November 2025

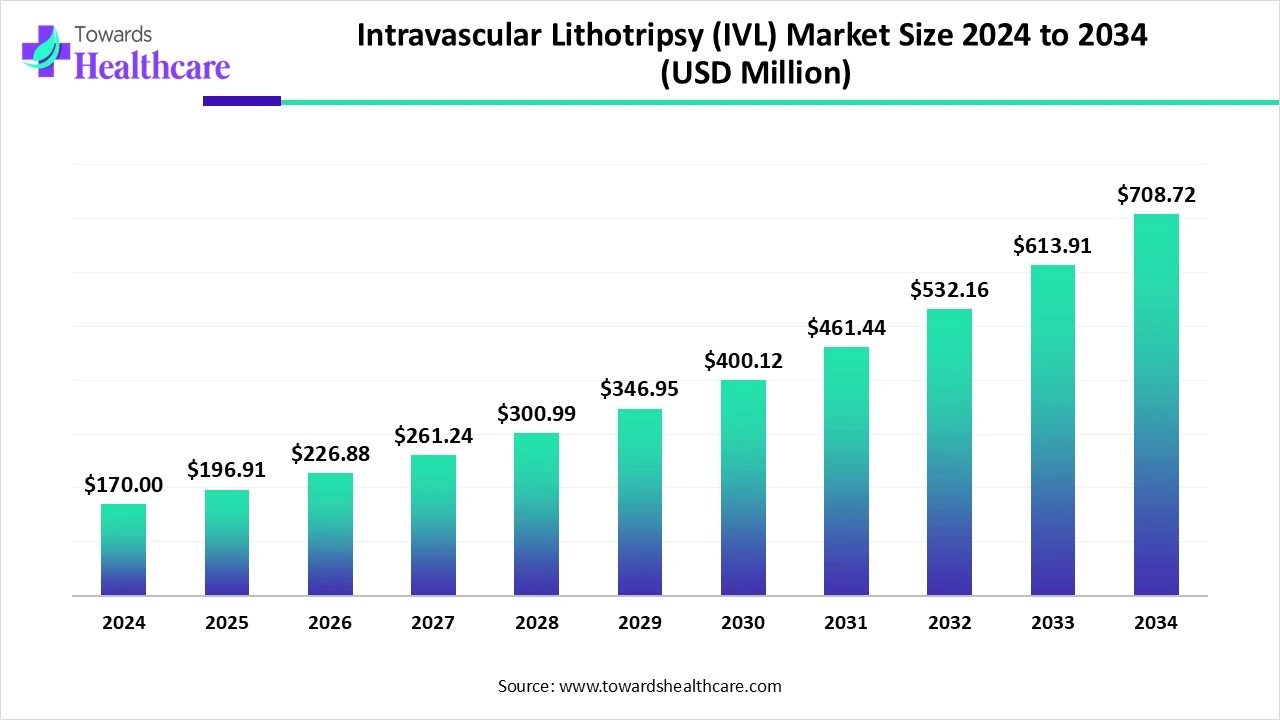

The global intravascular lithotripsy (IVL) market size is calculated at US$ 170 billion in 2024, grew to US$ 196.91 million in 2025, and is projected to reach around US$ 708.72 million by 2034. The market is projected to expand at a CAGR of 15.24% between 2025 and 2034.

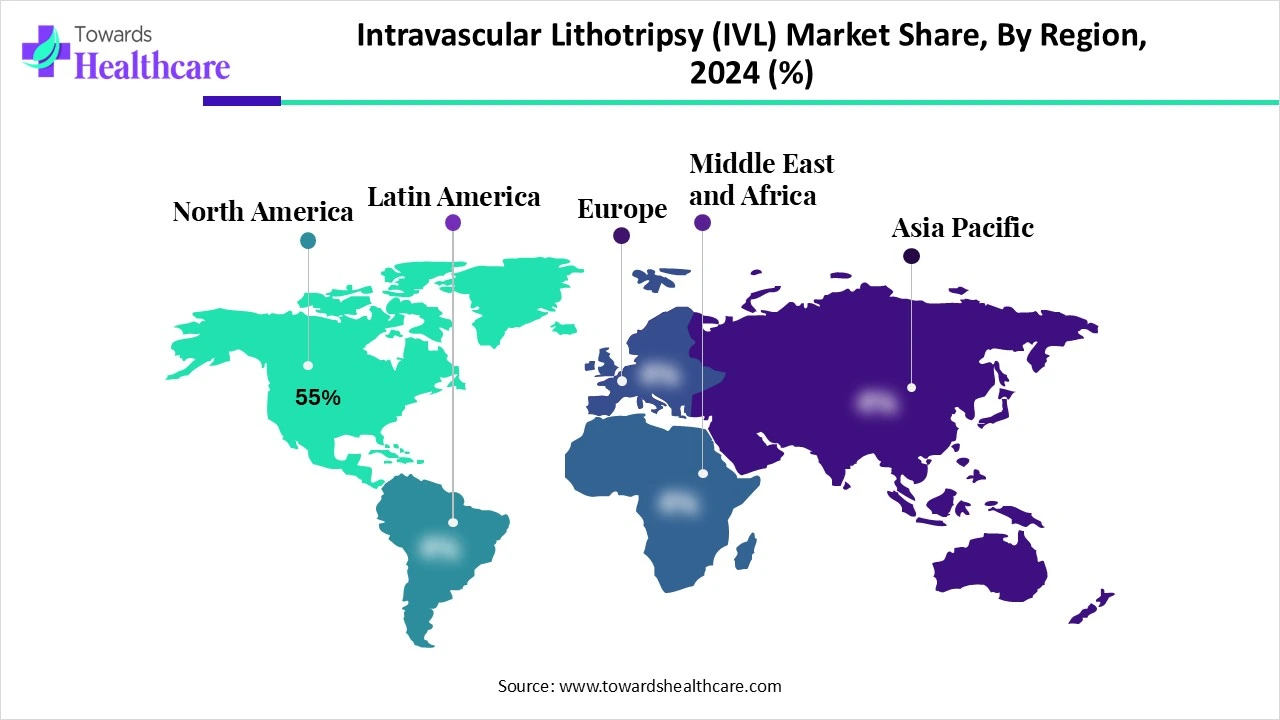

The intravascular lithotripsy (IVL) market is expanding due to the increasing prevalence of calcified cardiovascular diseases and growing trends of minimally invasive procedures. North America is dominated due to the presence of advanced medical infrastructure and an increasing volume of clinical trials. Asia Pacific is the fastest-growing region due to the increasing burden of cardiovascular diseases and rising government support for healthcare services.

| Metric | Details |

| Market Size in 2025 | USD 196.91 Million |

| Projected Market Size in 2034 | USD 708.72 Million |

| CAGR (2025 - 2034) | 15.24% |

| Leading Region | North America Share by 55% |

| Market Segmentation | By Vessel Type, By Product Type, By Application, By End User, By Region |

| Top Key Players | Shockwave Medical, Inc., Philips, Boston Scientific, Medtronic, Cardiovascular Systems, Inc. (CSI), Abbott Laboratories, Terumo Corporation, IVascular (Spain), Avinger Inc., Acotec Scientific (China), Meril Life Sciences (India), BIOTRONIK, Biosensors International, Cagent Vascular, Startups/Stealth R&D |

The intravascular lithotripsy (IVL) market refers to a specialized segment within interventional cardiology that uses pulsatile acoustic pressure waves to fracture calcified plaque in coronary and peripheral arteries. Unlike atherectomy or high-pressure balloons, IVL is designed to safely modify both intimal and medial calcifications with minimal vessel trauma. This enables better stent delivery and expansion, especially in heavily calcified lesions, a growing challenge in aging cardiovascular patient populations.

Integration of AI in intravascular lithotripsy (IVL) drives the growth of the market as incorporation with AI-driven systems, and microRNA expression analysis, an inclusive strategy developed for diagnosing and treating cardiac diseases. This integration offers a more effective and personalized treatment strategy for CVD patients by merging the advantages of IVL with advanced diagnostic tools and therapeutic interventions. IVL is a ground-breaking technique intended to address the risks posed by heavily calcified coronary artery lesions. Its mechanism of action leverages the principle of shockwave therapy, modified for cardiovascular applications. IVL uses controlled acoustic pressure waves to fracture calcified plaques in the arterial wall, enabling subsequent vessel dilation and stent placement. AI algorithms analyze intravascular imaging data to recognize deposition of calcium, guide the IVL catheter, and enhance treatment parameters.

