February 2026

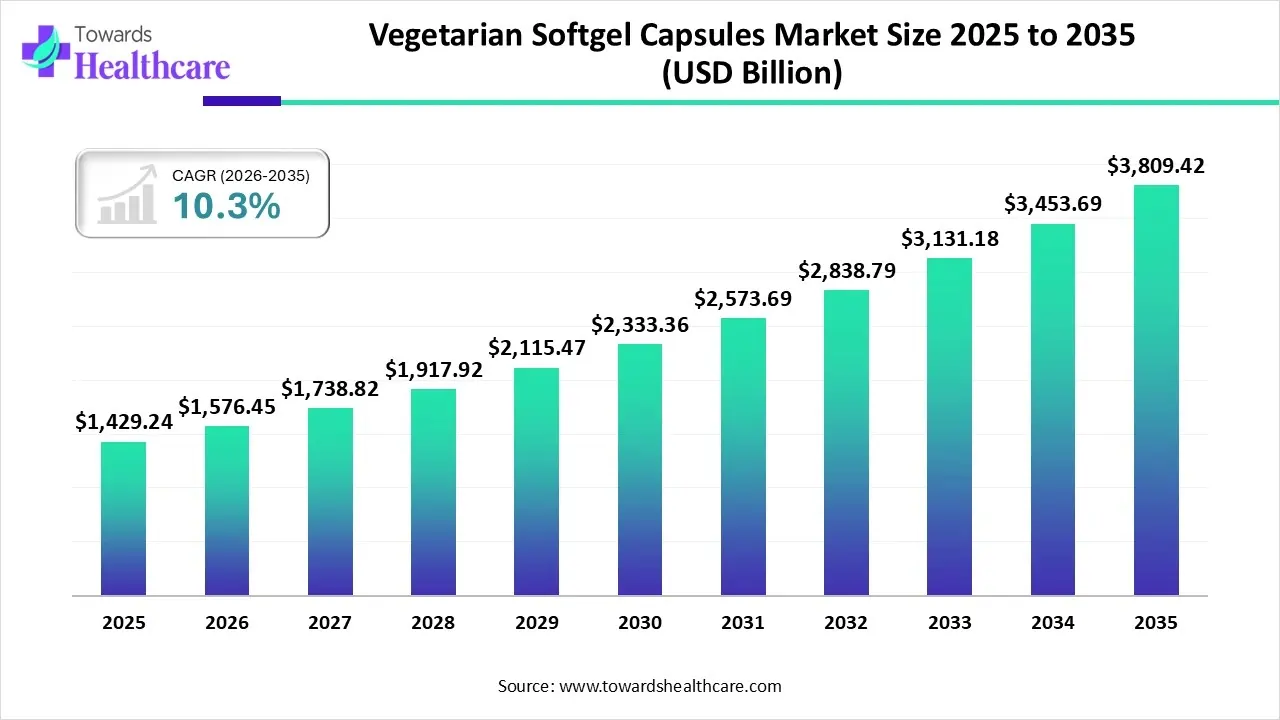

The global vegetarian softgel capsules market size is calculated at USD 996.32 million in 2025, grew to USD 1098.94 million in 2026, and is projected to reach around USD 2655.55 million by 2035. The market is expanding at a CAGR of 10.3% between 2026 and 2035.

The vegetarian softgel capsules market is primarily driven by the increasing demand for vegan products due to religious requirements. People are more aware of the global environmental impact and are switching to plant-based alternatives. Favorable regulatory support enables researchers to use excipients derived from natural sources. Artificial intelligence (AI) plays a crucial role in improving quality control and optimizing formulation. Advances in encapsulation technologies present future opportunities for market growth.

