content quality.

BetterMe

Company Overview:

- Mission: To help people live happier, healthier lives by making wellness simple, accessible, and inclusive.

- Focus: A holistic approach combining fitness, nutrition, and mental wellness (mindfulness).

Corporate Information:

- Headquarters: N/A (Globally distributed, often associated with Cyprus/Ukraine for development).

- Year Founded: 2016

- Ownership Type: Private Company

History and Background:

- Foundation: Established as a developer of user-friendly mobile health and fitness applications.

- Growth Driver: Utilized highly personalized digital content and aggressive performance marketing to quickly scale a massive global user base, focusing on accessible, no-equipment workouts.

- Expansion: Expanded from fitness to include nutrition (meal planning) and mental health (meditation, somatics).

Key Milestones/Timeline:

- 2016: Company founded, launch of first apps.

- 2024: Continued strong revenue performance, often ranking among the top-grossing health and fitness apps globally.

- 2025: Focus on integrating sophisticated mind-body practices like Somatics and developing highly personalized meal plans.

Business Overview:

- Core Model: Mobile application-based subscription model (freemium with paid subscription for full access to content, personalized plans, and coaching features).

- Revenue Generation: Driven by a large volume of paying digital subscribers globally.

Business Segments/Divisions:

- BetterMe: Health Coaching: Flagship app for holistic wellness (fitness, nutrition, mind).

- BetterMe: Yoga: Focused app for yoga and stretching.

- BetterMe: Mental Health: Dedicated app for sleep and meditation.

Geographic Presence:

Strong Global Presence (High engagement in North America, Europe, and Asia).

Key Offerings:

- Workout Plans: 1,500+ workouts for all levels (running, walking, bodyweight strength, HIIT).

- Nutrition: Customized meal plans, food tracking, recipe database.

- Mental Wellness: Guided meditations, sleep stories, Somatic exercises, and breathwork.

- Coaching: AI-driven personalization and digital coaching support.

End-Use Industries Served:

Individual Consumers (Digital Health and Wellness)

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Not a primary strategy; focus is on in-house development and strategic content partnerships.

- Partnerships & Collaborations: Focus is primarily on digital influencer marketing and content development rather than large corporate partnerships.

Product Launches/Innovations:

- 2025: Launched in-depth features for Somatic Movement and refined Customized Meal Planning to focus on holistic wellness and behavior change.

- Continuous updates to algorithms for personalized plan generation (Walking, Running, Weight Loss).

- Capacity Expansions/Investments: Investment in internal R&D for AI personalization and sophisticated content production.

- Regulatory Approvals: N/A (Operates as a consumer wellness platform, not a regulated medical device).

- Distribution channel strategy: App Stores (Apple App Store, Google Play Store) with heavy reliance on performance and social media marketing.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: AI/Machine Learning for personalized fitness and nutrition plan generation; complex behavioral change algorithms.

- Research & Development Infrastructure: Emphasis on data science, AI development, and psychology-informed content creation.

- Innovation Focus Areas: Behavior change psychology, Mind-Body connection (Somatic), and hyper-personalization of nutrition and fitness plans.

Competitive Positioning:

- Strengths & Differentiators: High accessibility (low-cost/subscription, no equipment needed), vast library of diverse content, strong focus on psychological and holistic wellness (Somatic, Mental Health).

- Market presence & ecosystem role: A global high-grossing app (top competitor in the exercise/weight loss and nutrition segments) known for its effective user acquisition and broad global reach.

SWOT Analysis:

- Strengths: Massive user base, high revenue generation, affordable price point, holistic health focus, strong marketing engine.

- Weaknesses: Reports of challenging subscription cancellation and billing issues from some users, content repetition in some plans, and less integration with high-end hardware than competitors.

- Opportunities: Further integration of mental wellness and clinical-grade health features, expansion in emerging markets.

- Threats: High user churn rates are common in app-only models, intense competition from free content and new entrants, increasing cost of user acquisition.

Recent News and Updates:

Press Releases:

- 2025 (Nov): Overview releases promoting new Somatic Pilates and Gentle Somatic Yoga sequences.

- 2025 (Sept): Detailed overview of the BetterMe Walking Plan and its research-backed benefits.

- Industry Recognitions/Awards: Frequently cited in top-grossing app lists for the Health & Fitness category.

Recent Developments in the Fitness App Market

- In May 2025, the Wall Street Journal stated that the fitness app Strava raised an undisclosed sum of new funding, including debt, to reach a $2.2 billion valuation. The company, which last raised capital in 2020 at a $1.5 billion valuation, will benefit greatly from the new agreement.

- In July 2025, ApClub, a fitness startup based in Bengaluru, raised ₹2 crore in its pre-seed funding round, which was spearheaded by Curefit Healthcare Pvt Ltd. PedalStart, a renowned start-up accelerator, and angel investors like Pranay Jivrajka strategically participated.

- In July 2025, the Palta-backed health tech company Zing Coach, which uses its AI-powered fitness app to lower rising rates of physical inactivity, announced today that it has raised a $10 million Series A funding round in debt and equity. With the funding, Zing Coach will be able to grow its workforce, penetrate new markets, and keep creating ground-breaking new features for its industry-leading AI-powered fitness app.

Segments Covered in the Report

By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

By Platform

By Device

- Smartphones

- Tablets

- Wearable Devices

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA