Top Companies in the AI in Regulatory Affairs Market

- IQVIA

- Freyr Solutions

- DDReg Pharma

- RegASK

- Deloitte (via its RegAI solution)

- IBM

- Oracle

- Microsoft

- Google (Alphabet)

- Tempus AI

- Accenture

- Wipro

- Zenovel

- Innoplexus

- Workiva

- ComplyAdvantage

- MetricStream

- Viz.ai

- ArisGlobal

- Veeva Systems

Introduction

The AI in regulatory affairs market is expanding due in large part to the increasing complexity of regulatory submissions and the growing cost pressures in drug development and regulatory operations. Further driving market expansion are technological developments and growing cost pressures in drug development and regulatory operations. The AI in regulatory affairs industry is driven by the growing volume and complexity of international regulatory requirements in the pharmaceutical, biotechnology, and medical device industries.

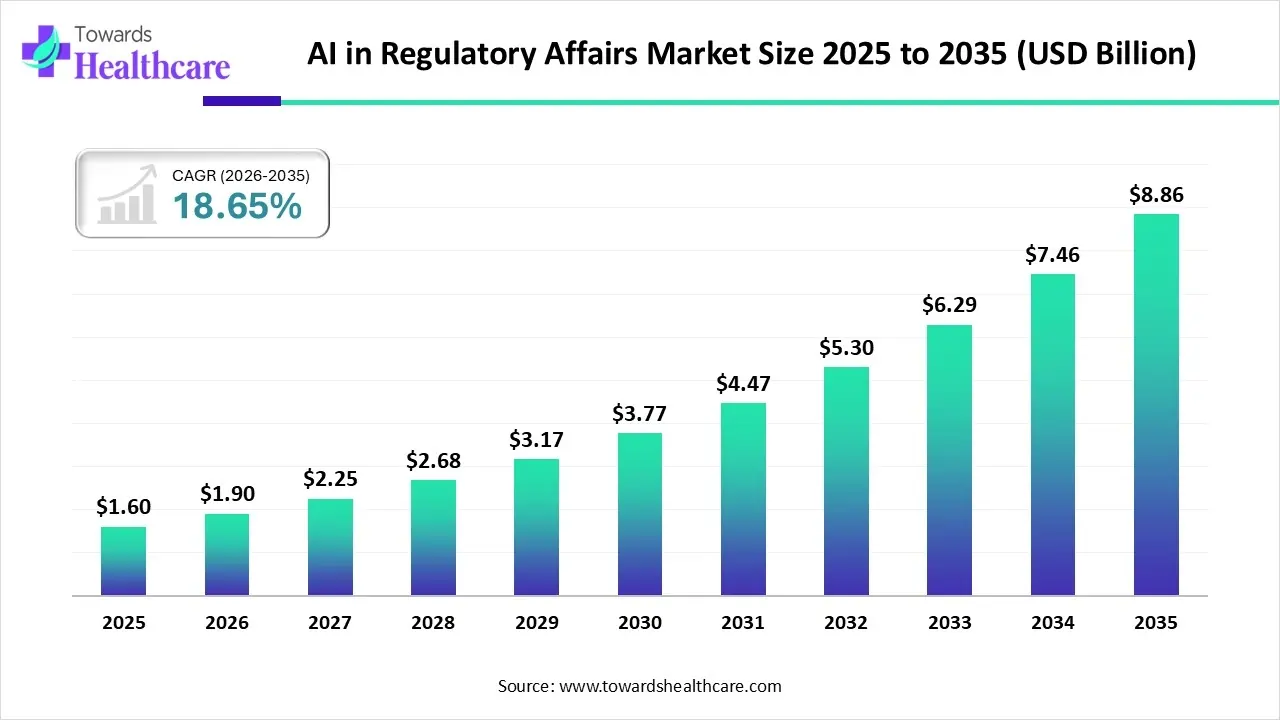

Market Growth

The global AI in regulatory affairs market size is calculated at US$ 1.6 in 2025, grew to US$ 1.9 billion in 2026, and is projected to reach around US$ 8.86 billion by 2035. The market is expanding at a CAGR of 18.65% between 2026 and 2035.

- Major Investors: Leading venture capital firms like Andreessen Horowitz (a16z), Sequoia Capital, Lightspeed Venture Partners, and Khosla Ventures are major investors in the AI in regulatory affairs market. Additionally, corporate investors like Microsoft and Google Ventures (GV) are heavily involved in the market.

Top Vendors in the AI in Regulatory Affairs Market & Their Offerings

Freyr Solutions

-

Offerings: AI submissions automation

-

Contributions: Speeds approvals using smart workflows globally

-

Highlights: Expanding global support rapidly

-

Impact: Enhances compliance efficiency overall

DDReg Pharma

-

Offerings: Automated dossier review tools

-

Contributions: Improves accuracy across regulatory tasks significantly

-

Highlights: Strong regional presence growing

-

Impact: Reduces review timelines effectively

RegASK

-

Offerings: AI monitoring dashboards

-

Contributions: Delivers timely global intelligence consistently

-

Highlights: Multilingual insights driving clarity

-

Impact: Strengthens regulatory foresight proactively

Deloitte RegAI

-

Offerings: Intelligent compliance engines

-

Contributions: Modernizes enterprise regulatory processes comprehensively

-

Highlights: Integrated ecosystem enabling trust

-

Impact: Supports scalable governance sustainably

IBM

-

Offerings: NLP-driven regulatory analytics

-

Contributions: Supports data-led decisions across industries strategically

-

Highlights: Broad automation capabilities are advancing

-

Impact: Improves operational resilience holistically today

Company Landscape

Veeva Systems

Company Overview:

- Veeva is the global leader in cloud software for the life sciences industry, offering a comprehensive suite of applications across R&D, Quality, Regulatory, and Commercial operations.

- Its flagship product for this area, Veeva Vault RIM, is a widely adopted Regulatory Information Management system that heavily integrates AI for content classification, data extraction, and process automation.

Corporate Information:

- Headquarters: Pleasanton, CA, USA

- Year Founded: 2007

- Ownership Type: Public (NYSE: VEEV)

History and Background:

- Founded by former Salesforce executives, Veeva initially focused on CRM for pharmaceutical sales.

- It rapidly expanded into the R&D and Quality space, launching the Veeva Vault platform to manage content and data with a strong focus on GxP and regulatory compliance.

- The transition to a Public Benefit Corporation in 2021 underscored its commitment to its life sciences mission and community.

Key Milestones/Timeline:

- 2007: Company founded, launches Veeva CRM on the Salesforce platform.

- 2013: IPO on the NYSE.

- 2015: Launches Veeva Vault Regulatory Suite (RIM, Submissions, Publishing).

- 2023-2024: Significant integration of Generative AI (GenAI) capabilities across the Vault platform, including Vault RIM.

Business Overview:

- Veeva operates the Industry Cloud for life sciences, providing software, data, and business consulting to streamline the drug development and commercialization lifecycle.

- Fiscal Year 2024 Total Revenues were $2,363.7 million.

Business Segments/Divisions:

- Veeva Commercial Solutions: Includes CRM, commercial content management, and data products.

- Veeva R&D and Quality Solutions (Vault Platform): Includes Clinical, Regulatory (RIM), Quality, Safety, and Medical solutions. This segment is the primary driver for AI in regulatory affairs.

Geographic Presence:

- Global, serving over 1,000 customers worldwide, including the largest pharmaceutical companies and emerging biotechs. Strong presence in North America and Europe.

Key Offerings:

- Veeva Vault RIM Suite: Cloud-based Regulatory Information Management, Submissions, and Publishing solutions.

- Veeva Vault AI: AI-powered functionality embedded across the Vault platform for content automation, data extraction, and compliance checking.

- Veeva Link: Data products providing intelligence on key opinion leaders and regulatory bodies.

End-Use Industries Served:

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device and Diagnostics Companies

- Biotechnology Companies

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Generally focuses on organic growth, with occasional acquisitions of smaller, specialized technology firms to enhance platform capabilities.

