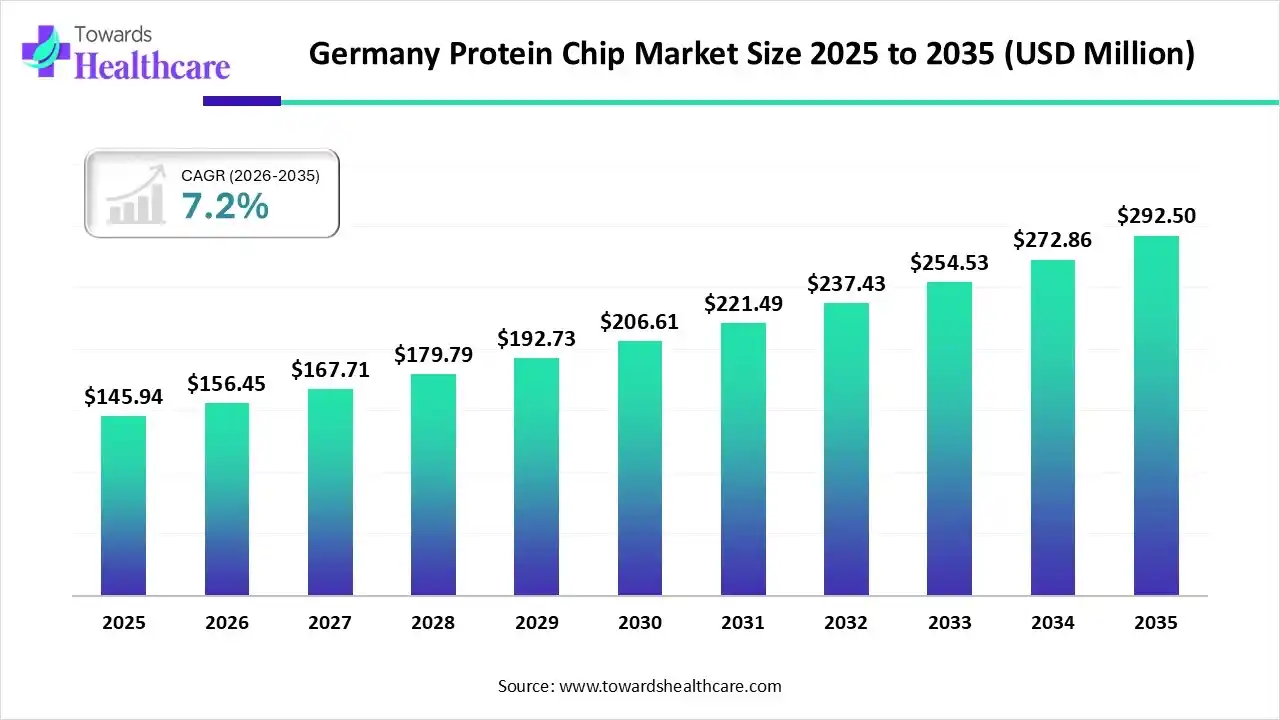

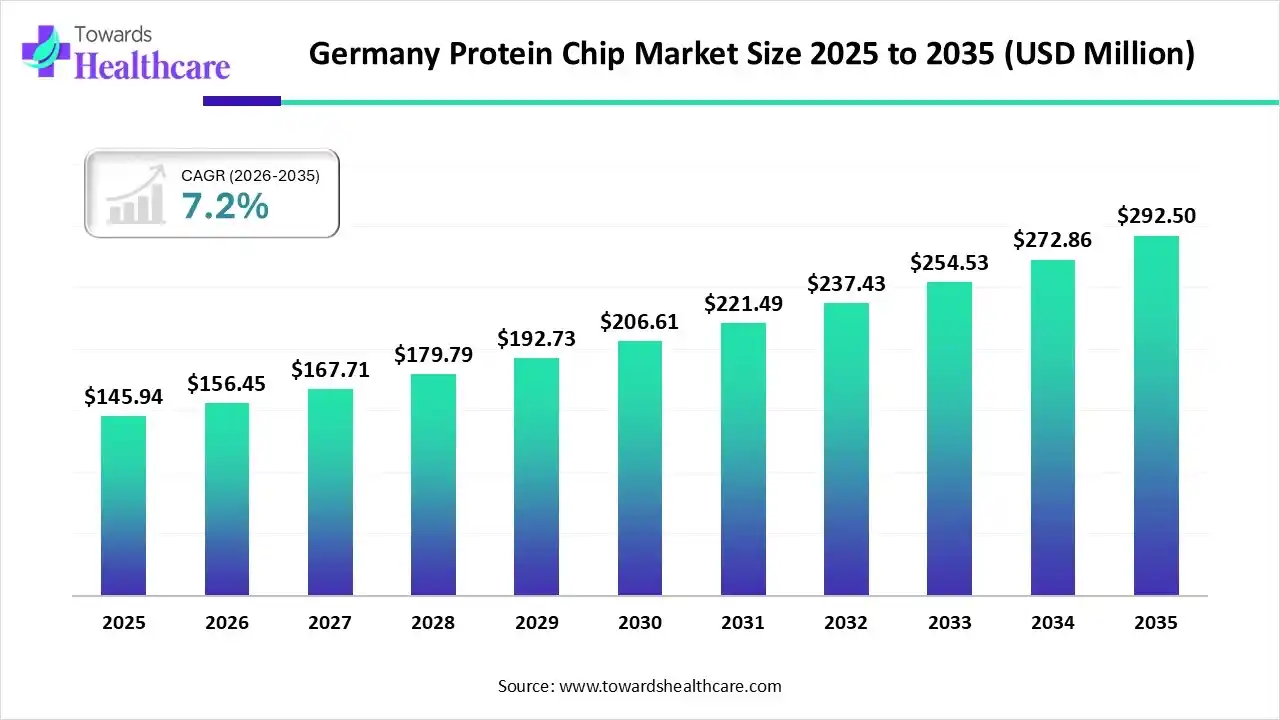

Revenue, 2025

USD 145.94 Million

Forecast, 2035

USD 292.50 Million

Germany Protein Chip Market Trends for 2026

The germany protein chip market is expected to increase from USD 145.94 million in 2025 to USD 292.50 million by 2035, growing at a CAGR of 7.20% throughout the forecast period from 2025 to 2035.

Germany is a major contributor to the European protein chip market due to its strong biotechnology and pharmaceutical sectors, extensive research infrastructure, and high investment in life sciences innovation. The country’s focus on proteomics, personalized medicine, and advanced diagnostics, supported by government and academic collaborations, drives significant demand for protein chip technologies. Additionally, the presence of leading research institutions and biotech companies fosters continuous innovation and market growth.

The growth of the market in Europe is primarily driven by increasing investments in proteomics research, rising adoption of personalized and precision medicine, and a strong focus on early disease detection. Supportive government initiatives and funding for biomarker discovery and clinical diagnostics further boost market expansion. Additionally, the presence of advanced research infrastructure, collaborations between academic institutions and biotechnology companies, and growing demand for efficient diagnostic tools contribute to the region’s market growth.

Key Takeways

- The protein chip market is projected to grow from US$ 2.36 billion in 2025 to US$ 4.98 billion by 2035, at a CAGR of 7.78%.

- Germany is a major contributor to the North America protein chip market by 6.5%.

- Planar Protein Microarrays hold the largest share in platform types at 38%, while Label-Free & Biosensor Arrays are set to grow the fastest at 18%.

- Biomarker Discovery & Validation leads applications with 30%, followed by Clinical Diagnostics & Companion Diagnostics at 25%.

- Pharmaceutical & Biotech Companies dominate end-users at 34%, with Clinical & Diagnostic Laboratories experiencing the fastest growth at 20%.

- Label-based Fluorescence / Chemiluminescence Assays lead detection chemistry with 45%, while Label-free Detection grows fastest at 25%.

