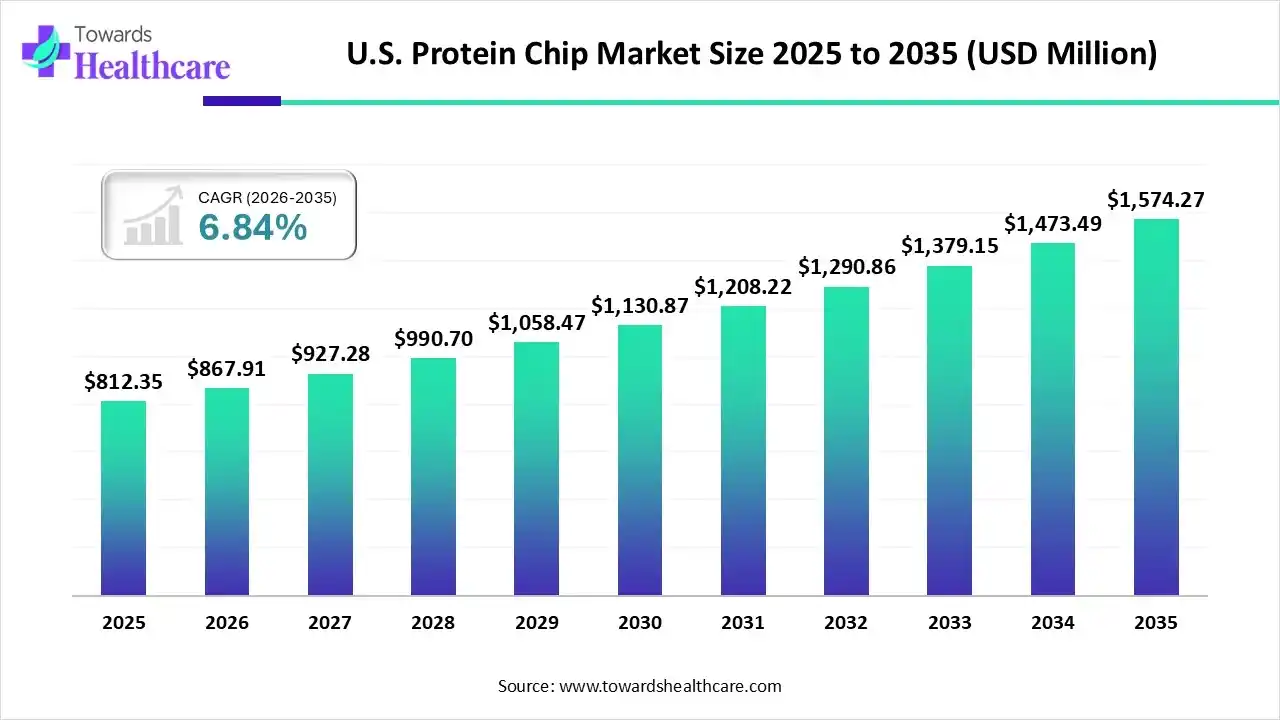

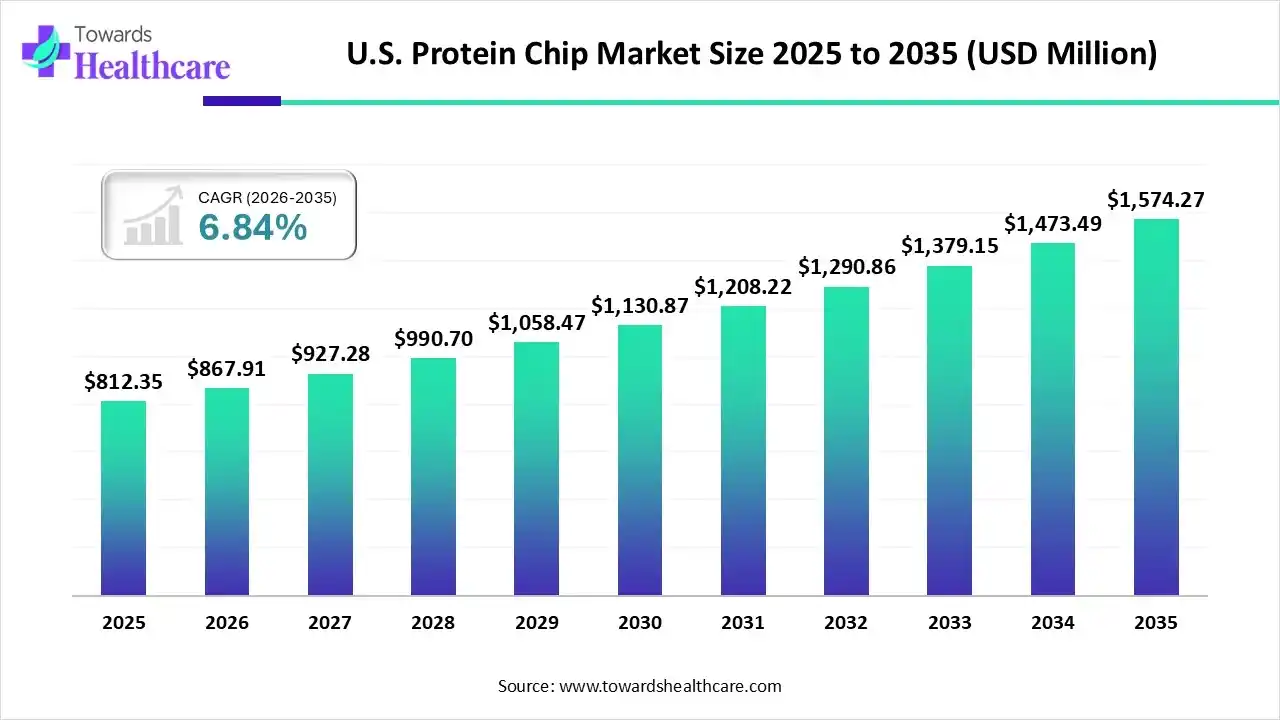

Revenue, 2025

USD 812.35 Million

Forecast, 2035

USD 1574.27 Million

Report Coverage

United States

U.S. Protein Chip Market Trends for 2026

The U.S. protein chip market size was estimated at USD 812.35 million in 2025 and is predicted to increase from USD 867.91 million in 2026 to approximately USD 1574.27 million by 2035, expanding at a CAGR of 6.84% from 2026 to 2035.

The U.S. is a major contributor to the North America protein chip market due to its strong biotechnology and pharmaceutical base, advanced research infrastructure, and extensive funding for proteomics. High adoption of personalized medicine, innovative R&D activities, and the presence of leading market players further strengthen its leadership position. The Asia-Pacific region is the fastest-growing in the protein chip market due to increasing investments in biotechnology research, expanding healthcare infrastructure, and rising adoption of advanced diagnostic technologies. Growing government funding, academic collaborations, and the presence of emerging biotech startups further drive innovation and market expansion across the region.

North America dominated the protein chip market with about 42% of the share in 2024. This is mainly because of its strong biotech and pharmaceutical industries, advanced research facilities, and high investment in proteomics and personalized medicine. The region benefits from active government funding, solid clinical research, and quick adoption of new diagnostic technologies, fueling ongoing innovation and widespread use of protein chip solutions.

Key Takeways

- The protein chip market is projected to grow from US$ 2.36 billion in 2025 to US$ 4.98 billion by 2035, with a CAGR of 7.78%.

- U.S. is a major contributor to the North America protein chip market by 35.5%.

- Planar Protein Microarrays dominate the platform segment, holding 38% of the market in 2024.

- Biomarker discovery & validation leads the application segment with a 30% market share.

- Pharmaceutical & biotech companies make up 34% of the end-user market in 2024.

- Label-based fluorescence/chemiluminescence assays account for 45% of the detection chemistry market.

- Protein chip kits & reagents hold 36% of the product market share.

- Label-free & biosensor arrays are expected to grow the fastest in the platform type category.

- Clinical & diagnostic laboratories are forecasted to experience the fastest growth in end users.

Segments

By Platform Type

| Segments |

Shares 2025 (%) |

| Planar Protein Microarrays |

38% |

| Bead-Based / Suspension Arrays |

18% |

| Reverse-Phase Protein Arrays |

10% |

| Label-Free & Biosensor Arrays |

15% |

| Peptide Arrays & Epitope Mapping Chips |

10% |

| Other Custom / Specialty Arrays |

9% |

- Planar Protein Microarrays (38%): This is the largest segment, dominating with glass slides and printed arrays that are commonly used in protein analysis.

- Bead-Based / Suspension Arrays (18%): These arrays, like Luminex-style and flow-based systems, offer flexibility in multiplexed analysis, accounting for a significant share.

- Reverse-Phase Protein Arrays (10%): This segment uses a reverse-phase format to analyze proteins, holding a smaller but notable share.

- Label-Free & Biosensor Arrays (15%): These arrays, which include SPR and nanoplasmonic biosensors, are growing rapidly due to their ability to analyze protein interactions without labels.

- Peptide Arrays & Epitope Mapping Chips (10%): Peptide arrays help map protein interactions and epitopes, gaining traction in targeted analysis.

- Other Custom / Specialty Arrays (9%): This includes specialized arrays like cell-based and glycan-protein arrays, contributing a smaller but important share.

By Application

| Segments |

Shares 2025 (%) |

| Biomarker Discovery & Validation |

30% |

| Drug Target Identification & Pharmacodynamics |

20% |

| Clinical Diagnostics & Companion Diagnostics |

25% |

| Immune Profiling & Vaccine Research |

10% |

| Protein–Protein Interaction & Pathway Analysis |

7% |

| Quality Control / Bioprocess Monitoring |

5% |

| Others |

3% |

- Biomarker Discovery & Validation (30%): The largest application, focusing on discovering and validating biomarkers for disease diagnosis and treatment.

- Drug Target Identification & Pharmacodynamics (20%): This segment looks at identifying drug targets and understanding their effects, holding a substantial market share.

- Clinical Diagnostics & Companion Diagnostics (25%): This rapidly growing segment involves using protein chips for clinical diagnostics and personalized medicine.

- Immune Profiling & Vaccine Research (10%): Used for studying immune responses and developing vaccines, this segment is a significant but niche player.

- Protein–Protein Interaction & Pathway Analysis (7%): A more specialized application used to study interactions between proteins, holding a smaller market share.

- Quality Control / Bioprocess Monitoring (5%): Focused on ensuring the quality of biomanufacturing processes, contributing a smaller share.

- Others (3%): A variety of other applications in fields like agriculture and environmental proteomics, with a small market share.

By End User

| Segments |

Shares 2025 (%) |

| Pharmaceutical & Biotech Companies |

34% |

| Academic & Research Institutes |

18% |

| Clinical & Diagnostic Laboratories |

25% |

| Contract Research Organizations (CROs) |

10% |

| Industrial / Bioprocess QC Users |

7% |

| Other |

6% |

- Pharmaceutical & Biotech Companies (34%): The largest end user, these companies rely heavily on protein chips for drug development and research.

- Academic & Research Institutes (18%): Universities and research labs use protein chips for studies in biology and medicine, holding a fair share.

- Clinical & Diagnostic Laboratories (25%): These labs use protein chips for clinical tests, diagnostics, and monitoring, showing solid growth potential.

- Contract Research Organizations (CROs) (10%): CROs, which provide outsourced research services, also use protein chips, though they hold a smaller share.

- Industrial / Bioprocess QC Users (7%): This group uses protein chips mainly for biomanufacturing and quality control, holding a smaller share.

- Other (6%): Includes sectors like agriculture and food safety labs, contributing a minor but noteworthy share.

By Detection Chemistry / Assay Type

| Segments |

Shares 2025 (%) |

| Label-based Fluorescence / Chemiluminescence Assays |

45% |

| Enzyme-Linked / Colorimetric Assays |

20% |

| Label-free (SPR, interferometry, photonic) Detection |

15% |

| Antibody/Antigen Capture Sandwich Assays |

10% |

| Affinity / Binding Kinetics Assays |

5% |

| Other |

5% |

- Label-based Fluorescence / Chemiluminescence Assays (45%): The largest share comes from traditional, label-based assays that use fluorescence and chemiluminescence for detection.

- Enzyme-Linked / Colorimetric Assays (20%): This is another significant assay type that uses enzyme-linked reactions to detect proteins, contributing a solid share.

- Label-free (SPR, interferometry, photonic) Detection (15%): These methods, which detect proteins without labels, are growing due to their precision and label-free advantages.

- Antibody/Antigen Capture Sandwich Assays (10%): Used for detecting specific proteins, this assay holds a moderate share in the market.

- Affinity / Binding Kinetics Assays (5%): Focuses on studying protein binding, this segment has a smaller share but is important for specific applications.

- Other (5%): This includes other unique assays like lectin-binding, contributing a small portion of the market.

By Product / Offering

| Segments |

Shares 2025 (%) |

| Protein Chip Kits & Reagents |

36% |

| Array Substrates & Slides |

20% |

| Detection Instruments & Scanners |

15% |

| Consumables (antibodies, buffers, blocking reagents) |

10% |

| Software & Data Analysis Tools |

10% |

| Contract Services / Assay Development |

9% |

- Protein Chip Kits & Reagents (36%): This is the largest product category, providing the necessary tools and reagents for protein analysis.

- Array Substrates & Slides (20%): These substrates and slides are crucial for preparing the arrays, holding a good portion of the market.

- Detection Instruments & Scanners (15%): Instruments and scanners for reading protein chips contribute a decent share, supporting the analysis process.

- Consumables (antibodies, buffers, blocking reagents) (10%): This category includes various consumables essential for protein analysis, holding a steady share.

- Software & Data Analysis Tools (10%): Software tools that help analyze protein chip data are growing, contributing to the future growth of the market.

- Contract Services / Assay Development (9%): This segment, offering custom assay development services, holds a smaller share of the market.

Key Players and Their Offerings

| Vendor |

Headquarters |

Key Offerings / Highlights |

| PerkinElmer Inc. |

U.S. |

Screening arrays & microarray solutions for proteomics research and drugdiscovery applications. |

| BioRad Laboratories |

U.S. |

Immunoarray systems and reagent kits adapted for protein chip applications in research & diagnostics. |

| Illumina, Inc. |

U.S. |

Entry into proteogenomics and highplex protein microarrays leveraging genomics platforms. |

| RayBiotech Life, Inc. |

U.S. |

Specialized cytokine/antibody microarray kits focusing on biomarker discovery for immunology & inflammation. |

| Arrayit Corporation |

U.S. |

Custom microarray fabrication & kits for protein chips, niche/highcustomization solutions. |

| Danaher Corporation |

U.S. |

Bioprocessing/Diagnostics arm (e.g., Cytiva): advanced protein array platforms and services. |

Segments Covered in the Report

By Platform Type

- Planar Protein Microarrays (glass slides, printed arrays)

- Bead-Based / Suspension Arrays (Luminex-style, flow-based)

- Reverse-Phase Protein Arrays (RPPA)

- Label-Free & Biosensor Arrays (SPR, photonic crystal, nanoplasmonic)

- Peptide Arrays & Epitope Mapping Chips

- Other Custom / Specialty Arrays (cell-based arrays, glycan-protein arrays)

By Application

- Biomarker Discovery & Validation

- Drug Target Identification & Pharmacodynamics

- Clinical Diagnostics & Companion Diagnostics

- Immune Profiling & Vaccine Research

- Protein–Protein Interaction & Pathway Analysis

- Quality Control / Bioprocess Monitoring (biomanufacturing)

- Others (agri- and environmental proteomics)

By End User

- Pharmaceutical & Biotech Companies

- Academic & Research Institutes

- Clinical & Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Industrial / Bioprocess QC Users

- Other (agriculture, food safety labs)

By Detection Chemistry / Assay Type

- Label-based Fluorescence / Chemiluminescence Assays

- Enzyme-Linked / Colorimetric Assays

- Label-free (SPR, interferometry, photonic) Detection

- Antibody/Antigen Capture Sandwich Assays

- Affinity / Binding Kinetics Assays

- Other (lectin-binding, glycoprotein-specific assays)

By Product / Offering

- Protein Chip Kits & Reagents

- Array Substrates & Slides

- Detection Instruments & Scanners

- Consumables (antibodies, buffers, blocking reagents)

- Software & Data Analysis Tools

- Contract Services / Assay Development

Protein Chip Market Quick Stats and Facts

| Key Elements |

Scope |

| Market revenue in 2026 |

USD 867.91 Million |

| Market revenue in 2035 |

USD 1574.27 Million |

| Growth Rate (2025 - 2035) |

6.84% |

| Historical Data |

2020 - 2023 |

| Base Year |

2025 |

| Forecast Period |

2026 - 2035 |

| measurable Values |

USD Millions/Units/Volume |

| Market Segmentation |

By Platform Type, By Application, By End User, By Detection Chemistry / Assay Type, By Product / Offering |

| Key Players |

PerkinElmer Inc., BioRad Laboratories, Illumina, Inc., RayBiotech Life, Inc., Arrayit Corporation, Danaher Corporation |