Let's Dive into the Top Vegetarian Softgel Capsules Market Companies

Vegetarian Softgel Capsules: Plant-Based Innovation

The vegetarian softgel capsules market is experiencing rapid growth, driven by rising demand for plant-based products, health & wellness trends, regulatory acceptance of non-animal excipients, and global expansion of nutraceuticals. It covers the production, distribution, and use of softgel capsule shells made from plant-based materials (such as starch, hydroxypropyl methylcellulose (HPMC), pullulan, carrageenan) instead of traditional gelatin. These capsules are used in pharmaceuticals, nutraceuticals/supplements, and cosmetics, and meet vegetarian/vegan, halal/kosher, and clean-label requirements.

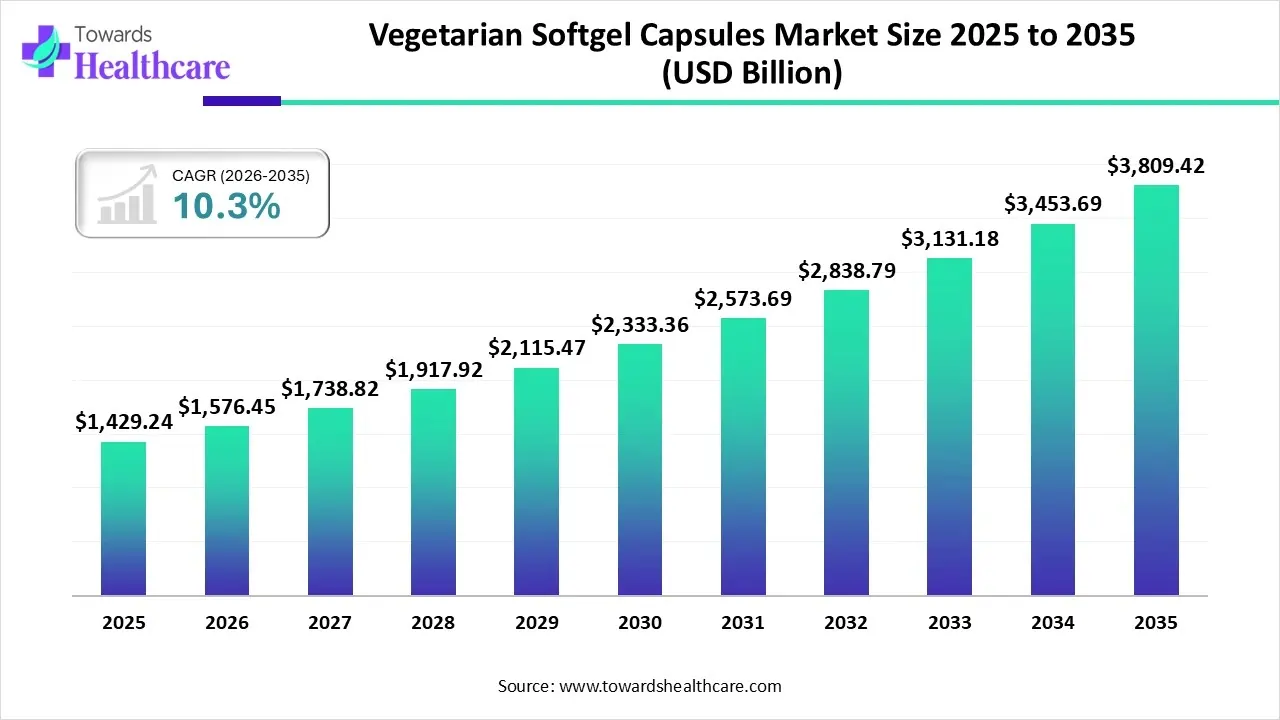

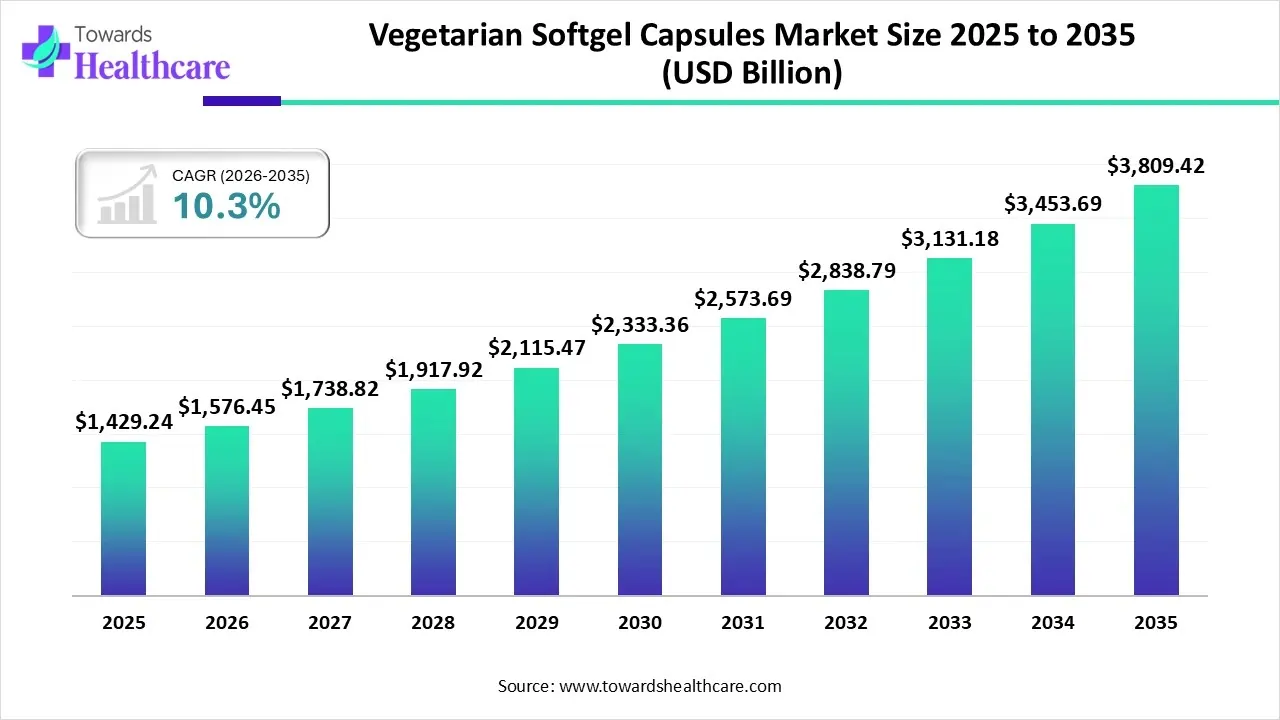

Market Growth

The global vegetarian softgel capsules market size is calculated at USD 996.32 million in 2025, grew to USD 1098.94 million in 2026, and is projected to reach around USD 2655.55 million by 2035. The market is expanding at a CAGR of 10.3% between 2026 and 2035.

Vegetarian Softgel Capsules Market Outlook

- Industry Growth Overview: The market is expected to accelerate due to advancements in encapsulation technology and the need for plant-based excipients. Stringent regulatory requirements for environmental sustainability to build a greener future promote market growth.

- Major Investors: Numerous government and private organizations provide funding for pharmaceutical research, supporting the development of formulations. Funding also enables small- and mid-sized companies to purchase complex manufacturing equipment.

- Startup Ecosystem: The startup ecosystem is maturing in the vegetarian softgel capsules market, with the development of novel technologies for capsule production and venture capital investment. Startups identify multiple plant-based products to derive vegetarian capsules.

Company Landscape

1. Catalent, Inc.

Company Overview

Company Overview: Catalent is a premier global provider of advanced delivery technologies and development and manufacturing solutions for drugs, biologics, gene therapies, and consumer health products, including leading vegetarian softgel capabilities.

Corporate Information

- Headquarters: Somerset, New Jersey, U.S.

- Year Founded: 2007 (spun off from Cardinal Health; roots trace back to 1933)

- Ownership Type: Public (NYSE: CTLT)

History and Background

History and Background: Initially, the pharmaceutical technologies and services division of Cardinal Health. It became Catalent in 2007, focusing on global pharmaceutical and consumer health development and manufacturing. Its acquisition of R.P. Scherer in 1998 solidified its position in softgel technology, which has since been expanded to include advanced non-animal formulations.

Key Milestones/Timeline

- Key Milestones/Timeline:

- 2020: Launched its OptiGel DR technology, a delayed/enteric release softgel specifically applicable to vegetarian formulations.

- 2022: Continued global expansion of manufacturing capacity, including sites focused on high-demand non-animal oral dose forms.

- 2024: Announced a definitive agreement to be acquired by Novo Holdings, the parent company of Novo Nordisk, which is expected to close in the second half of 2024.

Business Overview

- Business Segments/Divisions:

- Biologics: Biologic drug substance and drug product manufacturing.

- Softgel and Oral Technologies: Including development and manufacturing of softgels (animal and non-animal) and Zydis® fast-dissolve technologies.

- Drug Delivery Solutions: Including clinical supply services, modified release technologies, and analytical services.

- Geographic Presence: North America (largest revenue contributor), Europe, and Asia-Pacific, with over 50 sites worldwide.

- Key Offerings: OptiGel®, OptiGel DR (Delayed Release), Vegicaps® capsules (vegetarian softgels, often starch/carrageenan-based), Zydis® orally disintegrating tablets, sterile injectables, and advanced blow-fill-seal capabilities.

- End-Use Industries Served: Pharmaceuticals, Nutraceuticals (Vitamins, Minerals, Supplements, Omega-3s), and Consumer Health Products.

Key Developments and Strategic Initiatives

- Mergers & Acquisitions:

- Acquisition of Novo Holdings (Pending 2024): The planned acquisition by Novo Holdings for $16.5 billion is its most significant development, positioning Catalent within a major pharmaceutical ecosystem.

- Partnerships & Collaborations:

- Ongoing CDMO Collaborations: Continues to partner with global pharmaceutical and biotech companies for drug development and manufacturing, including oral drug delivery platforms for NCEs.

- Product Launches/Innovations:

- OptiGel DR: Innovation specifically designed to provide enteric protection and delayed release without traditional gelatin or coating, benefiting vegetarian formulations.

- Capacity Expansions/Investments:

- 2023-2024: Continual investment in expanding its global capacity for biologics and advanced oral dose forms, including high-potency and plant-based technologies.

Regulatory Approvals

- Regulatory Approvals: Facilities hold approvals from major global agencies, including the FDA, EMA, and Japan's PMDA.

Distribution Channel Strategy

- Distribution channel strategy: Primarily a Contract Development and Manufacturing Organization (CDMO) model, serving as a B2B partner for pharmaceutical and nutraceutical brand owners globally.

Technological Capabilities/R&D Focus

- Core Technologies/Patents: OptiGel® (Softgel technology), Vegicaps® (Vegetarian Softgel), OptiGel DR, Zydis® (Orally Disintegrating Tablet).

- Research & Development Infrastructure: Dedicated R&D centers across North America and Europe focused on complex formulation, advanced delivery technologies, and non-animal capsule shell materials.

- Innovation Focus Areas: Enhanced bioavailability for poorly soluble compounds, delayed/enteric release vegetarian formulations, and large-scale manufacturing of complex biologics.

Competitive Positioning

- Strengths & Differentiators: Global scale, reputation for quality, breadth of proprietary delivery technologies (including its leading vegetarian softgel offerings), and extensive regulatory compliance expertise.

- Market presence & ecosystem role: A dominant global CDMO for pharmaceutical and nutraceutical products, driving innovation in delivery technology, particularly in the shift toward non-animal and clean-label solutions.

SWOT Analysis

- S (Strengths): Market leadership in softgels (including vegetarian), vast global footprint, advanced proprietary technologies.

- W (Weaknesses): High debt burden (prior to Novo Holdings acquisition), reliance on contract manufacturing revenue, high capital expenditure needs.

- O (Opportunities): Rising demand for complex biologics, increasing consumer preference for vegetarian/vegan supplements, and expansion in Asian markets.

- T (Threats): Intense CDMO competition, raw material and supply chain volatility, potential integration risks with Novo Holdings acquisition.

Recent News and Updates

- Press Releases:

- February 2024: Announced the definitive agreement to be acquired by Novo Holdings.

- Late 2023/Early 2024: Continues to report strong segment growth in its softgel and oral technologies division, driven partly by nutraceutical demand.

- Industry Recognitions/Awards: Frequently recognized as a top-tier global CDMO for quality, reliability, and technological innovation.

2. Lonza Group (Capsugel)

Company Overview

Company Overview: Lonza Group is a leading global supplier to the pharmaceutical, biotech, and nutrition markets. Its Capsugel division, acquired in 2017, is a global leader in dosage form solutions, including premier vegetarian hard and soft capsule technologies.

Corporate Information

- Headquarters: Basel, Switzerland

- Year Founded: 1897

- Ownership Type: Public (SIX: LONN)

History and Background

History and Background: Lonza has a long history in chemistry and life sciences. The acquisition of Capsugel from KKR in 2017 for $5.5 billion was a transformative move, positioning Lonza as a global leader in drug development and manufacturing, with Capsugel providing the foundational expertise in capsule and dosage form technology, including vegetarian softgels.

Key Milestones/Timeline

- Key Milestones/Timeline:

- 2017: Lonza completes the acquisition of Capsugel, integrating the world's largest capsule manufacturer and dosage form solution provider.

- 2020: Continued scaling of Vcaps® Plus and DRcaps® (hard vegetarian capsules) and Vgels® (vegetarian softgels) production to meet soaring demand.

- 2024: Focuses on end-to-end solutions in the nutraceutical space, combining API development with advanced vegetarian delivery formats.

Business Overview

- Business Segments/Divisions:

- Lonza Pharma & Biotech: Integrated drug substance and drug product services (core Lonza business).

- Lonza Small Molecules: Development and manufacturing for small molecule APIs and specialized capsules (includes Capsugel softgel offerings).

- Lonza Nutrition: Dedicated focus on the nutraceutical market, heavily leveraging vegetarian softgel and hard capsule technologies.

- Geographic Presence: Global, with manufacturing and R&D facilities across North America, Europe, and Asia.

- Key Offerings: Vgels® (Carrageenan-based vegetarian softgels), DRcaps® (acid-resistant HPMC hard capsules for delayed release), Vcaps® Plus (HPMC hard capsules), lipid-based delivery systems, and complete formulation services.

- End-Use Industries Served: Pharmaceuticals, Biotech, Nutraceuticals (major focus on supplements, vitamins, herbal extracts, and Omega-3s).

Key Developments and Strategic Initiatives

- Mergers & Acquisitions:

- Capsugel (2017): The pivotal acquisition that established its market leadership in dosage forms, including the core vegetarian softgel IP.

- Partnerships & Collaborations:

- Strategic CDMO Agreements: Engages in numerous long-term agreements with global supplement and pharmaceutical brands, leveraging Vgels® technology for new vegetarian product lines.

- Product Launches/Innovations:

- Expanding Vgels® Portfolio: Continuous innovation to improve the stability, fill range, and sealing of the plant-based Vgels® softgel formulation, making them suitable for an even wider range of oil and paste fills.

- Capacity Expansions/Investments:

- 2023: Announced investment in expanding its capacity in its core markets, including dedicated lines for non-animal capsule manufacturing in the U.S. and Europe.

Regulatory Approvals

- Regulatory Approvals: Holds all necessary cGMP, FDA, EMA, and various Halal and Kosher certifications for its vegetarian products globally.

Distribution Channel Strategy

- Distribution channel strategy: Operates as a B2B Contract Manufacturer and Supplier, providing capsules and complete finished product manufacturing services to brand owners.

Technological Capabilities/R&D Focus

- Core Technologies/Patents: Vgels® (Vegetarian Softgel), DRcaps® (Delayed-Release Vegetarian Hard Capsule), Vcaps® Plus, lipid-based and multiparticulate capsule filling.

- Research & Development Infrastructure: Dedicated R&D and application centers (e.g., in the U.S.) focused on dosage form development, specifically targeting the stability and processing of plant-based shell materials like carrageenan and starch.

- Innovation Focus Areas: Developing next-generation, high-performance, plant-based capsules with superior moisture barrier and enteric properties, and optimizing filling systems for nutraceutical oils.

Competitive Positioning

- Strengths & Differentiators: Unmatched reputation in capsule technology (inherited from Capsugel), high-quality plant-based portfolio (Vgels® are a market standard), and synergy with Lonza's broader biopharma services.

- Market presence & ecosystem role: A critical supplier of vegetarian encapsulation technology, enabling countless nutraceutical and pharmaceutical brands to launch clean-label, plant-based products worldwide.

SWOT Analysis

- S (Strengths): World-renowned Capsugel brand, market leadership in vegetarian capsules, strong financial backing from Lonza Group.

- W (Weaknesses): High integration cost of past acquisitions, competition from low-cost Asian manufacturers.

- O (Opportunities): Explosive growth in the global vegan/clean-label supplement market, demand for vegetarian enteric-release systems.

- T (Threats): Supply chain volatility for key shell materials (e.g., carrageenan), the emergence of alternative oral dosage forms (e.g., gummies).

Recent News and Updates

- Press Releases:

- 2024: Lonza highlights the expansion of its Nutrition segment, emphasizing its ability to move products from concept to commercialization using advanced dosage forms like Vgels®.

- Industry Recognitions/Awards: Receives regular recognition for its capsule technology excellence and its role as a leading CDMO partner.

Top Companies & Their Offerings

Aenova Group (Stanberg, Germany)

- Provides Aenova VegaGels, which are heat- and temperature-sensitive but more stable.

IFF Pharma Solutions (New York, United States)

- Offers Verdigel SC, SeaGel, and Aquateric N100 capsules.

EuroCaps (South Wales, United Kingdom)

- Offers Vegesoft vegetarian softgel capsules made of starch and carrageenan.

Catalent, Inc. (Tampa, Florida)

- Leading innovator in softgel technology and Vegicaps Capsules.

Sirio Pharma Ltd. (China)

- Manufactures nutritional dietary supplements and pharmaceutical products in soft gelatin and plant-based capsules using advanced, complex formulations.

Value Chain Analysis – Vegetarian Softgel Capsules Market

R&D

Research focuses on developing novel technologies to enhance the strength and stability of vegetarian capsules compared to animal gelatin.

- Key Players: Catalent, Inc., EuroCaps, and Aenova Group.

Raw Material Procurement

Raw materials for vegetarian capsules include corn, potato, tapioca, and red seaweed.

- Key Players: PotatoPro, Cargill, Ingredion, and SPAC Group.

Formulation & Final Dosage Preparation

Formulation & final dosage preparation include polymer preparation, encapsulation, drying, and packaging.

Recent Developments in the Vegetarian Softgel Capsules Market

- In May 2025, Robinson Pharma announced a major expansion of its manufacturing capabilities by integrating 10 new softgel machines into its production lines. The facility can produce 23 billion softgels annually. This expansion enables the company to solidify its position as the largest softgel manufacturing capacity in the U.S.

- In May 2024, Roquette, a French ingredient supplier, launched a new Lycagel Flex hydroxypropyl pea starch premix for nutraceutical softgel capsules. The product was launched at Vitafoods Europe in Geneva, offering formulators a vegan gelatin alternative.

Partner with our experts to explore the Vegetarian Softgel Capsules Market at sales@towardshealthcare.com