February 2026

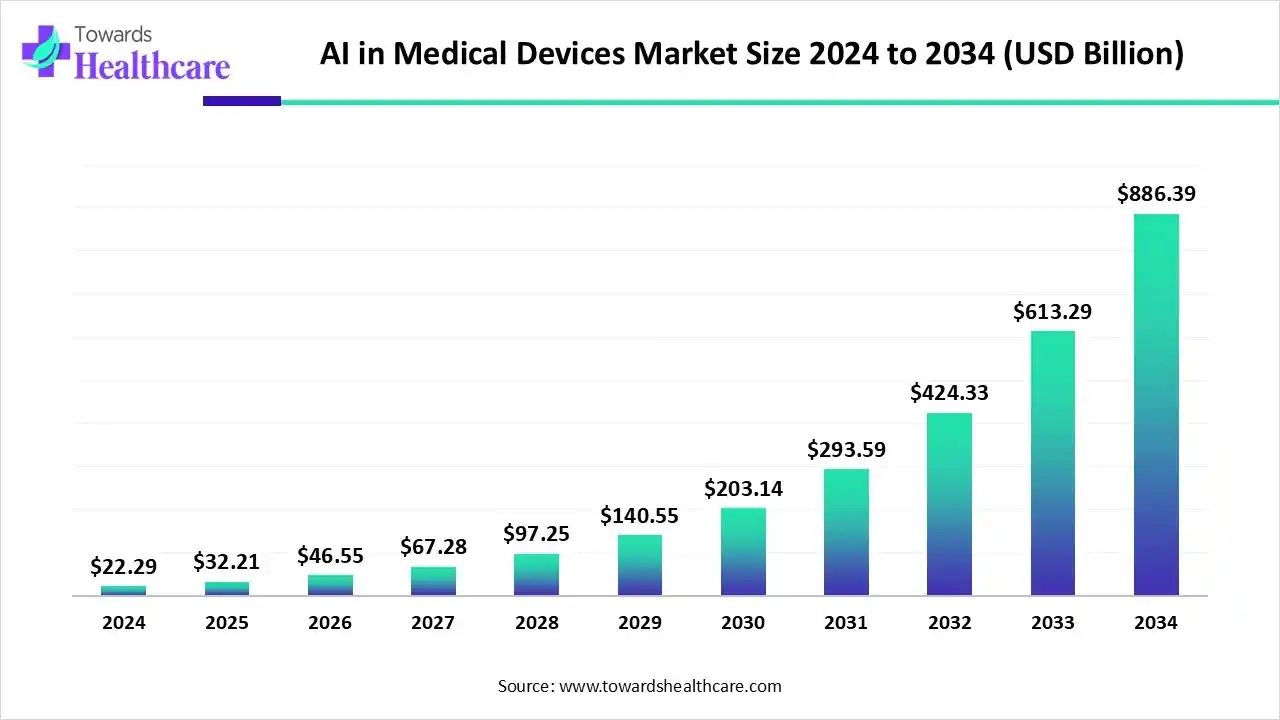

The global AI in medical devices market size is calculated at US$ 22.29 billion in 2024, grew to US$ 32.21 billion in 2025, and is projected to reach around US$ 886.39 billion by 2034. The market is expanding at a CAGR of 44.53% between 2025 and 2034.

The significant countries, like China and India, are facing a rise in the burden of an aging population and the greater cases of chronic/severe health concerns, which are supporting the comprehensive expansion of global AI in the medical devices market. Moreover, ongoing digitalization in the healthcare sector is boosting the usage of AI algorithms, especially machine learning & deep learning. These advances are further accelerating efficient and early disease detection, leveraging precise accuracy and enhanced patient safety. Nowadays, companies are widely involved in the progress of wearable devices for enhancing user-friendliness.

| Table | Scope |

| Market Size in 2025 | USD 32.21 Billion |

| Projected Market Size in 2034 | USD 886.39 Billion |

| CAGR (2025 - 2034) | 44.53% |

| Leading Region | North America |

| Market Segmentation | By Component, By Technology, By Device Type, By Application, By Functionality, By Region |

| Top Key Players | Fujifilm Holdings Corporation, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings, Inc., Samsung Medison, IBM Watson Health, Intel Corporation, NVIDIA Corporation, Aidoc, Butterfly Network, Inc. |

