January 2026

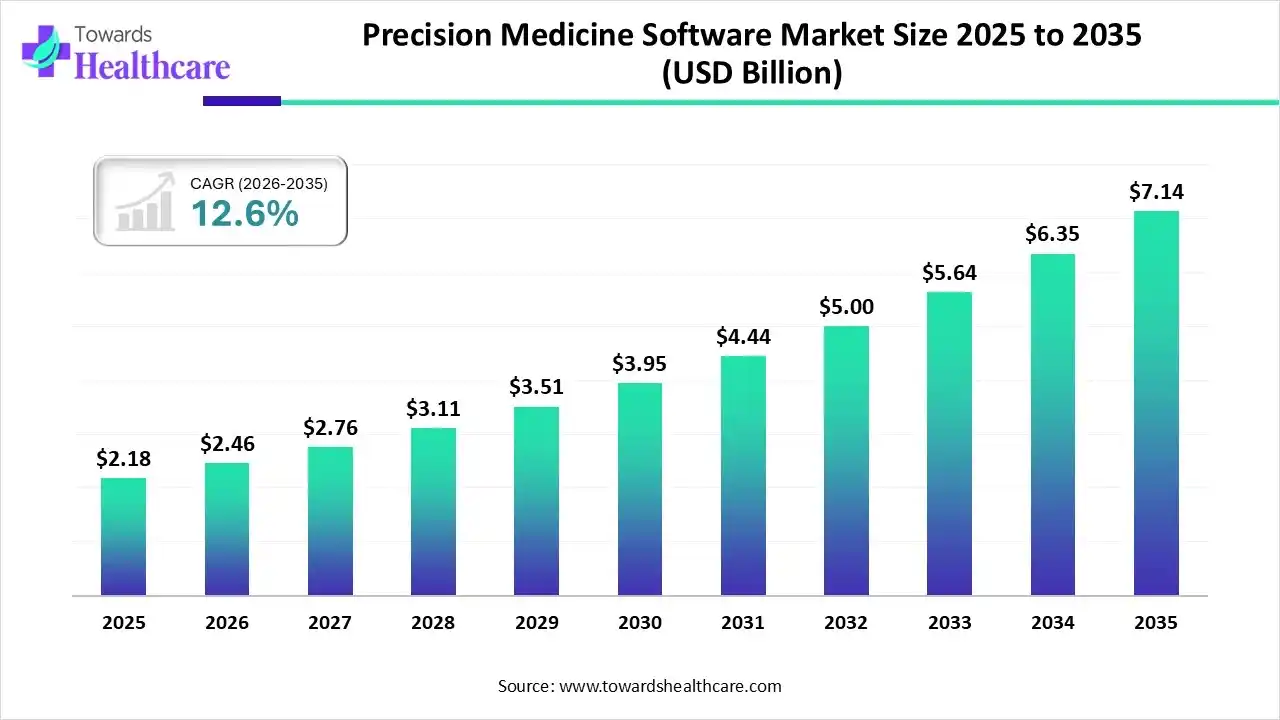

The global precision medicine software market size is calculated at US$ 2.18 billion in 2025, grew to US$ 2.46 billion in 2026, and is projected to reach around US$ 7.14 billion by 2035. The market is expanding at a CAGR of 12.6% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.46 Billion |

| Projected Market Size in 2035 | USD 7.14 Billion |

| CAGR (2026 - 2035) | 12.6% |

| Leading Region | North America |

| Market Segmentation | By Component, By Deployment Mode, By Application, By Technology, By Therapeutic Area, By End Use, By Region |

| Top Key Players | OSP, Genomind, IQVIA, Genedata AG, SOPHiA GENETICS, Tempus AI, Inc., Owkin, Inc, Syapse (acquired by N-Power in January 2025), Inspirata, Inc., Precision Medicine Group, LLC., Siemens, GenomOncology LLC, Qserve, Foundation Medicine, Inc., PierianDx |

The precision medicine software market is anticipated to grow significantly in the near future due to increased collaboration and licensing agreements between businesses, increased R&D investment in precision medicine, and increased partnerships between research institutions and businesses.

