January 2026

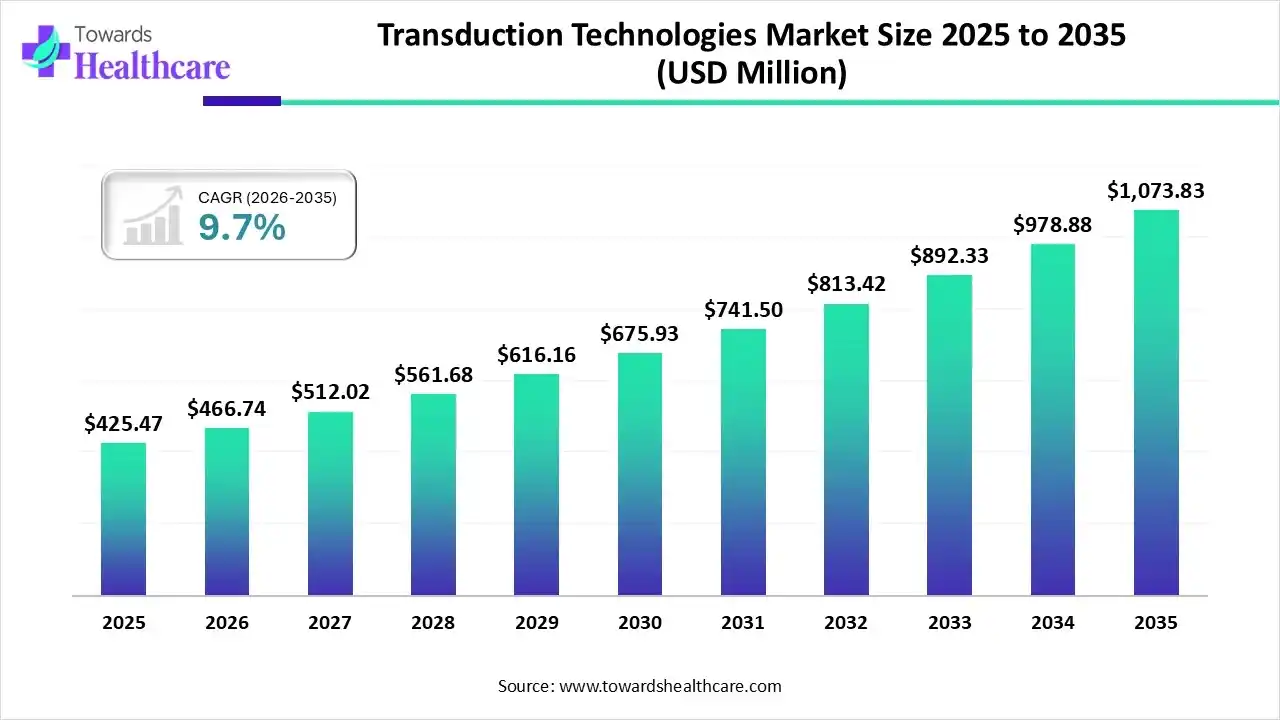

The global transduction technologies market size is estimated at US$ 425.47 million in 2025, increased to US$ 466.74 million in 2026, and is expected to reach around US$ 1073.83 million by 2035. The market is growing at a CAGR of 9.7% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 466.74 Million |

| Projected Market Size in 2035 | USD 1073.83 Million |

| CAGR (2026 - 2035) | 14.15% |

| Leading Region | North America |

| Market Segmentation | By Product, By Target Cell Type, By Application, By End-use, By Region |

| Top Key Players | Lonza Group, Takara Bio Inc., Bio-Rad Laboratories, Polyplus-transfection SA, SBI System Biosciences |

Viral transduction is a key step in manufacturing immune cell therapies that have transformed the treatment of autoimmune disorders, cancers, and infectious diseases. It allows for the delivery of therapeutic genes into immune cells, boosting the growth of the transduction technologies market. It also supports the development of effective, safe, and scalable production methods. Therapies derived from these approaches lead to better clinical outcomes.

Transduction technologies are methods that enable the delivery of DNA or RNA into cells to modify functions, express proteins, or study genes, using viral, non-viral, or physical methods. They are essential for gene therapy, genetic engineering, and biotech research. Advancements in transduction technologies are enhancing the safety, efficiency, and scalability of gene and cell delivery. Market growth is driven by rising demand for cell therapy, gene therapy, and personalized medicine. When combined with gene-editing tools like CRISPR/Cas9, these technologies enable precise genome modifications.

AI enables faster R&D, reduces costs, improves success rates, leads to discoveries and innovations, and provides personalized and precision solutions. It is a revolutionary trend in the transduction technologies market, optimizing gene delivery vectors, increasing gene editing accuracy and safety, and streamlining R&D and manufacturing processes. AI also facilitates laboratory automation, CRISPR optimization, and viral vector design.

Machine learning algorithms can analyze large datasets from experiments and simulations to identify the most effective viral or non-viral vectors for specific cell types, accelerating R&D timelines. Additionally, AI-driven automation can enhance scalability, improve reproducibility, and reduce costs in gene therapy and cell therapy manufacturing, ultimately increasing the accessibility and precision of advanced genetic treatments.

AI enables faster R&D, reduces costs, improves success rates, leads to discoveries and innovations, and provides personalized and precision solutions. It is a revolutionary trend in the transduction technologies market, optimizing gene delivery vectors, increasing gene editing accuracy and safety, and streamlining R&D and manufacturing processes. AI also facilitates laboratory automation, CRISPR optimization, and viral vector design.

Machine learning algorithms can analyze large datasets from experiments and simulations to identify the most effective viral or non-viral vectors for specific cell types, accelerating R&D timelines. Additionally, AI-driven automation can enhance scalability, improve reproducibility, and reduce costs in gene therapy and cell therapy manufacturing, ultimately increasing the accessibility and precision of advanced genetic treatments.

How Does the Transduction Kits Segment Dominate the Transduction Technologies Market in 2024?

The transduction kits segment dominated the market by holding the largest share in 2024. This is mainly due to their widespread use in therapeutic development, manufacturing, research and development, and safety and regulatory compliance. There is a strong focus on developing kits and related systems that enable seamless scalability from cost-effective commercial production to small- and large-scale research. The optimized kits for immune cells are essential in developing next-generation immunotherapies.

The transduction enhancers segment is expected to grow at the fastest CAGR in the market during the forecast period due to their crucial role in increasing gene expression levels, research, and drug discovery. They are vital in developing advanced formulations, gene therapy, and cell therapy. They have wide applications in research and therapy, driven by improved efficiency, consistency, and applicability of gene delivery.

What Made Immune Cells the Dominant Segment in the Transduction Technologies Market in 2024?

The immune cells segment led the market in 2024, thanks to the optimization of process parameters, integration with gene editing, and vector engineering. Viral vectors enable the stable insertion of therapeutic genes into the immune cell genome during ex vivo manufacturing. Immune cells continue to be the main target for delivering therapeutic genes. The high demand for engineered immune cells in oncology, autoimmune disorders, and infectious diseases drove the widespread adoption of viral and non-viral transduction methods.

The stem cells segment is expected to grow at the fastest rate in the market during the forecast period due to their key roles as cellular carriers for gene delivery, a source for gene-edited therapies, and for long-term therapeutic gene expression. Stem cells have become important in immunomodulation, cancer therapy, disease modeling, and drug discovery. They serve as vehicles for targeted gene delivery and the production of genetically modified cells for cancer treatments and regenerative medicine.

The cancer cells segment is expected to grow at a notable rate in the coming years due to due to their critical role in oncology research, drug discovery, and development of targeted therapies. Transduction of cancer cells enables precise genetic manipulation to study tumor biology, identify therapeutic targets, and evaluate novel anticancer compounds. The growing emphasis on personalized medicine and tumor-specific modeling further fueled the adoption of transduction technologies in cancer cell research.

Why Did the Gene Therapy Segment Dominate the Transduction Technologies Market in 2024?

The gene therapy segment dominated the market with the largest share in 2024, as transduction technologies enable efficient delivery of therapeutic genes into patient cells, which is critical for the success of both in vivo and ex vivo gene therapy approaches. Next-generation editing tools offer greater precision with fewer side effects. The rising demand for targeted treatments for genetic disorders, rare diseases, and chronic conditions further bolstered segmental growth.

The cell therapy segment is expected to grow the fastest in the market in the coming period due to the rise of non-viral methods and process optimization. Improved manufacturing platforms, the integration of gene editing, and next-generation vectors enhance transduction, increase efficiency, and reduce manual handling. Transduction technologies enable safe, efficient, and scalable delivery of therapeutic genes into target cells. The surging adoption of personalized cellular treatments, including CAR-T and TCR-T therapies, for cancer and immune disorders further supports segmental growth.

The vaccines segment is expected to grow significantly in the coming years due to the rising demand for next-generation vaccines and viral vector vaccines. Transduction technologies enable efficient antigen expression in host cells, enhancing immune responses and vaccine efficacy. The growing focus on rapid vaccine development, global immunization programs, and pandemic preparedness further accelerated adoption.

Why Did Pharmaceutical & Biotechnology Companies hold the Largest Share of the Transduction Technologies Market?

The pharmaceutical & biotechnology companies segment dominated the market by holding the largest share in 2024, owing to their extensive involvement in gene therapy, cell therapy, and vaccine development programs that rely on advanced gene delivery systems. These companies invest heavily in R&D to develop novel therapeutics and leverage transduction technologies for precise and efficient genetic modification. Additionally, strong collaborations with academic institutions and government-backed initiatives have accelerated the adoption of transduction platforms in drug discovery and biomanufacturing.

The CROs & CDMOs segment is expected to grow rapidly in the market during the studied period due to the essential role of CROs in preclinical studies, clinical trial management, data management, and data analysis. CDMOs are vital in viral vector manufacturing, quality control, GMP compliance, and supply chain optimization. Both CROs and CDMOs implement integrated solutions, focus on emerging trends, and address complexities. Their ability to reduce time-to-market and R&D costs while maintaining compliance with regulatory standards has driven widespread adoption of transduction technologies.

The academic & research institutes segment is expected to grow at a notable rate in the coming years due to their extensive use of these technologies for fundamental studies in gene function, disease modeling, and molecular biology. These institutes leverage transduction methods to explore novel gene and cell therapy approaches, optimize viral and non-viral delivery systems, and advance CRISPR-based genome editing. Additionally, collaborations with pharmaceutical companies and biotech firms for preclinical studies have reinforced their prominent role in the market.

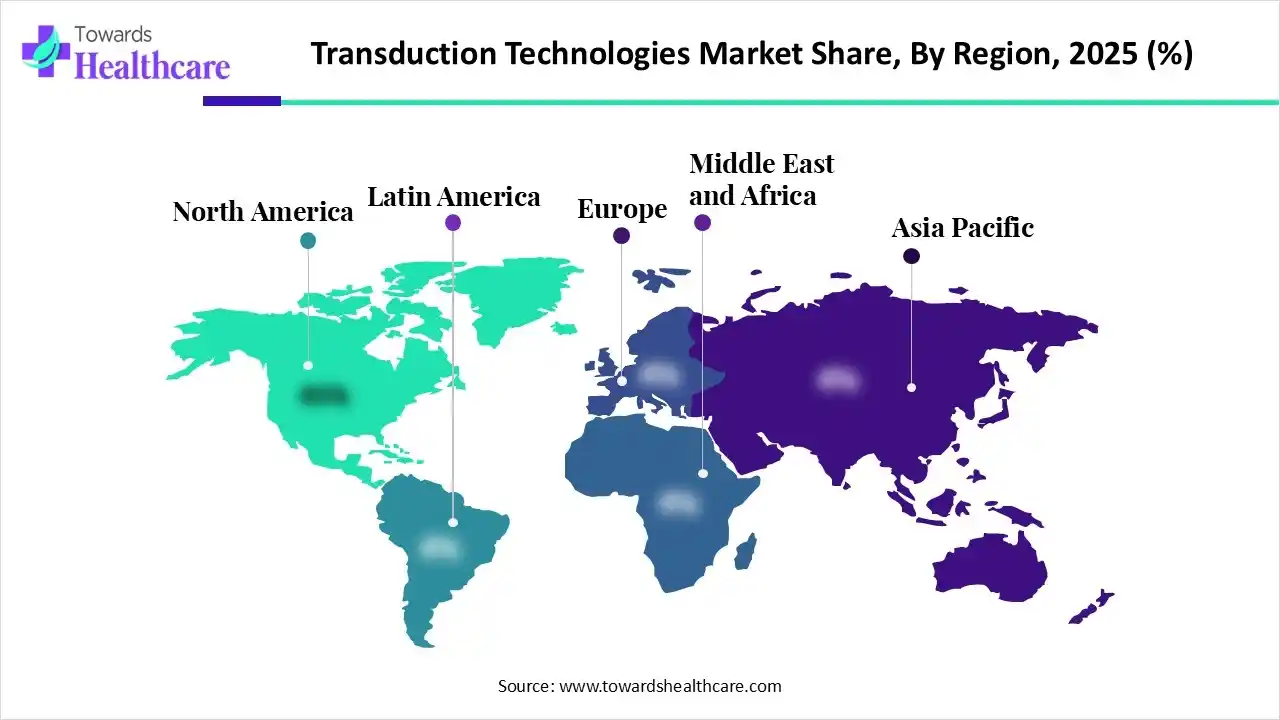

North America led the transduction technologies market in 2024, holding the largest share due to supportive regulatory frameworks for developing and approving cell and gene therapies. Major government initiatives are primarily driven by the U.S. Food and Drug Administration (FDA) and the National Institutes of Health (NIH). These efforts promote the development, approval, and accessibility of advanced transduction-based therapies and biotechnology. North America remains the top region for investments in biotechnology and research infrastructure. Government grants support infrastructure for advanced therapy manufacturing and also aid in developing non-viral delivery systems and viral vectors.

The U.S. is a major contributor to the market due to substantial investments in gene editing and synthetic biology, leveraging advanced tools such as CRISPR and base editing to boost demand for efficient delivery systems. The rapid expansion of cell and gene therapy pipelines across oncology and rare diseases is driving the need for robust transduction platforms. Additionally, the U.S. benefits from a well-established biotechnology research infrastructure and large clinical trial networks, which accelerate innovation in high-throughput screening and precision delivery technologies.

Asia Pacific is expected to expand at the fastest CAGR in the market during the forecast period, driven by rapid digital transformation, strong economic growth, and increased healthcare spending. Many government initiatives in biotechnology focus on biomanufacturing, AI in biotechnology, and overall R&D. Governments across Asia have launched programs to support research and infrastructure that advance cellular technologies and signal transduction. For instance, the Government of India has implemented several policies, including the Biotechnology Research, Innovation and Entrepreneurship Development (Bio-RIDE) Scheme.

In India, the transduction technologies market is gaining momentum as domestic manufacturing of viral and non-viral vectors accelerates, supported by government initiatives and infrastructure build-out in major biotech hubs. The major government initiatives supporting advanced biotechnology include the BioE3 (Biotechnology for Economy, Environment & Employment) policy, the Biotechnology Research Innovation and Entrepreneurship Development (Bio-RIDE) Scheme, and others. The BioE3 policy aims to boost innovation in synthetic biology, precision biotherapeutics, and six other sectors. The Anusandhan National Research Foundation (ANRF) offers funding opportunities for research in biotechnology and AI.

Europe is expected to experience notable growth in the market in the upcoming period, thanks to its strong biotechnology infrastructure, well-funded research networks, and robust academic-industry collaborations. The European Union has introduced several initiatives to support the development and application of new technologies in the biotechnology sector. These include the European Biotech Act and the European Life Sciences Strategy. Europe continues to be the hub for biotechnology and biomanufacturing, helping small and midsize enterprises (SMEs) and startups comply with EU regulations. The favorable funding opportunities facilitate the launch of biotechnology solutions into the market.

The German biotechnology sector has seen increased funding from both public and private sectors that support the development of cutting-edge technologies. The Medical Research Act aims to make Germany a strong hub for medical innovations, streamline clinical trial approvals, and improve market access for new therapies. It also seeks to boost research and innovation in commercial products. Furthermore, Germany’s strong biotechnology ecosystem, particularly in vector engineering, cell therapy manufacturing, and precision diagnostics, is driving increased adoption of transduction platforms in research and clinical settings.

South America is emerging as a high-potential region in the market, driven by growing biotechnology research hubs, increasing gene and celltherapy activities, and expanding local manufacturing capabilities. Countries such as Brazil are gaining traction as regional leaders, with rising public and private investment in vector development, therapeutic delivery platforms, and clinical innovation. Additionally, lower competitive pressure in comparison to mature markets, combined with tailored strategies for regional disease burdens and precisionmedicine needs, offers companies a strategic entry point for long-term growth.

Brazil stands out as the major contributor to the South American transduction technologies market due to its dominant share in the region’s market revenue and robust biotechnology infrastructure. According to regional data, Brazil accounted for the largest share of the Latin American transduction technologies sector, reflecting its strong pharmaceutical production and elevated healthcare expenditure. The country’s established biotech ecosystem, expanding gene and celltherapy activities, and supportive regulatory framework position it as the key hub for transductiontechnology growth in South America.

Several key factors are fueling the growth of the market in the Middle East and Africa (MEA). Governments are heavily investing in healthcare infrastructure and life sciences research, creating favorable conditions for the adoption of advanced gene delivery systems. Additionally, increasing rates of genetic and chronic diseases boost demand for innovative therapies, while partnerships between global biotech companies and local institutions accelerate technology transfer and regional development.

In the Middle East & Africa (MEA) transduction technologies market, the UAE emerges as a major contributor, thanks to its advanced life sciences infrastructure, robust investments in biotech research, and strategic positioning as a regional innovation hub. The combination of public-private partnerships, regulatory reforms supporting precision medicine, and partnerships with global biopharma firms has enabled the UAE to drive the adoption of gene and celltherapy delivery platforms across the region. As a result, the UAE is setting the pace for the uptake of transduction technology in MEA, serving as a gateway to broader market expansion into neighboring countries.

| Vendor | Key Offerings |

| Lonza Group | End-to-end CDMO services for viral vectors and cell/gene therapies, supporting process development to commercial manufacturing. |

| Takara Bio Inc. | Lentiviral and retroviral delivery systems and transduction reagents for gene therapy and regenerative medicine research. |

| Bio-Rad Laboratories | High-performance transduction reagents for viral and non-viral vectors in research and clinical workflows. |

| OriGene Technologies | Custom viral vector systems, plasmids, and delivery reagents for academic and industrial applications. |

| Polyplus-transfection SA | Non-viral transfection and transduction reagents to enhance viral-vector delivery efficiency in gene-therapy pipelines. |

| SBI System Biosciences | Viral vector systems, transduction reagents, and tools for research and manufacturing-scale gene/cell therapy applications. |

| GenScript Biotech Corporation | Custom viral vector design, delivery platforms, and reagent systems for global gene-therapy development. |

| Abcam plc | Viral-vector and transduction reagents with assay tools supporting gene-delivery and cell-engineering workflows. |

| Addgene | Non-profit repository of plasmids, viral vectors, and transduction tools for genome-engineering and research applications. |

| VectorBuilder Inc. | Custom viral vector design, production, and transduction reagents for gene therapy, cell engineering, and discovery research. |

Corporate Information

Headquarters: Waltham, Massachusetts, U.S. | Year Founded: 1956

Business Overview

Thermo Fisher Scientific is a global leader in serving the life sciences and diagnostics markets by providing reagents, instruments, consumables, and services that facilitate research, diagnostics, and manufacturing processes. In the transduction technologies field, the company supports gene and cell therapy developers with delivery platforms, vector systems, and auxiliary reagents necessary for effective gene transfer and manufacturing scale-up.

