January 2026

The inpatient behavioral health market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2024 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

Inpatient behavioral health refers to a structured, residential treatment setting where individuals with severe mental health or substance use disorders receive 24/7 medical and therapeutic care. It involves intensive, short-to-medium-term stays in hospitals or specialized facilities, focusing on stabilization, crisis intervention, and recovery planning. The market is growing due to the increasing prevalence of mental health disorders, substance abuse, and the rising demand for intensive, round-the-clock care. Greater public awareness, reduced stigma, and supportive government initiatives are encouraging more individuals to seek treatment. Additionally, the advancement in treatment methods, improved insurance coverage, and the expansion of healthcare infrastructure are driving investment in more specialized, accessible, and effective healthcare across various populations.

For Instance,

AI is driving growth in the market by enhancing diagnosis accuracy, streamlining patient monitoring, and personalizing treatment plans. It enables real-time data analysis to detect behavioral patterns and predict potential crises, improving care quality and patient outcomes. Additionally, AI-powered tools assist clinicians with administrative tasks, reducing workload and allowing more focus on patient care, ultimately boosting the efficiency and effectiveness of inpatient behavioral health services.

The Growing Prevalence of Mental Health

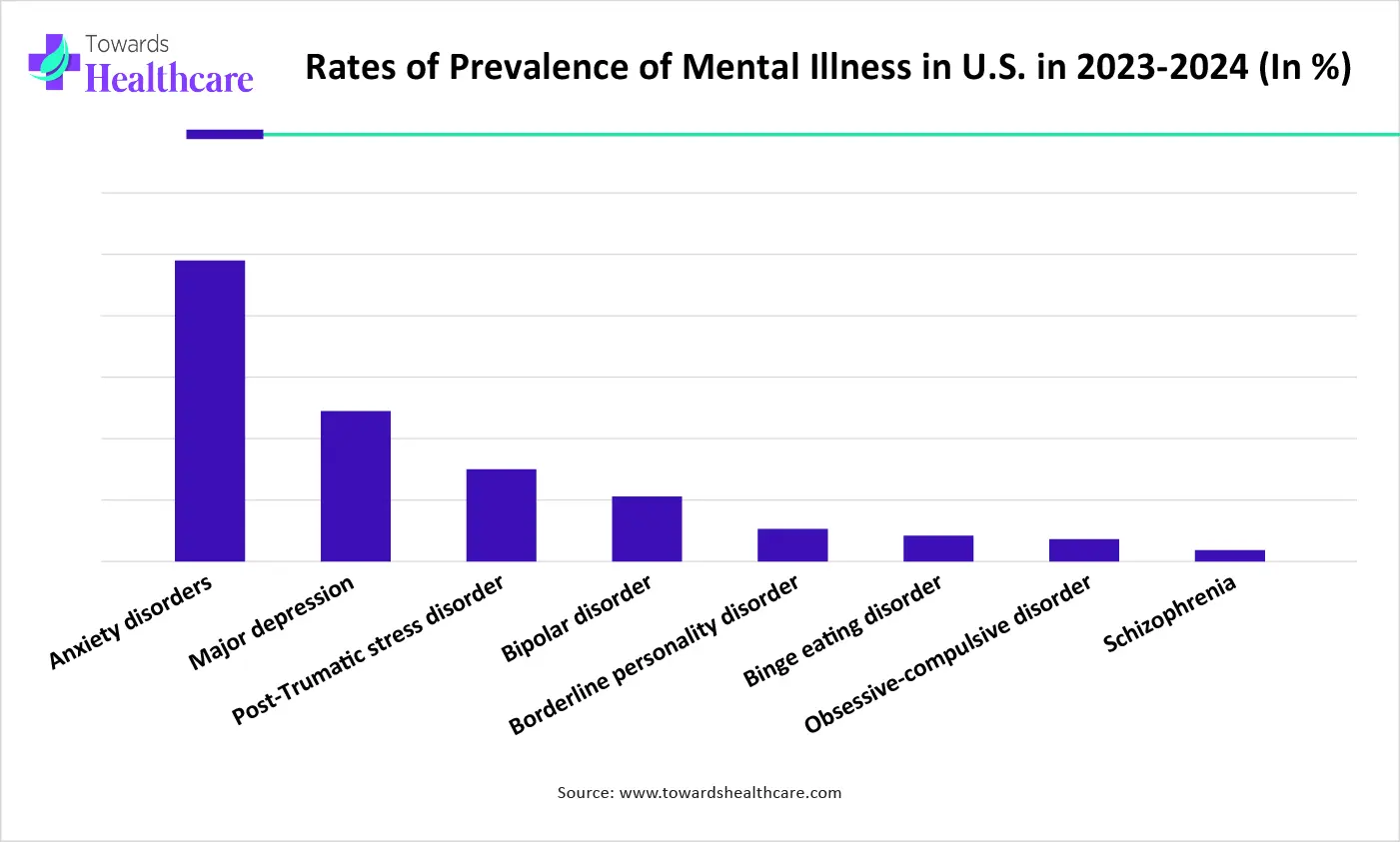

The increasing prevalence of mental health disorders is a major factor driving the inpatient behavioral health market. Conditions such as severe depression, bipolar disorders, and schizophrenia often require continuous, structured care that outpatient services cannot provide. Inpatient facilities offer 24/7 supervision, crisis management, and comprehensive treatment plans, making them essential for individuals with acute or complex needs. As mental health awareness improves and more people seek help, the demand for inpatient services rises, prompting healthcare providers to invest in expanding and enhancing these critical care facilities.

