November 2025

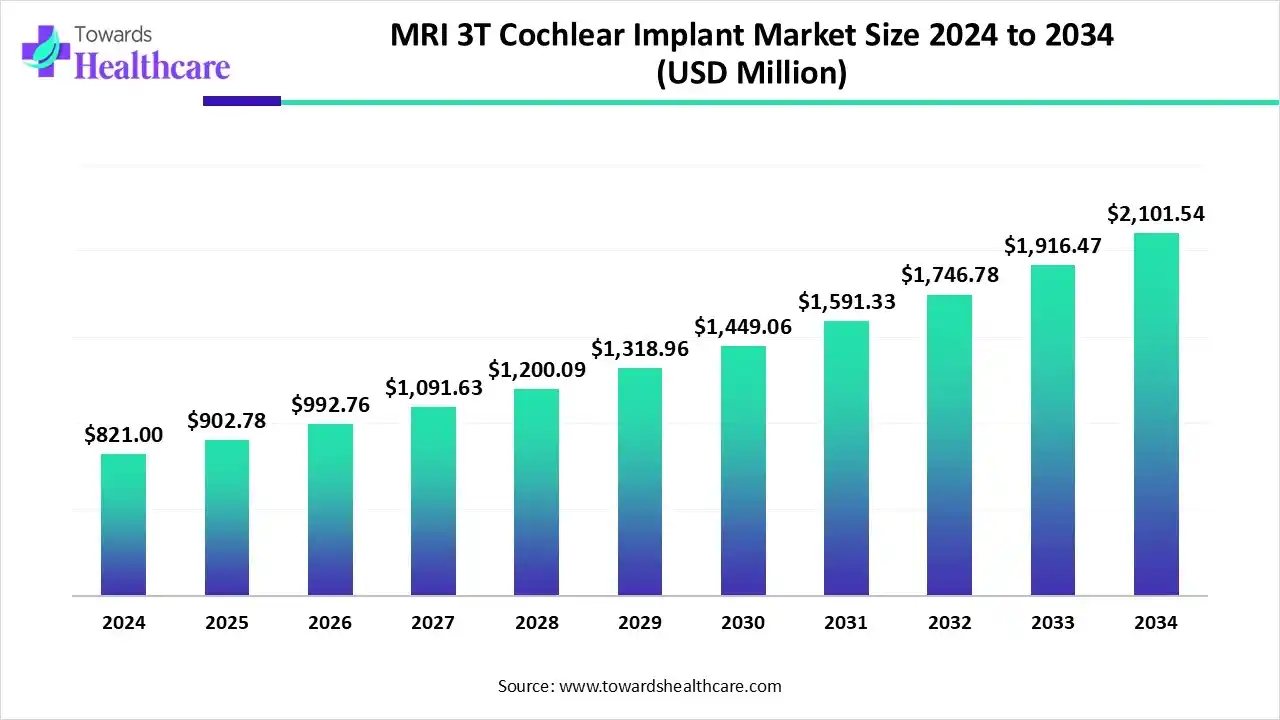

The global MRI 3T cochlear implant market size is calculated at US$ 821 million in 2024, grew to US$ 902.78 million in 2025, and is projected to reach around US$ 2101.54 million by 2034. The market is expanding at a CAGR of 9.96% between 2025 and 2034.

The leading cochlear implant manufacturers introduced new and advanced models that are approved for 3T MRI scans. The MRI 3T cochlear implant market is majorly driven by advances in implant magnet technology that have made 3T MRI safer for recipients and eliminated the need for magnet removal surgery.

| Table | Scope |

| Market Size in 2025 | USD 902.78 Million |

| Projected Market Size in 2034 | USD 2101.54 Million |

| CAGR (2025 - 2034) | 9.96% |

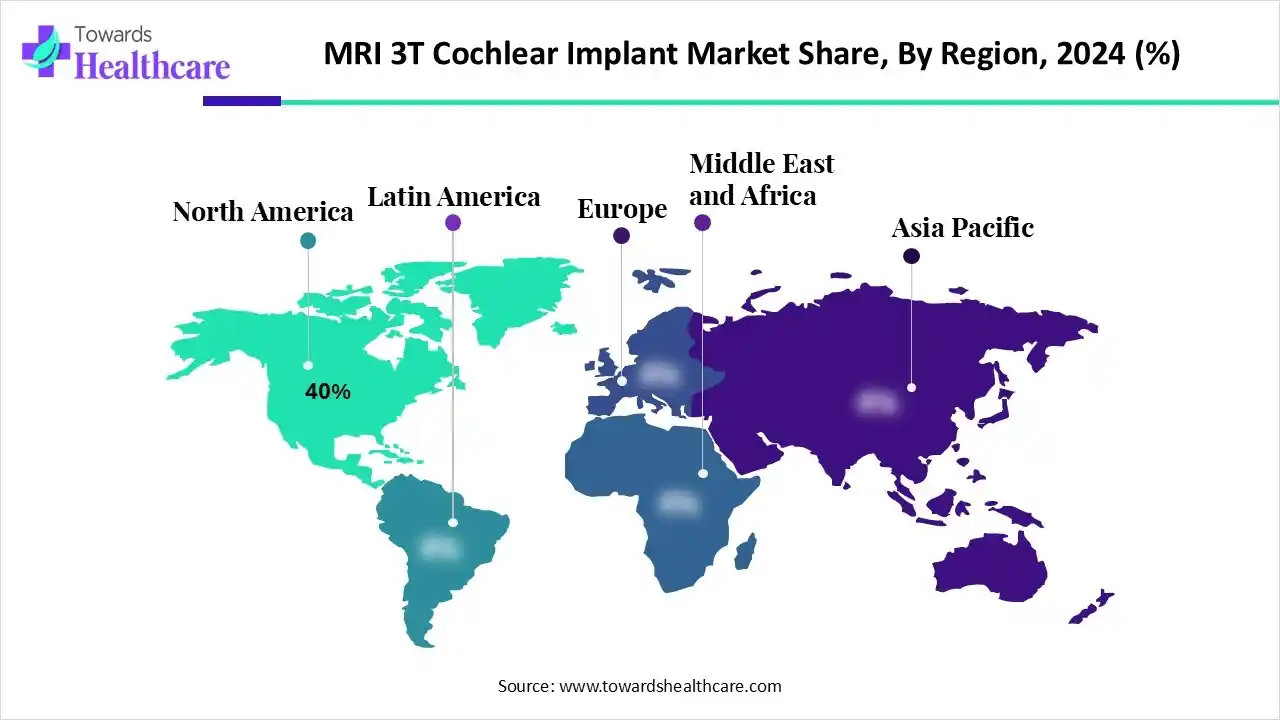

| Leading Region | North America by 40% |

| Market Segmentation | By Product, By Technology, By Application, By End User, By Region |

| Top Key Players | Cochlear Limited, MED-EL, Advanced Bionics, Nurotron, Oticon Medical, Neurelec, Sophono Inc., Envoy Medical Corporation, ABI Medical, Starkey Hearing Technologies, GN Hearing, Biome Devices, Audionics, Clarity Medical, MED-EL Austria |

The MRI 3T cochlear implant market is accelerated by the growth in pediatric and adult implants, the rising prevalence of age-related hearing loss, and greater adoption of advanced implant technologies. MRI 3T cochlear implants are advanced medical devices that restore hearing in patients with severe to profound hearing loss and are designed to be compatible with 3-Tesla (3T) magnetic resonance imaging (MRI) systems. These implants allow patients to safely undergo high-resolution MRI scans without device removal, improving diagnostic capabilities and patient care.

AI plays a significant role in the expansion of the MRI 3T cochlear implant market. AI improves MRI for patients with 3 Tesla (3T) cochlear implants (CIs). AI helps in image reconstruction and artifact reduction, and enhances pre-operative planning. It also improves patient safety and comfort, and improves rehabilitation and outcomes.

How does the Cochlear Implant Systems Segment Dominate the MRI 3T Cochlear Implant Market in 2024?

The cochlear implant systems segment dominated the market in 2024, with a revenue share of 55%, owing to the primary roles of cochlear implant (CI) systems in ensuring patient safety during high-field MRI scans and improving patient comfort by reducing pain and pressure. They allow MRI access without additional surgery and provide high-definition diagnostic imaging for patients with CIs. The safety and convenience of MRI for CI recipients are improved by major innovations and technological developments.

Accessories

The accessories segment is expected to grow at the fastest CAGR in the MRI 3T cochlear implant market during the forecast period due to the key role of 3T MRI accessories in preventing magnet dislodgement and securing the implant. They reduce patient discomfort, allow access for necessary scans, and ensure clear diagnostic imaging. There is a prime importance of primary accessories as specialized bandages and splint kits.

What made the 3T MRI Compatible the Dominant Segment in the MRI 3T Cochlear Implant Market in 2024?

The 3T MRI compatible segment dominated the market in 2024, with a revenue share of 60%, owing to the importance of 3T MRI-compatible technology in eliminating surgery for magnet removal, preventing magnet displacement, and reducing patient discomfort. The leading 3T-compatible cochlear implant technologies are MED-EL SYNCHRONY 2, Advanced Bionics HiRes™ Ultra 3D, and Cochlear Nucleus Profile Plus Series. This technology will enlarge the patient pool, ensure long-term access to modern medicine, and maintain industry standards.

Conventional MRI Compatible

The conventional MRI compatible segment is estimated to grow at the fastest rate of 7.5% in the MRI 3T cochlear implant market during the predicted timeframe due to the critical function of this technology in delivering mandatory protocols, risk assessment, and the ongoing need for conventional care. It drives improved patient experience and focuses on advanced technologies. The new medical devices with advanced features enable safe 3T MRIs without invasive or uncomfortable procedures.

How did the Hearing Restoration Segment Dominate the MRI 3T Cochlear Implant Market in 2024?

The hearing restoration segment dominated the market in 2024, with a revenue share of 65%, owing to the enhanced diagnostic imaging for CI users and improved patient safety and comfort. The new technologies for hearing restoration enable access for diverse patient populations. They eliminate additional surgeries and reduce patient anxiety.

Diagnostic Imaging Support

The diagnostic imaging support segment is anticipated to grow at the fastest rate of 8.0% in the MRI 3T cochlear implant market during the upcoming period due to safer and more accessible imaging and reduced pain and discomfort. The imaging technologies avoid surgical risks associated with infection and magnet removal and reinsertion. MRI offers a radiation-free option for the evaluation of the implant position and surrounding structures.

Which Segment by End User Dominated the MRI 3T Cochlear Implant Market in 2024?

The hospitals segment dominated the market in 2024, with a revenue share of 50%, owing to the expansion of diagnostic access, enhanced patient safety and comfort, and improved clinical efficiency and outcomes. The advanced technologies streamline hospital procedures and reduce the risk of complications. They allow better postoperative evaluation and minimize the risk of implant damage.

ENT Clinics

The ENT clinics segment is predicted to grow at a rapid rate of 8.5% in the MRI 3T cochlear implant market during the studied period due to expanded access to 3T scans and wider diagnostic utility. Advancements in implant technology enable ENT clinics to provide access to 3T MRI for cochlear implant (CI) patients. They are improving diagnostic imaging capabilities for CI recipients through device and patient management.

North America dominated the market in 2024, with a revenue share of approximately 40%, owing to the greater MRI safety and accessibility, tailored services, reimbursement, and funding. American organizations make efforts to preserve access to MRI for patients with implantable hearing devices. The current government health programs result in the expansion and availability of cochlear implant coverage and technology. The American Academy of Otolaryngology-Head and Neck Surgery reported the urgent need for all implantable hearing devices. The National Institute on Deafness and Other Communication Disorders under the National Institutes of Health (NIH) introduced certain innovations in hearing aid and cochlear implant technologies.

The U.S. government provides coverage for cochlear implants through federal and state programs, including Medicare, Medicaid, and other federal initiatives. Private companies in the U.S. developed new medical devices and received FDA approval for 3T MRI-safe implants. New smart technologies, medical guidelines, and improved access mainly drive the MRI 3T cochlear implant market in the U.S.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to urbanization, early intervention, aging population, and specialized care in clinics. The developments in MRI 3T-compatible cochlear implants across this region are driven by new product launches, expanding access, and the growing market. The government programs and related initiatives result in increased accessibility, new policies, and increased funding for existing programs in the Asian Pacific countries. The Asia Pacific Symposium on Cochlear Implants and Related Sciences (APSCI 2025) was held in Malaysia to ensure equal access to the benefits of improved hearing for everyone. Cochlear launched the World’s first smart hearing implant in the Asia Pacific.

The state-funded cochlear implant programs of India have transformed hearing care and improved access for adults and children across socioeconomic aspects. According to the World Health Organization (WHO), approximately 63 million people in India are dealing with auditory impairment, including an estimated 22 million children with deafness. Delhi has launched India’s first AI-powered ultra-fast MRI at the new center of Mahajan Imaging and Labs in Dwarka.

Europe is expected to grow at a notable rate in the market in 2024, led by improved patient outcomes, increased access in outpatient settings, and a focus on early intervention for pediatric patients. The developments, technological advancements, and market growth are driven by continuous innovations, specific products, and research across Europe. The national-level policies, European user advocacy, collaborative projects, and European conferences accelerate the activities of government and associations. The clinical standards in Europe are driven by safety guidelines and ongoing research. The EU-funded projects boost collaboration between researchers and medical technology manufacturers.

Germany is experiencing clinical and technological advancements through ongoing research, a focus on patient outcomes, and established technologies. The national public health insurance, technological availability, and recent innovations are expanding Germany. The expansion of health research funding, funding for hospital innovations, changes in hospital reimbursement, and market-based growth are also the major drivers of the German market.

