February 2026

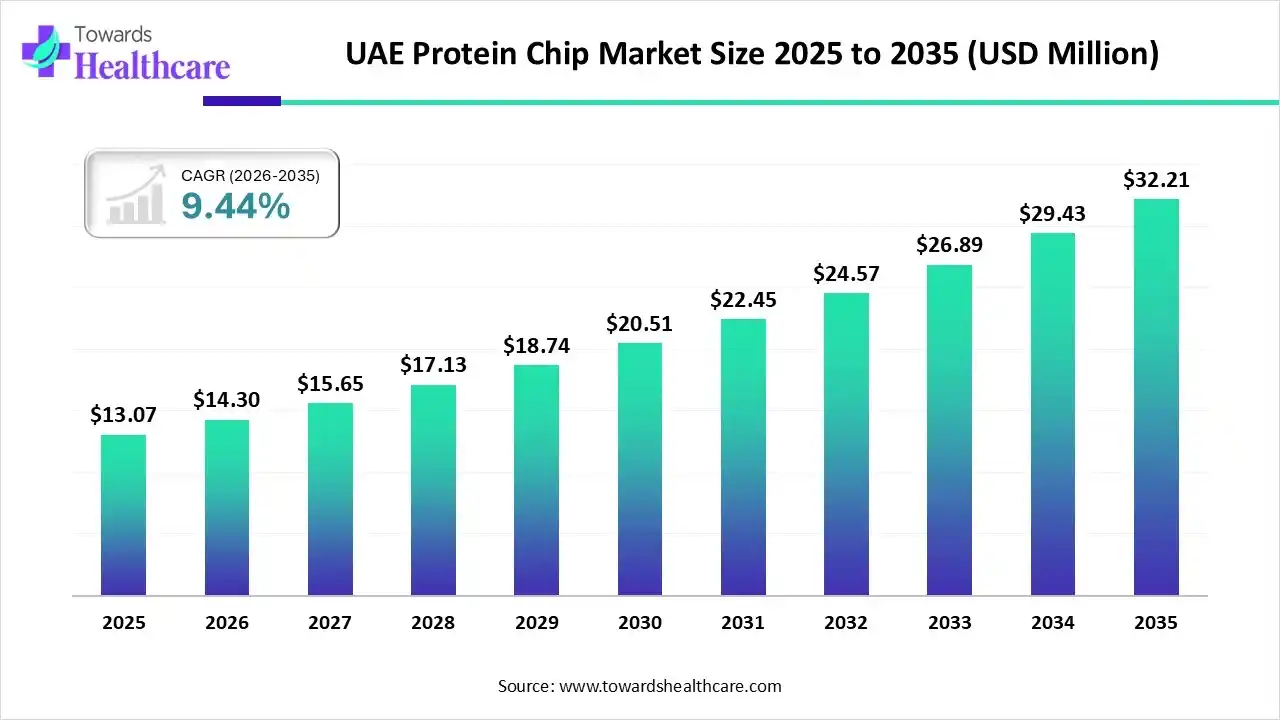

The UAE protein chip market is anticipated to grow from USD 13.07 million in 2025 to USD 32.21 million by 2035, with a compound annual growth rate (CAGR) of 9.44% during the forecast period from 2025 to 2035.

The UAE protein chip market is steadily expanding, fueled by strong government efforts to promote biotechnology and precision medicine. Growing healthcare infrastructure, increased investment in clinical research, and collaborations with global biotech firms are encouraging the use of advanced proteomic tools for diagnostics, biomarker discovery, and personalized treatment.

The Middle East and Africa offer significant growth opportunities in the market due to increasing healthcare modernization, rising investment in biotechnology research, and greater awareness of advanced diagnostic technologies. Expanding collaborations with global biotech companies and the development of clinical research centers are driving regional market growth.

| Segments | Shares 2025 (%) |

| Planar Protein Microarrays | 38% |

| Bead-Based / Suspension Arrays | 18% |

| Reverse-Phase Protein Arrays (RPPA) | 12% |

| Label-Free & Biosensor Arrays | 20% |

| Peptide Arrays & Epitope Mapping Chips | 6% |

| Other Custom / Specialty Arrays | 6% |

| Segments | Shares 2025 (%) |

| Biomarker Discovery & Validation | 30% |

| Drug Target Identification & Pharmacodynamics | 18% |

| Clinical Diagnostics & Companion Diagnostics | 24% |

| Immune Profiling & Vaccine Research | 10% |

| Protein–Protein Interaction & Pathway Analysis | 7% |

| Quality Control / Bioprocess Monitoring | 6% |

| Others (agriand environmental proteomics) | 5% |

| Segments | Shares 2025 (%) |

| Pharmaceutical & Biotech Companies | 34% |

| Academic & Research Institutes | 14% |

| Clinical & Diagnostic Laboratories | 18% |

| Contract Research Organizations (CROs) | 12% |

| Industrial / Bioprocess QC Users | 10% |

| Other (agriculture, food safety labs) | 12% |

| Segments | Shares 2025 (%) |

| Label-based Fluorescence / Chemiluminescence Assays | 45% |

| Enzyme-Linked / Colorimetric Assays | 15% |

| Label-free (SPR, interferometry, photonic) | 20% |

| Antibody/Antigen Capture Sandwich Assays | 10% |

| Affinity / Binding Kinetics Assays | 5% |

| Other (lectin-binding, glycoprotein-specific assays) | 5% |

| Segments | Shares 2025 (%) |

| Protein Chip Kits & Reagents | 36% |

| Array Substrates & Slides | 18% |

| Detection Instruments & Scanners | 15% |

| Consumables (antibodies, buffers, blocking reagents) | 12% |

| Software & Data Analysis Tools | 12% |

| Contract Services / Assay Development | 7% |

By Platform Type

By Application

By End User

By Detection Chemistry / Assay Type

By Product / Offering

| Key Elements | Scope |

| Market revenue in 2026 | USD 14.30 Million |

| Market revenue in 2035 | USD 32.21 Million |

| Growth Rate (2025 - 2035) | 9.44% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Platform Type, By Application, By End User, By Detection Chemistry / Assay Type, By Product / Offering |

| Key Players | PerkinElmer Inc., BioRad Laboratories, Illumina, Inc., RayBiotech Life, Inc., Arrayit Corporation, Danaher Corporation |

February 2026

February 2026

February 2026

February 2026