November 2025

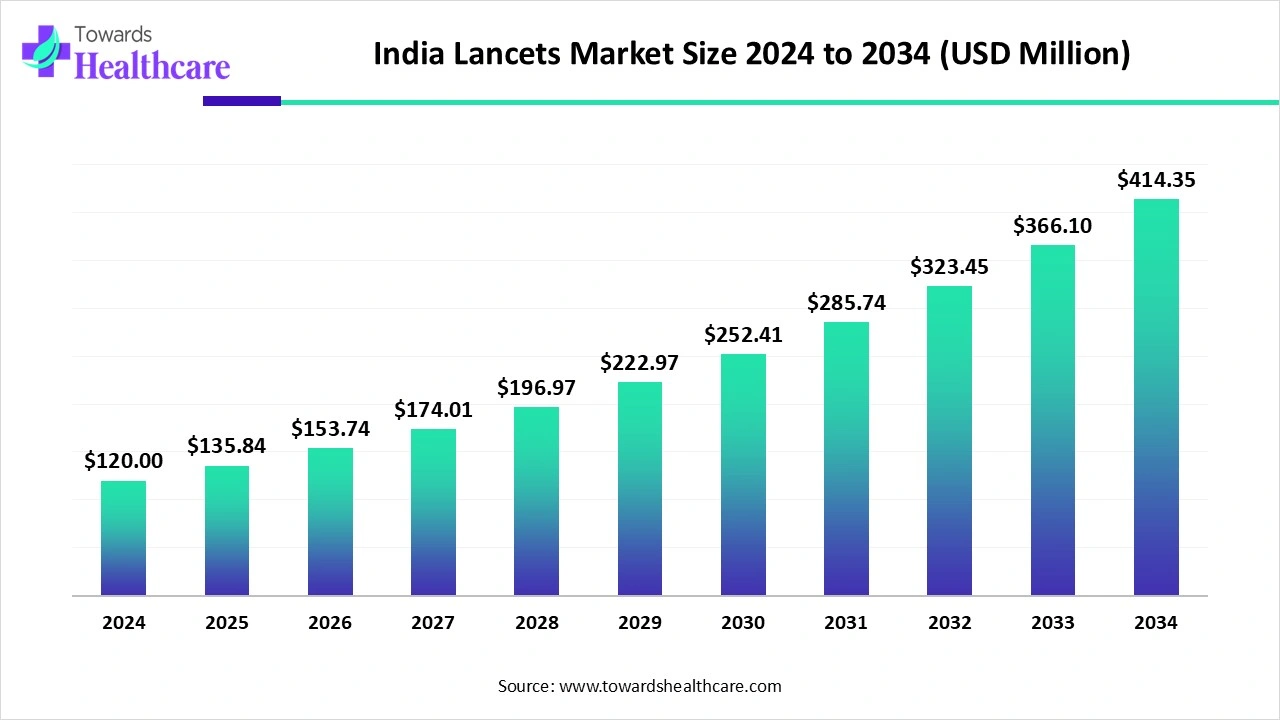

The India lancets market size is calculated at US$ 120 million in 2024, grew to US$ 135.84 million in 2025, and is projected to reach around US$ 414.35 million by 2034. The market is projected to expand at a CAGR of 13.2% between 2025 and 2034.

Higher prevalence of diabetes and strong demand for lancets for glucose monitoring is observed to support the market’s expansion in the upcoming years. Additionally, programs such as National Health Mission and multiple other initiatives that increase access to diabetes care are promoting the market’s growth.

| Metric | Details |

| Market Size in 2025 | USD 135.84 Million |

| Projected Market Size in 2034 | USD 414.35 Million |

| CAGR (2025 - 2034) | 13.2% |

| Market Segmentation | By Product Type, By Gauge (Needle Thickness), By Penetration Depth, By Usage, By Application, By End-User |

| Top Key Players | Becton, Dickinson and Company (BD), Roche Diagnostics (Accu-Chek), Abbott Laboratories (Freestyle), Terumo Corporation, Nipro Corporation, Medtronic Plc, Dr. Morepen (Morepen Laboratories Ltd.), Hindustan Syringes & Medical Devices Ltd. (HMD), Poly Medicure Ltd., Ypsomed India Pvt. Ltd., ARKRAY Healthcare Pvt. Ltd. |

The India lancets market refers to the segment of the medical device industry in India focused on the manufacture, distribution, and use of lancets, small, sharp instruments used to obtain capillary blood samples. Lancets are primarily used for blood glucose monitoring by people with diabetes, but also serve broader applications in diagnostic testing, anemia screening, and cholesterol checks

In March 2025, Mint published an article about a Lancet study predicting that 218 million men and 231 million women in India, with a total number of about 449 million people, will be overweight by 2050. This projection is based on the Global Burden of Disease (GD) Study 2021. (Source - India Today)

Multiple national health programs boost the overall utilization of blood collection medical devices. Guided by a preventive healthcare approach, the Ministry of Health (India) promotes universal access to affordable quality healthcare services.

Furthermore, the emphasis over at-home blood tests, especially for glucose monitoring is observed to boost the market’s expansion.

India is witnessing a steady rise in diabetes cases, with a growing number of individuals requiring regular blood glucose monitoring.

New lancet designs focus on ultra-fine gauge needles (often 30G or thinner) that minimize pain during blood sampling.

While traditional lancets are basic tools, the broader self-monitoring ecosystem in India is becoming digitally connected.

The shift toward online pharmacy platforms and direct-to-doorstep models is transforming how lancets reach consumers.

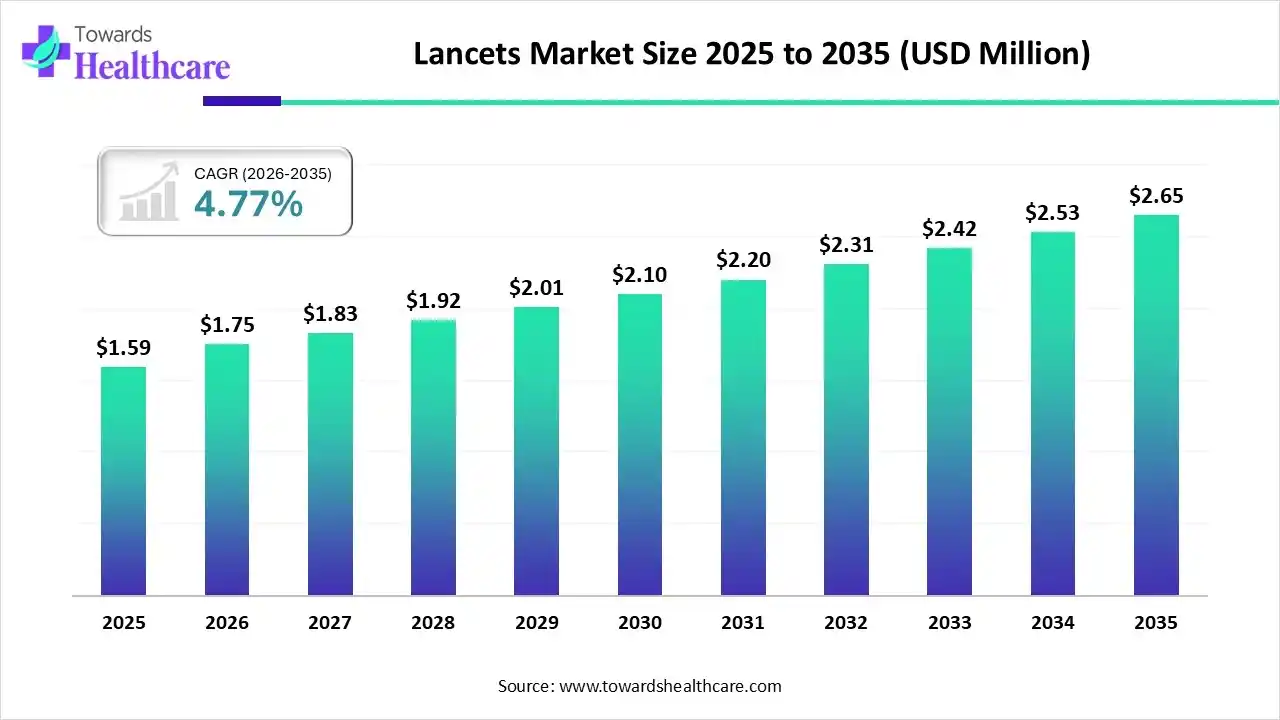

The lancets market is projected to grow from USD 1.59 million in 2025 to USD 2.65 million by 2035, registering a CAGR of 4.77% during the forecast period 2026–2035. This growth is primarily driven by the increasing prevalence of diabetes, a growing geriatric population, and the rising demand for at-home testing solutions.

Rising Diabetes Prevalence & Demand for Self-monitoring Tools

A key driver of the India lancets market is the increasing prevalence of diabetes, particularly type 2, which affects tens of millions of Indians. With India being one of the countries with the highest diabetic population globally, regular blood glucose monitoring has become a routine requirement for millions.

This has led to the growing adoption of home-based self-monitoring of blood glucose (SMBG) using devices like glucometers, which rely on lancets for capillary blood sampling. Lancets are disposable and require frequent replacement, leading to a high volume of repeat purchases, especially among insulin-dependent patients.

Limited Access and Affordability in Rural Areas

One of the major restraints in the India lancets market is the limited affordability and access in rural and underserved regions. Despite growing awareness, many people still rely on clinic-based testing rather than purchasing personal monitoring kits due to cost constraints.

Moreover, the recurring expense of consumables like lancets can be a burden for economically weaker sections. Lack of insurance coverage for diabetes supplies in many public schemes exacerbates the issue.

Government-Led Preventive Health Initiatives

An important opportunity in the India lancets market lies in the local manufacturing and low-cost product development, which can reduce dependency on imports and make lancets more affordable to the broader population. As the Indian government continues to promote self-reliance in medical devices under the “Make in India” initiative, there is scope for domestic players to scale up affordable, high-quality lancet production.

Additionally, public health programs such as the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) are increasingly integrating point-of-care screening into primary care systems. These initiatives can expand the use of lancets in government-run health centers, schools, and mobile diagnostic camps.

Which Product Type Segment Dominated the India Lancets Market in 2024?

The manual lancets segment dominated the market in 2024, due to its widespread adoption and cost-effectiveness. Manual lenses are easy to use, making them popular among both healthcare providers and patients. The adoption of manual lancets is high in chronic disease management, like diabetes. These lancets prick the skin for blood sampling, making them ideal for glucose monitoring in diabetes management. The manual lancets are usually featured with ergonomic designs, adjustable depth settings, and safety mechanisms that help to reduce accidental needle sticks. This lancet is cost-effective for patients who need frequent glucose monitoring.

The automatic/device-based lancets segment is the fastest-growing segment in the market, and contributes to growth due to increased concern about safety. The automatic/device-based lancets are easy to use and more comfortable compared to manual lancets, making them highly preferred for convenience and consistency. The patients with sensitive skin are the major adopters of the automatic/device-based lancets. The increased awareness of self-monitoring and demand for safety and comfortable lancets are driving growth adoption of automatic/device-based lancets.

What Made the 28G and Above Gauge Segment Lead the India Lancets Market?

The 28G and above segment led the market in 2024, due to its characteristics to provide patient comfort and efficiency of blood collection. The 28G and above lancets are small in needle size, making them comfortable while drawing blood. These lancets are suitable for patients who require continuous blood glucose monitoring, provide a minimally invasive experience, and ensure sufficient blood for testing. The 28G and above lancets are effective in achieving small incisions. The codification of 28G and above lancets for less apin and achieving an adequate blood sample makes them ideal among health professionals and patients.

How Did 1.0-2.0 mm Segment Lead the India Lancets Market in 2024?

In 2024, the 1.0–2.0 mm segment led the market, due to its effectiveness and patient comfort. The lancets with penetration depth between 1.0–2.0 mm are designed for less pain and discomfort, making them ideal for patient who needs frequent glucose monitoring. Individual patients who prefer self-monitoring are large adopters of these lancets. The 1.0–2.0 mm penetration depth balances comfort during the lancing process and generates a sufficient blood sample for accurate glucose readings. The Sarstedt Safety Lancet and TaiDoc Technology Safety Lancet are gaining traction in the market.

The <1.0 mm segment is expected to grow fastest over the forecast period, due to its design for pain and trauma reduction. The <1.0 mm penetration depth-based lancets are designed to reduce pain and discomfort. The lancets also reduce skin trauma and bleeding, making it suitable for quick healing and reducing the risk of infections. The lancets with a penetration depth of 0.8 mm to 1.0 mm are popular in reducing pain and discomfort during blood sampling.

What Made Single-use Lancets Hold the Largest Revenue of the India Lancet Market in 2024?

In 2024, the single-use lancets segment held the largest market share, due to their safety profile. The single-use lancets are easy to use and provide a convenient way for patients to monitor their blood glucose levels. The demand for devices to monitor blood glucose at home is the major factor driving the adoption of single-use lancets. The single-use lancets help to prevent infection risk, including cross-contamination and needlestick injuries. The increased prevalence of diabetes in India has boosted demand for single-use lancets for blood glucose monitoring. Additionally, the adoption of single-use lancets is growing in the rising geriatric population, for user-friendly and convenient needles.

Which Application Led the India Lancets Market in 2024?

The blood glucose testing segment led the market in 2024, due to increased adoption of self-monitoring blood glucose devices. The prevalence of diabetes has increased in India, driving demand for lancets used in blood glucose testing. The at-home blood glucose testing is becoming more convenient and accessible, driving the popularity of lancets among patients who prefer portable and user-friendly practices. Technological advancements like pain-minimizing features and safety mechanisms are further adding to the segment's growth.

The hemoglobin testing segment is the second-largest segment, leading the market, due to the increased prevalence of anemia in India. The demand for routine hemoglobin monitoring for various conditions has increased in hospitals and clinics. The growing trend of at-home testing and point-of-care testing is driving the adoption of lancets for hemoglobin testing. The government initiatives in promoting healthcare access and increasing awareness further contribute to the adoption of lancets for hemoglobin testing applications.

How Did Hospitals & Clinics Segment Dominated the India Lancets Market in 2024?

Hospitals and clinics conduct frequent blood tests for diabetes, anemia, infections, and general health screenings. Clinical settings prioritize single-use, sterile lancets to minimize infection risks and comply with safety regulations. Government-run health programs also distribute lancets to clinics under national screening and diabetes control initiatives.

On the other hand, the homecare setting segment is seen to grow at the fastest rate during the forecast period. With millions of people living with diabetes in India, more patients are advised to monitor blood glucose levels regularly at home. Low-cost glucose meters and lancets are now widely available in pharmacies and online stores, expanding access even in smaller towns.

By Product Type

By Gauge (Needle Thickness)

By Penetration Depth

By Usage

By Application

By End-User

November 2025

November 2025

November 2025

November 2025