December 2025

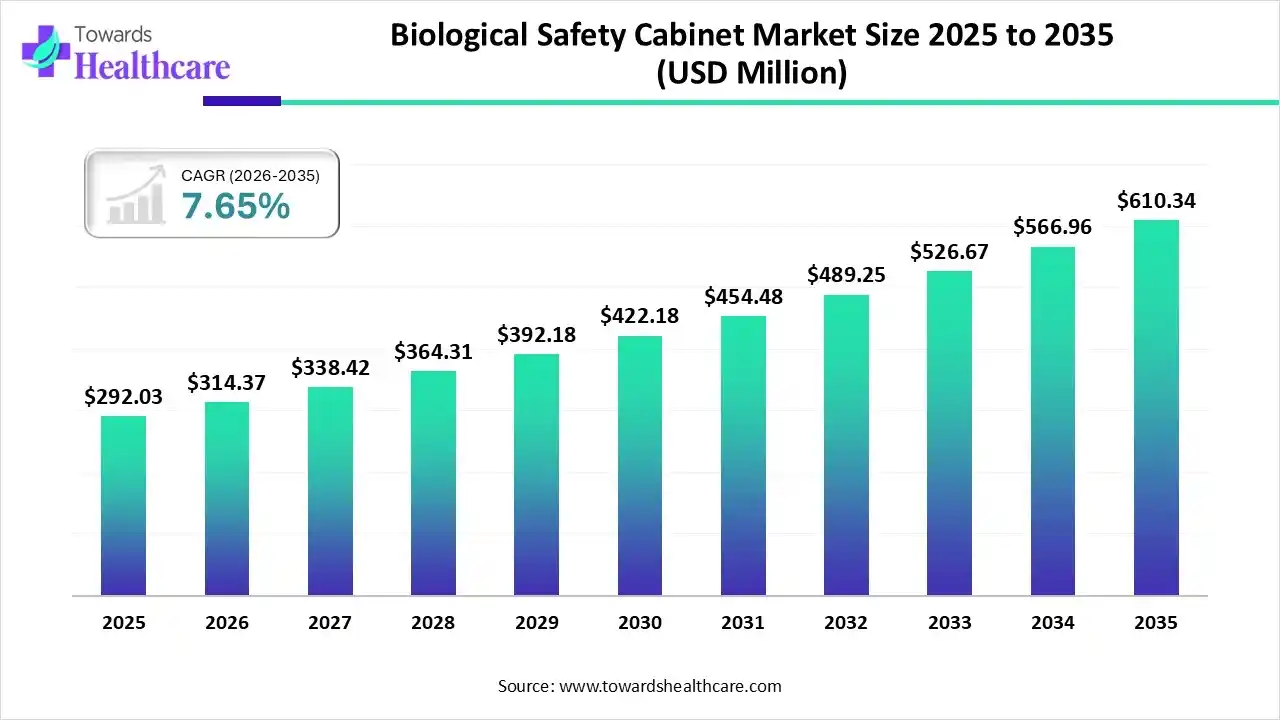

The global biological safety cabinet market size was estimated at USD 292.03 million in 2025 and is predicted to increase from USD 314.37 million in 2026 to approximately USD 610.34 million by 2035, expanding at a CAGR of 7.65% from 2026 to 2035.

The biological safety cabinet market is growing steadily as laboratories prioritize contamination control, biosafety compliance, and high-quality air filtration. Rising pharmaceutical and biotech research, increased infectious disease testing, and stricter global safety regulations are driving adoption. Demand is further supported by expanding healthcare infrastructure and the modernization of laboratories across emerging regions.

| Key Elements | Scope |

| Market Size in 2026 | USD 314.37 Million |

| Projected Market Size in 2035 | USD 610.34 Million |

| CAGR (2026 - 2035) | 7.65% |

| Leading Region | North America |

| Market Segmentation | By Product, By End-Use, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Labconco Corporation, NuAire.,Inc., The Baker Company, Inc., AZBIL TELSTAR, S.L.U, Jinan Biobase Co., Ltd., Germfree Laboratories, Inc., Haier Biomedical |

A biological safety cabinet (BSC) is a ventilated, enclosed workspace that protects users, samples, and the environment by filtering air through a HEPA filter to safely contain infectious or hazardous biological materials. The biological safety cabinet market is growing due to rising laboratory activities, expanding biotech and pharmaceutical R&D, and stricter global biosafety regulations. Increased focus on infectious disease control, growth in clinical diagnostics, and higher demand for safe handling of pathogens are also driving adoption across hospitals, research institutes, and industrial labs.

According to the WHO’s 2025 estimates, roughly 3–5 billion people worldwide experience significant seasonal flu each year. This highlights the widespread impact of influenza and the ongoing need for strong public-health measures.

AI is influencing the market by enabling smarter airflow control, predictive maintenance, and real-time monitoring of cabinet performance. It improves contamination detection, enhances user safety, and reduces operational errors. AI-driven automation also supports energy efficiency, remote diagnostics, and compliance tracking, making BSCs more reliable, efficient, and appealing for modern labs.

| Year | U.S. | EU |

| 2023-24 |

Cases-40M Hospitalization-470,000 Deaths- 28,000 |

Cases-26,118 Hospitalization-8,659 Deaths- 665 |

| 2024-25 |

Cases-47-82M Hospitalization-610,000-1.3M Deaths- 27,000-130,000 |

Cases-354,455 |

Why Did the Class II Segment Dominate in the Market in 2025?

The class II segment leads the biological safety cabinet market because it offers a higher balance of user protection and environmental protection, making it the preferred choice for handling infectious agents. Its versatility, compliance with global biosafety standards, and wide use in hospitals, diagnostics, pharma, and research labs drive its dominant adoption across applications.

In May 2025, Thermo Fisher Scientific Inc. introduced the Thermo Scientific 1500 Series Class II, Type A2 biosafety cabinet, offering enhanced protection and ease of use while expanding the company’s overall product lineup.

Class I

The class I segment is projected to record the fastest CAGR because it offers cost-effective protection for basic microbiological work and low-risk pathogen handling. Growing use in academic labs, small research facilities, and emerging biotech units is boosting adoption. Increasing awareness og biosafety compliance, rising entry-level lab setups, and demand for simple, energy-efficient systems further support the rapid expansion of class I cabinets.

What Made the Pharmaceutical & Biopharmaceutical Companies Segment Dominant in the Market in 2025?

The pharmaceutical & biopharmaceutical companies segment leads the biological safety cabinet market due to its intensive research, drug development, and biologics manufacturing activities that require stringent contamination control. High regulatory standards, continuous expansion of R&D facilities, and investment in advanced laboratory infrastructure drive consistent demand for reliable BSCs, making these companies the dominant end users in the global market.

As of 2025, Cross River Therapy reports that approximately 5,000 pharmaceutical companies are active in the U.S., highlighting the country’s extensive pharmaceutical industry presence.

Diagnostic & Testing Laboratories

The diagnostic & testing laboratories segment is expected to grow at the fastest CAGR due to rising demand for clinical testing, infectious disease screening, and personalized medicine. Increasing patient awareness, expansion of healthcare infrastructure, and the growing need for rapid and accurate diagnostics drive adoption. Additionally, stringent biosafety requirements in labs handling pathogens further accelerate the demand for advanced biological safety cabinets in this segment.

North America dominates the biological safety cabinet market due to the presence of major pharmaceutical, biotech, and research companies, advanced healthcare infrastructure, and stringent biosafety regulations. High R&D investment, increasing laboratory activities, and growing focus on infectious disease control and clinical diagnostics further drive the demand for advanced BSCs across hospitals, research institutes, and industrial laboratories.

The U.S. market is growing due to rising investments in pharmaceutical and biotech R&D, expansion of clinical and diagnostic laboratories, and strict regulatory standards for laboratory safety. Increasing focus on infectious disease control, vaccine development, and adoption of advanced, AI-enabled BSCs are also fueling demand across research institutes, hospitals, and industrial labs.

The Asia Pacific biological safety cabinet market is expected to grow at the fastest CAGR due to the rapid expansion of the pharmaceutical, biotech, and research sectors in countries like China and India. Rising healthcare infrastructure, increasing government initiatives for biosafety, growing laboratory setups, and the adoption of advanced BSC technologies are driving market growth across the region.

In November 2023, Esco Micro Pte. Ltd. introduced the Labculture Plus G4 Class II Biosafety Cabinet to expand and enhance its product portfolio.

The Indian market is growing due to increasing investments in pharmaceutical and biotech R&D, expanding hospital and diagnostic laboratory infrastructure, and rising focus on biosafety compliance. Government initiatives, growing awareness of infectious disease control, and adoption of advanced BSC technologies in research and clinical labs are further driving market demand across the country.

Europe is expected to grow significantly in the biological safety cabinet market due to stringent biosafety regulations, high adoption of advanced laboratory equipment, and strong pharmaceutical and biotechnology sectors. Rising investments in R&D, growing demand for clinical diagnostics, and increasing focus on infectious disease control are driving the adoption of BSCs across research institutes, hospitals, and industrial laboratories in the region.

In July 2025, NuAire, Inc. earned EN 12469 certification for its NU-543E and NU-543S Class II biological safety cabinets, enhancing its product lineup and compliance with European microbiological safety standards.

The UK biological safety cabinet market is increasing due to growing investments in pharmaceutical and biotech research, expanding clinical and diagnostic laboratories, and strict biosafety regulations. Rising focus on infectious disease management, vaccine development, and adoption of advanced, energy-efficient BSCs in hospitals and research facilities are further driving market growth across the country.

| Region | 2023 | 2024 |

| Europe | 17 | 18 |

| USA | 28 | 25 |

| Japan | 5 | 5 |

| China | 15 | 5 |

| Others | 25 | 28 |

| Companies | Headquarters | Offerings |

| Thermo Fisher Scientific, Inc. | USA | Class II biological safety cabinets like the 1300 Series, 1500 Series, and Herasafe models with advanced airflow, ergonomic design, and compliance features. |

| Labconco Corporation | USA | Diverse BSC products, such as Logic and Nexus Class II cabinets, are focused on safety, efficiency, and energy savings. |

| NuAire.,Inc. | USA | Class II biosafety cabinets with ergonomic design, HEPA filters, and variants including Type A2, B1, and B2. |

| The Baker Company, Inc. | USA | SterilGARD and BioChemGARD BSCs provide contamination protection and support for lab workflows. |

| AZBIL TELSTAR, S.L.U. | Spain | Class II cabinets like Bio II Advance Plus are designed for high-level biological protection. |

| Jinan Biobase Co., Ltd. | China | Class II A2 and B2 biosafety cabinets with UV lights and other standard features. |

| Germfree Laboratories, Inc. | USA | BSCs plus related containment solutions, including mobile and modular cleanrooms. |

| Air science | USA | BSCs plus related containment solutions, including mobile and modular cleanrooms. |

| Haier Biomedical | China | NSF Series biological safety cabinets for research, medical, and pharma labs. |

| Cruma S.A. | Spain | Workstations and Class II biosafety cabinets, including PCR workstations and containment solutions. |

By Product

By End-Use

By Region

December 2025

December 2025

October 2025

October 2025