February 2026

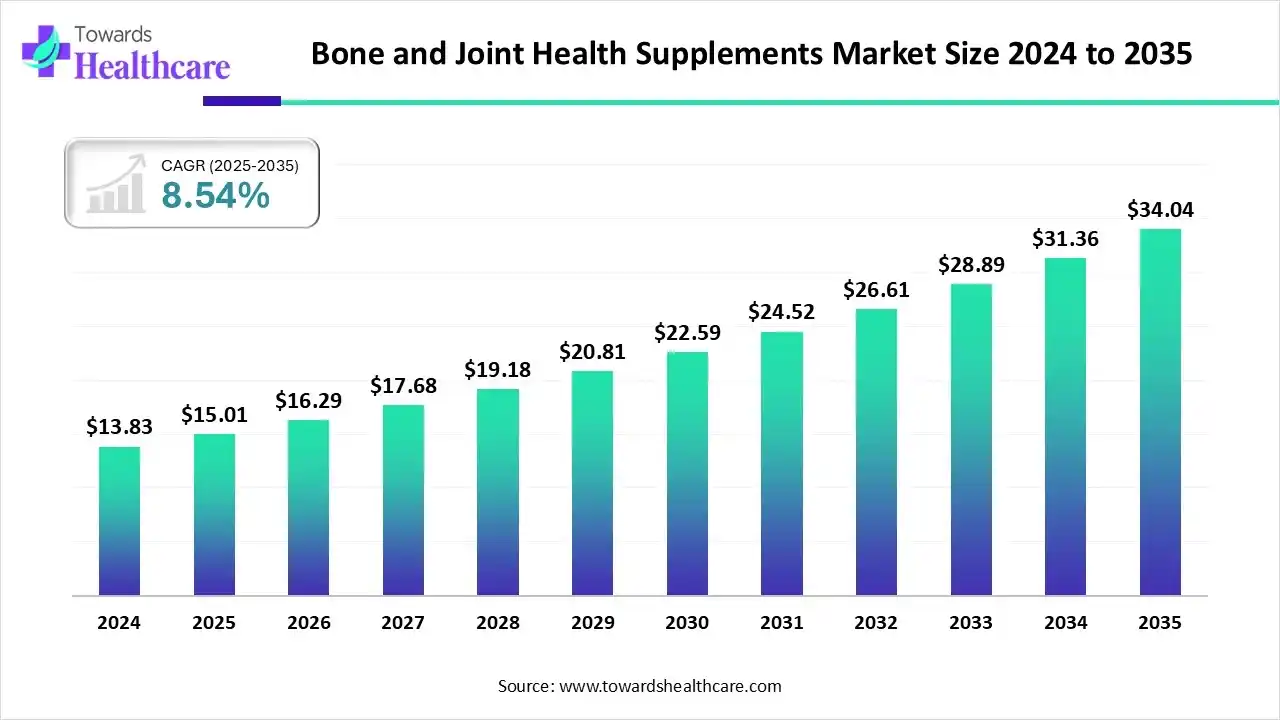

The global bone & joint health supplements market size is calculated at US$ 15.01 billion in 2025, grew to US$ 16.29 billion in 2026, and is projected to reach around US$ 34.04 billion by 2035. The market is expanding at a CAGR of 8.54% between 2026 and 2035.

The bone & joint health supplements market is anticipated to expand mainly as a result of a greater and ongoing emphasis on personal nutrition as people live with elevated risks of chronic bone and joint diseases. The industry is predicted to sustain its high road for the ensuing ten years through consistent product development and strategic brand positioning.

| Table | Scope |

| Market Size in 2025 | USD 15.01 Billion |

| Projected Market Size in 2035 | USD 34.04 Billion |

| CAGR (2026 - 2035) | 8.54% |

| Leading Region | North America |

| Market Segmentation | By Product, By Formulation, By Application, By Consumer Group, By Sales Channel, By Region |

| Top Key Players | Herbalife International of America, Inc., GNC Holdings, LLC, Nature's Bounty, Amway, Garden of Life, Thorne, Solgar Inc., Pure Encapsulations, LLC., Glanbia plc, NOW Foods |

The bone & joint health supplements market is driven by rising demand, a growing geriatric population, and greater awareness of health supplements in developing countries. While age, physical activity, and genetics all have a big impact on bone and joint health, nutrition is an important and frequently overlooked factor that affects how strong and functional bones and joints are over the long term. These days, there are a lot of supplements that can help reduce joint stiffness and pain.

By accelerating product development and improving research capabilities, artificial intelligence is drastically changing the bone & joint health supplements market. Faster identification of the best ingredient combinations is made possible by AI-driven algorithms, which guarantee maximum bioavailability and functional efficacy. To assist manufacturers in creating more specialized and tailored formulations, these intelligent systems examine dietary preferences, consumer health trends, and clinical data.

How the Vitamins Segment Dominated the Market in 2024?

The vitamins segment accounted for the largest share of the bone & joint health supplements market in 2024 because different vitamins play a crucial role in joint and bone health. Vitamin D is essential for healthy bones. Recent research has demonstrated that vitamin D facilitates the body's adequate absorption and use of calcium in the intestines. Vitamin K's function is to activate certain proteins that aid in bone production and stop bone deterioration.

Glucosamine

The glucosamine segment is expected to post the highest CAGR over the forecast period, as glucosamine promotes the health of joints. Osteoarthritis and other inflammatory diseases can be treated with supplements. Most individuals may safely eat it. It is a highly popular supplement for those who want to keep up an active lifestyle and is frequently paired with chondroitin.

Collagen

The collagen segment is growing significantly in the bone & joint health supplements market because numerous studies have been conducted on collagen as a possible therapy for OA. The majority of research findings are good, albeit the quality varies. Because of the increased emphasis on healthy aging, preventative healthcare, and sports nutrition worldwide, the use of collagen supplements for bones and joints is expanding quickly.

How did Tablets Segment Dominate the Market in 2024?

The tablets segment accounted for the largest share of the bone & joint health supplements market in 2024 due to their portability and consistent dosing. Tablets remain the most widely used form of nutritional supplement. For people who want reliable nutritional support without the hassle of measuring, they offer clear benefits. Powders cannot compare to the mobility and convenience of tablets. These conventional forms may increase shelf life by shielding ingredients from moisture and oxygen.

Capsules

The capsules segment is expected to register the highest CAGR over the forecast period. Without a doubt, the capsule format is more useful and more in line with our Western way of life. It enables quick ingestion, accurate dosing, and—most importantly- neutralization of the occasionally harsh or unpleasant tastes of vitamins.

Powders

The powders segment is growing significantly in the bone & joint health supplements market. Nutrient mixes that have been finely processed and are suitable for large-scale consumption are known as powdered supplements. For people who have trouble swallowing tablets or capsules, this supplement form is versatile and perfect.

What made Bone Density Support Dominant in the Market in 2024?

The bone density support segment accounted for the largest share of the bone & joint health supplements market in 2024. Osteoporosis, a prevalent condition, is characterized by decreased bone density and is linked to a higher risk of fragility fractures. Supplemental vitamins, minerals, and other nutrients can help maintain healthy bones. These supplements preserve the bones' natural structure and strengthen them.

For instance,

Performance Enhancement

The performance enhancement segment is expected to post the highest CAGR in the bone & joint health supplements market over the forecast period because athletes use bone and joint supplements to lower their risk of injury, control pain and inflammation brought on by activity, hasten their recuperation, and preserve their long-term musculoskeletal health. Glucosamine, chondroitin, collagen, calcium, vitamin D, and omega-3 fatty acids are important supplements.

Pain Relief & Inflammation Management

The pain relief & inflammation management segment is growing significantly in the bone & joint health supplements market. A growing and aging world population, more health consciousness, and a desire for natural or non-pharmacological options are all contributing factors to the rise in demand for supplements that address bone and joint pain and inflammation.

What made the Adults Segment Dominant in the Market in 2024?

The adults segment accounted for the largest share of the bone & joint health supplements market in 2024 because adults frequently take supplements including vitamins, minerals, and fish oil. Adults most frequently cited maintaining and enhancing general health as their key motivations for using dietary supplements. As they age, adults, particularly women, lose bone density, making supplementation increasingly common.

Geriatric Population

The geriatric population segment is expected to post the highest CAGR over the forecast period, driven by centenarians (those 100 years of age and older), who are expected to number around 3.7 million worldwide by 2050, a considerable increase from the anticipated 722,000 in 2024. Around the world, up to 37 million fragility fractures, or 70 fractures every minute, occur in people over 55 each year. Around 500 million men and women worldwide may be affected by osteoporosis, and in 2024, there will be up to one fragility fracture (shoulder, hip, spine, or distal radius) per second.

Pregnant Women

The pregnant women segment is growing significantly in the bone & joint health supplements market because women are at high risk of developing bone health issues during and after pregnancy. Osteoporosis is seen as a significant public health issue, particularly for women who have gone through menopause. Pregnancy and breastfeeding may contribute to osteoporosis in later life, according to certain theories. A low estrogenic condition and a high calcium need during pregnancy and breastfeeding lend credence to such theories.

Which Sales Channel Segment Dominated the Market in 2024?

The brick-and-mortar segment accounted for the largest share of the market in 2024. Even as e-commerce reaches new heights, brick-and-mortar retail remains strong in today's fast-paced digital environment. Even if internet shopping is convenient for customers, physical locations are still essential for brand engagement, customized service, and tactile product experiences.

E-Commerce

The e-commerce segment is expected to post the highest CAGR in the bone & joint health supplements market over the forecast period. Over the past ten years, the e-commerce sector has experienced tremendous expansion due to its emphasis on accessibility and convenience, which has resulted in an increase in online purchasing as more and more customers choose this method. Since supplements may be bought over the counter, many individuals prefer the ease of internet shopping and the wider selection and discounts that come with it.

North America dominated the bone & joint health supplements market in 2024. In the area, more individuals are spending a lot of money on supplements and other medical supplies. Better medical facilities, a growing number of insured individuals, cutting-edge technology, and an advanced pharmacy distribution system are also drawing additional producers of bone and joint health supplements to the area.

Government power and involvement in the natural products sector have significantly increased in Canada during the last nine years. The way Health Canada has regulated Natural Health Products (NHPs, the Canadian acronym for dietary supplements) has been one of the biggest changes.

In Canada in 2024: 20.6% of adults report arthritis, 10% of Canadians aged 40+ have diagnosed osteoporosis, 27.6% of those 65+ suffer pain-related disability, and about 6% of fractures stem from sporting injuries.

Asia Pacific is estimated to host the fastest-growing bone & joint health supplements market during the forecast period. The growing middle class, increased health consciousness, and expanding demand for nutritional goods have made Asia-Pacific a major market for bone and joint health supplements. Strong market expansion in the Asia-Pacific region is being driven by the adoption of Western eating habits, growing awareness of bone health, and the impact of fitness and wellness trends.

The growing awareness of health and well-being among Indian consumers has led to a rise in the demand for bone & joint health supplements. The Food Safety and Standards Authority of India (FSSAI), which is part of the Government of India's Ministry of Health and Family Welfare (MoHFW), oversees the strict legal and safety regulations governing dietary supplements in that country. The purpose of this framework is to demonstrate that dietary supplements are high-quality, safe, and effective in compliance with the Food Safety and Standards Act of 2006.

In India, about 18.3 % of adults have osteoporosis, and 49.9 % osteopenia. Elderly prevalence rises to 37 %. Sports-related injuries affect 18.4% of active students, contributing to increased orthopedic demand.

Europe is expected to grow at a significant CAGR in the bone & joint health supplements market during the forecast period. Algal calcium and marine collagen are becoming more and more well-liked by environmentally conscientious shoppers. Although EFSA's regulatory harmonization makes it easier to introduce products in several countries, it also sets strict evidentiary criteria that benefit well-funded businesses.

An older population, more health consciousness, and an emphasis on preventive healthcare are the main drivers of the growing use of bone health supplements in the UK, a trend that is predicted to last through 2024 and 2025.

In 2024 UK, 17.9% have musculoskeletal disorders, 4 million live with osteoporosis, 33% aged 65+ experience falls yearly, and sports-related trauma reaches 5.4 injuries per 100,000 participants, predominantly affecting active adult men.

South America is expected to grow significantly in the bone & joint health supplements market during the forecast period as consumers increasingly embrace preventive healthcare. Rising incidences of arthritis and osteoporosis, coupled with higher calcium and collagen supplement consumption, are driving demand. Brazil, Chile, and Argentina show growing interest in plant-based formulations.