To determine the prevalence of mental illness University of St. Augustine for Health Science gives a statistics report.

Shortage of Trained Mental Health Professionals

The shortage of trained medical professionals is a significant restraint for the market because it limits the ability of facilities to deliver quality, round-the-clock care. Inpatient settings require psychiatrists, psychologists, nurses, and therapists to manage complex mental health conditions effectively. Without enough qualified staff, patient care suffers, wait times increase, and facilities may operate below capacity. This staffing gap directly affects accessibility. Safety and effectiveness of treatment hinder the overall growth and efficiency of the market.

Integration of Digital Technologies

The integration of digital technology presents a major opportunity for the inpatient behavioral health market by improving access, efficiency, and quality of care. Tools like telepsychiatry, AI-powered diagnostics, and electronic health records streamline patient monitoring, enhance clinical decision-making, and reduce administrative burdens. These innovations enable remote consultations, faster diagnosis, and personalized treatment plans. They also help overcome geographic and staffing limitations, making mental health services more accessible, especially in underserved areas, and driving modernization and growth within inpatient care settings.

By disorder type, the substance abuse disorders segment held the major market share, due to the increasing number of individuals affected by drug and alcohol addiction globally, These conditions often require intensive, supervised inpatient treatment for detoxification, therapy, and relapse the growing need for comprehensive rehabilitation programs have further contributed to the market dominance.

By disorder type, the eating disorders segment is projected to grow at the fastest rate in the inpatient behavioral health market between 2025 and 2034, during increased awareness, early diagnosis, and the rising prevalence of conditions like anorexia, bulimia, and binge-eating disorder, particularly among adolescents and young adults. Growing social pressures, body image concerns, and mental health challenges contribute to the surge in cases. Additionally, advancements in specialized inpatient treatment programs and greater recognition of the severity of eating disorders are driving demand for intensive, structured care.

By service type, the inpatient hospital treatment services segment held a dominant presence in the market in 2024, due to its ability to provide comprehensive and intensive care for severe mental health conditions. Hospitals are equipped with multidisciplinary teams, advanced medical infrastructure, and 24/7 supervision, making them well-suited for managing complex psychiatric cases. Their capacity to handle emergencies, ensure patient safety, and deliver integrated treatment plans makes them a preferred choice, contributing to the inpatient behavioral health market expansion.

By service type, the emergency mental health services segment is expected to grow at the fastest rate in the market during the forecast period, because of increasing acute mental health crises requiring immediate intervention. Rising rates of severe psychiatric episodes, substance overdoses, and suicidal behavior drive demand for urgent, specialized care. Emergency services provide rapid assessment, stabilization, and referral to appropriate inpatient or outpatient treatments. Enhanced awareness, improved emergency response systems, and government focus on crisis management further boost growth in the inpatient behavioral health market.

By age group, the adult segment was dominant in the market in 2024 due to the higher prevalence of mental health disorders among adults compared to pediatric and geriatric populations. Conditions such as depression, anxiety, and substance use disorder are more commonly diagnosed in adults, leading to increased demand for inpatient services. Depression and anxiety are estimated to cost the global economy around $1 trillion each year, primarily because of reduced productivity. Additionally, adults often face stressors like work-related pressure, financial concerns, and family responsibilities, which can exacerbate mental health issues.

By age group, the geriatric population segment is predicted to grow at the highest CAGR in the market, due to the increasing global aging population. Older adults are more prone to mental health issues like depression, anxiety, and dementia, which often require specialized inpatient care. Additionally, healthcare systems are improving the integration of mental health services within geriatric care, enhancing access and treatment outcomes.

For Instance,

By end-user, the hospital segment held the highest share of the inpatient behavioral health market in 2024, due to its capacity to provide comprehensive, round-the-clock care for individuals with severe mental health conditions. Hospitals offer structured environments, multidisciplinary teams, and advanced therapeutic approaches, making them well-suited for managing complex psychiatric cases. Their ability to handle emergencies and deliver integrated treatment plans contributes to their leading position in the market.

