March 2026

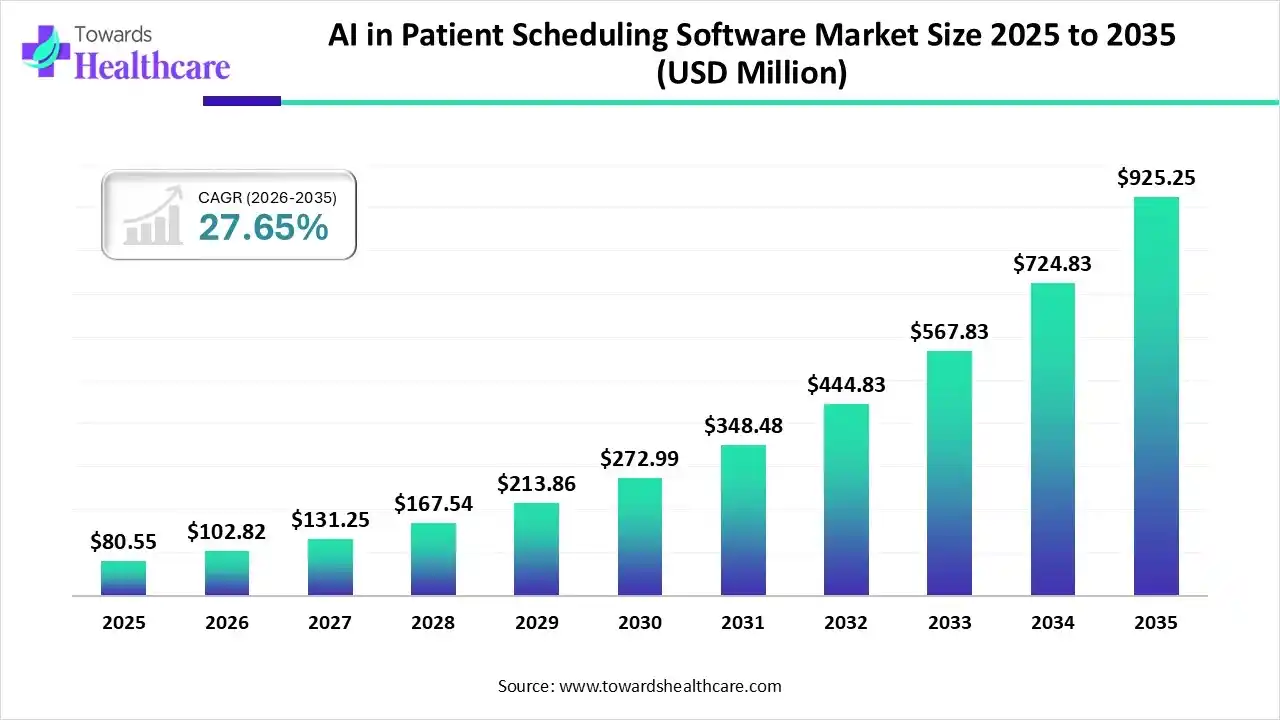

The global AI in patient scheduling software market size is calculated at USD 80.55 million in 2025, grew to USD 102.82 million in 2026, and is projected to reach around USD 925.25 million by 2035. The market is expanding at a CAGR of 27.65% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 102.82 Million |

| Projected Market Size in 2035 | USD 925.25 Million |

| CAGR (2026 - 2035) | 27.65% |

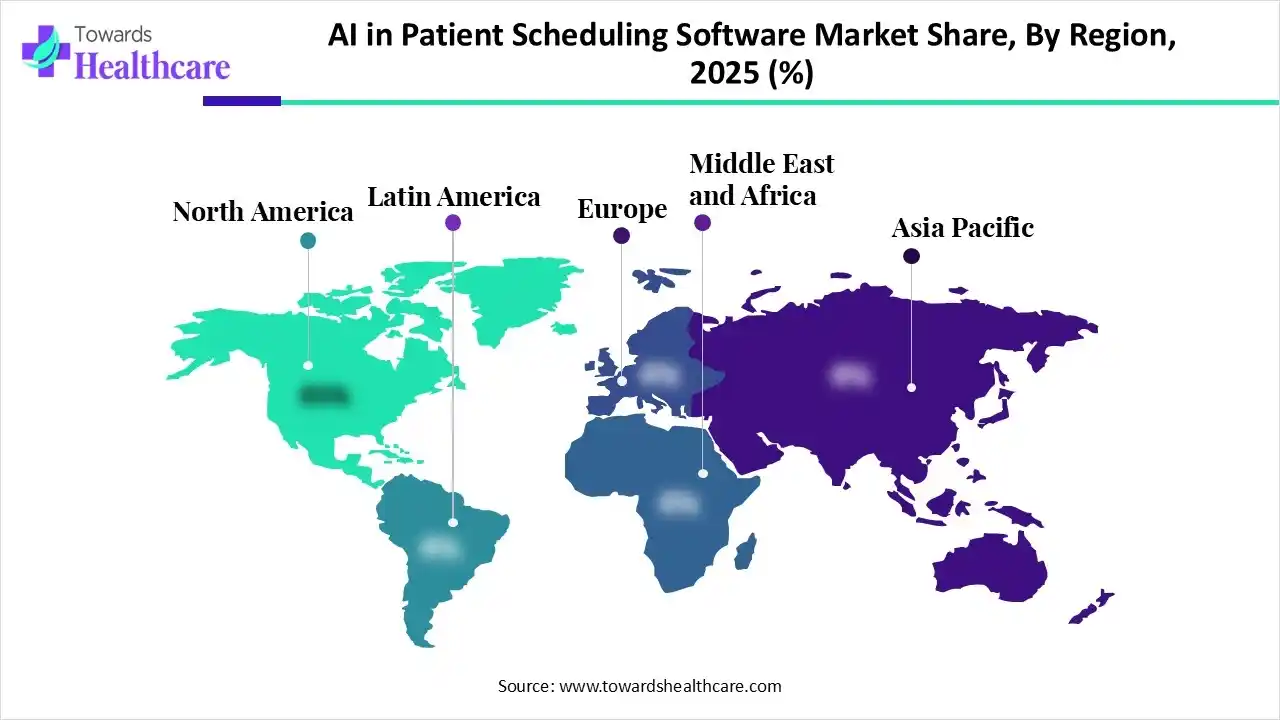

| Leading Region | North America |

| Market Segmentation | By Scheduling Type, By Deployment Mode, By End-Use, By Region |

| Top Key Players | Thinkiitive, Notable Health, TrueLark, Athelas, ScienceSoft, CleverDev Software, AdvancedMD, Hyro.ai, Hippocratic AI, Kyndryl |

The AI in patient scheduling software market is primarily driven by the increasing patient volumes and the growing need for personalized care. Shortage of healthcare professionals encourages them to use digital tools to serve a large patient population. Artificial intelligence (AI) automates patient scheduling to minimize wait times and enhance patient satisfaction. AI-powered solutions help deliver high-quality care, reducing stress among healthcare staff. The market future is promising, driven by the integration into electronic health records (EHRs) and a growing focus on patient experience.

The AI in patient scheduling software market is experiencing robust growth, driven by the rising adoption of advanced technologies, growing demand for patient-centric care, and the increasing number of patient visits. It encompasses the development of software designed specifically for automated patient scheduling. AI technologies, such as natural language processing (NLP) and large language models (LLMs), are embedded in the software to improve personalization, increasing the efficiency and effectiveness of patient scheduling.

Which Scheduling Type Segment Dominated the Market?

The outpatient scheduling segment held a dominant position in the AI in patient scheduling software market in 2024, due to the increasing number of patient visits. AI-powered tools are widely used to send notifications of scheduled appointments. They eliminate the need for patients to wait for longer times, saving the time of both patients and healthcare professionals. This enables providers to treat more patients in a short period. AI tools simplify allocating time for patients requiring emergency care.

Specialty Care Scheduling

The specialty care scheduling segment is expected to grow at the fastest CAGR in the AI in patient scheduling software market during the forecast period. Specialty care scheduling is essential for patients who need specialty care for a particular disease. It facilitates patient referrals for various diseases, including mental health treatment and cardiovascular disease. Specialty care scheduling on a prior basis accelerates the speed of appointments compared to community care appointments. It maximizes physicians’ time utility and improves patients’ satisfaction.

Inpatient Scheduling

The inpatient scheduling segment is expected to grow significantly, due to the growing number of hospital admissions and surgeries. Inpatient scheduling includes admission appointments and day-based planning. AI tools enable staff to access patient information by automating the flow of critical clinical data. They reduce the burden on the administrative staff by managing bed allocations and resource utilization.

Why Did the Cloud-based Segment Dominate the Market?

The cloud-based segment held the largest revenue share of the AI in patient scheduling software market in 2024, due to its high operational efficiency and scalability. Cloud-based solutions can store vast amounts of patient data, enabling providers and patients to access cloud-based solutions from anywhere and at any time. They use internet connectivity to manage patient bookings and meet patients’ needs. They offer superior advantages over on-premise solutions, such as low infrastructure requirements and high affordability.

On-Premise

The on-premises segment is expected to grow at a significant CAGR in the market during the study period. On-premise tools are handled by local healthcare professionals. They offer complete control over patient data and interoperability, allowing customization. They do not require internet connectivity, reducing the risk of data leakage and privacy breaches. Healthcare organizations must follow stringent regulatory policies to adopt on-premise tools.

How the Hospitals Segment Dominated the Market?

The hospitals segment accounted for the largest revenue share in the AI in patient scheduling software market in 2024, driven by favorable infrastructure and increasing patient visits. The Centers for Disease Control and Prevention (CDC) reported that 85.2% of adults and 95.1% of children visited a doctor in 2024. This resulted in 1 billion total physician visits. People mostly prefer hospitals as they provide multidisciplinary care, have favorable reimbursement policies, and have access to skilled professionals.

Clinics

The clinics segment is expected to expand rapidly in the market in the coming years. Clinics have sufficient capital investments to adopt specialized equipment for providing advanced treatment and care to patients. They have skilled professionals to provide outpatient services and personalized care. The growing number of specialty clinics potentiates the demand for patient scheduling software.

Ambulatory Surgical Centers (ASCs)

The ambulatory surgical centers (ASCs) segment is expected to grow in the AI in patient scheduling software market in the coming years. The demand for ASCs is increasing as they offer a faster, safer, and more affordable alternative to hospitals. ASCs facilitate same-day surgeries with high-quality outcomes and personalized care. This eliminates the need for patients to stay overnight, saving exorbitant treatment costs. ASCs enable physicians to work more efficiently and play a vital role in managing the increased need for surgical services.

North America dominated the global AI in patient scheduling software market in 2024. The rising number of hospital admissions and robust healthcare infrastructure are factors that govern market growth in North America. The rising adoption of electronic health records (EHRs) facilitates the use of patient scheduling software. Government bodies and regulatory agencies establish a supportive regulatory framework, enabling healthcare organizations to adopt digital tools for patient care.

Key players, such as Veradigm, Trigent Software, and Simbie AI, are major providers of scheduling software in the U.S. It is estimated that over 96% of hospitals in the U.S. have adopted EHRs to enhance workflow efficiency and manage patient data. According to Experian Health’s 2024 State of Patient Access survey, 89% of patients wanted to schedule their appointments online or using a mobile device.

Asia-Pacific is expected to be the fastest-growing region in the AI in patient scheduling software market during the forecast period. The growing geriatric population and the rising prevalence of chronic disorders foster the need for advanced care and remote monitoring. Countries like China, Japan, and India have a shortage of healthcare professionals, making it difficult to fulfill the unmet needs of a growing population. Thus, doctors and patients prefer using AI tools for telemedicine. Government organizations provide incentives to leverage digital tools in healthcare centers.

