December 2025

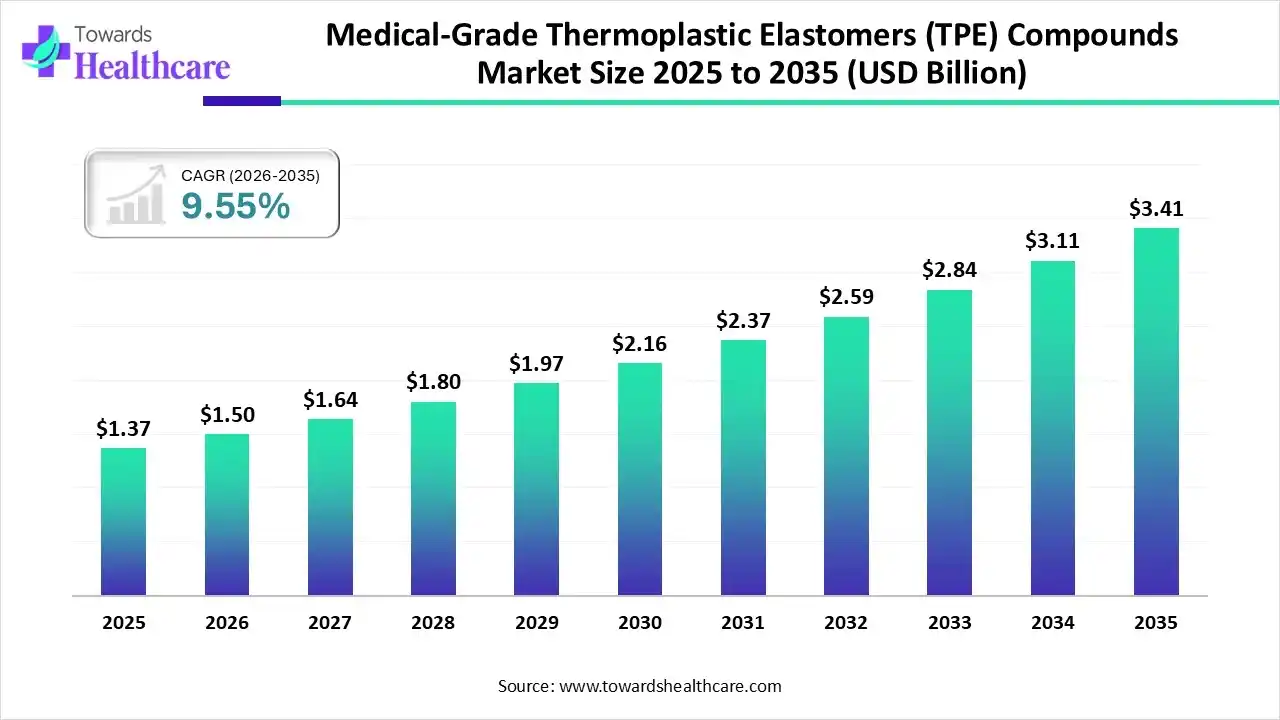

The global medical-grade thermoplastic elastomer (TPE) compounds market size was estimated at USD 1.37 billion in 2025 and is predicted to increase from USD 1.5 billion in 2026 to approximately USD 3.41 billion by 2035, expanding at a CAGR of 9.55% from 2026 to 2035.

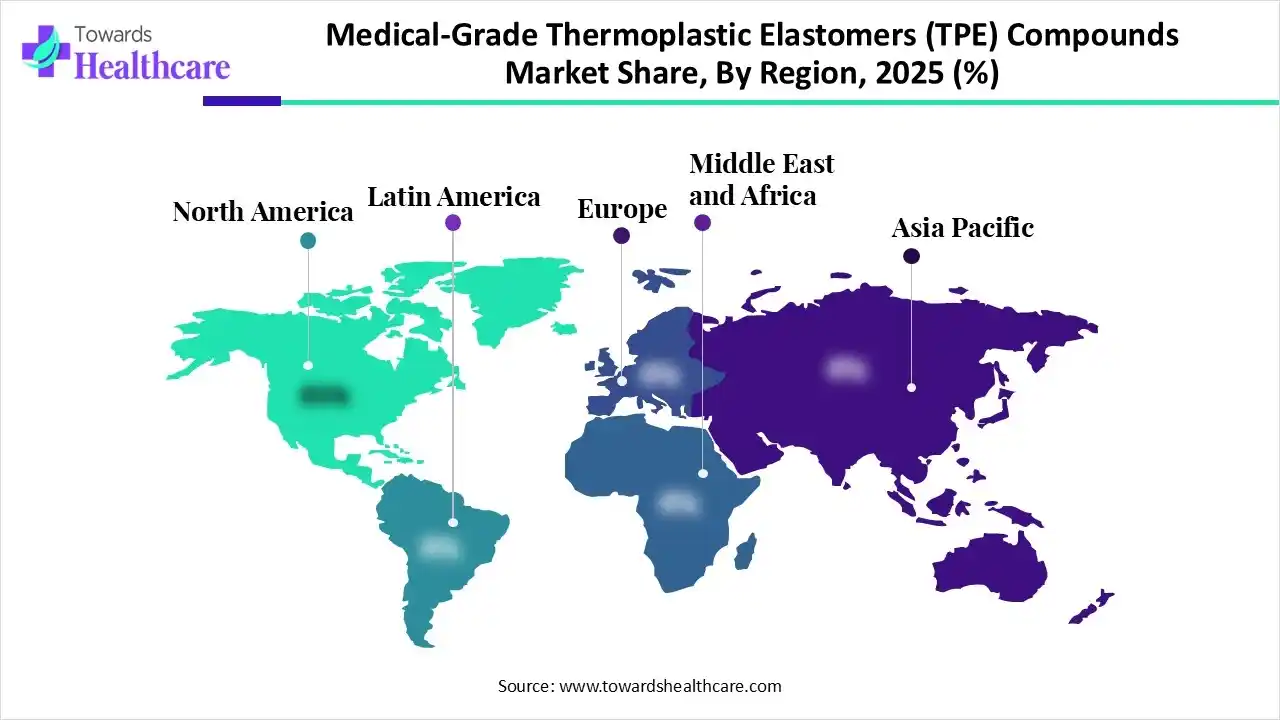

The market is growing steadily due to rising demand for flexible, biocompatible materials in tubing, catheters, wearables, and disposable medical devices. Manufacturers are shifting from PVC and silicone toward TPEs for better processability, safety, and sterilization compatibility. North America leads today, while Asia-Pacific shows the fastest future growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.5 Billion |

| Projected Market Size in 2035 | USD 3.41 Billion |

| CAGR (2026 - 2035) | 9.55% |

| Leading Region | North America |

| Market Segmentation | By TPE Type, By Application, By Processing Method, By Region |

| Top Key Players | BASF SE, Dow, Inc., ExxonMobil Chemical, SABIC, Teknor Apex Company, Lubrizol Corporation, Arkema S.A. |

Medical-grade thermoplastic elastomer (TPE) compounds are soft, flexible, rubber-like polymers engineered for medical use, offering high biocompatibility, sterilization compatibility, and ease of processing for devices like tubing, seals, and wearable compounds. The medical-grade thermoplastic elastomer (TPE) compounds market is growing due to rising demand for flexible, safe, and biocompatible materials, increasing use in medical devices, expanding minimally invasive procedures, stricter regulatory standards, and the shift toward latex-free, recyclable, and cost-effective alternatives.

AI can accelerate the medical-grade TPE compounds market by improving material design, predicting performance, and optimizing formulations for biocompatibility and durability. It enhances manufacturing efficiency through predictive maintenance and quality control, supports rapid prototyping, strengthens regulatory compliance analytics, and helps companies forecast demand, reduce waste, and speed up innovation in medical device materials.

Growing preference for non-allergenic, flexible, and sterilizable TPEs is replacing latex and PVC, driven by safety regulations, infection control needs, and demand for patient-friendly medical devices.

Manufacturers are developing specialty TPE grades with improved softness, strength, chemical resistance, and transparency, supporting next-gen applications in wearables, minimally invasive devices, and high-performance medical components.

Circular economy initiatives are boosting interest in recyclable TPEs, enabling reduced waste, eco-friendly manufacturing, and compliance with green regulations, encouraging medical device companies to adopt sustainable material alternatives

| Devices/System | Category/Use Case |

| Versius Surgical Systems | Robotic-assisted surgical robot |

| VARIPULSE Catheter Platform | Catheter-based vascular intervention system |

| Minima Stent System | Vascular stent systems |

| Altius Direct Electrical Nerve Stimulation System | Neuromodulation/nerve-stimulation therapy device |

| EVOQUE Tricuspid Valve Replacement System | Transcatheter heart valve for tricuspid valve replacement |

Why Did the Styrenic Block Copolymers (TPE-S/SEBS) Segment Dominate in the Market in 2025?

The styrenic block copolymers (TPE-S/SEBS) segment held the largest medical-grade thermoplastic elastomer (TPE) compounds market share in 2025 due to its excellent flexibility, high biocompatibility, and superior chemical resistance, making it ideal for medical devices, consumer products, and automotive applications. Its ability to combine rubber-like elasticity with thermoplastic processability drives high demand across diverse industries, sustaining its leading position in the TPE market.

Thermoplastic Polyurethanes (TPU)

The thermoplastic polyurethanes (TPU) segment is expected to grow at the fastest CAGR due to its excellent mechanical strength, abrasion resistance, and flexibility, along with biocompatibility and chemical stability, making it highly suitable for medical devices, footwear, electronics, and automotive applications. Increasing demand for durable and high-performance TPE solutions drives its rapid growth during the forecast period.

What Made the Medical Tubing Segment Dominant in the Market in 2025?

The medical tubing segment dominated the medical-grade thermoplastic elastomer (TPE) compounds market because it is widely used in critical medical applications such as catheters, IV lines, and respiratory devices. Its dominance is driven by high demand for biocompatible, flexible, and sterilizable TPE materials, increasing prevalence of minimally invasive procedures, and the expanding healthcare infrastructure globally, which sustains continuous growth in medical tubing applications.

Drug-Delivery & Wearable Devices

The drug delivery & wearable devices segment is expected to grow at the fastest CAGR due to the rising adoption of advanced drug delivery systems, wearable health monitors, and minimally invasive devices. Increasing focus on personalized medicine, patient convenience, and continuous health monitoring drives strong demand for flexible, biocompatible, and durable TPE materials in these applications.

How will the Extrusion-Grade TPE Compounds Segment dominate the Market in 2025?

The extrusion-grade TPE compounds segment dominated the medical-grade thermoplastic elastomer (TPE) compounds market because is a cost-effective, efficient, and versatile processing method suitable for producing methods suitable for producing tubing, films, and profiles. Its ability to provide consistent quality, high throughput, and compatibility with medical-grade applications drives widespread adoption across medical, automotive, and consumer industries, securing its leading position in the TPE market.

Injection-Molding TPE Compounds

The injection-molding TPE compounds segment is expected to grow at the fastest CAGR due to high demand for complex, precision-molded component devices, automotive parts, and consumer products. Its advantages include parts and consumer products. The advantages include design flexibility and fast production. Its advantages, including design flexibility, fast production cycles, and excellent surface finish, drive adoption particularly in applications requiring custom shapes and high-performance TPE components.

North America dominated the medical-grade thermoplastic elastomer (TPE) compounds market in 2025 due to its strong medical device manufacturing base, advanced healthcare infrastructure, and high adoption of premium biocompatible materials. Growing demand for minimally invasive devices, wearables, and high-performance medical tubing, along with strict regulatory standards and continuous R&D investments, further strengthened the region’s leadership.

The U.S. medical-grade thermoplastic elastomer (TPE) compounds market is growing due to its robust healthcare sector, strong presence of medical device manufacturers, and rapid adoption of advanced materials such as medical-grade TPEs. Rising demand for minimally invasive procedures, wearables, and high-performance medical components, along with continuous R&D investment and supportive regulatory pathways, further accelerates market expansion.

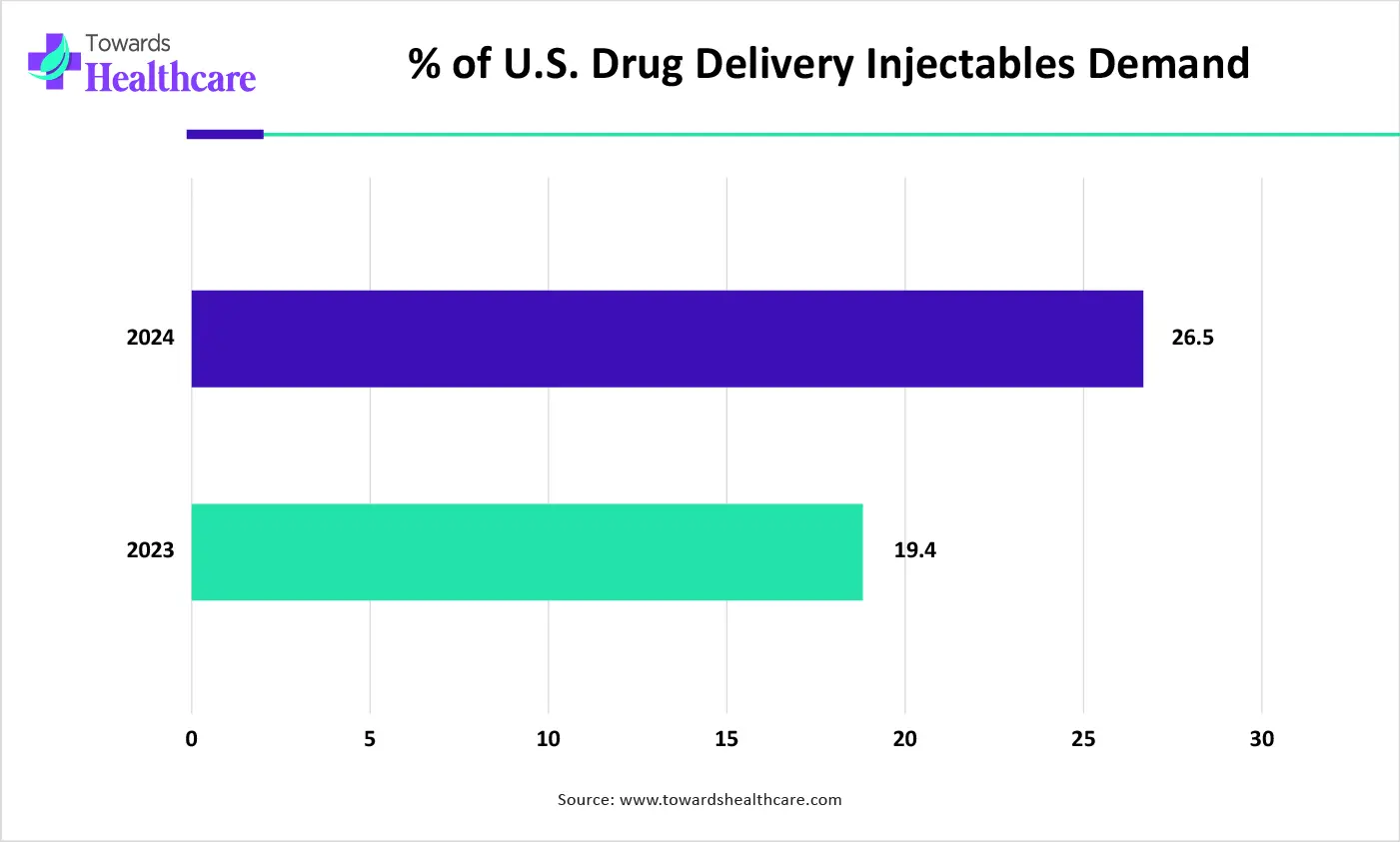

% of U.S. drug delivery injectables Demand

| Year | % |

| 2023 | 19.4 |

| 2024 | 26.5 |

Asia Pacific is anticipated to grow at the fastest CAGR due to the rapid expansion of medical device manufacturing, rising healthcare spending, and increasing adoption of cost-effective, high-performance materials. Strong growth in China, India, and Southeast Asia, coupled with expanding production capabilities, supportive government policies, and rising demand for minimally invasive and disposable medical products, drives the region’s accelerated market growth.

The India medical-grade thermoplastic elastomer (TPE) compounds market is growing due to expanding healthcare infrastructure, rising demand for affordable medical devices, and increasing local manufacturing under “Make in India.” Greater adoption of advanced materials like medical-grade TPEs, growth in minimally invasive procedures, supportive government policies, and rising investments from global med-tech companies further accelerate India’s strong market expansion.

Europe is a significantly growing region due to its strong medical device manufacturing base, advanced R&D capabilities, and strict quality standards that drive demand for high-performance materials like medical-grade TPEs. Rising adoption of minimally invasive devices, sustainability-focused materials, and innovative healthcare technologies, along with supportive regulatory frameworks, contributes to steady regional market growth.

The UK medical-grade thermoplastic elastomer (TPE) compounds market is growing due to its strong medical technology ecosystem, advanced research capabilities, and rising demand for high-quality, biocompatible materials in medical devices. Increased adoption of wearables, minimally invasive solutions, and innovative drug-delivery systems, along with supportive regulatory policies and investments in healthcare modernization, further accelerate the country’s market expansion.

| Company | Headquarters | Offerings |

| BASF SE | Ludwigshafen, Germany | Offers TPEs under brands such as Elastollan®. Their TPE portfolio is widely cited among top global TPE producers. |

| Dow, Inc. | Midland, Michigan, USA | Supplies olefin-based elastomers / TPE compounds (e.g., polyolefin-based elastomers) as part of the global TPE market. |

| ExxonMobil Chemical | Texas, USA | Produces elastomers / TPE-type materials (though product names are less consistently publicized for “medical-grade” in open sources). Listed among the major TPE market players. |

| SABIC | Riyadh, Saudi Arabia | Identified among global TPE suppliers/producers in marketreports for medicalpolymers / TPE markets. |

| Teknor Apex Company | Pawtucket, Rhode Island, USA | Offers dedicated medical-grade and medical-use TPE / elastomer compounds. Example: their Medalist® MD90000 Series TPE for medical applications. |

| Lubrizol Corporation | Wickliffe, Ohio, USA | Produces medical-grade TPU / elastomer polymers (medical tubing, catheters, etc.). They have planned expansion of medicaltubing manufacturing for neurovascular & cardiovascular applications (e.g., balloon catheters) as of 2024 in India. |

| Arkema S.A. | Paris, France | As a major specialtymaterials company, listed among global TPE / medicalresin suppliers. Their broader polymer portfolio may support medical-device supply chains. |

By TPE Type

By Application

By Processing Method

By Region

December 2025