Brazil leads regional growth with strong innovation in glucosamine, chondroitin, and vitamin D supplements. Urban consumers prioritize mobility and active aging, fueling e-commerce sales. Government nutrition campaigns and local nutraceutical manufacturing are further boosting accessibility, enhancing public awareness of bone health management.

In 2024, around 606 million people have osteoarthritis, 1.71 billion suffer musculoskeletal disorders, 19.7% experience osteoporosis, and by 2050, other musculoskeletal conditions may surpass 1.06 billion globally, worsening global disability burdens.

The Middle East and Africa are expected to grow at a lucrative CAGR in the bone & joint health supplements market during the forecast period. In the Middle East and Africa, growing awareness of age-related bone issues and vitamin deficiencies drives supplement adoption. The rising fitness culture and expanding pharmacy networks in South Africa, Egypt, and Saudi Arabia support the market penetration of joint-protective nutraceuticals and fortified functional foods.

The UAE’s bone & joint health supplements market is accelerating through premium, science-backed formulations. Increased consumer spending on bone and joint health products reflects lifestyle shifts toward proactive wellness. Pharmacies and digital retail channels are expanding rapidly, supported by government initiatives promoting healthy living and preventive nutrition.

In the United Arab Emirates, about 20% of the general population suffers from arthritis. The prevalence of osteoporosis is 3.1%. Work-related musculoskeletal disorders affect 75% of young adults and 71.4% of schoolteachers.

Scientific research, product development, and regulatory compliance are all systematically integrated in the R&D process for supplements that promote bone and joint health. From the original concept to commercialization, it usually requires a number of crucial steps.

Because bone and joint health supplements are controlled as food items rather than medications, clinical trials studies are often not required for market access in the U.S. and EU. But in order to validate some health claims on labels and win over customers, studies are essential.

In order to guarantee successful disease treatment, patient support measures for bone and joint supplements include education, usage instructions, adherence reminders, collaboration with healthcare providers, financial aid, and emotional support.

Company Overview

Bayer is a global life science company with core competencies in healthcare and agriculture. Its Consumer Health division is a major player in the bone and joint supplement market through brands like One A Day and Citracal.

Corporate Information

History and Background

Founded by Friedrich Bayer and Johann Friedrich Weskott for the production of dyes, Bayer expanded into pharmaceuticals, notably with Aspirin, and has grown through significant acquisitions, building a leading global Consumer Health portfolio.

Key Milestones/Timeline

Business Overview

Operates as a diversified life science company, with the Consumer Health division providing over-the-counter (OTC) medicines and dietary supplements globally. The division focuses on self-care and preventative health.

Business Segments/Divisions

Key Offerings

End-Use Industries Served

Direct, to Consumer, via mass market retail, pharmacy chains, and e, e-commerce platforms.

Key Developments and Strategic Initiatives

Mergers & Acquisitions

November 2022: Acquired a majority stake in Care/of, a direct-to-consumer vitamin and supplement company, strengthening its personalized nutrition capabilities and digital reach.

Partnerships & Collaborations

Ongoing collaborations with major global retail and pharmacy partners to ensure widespread access to its OTC and supplement brands.

Product Launches/Innovations

Focus on expanding the Vitamins, Minerals, and Supplements (VMS) portfolio with science-backed formulations and innovative delivery formats, like gummies and personalized packs, to meet evolving consumer preferences.

Capacity Expansions/Investments

Continuous investment in supply chain optimization and digital infrastructure to support the growth of the Consumer Health division.

Regulatory Approvals

Maintains stringent compliance with global regulatory standards for dietary supplements and OTC drugs across all operating regions.

Distribution channel strategy

Core Technologies/Patents

Innovation Focus Areas

Personalized nutrition, self-care, solutions, product form innovation (e.g., improved absorption), and digital health integration.

Competitive Positioning

Strengths & Differentiators

Market presence & ecosystem role

A market leader in the broader VMS and OTC categories, serving as a benchmark for product quality and scientific backing in the consumer health ecosystem.

SWOT Analysis

Recent News and Updates

The Consumer Health division reported slight sales growth in 2024 (Fx & portfolio adjusted), contributing to the company meeting its adjusted guidance despite headwinds in other divisions.

Press Releases

March 5, 2025: Announced full-year 2024 results, highlighting the Consumer Health division's steady contribution amidst the group's corporate restructuring efforts.

Industry Recognitions/Awards

Recognized consistently for its top-selling OTC and supplement brands across various regions.

Company Overview

Amway is an American multi-level marketing (MLM) company selling health, beauty, and home care products. Its Nutrilite brand is a global leader in dietary supplements, including a robust line for bone and joint health.

Corporate Information

History and Background

Founded by Jay Van Andel and Rich DeVos, Amway pioneered modern direct selling. Its acquisition of the Nutrilite brand in 1972 solidified its position in the nutrition market, which is now its largest revenue driver.

Key Milestones/Timeline

Business Overview

Amway operates globally through a unique direct sales model, utilizing millions of Independent Business Owners (IBOs) to distribute products, with nutrition products accounting for over 50% of global sales.

Business Segments/Divisions

Geographic Presence

Global, operating in over 100 countries and territories, with a particularly strong presence in Asia (China, Korea, Japan) and India, which is targeted to become the top three global markets.

Key Offerings

End-Use Industries Served

Mergers & Acquisitions

2022: Acquired the assets of Joint Juice, integrating a well-known retail bone and joint brand into its portfolio.

Partnerships & Collaborations

Active collaboration with academic and scientific bodies through the Nutrilite Health Institute to validate ingredient science.

Product Launches/Innovations

Capacity Expansions/Investments

October 2025: Announced a USD 12 million investment in India over 3-5 years, focused on expanding physical stores (hubs) for IBO engagement and enhancing R&D capabilities in the region.

Regulatory Approvals

Strict adherence to dietary supplement regulations globally, including the use of certified organic farming practices for key Nutrilite ingredients.

Distribution Channel Strategy

Technological Capabilities/R&D Focus

Core Technologies/Patents

Research & Development Infrastructure

Nutrilite Health Institute and certified organic farms (e.g., Trout Lake Farm), providing full vertical integration and control over plant-based ingredients.

Innovation Focus Areas

Personalized Nutrition, next-generation botanicals, and creating supplements with improved bioavailability and cleaner labels.

Competitive Positioning

Strengths & Differentiators

Market presence & ecosystem role

Dominates the Direct Selling channel for nutritional supplements and is a major influencer in the global health and wellness market, especially in Asia.

SWOT Analysis

Recent News and Updates

Strategic investment to strengthen the India market, a key growth engine.

Press Releases

October 2025: Announcement of the INR 100 crore investment in India, emphasizing the country's strategic role as one of only three global manufacturing hubs.

Industry Recognitions/Awards

Consistently ranked among the top global direct selling companies and recognized for its sustainability initiatives related to its Nutrilite farms.

| Company | Headquarters | Offerings & Ingredients | Market Contribution & Revenue |

| Herbalife International of America, Inc. | Los Angeles, U.S. | Offers Joint Support Advanced with glucosamine, botanical extracts, manganese, and copper for cartilage and joint mobility. | Expands global preventive nutrition via MLM channels, generating about US $5 billion in revenue in 2024. |

| GNC Holdings, LLC | Pittsburgh, U.S | Provides bone and joint supplements combining glucosamine, chondroitin, MSM, and collagen blends. | Strong global retail network influences accessibility, with estimated revenue near US$1 billion in 2024. |

| Nature’s Bounty (The Bountiful Company) | New York, U.S. | Offers calcium, vitamin D3, zinc, and glucosamine for bone density and flexibility. | Trusted wellness brand under Nestlé Health Science, earning ~US $2 billion in 2024. |

| Garden of Life | Palm Beach Gardens, U.S. | Features Vitamin Code Grow Bone System using plant calcium, strontium, turmeric, and collagen | Clean-label leader with eco-friendly focus, achieving ~US $350 million revenue. |

| Thorne HealthTech (Thorne) | Durham, U.S. | Produces Joint Support Nutrients with glucosamine, MSM, curcumin, and boswellia. | Clinical-grade personalized supplements brand with ~US $250 million revenue in 2023. |

Read further to see how top players are shaping the future of bones & joint health supplements market at: https://www.towardshealthcare.com/companies/bone-and-joint-health-supplements-companies

By Product

By Formulation

By Application

By Consumer Group

By Sales Channel

By Region

February 2026

February 2026

February 2026

January 2026