- Partnerships & Collaborations:

- Veeva AI Partner Program (Apr 2024): Provides partners with advanced technology and support to integrate GenAI solutions with Veeva Vault applications.

- Ongoing collaborations with leading global consulting firms to deploy Veeva Vault and AI features.

- Product Launches/Innovations: Continuous embedding of AI/GenAI into the Vault platform to automate routine regulatory tasks like document metadata extraction, content generation assistance, and quality checks.

- Capacity Expansions/Investments: Significant ongoing investment in its cloud platform infrastructure and R&D for AI innovation.

- Regulatory Approvals: Provides validated, GxP-compliant systems for customers to meet FDA, EMA, and other global regulatory requirements.

Distribution Channel Strategy:

- Primarily direct sales model to large enterprise customers.

- Strong ecosystem of consulting partners (system integrators) who implement and configure the Veeva Vault platform.

- Cloud-based, subscription services model.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Veeva Vault Platform (a multi-tenant, cloud-based architecture), proprietary data models for life sciences content, and domain-trained AI models for regulatory affairs.

- Research & Development Infrastructure: Dedicated R&D teams focused on platform evolution and AI integration.

- Innovation Focus Areas: Generative AI for regulatory content and submissions, unifying clinical and regulatory data, and enhancing the Vault platform's low-code configurability.

Competitive Positioning:

- Strengths & Differentiators: Deep life sciences domain expertise, single unified cloud platform (Vault) for all R&D and commercial needs, and a large, established customer base (high switching costs).

- Market presence & ecosystem role: Dominant market leader in the Regulatory Information Management (RIM) software space, setting the industry standard for cloud-based regulatory systems.

SWOT Analysis:

- Strengths: Deep industry focus, highly scalable cloud platform, strong customer loyalty.

- Weaknesses: High reliance on the life sciences sector, potential competition from large tech firms entering the space.

- Opportunities: Rapid adoption of GenAI in regulatory processes, expansion into adjacent regulated industries (e.g., CPG, Chemicals).

- Threats: Increased regulatory scrutiny of AI/ML models, evolving global data privacy laws.

Recent News and Updates:

- Press Releases: Veeva Announces Fourth Quarter and Fiscal Year 2025 Guidance (Feb 2025 - projected FY25 revenues of $2,725 - $2,740 million). Focus on AI integration across the Vault suite.

- Industry Recognitions/Awards: Consistently recognized as a leader in life sciences R&D and Quality management software by major analyst firms.

IQVIA INC.

Company Overview:

- IQVIA is a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry.

- Their AI regulatory solutions are delivered through their Technology & Analytics Solutions segment and within their Contract Research Organization (CRO) service offerings, leveraging massive, proprietary datasets.

Corporate Information:

- Headquarters: Research Triangle Park, NC, USA

- Year Founded: 2017 (Formed by the merger of Quintiles and IMS Health)

- Ownership Type: Public (NYSE: IQV)

History and Background:

- Formed from the merger of Quintiles (a global CRO) and IMS Health (a global provider of healthcare data and analytics).

- This combination created a "Human Data Science" powerhouse, linking clinical trial execution with real-world data and commercial insights.

- The company has made significant investments in AI/ML capabilities, primarily through its IQVIA Connected Intelligence platform.

Key Milestones/Timeline:

- 2017: Merger of Quintiles and IMS Health to form IQVIA.

- 2019: Launches the Orchestrated Clinical Trials platform, heavily featuring AI/ML for trial design and execution, with implications for regulatory submissions.

- 2024: Continues to heavily integrate Generative AI for faster data synthesis, clinical data quality, and regulatory documentation across its services.

Business Overview:

- IQVIA provides end-to-end solutions that blend proprietary data, technology, and domain expertise.

- Its regulatory AI capabilities are embedded in both its software solutions and its outsourced regulatory affairs services.

- FY 2024 Total Revenues: $15.8 billion (estimated/projected).

Business Segments/Divisions:

- Technology & Analytics Solutions (TAS): Offers cloud-based software, data, and analytics, including its Regulatory and Safety intelligence platforms.

