February 2026

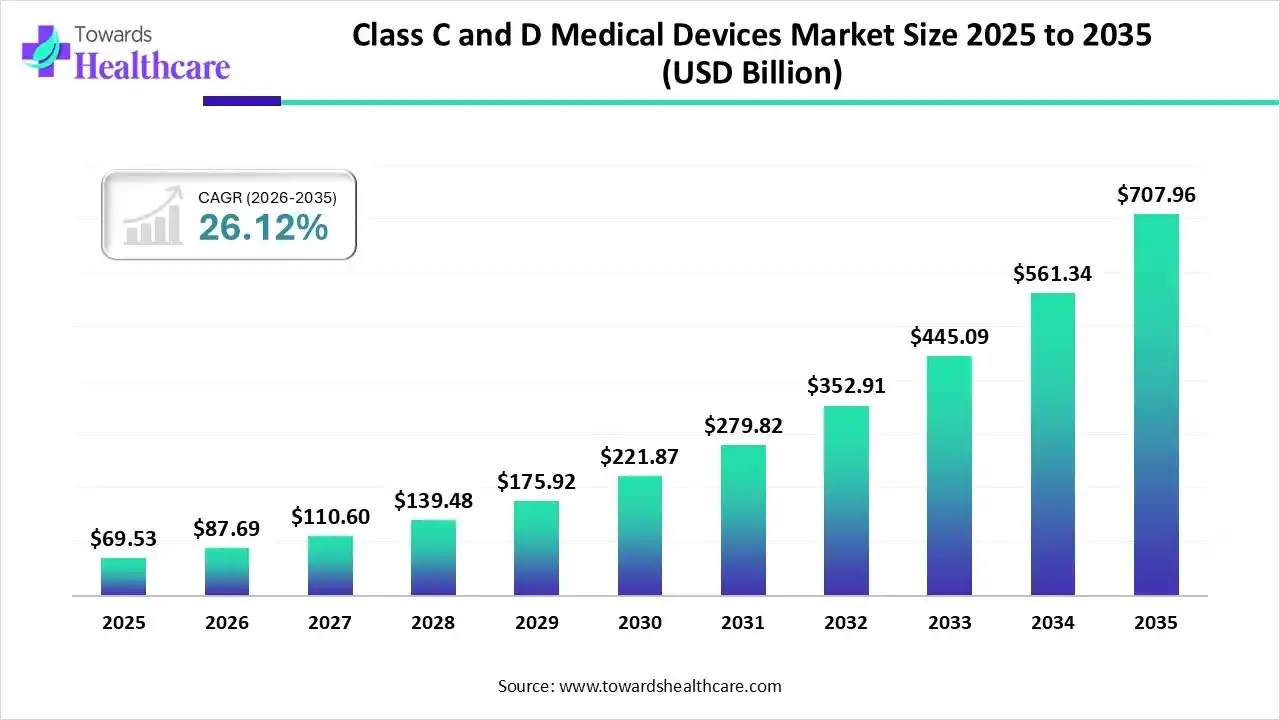

The global Class C & Class D medical devices market size recorded US$ 69.53 billion in 2025, set to grow to US$ 87.69 billion in 2026 and projected to hit nearly US$ 707.96 billion by 2035, with a CAGR of 26.12% throughout the forecast timeline.

The Class C & Class D medical devices market is expanding rapidly due to the increasing prevalence of chronic diseases, rising surgical procedures, and growing demand for high-risk, life-saving medical equipment. Advanced technologies, regulatory approvals, and rising healthcare expenditures are driving adoption in hospitals and specialty clinics. Additionally, emerging markets with improving healthcare infrastructure and heightened awareness of advanced medical devices contribute to steady market growth globally, making it a key segment in the medical devices industry.

Industry Growth Overview: The Class C and Class D medical devices industry is experiencing robust growth, driven by rising demand, Increased government initiatives, investments in healthcare infrastructure, and a focus on innovation in advanced diagnostic and therapeutic devices, which are shaping the market’s expansion globally. Emerging economies with improving healthcare access are contributing significantly to the industry’s growth trajectory.

Sustainability Trends: Sustainability trends in the medical devices market focus on eco-friendly manufacturing, including the use of biodegradable materials and energy-efficient production processes. Companies are also emphasizing device recyclability and reducing medical waste to minimize environmental impact while maintaining high safety and performance standards.

Major Investors: Leading investors include venture capital firms, private equity funds, and healthcare-focused investment companies seeking high-growth opportunities in advanced medical technology. Governments and international health organizations also provide funding to support innovation and infrastructure development in critical care devices.

Startup Ecosystem: The startup ecosystem for Class C and Class D medical devices is rapidly evolving, with early-stage companies focusing on AI-powered diagnostics, smart implants, and minimally invasive devices. Incubators, accelerators, and healthcare innovation hubs are providing mentorship, funding, and regulatory support to help these startups scale globally.

Blooming Diagnostic and Therapeutic Options: Due to growing disease burden, there is a rise in the development of advanced diagnostics and therapeutic options, which is driving the demand and adoption of class C and class D medical devices.

Growing Shift Towards Personalized Solutions: The growing health awareness is increasing the demand for personalized solution which is driving the development of personalized implants and telehealth integrated devices.

Technologies Advancements: To offer advanced solutions and improve patient outcomes, different types of smart medical devices, wearable technologies, and point-of-care devices are being developed.

AI can transform the Class C & Class D medical devices market by enabling smarter, data-driven diagnostics, predictive maintenance, and real-time patient monitoring. Integration of AI enhances device accuracy, reduces errors, and improves clinical outcomes. Additionally, AI supports the development of personalized treatment solutions, optimizes device performance, and streamlines regulatory compliance and manufacturing processes, ultimately driving efficiency, adoption, and innovation in high-risk, life-saving medical equipment globally.

In July 2023, Abbott announced that the FDA approved the AVEIR™ dual-chamber (DR) leadless pacemaker, the first system of its kind to provide dual-chamber pacing for patients with slow or irregular heart rhythms. Since over 80% of pacemaker patients require pacing in both the right atrium and ventricle, this approval greatly expands access to leadless pacing across the U.S. Dr. Vivek Y. Reddy of Mount Sinai Hospital highlighted that this innovation “adds dual-chamber leadless pacing to the list of technological achievements in modern medicine, improving treatment options for millions of patients.”

Rising Prevalence of Chronic and Critical Illnesses

The increasing incidence of chronic and critical illnesses fuels the class C and D medical devices market by creating a higher need for specialized equipment in intensive care and emergency settings. Rising patient populations, longer life expectancy, and more complex treatment protocols push healthcare facilities to adopt advanced monitoring and therapeutic devices, driving market demand and supporting continuous growth and technological innovation in high-risk medical equipment.

For Instance,

Stringent Regulatory Requirement

Strict regulatory requirements limit the Class C & Class D medical devices market by creating high entry barriers for manufacturers. Compliance with complex approval processes, detailed documentation, and region-specific standards can slow product development and increase operational costs. Smaller companies may struggle to meet these regulations, reducing competition and innovation. Additionally, delays in regulatory clearance can hinder the timely availability of advanced medical devices for patients in need.

Technological Advancements

Technological advancements in Class C and Class D medical devices create future opportunities by improving device accuracy, safety, and functionality. Smart implants, wearable monitoring systems, and connected healthcare devices simplify patient management and streamline clinical workflows. Enhanced ease of use reduces training requirements and operational errors, making devices more accessible in both hospitals and home-care settings. These innovations open new markets and applications, positioning the sector for sustained growth in advanced, high-risk medical equipment.

