Which Companies Are Leading the Precision Medicine Software Market ?

- OSP

- Genomind

- IQVIA

- Genedata AG

- SOPHiA GENETICS

- Tempus AI, Inc.

- Owkin, Inc

- Syapse (acquired by N-Power in January 2025)

- Inspirata, Inc.

- Precision Medicine Group, LLC.

- Siemens

- GenomOncology LLC

- Qserve

- Foundation Medicine, Inc.

- PierianDx

Introduction

The precision medicine software market is anticipated to grow significantly in the near future due to increased collaboration and licensing agreements between businesses, increased R&D investment in precision medicine, and increased partnerships between research institutions and businesses.

Markte Growth

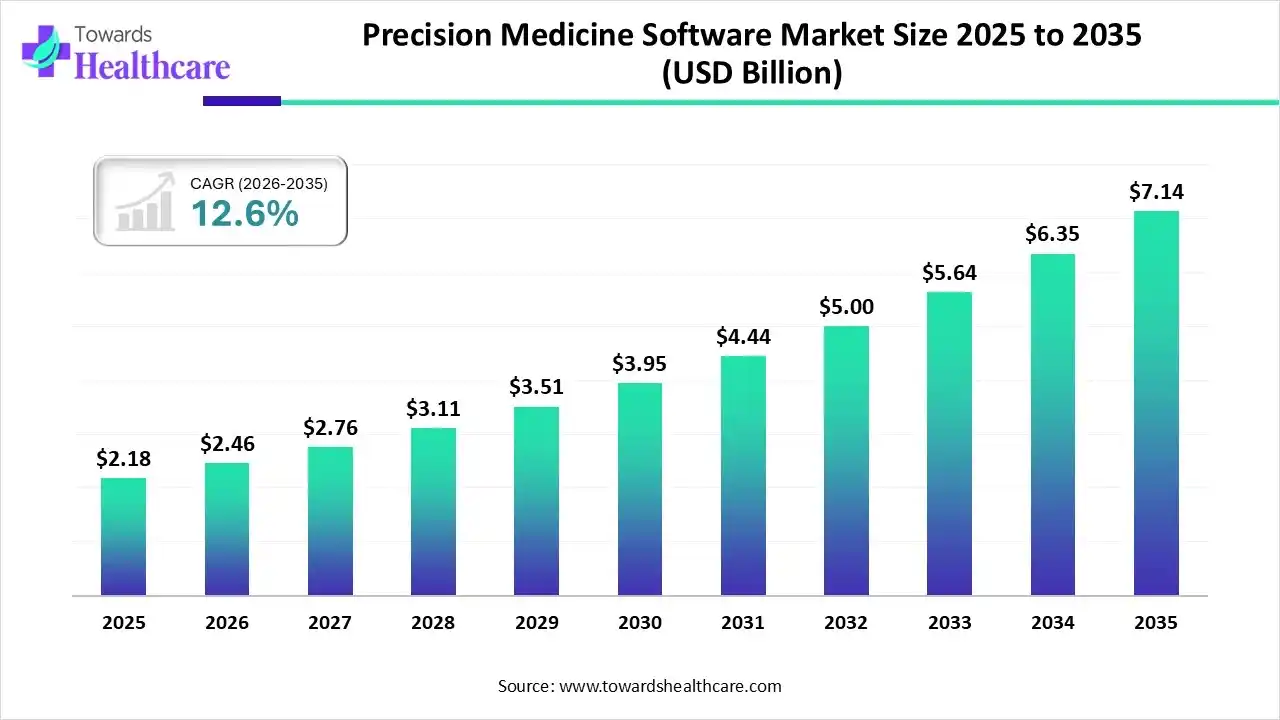

The global precision medicine software market size is calculated at US$ 2.18 billion in 2025, grew to US$ 2.46 billion in 2026, and is projected to reach around US$ 7.14 billion by 2035. The market is expanding at a CAGR of 12.6% between 2026 and 2035.

