January 2026

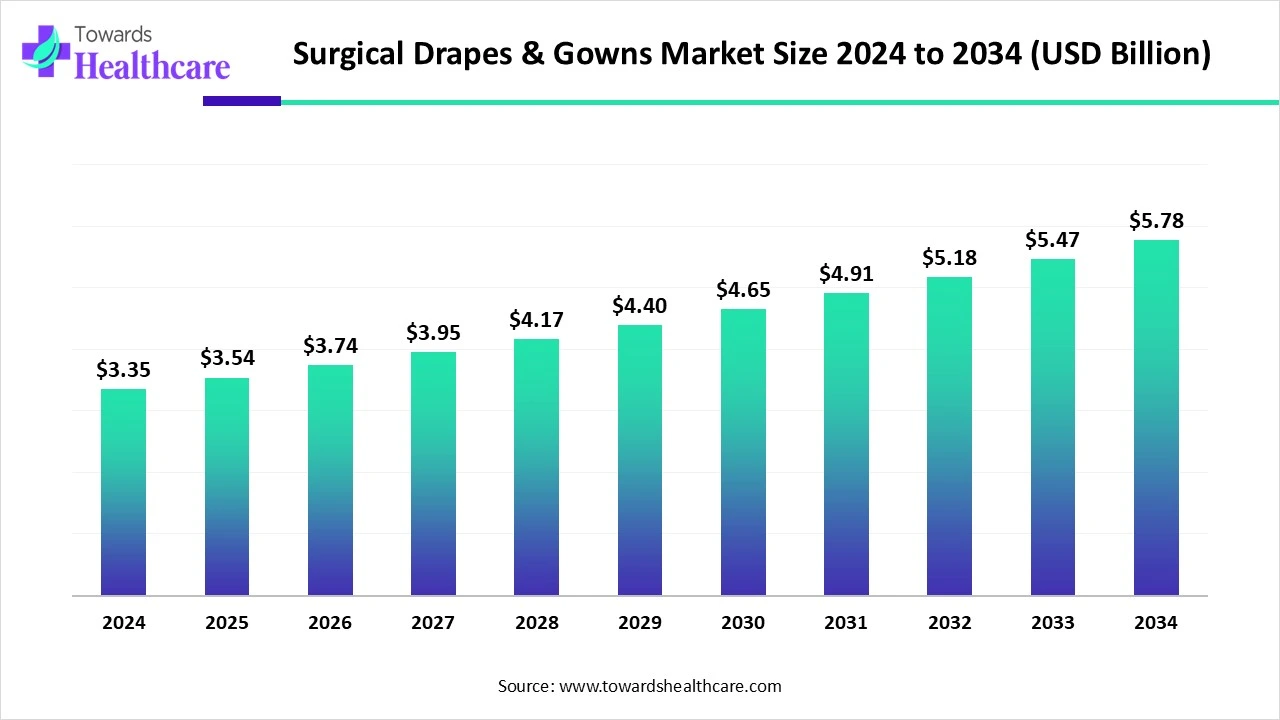

The global surgical drapes & gowns market size is calculated at US$ 3.35 billion in 2024, grew to US$ 3.54 billion in 2025, and is projected to reach around US$ 5.78 billion by 2034. The market is expanding at a CAGR of 5.64% between 2025 and 2034.

Across the world, major growth in the geriatric patients connected with surgical procedures, such as minimally invasive procedures, along with a rise in the number of accidents and sports injuries, are broadly impacting the expansion of the global surgical drapes & gowns market.

Whereas, significant awareness and prevention of hospital-acquired infections (HAIs) in the healthcare area emphasizes infection control practices in hospitals. In prospect, the market will represent numerous opportunities in innovations in materials, including breathable, liquid-proof, and durable fabrics, with the raised adoption of disposable drapes and gowns with enhanced sterility level.

| Metric | Details |

| Market Size in 2025 | USD 3.54 Billion |

| Projected Market Size in 2034 | USD 5.78 Billion |

| CAGR (2025 - 2034) | 5.64% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Usability, By Material, By Sterility, By End User, By Distribution Channel, By Region |

| Top Key Players | 3M Company, Cardinal Health, Medline Industries, Inc., Mölnlycke Health Care, Halyard Health, Paul Hartmann AG, Ahlstrom-Munksjö, Kimberly-Clark Health Care, Stryker Corporation, Winner Medical Co., Ltd., Priontex, Lohmann & Rauscher GmbH, TIDI Products, LLC, Surgeine Healthcare, Guardian Healthcare, Ecolab Inc. (Microtek Medical), Sysco Guest Supply, DuPont de Nemours, Inc., Delta Hospital Supplies, Medisafe Technologies |

The surgical drapes & gowns market refers to the global industry engaged in the production, distribution, and use of sterile protective apparel, primarily surgical drapes and surgical gowns used by medical professionals during surgical procedures. These products serve to maintain a sterile environment and prevent contamination between surgical staff and patients. Market growth is driven by the rising volume of surgeries, heightened infection control protocols, increasing awareness of HAIs (hospital-acquired infections), and demand for single-use disposable protective equipment, particularly following the COVID-19 pandemic.

