December 2025

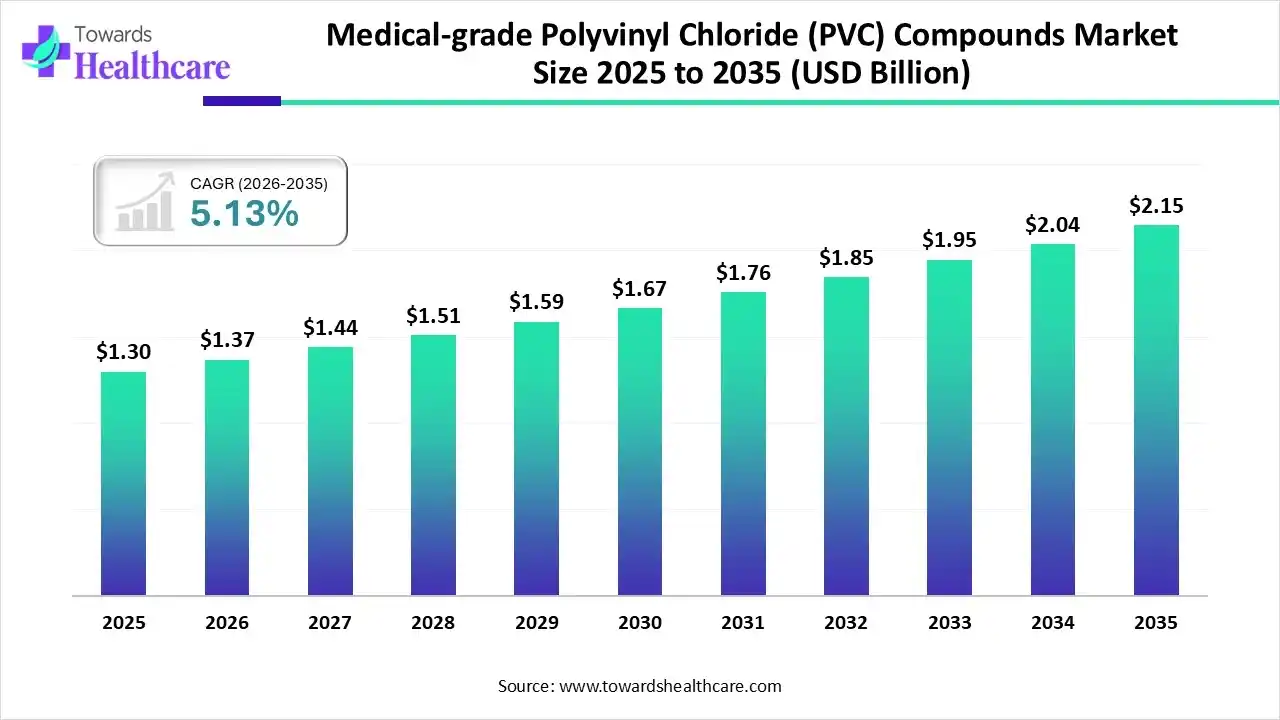

The medical-grade polyvinyl chloride (PVC) compounds market size was estimated at USD 1.30 billion in 2025 and is predicted to increase from USD 1.37 billion in 2026 to approximately USD 2.15 billion by 2035, expanding at a CAGR of 5.13% from 2026 to 2035.

The medical-grade polyvinyl chloride (PVC) compounds market is rapidly expanding due to technological innovations in sustainable formulations, rising demand for single-use medical devices, and stringent regulatory standards. The major trends, such as sustainability, regulatory compliance, the expanding healthcare sector, and material properties, are shaping the industry.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.37 Billion |

| Projected Market Size in 2035 | USD 2.15 Billion |

| CAGR (2026 - 2035) | 5.13% |

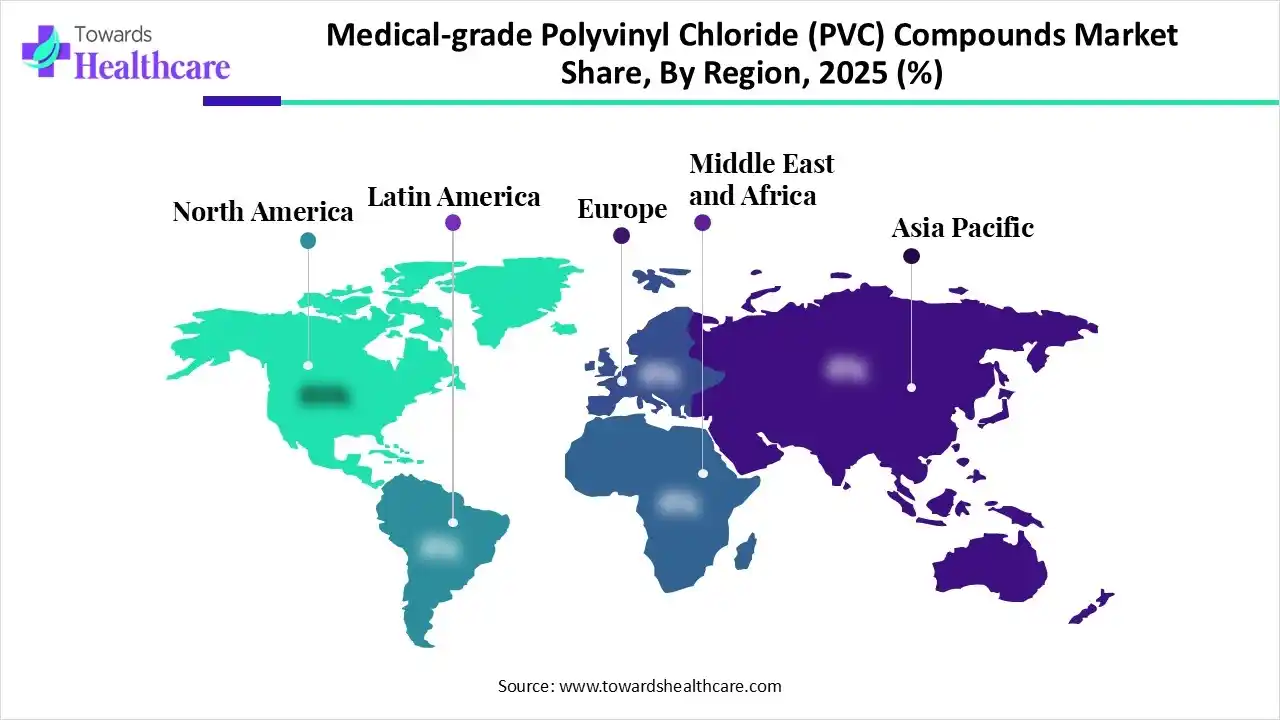

| Leading Region | North America |

| Market Segmentation | By Type of PVC Compound, By Application, By Additive Type, By Formulation Variations, By Region |

| Top Key Players | Teknor Apex Company, Tekni-Plex, Inc., Westlake Chemical Corporation, INEOS Group, Formosa Plastics Corporation, Shin-Etsu Chemical Co., Ltd., Benvic Europe SAS, Avient Corporation, RAUMEDIC AG, GW Plastics Inc. |

The medical-grade polyvinyl chloride (PVC) compounds market is shaping with exciting material features such as cost-effectiveness, durability, flexibility, clarity, and sterilization tolerance. There is an increased preference for environmentally-friendly formulations, while manufacturers focus on heavy metal-free, phthalate-free, and bio-based plasticizers. The industries prioritize aligning with stringent health and environmental standards in global markets. The expanding healthcare sector heavily demands single-use PVC products like blood bags, catheters, tubing, and IV bags.

The industry is accelerated by the expanded manufacturing and construction boom across various regions like the Asia Pacific and North America. The technological innovations include the integration of nanofillers, which enhance stability, performance, and homogeneity of medical-grade PVC compounds.

AI accelerates material design and formulation, and enhances quality assurance and defect detection. AI drives the medical-grade polyvinyl chloride (PVC) compounds market through process optimization, efficiency, and supply chain management. It facilitates personalization and customization of products through the design and 3D printing of patient-specific medical devices.

How does the Flexible PVC Segment Dominate the Medical-grade Polyvinyl Chloride (PVC) Compounds Market in 2025?

The flexible PVC segment dominated the market in 2025, owing to its flexibility, elasticity, chemical resistance, durability, and electrical insulation. It is in huge demand due to cost-effectiveness, hygiene, safety, and the ease of processing associated with it. The wide applications of flexible PVC are in medical devices, construction, plumbing, the electrical industry, consumer goods, automotive interiors, and packaging.

Rigid PVC

The rigid PVC segment is expected to grow at the fastest CAGR in the medical-grade polyvinyl chloride (PVC) compounds market during the forecast period due to its high mechanical strength and structural integrity. It has good properties of electrical and thermal insulation, and chemical resistance. It requires low maintenance and offers excellent cost-effectiveness.

What made Medical Devices the Dominant Segment in the Market in 2025?

The medical devices segment dominated the market in 2025, owing to the ease of sterilization, biocompatibility, and chemical stability of PVC. PVC is soft and flexible due to plasticizers, which are important for tubing and bags. PVC is highly transparent, which allows healthcare professionals to monitor the flow of blood or fluids.

Packaging

The packaging segment is estimated to grow at the fastest rate in the medical-grade polyvinyl chloride (PVC) compounds market during the predicted timeframe due to the critical role of PVC in packaging across various sectors such as medical devices, pharmaceuticals, food packaging, retail and consumer goods, and logistics. PVC offers barrier properties against chemicals, oils, moisture, and oxygen, which protect materials during storage and transport. PVC has efficient processing capabilities and is an economic material.

How did the Stabilizers Segment Dominate the Medical-grade Polyvinyl Chloride (PVC) Compounds Market in 2025?

The stabilizers segment dominated the market in 2025, owing to the primary role of stabilizers in PVC in thermal stabilization, UV and chemical resistance, mechanical integrity, and improved processability. There is a wide use of various types of stabilizers, which include mixed-metal systems, calcium-zinc, and tin. There is a rapid global shift away from traditional lead-based stabilizers due to environmental and health concerns.

Plasticizers

The plasticizers segment is anticipated to grow at a notable rate in the medical-grade polyvinyl chloride (PVC) compounds market during the upcoming period due to enhanced flexibility and improved processability of plasticizers in PVC. They have improved electrical properties, adjustable hardness, enhanced durability, and reduced brittleness. They have versatile applications in medical devices, wire and cable insulation, flooring and wall coverings, and automotive interiors.

Which Segment by Formulation Variations Dominated the Market in 2025?

The clear PVC compounds segment dominated the market in 2025, owing to the wide use of clear PVC in blood bags, medical tubing, and IV bags to monitor fluid levels and ensure hygiene. Clear PVC sheets are display and protective equipment, which are widely used in machine guards, display cases, and face shields to offer a durable and transparent barrier.

Antimicrobial PVC Compounds

The antimicrobial PVC compounds segment is predicted to grow at a rapid rate in the medical-grade polyvinyl chloride (PVC) compounds market during the studied period due to their major role in preventing microbial contamination, inhibiting biofilm formation, and enhancing hygiene and safety. They extend product lifespan by preventing microbial attack and physical degradation of the material. They have excellent applications in healthcare, food processing, packaging, consumer goods, building, and construction.

North America dominated the market in 2025, owing to the rising demand for disposable medical products, advanced healthcare infrastructure, and high healthcare spending. There is a growing demand for blood bags, catheters, and IV tubing in the North American healthcare sector. The private companies make investments and take initiatives, driven by the wide healthcare sector and the current regulatory framework. The North American and the global supply chain raise the importance of quality and availability, for which industries promote localized manufacturing and prefer strategic partnerships.

The U.S. FDA regulations ensure the safety and compliance of products, driving the medical-grade polyvinyl chloride (PVC) compounds market. The U.S. Department of Health and Human Services (HHS) launched an action plan for the period 2025-2028 to address shortages of medical products and strengthen supply chain resilience.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to emphasis on infection control and disposable devices, favorable material properties, and cost-effectiveness. The Asian Pacific countries, like India and South Korea, have taken many government initiatives by addressing sustainability, quality control, and domestic production. The governments are encouraging domestic production to meet the increasing demand for PVC products and reduce dependency on imports.

The Indian government has set higher standards that ensure consumer safety and address potential concerns of low-quality and carcinogenic imports. It has taken specific initiatives to strengthen the medical device manufacturing sector. It has also launched schemes to strengthen the medical device industry and the medical-grade polyvinyl chloride (PVC) compounds market.

Europe is expected to grow at a notable rate in the market in 2025, attributed to the growing healthcare needs, sustainability focus, and shift to home and outpatient care. A broad supply chain resilience aims to improve the general medical supply, which impacts medical PVC sourcing and production. The leading companies, like TekniPlex Healthcare and Vynova, have focused on R&D programs and launched new products. With the emerging sustainability goals and regulatory pressures, the companies have launched advanced recycling technologies and bio-based medical-grade PVC compounds.

The French and European developments are made in medical device regulation and the sustainability of PVC in healthcare. The French programs aim to drive the medical-grade polyvinyl chloride (PVC) compounds market through industry-led innovations and implement stringent EU regulations for more sustainable medical-grade PVC alternatives.

| Sr. No. | Name of the Company | Headquarter | Latest Update |

| 1 | Teknor Apex Company | Pawtucket, Rhode Island, USA | In January 2025, Teknor Apex Company displayed its material innovations for the healthcare industry at the MD&M West 2025. |

| 2 | Tekni-Plex, Inc. | Wayne, Pennsylvania, USA | In October 2024, Tekni-Plex, Inc. became the first to launch ISCC PLUS-certified and medical-grade bio-based PVC compounds. |

| 3 | Westlake Chemical Corporation | Houston, Texas, USA | In August 2025, Westlake made an acquisition of the ACI compounding solutions business. |

| 4 | INEOS Group | London, England | In November 2025, INEOS Group reported a surge in the usage of NEOVYN PVC due to its 37% lower carbon footprint. |

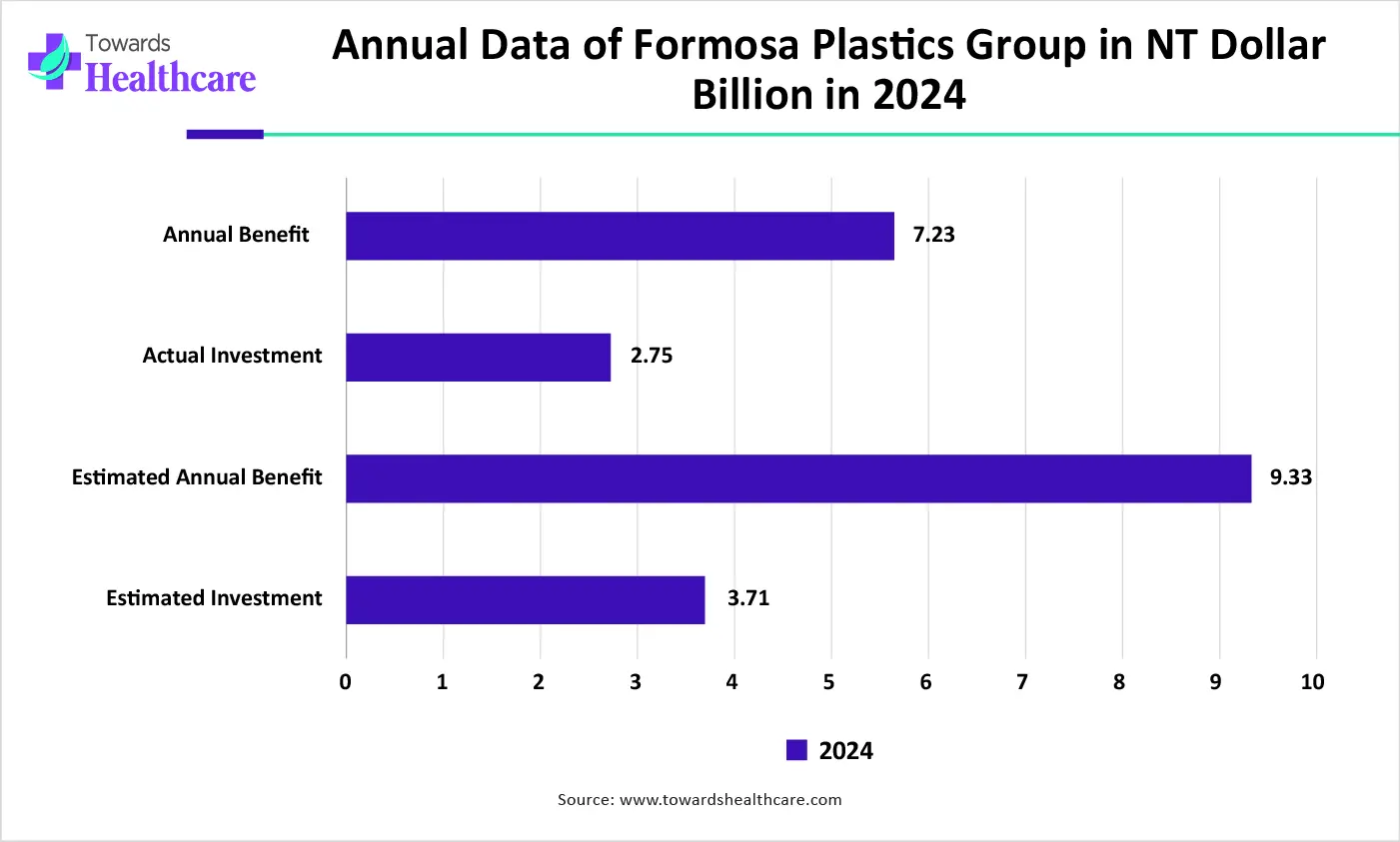

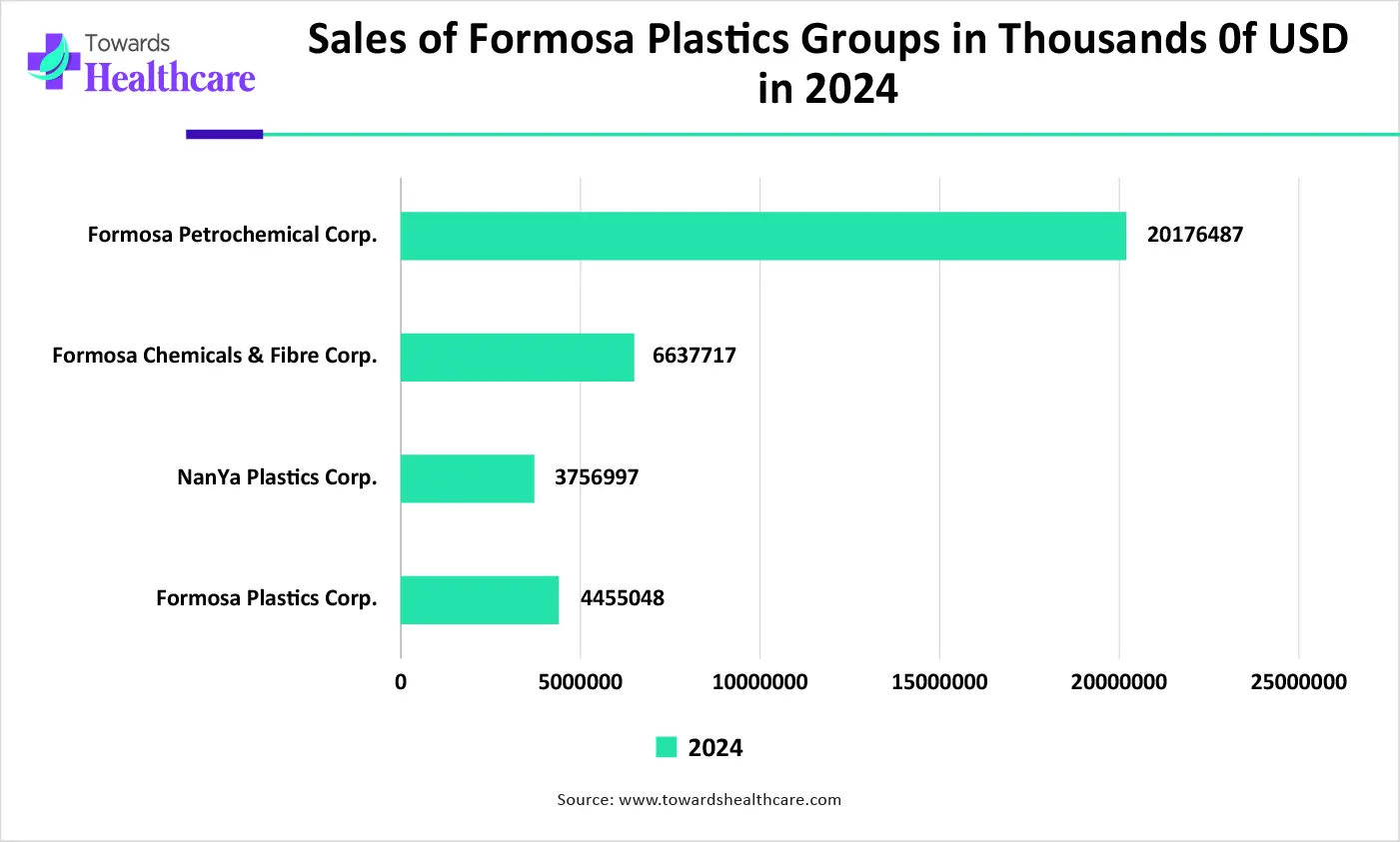

| 5 | Formosa Plastics Corporation | Taiwan | Formosa Plastics Corporation achieved a revenue of NT$2.1019 trillion in 2024. |

| 6 | Shin-Etsu Chemical Co., Ltd. | Chiyoda-ku, Tokyo, Japan | In March 2025, Yasuhiko Saitoh, President of Shin-Etsu Chemical Co., Ltd., proclaimed that the company is committed to sustained growth through technology, best-in-class quality, and practice. |

| 7 | Benvic Europe SAS | Dijon, France | In November 2025, Benvic Europe SAS planned to present its advanced polymer solutions at the Compounding World Expo in Cleveland. |

| 8 | Avient Corporation | Avon Lake, Ohio, USA | Avient Corporation focused on alternative polymers like PEEK and TPU and innovated many medical-grade polymer solutions. |

| 9 | RAUMEDIC AG | Helmbrechts, Germany | In November 2024, RAUMEDIC AG achieved ISCC Plus certification for the PVC-focused medical tubing plant. |

| 10 | GW Plastics Inc. | Bethel, Vermont, USA | GW Plastics Inc. remains a significant player in the medical plastic compounds market. |

By Type of PVC Compound

By Application

By Additive Type

By Formulation Variations

By Region

December 2025