Top Vendors in the Precision Medicine Software Market & Their Offerings

1. SOPHiA GENETICS

-

Key Offering: SOPHiA DDM™ Platform (AI/ML for Multi-Modal Data)

-

Focus Area: Democratizing data-driven medicine through cloud-based analysis of genomics, radiomics, and clinical data.

2. Genomind

-

Key Offering: GenMedPro™ Precision Medicine Software

-

Focus Area: Pharmacogenomic (PGx) clinical decision support in psychiatry. Integrates PGx test results with drug–drug interactions.

3. IQVIA

-

Key Offering: Health Data Apps & AI, Orchestrated Clinical Trials

-

Focus Area: Real-world evidence (RWE) and clinical trials. Uses AI for patient stratification and accelerating precision R&D.

4. Genedata AG

-

Key Offering: Genedata Profiler®

-

Focus Area: Enterprise multi-omics data integration. Standardizes and harmonizes complex multi-omics datasets for biomarker discovery and translational medicine.

5. OSP

-

Key Offering: Digital health solutions & custom software development

-

Focus Area: Custom software and implementation services for genomics data management, LIMS, and clinical trial support.

Company Landscape

Illumina, Inc.

Company Overview:

Company Overview: A global leader in DNA sequencing and array-based technologies, providing integrated systems for genetic variation and biological function analysis. Its software is crucial for managing and interpreting massive genomic datasets generated by its sequencers, driving the adoption of precision medicine in research and clinical settings.

Corporate Information:

- Headquarters: San Diego, California, USA

- Year Founded: 1998

- Ownership Type: Public (NASDAQ: ILMN)

History and Background:

History and Background: Founded by five individuals, including David Walt, to develop high-throughput DNA sequencing and genotyping technologies. Its growth was significantly bolstered by the 2007 acquisition of Solexa, Inc., which brought the foundational next-generation sequencing (NGS) technology to the company, establishing its market dominance.

Key Milestones/Timeline:

- 1998: Company founded.

- 2007: Acquired Solexa, Inc., gaining core NGS technology.

- 2012: Launched the MiSeqDx instrument, the first FDA-regulated next-generation sequencing platform.

- 2020: Launched the DRAGEN secondary analysis platform for ultra-fast genomic data processing.

- 2022: Launched the NovaSeq X Series, enabling the $200 whole genome.

- 2024 (August): Presented a Strategy Update focusing on next-gen sequencing and genomic AI.

Business Overview:

Business Overview: Primary revenue streams include sequencing instruments, consumables (reagents/kits), and informatics/software solutions (e.g., DRAGEN, Illumina Connected Analytics). The focus is on lowering the cost of sequencing and accelerating the adoption of genomic insights into clinical care.

Business Segments/Divisions:

- Core Illumina: Includes sequencing and array platforms, consumables, and sequencing services.

- GRAIL: (Note: The company was ordered by regulatory bodies to divest GRAIL, which focused on cancer detection).

- Geographic Presence: Operates globally, serving customers in over 165 countries across the Americas, Europe, and Asia-Pacific regions.

Key Offerings:

- DRAGEN Bio-IT Platform: Comprehensive, high-speed secondary analysis software for genomic data (variant calling, tertiary analysis preparation).

- Illumina Connected Analytics (ICA): Cloud-based software for secure data management, tertiary analysis, and collaborative research in a compliant environment.

- TruSight Oncology (TSO) Portfolio: Integrated sequencing and analysis solutions for precision oncology.

End-Use Industries Served:

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Clinical Diagnostic Laboratories

- Hospitals and Health Systems

- Government Laboratories

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Recent Focus: Efforts have been largely focused on the complex regulatory-driven divestiture of GRAIL.

Partnerships & Collaborations:

- 2025 (April): Announced a collaboration with Tempus AI to accelerate clinical adoption of NGS tests using novel evidence generation and AI-driven genomic algorithms.

- 2025 (May): Partnered with Ovation.io to launch a GLP-1 dataset to accelerate new therapy development.

Product Launches/Innovations:

DRAGEN Secondary Analysis v4.4: Latest software update delivers enhanced accuracy, including a 30% improvement in structural variant calling.