- Research & Development Solutions (R&DS): Provides outsourced clinical research services, including clinical trial management, lab services, and embedded regulatory support.

- Contract Commercial & Principal Primary Solutions (CCPPS): Commercialization services.

Geographic Presence:

- Global footprint, operating in over 100 countries. Offers regulatory intelligence covering all major global health authorities (FDA, EMA, PMDA, etc.).

Key Offerings:

- IQVIA RIM Smart Suite: Regulatory Information Management system that leverages AI for regulatory intelligence.

- IQVIA Connected Intelligence: Integrated platform blending R&D, commercial, and real-world data with AI/ML to drive decision-making.

- AI-Driven Regulatory Outsourcing Services: Comprehensive regulatory strategy, submission, and publishing services using proprietary AI tools.

End-Use Industries Served:

- Pharmaceutical and Biopharmaceutical Companies (largest customer base)

- Medical Device and Diagnostics Companies

- Government Agencies and Public Health Organizations

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Historically active in M&A to consolidate data assets and clinical capabilities. Focus on acquiring specialized data and technology firms.

- Partnerships & Collaborations:

- Continuous strategic partnerships with global healthcare systems and data providers to enrich its real-world data (RWD) assets, which in turn fuel its regulatory intelligence AI models.

- Product Launches/Innovations: Ongoing development of predictive analytics and GenAI tools within its TAS segment to forecast regulatory submission timelines and identify regulatory risks.

- Capacity Expansions/Investments: Substantial investment in its AI and RWD infrastructure to maintain a competitive advantage in data-driven services.

Distribution Channel Strategy:

- Direct sales through its global clinical and commercial teams.

- Service-led distribution where AI-enabled tools are bundled and delivered as part of its R&D and Regulatory Outsourcing services.

- Cloud-based, subscription model for its software products (TAS).

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: The IQVIA Connected Intelligence Platform, proprietary Real-World Data (RWD) assets (petabytes of non-identified patient data), and advanced AI/ML algorithms for predictive modeling.

- Research & Development Infrastructure: Extensive R&D team and data science labs focused on human data science and AI applications.

- Innovation Focus Areas: Using Generative AI for accelerated regulatory writing, predictive modeling for safety and compliance risk, and leveraging RWD for regulatory submissions.

Competitive Positioning:

- Strengths & Differentiators: Unmatched scale and integration of clinical services, technology, and proprietary data (RWD), which is a key input for regulatory AI.

- Market presence & ecosystem role: The largest global CRO and a leading technology provider, giving it a central, influential role across the drug development and regulatory ecosystem.

SWOT Analysis:

- Strengths: Massive proprietary data assets, global service delivery capability, deep expertise in both clinical and regulatory operations.

- Weaknesses: Potential complexity from managing two large predecessor companies (Quintiles/IMS), high competition in the CRO space.

- Opportunities: Leveraging its RWD for novel AI-driven regulatory pathways (e.g., synthetic control arms), growing demand for outsourced, data-driven regulatory services.

- Threats: Data privacy and security regulations in new markets, competition from technology-focused pure-play software vendors.

Recent News and Updates:

- Press Releases: Regularly announces new RWD partnerships and AI innovations focused on accelerating clinical development, which directly impacts regulatory submissions.

- Industry Recognitions/Awards: Often cited as a leader in CRO services, RWD, and Life Science IT by industry analysts.

Recent Developments in the AI in Regulatory Affairs Market

- In October 2025, the first vertical agentic AI command center for regulatory affairs will be introduced by RegASK, the leading agentic AI platform that is revolutionizing workflow orchestration and regulatory intelligence.

- In September 2025, PharmaPendium AI, a generative AI assistant for regulatory intelligence in drug development, was introduced by Elsevier, a multinational information and analytics company.

- In August 2025, the beta release of its AI-powered Regulatory Assistant within Cortellis Regulatory Intelligence was announced by Clarivate Plc, a prominent worldwide supplier of transformative intelligence.

Collaborate with our experts to explore the AI in Regulatory Affairs Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking