December 2025

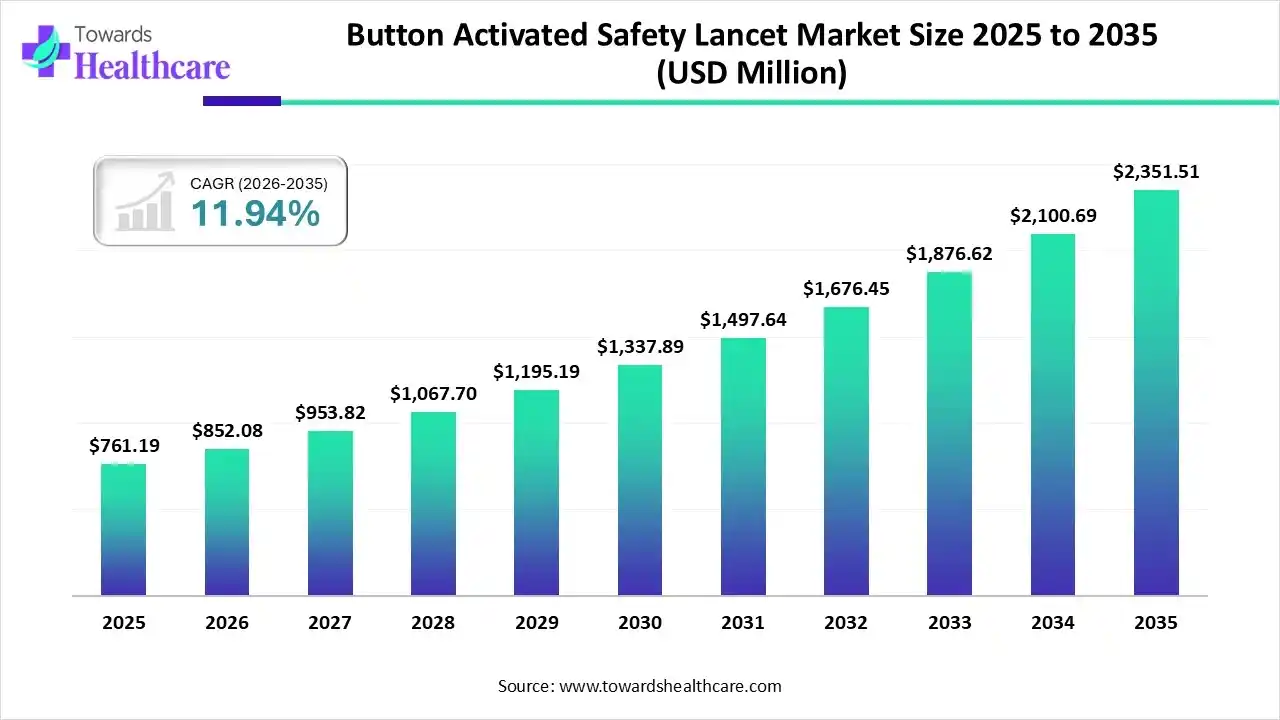

The global button-activated safety lancet market size is expected to be worth around USD 2351.51 million by 2035, from USD 761.19 million in 2025, growing at a CAGR of 11.94% during the forecast period from 2026 to 2035.

The button-activated safety lancet market is fueled by the increasing demand for painless blood withdrawal and the prevention of needlestick injuries. Patients mostly prefer home-based testing and increasingly adopt safety-engineered medical devices. Government organizations launch initiatives to encourage diabetic patients to monitor their blood glucose levels regularly. This enables healthcare professionals to keep track of patients’ health and provide early intervention.

| Key Elements | Scope |

| Market Size in 2026 | USD 852.08 Million |

| Projected Market Size in 2035 | USD 2351.51 Million |

| CAGR (2026 - 2035) | 11.94% |

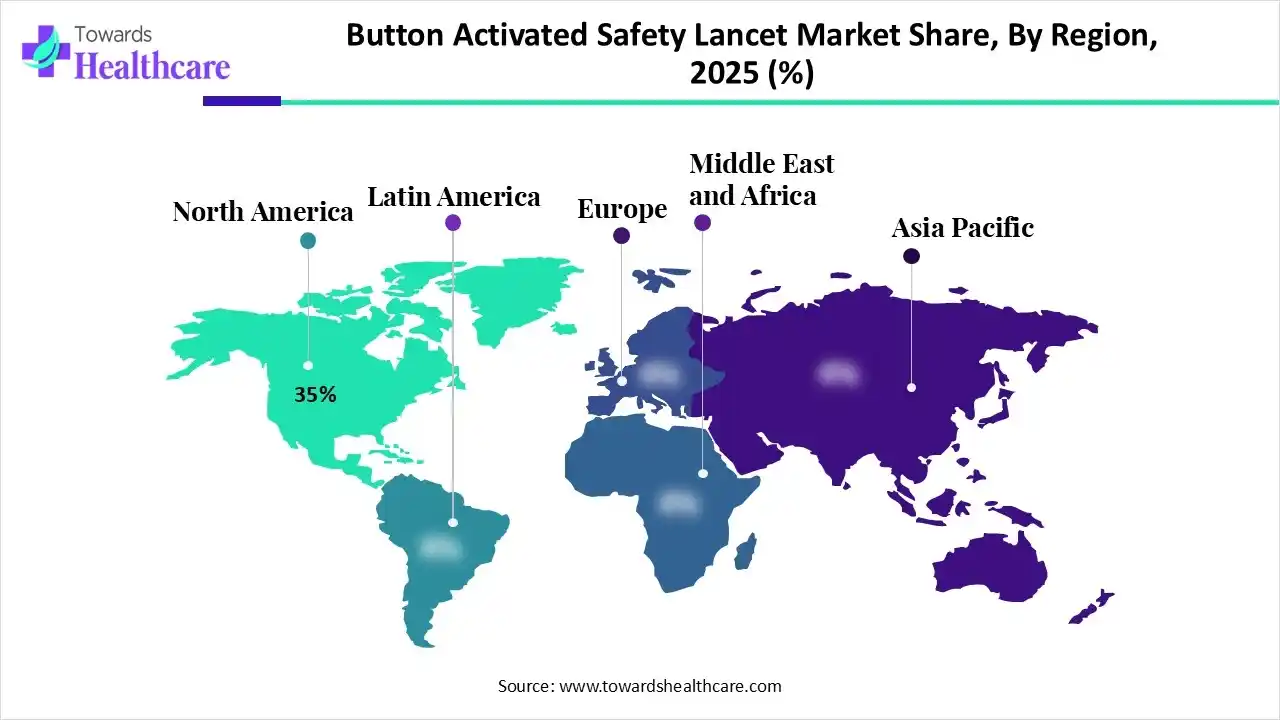

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Application, By End-User, By Region |

| Top Key Players | Cardinal Health, Inc., Yangzhou Viomed, Dynarex Corporation, Apollo Medical, Henso Medical, Jiangsu Huida Medical Instruments Co., Ltd., Niche Healthcare, Chem Labs Ltd., McKesson Medical-Surgical, Inc., SteriLance Medical, Inc. |

The button-activated safety lancet market comprises single-use, spring-loaded lancets that are activated by a push-button mechanism to obtain capillary blood samples while minimizing needlestick injuries and cross-contamination. These devices feature automatic needle retraction, controlled penetration depth, and ergonomic designs, making them suitable for point-of-care testing, self-monitoring of blood glucose (SMBG), neonatal screening, and diagnostic applications in clinical and home settings.

Leveraging artificial intelligence (AI) in button-activated safety lancets introduces automation in the needle release and retraction process. As stringent regulations demand safety and sterility of lancets, AI and machine learning (ML) algorithms can monitor and detect the presence of microorganisms. AI and ML can also streamline large-scale manufacturing of safety lancets, enhancing efficiency, productivity, and reproducibility. AI-based predictive analytics enable manufacturers to identify errors and make informed, proactive decisions.

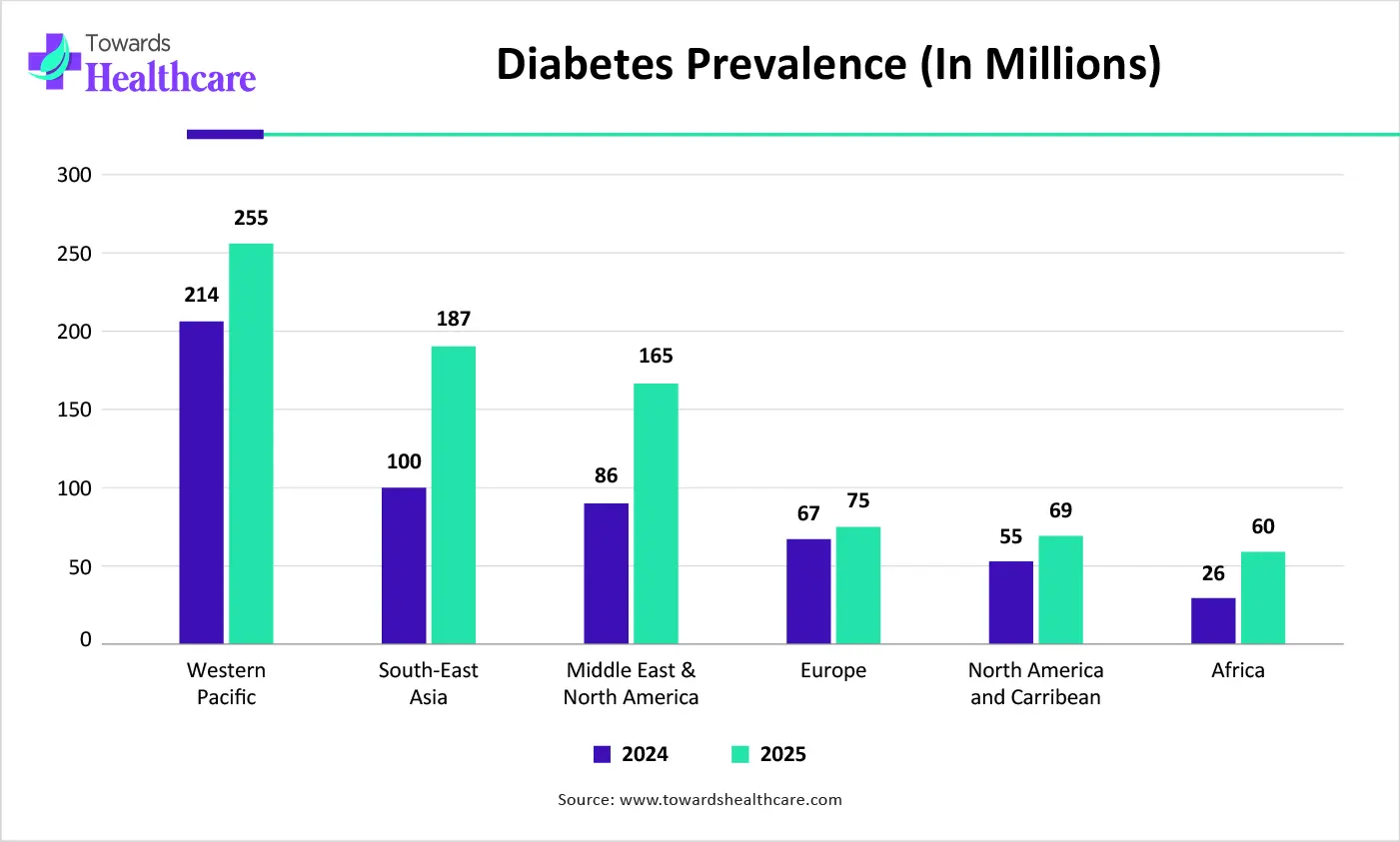

| Regions | 2024 | 2050 |

| Western Pacific | 214 | 255 |

| South-East Asia | 100 | 187 |

| Middle East & North Africa | 86 | 165 |

| Europe | 67 | 75 |

| North America and the Caribbean | 55 | 69 |

| Africa | 26 | 60 |

Which Product Type Segment Dominated the Button-Activated Safety Lancet Market?

The fixed-depth button-activated safety lancets segment held a dominant position with a share of approximately 55% in the market in 2025, due to the growing need for home use of diagnostic devices. Older age people and patients are unaware of the safe and effective use of lancet devices. Fixed-depth lancets trigger a pre-set needle depth with a simple button press. This ensures precision and high accuracy, minimizing the risk of inappropriate data.

Adjustable-Depth Button-Activated Safety Lancets

The adjustable-depth button-activated safety lancets segment is expected to grow at the fastest CAGR of approximately 9% in the market during the forecast period. Adjustable-depth safety lancets are widely preferred due to their ability to provide multiple depth options of 1.3 mm, 1.8 mm, and 2.3 mm in a single device. This eliminates the need for patients to purchase multiple devices for various applications. Patients can customize their needle depth, prioritizing their comfort.

How the Blood Glucose Monitoring (SMBG) Segment Dominated the Button-Activated Safety Lancet Market?

The blood glucose monitoring (SMBG) segment held the largest revenue share of approximately 60% in the market in 2025, due to the rising prevalence of diabetes and increasing awareness of constant blood sugar level monitoring. Most healthcare professionals guide patients to test their blood glucose levels 2-6 times a day. Hence, safety lancets are widely used to minimize needlestick injuries on frequent use. According to the International Diabetes Federation (IDF), approximately 589 million people were estimated to have diabetes in 2024.

Infectious Disease Testing

The infectious disease testing segment is expected to grow with the highest CAGR of approximately 12% in the market during the studied years. Infectious diseases are illnesses caused by harmful germs, such as viruses, bacteria, and fungi. In 2024, approximately 10.7 million people fell ill with TB worldwide, including 5.8 million men, 3.7 million women, and 1.2 million children. Safety lancets ensure minimal prick sensation and withdraw a sufficient amount of blood for testing.

Why Did the Home Healthcare/Self-Testing Users Segment Dominate the Button-Activated Safety Lancet Market?

The home healthcare/self-testing users segment contributed the biggest revenue share of approximately 42% in the market in 2025, due to the growing geriatric population and increasing awareness of point-of-care diagnostics. Developers have designed diagnostic devices that are easy to use, affordable, and accurate. The rising demand for personalized care also augments the segment’s growth. Home healthcare eliminates the need for patients to visit a healthcare organization, saving time and costs.

Diagnostic Laboratories

The diagnostic laboratories segment is expected to expand rapidly with a CAGR of approximately 10% in the market in the coming years. Diagnostic laboratories have favorable infrastructure and suitable capital investment to adopt advanced diagnostic tools. They possess specialized equipment and skilled professionals to provide personalized care. The increasing number of diagnostic centers and high patient trust boost the segment’s growth.

North America dominated the global market with a share of approximately 35% in 2025. The availability of a robust healthcare infrastructure, the presence of key players, and favorable government support are major factors that contribute to market growth in North America. Government bodies encourage the general public to undergo screening and early diagnosis of diabetes and other chronic disorders. Americans are aware of technological advancements and have developed advanced lancet tools for blood withdrawal.

The U.S. is home to multiple button-activated safety lancet companies, including Cardinal Health, Inc., Dynarex Corporation, and McKesson Medical-Surgical, Inc. This helps manufacturers to fulfill local demands for disease detection. As of 8th December 2025, the U.S. Food and Drug Administration (FDA) approved a total of 197 companion diagnostic devices for various indications.

Asia-Pacific is expected to grow at the fastest CAGR of approximately 12% in the market during the forecast period. The rising prevalence of diabetes, sedentary lifestyles, and the increasing geriatric population propel the market. The region records the highest prevalence of diabetes, accounting for 322 million people having diabetes in 2024. People are becoming aware of point-of-care diagnostics, promoting the demand for button-activated safety lancets. The burgeoning healthcare sector and advancements in medical device technologies augment the market.

Diabetes is a major public health concern among Indians, affecting more than 89.8 million individuals. The WHO and India’s Ministry of Health and Family Welfare (MoHFW) join forces to ensure access to care for patients with diabetes and hypertension by 2025, with the first national-level project funded by WDF in India.

Europe is expected to grow at a considerable CAGR in the upcoming period. The growing research and development activities and the rising adoption of advanced technologies foster market growth. The European Medicines Agency (EMA) regulates the approval and use of diagnostic devices. European nations introduced stringent regulations to prevent and manage the increasing number of diabetes cases. They offer suitable manufacturing infrastructure and capital investments, encouraging foreign companies to set up their facilities in the region.

The UK government has made national policies to tackle obesity and prevent type 2 diabetes in the region. The NHS Diabetes Prevention Programme (NHS DPP) identifies people at risk of developing type 2 diabetes. The Scottish government recently announced an investment of £4.8 million to prevent people from developing type 2 diabetes.

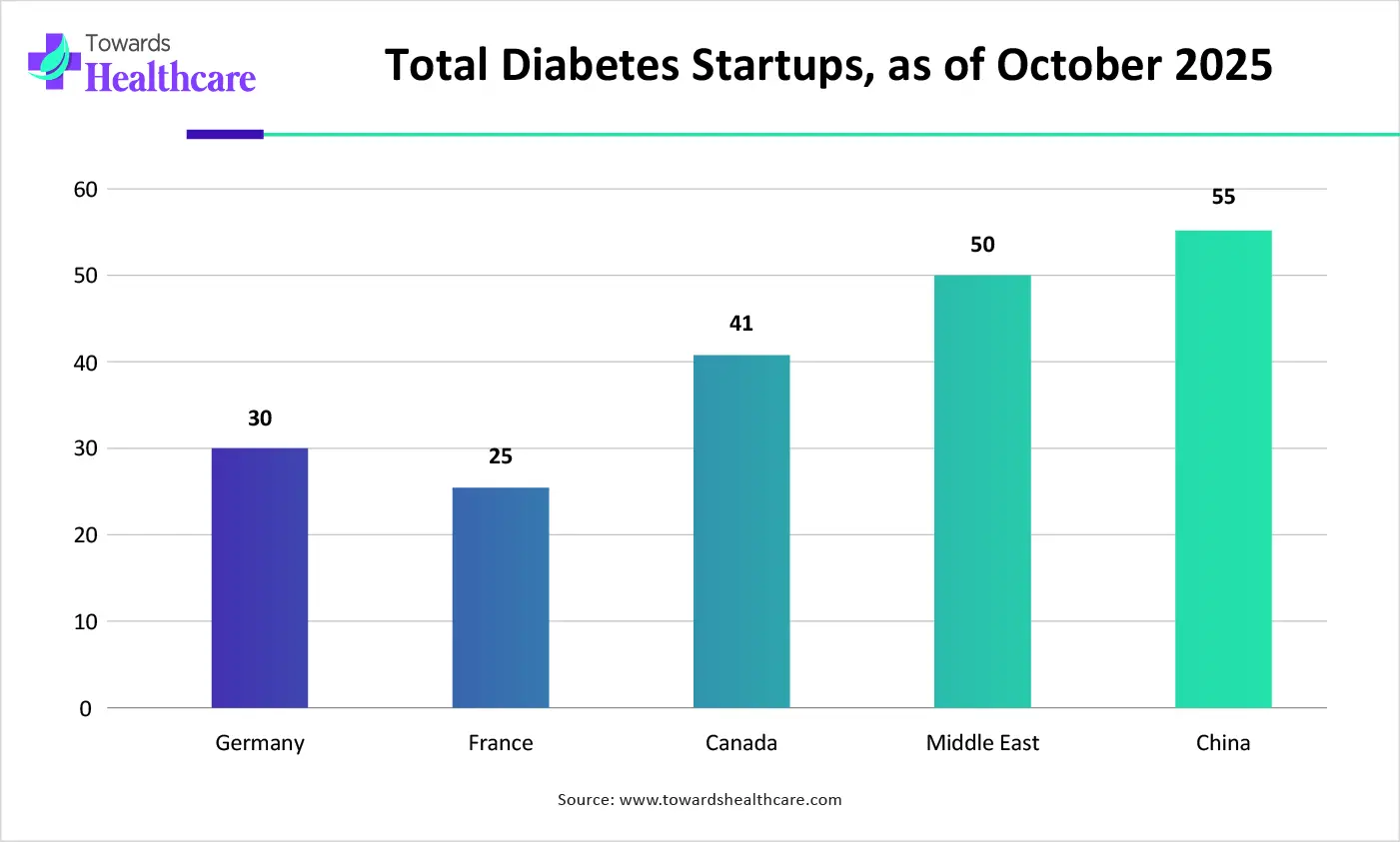

| Countries/Regions | No. of Diabetes Startups (as of October 2025) |

| Germany | 30 |

| France | 25 |

| Canada | 41 |

| Middle East | 50 |

| China | 55 |

| Companies | Headquarters | Offerings |

| Cardinal Health, Inc. | Ohio, United States | It offers push-button-activated safety Lancets to provide controlled needle depth for greater patient comfort. |

| Yangzhou Viomed | Jiangsu, China | It is the leading push-button safety Lancet manufacturer in China. |

| Dynarex Corporation | New Jersey, United States | Dynarex Safety Lancets are high-quality, medical-grade lancets used in capillary blood and diagnostic testing. |

| Apollo Medical | Missouri, United States | It offers Safety Lancets, Pressure Activated Safety Lancets 26G, and Tri-Plus Safety Lancets 23G. |

| Henso Medical | Hangzhou, China | Its Button-Activated Safety Lancets are single-use devices for capillary blood sampling for healthcare professionals. |

| Jiangsu Huida Medical Instruments Co., Ltd. | Jiangsu, China | It is a leading supplier of button-activated safety lancets across China. |

| Niche Healthcare | West Yorkshire, United Kingdom | It provides single-use, pre-loaded, button-activated safety lancets for blood glucose and other in vitro diagnostic tests. |

| Chem Labs Ltd. | Nairobi, Kenya | It offers push-button lancets of different sizes, including 18G, 21G, 23G, 26G, 28G, and 30G. |

| McKesson Medical-Surgical, Inc. | Virginia, United States | McKesson’s Safety Lancet 28G Retractable Push Button is used by healthcare professionals to obtain capillary blood samples. |

| SteriLance Medical, Inc. | Suzhou, China | It offers a wide range of pressure-activated, side button-activated, tail button-activated, and adjustable depth lancets. |

By Product Type

By Application

By End-User

By Region

December 2025

December 2025

November 2025

November 2025