A specialized collection of computer programs or apps, called precision medicine software, is intended to assist in the creation of individualized medical treatments. A customized treatment plan created based on a patient's DNA and molecular traits is known as personalized medicine. The need for cutting-edge software technologies, such as precision medicine applications, has increased due to growing concerns about oncological illnesses and chronic diseases.

The software segment dominated the precision medicine software market in 2024. By enabling personalized therapies tailored to each patient's unique genetic profile, precision medicine is revolutionizing healthcare. Numerous software programs are being developed to support clinical decision-making, patient care, and data analysis as the field advances more quickly. Mergers and acquisitions will likely combine specialist businesses into bigger platforms, delivering more complete solutions.

Services

The services segment is expected to grow at the fastest CAGR during the forecast period. A person's genetic, molecular, and lifestyle information is used by precision medicine services to customize illness preventive and treatment plans. These offerings go beyond the "universal" approach to give more precise predictions on which therapies will work for an individual patient, hoping to increase efficacy and decrease adverse effects.

The cloud-based segment dominated the precision medicine software market in 2024. The precision medicine platform, powered by cloud-based technology, enables researchers to interact with and analyze massive datasets from any computer worldwide in a secure environment, leveraging the power of machine learning. Users can access a variety of datasets via the research interface.

On-Premise

The on-premise segment is expected to grow at a significant CAGR during the forecast period. Organizations that use on-premises deployments retain total control and accountability over all of their IT systems' hardware, software, networking, storage, and security components. In addition to giving businesses the most control over their computer environment, data placement, and security procedures, on-premises infrastructure enables direct physical access to devices.

The genomic data management & analysis segment dominated the precision medicine software market in 2024. Genomics data is always an element of customized therapy. Every day, new uses and advancements in genetic analysis are being developed, and they will continue to emerge. With the rise of software automation, the capacity to process and analyze vast amounts of human genetic data has expanded, enabling tailored medicine to become increasingly complicated.

Companion Diagnostics & Biomarker Discovery Tools

The companion diagnostics & biomarker discovery tools segment is expected to grow at the fastest CAGR during the forecast period. Biomarker discovery and companion diagnostics employ high-throughput technologies including NGS, PCR, IHC, and mass spectrometry, with software such as Qlucore Omics Explorer and digital pathology AI. For targeted medicines, these technologies make data processing, interpretation, and patient classification easier.

Multi-Omics Analytics

The multi-omics analytics segment is growing in the precision medicine software market during 2025-2034. The expanding number of multi-omics investigations needs clear conceptual processes paired with easy-to-use software tools to allow data processing and interpretation. Innovative tools are important to integrate, understand, and extract relevant information.

The AI/machine learning models & generative AI segment dominated the precision medicine software market in 2024. Artificial intelligence (AI) has emerged as a disruptive force in precision medicine, revolutionizing the integration and analysis of health records, genomes, and immunological data. The synergistic approach of integrating AI across several data sources provides clinicians with a thorough view of patient health and potential risks. Machine learning algorithms excel in detecting high-risk individuals, forecasting disease activity, and improving therapeutic strategies based on clinical, genomic, and immunological profiles. Deep learning algorithms have considerably boosted variant identification, pathogenicity prediction, splicing analysis, and MHC-peptide binding predictions in genetics.

Interoperability/FHIR/HL7 Integration

The interoperability/FHIR/HL7 integration segment is expected to grow at the fastest CAGR during the forecast period. To combine heterogeneous data, including genetic and clinical information, from various systems, precision medicine requires interoperability via standards such as FHIR (the latest version of HL7). Real-time data access is made possible by FHIR's API-based methodology and contemporary web technologies, which facilitate the development of apps that leverage this integrated data to provide individualized treatment.

High-Performance compute/HPC for Genomics

The high-performance compute/HPC for genomics segment is growing in the precision medicine software market during 2025-2034. To handle complex problems more effectively than a single processor could, HPC systems use parallel computing, in which several processors operate concurrently. This feature is vital for processing the huge data volumes and extensive calculations typical of current scientific research, including genomics. HPC is essential to precision medicine because it enables researchers to rapidly analyze large volumes of data, build complex models, and run simulations.

The oncology segment dominated the precision medicine software market in 2024. In recent years, the growth of molecularly targeted cancer medicines has considerably enhanced precision oncology. Precision oncology applications have also benefited from parallel advancements in next-generation sequencing (NGS) technology, which have made tumor genomic analysis more accessible and cheap.

Rare & Genetic Disorders

The rare & genetic disorders segment is expected to grow at the fastest CAGR during the forecast period. Since 80% of rare diseases have a genetic component, the timely delivery of genomic data and the use of different precision medicine tools have been shown to improve patient outcomes, clinical decision-making, and personalized treatment plans, all of which contribute to better management of complex diseases.

Neurology/CNS

The neurology/CNS segment is growing in the precision medicine software market during 2025-2034. In neurology and psychiatry, precision medicine methods may offer screening options, facilitate prompt identification and diagnosis, and tailor treatment plans to each patient's unique clinical, genetic, and biological characteristics and risk factors.

The hospitals segment dominated the precision medicine software market in 2024. Hospitals use a range of tools for precision medicine, with some adopting open-source platforms such as MatchMiner from Dana-Farber Cancer Institute to match patients to clinical trials. Other hospitals support their precision medicine projects with products from firms such as Tempus Labs, Syapse, Fabric Genomics, and Philips.

Diagnostic Laboratories & Genomic Service Providers

The diagnostic laboratories & genomic service providers segment is expected to grow at the fastest CAGR during the forecast period. Several diagnostic laboratories and genomic service providers employ precision medicine software to handle, analyze, and interpret complicated genetic data for tailored patient treatment. Key participants include specialist diagnostic laboratories and software businesses that offer integrated solutions.

Pharmaceutical & Biotech Companies

The pharmaceutical & biotech companies segment is growing in the precision medicine software market during 2025-2034. To improve drug development, clinical trials, and diagnostics, many pharmaceutical and biotech businesses employ AI platforms and precision medicine software, either internally produced or through partnerships with specialist tech firms.

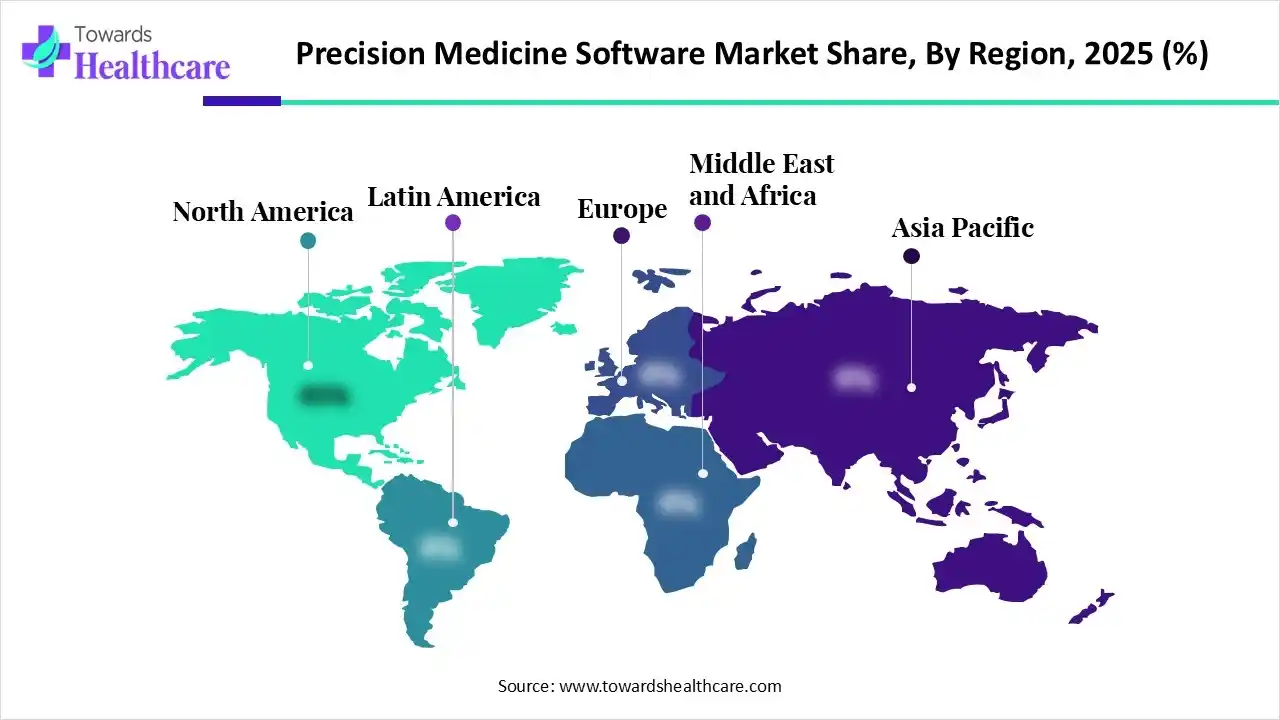

North America dominated the precision medicine software market in 2024. The rise is driven by the rising acceptance of HCITs and the expanding usage of ICT by healthcare providers and research groups. The region's focus on tailored medicine to treat a variety of uncommon and extremely difficult diseases is one of the main causes of this leadership. Precision medicine and genome sequencing have advanced significantly in North America, especially in the U.S., since the completion of the Human Genome Project.

Over 7,000 uncommon diseases afflict more than 30 million people in the U.S. The majority of uncommon illnesses have no known cure and are potentially fatal. Drug, biologic, and device development for rare illnesses is problematic for numerous reasons, including complex biology and an inadequate understanding of the natural history of many uncommon diseases. Therefore, the government, commercial enterprises, and academic institutions in the U.S. are focusing on developing superior software to address these challenges.

Asia Pacific is estimated to host the fastest-growing precision medicine software market during the forecast period, driven by healthcare digitalization, tailored medical knowledge, and genomics spending. To enhance health outcomes, nations like China, Japan, and South Korea are funding precision medicine initiatives and genetic research. The increasing prevalence of cancer and chronic illnesses needs precise, customized treatment options. Precision medicine software uptake is also being aided by improved hospital infrastructure and supporting government policy.

With its rapidly developing, cutting-edge research capabilities, extensive infrastructure development, and construction of technologically superior infrastructure, China has distinguished itself as a market leader in precision medical software. Major players are also working together to advance precision medicine.

For instance,

Europe is expected to grow at a significant CAGR in the precision medicine software market during the forecast period. It is anticipated that precision medication delivery systems would enhance patient outcomes throughout Europe. It is made up of investors prepared to fund the expenses of pharmaceutical and healthcare firms keen to develop genetic testing and analytics technologies. Additionally, European drug research facilities are focusing on developing tailored treatment plans, whilst companion diagnostics companies are focusing on effectively collecting data. Analysis of patient clinical data is also enhanced by genetic analytics.

The many people living with more than 7,000 distinct, uncommon illnesses in England sometimes struggle to receive the healthcare they need. With the support of the England Rare Diseases Action Plan 2025, our administration is steadfastly dedicated to improving the NHS and making it accessible to everyone.

The South American precision medicine software market is experiencing steady growth, supported by improving overall healthcare systems and rising awareness. Governments are increasingly backing genomics initiatives, which spur software platform implementation. This advancement is helping integrate genetic data into mainstream clinical decision-making to improve patient care.

Brazil is demonstrating robust expansion in precision medicine software, driven by rising demand for personalized healthcare solutions. Increased investments in digital health infrastructure and a growing focus on genomic research are critical recent factors. The adoption of advanced software to manage large genomic datasets is accelerating quickly.

The Middle East and Africa are expected to grow at a lucrative CAGR in the precision medicine software market during the forecast period, driven by the rising burden of chronic diseases. Enhanced healthcare spending and the initial adoption of AI for diagnostics are key drivers. There is a concerted effort to leverage technology to deliver more tailored and effective patient care.

