Major Companies & Their Key Offerings in Viral Vector and Transduction Reagents Market

Lonza Group

Key Offerings: End-to-end CDMO services for viral vectors and cell/gene therapies, from process development to commercial manufacturing.

Takara Bio Inc.

Key Offerings: Lentiviral and retroviral delivery systems and transduction reagents for gene therapy and regenerative medicine research.

Bio-Rad Laboratories

Key Offerings: High-performance transduction reagents for viral and non-viral vectors in research and clinical workflows.

OriGene Technologies

Key Offerings: Custom viral vector systems, plasmids, and delivery reagents for academic and industrial applications.

Polyplus-transfection SA

Key Offerings: Non-viral transfection and transduction reagents that enhance viral-vector delivery efficiency in gene-therapy pipelines.

SBI System Biosciences

Key Offerings: Viral vector systems, transduction reagents, and tools for research and manufacturing-scale gene/cell therapy applications.

GenScript Biotech Corporation

Key Offerings: Custom viral vector design, delivery platforms, and reagent systems for global gene-therapy development.

Abcam plc

Key Offerings: Viral-vector and transduction reagents with assay tools supporting gene-delivery and cell-engineering workflows.

Addgene

Key Offerings: Non-profit repository of plasmids, viral vectors, and transduction tools for genome-engineering and research applications.

VectorBuilder Inc.

Key Offerings: Custom viral vector design, production, and transduction reagents for gene therapy, cell engineering, and discovery research.

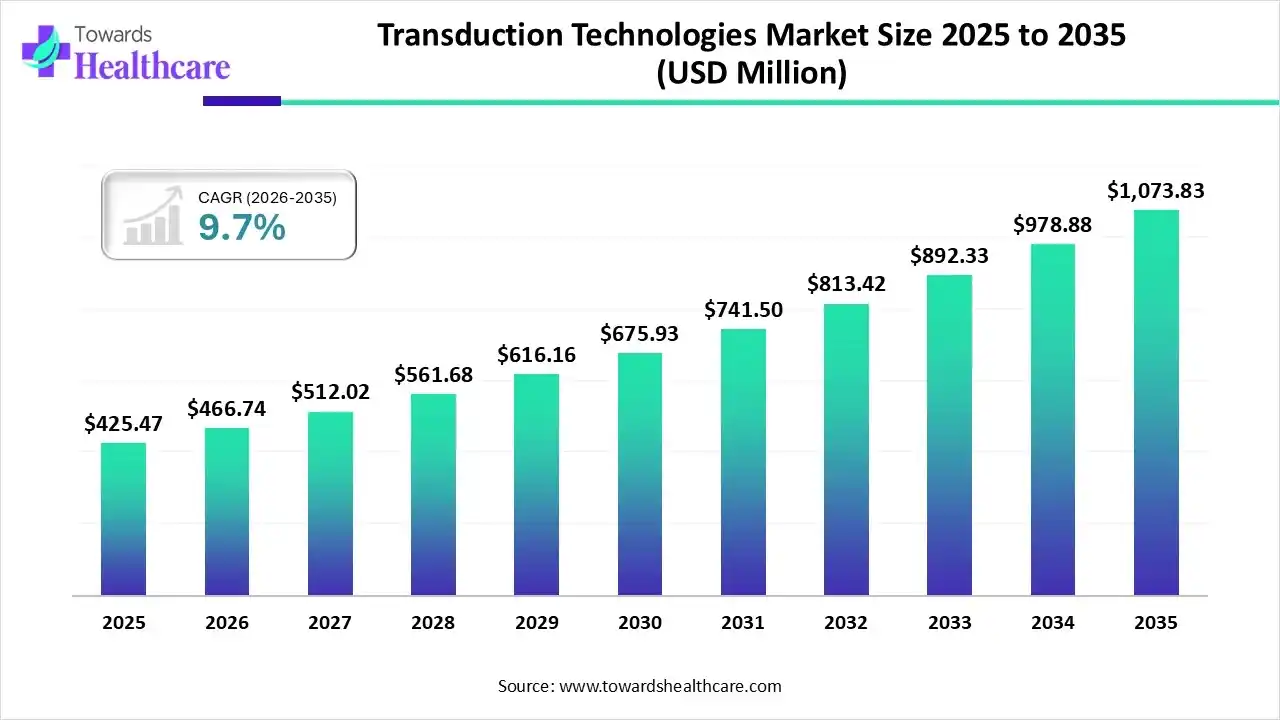

Market Growth

The global transduction technologies market size is estimated at US$ 425.47 million in 2025, increased to US$ 466.74 million in 2026, and is expected to reach around US$ 1073.83 million by 2035. The market is growing at a CAGR of 9.7% between 2026 and 2035.

Company Landscape

Thermo Fisher Scientific

Corporate Information

Headquarters: Waltham, Massachusetts, U.S. | Year Founded: 1956

Business Overview

Thermo Fisher Scientific is a global leader in serving the life sciences and diagnostics markets by providing reagents, instruments, consumables, and services that facilitate research, diagnostics, and manufacturing processes. In the transduction technologies field, the company supports gene and cell therapy developers with delivery platforms, vector systems, and auxiliary reagents necessary for effective gene transfer and manufacturing scale-up.

Business Segments / Divisions

Thermo Fisher operates through four primary business segments relevant to transduction technologies:

- Life Sciences Solutions – Instruments, consumables, and reagents for genomics, molecular biology, and bioproduction.

- Analytical Instruments – Analytical instrumentation and software that support R&D and manufacturing workflows.

- Specialty Diagnostics – Diagnostic test kits, instruments, and reagents for clinical and laboratory diagnostics, including molecular oncology.

- Laboratory Products & Biopharma Services – Laboratory consumables, equipment, and outsourced services supporting biotech and pharma clients.

Geographic Presence

The company has a worldwide presence, serving customers in the Americas, Europe, Middle East, Africa (EMEA), Asia-Pacific, and other regions through manufacturing facilities, distribution centers, R&D sites, and sales operations. This extensive geographic reach enables local support and the deployment of transduction technology offerings in key gene therapy markets.

Key Offerings

- Viral and non-viral vector systems, delivery reagents, and engineered tools designed for genetherapy and celltherapy pipelines.

- Integrated workflows that support gene transfer from research scale to clinical manufacturing, including vector production, optimization, and analytics.

- Platforms and reagents that allow researchers and biotech companies to evaluate transduction efficiency, optimize delivery to target cell types (e.g., immune cells), and support execution of advanced therapies.

SWOT Analysis

Strengths:

- Strong brand recognition and global scale in life sciences and diagnostics tools.

- A broad platform of technologies and service capabilities that align with gene and celltherapy trends.

- Extensive global infrastructure enabling delivery, support, and scaling of transduction-based solutions.

Weaknesses:

- High complexity and cost of advanced delivery systems may limit uptake in cost-sensitive markets.

- Large, diversified business model may dilute focus compared to pureplay vector or deliverytechnology companies.

- Heavy dependence on regulatory and reimbursement frameworks across multiple markets.

Opportunities:

- Rising global demand for gene and cell therapies opens new markets for transduction technologies.

- Growth in emerging markets and academic research institutions is expanding vector-based therapy pipelines.

- Innovation in AI, high-throughput screening, and automation can enhance transduction efficiency and scalability.

Threats:

- Intensifying competition from specialized vectormanufacture and genedelivery firms that could erode pricing or market share.

- Regulatory delays or clinical setbacks in genetherapy programs could slow adoption of transduction platforms.

- Macroeconomic or funding constraints (especially in research and biologics manufacturing) may reduce capital available for advanced delivery technologies.

Merck KGaA (MilliporeSigma)

Corporate Information

Headquarters: Darmstadt, Germany. | Year Founded: 1668

Business Overview

Merck KGaA is a global science and technology company operating in healthcare, life sciences, and electronics. Within its Life Science division (known as MilliporeSigma in North America), it supplies reagents, consumables, instrumentation, services, and manufacturing platforms to academic, biotech, and pharmaceutical customers. In the transduction technologies area, it supports the development and production of viral vectors (AAV, lentivirus, adenovirus), transfection/transduction reagents, and contract development and manufacturing services for gene and cell therapies.

Business Segments / Divisions

Key segments relevant to transduction technologies include:

- Life Science Solutions – covering tools, reagents, instrumentation, and services for research, biotech, and biomanufacturing.

- Life Science Services / Biomanufacturing (CDMO/CTDMO) – delivering viral vector manufacturing, process development, contract testing, and upstream/downstream manufacturing solutions for gene & cell therapies.

- While Merck also operates Healthcare and Electronics divisions, for transductiontechnology relevance, the Life Science segment is primary.

Geographic Presence

The company operates globally across all major geographies: Europe (including Germany HQ), North America (U.S./Canada operations as MilliporeSigma), AsiaPacific, Latin America and the Middle East/Africa. Its viralvector manufacturing and CDMO capacity includes facilities in the U.S. (e.g., Carlsbad, California) and globally scaled operations.

Key Offerings

- Viralvector manufacturing platforms: e.g., VirusExpress® 293 AAV and lentiviral production platforms designed for scalable, suspension culture viral vector manufacturing, reducing process development time by up to ~40%.

- Transduction/regimen reagents and services: through acquisition of companies like Mirus Bio (transfection/transduction reagent specialist) to augment vector & delivery technology stack.

- End-to-end viralvector CDMO/CTDMO services: supporting preclinical to commercial manufacturing, including AAV/lentivirus/adenovirus development and GMP supply.

- Ancillary tools and consumables for bioprocessing of gene and celltherapy vectors, enabling customers to access a broad delivery stack.

SWOT Analysis

Strengths

- Extensive history and deep capabilities in life sciences and biomanufacturing, enabling strong credibility in the viralvector/transduction domain.

- Broad portfolio and integrated offerings from reagents through manufacturing services, allowing Merck to capture value across the transduction valuechain.

- Global footprint with scalable manufacturing capacity (including large viralvector facilities) positions the company well for growth in gene and cell therapies.

Weaknesses

- Operating in a highly complex and heavily regulated space (viralvector manufacturing, gene & cell therapies) which involves long development cycles, high capital investment, and manufacturing risk.

- As a large, diversified company, focus on pureplay transduction technologies may be diluted compared with specialized smaller firms solely focused on delivery vectors or transduction reagents.

- Cost and scale pressures in emerging markets may challenge margin and pricing models for cutting-edge manufacturing services.

Opportunities

- The rapid expansion of gene and cell therapy pipelines globally (e.g., for rare diseases, oncology, regenerative medicine) is driving demand for reliable viralvector and transduction technologies.

- Emerging modalities (e.g., in vivo gene therapy, RNA delivery, CART/NK cell therapies) present new usecases and volume growth for transduction technologies.

- Partnerships with biotech firms, academic institutions, and geographic expansion into emerging markets provide growth levers for manufacturing services and regional delivery optimization.

Threats

- Intensifying competition from specialized vector manufacturers, contract developers, and new entrants offering low-cost or novel delivery technologies may erode market share or compress margins.

- Regulatory, safety, and supplychain vulnerabilities (e.g., viral vector production bottlenecks, raw material shortages) pose risks to manufacturing timelines and customer commitment.

- Macroeconomic headwinds or reduced funding for cell/genetherapy development could slow transductiontechnology demand growth.

Transduction Technologies Market Value Chain Analysis

R&D

The R&D process for transduction technologies includes target identification, discovery, validation, lead development, preclinical studies, clinical testing, regulatory approval, biomanufacturing, and commercialization.

Key Players: Novartis AG, Gilead Sciences, Inc., Amgen Inc., Bristol-Myers Squibb, AstraZeneca.

Clinical Trials and Regulatory Approvals

Global regulatory harmonization is achieved through agencies like EMA, FDA, and CDSCO. Regulatory approvals are granted for many gene and cell therapies, with a strong focus on both viral and non-viral vectors in clinical trials.

Key Players: Bluebird Bio, Novartis, Gilead Sciences / Kite Pharma, Bristol Myers Squibb, Pfizer, Sarepta Therapeutics, Vertex Pharmaceuticals.

Patient Support and Services

Gene and cell therapies have extensive therapeutic uses, while additional patient support services include clinical trial assistance, patient aid programs, advocacy groups, integrated care models, ongoing monitoring, and follow-up.

Key Players: Novartis, Gilead Sciences/Kite, Bristol-Myers Squibb, Vertex Pharmaceuticals, CRISPR Therapeutics, Pfizer.

Recent Developments in the Transduction Technologies Market

- On September 15, 2025, ProteoNic launched its 2G UNic® transposon platform for licensing, expanding compatibility across transposon systems to support biopharma applications in biologics and cell and gene therapy.

- In May 2024, Takara Bio USA launched the LentiX Transduction Sponge, a first-to-market dissolvable microfluidic enhancer that improves lentivirus-mediated gene delivery. With a simple, walkaway workflow, it achieves high transduction efficiency across all cell types, supporting gene and cell therapy research.

Partner with our experts to explore the Transduction Technologies Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking