January 2026

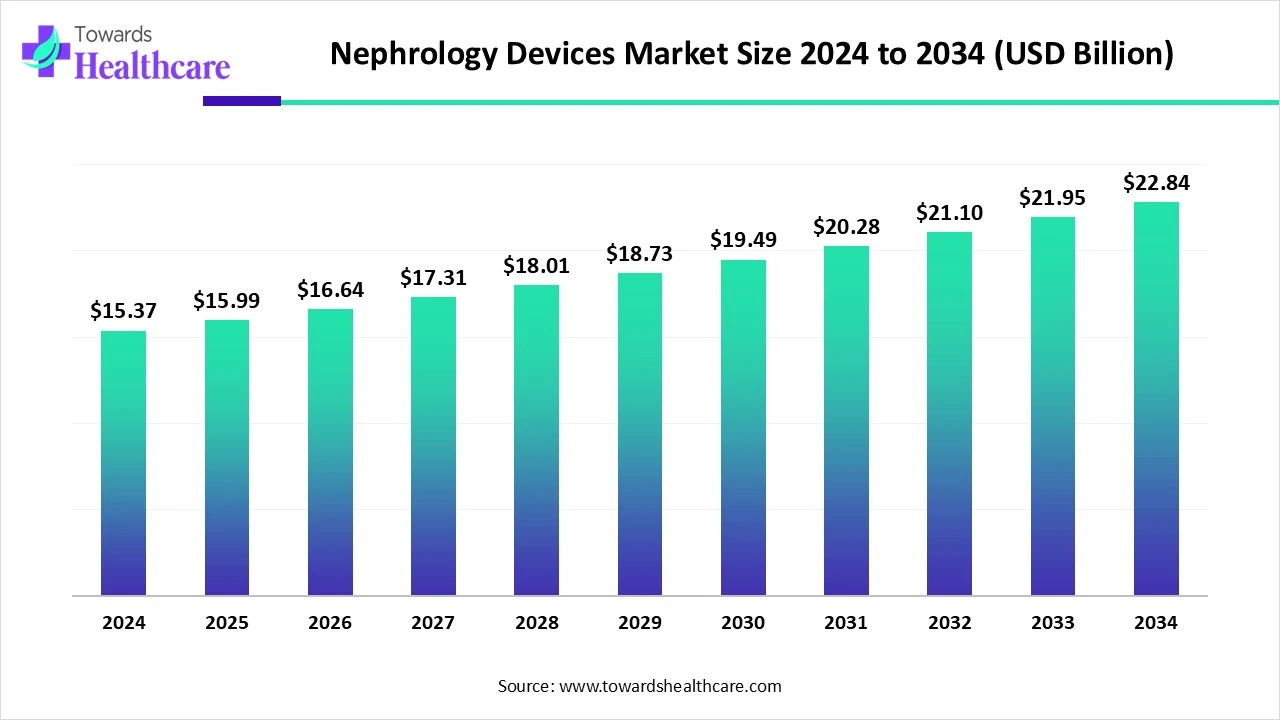

The global nephrology devices market size is calculated at US$ 15.37 billion in 2024, grew to US$ 15.99 billion in 2025, and is projected to reach around US$ 22.84 billion by 2034. The market is expanding at a CAGR of 4.04% between 2025 and 2034.

In 2025, across the globe in the nephrology devices market, significant growth in the prevalence of kidney-related diseases, such as chronic kidney disease and end-stage kidney disease, is fueled by a rise in hypertension and diabetes. This growing burden is leading to an increase in the adoption of innovative and highly advanced nephrology and urology devices, especially hemodialysis and peritoneal dialysis. Moreover, leading players are boosting the R&D process on the development of novel, home-based kidney care, with enhanced convenience, affordability, and patient outcomes. During the forecast period, the globe will focus on immense opportunities in increasing CKD, adoption of AI and machine learning powered early diagnosis, and improved treatment solutions.

| Metric | Details |

| Market Size in 2025 | USD 15.99 Billion |

| Projected Market Size in 2034 | USD 22.84 Billion |

| CAGR (2025 - 2034) | 4.04% |

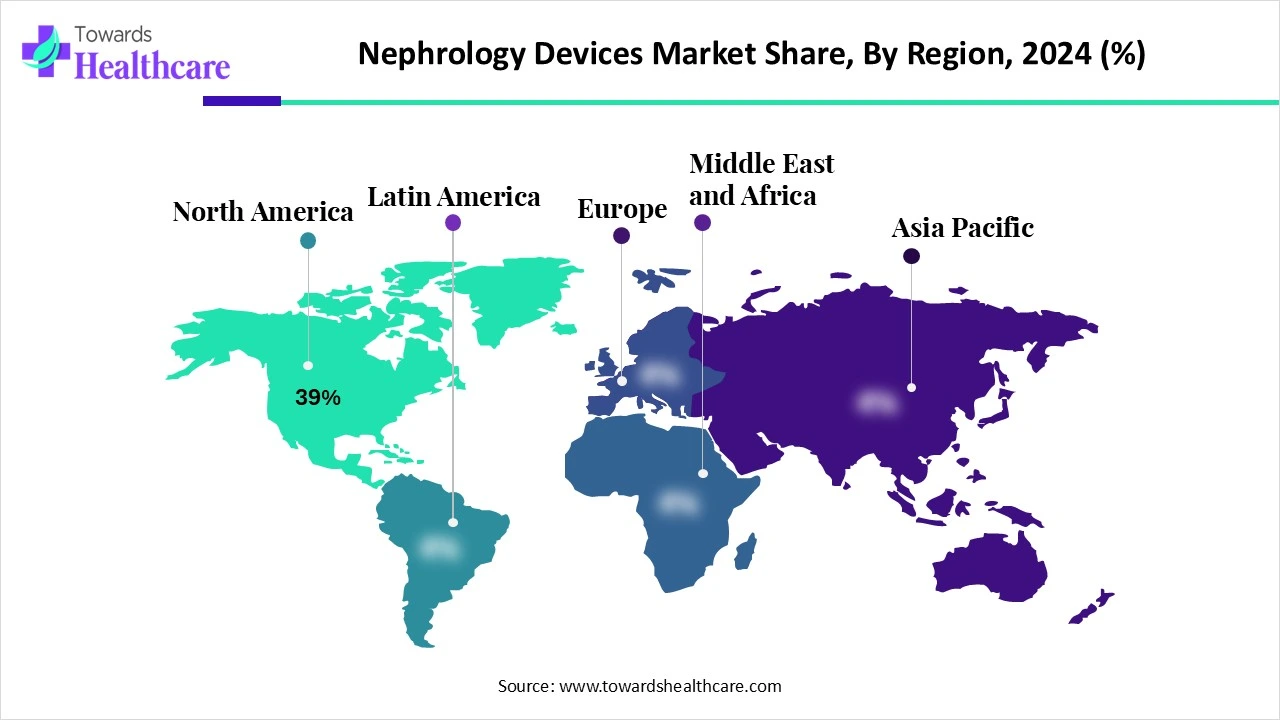

| Leading Region | North America share by 39% |

| Market Segmentation | By Product Type, By Modality, By Disease Type, By End User, By Technology, By Region |

| Top Key Players | Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG, Medtronic plc, Asahi Kasei Corporation (Asahi Kasei Medical), Nikkiso Co., Ltd., Dialife SA, Toray Medical Co., Ltd., JMS Co., Ltd., Outset Medical, Inc., Quanta Dialysis Technologies, Rockwell Medical, Inc., Mediana Co., Ltd., NxStage Medical, AWAK Technologies, Baxter-Gambro Renal, Cure Kidney Care, Medionics International, WEGO Group |

The nephrology devices market encompasses medical devices and equipment used in the diagnosis, treatment, and management of kidney-related disorders, such as chronic kidney disease (CKD), acute kidney injury (AKI), end-stage renal disease (ESRD), and renal failure. These devices include dialysis systems, catheters, water purification units, and monitoring systems used in hemodialysis, peritoneal dialysis, and renal replacement therapies. Market growth is driven by the rising global burden of diabetes and hypertension, the expanding geriatric population, and the increasing adoption of home dialysis and wearable kidney technologies.

Widespread impact of AI algorithms and machine learning models arises due to their sophisticated technologies, which allow high-accuracy estimations and suggestions on customized treatments. Moreover, these advanced AI algorithms assist in the reduction of healthcare expenditure by providing prior diagnosis, mitigating disease growth, and improving treatment plans. In case of early detection and diagnosis, AI comprises the analysis of medical images, lab results, and patient history for determining early signs of kidney disease. Hence, ultimately, AI-driven approaches support non-invasive diagnostic tools, including retinal imaging for detecting kidney disease biomarkers, enabling a promising and inexpensive approach.