By end-user, the rehabilitation centers segment is projected to grow at the fastest CAGR in the market during the studied years, due to rising demand for specialized, long-term care for substance abuse and severe mental health disorders. These centers offer holistic, multidisciplinary approaches, including therapy, medical care, and social support, facilitating long-term recovery and reintegration into society. Additionally, increasing awareness and acceptance of mental health issues, along with supporting the government of mental health issues, along with growing supportive government initiatives, are driving the growth of the inpatient behavioral health market.

By treatment duration, the long-term inpatient (30 days or more) segment led the market, due to its effectiveness in treating severe and chronic mental health conditions. Extended stays provide a structured environment for comprehensive care, including medical supervision, therapy, and rehabilitation for complex needs. This approach not only improves patient outcomes but also reduces the likelihood of readmission, making it a preferred choice for both healthcare providers and patients.

By treatment duration, the detoxification-only admission segment is estimated to grow at the fastest rate in the coming years. Firstly, the rising prevalence of substance use disorders necessitates immediate intervention, making detoxification a critical first step in treatment. Detox programs offer structured environments for medical supervision, ensuring patient safety during withdrawal. Additionally, the integration of detox services with mental health treatments addresses co-occurring disorders, enhancing overall patient outcomes and contributing to market expansion.

North America dominated the market in 2024, due to a high prevalence of mental health disorders like depression, anxiety, and substance abuse. The region's advanced healthcare infrastructure supports comprehensive inpatient care. Government policies, including Medicaid expansion and the Affordable Care Act, have improved access to mental health services. Additionally, increased public awareness and reduced stigma around mental health have encouraged more people to seek inpatient treatment, driving significant market growth in the region.

The U.S. market is experiencing growth due to several key factors. The increasing prevalence of mental health disorders, such as anxiety and depression, has heightened the demand for specialized care. Government initiatives, including Medicaid expansion and the establishment of the Substance Abuse and Mental Health Services Administration (SAMHSA), have improved access to treatment. Additionally, the integration of digital health tools and telehealth services has enhanced service delivery and patient engagement.

For Instance,

The Canadian market is expanding due to increased government investments, such as the $500 million Youth Mental Health Fund, aimed at enhancing access to mental health services. Additionally, the growing prevalence of mental health disorders and the expansion of inpatient facilities, like the Queensway Carleton Hospital's $9 million mental health unit redevelopment, are contributing to the market's growth. These efforts aim to address the rising demand for comprehensive mental health care across the country.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period, due to increasing awareness and acceptance of mental health issues. Rising cases of depression and anxiety, along with technological advances like telepsychiatry, are improving access to care. Additionally, supportive government initiatives are strengthening mental health services, driving market expansion in the region.

China's market is expanding due to increased awareness of mental health issues and rising demand for accessible care. The government has prioritized mental health services, integrating them into the public health system and allocating resources to enhance behavioral health services. This emphasis has led to expanded funding, improved infrastructure, and regulatory changes supporting better access to mental health care, driving market growth.

For Instance,

India's market is experiencing significant growth due to several key factors. The government has expanded the District Mental Health Programme (DMHP) to 767 districts, enhancing access to mental health services nationwide. Initiatives like the National Tele-Mental Health Programme (Tele-MANAS) have further improved accessibility, providing round-the-clock mental health support. Additionally, increased awareness and reduced stigma surrounding mental health issues are encouraging more individuals to seek inpatient care, contributing to market expansion.

For Instance,

Europe is expected to see significant growth in the market, driven by rising mental health awareness, supportive government policies, and the integration of digital health technologies. The region's aging population and increased prevalence of mental disorders further fuel demand for inpatient services. Additionally, initiatives to reduce stigma and enhance access to care contribute to the market's expansion.

Germany’s market is growing due to rising awareness of mental health issues, supportive public health policies, and increasing demand for specialized psychiatric services. Expanding insurance coverage for mental health treatment and investments in modernizing healthcare infrastructure are also key factors. Additionally, a greater societal focus on psychological well-being is encouraging more individuals to seek inpatient care.

The UK's market is expanding due to increasing mental health awareness, rising demand for specialized care, and government initiatives aimed at improving service accessibility. Efforts to reduce treatment waiting times and integrate digital health solutions are enhancing patient outcomes. Additionally, the growing prevalence of mental health disorders is driving the need for comprehensive inpatient services across the country.

For Instance,

In April 2025, Acuity Behavioral Health officially launched a groundbreaking approach in healthcare called Behavioral Health Operations Intelligence (BHOI). Developed with input from 11 major health systems, including Yale New Haven Health, the AI-powered platform aims to bring structure, efficiency, and real-time insights to inpatient psychiatric care. Backed by $1.5M in seed funding led by Valor Ventures, CEO Jim Szyperski stated, “We’re not just offering a solution—we’re creating an industry category.” (Source - MORNINGSTAR)

By Disorder Type

By Service Type

By Age Group

By End-User

By Treatment Duration

Short-Term Inpatient (Less than 30 Days)

Long-Term Inpatient (30 Days or More)

Detoxification-Only Admissions

By Region

January 2026

January 2026

January 2026

January 2026