- Protein Chip Kits & Reagents hold the largest product share at 36%, while Software & Data Analysis Tools grow the fastest at 20%.

Segments

By Platform Type

| Segments |

Shares 2025 (%) |

| Planar Protein Microarrays |

38% |

| Bead-Based / Suspension Arrays |

20% |

| Reverse-Phase Protein Arrays (RPPA) |

10% |

| Label-Free & Biosensor Arrays |

18% (highest growth) |

| Peptide Arrays & Epitope Mapping Chips |

7% |

| Other Custom / Specialty Arrays |

7% |

- Planar Protein Microarrays (38%) are the dominant technology, using glass slides or printed arrays.

- Bead-Based / Suspension Arrays (20%) use bead-based technology like Luminex for detection.

- Reverse-Phase Protein Arrays (RPPA) (10%) offer a solid platform for analyzing protein expression profiles.

- Label-Free & Biosensor Arrays (18%) use biosensors like SPR or nanoplasmonics, which are expected to grow rapidly due to their advanced capabilities.

- Peptide Arrays & Epitope Mapping Chips (7%) are specialized for mapping protein interactions at the peptide level.

- Other Custom / Specialty Arrays (7%) cover unique applications like glycan-protein or cell-based arrays.

By Application

| Segments |

Shares 2025 (%) |

| Biomarker Discovery & Validation |

30% |

| Drug Target Identification & Pharmacodynamics |

20% |

| Clinical Diagnostics & Companion Diagnostics |

25% (highest growth) |

| Immune Profiling & Vaccine Research |

10% |

| Protein–Protein Interaction & Pathway Analysis |

5% |

| Quality Control / Bioprocess Monitoring |

5% |

| Others |

5% |

- Biomarker Discovery & Validation (30%) remains the largest application area, crucial for identifying disease biomarkers.

- Drug Target Identification & Pharmacodynamics (20%) is growing due to increasing research in drug development.

- Clinical Diagnostics & Companion Diagnostics (25%) is seeing rapid growth due to its importance in precision medicine and diagnostics.

- Immune Profiling & Vaccine Research (10%) is essential for understanding immune responses and developing vaccines.

- Protein–Protein Interaction & Pathway Analysis (5%) focuses on understanding cellular mechanisms and diseases.

- Quality Control / Bioprocess Monitoring (5%) ensures the quality of biomanufacturing processes.

- Others (5%) includes niche areas like agri- and environmental proteomics.

By End User

| Segments |

Shares 2025 (%) |

| Pharmaceutical & Biotech Companies |

34% |

| Academic & Research Institutes |

15% |

| Clinical & Diagnostic Laboratories |

20% (highest growth) |

| Contract Research Organizations (CROs) |

10% |

| Industrial / Bioprocess QC Users |

10% |

| Other |

11% |

- Pharmaceutical & Biotech Companies (34%) dominate the market with their heavy investment in protein chip technologies for drug discovery.

- Academic & Research Institutes (15%) contribute to the development and application of protein chips for research purposes.

- Clinical & Diagnostic Laboratories (20%) are growing quickly as protein chips become essential for clinical diagnostics.

- Contract Research Organizations (CROs) (10%) perform outsourced research, using protein chips in their studies.

- Industrial / Bioprocess QC Users (10%) use protein chips for monitoring quality in industrial and manufacturing settings.

- Other (11%) includes agriculture and food safety labs utilizing protein chips.

By Detection Chemistry / Assay Type

| Segments |

Shares 2025 (%) |

| Label-based Fluorescence / Chemiluminescence Assays |

45% |

| Enzyme-Linked / Colorimetric Assays |

10% |

| Label-free (SPR, interferometry, photonic) Detection |

25% (highest growth) |

| Antibody/Antigen Capture Sandwich Assays |

5% |

| Affinity / Binding Kinetics Assays |

10% |

| Other |

5% |

- Label-based Fluorescence / Chemiluminescence Assays (45%) are the most common, offering high sensitivity and wide application.

- Enzyme-Linked / Colorimetric Assays (10%) use color changes to detect proteins, commonly in simpler settings.

- Label-free (SPR, interferometry, photonic) Detection (25%) is expected to grow rapidly as it offers real-time detection without labels.

- Antibody/Antigen Capture Sandwich Assays (5%) are specialized for detecting specific antigens.

- Affinity / Binding Kinetics Assays (10%) measure interactions between proteins and other molecules.

- Other (5%) includes unique assays like lectin-binding.

By Product / Offering

| Segments |

Shares 2025 (%) |

| Protein Chip Kits & Reagents |

36% |

| Array Substrates & Slides |

15% |

| Detection Instruments & Scanners |

10% |

| Consumables |

7% |

| Software & Data Analysis Tools |

20% (highest growth) |

| Contract Services / Assay Development |

12% |

- Protein Chip Kits & Reagents (36%) are the leading product category, including ready-to-use kits for experiments.

- Array Substrates & Slides (15%) are the foundation for building protein microarrays.

- Detection Instruments & Scanners (10%) are essential tools for detecting and analyzing protein interactions.

- Consumables (7%) include items like antibodies, buffers, and reagents used during experiments.

- Software & Data Analysis Tools (20%) are essential for analyzing the large amounts of data generated by protein chips and are growing quickly.

- Contract Services / Assay Development (12%) include services that develop custom assays for specific applications.

Companies

- PerkinElmer Inc.

- BioRad Laboratories

- Illumina, Inc.

- RayBiotech Life, Inc.

- Arrayit Corporation

- Danaher Corporation

Segments Covered in the Report

By Platform Type

- Planar Protein Microarrays (glass slides, printed arrays)

- Bead-Based / Suspension Arrays (Luminex-style, flow-based)

- Reverse-Phase Protein Arrays (RPPA)

- Label-Free & Biosensor Arrays (SPR, photonic crystal, nanoplasmonic)

- Peptide Arrays & Epitope Mapping Chips

- Other Custom / Specialty Arrays (cell-based arrays, glycan-protein arrays)

By Application

- Biomarker Discovery & Validation

- Drug Target Identification & Pharmacodynamics

- Clinical Diagnostics & Companion Diagnostics

- Immune Profiling & Vaccine Research

- Protein–Protein Interaction & Pathway Analysis

- Quality Control / Bioprocess Monitoring (biomanufacturing)

- Others (agri- and environmental proteomics)

By End User

- Pharmaceutical & Biotech Companies

- Academic & Research Institutes

- Clinical & Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Industrial / Bioprocess QC Users

- Other (agriculture, food safety labs)

By Detection Chemistry / Assay Type

- Label-based Fluorescence / Chemiluminescence Assays

- Enzyme-Linked / Colorimetric Assays

- Label-free (SPR, interferometry, photonic) Detection

- Antibody/Antigen Capture Sandwich Assays

- Affinity / Binding Kinetics Assays

- Other (lectin-binding, glycoprotein-specific assays)

By Product / Offering

- Protein Chip Kits & Reagents

- Array Substrates & Slides

- Detection Instruments & Scanners

- Consumables (antibodies, buffers, blocking reagents)

- Software & Data Analysis Tools

- Contract Services / Assay Development

Protein Chip Market Quick Stats and Facts

| Key Elements |

Scope |

| Market revenue in 2026 |

USD 156.45 Million |

| Market revenue in 2035 |

USD 292.50 Million |

| Growth Rate (2025 - 2035) |

7.20% |

| Historical Data |

2020 - 2023 |

| Base Year |

2025 |

| Forecast Period |

2026 - 2035 |

| measurable Values |

USD Millions/Units/Volume |

| Market Segmentation |

By Platform Type, By Application, By End User, By Detection Chemistry / Assay Type, By Product / Offering |

| Key Players |

PerkinElmer Inc., BioRad Laboratories, Illumina, Inc., RayBiotech Life, Inc., Arrayit Corporation, Danaher Corporation |