February 2026

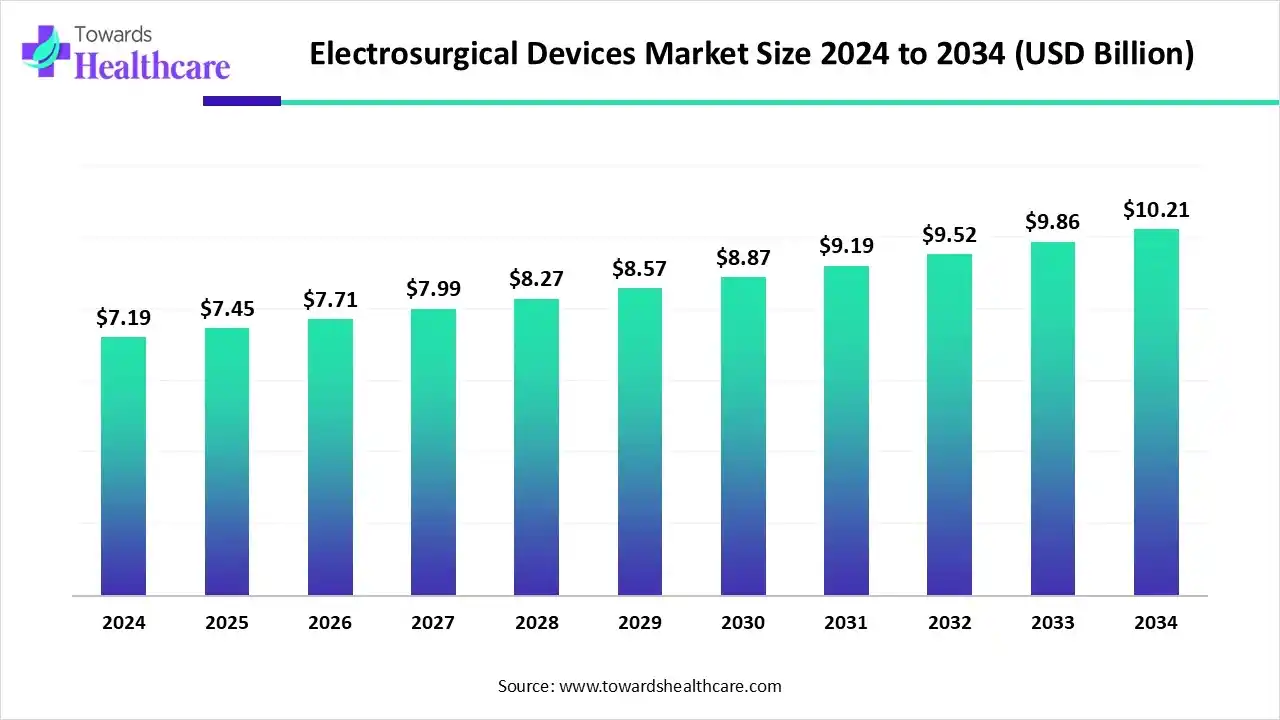

The global electrosurgical devices market size is calculated at USD 7.45 billion in 2025, grew to USD 7.71 billion in 2026, and is projected to reach around USD 10.58 billion by 2035. The market is expanding at a CAGR of 3.57% between 2026 and 2035.

The electrosurgical devices market is primarily driven by the advancements in medical technology and the rising prevalence of chronic disorders. Electrosurgical devices allow greater precision with cutting and coagulation settings. Government bodies provide funding for the development and adoption of innovative devices in healthcare organizations. Prominent players collaborate to access advanced technologies and strengthen their market position. Artificial intelligence (AI) embedded into electrosurgical devices enhances precision and accuracy. Robotic surgeries present future opportunities for market growth.

FDA Approval: Electrosurgical devices are approved by regulatory agencies to benefit patients and surgeons in the respective countries.

New Product Launches: Medical device companies launch novel electrosurgical devices to improve surgical efficiency and treat a large patient population.

Surge in Surgeries

The growing chronic diseases are increasing the number of surgeries, which is driving the demand for electrosurgical devices as a minimally invasive approach for precise cutting and coagulation.

Growing Shift Towards Outpatient Care

Due to the presence of affordable solutions, advanced devices, and skilled personnel, there is a rise in the dependence on outpatient care services, which is increasing the adoption of electrosurgical devices.

Advancing Technologies

The companies are developing various types of electrosurgical devices with bipolar vessel sealing, hybrid modalities, ultrasonic energy devices, and robotic-assisted surgical devices, which are driving their innovations.

Integrating AI and machine learning (ML) algorithms into electrosurgical devices improves their functionalities and enhances precision. AI and ML provide real-time alerts to surgeons about the energy output on the surgical site. This results in reduced complications, such as thermal injury. AI and ML can lead to more personalized treatment protocols that are tailored to individual patient needs, improving surgical efficacy and patient safety. Apart from helping surgeons, these technologies can provide realistic, scenario-based training for surgeons. This helps them develop skills in a low-risk environment.

Minimally Invasive Surgeries

The major growth factor for the electrosurgical devices market is the increasing demand for minimally invasive surgeries. Minimally invasive surgeries offer numerous benefits, such as less pain, lower complication rates, and faster recovery. Patients do not need to stay for a longer period in a hospital, saving treatment costs. Electrosurgery is the most common form of surgical energy due to its availability, low cost, and versatility. Electrosurgical devices play a critical role in minimally invasive procedures, leading to less pain and complications. They allow surgeons to operate through small incisions.

Lack of Skilled Professionals

Electrosurgical devices are difficult to operate without skilled professionals. Several underdeveloped and developing countries lack skilled professionals, reducing access to electrosurgery for patients. Lack of knowledge may result in several complications, such as the risk of thermal injury.

What is the Future of the Electrosurgical Devices Market?

The market future is promising, driven by the increasing use of robotic-assisted electrosurgery. Robotic electrosurgical devices can navigate complex anatomical structures with enhanced dexterity, leading to reduced trauma. They enhance surgical outcomes and expand the scope of minimally invasive surgeries. Robotic systems reduce manual errors and accelerate the speed of surgeries with improved accuracy. They establish long-term safety and efficacy outcomes, particularly in comparison to established ablation techniques. They also address technical limitations and optimize energy delivery parameters.

| Table | Scope |

| Market Size in 2026 | USD 7.71 Billion |

| Projected Market Size in 2035 | USD 10.58 Billion |

| CAGR (2026 - 2035) | 3.57% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Mode/Energy Type, By Surgical Application/Specialty, By End-User/Care Setting, By Distribution Channel/Business Model, By Region |

| Top Key Players | Ethicon (Johnson & Johnson), Medtronic, B. Braun/Aesculap, Olympus, ConMed, Integra LifeSciences, Stryker, Smith & Nephew, BOWA-med, Erbe Elektromedizin, Gebrüder Martin/KLS Martin, Symmetry Surgical, SurgiQuest/Lexion Medical, Smiths Medical/Teleflex, Gyrus ACMI, Aesculap |

Which Product Type Segment Dominated the Electrosurgical Devices Market?

By product type, the electrosurgical generators/units segment held a dominant presence in the market with a share of approximately 38% in 2024. This segment dominated because electrosurgical generators are essential for supplying the high-frequency electrical current for many endoscopic accessories. There are two types of electrosurgeries: bipolar and monopolar electrosurgery. Electrosurgical generators reduce blood loss through precise vessel sealing and lead to faster operating times. Novel generators are developed for use in diverse surgical procedures.

By product type, the vessel-sealing devices & advanced energy instruments segment is expected to grow at the fastest CAGR in the market during the forecast period. Vessel sealing devices operate with high pulsatile current and lower voltage energy, allowing tissue cooling during activation and adequate tissue compression. The integration of AI/ML streamlines the functions of vessel-sealing devices, facilitating the monitoring of tissue impedance. This helps surgeons to guarantee precise tissue cutting and sealing.

How the Monopolar Electrosurgery Segment Dominated the Electrosurgical Devices Market?

By mode/energy type, the monopolar electrosurgery segment held the largest revenue share of approximately 45% in the market in 2024. This is due to the high versatility and effectiveness of monopolar electrosurgery. In monopolar electrosurgery, only one electrode tip comes into contact with the body. The active electrode is placed in the entry site and is used to cut tissue and coagulate bleeding, while the return pad is attached to the patient. This enables electrical current to flow from the generator to the electrode through the target tissue.

By mode/energy type, the advanced energy segment is expected to grow with the highest CAGR in the market during the studied years. Advanced energy devices use advanced radiofrequency (RF) currents to achieve precise tissue cutting, sealing, and vaporization. They offer advantages in minimally invasive surgeries, enabling surgeons to perform surgeries with high precision and reduced tissue trauma. Advanced devices ensure patient safety and minimize interference with other medical devices.

Why Did the General Surgery Segment Dominate the Electrosurgical Devices Market?

By surgical application/specialty, the general surgery segment contributed the biggest revenue share of approximately 28% in the market in 2024. This is due to widespread applications of general surgery for any organ or system throughout the body. General surgery refers to the diagnosis, preoperative, operative, and postoperative management of several surgical types, including the management of complications. It is performed either through open or minimally invasive procedures. The increasing number of general surgeries also potentiates the demand for electrosurgical devices. Cooper and Inspira, a New Jersey hospital, performed more than 1,000 cardiac surgeries in 2024.

By surgical application/specialty, the minimally invasive & robotic-assisted segment is expected to expand rapidly in the market in the coming years. The availability of advanced equipment and the integration of electrosurgical devices into robotic platforms augment the segment’s growth. Patients mostly prefer minimally invasive surgeries due to faster recovery and reduced healthcare costs. Approximately 13 million laparoscopic surgeries are performed annually in the world.

Which End-User/Care Setting Segment Led the Electrosurgical Devices Market?

By end-user/care setting, the hospitals & surgical centers segment led the market with a share of approximately 72% in 2024. The segmental growth is attributed to the presence of favorable infrastructure and suitable capital investment. This enables hospitals and surgical centers to adopt advanced medical devices and surgical techniques. Hospitals and surgical centers possess professionals from diverse disciplines, providing multidisciplinary expertise to patients. Patients also prefer hospitals due to favorable reimbursement policies and cashless treatment.

By end-user/care setting, the ambulatory surgery centers segment is expected to witness the fastest growth in the market over the forecast period. Ambulatory surgery centers are gaining traction due to the availability of advanced technologies and the presence of skilled professionals. They provide outpatient treatment to patients, eliminating the need to stay overnight. This saves exorbitant healthcare costs and enables patients to receive personalized treatment.

What Made Direct Sales the Dominant Segment in the Electrosurgical Devices Market?

By distribution channel/business model, the direct sales segment accounted for the highest revenue share of the market in 2024. This is due to the availability of cost-effective devices and the demand for high-end generators. Hospitals sign a contract with original equipment manufacturers (OEMs) to receive high-quality devices without the mediation of distributors/wholesalers. This enables hospitals to keep a stock of devices based on their usage.

By distribution channel/business model, the consumable annuity/subscription models segment is expected to show the fastest growth over the forecast period. Subscription models are widely preferred due to shifting trends from the pay-per-use model to the pay-for-access model. This enables OEMs to generate recurring revenue from single-use tips, electrodes, and pads. OEMs provide customized services and access to upgraded technology.

North America dominated the global market with a share of approximately 35-38% in 2024. The market is driven by the availability of state-of-the-art healthcare infrastructure, the presence of key players, and the increasing adoption of advanced technologies in the U.S. and Canada. The rising healthcare expenditure and growing demand for personalized treatment boost the market. Government and private organizations provide funding for the research and manufacturing activities of electrosurgical devices.

U.S. Market Trends

The American Hospital Association reported that over 34 million people were admitted to hospitals in 2023. Around 50 to 60 million surgeries are performed annually in the U.S. Key players, such as Conmed Corporation, Boston Scientific Corporation, and Johnson & Johnson, are the major contributors to the market in the U.S.

Canada Market Trends

It is estimated that more than 2.3 million surgeries are performed in Canada annually. Approximately 44% of adults in Canada suffer from at least one chronic disease, accounting for 67% of all deaths. Companies like ValueMed Pharma, The Stevens Company, and Med-Equip provide high-quality electrosurgical devices to Canadians.

Asia-Pacific is expected to grow at the fastest CAGR in the electrosurgical devices market during the forecast period. The increasing number of surgeries in China, India, and Southeast Asia, due to the rising prevalence of chronic disorders, potentiates the demand for electrosurgical devices. The burgeoning healthcare sector and rapid hospital expansion facilitate market growth. Asia-Pacific countries have a suitable manufacturing infrastructure, allowing foreign companies to set up their manufacturing facility. Government bodies launch initiatives to encourage indigenous manufacture of electrosurgical devices.

Europe is expected to grow significantly in the electrosurgical devices market during the forecast period, due to growth in the surgical volume. The presence of advanced healthcare infrastructure is also increasing their adoption rates, where the growing shift toward minimally invasive products is also increasing their demand. Increasing chronic diseases and technological advancements are also promoting their use, enhancing the market growth.

UK Electrosurgical Devices Market Trends

The UK consists of well-developed healthcare systems that promote the use of electrosurgical devices during surgical procedures. The growing chronic disease and geriatric population are also increasing their demand. Furthermore, growing focus on patient safety and increasing innovations are also encouraging their use and advancements.

South America is expected to grow significantly in the electrosurgical devices market during the forecast period, due to expanding healthcare infrastructure, which is increasing the adoption of advanced surgical tools like electrosurgical devices. The growing geriatric population and diseases are increasing the number of surgeries, driving their demand. Moreover, growing medical tourism and government initiatives are also promoting the market growth.

Brazil Electrosurgical Devices Market Trends

The growing number of surgical procedures in Brazil are increasing the adoption of the electrosurgical devices. The growth in healthcare investments and government initiatives are also increasing their use, where the rising disease burden and shift towards the use of advanced surgical technologies are also increasing their use.

Researchers focus on developing novel electrosurgical devices embedded with AI and ML technologies and sensors, allowing real-time monitoring of surgical complications.

Key Players: Johnson & Johnson, Erbe Elektromedizin GmbH, and Syensqo.

Clinical trials are conducted to assess the safety and efficacy of innovative electrosurgical devices on humans, as well as to compare the efficacy of electrosurgical devices with conventional devices.

Key Players: Eppendorf SE, SurgiQuest, Inc., and Medtronic.

Patients benefit from electrosurgical devices through preoperative, intraoperative safety measures, and postoperative patient care. Healthcare professionals provide direct technical support to patients.

| Companies | Headquarters | Electrosurgical Devices |

| Medtronic | Dublin, Ireland | Valleylab generators, Cool-tip ablation systems, and LigaSure Vessel sealing systems |

| Ethicon | Ohio, U.S. | HARMONIC ultrasonic devices, Megadyne generators, and ENSEAL advanced bipolar tissue sealers |

| Olympus | Tokyo, Japan | Thunderbeat hybrid energy platforms and ESG-400 electrosurgical generators |

| CONMED | Florida, U.S. | System 5000 generators, various monopolar/bipolar handpieces, and AirSeal iFS systems |

| Erbe Elektromedizin | Tubingen, Germany | VIO workstation, APC systems, and BiClamp instruments |

Natalie Dragunat, Global Marketing Manager of Healthcare at Syensqo, commented that brands like Radel and Udel have helped advance medical technologies for decades. The company is extending its legacy with the introduction of medical-grade Amodel PPA, giving customers a new option for devices that must withstand modern assembly processes.

By Product Type

By Mode/Energy Type

By Surgical Application/Specialty

By End-User/Care Setting

By Distribution Channel/Business Model

By Region

February 2026

February 2026

February 2026

February 2026