| Key Elements | Scope |

| Market Size in 2025 | USD 996.32 million |

| Projected Market Size in 2035 | USD 2655.55 million |

| CAGR (2025 - 2035) | 10.3% |

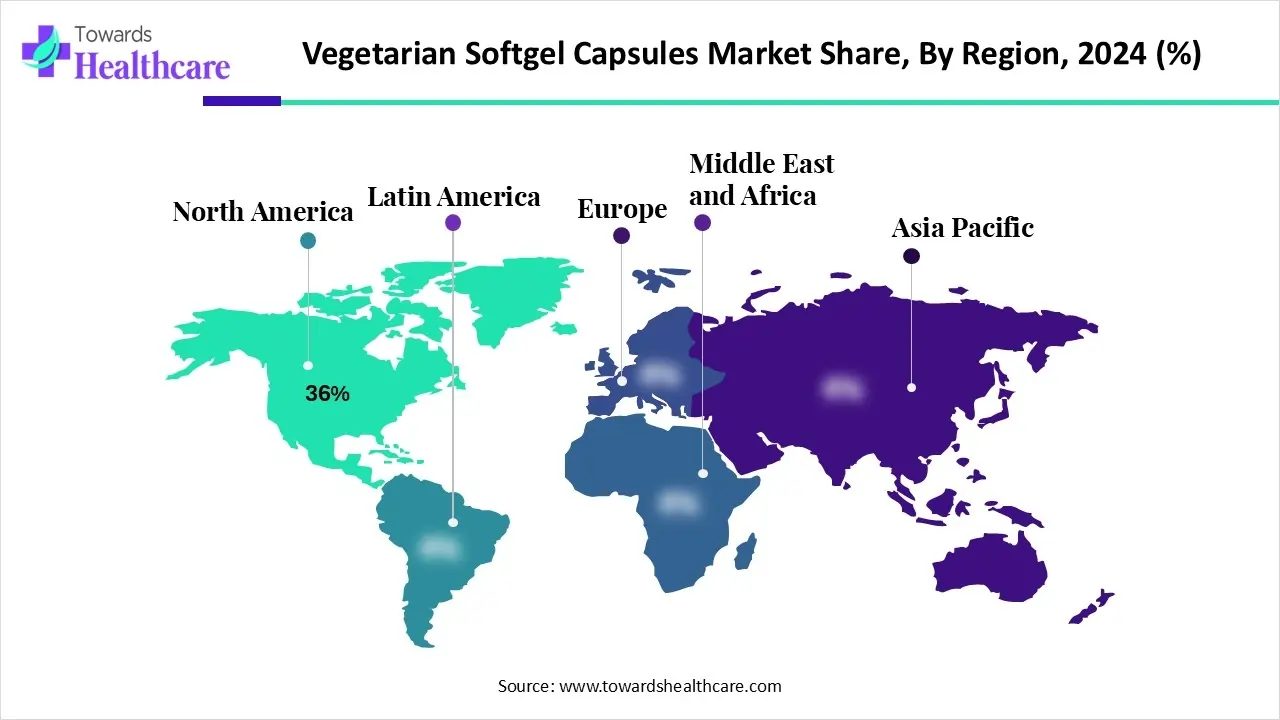

| Leading Region | North America by 36% |

| Market Segmentation | By Product/Material, By Application, By Distribution Channel, By Region |

| Top Key Players | Roquette, Smayan Healthcare, Fermentis Life, Forgo Pharmaceuticals, Natural Capsules Ltd., GNova Biotech, Erkang Pharmaceutical, ACG-Capsules |

The vegetarian softgel capsules market is experiencing rapid growth, driven by rising demand for plant-based products, health & wellness trends, regulatory acceptance of non-animal excipients, and global expansion of nutraceuticals. It covers the production, distribution, and use of softgel capsule shells made from plant-based materials (such as starch, hydroxypropyl methylcellulose (HPMC), pullulan, carrageenan) instead of traditional gelatin. These capsules are used in pharmaceuticals, nutraceuticals/supplements, and cosmetics, and meet vegetarian/vegan, halal/kosher, and clean-label requirements.

AI streamlines the research and manufacturing processes of vegetarian softgel capsules, enhancing the efficiency and precision. It allows researchers to choose from a wide range of plant-based products based on their manufacturing equipment and research requirements. AI and machine learning (ML) algorithms analyze vast amounts of data and predict the compatibility of natural excipients with active ingredients. They improve quality control and optimize the formulation of softgel capsules. AI-powered automation enhances manufacturing consistency and reproducibility.

Which Product Segment Dominated the Vegetarian Softgel Capsules Market?

Starch-based Capsules

The starch-based capsules segment held a dominant presence with a share of approximately 35% in the market in 2024, due to high stability and strength. Starch is the most widely used excipient in the pharmaceutical sector for the preparation of tablets and capsules. It can be modified to achieve the desired properties, such as swelling capacity, mucoadhesive properties, and extended shelf-life. Starch-based capsules are specifically designed for intestinal release, supported by the presence of enzymes.

Pullulan-based Capsules

The pullulan-based capsules segment is expected to grow at the fastest CAGR of approximately 6-8% in the vegetarian softgel capsules market during the forecast period. The demand for pullulan capsules is increasing as researchers are becoming aware of their numerous benefits, such as a potential safety profile, superior oxygen barrier, and high transparency. Pullulan capsule is derived from a natural polysaccharide through the fermentation of starch by the fungus Aureobasidium pullulans.

HPMC (Hydroxypropyl methylcellulose)-based capsules

The HPMC (hydroxypropyl methylcellulose)-based capsules segment is expected to grow significantly, due to higher stability, longer shelf life, and lower moisture content. HPMC capsules have a faster dissolution time than gelatin capsules, allowing for quicker absorption of nutrients. In addition, HPMC capsule shells offer enhanced handling properties during the manufacturing and packaging phases.

Why Did the Health Supplements/Nutraceuticals Segment Dominate the Vegetarian Softgel Capsules Market?

Health Supplements/Nutraceuticals

The health supplements/nutraceuticals segment held the largest revenue share of approximately 45% in the market in 2024, due to the rising awareness of health & wellness products. The World Health Organization (WHO) reported that more than 80% of people in emerging economies consume plant extracts for various healthcare needs. Several multivitamins and omega capsules are available in the market. These capsules boost immunity and support the heart, brain, joints, and overall wellness. They are vegan, allergen-friendly, compatible with sensitive ingredients, and chemical-free, reducing toxicity and enhancing safety.

Pharmaceuticals

The pharmaceuticals segment is expected to grow with the highest CAGR of approximately 7% in the vegetarian softgel capsules market during the studied years. The growing demand for oral drug delivery and favorable properties, such as immediate-release or sustained-release, contribute to the segment’s growth. Capsules enhance patient convenience and can be administered by people of all age groups. Several studies have found that capsules are the most preferred oral route for numerous patients. Vegetarian capsules offer desired properties, such as moisture-sensitive and long shelf-life.

Cosmetics & Personal Care

The cosmetics & personal care segment is expected to show lucrative growth, driven by the consumer demand for plant-based and clean-label products. The shifting trend toward dietary and lifestyle preferences augments the segment’s growth. People consume vegan capsules for youthful & glowing skin, vitamin E, and better hair growth. Veg capsules are preferred due to more bioavailability and easier digestibility.

How the Offline Retail Segment Dominated the Vegetarian Softgel Capsules Market?

Offline Retail

The offline retail segment contributed the biggest revenue share of approximately 50% in the market in 2024, due to the presence of skilled professionals and favorable infrastructure. Skilled professionals guide patients about the type of capsules they require based on their needs. The increasing number of retail stores enhances consumers’ accessibility. Retail stores allow customers to purchase a wide range of products for various purposes. They also offer 24/7 services.

Online/E-commerce

The online/e-commerce segment is expected to expand rapidly in the vegetarian softgel capsules market with a CAGR of approximately 9% in the coming years. The burgeoning e-commerce sector and the increasing adoption of smartphones propel the segment’s growth. Consumers can purchase capsules in the comfort of their homes directly from the manufacturer’s website. This helps them purchase products at affordable rates, eliminating the extra costs of wholesalers.

Institutional/B2B

The institutional/B2B segment is expected to grow in the coming years. B2B supply of capsules refers to wholesale sourcing of various capsule types, including empty shells and finished formulations. Wholesalers are aware of the established supply chain to deliver a reliable, long-term supply and complete traceability.

North America dominated the global market with a share of approximately 36% in 2024. The availability of state-of-the-art research and development facilities, the shifting trend toward vegetarian/vegan products, and increasing R&D investments are the major factors that contribute to market growth in North America. Favorable regulatory support promotes the use of vegetarian softgel capsules. People are more aligned towards a healthy lifestyle and are aware of wellness-related products.

The U.S. is the largest exporter of dietary supplement capsules in the world. From May 2024 to April 2025, the nation exported 1,440 shipments, marking a growth rate of 182% compared to the previous year. Most of the exports were made to Kazakhstan, the Philippines, and Costa Rica. Thus, favorable trade policies are a result of the veg capsules manufacturing and supply from the U.S.

Asia-Pacific is expected to host the fastest-growing market with a CAGR of approximately 8% in the coming years. The increasing population, growing awareness of a healthy lifestyle, and the rising adoption of plant-based diets foster market growth. The burgeoning healthcare infrastructure and the rising disposable incomes boost the market. Countries like China, India, and Japan have a well-established manufacturing infrastructure. This encourages foreign investors and manufacturers to set up their facilities in the region.

India has the highest number of vegetarians in the world. Over 39% of the total population of India is vegetarian. This is due to religious belief, ethical motivations, economic considerations, distaste for meat, and cultural influences. Key players, such as Lifevision Healthcare, Zoic Biotech, and Fermentis Life, are the major manufacturers of vegetarian softgel capsules in India.

Europe is expected to grow at a considerable CAGR in the upcoming period. The rapidly expanding pharmaceutical and cosmetics sectors and favorable government support propel the market. The increasing adoption of advanced technologies and growing research and development activities also contribute to market growth. The rising investments and public-private partnerships facilitate market growth. Germany, Italy, France, the UK, Spain, and the Netherlands are the major markets for natural products in Europe.

As of 2023, there were 2.5 million vegans in the UK, representing 4.7% of the total UK population. NaturSupps, SC Nutra, and G. Baldwin & Co. are the major manufacturers of vegan softgel capsules in the UK. The UK government is also making constant efforts to regulate the use of gelatin in capsules and encourage researchers to find gelatin alternatives in capsules.

Vibrant and verdant, the South American vegetarian softgel capsules market is steadily expanding as health-conscious consumers in Brazil and beyond adopt plant-based wellness regimes. Rising supplement penetration and cleaner formulations are reshaping the landscape in key urban hubs.

In Brazil, vegetarian softgels are riding a powerful wave of clean-label and ethical consumption. Local supplement companies and manufacturers are ramping up production, leveraging regional infrastructure to meet growing demand for non-animal, highly bioavailable formulations.

Across the Middle East and Africa, vegetarian softgel capsules are becoming increasingly strategic due to rising health awareness and strong demand for halal-certified supplements. This region’s wellness market is pivoting to plant-derived, culturally compliant delivery systems.

In the GCC, vegetarian softgels are emerging as an aspirational wellness choice, fueled by innovation, regulatory support, and high per capita supplement consumption. Manufacturers are capitalizing on technology to deliver premium, plant-based softgels suited to regional preferences.

Research focuses on developing novel technologies to enhance the strength and stability of vegetarian capsules compared to animal gelatin.

Raw materials for vegetarian capsules include corn, potato, tapioca, and red seaweed.

Formulation & final dosage preparation include polymer preparation, encapsulation, drying, and packaging.

Company Overview

Company Overview: Catalent is a premier global provider of advanced delivery technologies and development and manufacturing solutions for drugs, biologics, gene therapies, and consumer health products, including leading vegetarian softgel capabilities.

Corporate Information

History and Background

History and Background: Initially, the pharmaceutical technologies and services division of Cardinal Health. It became Catalent in 2007, focusing on global pharmaceutical and consumer health development and manufacturing. Its acquisition of R.P. Scherer in 1998 solidified its position in softgel technology, which has since been expanded to include advanced non-animal formulations.

Key Milestones/Timeline

Business Overview

Key Developments and Strategic Initiatives

Regulatory Approvals

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

Company Overview

Company Overview: Lonza Group is a leading global supplier to the pharmaceutical, biotech, and nutrition markets. Its Capsugel division, acquired in 2017, is a global leader in dosage form solutions, including premier vegetarian hard and soft capsule technologies.

Corporate Information

History and Background

History and Background: Lonza has a long history in chemistry and life sciences. The acquisition of Capsugel from KKR in 2017 for $5.5 billion was a transformative move, positioning Lonza as a global leader in drug development and manufacturing, with Capsugel providing the foundational expertise in capsule and dosage form technology, including vegetarian softgels.

Key Milestones/Timeline

Business Overview

Key Developments and Strategic Initiatives

Regulatory Approvals

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Competitive Positioning

SWOT Analysis

Recent News and Updates

| Companies | Headquarters | Offerings |

| Aenova Group | Stanberg, Germany | Provides Aenova VegaGels that are heat and temperature-sensitive and more stable. |

| IFF Pharma Solutions | New York, United States | Offers Verdigel SC, SeaGel, and Aquateric N100 capsules |

| EuroCaps | South Wales, United Kingdom | Offers Vegesoft vegetarian softgel capsules made of starch and carrageenan. |

| Catalent, Inc. | Tampa, Florida | A leading innovator of softgel technology and Vegicaps Capsules. |

| Sirio Pharma Ltd. | China | Manufactures nutritional dietary supplements and pharmaceutical products in soft gelatin and plant-based capsules using advanced and complex formulations. |

By Product/Material

By Application

By Distribution Channel

By Region

February 2026

December 2025

December 2025

December 2025