For Instance,

| Table | Scope |

| Market Size in 2026 | USD 87.69 Billion |

| Projected Market Size in 2035 | USD 707.96 Billion |

| CAGR (2026 - 2035) | 26.12% |

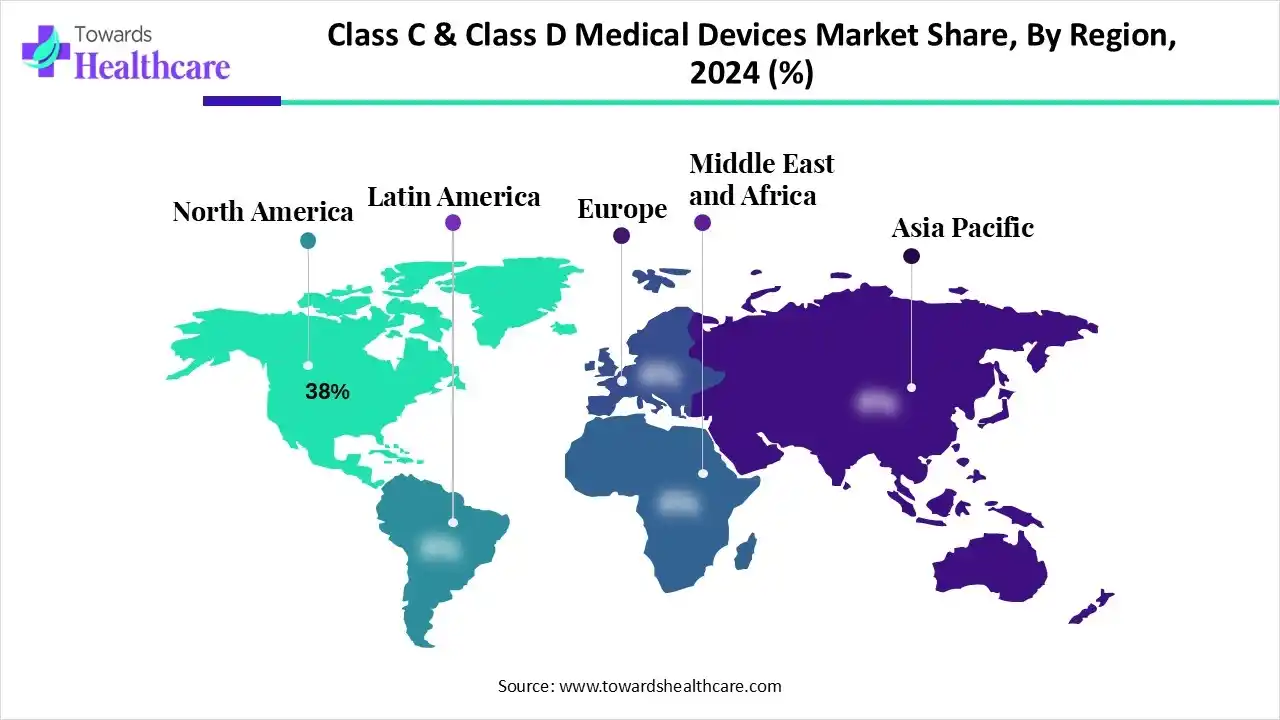

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Clinical Application / Indication, By Technology / Platform, By End User / Buyer, By Business Model / Revenue Stream, By Region |

| Top Key Players | Siemens Healthineers, Becton Dickinson (BD), bioMérieux, Qiagen, Illumina, Bio-Rad Laboratory, Ortho Clinical Diagnostics, DiaSorin (Luminex), Grifols, PerkinElmer, Sysmex Corporation, Agilent Technologies, Cepheid, Mologic, plus regional specialized QC, screening suppliers. |

How does the Reagents & Kits Segment dominate the Market in 2024?

In 2024, the reagents & kits segment held the largest class C & class D medical devices market share with the revenue shares of approximately 58%, due to their high usage in diagnostic tests, frequent need for replenishment, and compatibility with a wide range of devices. Their critical role in ensuring accuracy, quick turnaround time, and cost-effectiveness further supported demand. Additionally, growing adoption of molecular and immunoassay testing in hospitals, laboratories, and research facilities drove continuous consumption, making reagents and kits indispensable for routine and specialized diagnostic procedures.