Increasing Prevalence of Vascular Calcification

The prevalence of vascular calcification, based on ABI values, is also notably high in the general population. In males, risk factors such as increased age, BMI, and elevated DBP independently contribute to vascular calcification. For females, independent risk factors include higher BMI, UA, LDL-C levels, and lack of exercise. Vascular calcification involves vascular cells transforming from their usual contractile phenotype to an osteoblast-like phenotype after stimulation by various factors. Vascular smooth muscle cells (VSMCs) are mainly responsible for this process. The breakdown products from smooth muscle cells after apoptosis or necrosis facilitate VSMC calcification, which is driving the growth of the intravascular lithotripsy (IVL) market.

High Cost Challenges of Intravascular Lithotripsy

The relatively high failure rate of current IVL devices, given their significant cost, indicates a need for improvement in the coming years. Priced at $4,700, the new intravascular lithotripsy system was initially positioned for NTAP coverage. However, some find the pricing and associated calculations bothersome, which restricts the expansion of the intravascular lithotripsy (IVL) market.

Advancement in Next-Generation IVL

Recent advances in IVL are enhancing treatments and outcomes, paving the way for next-generation IVL procedures and techniques. While progress has been made in targeting calcium, there remains significant scope for improvement. Feedback from top interventional physicians highlights issues with the deliverability and crossability of current IVL catheters, particularly in coronary applications. Specifically, the balloon often struggles to navigate tortuous, diseased arteries. This challenge limits the treatment's effectiveness, indicating a need for improved delivery solutions. Consequently, this opens up opportunities in the intravascular lithotripsy (IVL) market.

By vessel type, the peripheral IVL systems segment led the intravascular lithotripsy (IVL) market, due to IVL is an advanced method to manage calcified stenotic vessels in the peripheral. It's minimally invasive, lowers the risk of downstream embolization, and can treat complex calcified lesions that are stimulating to manage with predictable techniques. The IVL system does not need a filter system for distal embolization, and it does not damage the surrounding soft tissue.

On the other hand, the coronary IVL systems segment is projected to experience the fastest CAGR from 2025 to 2035, as intravascular lithotripsy is a relatively safe and efficient treatment for coronary blockages. IVL plays a significant role in treating calcification in coronary arteries and offers a hopeful solution for patients with serious calcified coronary stenoses. IVL effectively reduced the normal stenosis, enabling stent delivery to entirely target areas, and attained a clinical success rate with negligible complications

By product type, the IVL catheter balloons segment dominated the intravascular lithotripsy (IVL) market in 2024, as they provide relief to the patients. An IVL catheter balloon is a minimally invasive process that helps restore the flow of blood through an artery or vein. This process involves inserting a small balloon that is inflated into the affected vein or artery to open it up. It helps to reduce the chances of suffering a stroke and offers instant relief from shortness of breath, chest pains, and fatigue related to PAD or CAD. It helps to enhance kidney function and improve blood flow to the legs.

The generators & console units segment is projected to grow at the highest CAGR from 2025 to 2035, as it is used to deliver localized, lithotripsy-enhanced, balloon dilatation of calcified, stenotic arteries. The IVL Generator and console units are designed to exchange data during patient treatment. This feature is designed to robotically set pulse parameters unique to every catheter type, like catheter pulse life; refer to the appropriate IVL catheter instructions for use for extra information.

By line of therapy, the peripheral artery disease (PAD) segment led the intravascular lithotripsy (IVL) market in 2024, due to its being a general condition in which narrowed arteries lower blood flow to the arms or legs. PAD is caused by atherosclerosis, or plaque buildup, which lowers the flow of blood in peripheral arteries, the blood vessels that carry blood away from the heart to different parts of the body. Intravascular lithotripsy (IVL) is applied in peripheral artery disease (PAD) to adjust calcified plaques, making it simple to open up blocked arteries and enhance blood flow.

The coronary artery disease (CAD) segment is projected to experience the fastest CAGR from 2025 to 2035, as intravascular lithotripsy (IVL) is a standard shifting device allowing interventional cardiologists to bridge the gap between probable safe and constantly effective coronary calcium modification in patients suffering from calcified coronary artery disease. It allows safe, efficient coronary calcium modification for patients with calcified coronary artery disease.

By end user, the hospitals & cath labs segment dominated in the intravascular lithotripsy (IVL) market in 2024, as the accuracy of the sonic waves enables the optimal placement of stents, leading to enhanced blood flow and lowering the chances of difficulties. Unlike outdated procedures that lead to arterial damage, IVL reduces these risks, providing a safer substitute for patients in hospitals. IVL offers important advantages over earlier balloon-based interventions. The device does not require further training and is performable by a mainstream of interventional cardiologists. Balloon opening pressure is minimal, which reduces the chance of vascular injury.

On the other hand, the ambulatory surgical centers segment is expected to grow at a lucrative CAGR over the forecast period, 2025 to 2035, as the advantage of IVL therapy compared with direct atherectomy is the ease of use, as with a standard balloon, which is inflated with low pressure. Soft tissue from the intimal layer is unaffected by the shockwaves, and the output is minimal risk of dissection or damage to the vessel, so increasing demand for IVL in ambulatory surgical centers. IVL leads to growing vessel compliance before stent embedding with high effectiveness and an outstanding safety profile.

North America dominated the market share by 55% in 2024, as growing cases of cardiovascular diseases, such as high blood pressure, high blood cholesterol, and smoking, increased demand for intravascular lithotripsy (IVL). Within the landscape of North America, differences in economic development, cultural practices, genetic susceptibility, and trends in risk factors and treatment entirely contribute to intercontinental and within-continent differences in heart failure, which drives the growth of the market.

For Instance,

In the United States, each year, more than 800,000 people in the U.S. have a heart attack. Many heart attacks are caused by coronary artery disease, which is the most common cause of death in the United States. By 2030, 40.5% of the US population is projected to have some form of CVD, which drives the growth of the market. High presence of modern catch labs and interventional cardiology centers is increasing the adoption of IVL technology.

In Canada, with the development, dissemination, and adoption of innovations in cardiac care increasing demand for IVL services. Increasing research advancements have potentially transformed the treatment and management of CVDs in this region. Nine in ten Canadians have at least one risk factor for CVD, which increases the need for management of it, so increasing adoption of advanced technology, including intravascular lithotripsy. The federal government makes policy and funding decisions that mitigate the climate crisis and advance cardiovascular health, which drives the growth of the market.

Asia Pacific is estimated to be the fastest-growing during the forecast period, as increasing systolic blood pressure is the largest contributing cardiovascular risk factor in Asia, although high BMI and fasting plasma glucose are identified to be the rapidly rising cardiovascular risk factors in Asia-Pacific. Population-wide lifestyle adjustments in Asia-Pacific diets lead to higher salt content, corresponding to rising CVD events, which drives the growth of the market. Strong presence of key players such as Boston Scientific, Medtronic, Cardiovascular Systems Inc., Terumo Corporation, B. Braun Melsungen AG, and Acoustic MedSystems Inc., which is growing the research and regulatory approvals in this region.