Around the globe, the market is witnessing the adoption of AI in a growing number of surgical procedures, especially in developing countries, and also rising cases of HAIs, particularly surgical site infections (SSIs). This will result in stringent infection control and raised demand for disposable drapes and gowns. In these instances, AI and IoT are united into surgical drapes and gowns to evolve smart textiles, which can control critical signs, detect infections, and alert healthcare professionals to deviations. Moreover, AI-driven approaches assist in the analysis of data derived from equipment used in sterilization and surgical procedures, potentially fueling the demand for reusable drapes and gowns.

Major Growth in Surgical Procedures and Awareness & Mitigation of HAIs

Generally, broadly impacting factors on the expansion of the surgical drapes & gowns market are a rise in surgical procedures, fueled by the emerging geriatric population, growing incidence of chronic conditions, and accelerating cases of accidents and sports injuries. As well as an escalating awareness and prevention of hospital-acquired infections (HAIs) in the healthcare sector is a major driver for this market, which emphasizes infection control practices in hospitals.

Limitations of Volatile Raw Material Costs and Competition from Reusable Products

Majorly, wide range changes in the costs of raw materials, such as textiles and other components, are creating a challenge in the expanding surgical drapes & gowns market. Because of this hurdle, few regions are stepping towards the reuse of drapes and gowns, which are developing barrier for disposable choices. Also, these disposable options with its vital performance are propelling the competition with reuseable products.

Advancements in Materials and Increasing Adoption of Disposable Choices

During 2025-2034, the surgical drapes & gowns market will encompass many opportunities, including major innovations in materials, like breathable, liquid-proof, and durable fabrics, with wider awareness of hospital-acquired infections and stricter sterilization regulations by healthcare organizations. Along with this, the progressing adoption of disposable drapes is a trend in this developing market, with consideration of advanced reusable drapes as an option, particularly with increasing focus on reducing medical waste, supporting the development of new opportunities in the growing market.

In 2024, the surgical gowns segment was dominant in the market, due to rising innovations in materials, such as Hightex Hybrid Spunmelt Nonwoven fabrics and liquid repellent micro-filament materials boost the protective capabilities and comfort of surgical gowns. Besides this, a raised focus by the healthcare sector to reduce medical waste and minimize long-term procurement prices, coupled with environmental considerations, is driving the overall segment growth.

On the other hand, the surgical drapes segment will grow fastest, with an increasing number of surgical procedures due to growing instances of chronic diseases and an aging population, driving the adoption of these surgical drapes. Whereas, these surgical drapes have a crucial role in mitigating surgical site infections, making them necessary in both hospitals and ambulatory surgical centers. In the current era, various hospitals are encouraging expansion of their facilities by acquiring advanced products, including surgical drapes with innovative materials.

By usability, the disposable segment led the surgical drapes & gowns market in 2024 and will expand rapidly in the upcoming years. As the COVID-19 pandemic addressed the significance of personal protective equipment (PPE), with implementation of stricter infection control regulations has boosted the adoption of these kinds of disposable drapes and has grown. Also, disposable products allow ease of use and disposal, which helps in simplifying the surgical procedures with decreased time and resources needed for cleaning and sterilization.

Mainly, the spunbond-meltblown-spunbond (SMS) segment dominated the market, due to the immense movement from reusable to disposable surgical drapes and gowns, fueled by issues about hospital-acquired infections and affordability. Furthermore, novel developments in the SMS approach, like optimized fiber laydown and the development of antimicrobial treatments, are accelerating the performance and functionality of these fabrics, further impelling their adoption.

However, the spunlace segment is estimated to register the fastest growth, with its major application in minimally invasive procedures, which frequently need high-quality, absorbent, and sterile drapes, which can be fulfilled by spunlace materials. Also, it has advantages like creating a hurdle against contamination to protect both patients and healthcare personnel. In addition, expansion in the development of eco-friendly spunlace materials and those with enhanced barrier properties are assisting the overall market growth.

By sterility, the sterile segment held a major share of the market, and is predicted to grow rapidly, due to the major impact of the COVID-19 pandemic, with the adoption of surgical drapes with antimicrobial agents. Primarily, the need for surgical procedures, rising awareness of healthcare-associated infections, and the need for effective infection control measures are raising focus on healthcare and patient safety, which is ultimately impacting the accelerating adoption of sterile drapes and gowns.

In 2024, the hospitals segment was dominant in the surgical drapes & gowns market. The segment is driven by advancements in surgical techniques, which are boosting demand for specialized and advanced surgical drapes and gowns in hospitals, as well as rising healthcare spending in developing countries, are propelling the enhanced investment in hospital infrastructure and equipment, are impacting the overall segment growth.

Whereas, the ambulatory surgical centers segment will show rapid expansion, with its enormous benefits, such as enabling inexpensiveness for both patients and healthcare systems as compared to a conventional hospital. Also, ASCs are a highly convenient approach for both patients and surgeons, with lessen wait times and more focused care, possessing decreased infection chances than hospitals. Additionally, adaptable government regulations and reimbursement policies for ASCs are further expanding their adoption and demand for surgical supplies.

In 2024, the direct tenders segment held the largest revenue share of the market, which allowed healthcare facilities to directly involve themselves with producers and suppliers, which probably resulted in minimal expenses and tailored measures. Along with this, acceleration in surgical procedures, developing awareness of hospital-acquired infections, and the need for efficient infection prevention are influencing the comprehensive segment and market growth.

And the online retail/procurement platforms segment is anticipated to expand at the fastest CAGR in the upcoming years. Mainly, the segment comprising enhancing digitalization in the healthcare area, like online platforms for procurement with possession of properties, such as simplifying processes, minimizing spending, and optimizing access to information. Also, these online approaches offer the convenience of browsing and purchasing surgical drapes and gowns, with real-time tracking of inventory levels is highly impacting the segment expansion.

In 2024, across the world, North America held a major share of the market, with its accelerating urbanization, industrialization, and progressing healthcare investments. As well as escalating surgical procedures, growing awareness of healthcare-associated infections, and the need for effective infection control are encouraging demand for advanced and innovative surgical products in this region.

For this market,

The US is a major and widely expanding country in the North American in the respective market, due to the broad adoption of novel and advanced surgical technologies, which are essential for the application of high-quality surgical drapes and gowns. Moreover, the US is immensely focusing on infection control solutions in healthcare provisions, which is leading to the accelerating demand for robust barrier protection offered by surgical drapes and gowns.

For instance,

Canada is another crucial region in the North American market, where the government is putting efforts through its regulations and guidelines to promote hygiene and safety in the healthcare sector. These initiatives are boosting demand for novel surgical products, like drapes and gowns, in Canada. As well as revolutions in materials and manufacturing systems, including the utilization of non-woven fabrics, are being incorporated as a growth factor in Canada’s market.

During 2025-2034, Asia Pacific will register the fastest expansion in the surgical drapes & gowns market. Primarily, the region’s market is fueled by significant income levels and accelerated healthcare coverage are resulting in wider investment in the healthcare domain. Along with this, broad improvements in healthcare infrastructure, with a huge patient population, and increased access to healthcare services are leading to growing surgeries with enhanced demand for surgical drapes and gowns.

In ASAP, India has a huge pool of developing geriatric population, who need more surgical treatments are boosting ultimate market growth. Besides this, India has been widely focusing on adoption of single-use medical products, including disposable drapes and gowns, and convenient with affordable disposable surgical products are also impacting the India’s market growth.

For this market,

Likewise, India, China also possess a huge aging population having major chronic health concerns, which are highly demanding for novel healthcare methods, including advanced surgeries with convenient drapes and gowns. China also emphasizes material innovations, which are enabling to improved protection, comfort, and barrier properties, leading to broader adoption. Furthermore, China is pushing its initiatives to accelerate the domestic production of PPE, like surgical gowns are ultimately impacting the market growth.

In 2025 and the upcoming years, Europe is growing with a notable CAGR, due to rising awareness about hospital-acquired infections (HAIs) and stringent regulatory frameworks are support the adoption of disposable surgical drapes and gowns, which are considered more reliable for preventing cross-contamination. In Europe, various healthcare systems are allowing wider demand for favorable disposable products, like disposable drapes and gowns over reusable ones, with their benefits in the protection for risk and ease of use.

In Germany, the market is propelled by innovations in surgical materials, including nonwoven fabrics with improved liquid resistance, bacteria barriers, and breathability. Along with this, Germany is highly contributing to collaborations and partnerships among leading market companies through the progression of novel products and standardization efforts. Also, the expansion in hospitals is fueling the adoption of these advanced and eco-friendly surgical drapes and gowns.

Mainly, the UK has been implementing its regulations, such as the EU Medical Device Regulation (MDR) fuels the adoption of compliant and high-quality surgical drapes and gowns. Besides this, the UK is immensely focused on patient and healthcare worker safety, along with the execution of strong practices for surgical procedures. Also, the development of new hospitals and surgical centers, along with upgrades to existing ones, is influencing the adoption of surgical products.

By Product Type

By Usability

By Material

By Sterility

By End User

By Distribution Channel

By Region

January 2026

January 2026

December 2025

December 2025