The instruments & systems segment is expected to expand rapidly due to the growing adoption of point-of-care solutions and portable devices that support quicker clinical decisions. Rising emphasis on personalized treatment and integration of connected systems with hospital infrastructure is driving their acceptance. Moreover, manufacturers are focusing on compact, user-friendly designs and interoperability features, making them more practical for varied healthcare settings, including emergency care and remote facilities, thereby fueling strong growth during the forecast period.

Why Did the Blood Transfusion & Door Screening Segment Dominate the Market in 2024?

In 2024, the blood transfusion & donor screening segment dominated the class C & class D medical devices market with the revenue shares of approximately 34%, as global blood donation drives and awareness campaigns significantly boosted donor participation. The expansion of accredited blood banks and cross-border collaborations for plasma exchange enhanced demand for advanced screening solutions. Furthermore, increasing reliance on automated systems for faster and error-free donor testing supported efficiency and trust, making this segment a key revenue leader in the market.

The oncology companion diagnostics segment is expected to expand quickly as healthcare systems increasingly focus on early and accurate disease detection. In 2024, the rising use of genomic and molecular profiling in hospitals enabled clinicians to select safer, more effective treatments for complex cases. Additionally, supportive reimbursement policies and integration of digital health tools have enhanced accessibility, making companion diagnostics a vital component in improving patient outcomes and reducing trial-and-error in treatment approaches.

How does the PCR/molecular Amplification Platforms Segment Dominate the Market?

In 2024, the PCR/molecular amplification platforms segment led the class C & class D medical devices market with the revenue shares of approximately 50%, as they became central to expanding point-of-care diagnostics and decentralized testing models. Their ability to process small sample volumes with high precision made them suitable for use in emergency care, remote locations, and resource-limited settings. Additionally, ongoing integration with portable instruments and user-friendly kits increased accessibility for non-specialist users, strengthening their role as a backbone technology for rapid and scalable molecular testing worldwide.

The next-generation sequencing (NGS) segment is anticipated to grow quickly as demand rises for high-throughput, precise genetic analysis in clinical and research settings. Innovations in library preparation, bioinformatics, and portable sequencing devices are making NGS faster and easier to implement. Additionally, expanding applications in population genomics, pathogen surveillance, and targeted therapies are encouraging adoption across hospitals, diagnostic labs, and academic institutions, positioning NGS as a leading technology in advanced molecular diagnostics.

What made the Blood Banks & Transfusion Services Segment Dominant in the Market in 2024?

In 2024, the blood banks & transfusion services segment led the class C & class D medical devices market with the revenue shares of approximately 36%, as they played a pivotal role in supporting emergency care, disaster response, and routine hospital transfusions. Increasing collaborations with hospitals, NGOs, and government health programs improved blood collection and distribution efficiency. The adoption of automated inventory management and advanced pathogen screening technologies further enhanced operational effectiveness, ensuring reliable and safe blood supplies, which reinforced this segment’s dominance in market revenue.

The oncology centers & pharma/clinical-trial labs segment is projected to grow rapidly due to rising investment in targeted cancer therapies and precision medicine programs. Expansion of specialized cancer treatment facilities, coupled with increased outsourcing of clinical trials to advanced labs, drives the demand for high-end diagnostic and sequencing technologies. Additionally, the integration of automated and AI-enabled testing systems allows faster and more accurate results, making these end users key contributors to market growth during the forecast period.

Why Did the Test Kits & Consumables Segment Dominate the Market in 2024?