Capacity Expansions/Investments:

Continuous investment in R&D to drive down the cost of sequencing and improve software processing speed and accuracy.

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

- Sequencing by Synthesis (SBS): Core technology for Next-Generation Sequencing.

- DRAGEN (Dynamic Read Analysis for GENomics): Field-programmable gate array (FPGA) based hardware and software for ultra-rapid analysis.

- Extensive patent portfolio covering sequencing chemistry, instruments, and bioinformatics.

- Research & Development Infrastructure: Global R&D centers focused on genomics, bioinformatics, and AI/Machine Learning for clinical applications.

- Innovation Focus Areas: Genomic AI (to improve sequencing data interpretation), multi-omics integration, and expanding the clinical utility of sequencing in areas beyond oncology, such as cardiology and neurology.

Competitive Positioning:

Strengths & Differentiators:

- Dominant Market Share in NGS: Virtually all genomic labs use Illumina technology, creating a massive data and platform ecosystem.

- Integrated Platform: Seamless integration of instruments, reagents, and robust bioinformatics software (DRAGEN).

- Scale and Reliability: Industry standard for data quality and high-throughput sequencing.

- Market presence & ecosystem role: The foundational platform provider for the global genomics and precision medicine ecosystem, enabling virtually all major research and population-scale genomics projects.

SWOT Analysis:

- Strengths: NGS market dominance, high-quality, high-throughput data, powerful bioinformatics (DRAGEN).

- Weaknesses: High cost of sequencers (though decreasing), reliance on consumables sales.

- Opportunities: Expansion of clinical adoption beyond cancer (pharmacogenomics, rare disease, population screening), growth in AI/ML applications.

- Threats: Competition from long-read sequencing technology, regulatory challenges.

Recent News and Updates:

Press Releases:

- 2025 (April): Announced partnership with Tempus AI to drive the future of precision medicine through genomic AI innovation.

- Industry Recognitions/Awards: Frequently recognized as a top innovator in life sciences and genomics technology.

Oracle Corporation

Company Overview:

Company Overview: A global technology corporation that, through its acquisition of Cerner, provides a comprehensive portfolio of Electronic Health Record (EHR), clinical, and administrative software, making it a critical player in health data management and precision medicine workflow.

Corporate Information:

- Headquarters: Austin, Texas, USA (Corporate), Nashville, Tennessee, USA (Oracle Health)

- Year Founded: 1977 (Oracle)

- Ownership Type: Public (NYSE: ORCL)

History and Background:

History and Background: Oracle is a leading enterprise technology provider known for its database and cloud infrastructure. Its entry into dominant healthcare IT was cemented by the $28 billion acquisition of Cerner in June 2022, creating Oracle Health. This positioned Oracle to integrate patient data from the EHR the largest source of clinical data with genomic and AI platforms to enable precision medicine at the point of care.

Key Milestones/Timeline:

- 2022 (June): Acquired Cerner Corporation for $28 billion.

- 2024 (October): Announced the plan to release a next-gen EHR platform in 2025, heavily embedded with AI and cloud capabilities to enable precision medicine workflows.

- 2025 (May): Strategic partnership with Cleveland Clinic and G42 to launch an AI-based global healthcare delivery platform, with a focus on precision medicine.

- 2025 (November): Collaboration with M42 to integrate Emirati Genome Program data into the EHR for pharmacogenomic insights at the point of care in the UAE.

Business Overview: Oracle Health provides EHR systems and a suite of clinical, financial, and population health management solutions. The strategic direction is to leverage Oracle Cloud Infrastructure (OCI) and AI/ML to transform the EHR from a system of record into a system of intelligence that supports personalized medicine.

Business Segments/Divisions:

- Cloud Services and License Support

- Cloud License and On-Premise License

- Oracle Health (formerly Cerner)

- Oracle Life Sciences (solutions for clinical trials, pharmacovigilance)

- Geographic Presence: Global presence with a vast installed base of Cerner EHR systems across North America, Europe, Asia Pacific, and the Middle East.