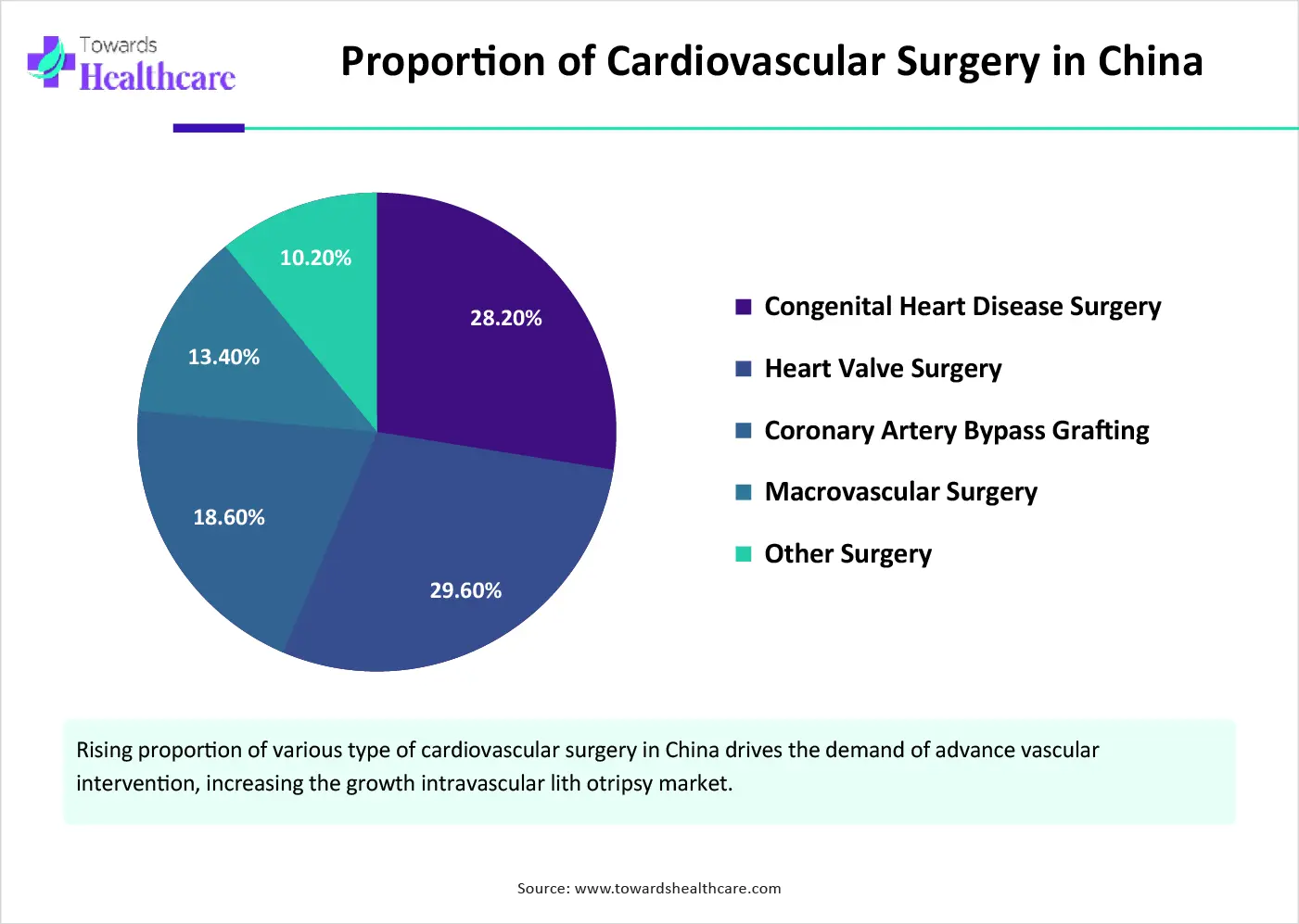

In China, CVD is growing due to the increasing prevalence of unhealthy lifestyles among Chinese residents, faster-growing population aging, and other reasons. The incidence and mortality of CVD in China are also increasing. Major cardiovascular technologies adopting and China has made significant progress in solving the problem of “treatment difficulty” of CVD, which drives the growth of the market.

In India, rising awareness among patients and physicians increases earlier diagnosis and treatment of calcified lesions. Increasing government support, such as the Union Government of India recently conferred increasing attention on CVD, with the initiation of the National Program for the Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke, which contributes to the growth of the market.

Europe is notably growing in the market as various types of heart diseases are the significant cause of disability and premature death in the European Region, causing more than 42.5% of deaths per year, which is increasing demand for intravascular lithotripsy solutions. Europe has experienced a rapid expansion of public health-care spending, which drives the market growth.

For Instance,

The German government is supporting to conduct of new trials, and to make it easier for novel trial concepts like trials for innovative therapies and decentralized trials, which also host IVL-related clinical trials, increasing regulatory approval and doctors' trust about the IVL, which contributes to the growth of the market.

In the UK, increasing collaboration among medtech companies and European hospitals is increasing healthcare awareness and accessibility. The presence of high-quality healthcare services and an interventional cardiology center supports the implementation of cutting-edge procedures, which drive the growth of the market.

In March 2025, JD Corl, M.D., FACC, FSCAI, Medical Director of the PAD/CLI Program, stated, “With proven safety and effectiveness similar to existing IVL devices, Shockwave’s novel IVL platform will bring a transformative approach to our peripheral practices, enabling us to make cases more efficient and optimize outcomes for our patients living with PAD, particularly those with more complex CLTI.” (Source - Johnson & Johnson)

By Vessel Type

By Product Type

By Application

By End User

By Region

November 2025