In South America, the MRI 3T cochlear implant market is resonating with growth, driven by improved healthcare infrastructure and rising awareness of advanced hearing technologies. Governments and private clinics are investing in modern diagnostic systems, creating broader accessibility and boosting patient confidence in cochlear solutions.

Brazil leads regional adoption with expanding reimbursement policies and partnerships between audiology centers and implant manufacturers. Technological upgrades in hospitals, combined with growing consumer demand for MRI-safe devices, are accelerating market penetration. Urban centers like São Paulo are emerging as hubs for advanced hearing restoration services.

Across the Middle East and Africa (MEA), economic diversification and healthcare modernization are fueling demand. Nations are emphasizing early hearing loss intervention, supported by international collaborations. Investments in medical imaging infrastructure, especially MRI 3T units, are driving higher adoption rates and long-term treatment sustainability.

In the United Arab Emirates (UAE), premium healthcare standards and a thriving medical tourism industry are catalyzing cochlear implant advancements. With hospitals integrating next-generation MRI systems and public initiatives promoting hearing health, the country is positioning itself as a regional leader in audiological innovation and patient-centric care.

The R&D process for MRI 3T-compatible cochlear implants involves feasibility and concept, animal and bench testing, Investigational Device Exemption (IDE), clinical trials, premarket approval (PMA) submission, FDA review, and post-market surveillance.

Key Players: Cochlear Ltd., Sonova (Advanced Bionics), MED-EL Medical Electronics, Zhejiang Nurotron Biotechnology Co., Ltd., MicroPort Scientific Corporation, Shanghai Lishengte Medical Technology Co., Ltd.

The distribution channels include direct-to-hospital sales, specialty clinics, procurement and inventory management, and professional channels.

Key Players: Cochlear Limited (Australia), MED-EL (Austria), Advanced Bionics (Switzerland).

Patient advocacy organizations like the American Cochlear Implant Alliance (ACI Alliance) provide educational resources, ACI Alliance meetings, and an advocacy network.

Key Players: Cochlear Americas, MED-EL, Advanced Bionics, MED-EL, Oticon Medical.

Company Overview

Cochlear Limited is the global leader in implantable hearing solutions, specializing in cochlear implants and sound processors for severe-to-profound hearing loss. It focuses on innovation, MRI-3T compatibility, and expanding access across global healthcare markets.

Corporate Information

History and Key Milestones

Originating from Professor Graeme Clark’s pioneering work, Cochlear launched the first multichannel implant. By 2025, it operates in 180+ countries and recently introduced the Nucleus Nexa smart implant with firmware upgrade capability.

Business Overview & Segments

Core segments include cochlear implants, external processors, and after-care services. Cochlear also develops bone conduction and acoustic implants for diverse patient needs.

Geographic Presence

Global operations spanning North America, Europe, Asia-Pacific, Latin America, and the Middle East. Strong market penetration in both developed and emerging economies.

Key Offerings & End-Use Industries

Strategic Developments

Technological Capabilities / R&D Focus

Focus on smart implants, MRI-safe designs, AI-enabled connectivity, and digital care. Extensive patent portfolio supports its leadership in implantable hearing technology.

Competitive Positioning

Recent Updates & Awards

In 2025, Cochlear launched its first firmware-upgradeable implant and was recognized among the most trusted healthcare firms globally.

Company Overview

Sonova Holding AG, through its subsidiary Advanced Bionics, is the world’s second-largest provider of cochlear implants. It integrates hearing aids, implants, and digital services to deliver a complete hearing-care ecosystem.

Corporate Information

History and Key Milestones

Sonova entered the implant market via its 2009 acquisition of Advanced Bionics. In 2024–2025, it opened a new operations facility in Mexico and expanded its AI-driven Marvel CI platform.

Business Overview & Segments

Divisions include Hearing Instruments, Audiological Care, Consumer Hearing, and Cochlear Implants. Advanced Bionics serves patients with severe-to-profound hearing loss worldwide.

Geographic Presence

Presence in over 100 countries, with key manufacturing in the U.S. and Mexico, and a growing footprint in Asia and the Middle East.

Key Offerings & End-Use Industries

Strategic Developments

Technological Capabilities / R&D Focus

Advanced Bionics emphasizes wireless connectivity, remote programming, and AI integration. Its R&D is based in Switzerland and the U.S., with over 1,000 specialists.

Competitive Positioning

Recent Updates & Awards

In 2025, Sonova ranked among Europe’s most innovative companies and launched next-gen AI solutions to enhance patient outcomes and remote hearing care.

By Product

By Technology

By Application

By End User

By Region

November 2025

November 2025

November 2025

November 2025