Business Segments / Divisions

Thermo Fisher operates through four primary business segments relevant to transduction technologies:

Geographic Presence

The company has a worldwide presence, serving customers in the Americas, Europe, Middle East, Africa (EMEA), Asia-Pacific, and other regions through manufacturing facilities, distribution centers, R&D sites, and sales operations. This extensive geographic reach enables local support and the deployment of transduction technology offerings in key gene therapy markets.

Key Offerings

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Corporate Information

Headquarters: Darmstadt, Germany. | Year Founded: 1668

Business Overview

Merck KGaA is a global science and technology company operating in healthcare, life sciences, and electronics. Within its Life Science division (known as MilliporeSigma in North America), it supplies reagents, consumables, instrumentation, services, and manufacturing platforms to academic, biotech, and pharmaceutical customers. In the transduction technologies area, it supports the development and production of viral vectors (AAV, lentivirus, adenovirus), transfection/transduction reagents, and contract development and manufacturing services for gene and cell therapies.

Business Segments / Divisions

Key segments relevant to transduction technologies include:

Geographic Presence

The company operates globally across all major geographies: Europe (including Germany HQ), North America (U.S./Canada operations as MilliporeSigma), AsiaPacific, Latin America and the Middle East/Africa. Its viralvector manufacturing and CDMO capacity includes facilities in the U.S. (e.g., Carlsbad, California) and globally scaled operations.

Key Offerings

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

The R&D process for transduction technologies includes target identification, discovery, validation, lead development, preclinical studies, clinical testing, regulatory approval, biomanufacturing, and commercialization.

Key Players: Novartis AG, Gilead Sciences, Inc., Amgen Inc., Bristol-Myers Squibb, AstraZeneca.

Global regulatory harmonization is achieved through agencies like EMA, FDA, and CDSCO. Regulatory approvals are granted for many gene and cell therapies, with a strong focus on both viral and non-viral vectors in clinical trials.

Key Players: Bluebird Bio, Novartis, Gilead Sciences / Kite Pharma, Bristol Myers Squibb, Pfizer, Sarepta Therapeutics, Vertex Pharmaceuticals.

Gene and cell therapies have extensive therapeutic uses, while additional patient support services include clinical trial assistance, patient aid programs, advocacy groups, integrated care models, ongoing monitoring, and follow-up.

Key Players: Novartis, Gilead Sciences/Kite, Bristol-Myers Squibb, Vertex Pharmaceuticals, CRISPR Therapeutics, Pfizer.

The transduction technologies market is poised for substantial growth, underpinned by the accelerating adoption of gene and cell therapies and the increasing reliance on viral and non-viral delivery platforms for precise genetic modulation. As the biotechnology and pharmaceutical sectors intensify their focus on personalized medicine, the need for highly efficient, scalable transduction solutions has become critical, creating a fertile landscape for technological innovation and strategic partnerships. Enhanced vector design, optimization of transduction efficiency, and integration with advanced genome editing platforms are redefining the market’s trajectory, creating significant competitive differentiation opportunities for early adopters.

Emerging applications in immuno-oncology, regenerative medicine, and therapeutic vaccines are further catalyzing market expansion, as research institutes and CROs increasingly invest in cutting-edge delivery systems to support complex cellular therapies. The convergence of transduction technologies with AI-driven analytics, high-throughput screening, and automated laboratory workflows enables faster, cost-effective development cycles, reducing translational bottlenecks and enhancing the precision of targeted therapies. Consequently, companies capable of delivering robust, reproducible, and clinically validated solutions are well-positioned to capitalize on the growing demand from both academic and commercial end users.

Geographically, regions with strong biotech infrastructure, supportive regulatory frameworks, and robust funding for advanced therapies are likely to emerge as hotspots for market penetration. The increasing presence of multinational collaborations, licensing agreements, and strategic acquisitions underscores a consolidating yet opportunity-rich ecosystem, offering market entrants avenues to leverage complementary technologies and expand their clinical and commercial reach. In essence, the transduction technologies market represents a confluence of scientific innovation and commercial potential, where strategic investments in R&D, regulatory alignment, and platform scalability can drive sustained growth and long-term value creation.

By Product

By Target Cell Type

By Application

By End-use

By Region

January 2026

January 2026

January 2026

January 2026