The Rising Burden of Kidney Diseases and the Rising Demand for Novel Methods

Around the world, the nephrology devices market is fueled by increasing cases of kidney issues, such as chronic kidney disease (CKD), urinary incontinence, and kidney stones are common conditions, resulting in enhanced demand for these advanced devices. Alongside, another driver for this market expansion is a rise in demand for minimally invasive procedures, which offer advantages, such as minimized recovery time and scarring are boosting the adoption of innovative measures of nephrology and urology. Generally, these innovations encompass portable ultrasound, automated urine analyzers, and wireless monitoring, which allow accelerated diagnostics and treatment.

Increased Spending and Product Recalls

Due to significant initial purchase cost and continuous maintenance of nephrology devices, especially dialysis machines and relevant equipment, they are creating a crucial hurdle with less accessibility to specific healthcare facilities in a few developing regions. Also, recall of these devices can develop another barrier for market supply and erode consumer confidence, resulting in financial losses for producers and possible delays in patient care.

Expansion in the Adoption of Home-Based Therapies and Sustainable Devices

In 2025-2034, the nephrology devices market will experience increasing movement towards minimally invasive approaches, by employing sophisticated technologies, like robotic systems and laser lithotripsy. Along with this, boosting interest and adoption for telemedicine, remote monitoring, and home-based therapies, such as home dialysis and other treatments, is also impacting the creation of opportunities for these device manufacturers. Other than this, one of the vital prospects in this market is escalating awareness and adoption towards the development of eco-friendly or sustainable devices.

In 2024, the hemodialysis devices segment was dominant in the global nephrology devices market. The segment is driven by a growing geriatric population, who are highly prone to kidney-related concerns, as well as a rise in number of prevalence of CKD and ESRD, often associated with diabetes and hypertension. The emergence of novel developments in this device, particularly enhanced user interfaces, automation, and connectivity features, is improving treatment effectiveness and patient outcomes.

On the other hand, the peritoneal dialysis devices segment is predicted to expand rapidly, due to its various benefits over other approaches. Mainly, these devices provide more flexibility and convenience compared to in-center hemodialysis, which is developing as an important choice for many patients, particularly those looking for a highly normalized lifestyle. Furthermore, ongoing breakthroughs in this segment, like automated peritoneal dialysis (APD) systems and wearable devices, are supporting its rising adoption with optimized treatment efficacy, patient comfort, and accessibility.

By modality, the in-center dialysis segment held the biggest share of the market, with possession of a well-structured environment with specialized healthcare professionals. This leads to a boost in patient preference with required close monitoring and management of their health conditions. As well as the segment is propelled by government-backed healthcare programs and insurance coverage for dialysis treatments, making it more accessible and cost-effective for a wider population.

Whereas, in the upcoming years, the peritoneal dialysis (home-based) segment will expand at the fastest CAGR. Majorly influencing factors in this segment expansion are a rise in patient preference for this approach, due to its greater flexibility and convenience of home-based dialysis, with its reduced expenses than hemodialysis. Besides this, the worldwide growing digital health integration, like telemedicine and remote monitoring, is also fueling its adoption, coupled with expanded patient management and treatment results.

In the global nephrology devices market, the end-stage renal disease (ESRD) segment accounted for a major share in 2024. A major precursor to this condition is an increasing global burden of chronic kidney diseases, which are propelled by growth in hypertension and diabetes cases, ultimately leading to the expansion of nephrology devices and treatments. Side by side, ongoing technological advancements in these conditions are impacting overall market development.

Moreover, the acute kidney injury (AKI) segment is estimated to register rapid expansion. The segment will be driven by rising instances of diabetes and hypertension, both of which are major reasons for kidney damage. Alongside enhancing the number of hospitalizations and surgeries, particularly in older adults, growth in the risk of AKI due to factors like sepsis, trauma, and medication-related nephrotoxicity is also assisting the overall segment growth.

In 2024, the hospitals & dialysis centers segment dominated the market. Widespread growing awareness about kidney concerns and the advantages of prior detection and treatments is highly influencing the growth of demand for nephrology devices and services. Furthermore, the segment is fueled by a raised expenditure on healthcare infrastructure, including both standalone dialysis centers and hospitals, enabling dialysis services to provide accelerated access to treatment for patients with kidney failure.

However, the home healthcare settings segment will grow rapidly, due to escalating preference for home-based care, which gives more convenience and comfortable environment options, resulting in wider demand for home dialysis and other home-based nephrology services. On the other hand, consistent technological developments, especially those created for home use, are making treatments more effective, user-friendly, and portable. Major examples include smaller, more compact dialysis machines and wearable devices that can enable remote monitoring and treatment.

The conventional dialysis systems segment held the largest revenue share of the market in 2024. The segment is driven by growth in the prevalence of diverse kidney-related conditions, with enhanced adoption of technologies in the dialysis process, like optimized dialyzer membranes, wearable dialysis devices, and more precise fluid management systems, which give rise to increased efficiency, patient comfort, and availability.

During the forecast, the portable & wearable dialysis devices segment will show rapid growth. One of the important factors for this segment development is the emergence of widespread digitalization in the healthcare sector, which provides integrated health technologies, such as remote monitoring and data analysis, and boosts the appeal and efficiency of portable and wearable dialysis devices. Furthermore, continuous developments in miniaturization, materials science, and sensor technology are facilitating the robust growth of highly effective and user-friendly portable and wearable dialysis devices.

Around this market, North America experienced dominance share by 39% in 2024. Because the presence of the advanced healthcare system with sophisticated medical technologies and trained personnel is fueling the adoption and utilization of nephrology devices, along with this, the region’s government is encouraging research and development, along with favorable reimbursement policies, which foster the adoption of novel and innovative nephrology devices.

For instance,

In the US, the market is driven by an increasing elderly population, who are highly susceptible to kidney-related and urological issues, further assisting in the demand for these services. As well as ongoing advancements in domains, including nanotechnology, robotic surgery, and digital health solutions, are supporting the development and adoption of advanced nephrology and urology devices.

For this market,

This region is highly focused on the adoption of innovative, minimally invasive surgeries, which offer decreased recovery times with affordability. As well as in Canada, catheters are widely used in different nephrology and urology procedures, which is a crucial driver for overall market growth. And, a raised interest in home-based dialysis, provided by technological advancements, is boosting new opportunities for device manufacturers.

During 2025-2034, the Asia Pacific will grow at the fastest CAGR, due to this region being faced with growth in an aging population, coupled with a greater incidence of kidney and urinary tract diseases. Along with this, many countries of ASAP are heavily investing in the healthcare sector, including major investments in healthcare infrastructure and access to more sophisticated medical technologies. Also, rising focus on healthcare services, fueled by enhanced disposable incomes in the ASAP region.

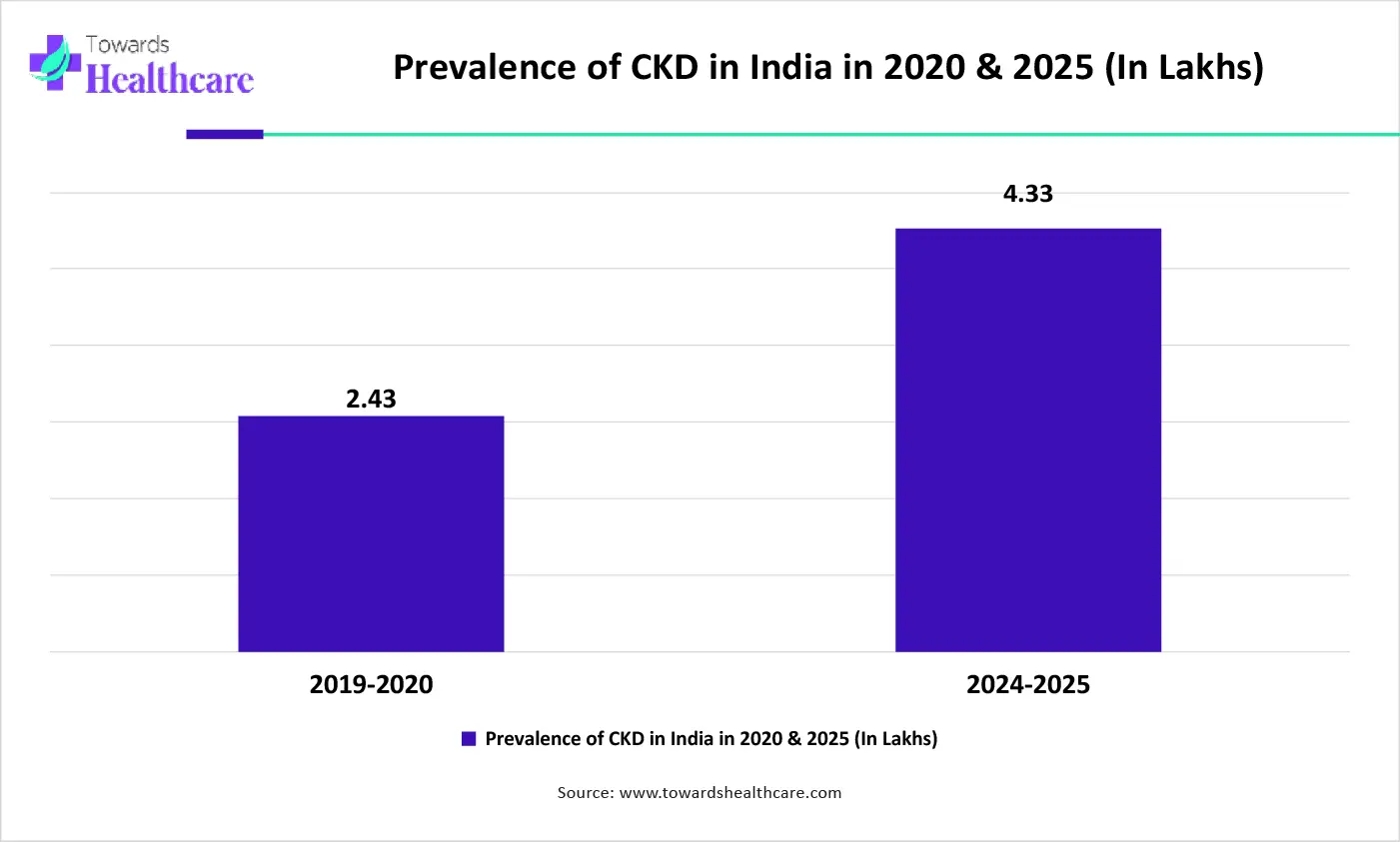

In India, there is a significant growth in kidney disease cases is fueling expansion in novel technologies are fostering the adoption of advanced nephrology devices. Moreover, the Indian government is assisting in initiatives related to accelerating awareness about these issues and advanced treatments, like dialysis, and regarding the same.

For instance,

China has a huge aging population, associated with CKD are greatly prone to adopting these devices with enhanced comfort, accessibility, and affordability. Whereas, China is focusing on the wider emergence of dialysis devices, such as hemodialysis and peritoneal dialysis equipment, which are vital for patients having end-stage renal disease. Besides this, China possesses highly developed urology surgical devices comprising minimally invasive procedures for treating kidney stones, urinary tract infections, and other urological conditions.

In the nephrology devices market, Europe is experiencing a notable expansion, due to increasing developments in technologies, such as robotic systems, high-definition imaging, and AI-driven diagnostic tools, which have optimized the accuracy and efficiency of nephrology procedures. Also, the utilization and boosting demand for portable and home-based devices are supporting overall market growth in this region. However, the supportive policies and awareness campaigns are fostering the adoption of nephrology and urology technologies.

Germany’s population encompasses major disposable incomes, which are fueling a rise in the adoption of advanced healthcare services. Alongside, a crucial investment in healthcare infrastructure and a rise in illness are also driving the adoption of innovative surgery approaches, including nephrology devices and hemodialysis. The development of sustainable and eco-friendly measures in kidney disease is supporting in creation of new opportunities across this market.

Combined factors are widely impacting this region’s market, including significant government funding in the healthcare area to develop advanced healthcare infrastructures with easy access for patients, as well as rising preference for less invasive approaches, which frequently use specialized nephrology devices. Also, this country is raising its focus on enhanced demand for portable and home-based nephrology and urology solutions.

For instance,

In July 2025, the North East and North Cumbria NHS launched the Healthinote digital health platform to assist patients with chronic kidney disease (CKD), a condition affecting one in ten UK adults. (Source - Pharma Times)

By Product Type

By Modality

By Disease Type

By End User

By Technology

By Region

January 2026

December 2025

December 2025

December 2025