The prevalence of chronic diseases in China is estimated to be 81.1%, representing approximately 180 million people. From January 2023 to September 2023, a total of 5.11 billion visits were reported in Chinese medical institutions, along with 220 million discharged patients. In the first half of 2023, 89.88 million individuals aged 65 and above visited public health institutions for health management services.

Europe is expected to grow at a considerable CAGR in the upcoming period. Favorable government initiatives and growing awareness boost the market. People are becoming aware of mobile-friendly, automated scheduling, encouraging healthcare organizations to use scheduling software. The burgeoning healthcare sector and increasing investments and collaborations augment market growth. European nations have suitable regulatory frameworks to support IT and healthcare startups, promoting the development of innovative software tools.

As of June 2024, the Federal Institute for Drugs and Medical Devices approved 56 digital health applications (DiGA), of which 35 are permanent, and 21 are preliminary listed applications. The German government has launched the Digital Act (DigiG) to accelerate the digitalization of the healthcare system using digital solutions.

South America's AI patient scheduling market is expanding due to rising digitalization and chronic disease prevalence. Brazil is leading this growth, integrating AI into both public and private health systems for better efficiency. Cloud-based solutions and mobile health applications are increasingly popular across the region.

Brazil is strongly adopting AI for healthcare, driven by the need to optimize its complex system and vast geography. AI-powered virtual assistants and smart chatbots streamline appointment bookings and patient experience. This focus is improving remote care access and supporting rapid telemedicine expansion.

The Middle East and Africa (MEA) region, particularly the GCC countries, is witnessing substantial growth. Government-led digital health initiatives, like Saudi Vision 2030, are funding AI deployment. This accelerates the adoption of smart scheduling tools, aiming to modernize healthcare infrastructure and patient service.

GCC nations are prioritizing operational efficiency, making AI scheduling critical for hospitals and clinics. The market is propelled by a rising patient population and demand for convenient, personalized care experiences. Investments in AI platforms are focusing on reducing patient wait times and optimizing resource allocation.

| Companies | Headquarters | Offerings |

| Veradigm | Illinois, United States | Predictive Scheduler is an advanced scheduling solution that uses AI and predictive analytics. |

| Qventus | San Francisco, United States | Inpatient Capacity Solution enables early, accurate discharge planning. Qventus Perioperative Solution simplifies surgical scheduling and unlocks capacity. |

| Trigent Software | Massachusetts, United States | Trigent AXLR8 Labs can deploy pre-built AI and ML solutions to accelerate scheduling automation, improve interoperability, and enhance patient experiences. |

| Intellectyx Data Science India Pvt. Ltd. | Coimbatore, Tamil Nadu | The company offers AI Patient Appointment Scheduling with Voice AI Agents to automate patient scheduling, reminders, and rescheduling 24/7. |

| Simbie AI | New York, United States | Simbie AI’s AI-powered voice agents act as a 24/7 medical receptionist, handling scheduling, refills, and intake with 60% cost savings. |

Company Overview: Epic Systems is a leading provider of comprehensive health information technology, primarily focused on Electronic Health Records (EHR) systems used by large hospitals and healthcare systems. Its scheduling software is deeply integrated into its broader patient access and clinical platform.

Corporate Information:

Headquarters: Verona, Wisconsin, USA | Year Founded: 1979 | Ownership Type: Private

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Primarily focused on a single, unified EHR and related health IT platform, including modules for clinical, access, financial, and analytics.

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Competitive Positioning:

Company Overview: Oracle Health, after acquiring Cerner, offers a broad portfolio of health information technologies and services, including EHR, revenue cycle management, and patient access solutions. Its AI scheduling tools are being integrated with Oracle’s powerful cloud infrastructure.

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Competitive Positioning:

Recent News and Updates:

Press Releases: January 2025 announced collaboration with major U.S. health systems to expand cloud-based behavioral health data platforms, which leverage AI for better patient flow and scheduling.

By Scheduling Type

By Deployment Mode

By End-Use

By Region

March 2026

March 2026

March 2026

March 2026