February 2026

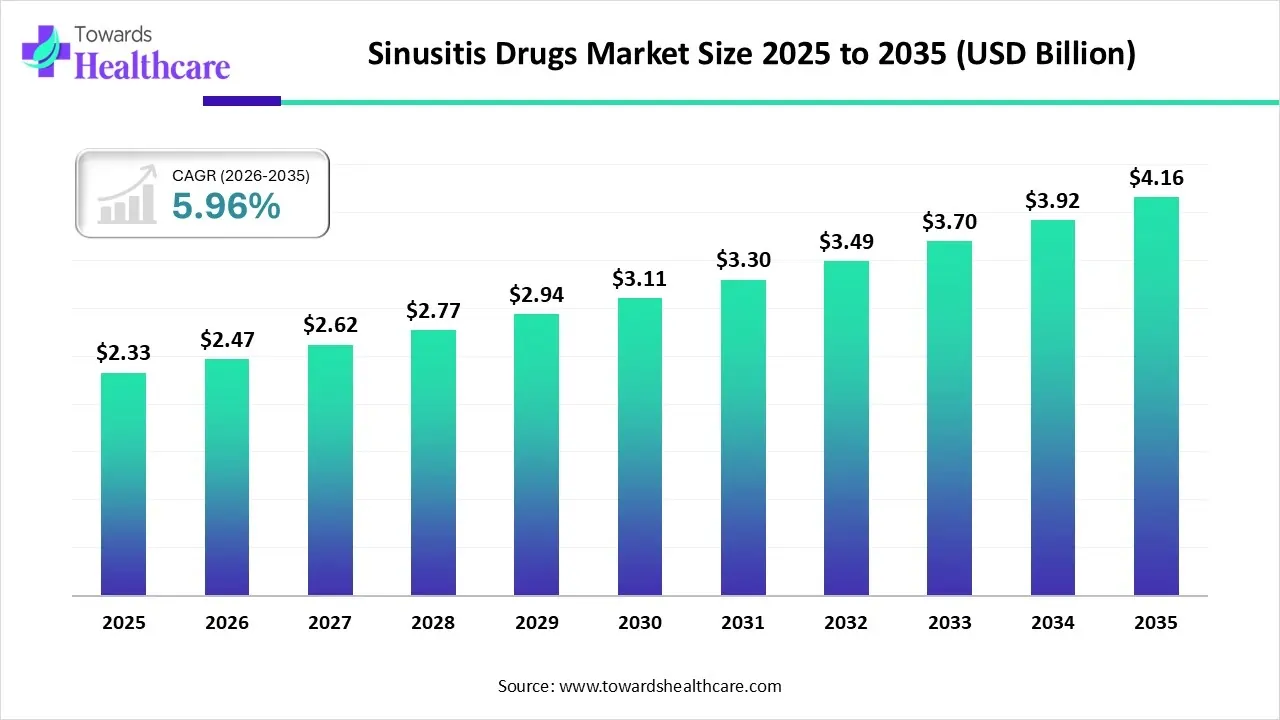

The global sinusitis drugs market size is calculated at USD 2.33 billion in 2025, grew to USD 2.47 billion in 2026, and is projected to reach around USD 4.16 billion by 2035. The market is expanding at a CAGR of 5.96% between 2026 and 2035.

The sinusitis drugs market is primarily driven by the rising prevalence of sinus-related conditions and growing research and development activities. Government and private organizations provide funding to support research related to sinusitis. Artificial intelligence (AI) can help develop novel sinusitis drugs and accurately predict disease outcomes. The market future is promising, driven by advancements in drug delivery systems.

| Key Elements | Scope |

| Market Size in 2025 | USD 2.33 Billion |

| Projected Market Size in 2035 | USD 4.16 Billion |

| CAGR (2025 - 2035) | 5.96% |

| Leading Region | North America |

| Market Segmentation | By Disease, By Drug Class, By Distribution Channel, By Region |

| Top Key Players | J & J Dechane Laboratories Pvt. Ltd., Dr. Reddy’s Laboratories, Bristol Myers Squibb, Aetna, Himalaya Drug Company, Teva Pharmaceuticals, AstraZeneca, GlaxoSmithKline, Inc. |

The sinusitis drugs market is experiencing robust growth, driven by the rising prevalence of sinusitis, growing demand for biologics, increasing research activities, and advances in drug delivery technologies. It encompasses the development, manufacturing, and supply of drugs for the treatment of sinusitis. Sinusitis refers to the inflammation of the sinuses that is usually caused by bacteria, allergies, a deviated septum, and a weakened immune system. Common medications include antibiotics (penicillin, cephalosporin, amoxicillin/clavulanate), antihistamines (diphenhydramine, doxylamine, loratadine), and corticosteroids (fluticasone, budesonide, mometasone).

AI has emerged as a transformative technology, revolutionizing diagnostics and patient care in the field of medicine. It streamlines the diagnosis and treatment of sinusitis, enhancing the accuracy and precision. AI and machine learning (ML) algorithms analyze vast amounts of datasets and enable researchers to tailor treatment strategies for sinusitis. Tailoring treatment can enhance efficacy, reduce unnecessary costs, and minimize potential side effects. AI can be instrumental in identifying novel biomarkers that correlate with treatment response over time.

Which Disease Segment Dominated the Sinusitis Drugs Market?

Chronic Sinusitis

The chronic sinusitis segment held a dominant position in the market in 2024, due to the need for long-term treatment, as chronic sinusitis lasts for about 12 weeks or longer. Advanced diagnostic tools have been developed to promote the early detection of chronic sinusitis. Chronic sinusitis treatment focuses on controlling or easing inflammation using corticosteroids, antibiotics, and antihistamines. It is a more common condition compared to acute sinusitis.

Acute Sinusitis

The acute sinusitis segment is expected to grow at the fastest CAGR in the sinusitis drugs market during the forecast period. Acute sinusitis is a common ailment, especially among Americans, affecting almost 90% of all adults at some point in their lifetime. It is commonly treated using antibiotics, topical steroids, decongestants, and mucolytics. It requires timely treatment to stop the infection from spreading and prevent further complications.

Why Did the Antibiotics Segment Dominate the Sinusitis Drugs Market?

Antibiotics

The antibiotics segment held the largest revenue share of the market in 2024. The segment dominated because sinusitis is mainly caused by bacterial infections. Antimicrobial therapy is the mainstay of treatment for sinusitis. The choice of antibiotics depends on the type and severity of sinusitis. A research study demonstrates that almost 90% of the U.S. adults diagnosed with acute sinusitis are prescribed antibiotics. Antibiotics kill or inactivate bacteria and help relieve symptoms faster.

Corticosteroids

The corticosteroids segment is expected to grow with the highest CAGR in the sinusitis drugs market during the studied years. Adjuvant treatment with corticosteroids along with antibiotics is beneficial for short-term symptom relief, especially in acute sinusitis. Intranasal corticosteroids are prescribed for mild to moderate sinusitis. Novel drug delivery systems are developed to modify the release of corticosteroids in the nasal passage.

Antihistamines

The antihistamines segment is expected to grow significantly, due to the need to treat allergy symptoms. Antihistamines block inflammation caused by an allergic reaction, so they can help fight symptoms of allergies that can lead to swollen nasal and sinus passages. The availability of over-the-counter (OTC) antihistamines also augments the segment’s growth. Antihistamines have reduced the chances of drug resistance.

How the Hospital Pharmacies Segment Dominated the Sinusitis Drugs Market?

Hospital Pharmacies

The hospital pharmacies segment contributed the biggest revenue share of the market in 2024, due to favorable infrastructure and the presence of skilled professionals. Skilled professionals guide patients on the indications, dosage regimen, and delivery of sinusitis drugs. Suitable capital investments enable pharmacists to purchase high-quality, branded drugs for sinusitis. The increasing number of patient visits in hospitals also propels the segment’s growth.

Online Pharmacies

The online pharmacies segment is expected to expand rapidly in the sinusitis drugs market in the coming years. Online pharmacies allow patients to purchase the desired medications from a wide range of options and compare price ranges. The growing geriatric population and the burgeoning e-commerce sector boost the segment’s growth. Online pharmacies offer numerous benefits, such as free home delivery and virtual consultations.

Retail Pharmacies

The retail pharmacies segment is expected to show lucrative growth, driven by the increasing number of retail pharmacies, thereby enhancing patient accessibility to affordable medications. It is estimated that approximately 88.9% of the U.S. population lives within 5 miles of a community pharmacy. Patients mostly prefer retail pharmacies as they possess OTC drugs and generic alternatives. Retail pharmacies provide special discounts, same-day home delivery, and 24/7 services.

North America dominated the global market in 2024. The presence of a robust healthcare infrastructure, the availability of state-of-the-art research and development facilities, and favorable regulatory support are factors that govern market growth in North America. The rising prevalence of sinus-related disorders and increasing R&D investments boost the market.

The Centers for Disease Control and Prevention (CDC) reported that approximately 28.9 million adults suffer from chronic sinusitis in the U.S. The Allergy Asthma & Sinus Associates stated that Americans spend more than $1 billion on OTC medications to manage the symptoms of sinusitis and over $150 million on prescription medications.

Asia-Pacific is expected to grow at the fastest CAGR in the upcoming years. Countries like China, India, and Japan are at the forefront of developing novel drugs for the treatment of sinusitis. The burgeoning healthcare, pharmaceutical, and biotech sectors facilitate the use of innovative therapeutic regimens for sinusitis. The region has a favorable manufacturing infrastructure, enabling foreign companies to set up their manufacturing facilities. Additionally, it is also home to companies that focus on developing generic drugs for sinusitis treatment.

Key players, such as Asgen Pharmaceuticals Co. Ltd., GSK, and Henan Kangzhimei Daily Chemical Co., Ltd., are major contributors to the market in China. The most common treatment regimen for sinusitis among the Chinese is the Chinese herbal medicines (CHMs). CHMs have long been used for nasal disorders, including rhinosinusitis, and feature in Chinese clinical guidelines.

Europe is expected to grow at a notable CAGR in the foreseeable future. Government organizations launch initiatives and provide funding to support research in sinusitis. The European Medicines Agency (EMA) regulates the approval of sinusitis drugs in Europe. European nations are making constant efforts to establish their research and clinical trial infrastructure. As of November 2025, 78 trials are registered on the EudraCT website related to sinusitis.

Acute sinusitis is estimated to affect 3 in 1000 people in the UK, while chronic sinusitis affects 1 in 7 people in the UK. The UK government also actively supports sinusitis research through funding initiatives. It has formed the NHS Antimicrobial Product Subscription Model to incentivize research and innovation in the antibiotic development sector by providing a guaranteed financial return.

Treatment uptake is rising across South America, both in public and private clinics. Urban pollution, seasonal allergies, and the growing need for patient education are driving demand. Local and regional drugmakers, alongside global players, are expanding intranasal therapies and diagnostics initiatives.

In Brazil, sinusitis care is surging through urban hospitals and specialty clinics. Rising pollution and insurance coverage expansion are fueling demand for intranasal corticosteroids, combination therapies, and minimally invasive procedures. Local-global partnerships are helping scale access and supply.

Across the Middle East and Africa, improving healthcare infrastructure is expanding sinusitis diagnosis. Hospitals in Gulf and North African nations are increasingly prescribing corticosteroids and biologics. Telemedicine and awareness programs are closing care gaps, especially in underserved populations.

In the UAE, specialized ENT centers are seeing a growing caseload of chronic sinusitis driven by lifestyle and environmental factors. Advanced diagnostics, biologic therapies, and non-invasive treatment options are being embraced, backed by private investment and trained specialists.

The latest research focuses on developing monoclonal antibodies and novel drug delivery systems.

Key Players: Sanofi, Pfizer, Inc., and AstraZeneca.

Clinical trials are conducted to compare the symptom relief of sinusitis drugs, as well as to demonstrate their efficacy.

Key Players: Lyra Therapeutics, Clinrol, Bayer AG, and Chia Tai Tianqing Pharmaceutical Group Co., Ltd.

It refers to medications and supportive care measures, such as self-care, lifestyle adjustments, and professional guidance.

Company Overview:

Corporate Information:

History and Background:

Key Milestones / Timeline:

Business Overview:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments & Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations:

Product Launches / Innovations:

Capacity Expansions / Investments:

Regulatory Approvals:

Distribution Channel Strategy:

Technological Capabilities / R&D Focus:

Core Technologies / Patents:

Research & Development Infrastructure:

Innovation Focus Areas:

Competitive Positioning:

Strengths & Differentiators:

Market Presence & Ecosystem Role:

SWOT Analysis:

Recent News & Updates / Press Releases:

Industry Recognitions / Awards:

Company Overview:

Corporate Information:

History and Background:

Key Milestones / Timeline:

Business Overview:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments & Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations:

Product Launches / Innovations:

Capacity Expansions / Investments:

Regulatory Approvals:

Distribution Channel Strategy:

Technological Capabilities / R&D Focus:

Core Technologies / Patents:

Research & Development Infrastructure:

Innovation Focus Areas:

Competitive Positioning:

Strengths & Differentiators:

Market Presence & Ecosystem Role:

SWOT Analysis:

Recent News & Updates / Press Releases:

Industry Recognitions / Awards:

| Companies | Headquarters | Offerings | Sales |

| Cipla Ltd. | Mumbai, India | Naselin Nasal Spray | The company generated a revenue of INR 25,455 crore in FY 2024 |

| Sanofi | Paris, France | Dupixent | Dupixent reported total sales of €4.2 billion in Q3 2025 |

| Bayer AG | Leverkusen, Germany | Claritin (loratadine) | The Allergy & Cold segment generated sales of €266 million in Q2 2025 |

| Monaghan Medical Corporation | New York, United States | Nasoneb Sinus Therapy System | - |

| Pfizer, Inc. | New York, United States | Zithromax | The full-year 2024 revenue of the company was $63.6 billion |

By Disease

By Drug Class

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026