In 2024, the test kits & consumables segment led the class C & class D medical devices market with the revenue shares of approximately 58%, as they provide cost-effective, ready-to-use solutions that simplify diagnostic procedures. Their widespread application across point-of-care testing, research studies, and preventive health programs ensured steady demand. Frequent replenishment cycles and growing adoption in emerging markets further strengthened revenue streams, while innovations in miniaturized and multiplexed kits increased efficiency and accessibility, making this segment a primary contributor to overall market share.

The service, validation, & QC contracts segment is projected to expand rapidly as laboratories and hospitals seek expert support for maintaining compliance with evolving regulations and standards. Increasing reliance on outsourced technical services for instrument calibration, software updates, and performance monitoring reduces operational risks and ensures accuracy. Moreover, the rising complexity of advanced diagnostic and molecular platforms drives demand for specialized service agreements, making this segment a fast-growing revenue stream in the medical devices and diagnostics market.

In 2024, North America led the class C & class D medical devices market with the revenue shares of approximately 38%, owing to the widespread availability of specialized hospitals and advanced clinical laboratories. High investment in healthcare technology, rapid integration of AI and digital solutions, and collaborations between manufacturers and research institutions drove adoption. Moreover, growing patient awareness and demand for precision therapies, along with strong support for medical innovation from both public and private sectors, reinforced the region’s dominance in the high-risk medical devices segment.

U.S. Class C & Class D Medical Devices Market Trends

In 2024, notable medical device launches included the Altius Direct Electrical Nerve Stimulation System and Mynx Control Venous Vascular Closure Device, alongside AI-powered diagnostic tools like Olympus’s CADDIE, CADU, and SMARTIBD (CE-marked in Europe). Key industry trends involved the growing adoption of digital and wearable technologies, developments in AI-driven manufacturing, the influence of weight-loss drugs, and the WHO’s MeDevIS platform, aimed at enhancing global access to medical devices.

Canada Class C & Class D Medical Devices Market Trends

In July 2024, Health Canada issued SOR/2024-136, amending the Food and Drug Regulations and Medical Device Regulations to modernize the regulatory framework for recalls and establishment licenses, while addressing innovations in medical technology and emerging challenges like COVID-19. These amendments, effective December 14, 2024, introduce new reporting requirements for drug and medical device recalls, enhancing safety oversight and compliance across Canada.

Asia-Pacific is projected to grow fastest as governments and the private sector increasingly focus on modernizing healthcare facilities and improving patient care. Rising medical tourism, expanding clinical research activities, and growing demand for advanced diagnostics and therapeutic devices in urban and semi-urban areas drive adoption. Additionally, the presence of a large patient pool, increasing awareness of high-risk medical devices, and collaborations between local and international manufacturers are accelerating the uptake of Class C and Class D medical devices across the region.

China Market Trends

China is experiencing a rapid growth in the healthcare infrastructure, which is increasing the adoption of advanced medical devices. The growing chronic diseases and health awareness are also increasing their demand, where the growing government initiatives are also supporting their advancements.

Europe is expected to grow significantly in the class C and class D medical devices market during the forecast period, due to the presence of an advanced healthcare infrastructure. The growing geriatric population and technological advancements are also increasing the adoption and innovations of various medical devices. The growing government initiatives and increasing chronic diseases are also driving their demand, which is enhancing the market growth.

UK Market Trends

Due to a rise in the geriatric population and incidences of chronic disease across the UK, the demand for class C and class D medical devices is increasing. The presence of well-developed healthcare systems and growing R&D actives are also increasing their adoption, where companies are also developing advanced devices.

South America is expected to grow significantly in the class C and class D medical devices market during the forecast period, due to growing chronic diseases, which are increasing the demand for their accurate diagnostic devices. The expanding healthcare are growing geriatric population are also increasing their adoption rates. Additionally, increasing government initiatives and medical tourism are also encouraging their use, promoting the market growth.

Brazil Market Trends

The growing advancements in the healthcare sector across Brazil are increasing the adoption of a wide range of class C and class D medical devices. The growing incidences of cancer, cardiovascular diseases, and diabetes are also increasing the demand for their diagnostic devices. Furthermore, blooming medical tourism, government initiatives, and healthcare investment are also increasing their use.