The GCC countries are witnessing a strong market surge, fueled by substantial government investments in genomic technologies and IT. Key initiatives, such as large-scale national genomics programs, are boosting demand for software. This regional focus aims to integrate complex multiomics data into patient-specific treatment plans.

| Company | Key Offerings | Focus Area |

| SOPHiA GENETICS | SOPHiA DDM™ Platform (AI/ML for Multi-Modal Data) | Democratizing Data-Driven Medicine: Cloud-based analysis of genomics, radiomics, and clinical data. |

| Genomind | GenMedPro™ Precision Medicine Software | Pharmacogenomic (PGx) Clinical Decision Support in psychiatry. Integrates PGx test results with drug-drug interactions. |

| IQVIA | Health Data Apps & AI, Orchestrated Clinical Trials | Real-World Evidence (RWE) and Clinical Trials. AI for patient stratification and accelerating precision R&D. |

| Genedata AG | Genedata Profiler® | Enterprise Multi-omics Data Integration. Standardizes and harmonizes complex multi-omics data for biomarker discovery and translational medicine. |

| OSP | Digital Health Solutions, Custom Software Development | Custom Software & Implementation Services for genomics data management, LIMS, and clinical trial support. |

Company Overview:

Company Overview: A global leader in DNA sequencing and array-based technologies, providing integrated systems for genetic variation and biological function analysis. Its software is crucial for managing and interpreting massive genomic datasets generated by its sequencers, driving the adoption of precision medicine in research and clinical settings.

Corporate Information:

History and Background:

History and Background: Founded by five individuals, including David Walt, to develop high-throughput DNA sequencing and genotyping technologies. Its growth was significantly bolstered by the 2007 acquisition of Solexa, Inc., which brought the foundational next-generation sequencing (NGS) technology to the company, establishing its market dominance.

Key Milestones/Timeline:

Business Overview:

Business Overview: Primary revenue streams include sequencing instruments, consumables (reagents/kits), and informatics/software solutions (e.g., DRAGEN, Illumina Connected Analytics). The focus is on lowering the cost of sequencing and accelerating the adoption of genomic insights into clinical care.

Business Segments/Divisions:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Recent Focus: Efforts have been largely focused on the complex regulatory-driven divestiture of GRAIL.

Partnerships & Collaborations:

Product Launches/Innovations:

DRAGEN Secondary Analysis v4.4: Latest software update delivers enhanced accuracy, including a 30% improvement in structural variant calling.

Capacity Expansions/Investments:

Continuous investment in R&D to drive down the cost of sequencing and improve software processing speed and accuracy.

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

Competitive Positioning:

Strengths & Differentiators:

SWOT Analysis:

Recent News and Updates:

Press Releases:

Company Overview:

Company Overview: A global technology corporation that, through its acquisition of Cerner, provides a comprehensive portfolio of Electronic Health Record (EHR), clinical, and administrative software, making it a critical player in health data management and precision medicine workflow.

Corporate Information:

History and Background:

History and Background: Oracle is a leading enterprise technology provider known for its database and cloud infrastructure. Its entry into dominant healthcare IT was cemented by the $28 billion acquisition of Cerner in June 2022, creating Oracle Health. This positioned Oracle to integrate patient data from the EHR the largest source of clinical data with genomic and AI platforms to enable precision medicine at the point of care.

Key Milestones/Timeline:

Business Overview: Oracle Health provides EHR systems and a suite of clinical, financial, and population health management solutions. The strategic direction is to leverage Oracle Cloud Infrastructure (OCI) and AI/ML to transform the EHR from a system of record into a system of intelligence that supports personalized medicine.

Business Segments/Divisions:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

2022: Cerner Corporation acquisition, a transformative event for their presence in healthcare IT and precision medicine software.

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Significant investment in moving Cerner systems onto the Oracle Cloud Infrastructure (OCI) for improved scalability and data processing for AI/ML.

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

Competitive Positioning:

Strengths & Differentiators:

SWOT Analysis:

Recent News and Updates:

Press Releases:

By Component

By Deployment Mode

By Application

By Technology

By Therapeutic Area

By End Use

By Region

January 2026

January 2026

January 2026

January 2026