Which are the Largest Companies in the AI in Patient Scheduling Software Market

- Thinkiitive

- Notable Health

- TrueLark

- Athelas

- ScienceSoft

- CleverDev Software

- AdvancedMD

- Hyro.ai

- Hippocratic AI

- Kyndryl

Introduction:

The AI in patient scheduling software market is primarily driven by the increasing patient volumes and the growing need for personalized care. Shortage of healthcare professionals encourages them to use digital tools to serve a large patient population. Artificial intelligence (AI) automates patient scheduling to minimize wait times and enhance patient satisfaction. AI-powered solutions help deliver high-quality care, reducing stress among healthcare staff. The market future is promising, driven by the integration into electronic health records (EHRs) and a growing focus on patient experience.

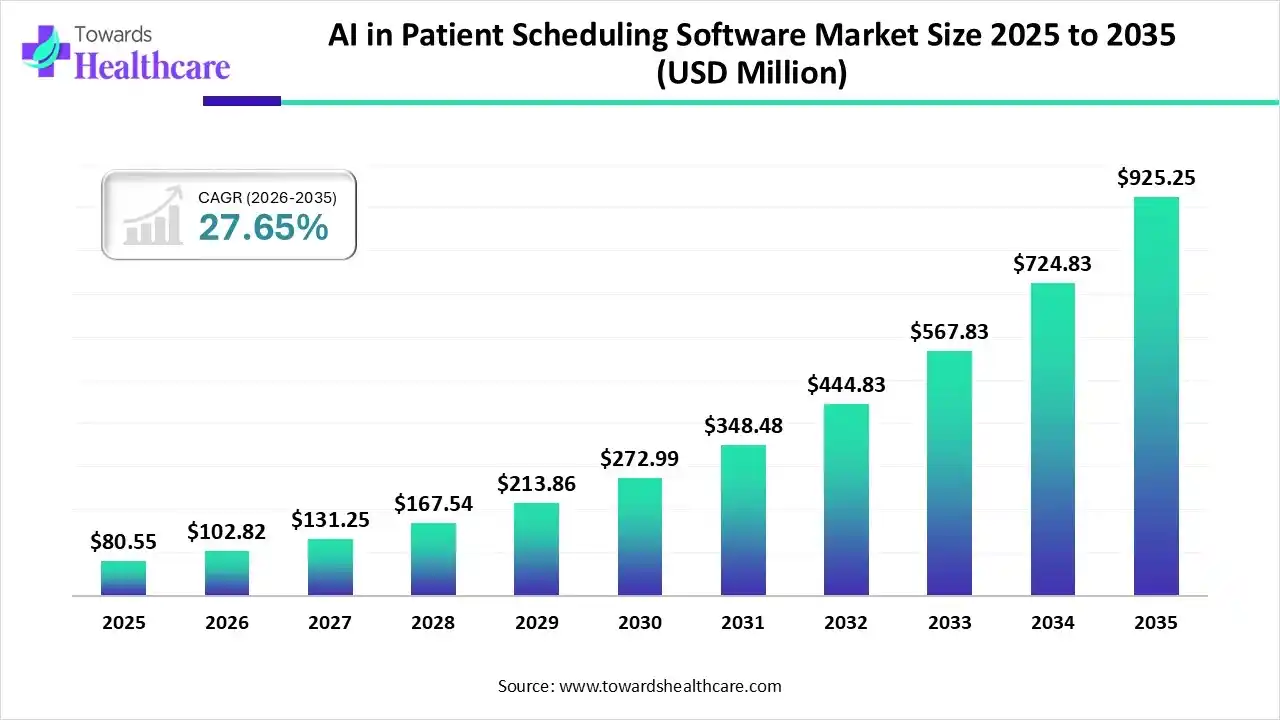

Market Growth

The global AI in patient scheduling software market size is calculated at USD 80.55 million in 2025, grew to USD 102.82 million in 2026, and is projected to reach around USD 925.25 million by 2035. The market is expanding at a CAGR of 27.65% between 2026 and 2035.

Top Companies & Their Offerings in the AI in Patient Scheduling Software Market

Veradigm – Illinois, United States

- Offers Predictive Scheduler, an advanced scheduling solution that uses AI and predictive analytics.

Qventus – San Francisco, United States

- Inpatient Capacity Solution enables early and accurate discharge planning.

- Qventus Perioperative Solution simplifies surgical scheduling and unlocks capacity.

Trigent Software – Massachusetts, United States

- Trigent AXLR8 Labs deploys pre-built AI and ML solutions to accelerate scheduling automation, improve interoperability, and enhance patient experiences.

Intellectyx Data Science India Pvt. Ltd. – Coimbatore, Tamil Nadu

- Provides AI Patient Appointment Scheduling with Voice AI Agents to automate patient scheduling, reminders, and rescheduling 24/7.

Simbie AI – New York, United States

- Delivers AI-powered voice agents acting as a 24/7 medical receptionist for scheduling, refills, and intake with up to 60% cost savings.

Company Landscape

Epic Systems Corporation

Company Overview: Epic Systems is a leading provider of comprehensive health information technology, primarily focused on Electronic Health Records (EHR) systems used by large hospitals and healthcare systems. Its scheduling software is deeply integrated into its broader patient access and clinical platform.

Corporate Information:

Headquarters: Verona, Wisconsin, USA | Year Founded: 1979 | Ownership Type: Private

History and Background:

- Focus: Started as a provider of database management solutions, shifting focus to healthcare software.

- Growth Strategy: Focused on creating a single, integrated database platform (EHR) for all clinical and administrative functions, which led to high market penetration in major US hospitals.

