January 2026

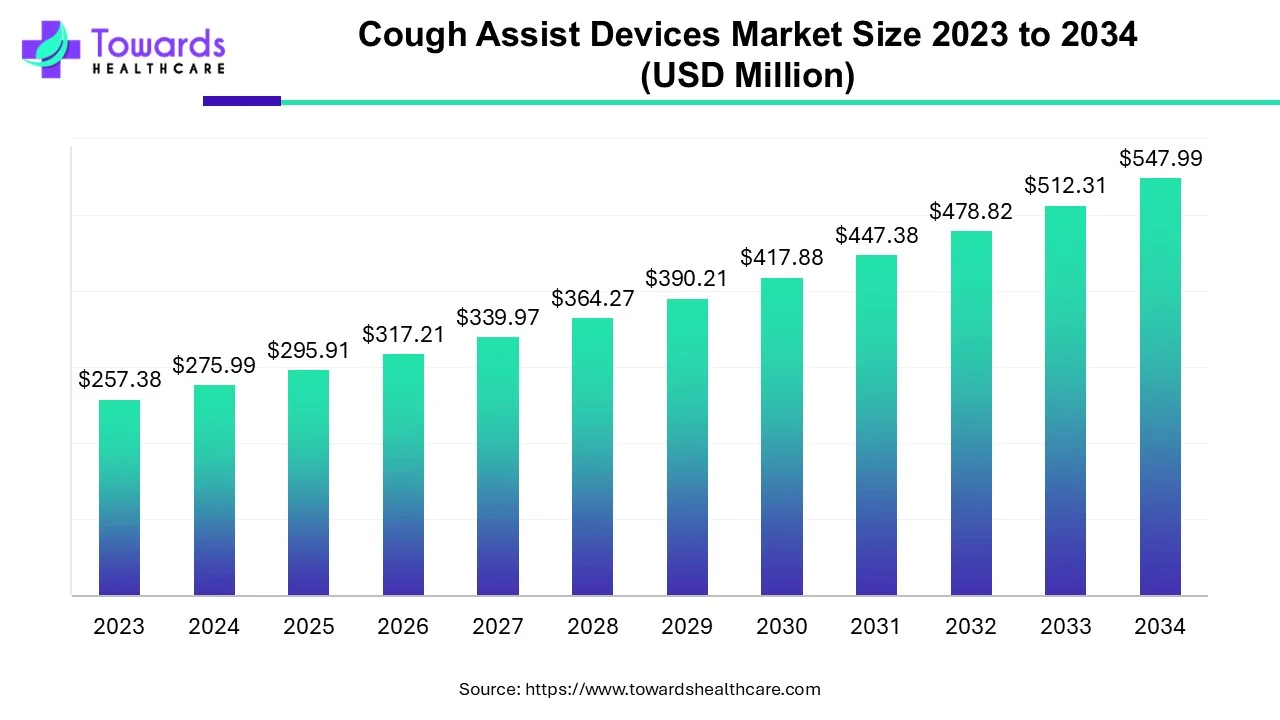

The global cough assist devices market size is calculated at USD 275.99 million in 2024, grew to USD 295.91 million in 2025, and is projected to reach around USD 547.99 million by 2034. The market is expanding at a CAGR of 7.24% between 2025 and 2034. Technological advancements and the rising prevalence of spinal cord injury or neuromuscular disorders drive the market.

| Metric | Details |

| Market Size in 2024 | USD 275.99 Million |

| Projected Market Size in 2034 | USD 547.99 Million |

| CAGR (2025 - 2034) | 7.24% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Choice of Delivery, By End-Use and By Region |

| Top Key Players | Dima Italia Srl, Genotronics, Hill-Rom Holdings, Inc., Intersurgical, Inc., McKesson Corporation, Oxycare Medical Group, Percussionaire Corp., Philips Respironics, US Med-Equip, Ventec Life Systems, Wave Healthcare |

Cough assist devices help patients clear mucus secretions from the respiratory tract. They are generally used when airway muscles weaken, secretions pool in the airways, respiratory infections develop, and breathing becomes strained. These devices work by inflating the lungs with positive airway pressure and then rapidly changing to negative airway pressure, enabling them to cough and mobilize secretions. They are also known as mechanical insufflation-insufflation. They can be applied via a mask, mouthpiece, endotracheal, or tracheostomy tube. These devices help avoid unplanned hospitalizations and can prevent the need for tracheostomy and long-term ventilation in patients with weakness in the muscles or nerves.

Cough assist devices are widely used for patients with muscular dystrophies, myasthenia gravis, spinal muscular atrophy, spinal cord lesions, and motor neuron disease. The rising prevalence of spinal cord injury or neuromuscular disorders necessitates the use of cough assist devices. The advent of advanced technologies drives the latest innovations in these devices, enhancing their overall potential. The growing research and development activities enable researchers to develop novel devices.

Advanced technologies such as artificial intelligence (AI) and machine learning (ML) algorithms revolutionize cough assist devices. AI and ML can be used to detect the presence of severe respiratory disorders and the stage of the disease. They can detect coughs in more real-world settings. Integrating AI in cough assist devices enhances efficiency, accuracy, and precision. The advent of digital displays further transforms the device. AI-assisted digital displays help monitor the inhalation and exhalation rate of patients. AI and ML enable customizable solutions for diverse patients at home or in hospitals. They introduce automation in the devices, reducing the efforts of patients and simplifying their coughing process. They can detect other essential parameters such as oxygen levels, heart rate, and tidal volume, allowing healthcare professionals for real-time monitoring of the patient’s conditions.

Rising Prevalence of Severe Disorders

The major growth factor of the cough assist devices market is the rising prevalence of spinal cord injuries, neuromuscular disorders, or severe fatigue. Myasthenia gravis is estimated to affect around 75,000-100,000 people in the U.S. Additionally, more than 15 million people in the world are living with spinal cord injuries. The increasing geriatric population, genetic disorders, immune system reactions, and environmental exposures are the major risk factors for these disorders. All these disorders cause severe muscle weakness and excessive mucus secretion. Patients suffering from such severe disorders are unable to cough and effectively clear secretions. Cough assist devices help to remove mucus from the airways, helping patients breathe better and lower the chance of infection.

High Cost

The major challenge faced by the market is the high cost of the cough-assisted devices. This restricts the affordability of several people from low- and middle-income groups and those with a lack of medical insurance. The average cost of these devices ranges from a few hundred dollars to several thousand dollars, hindering the market growth.

Latest Innovations

The future of the cough assist devices market is promising, driven by the latest innovations in the devices. Several manufacturers design and develop small and portable devices with advanced features. The latest innovations lead to user-friendly features, simplifying device usage. Technological advancements also result in increased customization and improved monitoring capabilities. Cough assist devices come in three to four modes, including auto and manual modes. Healthcare professionals and patients can opt for any mode based on their preferences. They can seamlessly switch between therapies with the touch of a button and no longer need to change the patient circuit between therapies. Some devices give patients pre-therapy breaths to improve patient tolerance by providing a warm-up period before the initiation of their treatment. Moreover, devices have been developed with combined respiratory devices such as ventilation, oxygen, cough, suction, and nebulization.

By product type, the automatic cough assist device segment held a dominant presence in the cough assist devices market in 2024 and is expected to sustain its dominance during the forecast period. Advanced technologies enable manufacturers to design and develop automatic cough assist devices. Automatic devices allow the machine to cycle automatically through inspiration, expiration, and pause. They run on a specific timer system, increasing patient medication adherence. The development of portable devices offers freedom and support to patients. Automatic devices are more user-friendly, reducing the efforts taken by healthcare professionals or patients.

By choice of delivery, the mouthpiece segment held the largest share of the cough assist devices market in 2024 and is projected to expand rapidly in the coming years. A mouthpiece is an essential component of the cough assist device that is placed over the mouth to enable breathing. These devices work by applying positive and negative airway pressure through the mouthpiece. They are very comfortable and can be easily held in the mouth. The mouthpiece can either be used with a face mask or as an alternative to a face mask.

By end-use, the hospitals segment led the global cough assist devices market in 2024. Hospitals have suitable capital investment and favorable infrastructure that enables them to adopt cough assist devices. The availability of specialized equipment and the presence of key players propel the segment's growth. Favorable reimbursement policies enable patients to afford such devices and also favor the segment's growth. Hospitals are more prone to hospital-associated infections (HAIs), necessitating the use of cough assist devices.

By end-use, the home care settings segment is predicted to grow at the fastest rate over the studied period. Home care allows patients to access treatment in the comfort of their homes. The increasing geriatric population and the demand for home healthcare boost the segment’s growth. Advancements in technology enable healthcare professionals to provide state-of-the-art treatment at home. The development of small, portable, and user-friendly devices also favors effective treatment in home care settings. Additionally, the growing demand for personalized care, improved quality of life, and cost-effectiveness augment the segment’s growth. Personal cough assist devices also eliminate the risk of cross-contamination.

North America dominated the global market in 2024. The rising prevalence of spinal cord injuries or neuromuscular disorders and favorable regulatory policies drive the market. Several government and private organizations provide funding for conducting research based on medical devices for cough. The rising disposable income and the increasing geriatric population also contribute to the market. The market is also driven by advanced healthcare infrastructure and state-of-the-art research and development facilities.

The U.S. held a dominant position in North America due to several factors, such as the presence of key players. Key players such as Hill-Rom Holdings, Inc., McKesson Corporation, Philips Respironics, and US Med-Equip hold a major share of the market in the U.S. Favorable regulatory frameworks augment the market. The Food and Drug Administration regulates the approval of cough assist devices in the U.S. Additionally, favorable reimbursement policies enable people from low- and middle-income groups to afford these devices. Government policies like Medicare and several private insurance companies provide reimbursement for cough assist devices.

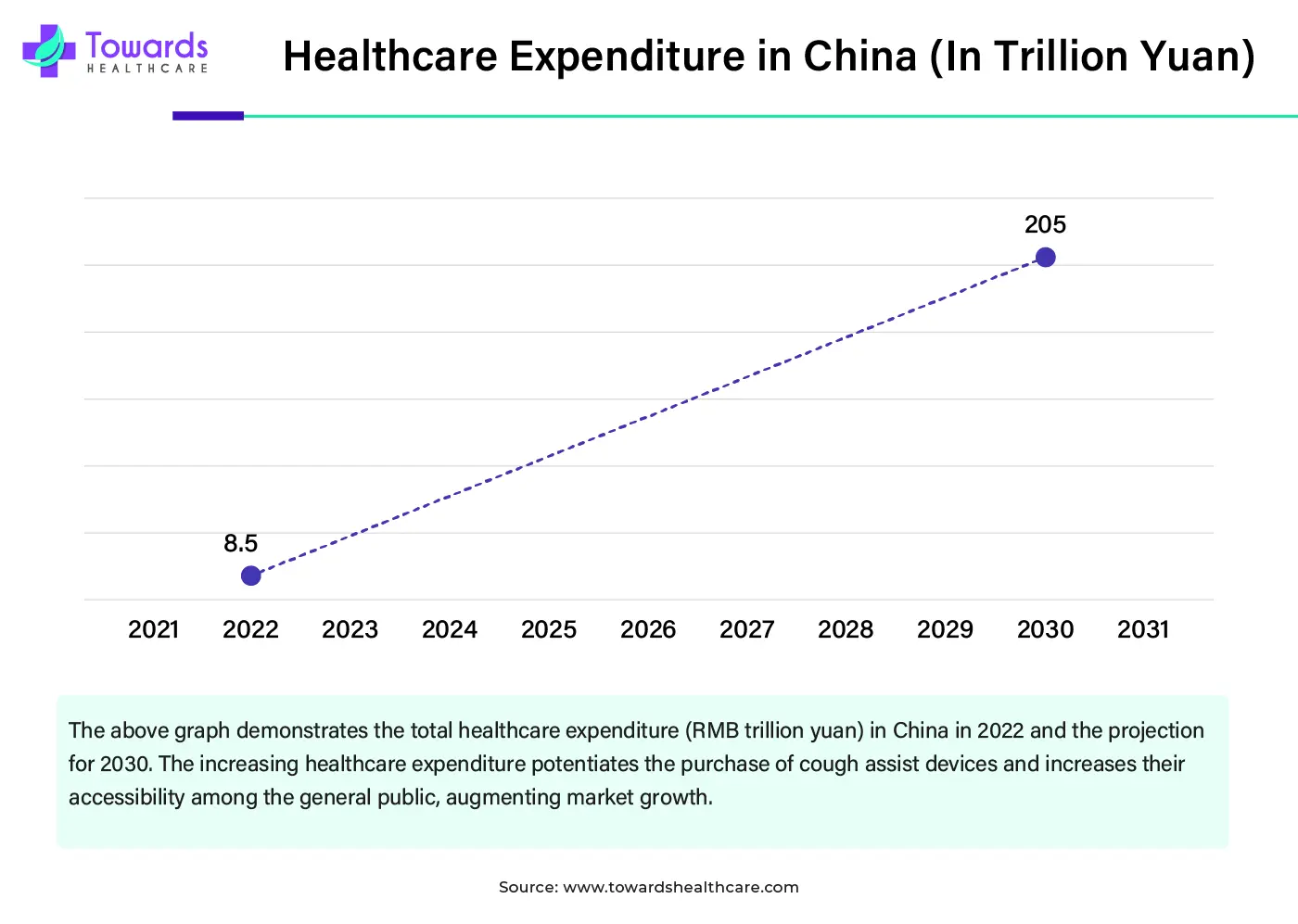

Asia-Pacific is anticipated to grow at the fastest rate in the cough assist devices market during the forecast period. Favorable regulatory policies and the rising geriatric population boost the market. The availability of suitable manufacturing infrastructure encourages foreign manufacturers to set up their manufacturing facilities in Asia-Pacific countries. The rising adoption of advanced technologies and increasing awareness about advanced cough assist devices fuel the market. Asia-Pacific countries offer affordable devices and products compared to other countries in the world, enabling foreigners to achieve their treatment in these countries.

The rising prevalence of chronic cough cases and the burgeoning healthcare sector promote the market. According to a study published in the European Respiratory Society journal, 3.6% of Chinese adults were affected by chronic cough. Favorable government policies and initiatives for screening and early diagnosis of severe chronic disorders propel the market. The growing research and development activities also contribute to the cough assist devices market growth.

Favorable government policies support the development and use of medical devices in India. The Ministry of Health and Family Welfare, Government of India, launched the National Medical Device Policy 2023, the Export Promotion Council for Medical Devices, and the Assistance to Medical Devices Clusters for Common Facilities (AMD-CF). This promotes the development and manufacturing of medical devices in India and exports to other nations.

Europe is estimated to grow at a considerable growth rate in the cough assist devices market in the upcoming period. The presence of key players and the increasing number of clinical trials boost the market. Most of the key players or cough assist device manufacturers are present in the U.S. and Europe. Key players such as Dima Italia Srl, Intersurgical, Inc., and Oxycare Medical Group hold a major share. Out of the total 39 clinical trials related to cough assist devices registered on the clinicaltrials.gov website, around 12 trials are from European countries, accounting for 31% of the total trials.

The market in Germany is driven by increasing investment and favorable government policies. Additionally, Germany has a strong healthcare ecosystem with regard to infrastructure, hospital beds, and trained professionals. According to the International Trade Organization, Germany's healthcare sector generates an economic footprint of EUR 775 billion ($883 billion), accounting for 12% of its GDP. This supports the development and demand for cough assist devices in Germany. Key companies like Air Liquide Medical Systems, Philips Healthcare, and Breas Medical are the major manufacturers of cough assist devices in Germany.

In May 2024, Michael Garron Hospital (MGH) became the first hospital in Ontario to implement the newest model of the Synclara cough system. Tracey Monahan, Senior Respiratory Therapist and Certified Respiratory Educator Clinical Coordinator at MGH, commented that the machine would enhance their capacity to provide high-quality care by leveraging the latest technology on the market, ensuring patients receive the most effective and efficient treatment.

By Product Type

By Choice of Delivery

By End-Use

By Region

January 2026

December 2025

December 2025

December 2025