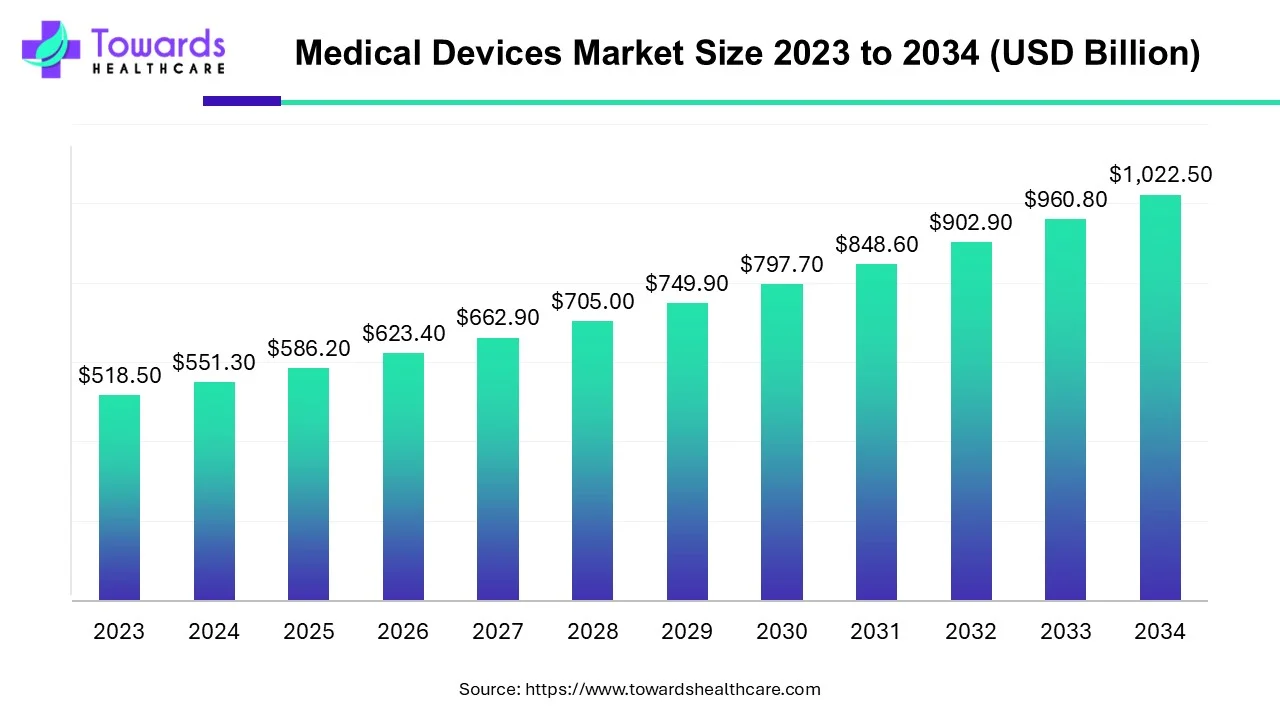

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

Global clinical trials for the market require compliance with diverse regulatory standards across countries.

These studies often involve multiple international sites to ensure safety, effectiveness, and timely patient enrollment, while focusing on data that meets the requirements of major regulators such as the FDA in the U.S. and EU authorities.

Packaging and serialization standards for the market differ across regions, emphasizing patient safety, maintaining product quality, and enabling traceability throughout the supply chain.

Patient support for Class C and D medical devices is regulated, requiring manufacturers to provide clear usage instructions, conduct post-market monitoring, and adhere to strict clinical and risk assessment standards to ensure safety.

By Product Type

By Clinical Application / Indication

By Technology / Platform

By End User / Buyer

By Business Model / Revenue Stream

By Region

February 2026

February 2026

February 2026

February 2026