The AI in medical devices market refers to the integration of artificial intelligence technologies such as machine learning, deep learning, natural language processing, and computer vision into diagnostic, monitoring, surgical, imaging, and therapeutic medical devices. The market is driven by the growing demand for precision medicine, faster diagnostics, and cost-efficient healthcare delivery, alongside regulatory approvals of AI-powered devices. These AI-enabled devices enhance clinical decision-making, automate workflows, improve diagnostic accuracy, and support personalized treatment plans.

Enhancements in Data Analytics & Precision Solutions

A prominent catalyst in the AI in medical devices market is the widespread benefits of AI in the analysis of large volume patient data, which comprises genomics and lifestyle factors, to offer the development of customized treatment strategies. Alongside the emergence of AI algorithms, especially machine learning, in the study of X-rays, MRIs, and CT scans, there is an expanding accuracy and a lowering misdiagnosis rate. Whereas, in the case of medical data, AI-enabled solutions are allowing innovations in devices to boost data management, predictive analytics, and clinical decision support.

Concerns in Data Privacy

As AI is widely involved in the data management approaches, it raises a concern regarding the protection of patients’ sensitive data. Stringent regulations, mainly HIPAA & GDPR, are demanding to adhere to their regulations and defense against advanced cyberattacks like ransomware and adversarial attacks.

Prospective Application in Remote Solutions

The global AI in medical devices market is pushing its broader contribution in developing remote solutions, particularly smart wearable technology. This solution will facilitate AI-powered continuous, real-time monitoring of vital signs and health metrics, to address possible concerns by early warnings & leverage preventive actions. Along with this, AI algorithms will have a vital role in remote patient monitoring and virtual consultations by offering personalized recommendations to accelerate accessibility and efficiency of remote healthcare. However, AI-enabled prosthetics and exoskeletons will support in managing patients' movements, aiding in rehabilitation, and assisting them in regaining mobility and independence.

The software segment held the biggest share of the global market in 2024. The segment is mainly propelled by the growing need for expanded diagnostic accuracy, precision medicine, and operational effectiveness within healthcare systems. Current inclusion of NVIDIA provides scalable computing power for creating and deploying AI models in healthcare settings. The contribution of SiMD supports the control of a device's core function and Software as a Medical Device (SaMD), which helps in performing a medical purpose independently.

Moreover, the services segment is anticipated to register the fastest growth. This segment encompasses diverse services, such as consulting, maintenance, integration, and training. Nowadays, AI is increasingly boosting the analysis of medical images for greater accuracy, as well as AI chatbots for patient communication, and AI-enhanced platforms are being leveraged to streamline the administrative tasks, minimize diagnostic times, and expand regulatory compliance through data analysis. Day by day, AI is accelerating its services in robotic-assisted surgery and remote patient monitoring solutions.

In the AI in medical devices market, the machine learning (ML) segment registered dominance in 2024. ML possesses its crucial role in the analysis of huge datasets, the reduction of diagnostic errors, and boosting earlier detection approaches. Recent examples include Optellum’s mammography for breast cancer detection, the Red Dot system from Behold.ai for CT scans, and other companies' latest innovations, especially smart wearables. These wearable solutions & biosensors are continuously monitoring critical signs and supporting the predictive analysis.

Whereas the deep learning segment will expand rapidly in the coming era. Majorly, the rising availability of big data and wider demand for tailored approaches are impacting the global adoption of this technology. Nowadays, the use of deep convolutional neural networks (CNNs) in the analysis of electrocardiogram (ECG) data, EchoGo Core in the analysis of echocardiograms, and Arterys Cardio DL in the quantitative analysis of cardiac magnetic resonance (CMR) images is driving the overall market expansion.

In 2024, the diagnostic devices segment captured a major share of the AI in medical devices market. A surge in cases of chronic illness, a wider lack of well-trained healthcare personnel, and consistent technological breakthroughs are boosting the greater adoption of AI in diagnostic devices. The contribution of phenomenal steps, like the FDA-approved platforms for radiology, including Viz LVO for stroke detection and Paige. AI for cancer pathology, and AI-driven systems in ophthalmology for conditions such as diabetic retinopathy, is facilitating the overall market growth.

Although the wearable devices segment is estimated to witness rapid expansion, these kinds of devices are empowering preventive care, continuous tracking, and user-friendliness. With the reduction of healthcare expenditures, they are providing smartwatches (like Apple Watch) with ECG for irregular heart rhythm determination and fall detection, AI-enabled earbuds with real-time language translation, smart clothing (like Hexoskin) monitoring posture and muscle engagement.

The medical imaging & diagnostics segment held the largest revenue share of the market in 2024. The segment is mainly fueled by a rise in the requirement to highlight radiologist shortages and the higher demand for more precise and robust diagnostic solutions. The possession of tools, like Qure.ai's qXR, is supporting lung cancer detection, and faster intracranial hemorrhage (ICH) from RapidAI employed AI in the identification of brain hemorrhages on non-contrast CT scans within minutes. Moreover, AI models are boosting the analysis of CT angiography (CCTA) scans in the evaluation of the severity of coronary stenosis and characterizing atherosclerotic plaque.

On the other hand, the clinical decision support systems (CDSS) segment will expand rapidly. The global market is emphasizing value-based care, escalating demand for greater patient safety and diagnostic accuracy, and a supportive government landscape. Aidoc, an AI-driven tool, analyzes medical images, like CT, MRI, and X-ray scans, as well as PathAI, supporting pathologists in efficient cancer detection by studying tissue slides. Recently, Mayo Clinic has merged an AI system for lung cancer to analyze low-dose CT scans and further find cancerous patterns.

The detection & diagnosis segment accounted for the biggest revenue share of the AI in medical devices market in 2024. Eventual incorporation of AI tools is simplifying the diagnostic process, coupled with the automation of repetitive tasks, such as image sorting and report generation, freeing up healthcare professionals to emphasis on more complex cases and patient care. In the last year, the FDA approved the DermaSensor device, an AI-driven tool for primary care physicians, coupled with the identification of skin cancer.

Whereas, the prediction & risk stratification segment will register rapid growth during 2025-2034. The emergence of AI is propelled by major investment and the developing regulatory pathways that support commercializing these innovations. Latest approaches comprise ColonFlag, which utilizes machine learning in the study of electronic health record (EHR) data, particularly age, sex, and blood biomarkers, to screen for and predict colorectal cancer risk. However, Canada has described an ML-based model with its superior risk stratification for HF patients visiting the emergency department, and further effective prediction of adverse outcomes at 30 days and 1 year as compared to standard logistic regression.

By capturing the largest revenue share of the AI in medical devices market, North America registered dominance in 2024. A crucial driver of this region’s market is the emergency requirement for expanded diagnostics, increasing healthcare expenditures, and suitable regulatory action. In December 2024, the FDA leveraged final guidance on Predetermined Change Control Plans for AI/ML devices.

For instance,

In March 2025, GE HealthCare collaborated with NVIDIA at GTC 2025 to emphasize establishing innovation in autonomous imaging, starting with autonomous X-ray technologies and autonomous applications within ultrasound.

In July 2025, FluidAI secured a $2-million Government of Canada investment to expand the global commercialization of AI-enabled postoperative care technology.

The AI in medical devices market in the Asia Pacific is anticipated to expand at a rapid CAGR in the predicted timeframe. In the ASAP countries, especially China, Singapore, and India, stepping into the AI market is coupled with a major government investment in the promotion of applications of AI in healthcare. This further enabled crucial funding, tax incentives, and the creation of regulatory landscapes to foster innovation and market growth. As well as a few regions in ASAP are facing a shortage of well-trained healthcare professionals, which is bolstering the demand for AI-based devices and robotic assistance in streamlining the workflows.

In September 2025, WORK Medical Technology Group LTD, a supplier of medical devices in China, signed a strategic cooperation agreement between Work Hangzhou and the Wuxi Branch of Ruijin Hospital-Shanghai Jiao Tong University School of Medicine to boost the development of a next-generation, AI-enabled smart clinical ecosystem.

In May 2025, Johnson & Johnson MedTech, a global player in surgical technologies and solutions, partnered with Qure.ai, a leading company in artificial intelligence (AI) for healthcare, to enhance early detection of lung cancer in India.

Europe is experiencing a lucrative growth in the AI in medical devices market. Due to the enforcement of the European Health Data Space (EHDS), it is providing the secure and robust reuse of health data for research and AI development across the EU. Alongside, the participation of industrial bodies, such as MedTech Europe, and professional associations like the European Society of Radiology (ESR) is actively engaging with regulators to foster the AI framework. Recently, the ESR published recommendations to guide the representation of the AI Act in radiology.

For instance,

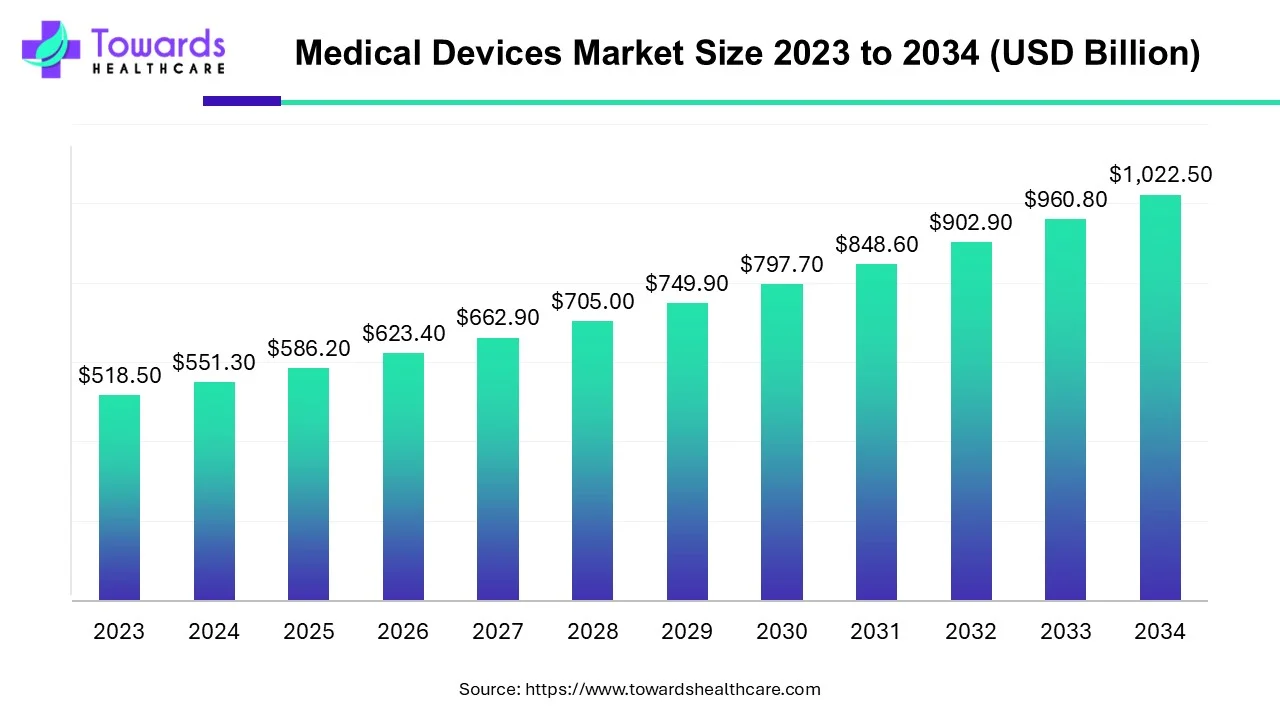

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

By Component

By Technology

By Device Type

By Application

By Functionality

By Region

February 2026

February 2026

February 2026

February 2026