Key Offerings:

- EHR and Clinical Systems: (e.g., Millennium, PowerChart), which serve as the central repository for patient data.

- Oracle Health Data Intelligence (HDI): A solution integrating patient data from thousands of sources (clinical, claims, social determinants) for sophisticated analytics, crucial for precision medicine.

- Oracle Life Sciences Solutions: Platforms like Clinical One for clinical trials management, which increasingly incorporate precision medicine criteria.

End-Use Industries Served:

- Hospitals and Health Systems (Dominant)

- Pharmaceutical and Biotechnology Companies (via Oracle Life Sciences)

- Academic Medical Centers

- Government Health Agencies

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

2022: Cerner Corporation acquisition, a transformative event for their presence in healthcare IT and precision medicine software.

Partnerships & Collaborations:

- 2025 (May): Partnership with Cleveland Clinic and G42 to create an AI-based global healthcare platform.

- 2025 (September): Announced intent with DNAnexus to integrate genomic data into select Oracle Health clinical applications.

Product Launches/Innovations:

- 2025 Next-Gen EHR: Focus on a "voice-first" solution, clinical AI agents, and personalized workflows.

- Ramping up Agentic AI features for clinical trials, revenue cycle, and the patient experience.

Capacity Expansions/Investments:

Significant investment in moving Cerner systems onto the Oracle Cloud Infrastructure (OCI) for improved scalability and data processing for AI/ML.

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

- Oracle Cloud Infrastructure (OCI): Provides the secure, scalable backbone for handling large, multi-modal health data.

- Database Technologies: Industry-leading data management and analytics.

- AI/Machine Learning: Embedding a Clinical AI Agent directly into the EHR workflow.

- Research & Development Infrastructure: Large R&D focus on cloud, database, and AI, with dedicated teams in Oracle Health developing integrated clinical and genomic solutions.

- Innovation Focus Areas: Point-of-care pharmacogenomics, AI-driven diagnostics, leveraging a longitudinal patient record (clinical + genomic data), and interoperability (e.g., becoming a Qualified Health Information Network, QHIN).

Competitive Positioning:

Strengths & Differentiators:

- EHR Integration Power: Controls the core clinical workflow (EHR) where precision medicine decisions are made.

- Cloud and AI Scale: Leverages the massive infrastructure and AI capabilities of a major global tech company (Oracle).

- Broad Data Access: The EHR installed base provides access to a huge volume of real-world patient data.

- Market presence & ecosystem role: A dominant Enterprise Platform and Data Integrator, focused on bringing genomic and AI insights into the existing, day-to-day practice of medicine.

SWOT Analysis:

- Strengths: Massive EHR installed base, powerful cloud infrastructure (OCI), significant AI R&D investment.

- Weaknesses: Complex integration of legacy Cerner systems, history of challenging physician workflows.

- Opportunities: Leading the push for AI-embedded EHR and national-scale health data exchange (TEFCA).

- Threats: Competition from other major EHR vendors (Epic) and cloud providers (Microsoft, Amazon) in healthcare AI.

Recent News and Updates:

Press Releases:

- 2025 (November): M42 and Oracle Health partnership announced to advance healthy longevity and deliver pharmacogenomic insight at the point of care in the UAE.

- Industry Recognitions/Awards: Receives regular recognition for its enterprise cloud solutions and its Life Sciences suite for clinical trials.

Recent Developments in the Precision Medicine Software Market

- In November 2025, precision medicine is approaching a new age, propelled by discoveries in genetic technology and Artificial Intelligence (AI). With the launch of SPOT-MAS, an advanced screening technology created by Gene Solutions, a world leader in precision oncology and genomics, in partnership with local partner Gene Health, Taiwan has joined the worldwide trend of Multi-Cancer Early Detection (MCED).

- In January 2024, with involvement from current investors including MMC Ventures, Episode 1, and Seedcamp, Sano Genetics, a software business aiming to expedite precision medical research, has secured $11.4 million in additional investment, spearheaded by Plural.

Partner with our experts to explore the Precision Medicine Software Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking