January 2026

The worldwide implantable sensor orthopedic market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034. This growth is driven by emerging trends and strong demand across key sectors.

The implantable sensor orthopedic market is primarily driven by the growing need for orthopedic implants and technological advancements. The burgeoning medical device sector and growing research activities contribute to market growth. The increasing number of orthopedic surgeries and the rising demand for digital health augment the market. Government and private organizations encourage patients to diagnose orthopedic conditions. Artificial intelligence (AI) plays a crucial role in implantable sensors and enables continuous monitoring. The integration of the Internet of Things (IoT) presents future opportunities for orthopedic implants.

The implantable sensor orthopedic market covers implants and embedded sensor modules placed within or attached to orthopedic implants (hips, knees, spine, trauma plates, etc.) that measure biomechanical and biological signals, e.g., load/force, strain, pressure, motion/range-of-motion, wear, implant micromotion/loosening, and biochemical markers related to infection or bone healing. These sensors typically include MEMS strain gauges, pressure transducers, inertial measurement units (IMUs), electrochemical biosensors, and wireless telemetry modules for real-time or episodic remote monitoring.

Orthopedic implants are widely used for postoperative monitoring, rehabilitation optimization, early detection of complications (loosening and infection), outcome tracking, and supporting value-based care and remote follow-up. Demand is driven by aging populations, growth in arthroplasty & spinal fusion volumes, interest in objective outcome metrics, and digital health reimbursement models.

AI plays a pivotal role in orthopedic implants to measure significant physiological parameters, such as bone growth, infection markers, and biomechanical loads. AI-based sensors offer personalized therapeutic and diagnostic functions. They monitor pressure levels and motion to detect wear and tear of implants or infection. They can measure biochemical markers of bone metabolism, providing real-time feedback on the healing process. They also act as reservoirs to deliver drugs directly to the site of surgery. Additionally, AI enables continuous monitoring of the implant’s performance and the patient's progress.

Rising Prevalence of Orthopedic Disorders

The major growth factor for the implantable sensor orthopedic market is the rising prevalence of orthopedic disorders. The growing geriatric population, increasing number of accidents, and escalating sports injuries are the major causes of orthopedic disorders. This hampers the quality of life of individuals, restraining them from performing routine activities. In the U.S., the total number of sports injuries was more than 3.27 million in 2023. Orthopedic disorders potentiate the demand for surgeries and orthopedic implants.

Technical Limitations

Implantable sensors have certain limitations, such as chronic inflammation, infection, degradation, migration, and limited sensing capabilities. These limitations restrict the use of orthopedic implants.

What is the Future of the Implantable Sensor Orthopedic Market?

The market future is promising, driven by the integration of IoT technology in orthopedic implants. IoT-enabled sensors facilitate real-time monitoring through smart orthopedic implants. It helps to detect infections and track the healing progress of a patient. They also send notifications to healthcare professionals, allowing them to make proactive clinical decisions. They enable remote monitoring of patients, eliminating the need to visit any healthcare organization. Thus, IoT-based sensors provide the measurement of bone and fracture information, improving the quality of treatment.

By product/device type, the instrumented joint implants segment held a dominant presence in the market in 2024. This is due to the ability of implants to monitor joint conditions and provide real-time information. Instrumented joint implants can measure biomechanical quantities to assist in rehabilitation and physical therapy. Healthcare professionals can get a better understanding of joint implants and their placement during surgery. Sensors used in instrumented joint implants can also detect potential infection risks.

By product/device type, the implantable biosensors segment is expected to grow at the fastest CAGR in the market during the forecast period. Advancements in electronics and microfabrication techniques and the increasing need for personalized treatment boost the segment’s growth. Implantable biosensors are analytical devices used for the diagnosis, monitoring, management, and treatment of orthopedic disorders. Researchers develop novel biosensors that can prevent biofouling and unwanted immune reactions.

By application/use case, the post-operative performance monitoring segment held the largest revenue share of the market in 2024. This segment dominated because of the increasing number of orthopedic surgeries and the need for post-operative monitoring. Healthcare professionals need to monitor a patient after a surgery. Implantable sensors provide information about various biophysical and biochemical parameters, allowing healthcare professionals to monitor a patient from a remote location.

By application/use case, the infection detection & local biochemical monitoring segment is expected to grow with the highest CAGR in the market during the studied years. Implants carry a high risk of infection or rejection by the body. Sensors can detect the risk of infection and continuously monitor internal physiological or biochemical changes. They monitor local temperature fluctuations and pH changes to provide early warning to healthcare professionals.

By technology/sensing principle, the MEMS strain/force sensors segment contributed the biggest revenue share of the market in 2024. Microelectromechanical systems (MEMS)-based sensors can read biochemical signals even before the formation of biofilm due to infection. They capture real-time gait loads and enable precise, repeatable force estimation. Sensors provide the essential framework for implant loosening or instability, demonstrating the feasibility of embedded load sensing.

By technology/sensing principle, the electrochemical/biosensing segment is expected to expand rapidly in the market in the coming years. Electrochemical/biosensing implants use electrodes to detect biomarkers or implant degradation products in the body. They can detect even minute changes in temperature and pH. They are predominantly used for the detection of suitable marker proteins, antibodies, DNA sequences, or cells.

By implant site/type, the knee implants segment accounted for the highest revenue share of the market in 2024. This is due to the increasing number of knee replacement surgeries and the rising prevalence of knee-related injuries or disorders. According to a recent meta-analysis and systematic review, the prevalence of osteoarthritis among elderly people in India was 47%. (Source: https://pmc.ncbi.nlm.nih.gov/articles/PMC12178484/) It is estimated that around 3.5 million knee replacement surgeries are performed annually and projected to rise by 673% by 2030.

By implant site/type, the spine segment is expected to witness the fastest growth in the market over the forecast period. Lumbar disk replacement refers to replacing a worn or degenerated disk in the lower part of the spine. The rising incidence of chronic low back pain potentiates the demand for lumbar disk replacement. The replacement surgery involves replacing a damaged or degenerated intervertebral disc with an artificial disc implant. This surgery is performed in patients with disc degeneration, herniated disc, failed non-surgical treatments, and the desire to preserve motion.

By end-user, the hospitals & orthopedic surgery centers segment led the market in 2024. The segmental growth is attributed to the availability of favorable infrastructure and suitable capital investment. The increasing number of hospital admissions and the presence of skilled professionals propel the segment’s growth. Skilled professionals provide multidisciplinary expertise to patients. Hospitals host numerous implant programs to encourage patients to seek early diagnosis and treatment.

By end-user, the device OEMs/implant manufacturers segment is expected to show the fastest growth over the forecast period. Original equipment manufacturers (OEMs) purchase orthopedic implant sensors for integrated smart implants. The integration of AI-based sensors improves the functionality of medical devices. Adding sensor-enabled differentiation to product portfolios strengthens the market position of a company.

By deployment model, the OEM-integrated smart implants segment held a major revenue share of the market in 2024. Sensors are integrated within orthopedic implants during the manufacturing stage. Advances in microchip technologies have led to the development of innovative sensors, potentiating their demand. OEMs purchase sensors at an early stage and use them for large-scale manufacturing of orthopedic implants.

By deployment model, the retrofit sensor kits/trial instrumentation segment is expected to account for the fastest growth in the market over the upcoming years. Trial instrumentation serves as a guide for surgeons to select the most appropriate orthopedic implants for patients based on their conditions. Surgeons use retrofit sensor kits before and during surgery to assess the correct size, shape, and placement of an implant.

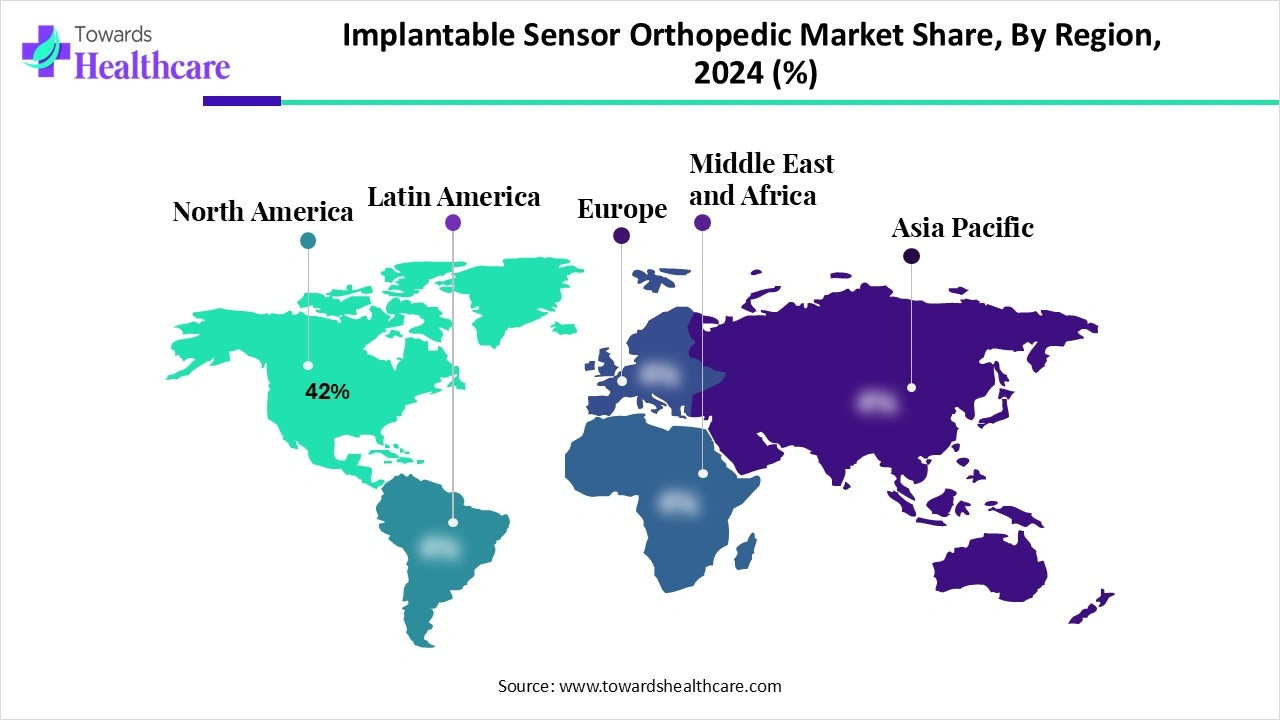

North America dominated the global market share 42% in 2024. The rising prevalence of orthopedic disorders, the availability of a robust healthcare infrastructure, and favorable government support are the major growth factors for the market in North America. The market is also driven by the largest early adoption due to implant volumes and digital health pilots. Government and private agencies provide reimbursement for complex surgeries.

The Centers for Disease Control and Prevention (CDC) estimated that 1 in 5 adults, or 53.2 million people, in the U.S. have some form of arthritis. Key players, such as Stryker Corporation, Globus Medical, and Zimmer Biomet, are the major contributors to the market in the U.S. More than 32 million individuals are living with medical implants in the U.S.

Arthritis is a common medical condition among Canadians, affecting 1 in 5, or 6 million people. The Arthritis Society Canada estimated that this number is estimated to reach 9 million by 2045. The Canadian government actively supports digital health infrastructure and the use of AI/ML-powered medical devices.

Asia-Pacific is expected to grow at the fastest CAGR in the implantable sensor orthopedic market during the forecast period. The rising adoption of advanced technologies and the growing geriatric population foster the market. The rapidly expanding medical device sector and the increasing number of startups contribute to market growth. Asia-Pacific is also emerging as a venture capital hub, recording the highest investments for startups. Countries in this region also have a suitable manufacturing infrastructure.

Chinese researchers are at the forefront of developing novel and innovative joint implants embedded with sensors. China is home to about 1,104 medical device startups as of August 2025. Local governments provide sufficient funding through initiatives, such as RMB 21.5 billion allocated for high-end medical devices.

The Indian government’s “Make in India” initiative promotes the domestic manufacturing of medical devices, including orthopedic implants. There are 898 medical device startups in India. India also exports large quantities of medical devices to the world. It exported around $427.83 million of surgical devices from April 2024 to October 2024.

Researchers conduct research activities to develop innovative implantable sensors using advanced technologies for orthopedic applications.

Key Players: Stryker Corporation, Medtronic, and DePuy Synthes.

Smart implants undergo clinical trials to assess their potential against numerous orthopedic disorders. Regulatory agencies, such as the FDA, NMPA, and EMA, give approval for these sensors based on the clinical trial data.

Patient support & services refer to providing personalized treatment and educating patients about the use of orthopedic implants.

Stephen Laffoon, CEO at Penderia, commented that the company believes the platform will improve the standard of care in soft-tissue repairs and is excited to receive the Breakthrough Device designation as validation of the company’s vision. The company looks forward to engaging with the FDA through the TAP program as an important milestone on the way to clinical impact.

By Product/Device Type

By Application/Use Case

By Technology/Sensing Principle

By Implant Site/Type

By End-User

By Deployment Model

By Region

January 2026

November 2025

November 2025

November 2025