January 2026

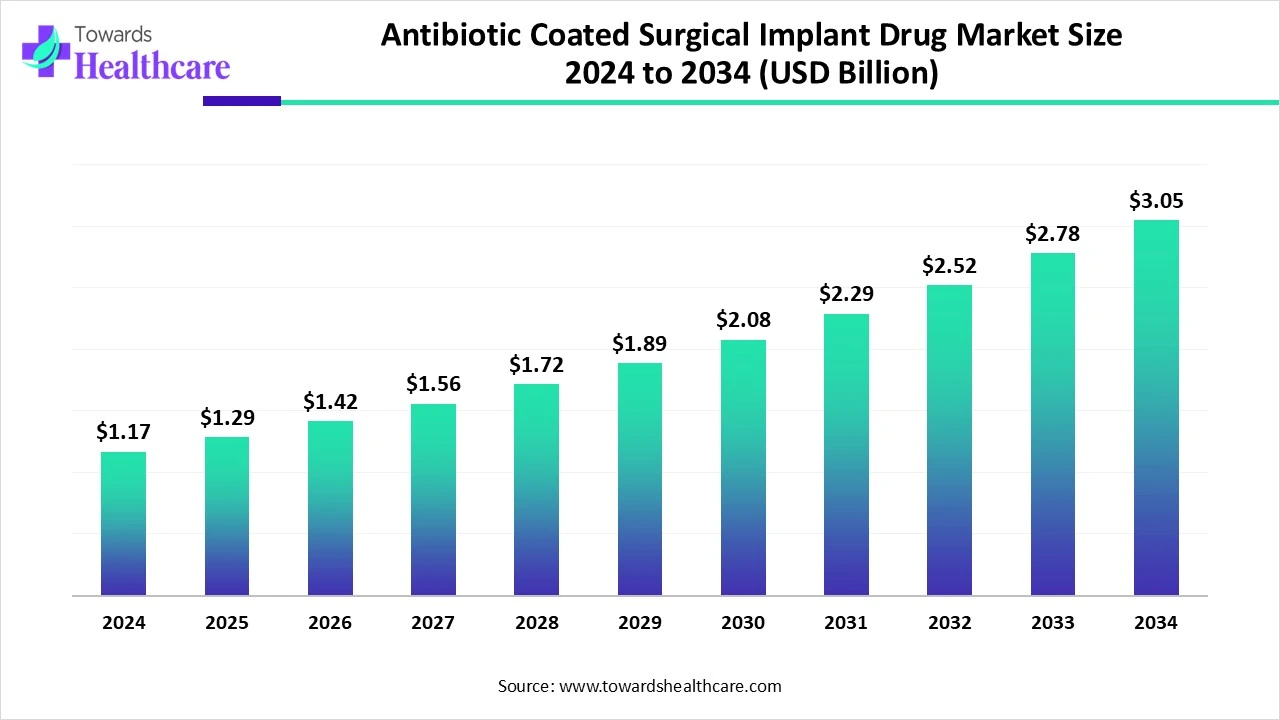

The global antibiotic-coated surgical implant drug market size is calculated at USD 1.17 billion in 2024, grew to USD 1.29 billion in 2025, and is projected to reach around USD 3.05 billion by 2034. The market is expanding at a CAGR of 10.05% between 2025 and 2034.

The antibiotic-coated surgical implant drug market is primarily driven by the increasing number of surgeries. The burgeoning medical device sector, along with rising investments by several government and private organizations, boosts the market. Integrating artificial intelligence (AI) and machine learning (ML) revolutionizes the antibiotic-coated surgical implants. The future looks promising, with the advancements in medical technology and the increasing use of innovative manufacturing techniques.

| Metric | Details |

| Market Size in 2025 | USD 1.29 Billion |

| Projected Market Size in 2034 | USD 3.05 Billion |

| CAGR (2025 - 2034) | 10.05% |

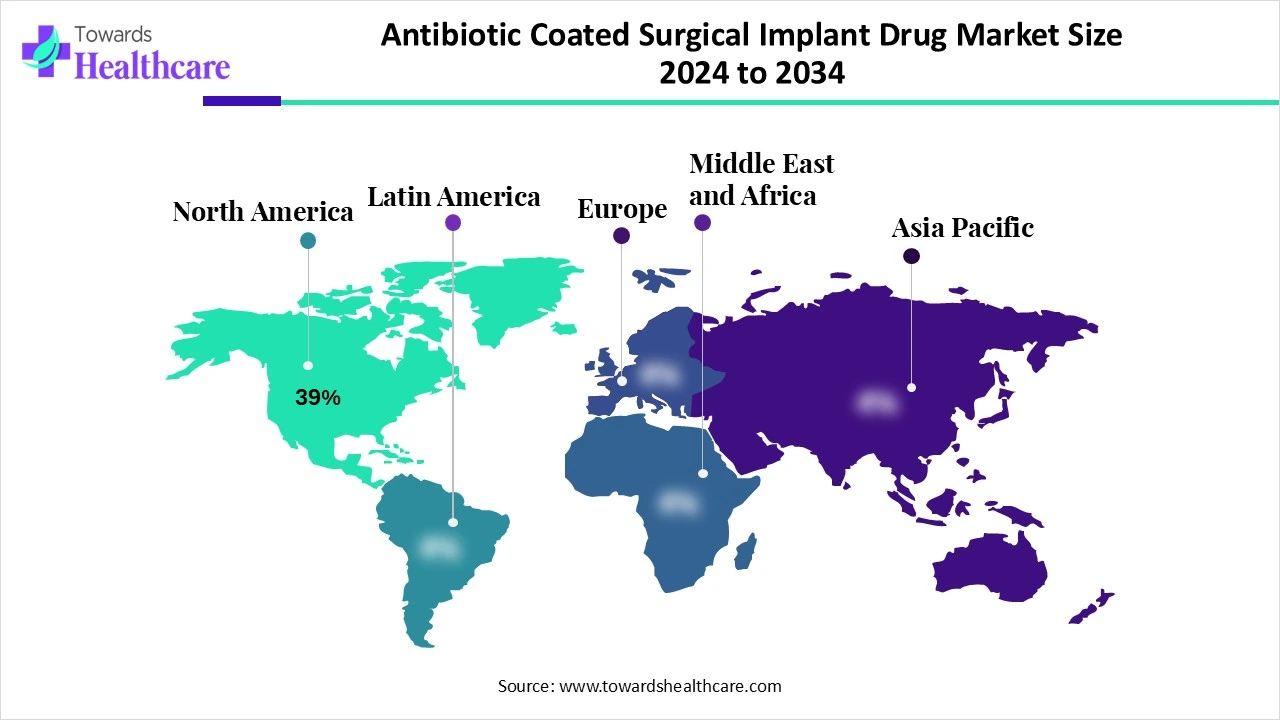

| Leading Region | North America Share 39% |

| Market Segmentation | By Implant Type, By Coating Antibiotic Agent, By Release Mechanism, By Material of Implant, By Application, By End-User, By Region |

| Top Key Players | Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Stryker Corporation, Smith & Nephew plc, B. Braun Melsungen AG, Medtronic plc, Orthofix Medical Inc., Globus Medical Inc., BioVentrix Inc., Heraeus Holding GmbH, Aesculap Inc., BioHorizons IPH, Inc., Dentsply Sirona Inc., RTI Surgical Holdings, Evonik Industries AG, Collagen Matrix Inc., OsteoRemedies, LLC, Biocomposites Ltd, MicroPort Scientific Corporation, Xtant Medical Holdings, Inc. |

The antibiotic-coated surgical implant drug market refers to the specialized segment of the medical device and pharmaceutical industries focused on surgical implants that are embedded, impregnated, or coated with antibiotic agents to prevent post-surgical infections, particularly surgical site infections (SSIs). These coatings are designed to release antimicrobial agents in a controlled manner, inhibiting bacterial colonization and biofilm formation on the implant surface. This market includes a wide range of coated implants such as orthopedic screws, plates, joint prostheses, cardiac devices, dental implants, mesh, and more, across trauma, orthopedic, cardiovascular, dental, and reconstructive surgeries.

AI can improve the antibiotic-coated surgical implant drug market by aiding researchers in designing novel implants with appropriate antibiotics. Integrating AI in antibiotic-coated implants can identify potential bacteria-rich environments and diffuse the antibiotic into the environment. AI and machine learning (ML) algorithms can analyze vast amounts of data and can predict the effect of antibiotic-coated implants in the human body. Additionally, AI and ML can be used to design novel antibiotic coatings and predict their performance. They can also be used to optimize drug release profiles.

Increasing Number of Surgeries

The major growth factor for the antibiotic-coated surgical implant drug market is the increasing number of surgeries. The rising prevalence of chronic disorders, the growing geriatric population, and the increasing road accidents are the major reasons for surgeries. The Lancet Commission on Global Surgery (LCoGS) proposed a “National Surgical, Obstetric, and Anesthesia Plan” to reach a target of 5,000 surgeries per 100,000 population globally. In 2023, out of 213 countries reporting surgical volume, 45 countries had achieved the target of 5,000 surgeries per 100,000 population.This potentiates the demand for surgical implants and the risk of developing infections, necessitating the use of an antibiotic-coated surgical implant drug.

Antibiotic Resistance

The antibiotic coated on the surgical implant may have the potential to develop resistance, limiting its effect. Thus, researchers find alternative coatings for surgical implants instead of antibiotics, restricting the use of such implants.

Additive Manufacturing

The future of the antibiotic-coated surgical implant drug market is promising, driven by the use of additive manufacturing techniques. Additive manufacturing techniques, such as 3D printing and 4D printing, are utilized to create customized surgical implants tailored to each patient's specific anatomy. Implants developed through these techniques offer numerous advantages, such as increased surface area for drug distribution and sequential layers of antibiotics. These techniques lead to less waste generation, as well as cost-effective and rapid production. Advancements in materials science and technology, as well as the continuous development of novel preparation techniques, have potentiated research and development activities for multiple antibacterial coatings.

By implant type, the orthopedic implants segment held a dominant presence in the antibiotic-coated surgical implant drug market in 2024. This is due to the need to replace a missing joint or bone and support a damaged bone. Metallic alloys, ceramics, and polymers are the common materials used in orthopedic implants. Researchers are developing novel orthopedic implants with biomaterials to reduce toxicity levels and minimize the risk of host rejection. Antibiotic coatings are applied on orthopedic implants through three methods such as anti-adhesion, contact-killing, and releasing-type.

The trauma fixation devices sub-segment held the largest revenue share. The rising prevalence of trauma caused by physical violence or accidents. Trauma fixation devices, such as rods, plates, screws, and wires, are used in orthopedic implants. They provide tailored solutions to promote healing.

By implant type, the cardiovascular implants segment is expected to grow at the fastest CAGR in the market during the forecast period. Cardiovascular implants are used to control irregular heartbeats and support the heart’s pumping function. Certain implants can replace damaged veins and carry out their function. Cardiovascular implants can be temporary or permanent, potentiating the risk of microbial infections. Antimicrobial coatings, such as silver sulfadiazine, gentamicin, amikacin, vancomycin, and rifampicin, are common examples in cardiovascular implants.

By antibiotic agent, the gentamicin segment registered its dominance over the global antibiotic-coated surgical implant drug market in 2024. This segment dominated because gentamicin is a broad-spectrum antibiotic that can inhibit diverse types of bacteria. Several research studies have demonstrated the potential of gentamicin as an effective antibacterial coating, especially in orthopedic implants. Gentamicin can also be coated in multilayers to modify its release for long-lasting effects.

By antibiotic agent, the combination antibiotics segment is expected to grow with the highest CAGR in the market during the studied years. A single antibiotic may fail to provide the desired antibacterial effect. Hence, combination antibiotics are used to cover a wider range of microbes. This also reduces the chances of developing antimicrobial resistance and enhances the effectiveness against biofilms.

By release mechanism, the passive release (surface-coated) segment contributed the biggest revenue share of the antibiotic-coated surgical implant drug market in 2024. Passive coating is widely preferred due to its ability to prevent bacterial infection at the initial stage. It acts by changing surface wettability properties, surface energy, and surface topography of implants. Some common coating materials used are polyethylene glycol (PEG), hyaluronic acid, and superhydrophobic material.

By release mechanism, the nanoparticle-based delivery segment is expected to expand rapidly in the market in the coming years. Advancements in nanotechnology and the growing development of novel drug delivery systems boost the segment’s growth. Ongoing efforts are made to develop 2D nanomaterials, like graphene oxide, black phosphorus, and boron nitride, in different antimicrobial coating agents. Recent studies have revealed that hybrid nanoparticles and nanocomposites provide an effective coating method.

By material, the titanium & titanium alloys segment accounted for the highest revenue share of the antibiotic-coated surgical implant drug market in 2024. This is due to their mechanical strength, biocompatibility, and corrosion resistance. Antibacterial agents coated on the surface of titanium can also promote tissue integration around the implant. Surface modifications of titanium implants can enhance bone regeneration. Their easy availability and cost-effectiveness also make them a suitable choice.

By material, the polyether ether ketone (PEEK) segment is expected to witness the fastest growth in the market over the forecast period. PEEK is widely used as an implant due to its fracture resistance, shock-absorbing capabilities, and enhanced stress reloading properties. It is used in implants for a wide range of applications; however, its use is predominant in dental implants. PEEK prevents restoration breakage and root fracture.

By application, the orthopedic surgery segment led the global antibiotic-coated surgical implant drug market in 2024. The rising prevalence of orthopedic disorders and accidents augments the segment’s growth. It is estimated that 30.5 million orthopedic surgeries were performed globally in 2024, an increase of 4.5% from 2023. Osteoarthritis, rheumatoid arthritis, and osteoporosis are common orthopedic disorders. The increasing number of post-menopausal women and the growing geriatric population also propel the segment’s growth.

By application, the cardiac surgery segment is expected to show the fastest growth over the forecast period. The increasing prevalence of cardiac disorders and other heart-related conditions potentiates the need for cardiac surgery. Rapid urbanization and sedentary lifestyles are the major reasons for cardiovascular disorders. More than 1 million cardiac surgical procedures are estimated to be performed annually.

By end-user, the hospitals segment held a major revenue share of the antibiotic-coated surgical implant drug market in 2024. The segmental growth is attributed to the favorable infrastructure and suitable capital investments. This enables hospitals to adopt advanced technological products and provide effective treatment. Hospitals have professionals from all departments, providing multidisciplinary expertise to patients. People also prefer hospitals due to appropriate reimbursement policies.

By end-user, the ambulatory surgical centers segment is expected to account for the fastest growth in the upcoming years. Ambulatory surgical centers (ASCs) eliminate the need for patients to stay overnight, saving overhead costs. They have specialized equipment and skilled professionals, providing tailored treatments to patients. They offer a more convenient and cost-effective alternative to hospital-based care.

North America dominated the antibiotic-coated surgical implant drug market share by 39% in 2024. The presence of a robust healthcare infrastructure, favorable reimbursement policies, and the increasing number of surgeries are the major growth factors for the market in North America. The presence of key players leads to the development of innovative implants for diverse applications.

Key players, such as Stryker Corporation, Orthofix Medical, Inc., and Zimmer Biomet Holdings, are the major companies that provide surgical implants in the U.S. According to the 2023 American Hospital Association (AHA) Annual Survey, more than 34.43 million people were admitted to all U.S. hospitals.

The Canadian Institute for Health Information (CIHI) reported that approximately 102,227 surgeries were performed in Manitoba between April 2023 and March 2024. (Source: https://www.cbc.ca/news/canada/manitoba/surgical-backlog-pandemic-recovery-manitoba-1.7370037) The Canadian Life & Health Insurance Association (CLHIA) reported that $128 billion was paid by insurers in Canada in 2023, including retirement benefits, health benefits, and life insurance.

Asia-Pacific is expected to grow at the fastest CAGR in the antibiotic-coated surgical implant drug market during the forecast period. The increasing geriatric population and the rising prevalence of chronic disorders potentiate the need for surgeries. The burgeoning healthcare and medical device sectors contribute to market growth. Government organizations provide funding to install and adopt advanced medical equipment in healthcare organizations.

According to a BBC article, the geriatric population in China is increasing at a fast pace. As of 2020, approximately 15% of the total population was above 60 years of age and is projected to rise to over 45% by 2080, surpassing Japan. The Chinese National Medical Products Administration (NMPA) encourages foreign manufacturers to set up their medical device production facilities in China.

The United Nations Population Fund (UNFPA), India, estimated that the population of people aged 80 years and above will grow at a rate of around 279% between 2022 and 2050. Approximately 311 million Indians are suffering from hypertension, accounting for 30.7% of the total population. Around 300,000 surgeries are performed annually in India.

Europe is expected to grow at a notable CAGR in the antibiotic-coated surgical implant drug market in the foreseeable future. Favorable government support and growing research and development activities bolster market growth. Government organizations launch initiatives to support the development of novel medical devices. Favorable trade policies, i.e., import and export of surgical implants, positively impact market growth.

Germany exports the highest number of surgical implants globally. It exported about 2,701 shipments of surgical implants from October 2023 to September 2024. Most of its exports were made to India, Ukraine, and Kazakhstan. Germany is home to key players in the field of surgical implants, such as Evonik Industries AG, B. Braun Melsungen AG, and Heraeus Holding GmbH.

Steven Gitelis, Chief Medical Officer at Onkos Surgical, commented that the NanoCept technology represents a significant advancement in the preventive measures to mitigate the potentially devastating complications related to intraoperative bacterial contamination of implants. He also said that it can create a paradigm shift in implant selection and is a valuable tool for surgeons to help address an unsolved clinical problem.

By Implant Type

By Coating Antibiotic Agent

By Release Mechanism

By Material of Implant

By Application

By End-User

By Region

North America

US

Canada

Asia Pacific

China

Japan

India

South Korea

Thailand

Europe

Germany

UK

France

Italy

Spain

Sweden

Denmark

Norway

Latin America

Brazil

Mexico

Argentina

Middle East and Africa (MEA)

South Africa

UAE

Saudi Arabia

Kuwait

January 2026

January 2026

January 2026

January 2026