Key Milestones/Timeline:

- Early 2000s: Became a dominant player in the US hospital EHR market.

- 2010s: Increased focus on patient engagement tools, including online portals and self-scheduling.

- May 2025: Introduced a conversational AI tool enabling patients to schedule appointments via SMS without needing a portal login, enhancing patient access.

Business Overview:

- Primary Business: Developing, implementing, and supporting comprehensive EHR systems.

- Revenue: Not publicly disclosed, but estimated to be in the billions of USD annually.

Business Segments/Divisions:

Primarily focused on a single, unified EHR and related health IT platform, including modules for clinical, access, financial, and analytics.

Geographic Presence:

- Dominant Market: North America (USA and Canada).

- International Presence: UK, Netherlands, Australia, and other global markets.

Key Offerings:

- EpicCare (EHR): The core clinical system.

- MyChart: Patient portal and self-scheduling application.

- AI-Driven Scheduling: Tools leveraging AI for optimal slot recommendation, appointment routing, and conversational scheduling via text/chatbots.

- Cosmos: Large-scale database for research and AI model training.

End-Use Industries Served:

- Hospitals and Large Health Systems (Academic Medical Centers, Integrated Delivery Networks).

- Specialty Clinics and Ambulatory Practices.

Key Developments and Strategic Initiatives:

- Product Launches/Innovations: May 2025 launch of conversational AI for scheduling via SMS, streamlining patient access, and reducing phone volume.

- Technological Capabilities/R&D Focus: Continual enhancement of AI/ML models within the EHR for clinical decision support, revenue cycle, and access management, including scheduling optimization.

Competitive Positioning:

- Strengths & Differentiators: Deep integration of scheduling within a unified, market-leading EHR; high interoperability within the Epic ecosystem; a vast network of users and patient data (Cosmos) for AI refinement.

- Weaknesses: High cost and complexity of implementation; integration challenges with non-Epic systems.

Oracle Health

Company Overview: Oracle Health, after acquiring Cerner, offers a broad portfolio of health information technologies and services, including EHR, revenue cycle management, and patient access solutions. Its AI scheduling tools are being integrated with Oracle’s powerful cloud infrastructure.

Corporate Information:

- Headquarters: Austin, Texas, USA (Oracle's global HQ); North Kansas City, Missouri, USA (Cerner's historical operations).

- Year Founded: 1979 (Cerner); 1977 (Oracle).

- Ownership Type: Public (Acquired by Oracle Corporation in June 2022).

History and Background:

- Cerner: Focused on providing clinical and financial information systems primarily to hospitals.

- Acquisition by Oracle: Oracle's major $28.3 billion acquisition in 2022 aimed to build a comprehensive, modern, cloud-based health system platform leveraging Cerner's healthcare domain expertise and Oracle's cloud and AI capabilities.

Key Milestones/Timeline:

- June 2022: Oracle completes the acquisition of Cerner, rebranding the entity to Oracle Health.

- 2024: Unveiled "Health Data Intelligence," a platform to combine EHR data with cloud and AI features.

- 2025: Focus on integrating AI and ML into core Cerner Millennium features, including appointment scheduling, under the Oracle Cloud umbrella.

Business Overview:

- Primary Business: Providing mission-critical clinical and administrative software and services for healthcare organizations globally.

- Revenue: Financials are now integrated into Oracle Corporation's overall cloud and application revenue reports.

Business Segments/Divisions:

- Part of the broader Oracle Cloud Applications and Industry Applications division.

- Focuses on EHR/Clinical Systems, Patient Engagement, Revenue Cycle Management, and Health Analytics.

Geographic Presence:

- Strong Presence: North America, Europe (UK NHS), and the Middle East.

- Global Reach: Operates in over 35 countries.

Key Offerings:

- Cerner Millennium (EHR): Core platform for clinical, financial, and administrative operations.

- Patient Portal & Scheduling Tools: Solutions for patient self-scheduling, provider search, and referral management, increasingly powered by AI.

- Oracle Cloud Data Platform: The foundation for new AI-driven capabilities in healthcare interoperability and analytics.

End-Use Industries Served:

- Hospitals and Large Integrated Health Networks.

- Government and Military Health Systems.

Key Developments and Strategic Initiatives:

- Capacity Expansions/Investments: September 2024 Oracle opened a new healthcare innovation hub in Nashville, Tennessee, signaling major R&D focus on health tech.

- Product Launches/Innovations: 2024 unveiled Health Data Intelligence; May 2024 launched an AI-powered behavioral health clinical workflow module, setting a precedent for AI integration across the platform, including scheduling.

Competitive Positioning:

- Strengths & Differentiators: Massive resources and cloud infrastructure of parent company Oracle; strong presence in the global health IT market; expertise in large-scale system implementations.

- Weaknesses: Ongoing challenge of integrating Cerner's legacy architecture with Oracle's modern cloud ecosystem; strong competition from Epic in the EHR segment.

Recent News and Updates:

Press Releases: January 2025 announced collaboration with major U.S. health systems to expand cloud-based behavioral health data platforms, which leverage AI for better patient flow and scheduling.

Recent Developments in AI in Patient Scheduling Software Market

- In July 2025, Symplr and Charlesbank Capital Partners LLC acquired the Smart Square scheduling software from AMN Healthcare. This strengthens Symplr’s position in the healthcare workforce and operations management, bolstering its Operations Platform.

- In May 2025, Epic launched a new conversational AI tool to enable health systems to offer and schedule appointments to patients through text. Four healthcare organizations incorporate Conversational SMS Scheduling, Rebooking cancelled appointments for the future version.

Partner with our experts to explore the AI in Patient Scheduling Software Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking