Here are the Top Companies in the Sinusitis Drugs Market - You Must Know!

Sinusitis Drugs: From Congestion to Clarity

The sinusitis drugs market is experiencing robust growth, driven by the rising prevalence of sinusitis, growing demand for biologics, increasing research activities, and advances in drug delivery technologies. It encompasses the development, manufacturing, and supply of drugs for the treatment of sinusitis. Sinusitis refers to the inflammation of the sinuses that is usually caused by bacteria, allergies, a deviated septum, and a weakened immune system. Common medications include antibiotics (penicillin, cephalosporin, amoxicillin/clavulanate), antihistamines (diphenhydramine, doxylamine, loratadine), and corticosteroids (fluticasone, budesonide, mometasone).

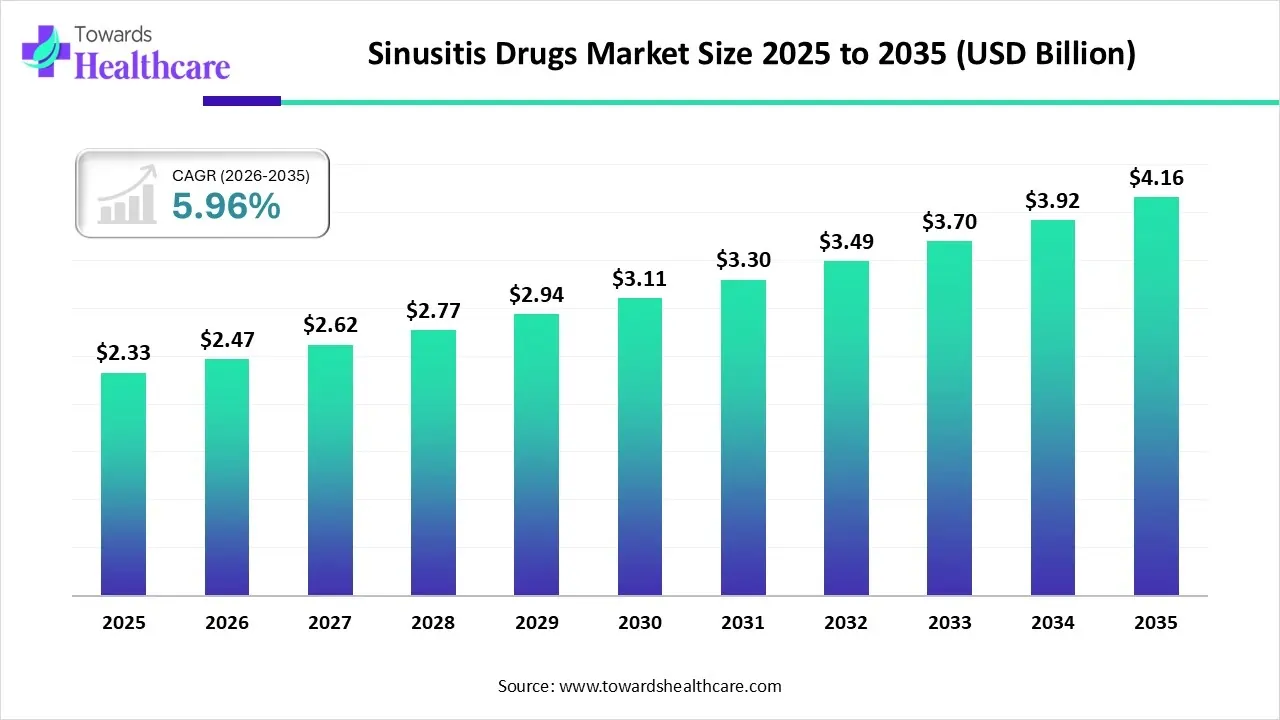

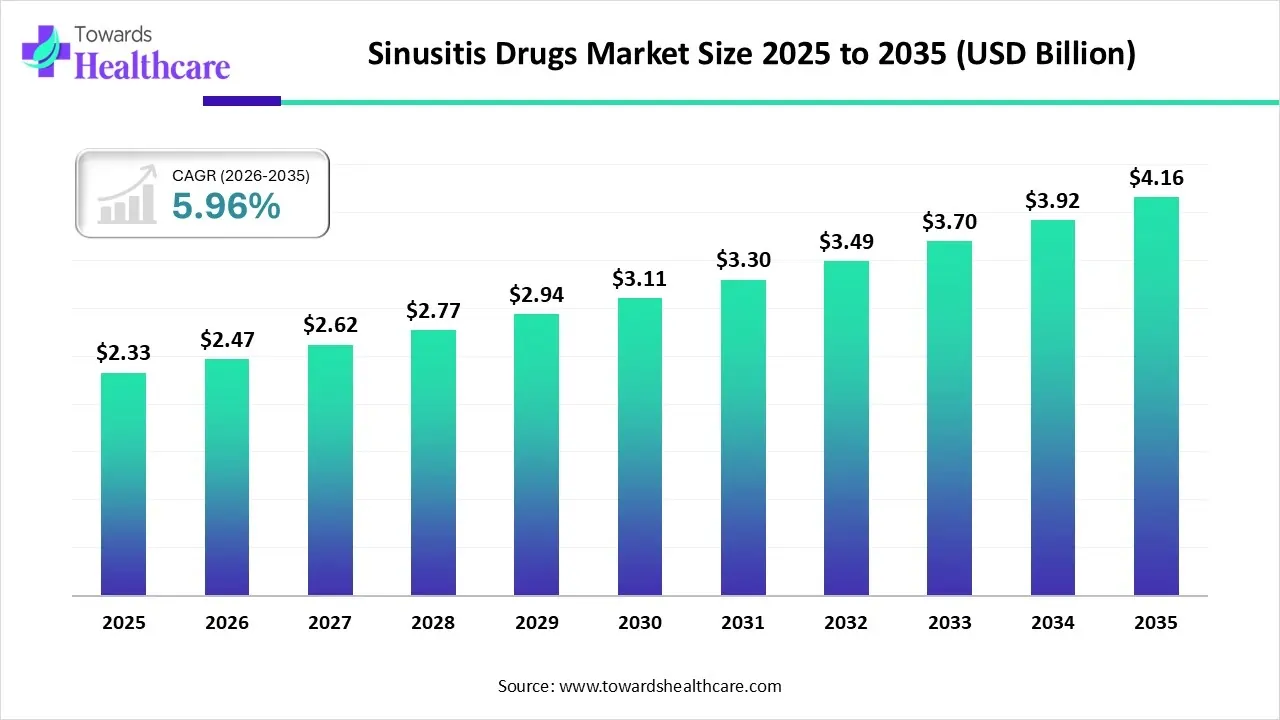

Market Growth

The global sinusitis drugs market size is calculated at USD 2.33 billion in 2025, grew to USD 2.47 billion in 2026, and is projected to reach around USD 4.16 billion by 2035. The market is expanding at a CAGR of 5.96% between 2026 and 2035.

Sinusitis Drugs Market Outlook

- Industry Growth Overview: The market is expected to accelerate in the coming years, especially in underdeveloped and developing countries. Innovations in drug delivery systems and the development of combination therapies contribute to market growth. Novel biologics are developed to provide targeted treatment.

