February 2026

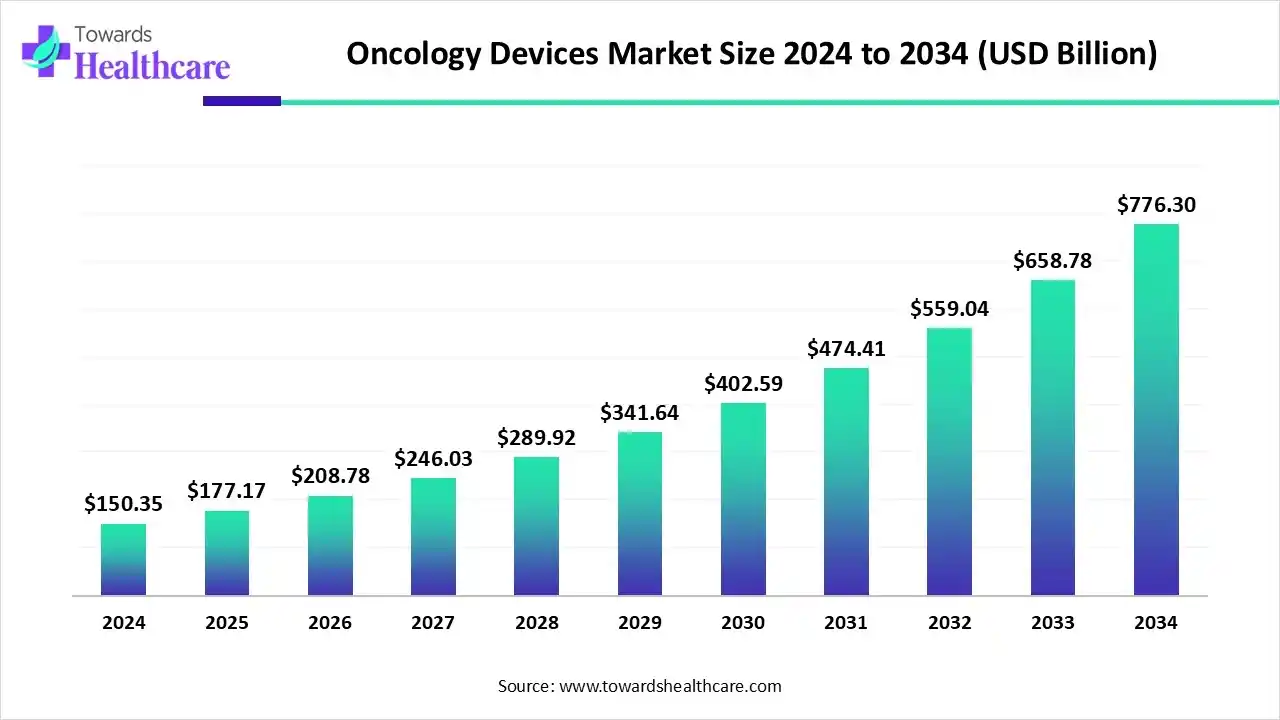

The global oncology devices market size is calculated at US$ 150.35 billion in 2024, grew to US$ 177.17 billion in 2025, and is projected to reach around US$ 776.3 billion by 2034. The market is expanding at a CAGR of 17.84% between 2025 and 2034.

The U.S. Food and Drug Administration (FDA) approved several medical devices, which are products from the newest medical technologies and are approved for specialized medical uses. The oncology devices market is experiencing massive growth due to the significant efforts of certain organizations. These include the Oncology Center of Excellence (OCE), which supports clinical projects in oncology to improve the development of oncology products for the benefit of people with cancer. The OCE introduced the Project Catalyst initiative, which has resulted in the expansion of educational resources across small pharmaceutical companies and academic life science centers to support informed anticancer therapy development.

| Table | Scope |

| Market Size in 2025 | USD 177.17 Billion |

| Projected Market Size in 2034 | USD 776.3 Billion |

| CAGR (2025 - 2034) | 17.84% |

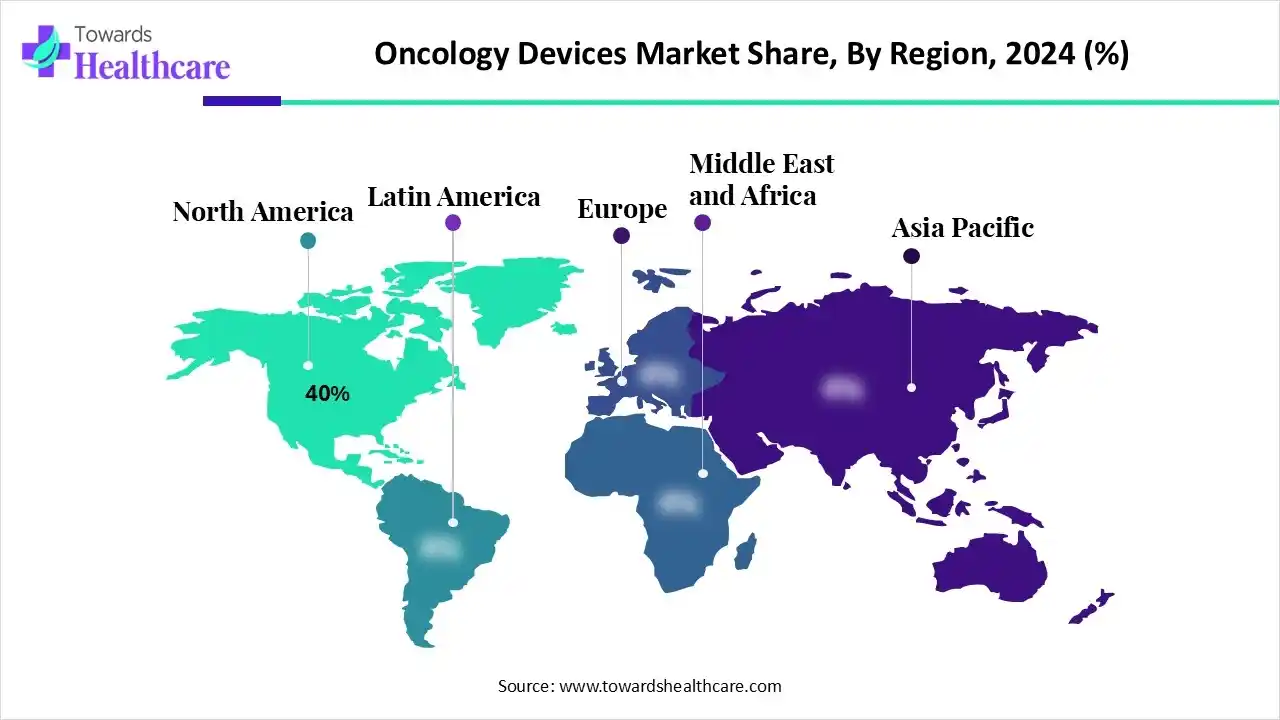

| Leading Region | North America by 40% |

| Market Segmentation | By Device & Product Type, By Clinical Application/Indication, By Procedure Type/Care Pathway, By End-User/Buyer, By Region |

| Top Key Players | Varian, Elekta, Accuray, ViewRay, Siemens Healthineers, GE Healthcare, Philips, Canon Medical Systems, Intuitive Surgical, Medtronic, Boston Scientific, Johnson & Johnson, Hologic, AngioDynamics, Terumo, Cook Medical, Merit Medical, Becton Dickinson, Stryker, Olympus |

The major surge in oncology equipment is driven by surgical and imaging devices, diagnostics and laboratory tests, radiation, nuclear medicine, and targeted therapy delivery. The oncology devices market comprises medical devices, instruments, systems, consumables, and software used for the detection, diagnosis, image-guided intervention, local tumour ablation, radiation treatment, surgical resection, and post-treatment management of cancer. It includes diagnostic imaging and biopsy tools, pathology, and molecular-diagnostic platforms where device-driven, image-guided interventional oncology (catheters, ablation systems, embolization), surgical systems and robots, radiation-therapy platforms (external beam, brachytherapy, planning & delivery software), and disposables/consumables and support services used across hospitals, cancer centres, and outpatient specialty clinics.

In October 2024, UK Research and Innovation announced £118 million funding through which new medical technologies like AI models and scanners will be trialled in the UK to diagnose cancer.

AI/ML tools allow early detection of cancer, computer-aided detection, diagnosis, triage, and assessment. AI helps clinicians and researchers with diagnostic precision, prioritizing critical cases, and guiding treatment decisions. MRIs and CT scans are advances in AI-assisted imaging and analysis of imaging, which strongly impact the early detection of cancer.

| Sr. No. | Strategic framework | Success Rate |

| 1 | R&D | 12% of net sales in R&D investments |

| 2 | Sourcing & Manufacturing | 45% of suppliers are targeted to engage in emission reduction efforts for climate action. |

| 3 | Aftermarket & Service | 43% of net sales in services. |

| 4 | Marketing & Sales | More than 120 countries with an installed base. |

The radiation therapy systems segment dominated the market with a revenue of approximately 28% in 2024, owing to their crucial role in oncology, from initial treatment planning, precise delivery of radiation, and detailed quality assurance. Quality assurance systems are critical parts of radiation therapy, which help in systematic protocols, audits, peer review, and verification. These systems help in targeting the tumor while reducing damage to surrounding healthy tissues.

The diagnostic imaging systems segment is expected to grow at the fastest CAGR in the market during the forecast period due to the efficient role of these systems in screening, early detection, diagnosis, and treatment planning. They help in guiding treatments, monitoring treatment response, and detecting recurrence of cancer. These emerging technologies have wide applications in molecular imaging, which enable doctors to understand tumor biology at a molecular level and allow for more personalized therapies.

The solid tumor external radiation segment dominated the market with a revenue of approximately 40% in 2024, owing to the assistance of these devices in treatment planning, simulation, radiation delivery, and protection of healthy tissues. The images obtained from MRI, CT scans, and PET scans are helpful to radiologists and oncologists in developing a customized treatment plan. Radiation can be performed in combination with other treatments like chemotherapy and immunotherapy to increase the effectiveness of treatments.

The interventional oncology segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the expanding role of cancer devices in guiding treatments and combination therapies. These devices and technologies include medical imaging systems, AI, robotics, and image fusion technology. The interventional oncology devices enable localized and targeted cancer treatments.

The curative/definitive external beam radiation procedures segment dominated the market with a revenue of approximately 35% in 2024, owing to the increased utilization of advanced oncology devices to offer high doses of radiation for treating tumors and eliminating cancer. The various oncology equipment is used in primary treatment, neoadjuvant therapy, adjuvant therapy, and combined modality therapy. There is an expansion of modern techniques for curative procedures, which include image-guided radiation therapy, intensity-modulated radiation therapy, etc.

The oncologic surgeries segment is anticipated to grow at a notable rate in the market during the upcoming period due to the huge adoption of robotic surgical systems, minimally invasive surgical tools, and ablation systems. Moreover, the increased adoption of intraoperative imaging and pre- and post-operative monitoring devices raised the need for infusion pumps and wearable technology. These devices enable surgeons to precisely diagnose, remove, and treat cancerous tissues with minimally invasive techniques.

The hospitals & comprehensive cancer centers segment dominated the market with a revenue of approximately 62% in 2024, owing to the critical role of CT scans, MRI scans, PET-CT scans, ultrasound, and biopsy devices in healthcare systems. They are widely applicable in radiation therapy, surgical oncology, etc. The huge adoption of robotic surgery, tumor-sensing technology, and supportive devices drives the importance of technological modernization in healthcare and cancer care.

The ambulatory surgical centers (ASCs) & outpatient oncology clinics segment is predicted to grow at a rapid rate in the market during the studied period due to the significance of image-guided surgery, minimally invasive surgical tools, biopsy systems, and robotic surgical systems. The wide utilization of chemotherapy infusion devices and external beam radiation therapy devices drives the growth of outpatient oncology clinics. There is a rapid shift towards more efficient, cost-effective, and convenient outpatient treatment.

North America dominated the market share by 40% in 2024, owing to supportive healthcare infrastructure, high healthcare spending, and favorable regulatory policies. Government programs related to oncology medical appliances in North America include research funding initiatives, changes to access and coverage policies, and pilot programs for technology review. Certain initiatives by public and private organizations aim to increase awareness about cancer prevention, screening, and treatment options, which boost the demand for diagnostic devices. The public and private funding, and R&D investments, support innovations in oncology. These significant efforts led to the development of innovative therapies and devices.

The U.S. holds a strong presence of research institutes and government organizations such as the National Cancer Institute (NCI), the Oncology Center of Excellence (OCE), Informatics Technology for Cancer Research (ITCR), and many others. They provide funding opportunities, bioengineering research grants, partnerships, and AI-based clinical decision support. Certain programs launched by the OCE include FDA-OCE programs, Oncology Specific AI initiative, Review of Diagnostic Tests, and Project Confirm, which are intended for technologies in oncology and patient care.

Abbott Laboratories is the leading medical device manufacturer that has expanded its presence in Canada through the launch of the first dual-chamber leadless pacemaker system, named AVEIR DR, in this country. The national research programs and robust R&D of new cancer-related technologies are supported by the government-funded bodies like the Canada Foundation for Innovation (CFI) and the Canadian Partnership Against Cancer (CPAC). The large-scale federal government programs focus on bringing oncology devices into the Canadian market.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the rising cancer prevalence, technological advancements, and improved healthcare infrastructure. Several Asian Pacific countries implement and streamline regulatory pathways for medical devices, which boosts the review and approval process for new oncology devices. The pharmaceutical companies and medical device manufacturers in India and China are investing in R&D to accelerate innovations in oncology technologies. There is an increased demand for screening and treatment devices in the Asia Pacific due to the rising awareness of cancer prevention and treatment options among the public and patients. The public-private partnerships and government initiatives are making efforts to improve healthcare accessibility and affordability, particularly in developing economies.

The R&D process for oncology devices encompasses key stages such as discovery and conceptualization, design and development, clinical research, regulatory review and approval, and post-market surveillance.

Key Players: Medtronic, Johnson & Johnson, GE HealthCare, and Siemens Healthineers.

Distributors play a crucial role in the management of complex supply chains that are driven by evolving healthcare needs and technological innovation.

Key Players: AmerisourceBergen, Cardinal Health, McKesson, Medtronic, Johnson & Johnson MedTech, Siemens Healthineers.

The holistic and personalized support focuses on the patient’s experience, customized care, and addresses psychosocial needs.

Key Players: Medtronic, Johnson & Johnson MedTech, Siemens Healthineers, Boston Scientific.

By Device & Product Type

By Clinical Application/Indication

By Procedure Type/Care Pathway

By End-User/Buyer

By Region

February 2026

February 2026

February 2026

February 2026