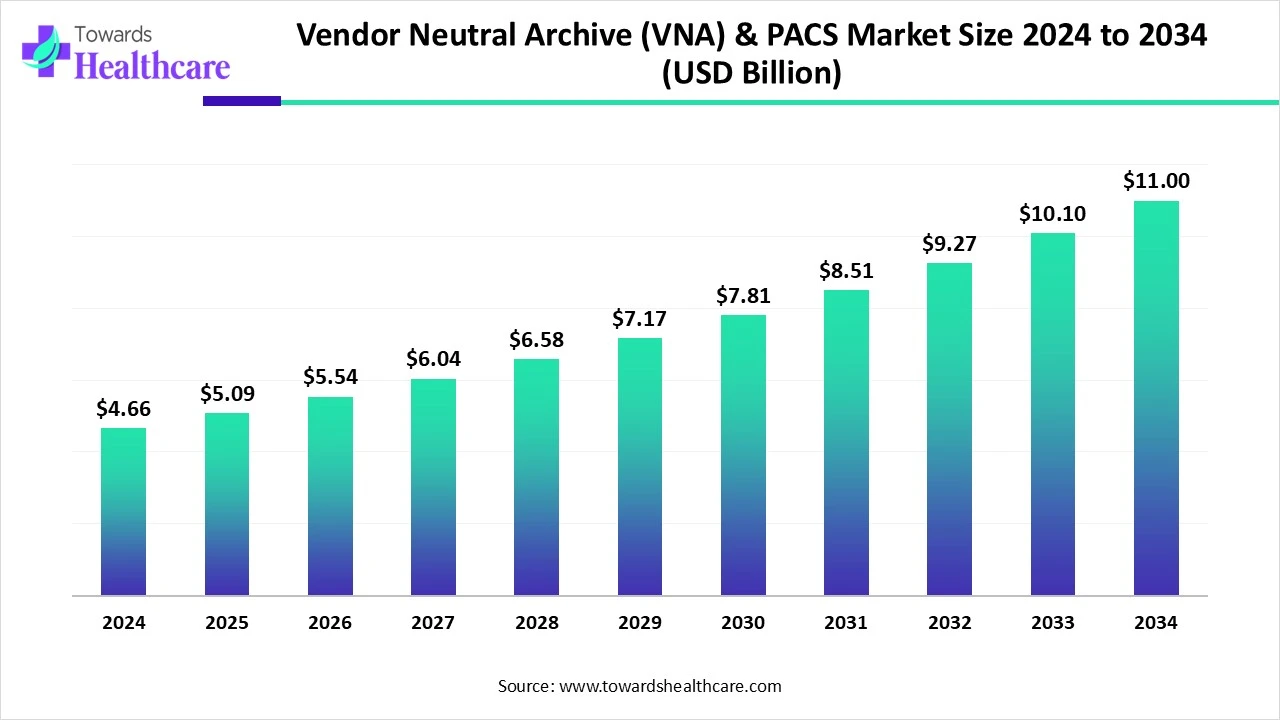

The global vendor neutral archive (VNA) & PACS market size reached USD 4.66 billion in 2024, grew to USD 5.09 billion in 2025, and is projected to hit around USD 11 billion by 2034, expanding at a CAGR of 9.16% during the forecast period from 2025 to 2034.

The vendor neutral archive (VNA) is a digital healthcare technology which is widely used to store medical images in a standard format to help healthcare professionals access essential medical information easily. The VNA is used by healthcare professionals to archive or retrieve medical data and images from picture archiving and communication systems.

The VNA facilitates easy transfer of medical data and improved efficiency in clinical workflows. The VNA allows the integration of this reliable healthcare information into PACS, electronic health records, radiology information systems, radiology information systems, and healthcare information systems that are routinely used in healthcare organizations. The PACS is used by several companies and healthcare systems to view created and stored medical images on scanners, while VNA allows the storage and transfer of data beyond the PACS and scanners.

| Table | Scope |

| Market Size in 2025 | USD 5.09 Billion |

| Projected Market Size in 2034 | USD 11 Billion |

| CAGR (2025 - 2034) | 9.16% |

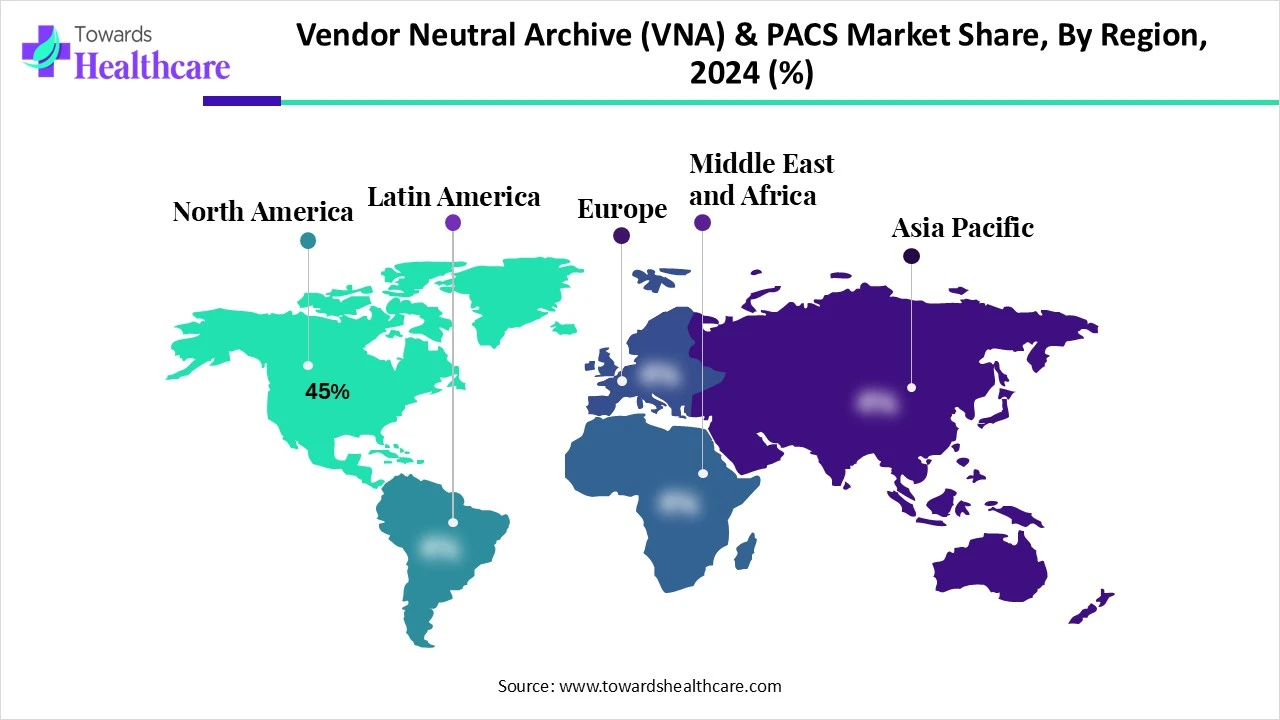

| Leading Region | North America Share 45% |

| Market Segmentation | By Product Type, By Deployment Mode, By Component, By End User, By Region |

| Top Key Players | IBM Watson Health, GE Healthcare, Philips Healthcare, Siemens Healthineers, Agfa HealthCare, Carestream Health, Sectra AB, Hyland Software, Change Healthcare, Fujifilm Holdings Corporation, RamSoft, Inc., Infinitt Healthcare, McKesson Corporation, Cerner Corporation (Oracle), Merge Healthcare (IBM), Visage Imaging, TeraMedica (part of FujiFilm), Medicalis (Change Healthcare), Novarad Corporation, Intelerad Medical Systems |

The vendor neutral archive (VNA) & picture archiving and communication system (PACS) market involves solutions designed to store, manage, and retrieve medical imaging data and associated clinical information across healthcare enterprises. VNAs provide a centralized, standardized, and interoperable storage repository independent of imaging device vendors, while PACS are systems that enable image storage, viewing, and distribution primarily within radiology departments. These systems improve workflow efficiency, facilitate data sharing, support clinical decision-making, and ensure regulatory compliance. The market growth is driven by increasing imaging volumes, adoption of digital healthcare, regulatory mandates, and technological advances like AI integration.

Artificial intelligence plays a pivotal role in precise medical imaging and delivering accurate results. AI avoids human errors in clinical practices and diagnosis by enhancing operational efficiency. AI allows efficient data collection, storage, and analysis that assist medical professionals in improved diagnosis of several health conditions. AI-powered medical imaging enables healthcare professionals to focus on patient care without investing more time in operating and monitoring medical devices and technologies.

What are the Various Trends Observed in the Vendor Neutral Archive (VNA) & PACS Market?

The key rationales behind the growth of VNA & PACS are increasing imaging data volume, the need for interoperability, regulatory compliance, rising adoption of AI for imaging analytics, and the shift towards cloud solutions. The excellent features of VNA & PACS include interoperability, long-term storage, data migration, and access control, which make them popular among all other digital healthcare technologies. The VNA & PACS technologies provide a standardized and centralized solution for the storage of medical images and related home healthcare data.

What are the Potential Challenges in the Vendor Neutral Archive (VNA) & PACS Market?

The prominent concerns associated with VNA & PACS are data security and privacy concerns, high implementation costs, and integration complexities with legacy systems. There is differentiation of medical data across vendors, departments, and facilities, which leads to inefficiencies. As a result, healthcare providers face challenges in accessing detailed patient records immediately. The challenges associated with standardization and unified data storage are resolved by VNAs. The essential data can get lost or systems may fail due to cyber-attacks, power shortages, or natural disasters.

What is the Future of the Vendor Neutral Archive (VNA) & PACS Market?

The opportunistic growth of the market lies in AI-enabled VNAs & PACS, cloud migration services, and expansion in emerging markets. There is an increasing popularity of cloud-based VNAs due to their cost-efficiency, scalability, and potential to support vast data volumes. The emerging trend of the integration of AI-driven tools into VNAs presents workflow automation and predictive analytics, which also improve the efficiency of radiology departments. A multi-tenant architecture enables healthcare organizations to manage various departments separately, which benefits multi-site institutions.

The picture archiving and communication system (PACS) segment dominated the market in 2024, owing to enhanced diagnostic accuracy, improved workflow efficiency, and cost-effectiveness. The PACS is combined with robust security features like audit trails, encryption, and access controls that protect patients' privacy and comply with HIPAA and other regulations. The PACS offers reduced operational expenses and a lower risk of damaged or lost medical images.

The vendor neutral archive (VNA) segment is expected to grow at the fastest CAGR in the market during the forecast period due to long-term flexibility and scalability in healthcare and medical operations and processes. The vendor neutral archive (VNA) & PACS market introduces a simplified view of medical images and their access while adhering to compliance and enhanced data security. The VNA offers cost savings, efficiency, improved interoperability, and data exchange.

The cloud-based segment dominated the vendor neutral archive (VNA) & PACS market in 2024, and the segment is expected to grow at the fastest CAGR during the predicted timeframe, owing to streamlined workflows and interoperability. The cloud-based VNA systems facilitate cost savings, scalability, enhanced accessibility, and collaborations. These systems allow improved data security and management of medical imaging data.

The software segment dominated the market in 2024, owing to the benefits of VNA software in healthcare, which include seamless data exchange, interoperability, reduced costs, and optimized storage. The software presents improved patient care, satisfaction, scalability, and enhanced data security. The use of software also allows enhanced collaborations between facilities and departments within a healthcare network.

The services segment is expected to grow at the fastest CAGR in the vendor neutral archive (VNA) & PACS market during the forecast period due to the numerous benefits of these services. These benefits include tailored solutions, optimal performance, enhanced data sharing, and streamlined workflows. They make systems reliable and manage maintenance services. Proactive maintenance of systems and services offers cost efficiency and prevents system failures.

The hospitals & healthcare providers segment dominated the vendor neutral archive (VNA) & PACS market in 2024. This segmental growth is attributed to the advantages of VNA & PACS in improving the standards of healthcare organizations. VNAs can upgrade imaging applications and storage solutions by ensuring long-term data accessibility. VNAs empower healthcare providers and organizations with better management and control of medical imaging data, which leads to a more efficient healthcare environment.

The ambulatory care centers segment is expected to grow at the fastest CAGR in the vendor neutral archive (VNA) & PACS market during the predicted timeframe due to the integration of VNAs into advanced technologies like AI, ML, and many other diagnostic techniques. The VNAs enable free and easy data exchange between different electronic health record systems that support coordinated patient care and informed clinical decision-making.

North America dominated the vendor neutral archive (VNA) & PACS market share by 45%, in 2024, owing to the increased demand for efficient data management. The National Institute of Biomedical Imaging and Bioengineering provides funding opportunities to enhance imaging, biomedical engineering, and other technologies like quantum sensing in biomedical applications. The American Society of Radiologic Technologists, the Joint Review Committee on Education in Radiologic Technology, and the American Registry of Radiologic Technologists made efforts to address the existing shortages in the workforce and recognize ideal solutions. These efforts will shape the future of medical imaging and radiation therapy in America.

The Radiological Society of North America focuses on advancing biomedical imaging innovations and public health. Furthermore, the Medical Imaging and Data Resource Center of the National Institute of Biomedical Imaging and Bioengineering focuses on the development of a high-quality repository for medical images.

The U.S. Department of Health and Human Services (HHS) has set the vision to become a global leader in innovations and the adoption of AI to advance the health and well-being of all Americans. The U.S. HHS has also set its strategic plan to use AI in health, public health, and human services. United Imaging Healthcare is one of the global leaders in advanced medical imaging and radiotherapy equipment, and the company reported its revenue of CNY 10.30 billion for 2024, with net income caused by shareholders reaching CNY 1.26 billion.

Asia Pacific is expected to grow at the fastest CAGR in the vendor neutral archive (VNA) & PACS market during the forecast period due to expanding healthcare infrastructure and digital transformation. In July 2024, the World Health Organization introduced the MeDevIS (Medical Devices Information System) to support governments, users, and regulators in their decision-making about using medical devices for the diagnostics of health conditions.

The R&D processes in the development of VNA & PACS systems lie in the assessment, feasibility study, system design, technology selection, testing, validation, and several other stages.

Key Players: Siemens Healthineers, GE HealthCare, Fujifilm Holdings Corporation, Koninklijke Philips N.V.

The distribution of VNAs and PACS to hospitals and pharmacies is associated with direct sales from vendors or partnerships with distributors that hold specialized expertise in healthcare IT solutions.

Key Players: Siemens Healthineers, Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips N.V.

VNAs and PACS play a significant role in enhancing patient support and services within healthcare through improved image access, streamlined clinical workflows, and active patient engagement.

Key Players: Sectra, Agfa Healthcare, INFINITT Healthcare, GE HealthCare

By Product Type

By Deployment Mode

By Component

By End User

By Region