- Global Expansion: Key players in the sinusitis drugs market collaborate to expand their geographical presence across diverse geographical locations, serving a larger patient population. In March 2025, Paratek Pharmaceuticals acquired Optinose, Inc., including its product XHANCE (fluticasone propionate).

- Major Investors: Private equity firms and venture capitalists provide funding to pharmaceutical and biotech companies to develop novel drugs against sinusitis and evaluate them in humans. In May 2025, the National Institute of Health (NIH) granted $7 million to Oregon Health & Science University to study new medical treatments for chronic sinusitis.

Top Companies & Their Offerings in the Sinusitis Drugs Market

-

Cipla Ltd.

-

Headquarters: Mumbai, India

-

Offering: Naselin Nasal Spray

-

Sales: The company generated a revenue of INR 25,455 crore in FY 2024

-

Sanofi

-

Bayer AG

-

Headquarters: Leverkusen, Germany

-

Offering: Claritin (loratadine)

-

Sales: The Allergy & Cold segment generated sales of €266 million in Q2 2025

-

Monaghan Medical Corporation

-

Pfizer, Inc.

-

Headquarters: New York, United States

-

Offering: Zithromax

-

Sales: The full-year 2024 revenue of the company was $63.6 billion

Company Landscape

GSK plc

Company Overview:

- GSK (formerly GlaxoSmithKline) is a leading global biopharmaceutical company focused on pharmaceuticals, vaccines, and specialty medicines.

Corporate Information:

- Headquarters: London, United Kingdom.

- Year Founded: 2000 (merger of Glaxo Wellcome and SmithKline Beecham).

- Ownership Type: Public (FTSE 100 company).

History and Background:

- GSK has roots going back to Glaxo Wellcome and SmithKline & French; the 2000 merger formed GSK.

- Over time, it has built a strong respiratory and inflammation drug portfolio.

Key Milestones / Timeline:

- 2024: Acquired Aiolos Bio for over $ 1 billion to strengthen the respiratory pipeline.

- 2025: Launched a £2.5 billion share buyback amid strong specialty-medicine growth.

- 2025 (planned): GSK CEO Emma Walmsley to step down end-year, successor Luke Miels from Jan 2026.

Business Overview:

- Divisions: Pharmaceuticals, Vaccines, Specialty Medicines (Respiratory, HIV, Oncology, etc.).

- Focus on respiratory disease and inflammation.

Geographic Presence:

- Operates globally with manufacturing, R&D, and commercial operations in Europe, the U.S., Asia, and emerging markets.

Key Offerings:

- Respiratory biologics, corticosteroids, long-acting antibodies.

- An investigational ultra-long-acting biologic (depemokimab) in development for chronic rhinosinusitis with nasal polyps.

End-Use Industries Served:

- Hospitals, specialty ENT clinics, respiratory care centers.

Key Developments & Strategic Initiatives:

- Acquisition of Aiolos Bio to boost respiratory pipeline.

- Presenting new pipeline data at major respiratory conferences.

Mergers & Acquisitions:

- Acquired Aiolos Bio in 2024 (~$1.4B) for its respiratory treatment AIO-001.

- Historically formed via the merger of Glaxo Wellcome & SmithKline Beecham in 2000.

Partnerships & Collaborations:

- Works with external biotech firms to co-develop respiratory therapies.

Product Launches / Innovations:

- Depemokimab: investigational monoclonal antibody for nasal polyps, designed for twice-yearly dosing.

Capacity Expansions / Investments:

- Increased R&D investment in respiratory, immunology & inflammation.

Regulatory Approvals:

- Has regulatory expertise in respiratory and biologic drug approval globally.

Distribution Channel Strategy:

- Uses both hospital pharmacies and specialty clinic networks.

Technological Capabilities / R&D Focus:

- Deep R&D in biologics targeting type 2 inflammation, cytokine pathways (like IL-5).

- Strong pipeline in respiratory immunology.

Core Technologies / Patents:

- Biological therapeutics (monoclonal antibodies), long-acting cytokine inhibitors.

Research & Development Infrastructure:

- Major R&D centers in the UK, the U.S., and collaborations globally.

Innovation Focus Areas:

- Respiratory biologics, long-acting antibodies, novel inflammation pathways.

Competitive Positioning:

- Strong heritage in respiratory; positioning as specialty medicine leader.

Strengths & Differentiators:

- Broad respiratory portfolio, strong pipeline, financial strength.

- Strategic M&A to bolster innovation.

Market Presence & Ecosystem Role:

- One of the leading players in sinusitis via its respiratory biologics strength.

SWOT Analysis:

- Strengths: Deep respiratory R&D, strong global footprint, robust cash flow

- Weaknesses: Patent risk, high R&D spending

- Opportunities: Emerging biologics, unmet need in chronic sinusitis

- Threats: Competition from other biologics, regulatory hurdles

Recent News & Updates / Press Releases:

- In 2025, GSK launched a £2.5B share buyback.

- Collaboration deal with China’s Hengrui Pharma for respiratory drug development.

Industry Recognitions / Awards:

- Not specific to sinusitis, but GSK is widely recognized for its respiratory innovation leadership.

Sanofi S.A.

Company Overview:

- Sanofi is a major global pharmaceutical and biotech company focused on specialty care, vaccines, and immunology.

Corporate Information:

- Headquarters: Paris, France.

- Year Founded: 1973 (as Sanofi), evolved via several mergers.

- Ownership Type: Public (traded on Euronext Paris and NASDAQ).

History and Background:

- Formed from multiple mergers (Sanofi-Aventis, Genzyme acquisition) to build a diversified global pharma.

- Has grown by combining research, biotechnology, and established drug portfolios.

Key Milestones / Timeline:

- Acquired Genzyme in 2011 to strengthen its biotech and rare-disease capability.

- 2025: Sanofi’s Dupixent sBLA for pediatric allergic fungal rhinosinusitis accepted for FDA priority review.

- 2025: Phase 4 EVEREST trial: Dupixent superior to Xolair in CRSwNP with asthma.

Business Overview:

- Segments: Specialty Care (immunology, rare disease), General Medicines, Vaccines.

- Strong focus on immunology and inflammation.

Geographic Presence:

- Global operations, with major markets in Europe, North America, Asia, and emerging markets.

Key Offerings:

- Dupixent (dupilumab): monoclonal antibody targeting IL-4/IL-13, approved for chronic rhinosinusitis with nasal polyps (CRSwNP).

- Other immunology, respiratory, and rare disease therapies.

End-Use Industries Served:

- Hospitals, ENT clinics, immunology centers, allergy treatment centers.

Key Developments & Strategic Initiatives:

- Sanofi and Regeneron’s EVEREST Phase 4 study showed Dupixent superiority over omalizumab in CRSwNP with asthma.

- sBLA for dupilumab in children (6+) for allergic fungal rhinosinusitis accepted by FDA.

Mergers & Acquisitions:

- Acquired Genzyme in 2011.

- Ongoing partnership with Regeneron for Dupixent development.

Partnerships & Collaborations:

- Global collaboration with Regeneron for dupilumab.

Product Launches / Innovations:

- In June 2025, reported positive Phase 4 data from EVEREST (Dupixent vs Omalizumab) in CRSwNP + asthma.

- Developing new indications; in Nov 2025, sBLA for AFRS in children was accepted.

Capacity Expansions / Investments:

- Continues investing in clinical trials and manufacturing capacity for biologics globally.

Regulatory Approvals:

- Dupixent is approved in the EU for CRSwNP.

- sBLA under priority review by the FDA for pediatric allergic fungal rhinosinusitis.

Distribution Channel Strategy:

- Uses hospital and specialty clinic networks, and works via immunology and ENT specialists.

Technological Capabilities / R&D Focus:

- Biologics (monoclonal antibodies), immunology, type-2 inflammation pathways.

Core Technologies / Patents:

- IL-4/IL-13 inhibition technology (dupilumab), other immunologic biologic platforms.

Research & Development Infrastructure:

- Global R&D capabilities across Europe, US, Asia; dedicated immunology research units.

Innovation Focus Areas:

- Inflammatory diseases, type-2 inflammation, sinusitis biologics, allergic respiratory conditions.

Competitive Positioning:

- Strong in immunology biologics, especially in severe sinusitis (CRSwNP), with Dupixent as a flagship product.

Strengths & Differentiators:

- Proven biologic therapy, strong clinical data, broad global presence, deep R&D partnerships.

Market Presence & Ecosystem Role:

- Key leader in sinusitis biologics market; driving advanced, targeted therapies.

SWOT Analysis:

- Strengths: Best-in-class biologic, established global partnership, robust pipeline

- Weaknesses: High cost of biologics, regulatory risk, competition from other antibody therapies

- Opportunities: New indications (e.g., AFRS), pediatric approvals, expanding in emerging markets

- Threats: Competing biologics, biosimilars, payer access constraints

Recent News & Updates / Press Releases:

- June 2025: EVEREST Phase 4 showed Dupixent outperforms Omalizumab in nasal polyp + asthma.

- Nov 2025: FDA accepted sBLA for Dupixent in pediatric allergic fungal rhinosinusitis.

Industry Recognitions / Awards:

- While no sinusitis-specific awards, Dupixent is widely recognized in immunology and respiratory therapy circles for innovation.

Value Chain Analysis - Sinusitis Drugs Market

R&D

The latest research focuses on developing monoclonal antibodies and novel drug delivery systems.

Key Players: Sanofi, Pfizer, Inc., and AstraZeneca.

Clinical Trials & Regulatory Approvals

Clinical trials are conducted to compare the symptom relief of sinusitis drugs, as well as to demonstrate their efficacy.

Key Players: Lyra Therapeutics, Clinrol, Bayer AG, and Chia Tai Tianqing Pharmaceutical Group Co., Ltd.

Patient Support & Services

It refers to medications and supportive care measures, such as self-care, lifestyle adjustments, and professional guidance.

Recent Developments in the Sinusitis Drugs Market

- In October 2025, Amgen and AstraZeneca announced that they received the U.S. Food and Drug Administration (FDA) approval for TEZSPIRE (tezepelumab-ekko) for the add-on maintenance treatment of controlled chronic rhinosinusitis with nasal polyps (CRSwNP) in adults and adolescents.

- In May 2024, Optinose received the U.S. FDA approval for its XHANCE (fluticasone propionate) nasal spray, a drug-device combination product, for the treatment of chronic rhinosinusitis without nasal polyps in patients 18 years or older. The approval was based on data from the ReOpen program.

Collaborate with our experts to explore the Sinusitis Drugs Market at sales@towardshealthcare.com