November 2025

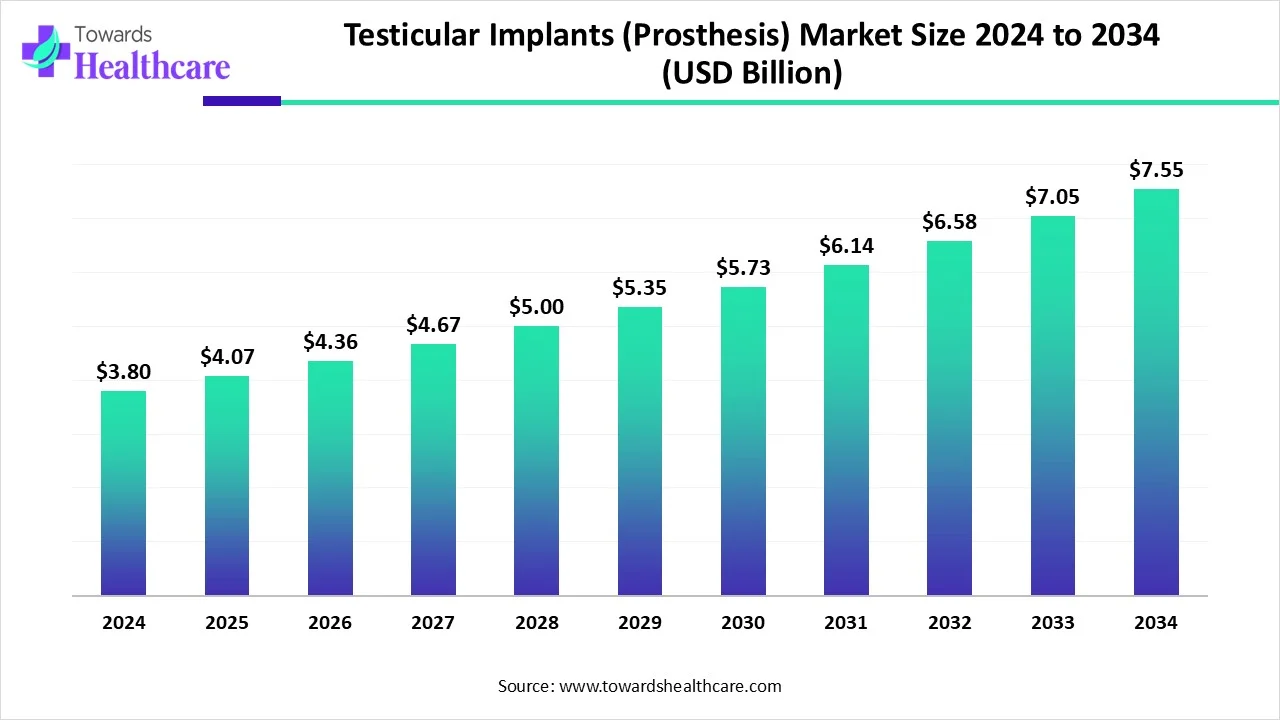

The global testicular implants (prosthesis) market size is calculated at US$ 3.8 in 2024, grew to US$ 4.07 billion in 2025, and is projected to reach around US$ 7.55 billion by 2034. The market is expanding at a CAGR of 7.14% between 2025 and 2034.

The global testicular implants (prosthesis) market is experiencing major expansion due to several factors, including increasing cases of testicular cancer, other conditions like cryptorchidism (undescended testicles) or monorchism (having only one testicle), which highly demand orchiectomy (testicle removal) treatment. Along with growing awareness about these conditions and psychological impacts leads to patient will achieve positive effects in their body image, with a natural look and feel by using this kind of implants.

In the coming years, various innovations will be created by using biocompatible and durable materials like saline-filled silicone implants. Along with this, accelerating innovation in 3D printing techniques and surgeries to develop customized implants of size and shape according to patients' characteristics.

A testicular implant, also termed a testicular prosthesis, is an artificial testicle placed surgically to substitute for a testicle that is missing or has been separated due to injury, disease, or congenital conditions. Mainly, this market is fueled by rising cases of testicular cancer, congenital issues, including cryptorchidism, and growing awareness of gender reassignment surgery. Latest updates in testicular implants, such as breakthroughs in materials and surgical techniques, with a rising focus on enhancing patient satisfaction and highlighting concerns about long-term effects, are included. As well as tissue engineering and 3D printing are also putting efforts into tailored and potentially functional prostheses.

Due to rising awareness about technological advancements, AI is widely employed in various aspects of the respective market. It includes help in the analysis of medical images such as CT scans to determine potential implant placement, coupled with factors like scrotal anatomy and tissue characteristics, also. Its algorithms assist in processing patient data to study individual risk factors for complications such as infection or extrusion, aiding in preventative measures. Furthermore, AI supports to detection of the robust implant size and type based on patient-specific characteristics, which ultimately enhances patient satisfaction.

Accelerating cases of cancer and other conditions & advanced technology

Across the world, the number of testicular cancer cases in young men, with the rising adoption of orchiectomy treatment are major driver for the expansion of the global testicular implants (prosthesis) market. These cases are raising demand for innovative and more effective implants for patient satisfaction. Along with this increasing concerns like cryptorchidism (undescended testicles) or monorchism (having only one testicle), resulting in the need for a prosthesis. Besides this, ongoing research in materials improvement, like silicone and saline-filled options, and surgical techniques, boosts patient satisfaction with results.

Rising limitations for the cost and risk of complications

Based on single or double implants, and the particular clinic or hospital gives variances in the expenses, which may create a hurdle to access for some patients. Along with this, previous issues with silicone gel-filled implants have led to hesitation among patients and healthcare professionals. The major risk of complications in these surgeries is infection, erosion/extrusion, scar formation, and psychological impact.

Adoption of personalized implants and biocompatible materials

Different opportunities are rising in the future in the testicular implants (prosthesis) market, including the use of 3D scanning, modeling, and printing technology in the creation of customized implants that rely on individual size, shape, and rigidity, which also assist in addressing discomfort regarding standard sizes. Moreover, the R&D department is highly focused on the properties of materials like their biocompatibility and mechanical properties, by employing 3D-printed prostheses is important for long-term success.

By product type, the silicone implants segment led the market in 2024. The segment is fueled by its desire for a natural feel and appearance after the orchiectomy (testicle removal) treatment. As well as with patient increased satisfaction, another factor is the easy surgical procedure in which these implants are easier to insert, especially in the time of orchiectomy.

By product type, the saline-filled implants segment is expected to grow at a notable CAGR during 2025-2034. The expansion of this segment is propelled by its advantages, as it enhances patients’ self-esteem, body image, and complete well-being, along with more effective and fewer complications. It has major demand in orchiectomy (testicle removal) due to testicular cancer, injury, or congenital conditions like undescended testicles.

By material, the silicone segment held the biggest revenue share of the testicular implants (prosthesis) market in 2024. Due to the popular choice of silicone implants, in which silicone is used to provide a natural feel and appearance, among patients with more satisfaction is fueled the segment growth. Also, the growing awareness about the orchiectomy procedure is propelling demand for this material.

By material, the polyurethane segment is anticipated to register rapid growth during the forecast period. Primarily, this material has benefits in conjunction with silicone, are its biocompatibility and tissue mimicry are driving the expansion of the segment and overall market. Also, ongoing research on this material is focusing on its raised mechanical properties, durability, and infection resistance is fueling demand for the polyurethane implants.

By end-user, the hospitals segment was dominant in the market in 2024. Hospitals possess comprehensive facilities for both the initial consultation, surgical placement, and follow-up care related to testicular prostheses is a major driver for its dominance in the market. As well as being highly demanding of a natural appearance after surgery, it also helps to expand the segment and complete the market.

By end-user, the specialty clinics segment is predicted to show the fastest growth during 2025-2034. Along with the psychological impact, advancements in implant technology, including more realistic and durable implants such as saline-filled prostheses, are widely adopted by patients in specialty clinics is driving the segment growth. Also, the rising reconstructive procedures, including gender-affirming surgeries and surgeries for congenital anomalies, fuel demand for sophisticated devices available in specialty clinics.

North America held the major revenue share of the market in 2024, due to contributing factors such as rising incidences of testicular cancer, along with growing awareness and acceptance among patients about their positive impact on body image, self-esteem, and complete psychological well-being, especially after conditions like testicular cancer or congenital absence. Although the increasing application of durable implants like the saline-filled silicone implants, with rising satisfaction and minimum concerns about long-term complications, is also demanding for testicular implants and ultimately boosts the market growth.

The foremost driver of the US market is that the Torosa saline-filled implant is the only FDA-approved choice in the US, whereas other producers offer silicone-based implants internationally. Also, the greater awareness among patients and healthcare professionals regarding the availability and advantages of testicular prostheses is impelling the demand. Besides this, advancements in surgical approaches for implant placement, including minimally invasive techniques, lead to high outcomes and increased patient acceptance.

The Canadian market is driven by the rising psychological impacts from testicular loss, whether from cancer, trauma, or other conditions are accelerating demand for testicular prostheses to support alleviating body image issues and optimizing self-esteem. As cost is also a significant barrier, Canada possesses some insurance plans for these implants, particularly in instances of medically necessary removal.

For this market,

Asia Pacific is anticipated to be the fastest-growing region in the upcoming years. In ASAP, the market is fueled by the increasing cases of testicular cancer in young men, who require treatment including orchiectomy a part is demanding for the novel implants in these approaches. Along with this, testicular prostheses are widely used in gender-affirming surgeries for transgender men, further contributing to market growth.

The Chinese market is driven by growing awareness about cancer and treatment, with increasing innovations in 3D printing and other advanced technologies, which further support the personalization and functionality of the testicular implants. Moreover, breakthroughs in surgical techniques and post-operative care, such as pain management and wound care, are making the approach more accessible and appealing.

Factors including rising awareness of reconstructive choices, advancements in implants and surgical procedures, along with cost-effective procedures compared to other countries in India offering to expand the market.

For instance,

In Europe, the market is experiencing significant growth due to growing awareness about the adoption of testicular prostheses to address psychological impacts, which also supports more acceptance of these innovative implants and procedures. As well as Europe is also taking steps for research into functional prostheses, which release testosterone or other hormones, could further drive market growth with the reduction of the need for hormone replacement therapy.

The German market is propelled by advancements in implant materials and surgical techniques, which enable safe, more effective, and more appealing procedures for patients. Also, the healthcare system in Germany provides standard reimbursement policies for inpatient treatments, assists in adopting testicular prostheses, allowing the procedure to be more cost-effective.

Along with accelerating awareness about testicular cancer and adoption of implant placement, the UK emphasizes aesthetic considerations, such as individuals seeking cosmetic reasons, who need improvements in their appearance and body image, particularly with access to prostheses with customized properties, are fueling demand for implants with fewer complications.

For this market,

In April 2025, MANSCAPED, the global men’s grooming company, and NASCAR Driver Josh Bilicki announced a brand new partnership to support the Testicular Cancer Society (TCS) and their efforts to accelerate awareness around the ball-busting disease. Lucas Coyle, Associate Director, Brand Marketing at MANSCAPED, replied that this partnership with TCS is to increase the awareness of testicular cancer and the life-saving power of early detection. (Source- Businesswire)

By Product Type

By Material

By End-User

By Region

November 2025

November 2025

November 2025

January 2026