January 2026

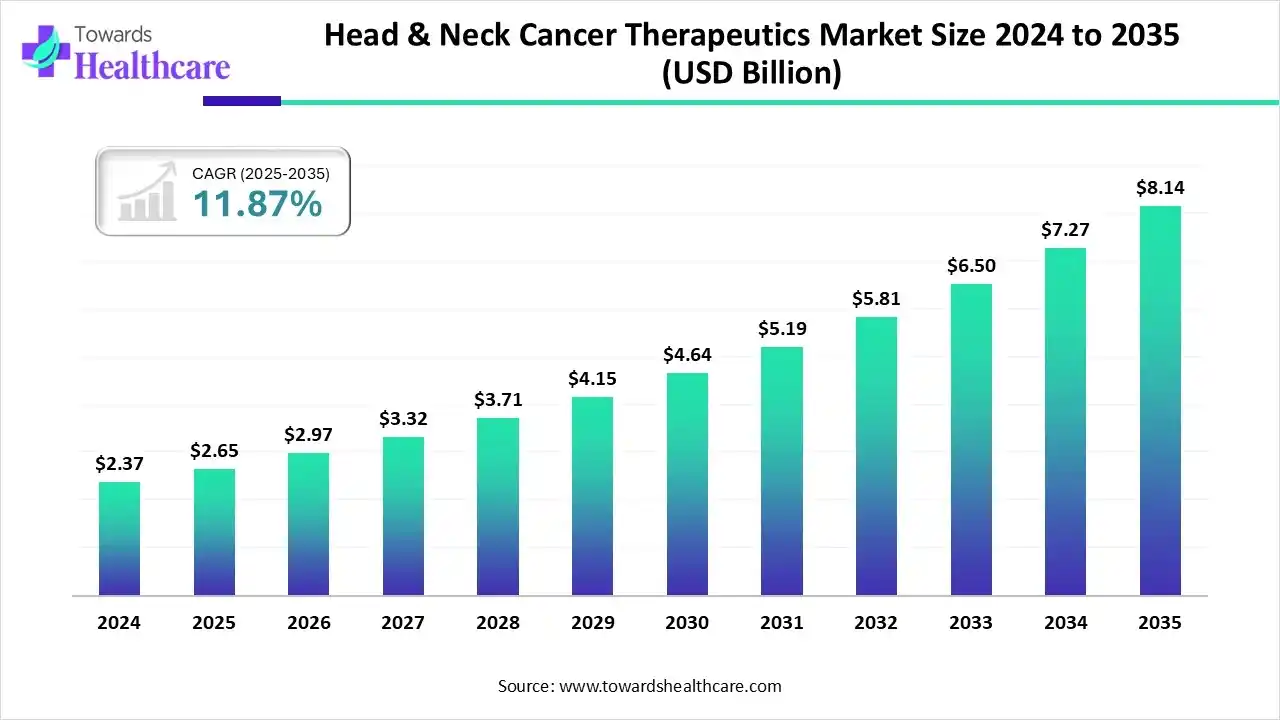

The global head & neck cancer therapeutics market size is calculated at US$ 2.65 billion in 2025, grew to US$ 2.97 billion in 2026, and is projected to reach around US$ 8.14 billion by 2035. The market is expanding at a CAGR of 11.87% between 2026 and 2035.

Specifically, a rise in various kinds of cancer cases, including HNC, NPC, and others, along with this, an expansion of regulatory approvals for advanced therapies is supporting the overall development of the head & neck cancer therapeutics market. Whereas, the leading players are promoting extensive clinical trials for novel therapeutics, especially ADC, radiotherapy, immunotherapy, and combinations of therapies. However, researchers are increasingly stepping into the investigation of robust oncology treatments, their delivery solutions, and innovative biodegradable substances.

| Table | Scope |

| Market Size in 2025 | USD 2.65 Billion |

| Projected Market Size in 2035 | USD 8.14 Billion |

| CAGR (2026 - 2035) | 11.87% |

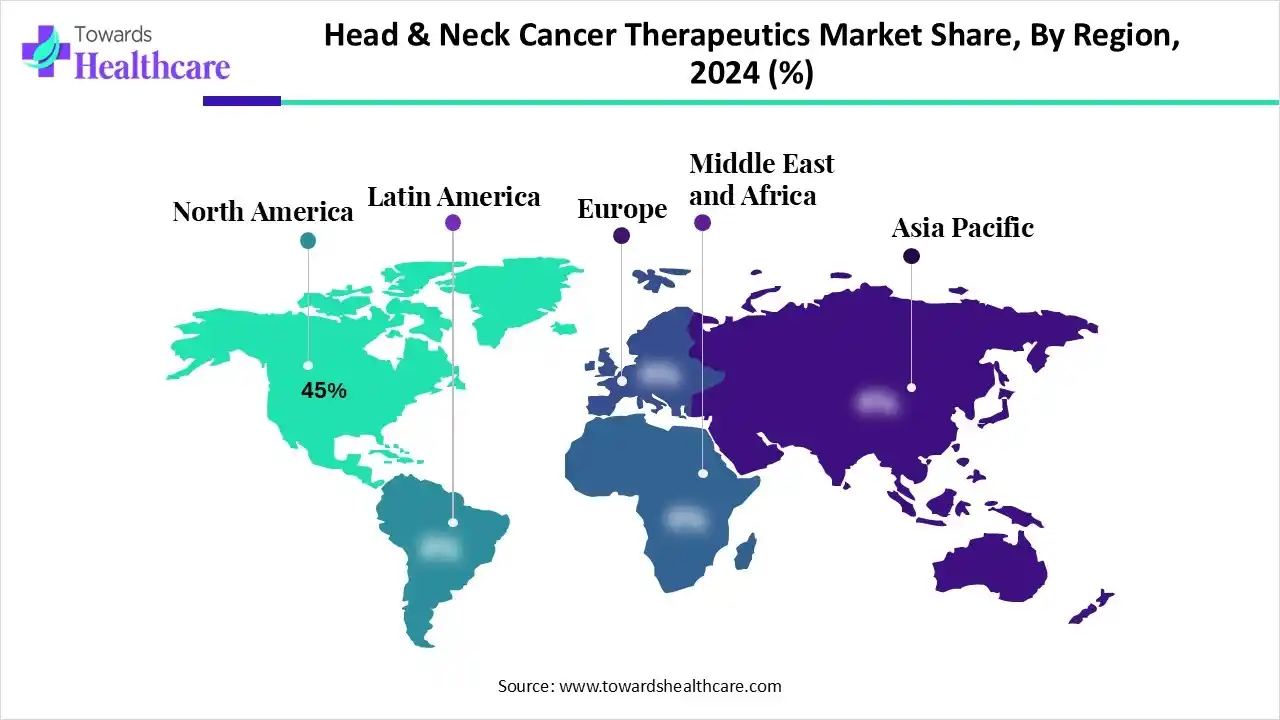

| Leading Region | North America by 45% |

| Market Segmentation | By Therapy Type, By Mechanism/Modality, By Indication/Anatomical Subtype, By Route of Administration & Formulation, By Region |

| Top Key Players | Novartis, Eli Lilly & Company, Johnson & Johnson (Janssen), Amgen, Sanofi, Takeda Pharmaceutical Company , Seagen (Seattle Genetics), Regeneron Pharmaceuticals, Gilead Sciences (incl. CAR-T / cell therapy interests), BeiGene |

The head & neck cancer therapeutics market covers approved and late-stage pharmaceutical and biologic treatments used to manage malignancies arising in the oral cavity, pharynx, larynx, nasal cavity & paranasal sinuses, salivary glands, and related sites. Scope includes systemic therapies (chemotherapy, targeted small molecules, monoclonal antibodies, antibody-drug conjugates, immune checkpoint inhibitors, targeted synthetic agents), loco-regional systemic adjuncts (neoadjuvant/adjuvant), biologic modalities (cell therapies, oncolytic viruses), supportive oncology medicines and delivery formats (IV/infusion, oral targeted agents, intratumoral). The market serves surgical and radiation oncology pathways (combined modality) and late-line/metastatic disease management.

Ongoing technological breakthroughs worldwide are driving rapid innovation across diverse therapeutic areas, including the head & neck cancer therapeutics market. This market is fostering the adoption of transoral robotic surgery (TORS), a minimally invasive approach that uses a computer system to guide small, articulating robotic arms through the mouth, further facilitating surgeons with a high-definition, magnified, 3D view of the surgical site. However, the developments in radiotherapy, like intensity-modulated radiotherapy (IMRT) and proton therapy (PT), further transfer high doses of radiation to the tumour.

Which Therapy Type Led the Head & Neck Cancer Therapeutics Market in 2024?

In 2024, the immunotherapies segment held nearly 42% share of the market. Continuous advancements, such as PD-1 and PD-L1 inhibitors (pembrolizumab, nivolumab), are leveraging major benefits and resulting in greater adoption. The recent study of TIGIT inhibitors in combination with PD-1/PD-L1 inhibitors, is supporting to enhance T-cell responses. The expanding application of neoadjuvant immunotherapy is lowering the need for post-operative chemotherapy and radiation.

Antibody-Drug Conjugates (ADCs) & Radioligand Conjugates

The antibody-drug conjugates (ADCs) & radioligand conjugates segment will expand fastest in the coming era. A prominent catalyst is a rise in greater unmet medical requirements for robust therapies in recurrent/metastatic disease. A surge in the latest enhancement in linker technology (for expanded stability and controlled release), more potent payloads, and site-specific conjugation methods are impacting next-generation ADCs safer and more effective.

Cell & Gene Therapies; Oncolytic Viruses

The cell & gene therapies, oncolytic viruses segment will expand notably in the head & neck cancer therapeutics market. These viruses facilitate unique dual functions, such as destroying cancer cells via replication & lysis, and simultaneously triggering a systemic anti-tumour immune response. Whereas emerging advances in CAR-T cells targeting new antigens, especially CD70 and c-MET, new gene therapy delivery approaches using lipids and protein complexes also promote the overall expansion.

Why did the Checkpoint Blockade Segment Dominate the Market in 2024?

By capturing approximately 35% share, the checkpoint blockade segment led the head & neck cancer therapeutics market in 2024. Specific use of combined checkpoint inhibitors with conventional treatments like chemotherapy and radiation is delivering more efficacy and safer results. As this segment mainly works through targeting the PD-1/PD-L1, highly effective in head and neck squamous cell carcinoma (HNSCC). As per an NIH study, it is projected that HNSCC will rise to 1.08 million annually, which is 30% greater than in 2021.

Immune-Engaging Biologics

In the future, the immune-engaging biologics segment is estimated to grow rapidly. Mainly, this comprises immune checkpoint inhibitors (ICIs), like pembrolizumab (Keytruda) and nivolumab (Opdivo), with their superior efficacy, durable responses, and optimised survival rates. Usually, they act by activating or boosting the patient's own immune system to understand and attack tumour cells. The market is emphasising tumour-infiltrating lymphocyte (TIL) therapy and bispecific antibodies.

Cytotoxic Payload Delivery

The cytotoxic payload delivery segment is anticipated to show a significant expansion in the head & neck cancer therapeutics market. They prominently focus on targeted approaches using Antibody-Drug Conjugates (ADCs) and different nanoparticle-based systems, which are increasing effectiveness with reduced systemic toxicity. Inclusion of new types of payloads, such as proteolysis targeting chimeras (PROTACs) and immune-stimulating antibody conjugates (ISACs), is supporting the prospective developments.

How did the Oropharyngeal (HPV-positive/HPV-negative) Segment Lead the Market in 2024?

The oropharyngeal (HPV-positive/HPV-negative) segment held nearly 30% share of the head & neck cancer therapeutics market in 2024. The segment is driven by p16 immunohistochemistry and HPV DNA/RNA testing, which enables robust patient stratification and eligibility for HPV-specific treatments. The latest solutions comprise an exploration of innovative surgical techniques, such as transoral robotic surgery (TORS) and transoral laser surgery (TOLS).

Nasopharyngeal (NPC)

The nasopharyngeal (NPC) segment is predicted to witness rapid expansion. The eventual rise in NPC cases and growing awareness of the disease is fueling demand for advanced therapies, like immunotherapy & other combination therapies. Research studies are showing promising effects of monoclonal antibodies and tyrosine kinase inhibitors, and intensity-modulated radiotherapy (IMRT). In 2024, the Southern part of China has shown higher cases of NP

Oral Cavity

The oral cavity segment is predicted to expand at a notable CAGR in the head & neck cancer therapeutics market. The immersion issues are the growing HPV, tobacco, and alcohol use, and the rising ageing population, which are bolstering demand for novel therapeutics. The latest advances, including robotics, endoscopic platforms, and image-guided navigation, are allowing more accurate and minimally invasive surgeries.

What Made the Intravenous/Infusion Segment Dominant in the Market in 2024?

In 2024, the intravenous/infusion segment captured approximately 78% share of the head & neck cancer therapeutics market. Primarily, they offer rapid systemic absorption and better bioavailability, with precise control over dosage and administration. This era’s preclinical studies are leveraging biodegradable polymer gels containing cisplatin that can be injected into the tumour.

Oral Small Molecules

In the prospective period, the oral small molecules segment will expand rapidly. They often consist of targeted therapies and novel formulations like nanotechnology and Proteolysis-Targeting Chimeras (PROTACs). Recent developments are using nanoparticles, nanolipids, and hydrogels for oral drug delivery, and researchers are imposing detection of natural small molecules (e.g., polyphenols, isothiocyanates, terpenoids, and statins) for their anti-cancer properties in HNC.

Intratumoral/Localized Delivery

The intratumoral/localized delivery segment will grow significantly. Ongoing studies of hafnium oxide nanoparticle (NBTXR3) are exploring its radioenhancer activity when injected intratumorally and activated by radiotherapy. Specifically, biodegradable poly(ester-anhydride) (PSARA) gels and diverse nanoparticles (NPs) that form a localized drug reservoir at the injection site are also widely used.

By capturing nearly 45% share, North America registered dominance in the head & neck cancer therapeutics market in 2024. This dominance is led by the highest per-patient spend, & early access to biologics. Alongside, the region possesses a strong clinical trials ecosystem and transformations in diagnostics like PET-CT and MRI to allow early and more precise tumour detection.

For instance,

As the U.S. is one of the vital countries across the globe, its market is experiencing major growth due to the rising FDA approvals for novel therapeutics. Recently, the FDA has approved toripalimab (Loqtorzi) for nasopharyngeal cancer, the advanced therapy designation for petosemtamab, and highly effective results for combination therapies, especially pisytomab with pembrolizumab.

For instance,

During 2025-2034, the Asia Pacific is anticipated to expand at the fastest CAGR in the head & neck cancer therapeutics market. This expansion will be propelled by the growing tobacco & alcohol consumption and escalating instances of HPV-related oropharyngeal cancers. These cases further bolster to boost healthcare expenditures, with expanded studies. These ongoing clinical studies are exploring an emphasis on precision medicine and newer solutions like subcutaneous administration.

As ASAP is facing a gradual rise in diverse cancer cases, including in China, it is bolstering its R&D activities through the various government initiatives, funding for cancer research. Moreover, Chinese researchers have been studying a next-generation anti-CD47 antibody, AK117, which is in Phase 3 clinical trials in China.

For this market,

Europe is experiencing a notable growth in the head & neck cancer therapeutics market. A particular driver of this growth is the wider contribution of robust regulations. This is usually assisted through mechanisms, such as fast-track approvals and orphan drug designations from organisations like the EMA, which further propel innovation. Recently, at the ESMO 2025 Congress, the European phase Ib/II Orig-AMI 4 clinical trial presented highly effective results for amivantamab in patients with recurrent or metastatic HNSCC.

Continuous research studies are emphasising combination treatments, which will have positive results from clinical trials. They evaluate new combinations of existing therapies. Furthermore, the German players are empowering improvements in earlier diagnosis by using well-sophisticated imaging techniques and simplifying further drug approval processes.

For instance,

The head & neck cancer therapeutics market in South America is witnessing a rapid adoption of cutting-edge immunotherapy treatments for head and neck cancers. Increased government focus on advanced oncology centers and early diagnosis initiatives significantly powers this market expansion. Brazil and Argentina are at the forefront of this strong therapeutic upswing.

The Brazil head & neck cancer therapeutics market is accelerating due to a rising incidence linked to traditional risk factors and HPV infections. Crucial to this growth are advancements in precision oncology and targeted therapies, giving new hope to patients. Government programs like PRONON also support vital research funding.

The broader Middle East and Africa region is seeing market growth propelled by the increasing availability of checkpoint inhibitors and other novel drugs. Heightened disease awareness and enhanced government spending are improving patient access. Immunotherapy is currently the largest and fastest-growing segment.

The Gulf Cooperation Council or GCC nations, including Saudi Arabia and the UAE, are aggressively investing in high-tech healthcare infrastructure. This drive ensures the quick integration of global standards and the latest treatment options. The focus on specialized cancer centers is a main growth propellant.

This encompasses usual research stages, i.e., from target detection, preclinical studies, clinical studies, and finally regulatory approval processes.

Key Players: Adaptimmune, Galectin Therapeutics, AVEO Pharmaceuticals, etc.

Phases I to IV are widely involved in investigating various therapeutic approaches, like chemotherapy, radiation therapy, immunotherapy, and targeted therapy, often in combination with each other.

Key Players: Catalysis SL, Charité University, Berlin, Germany, Stanford University, etc.

The head & neck cancer therapeutics market mainly comprises comprehensive rehabilitation and support, including speech and swallowing therapy, dental care, physiotherapy, nutritional support, and prosthetic services.

Key Players: Merck, Bristol-Myers Squibb, AstraZeneca, etc.

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations:

Product Launches/Innovations:

Ongoing clinical studies (Phase 3) for Keytruda in various combinations for head and neck cancer, aiming to solidify its first-line dominance.

Capacity Expansions/Investments:

Investing billions in new manufacturing and R&D facilities to support the long-term supply of its key products like Keytruda.

Regulatory Approvals:

Keytruda has received numerous expanded approvals globally in 2024 and 2025 across multiple cancer types, including label updates for combination therapies in HNSCC.

Distribution channel strategy:

Primarily relies on a Specialty Pharmacy and Hospital Pharmacy distribution model due to the high cost and complex administration (intravenous infusion) of its oncology biologics.

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Focusing on advancing a subcutaneous formulation of Opdivo (nivolumab) in 2024/2025 to offer greater patient convenience and potentially maintain market share against biosimilar erosion.

Capacity Expansions/Investments:

Continuing major investments in its oncology and cell therapy manufacturing capabilities globally.

Regulatory Approvals:

Received multiple key FDA and EMA approvals in 2024 and 2025 across its portfolio, including expanded use of Opdivo in combination regimens for various solid tumors.

Distribution channel strategy:

Leverages a sophisticated Specialty Distribution network to manage the distribution of its complex biologic therapies (injectables/infusions) and high-value oral specialty drugs (from the Celgene acquisition).

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

Key Companies and Their contributions and offerings

By Therapy Type

By Mechanism/Modality

By Indication/Anatomical Subtype

By Route of Administration & Formulation

By Region

January 2026

January 2026

January 2026

December 2025