January 2026

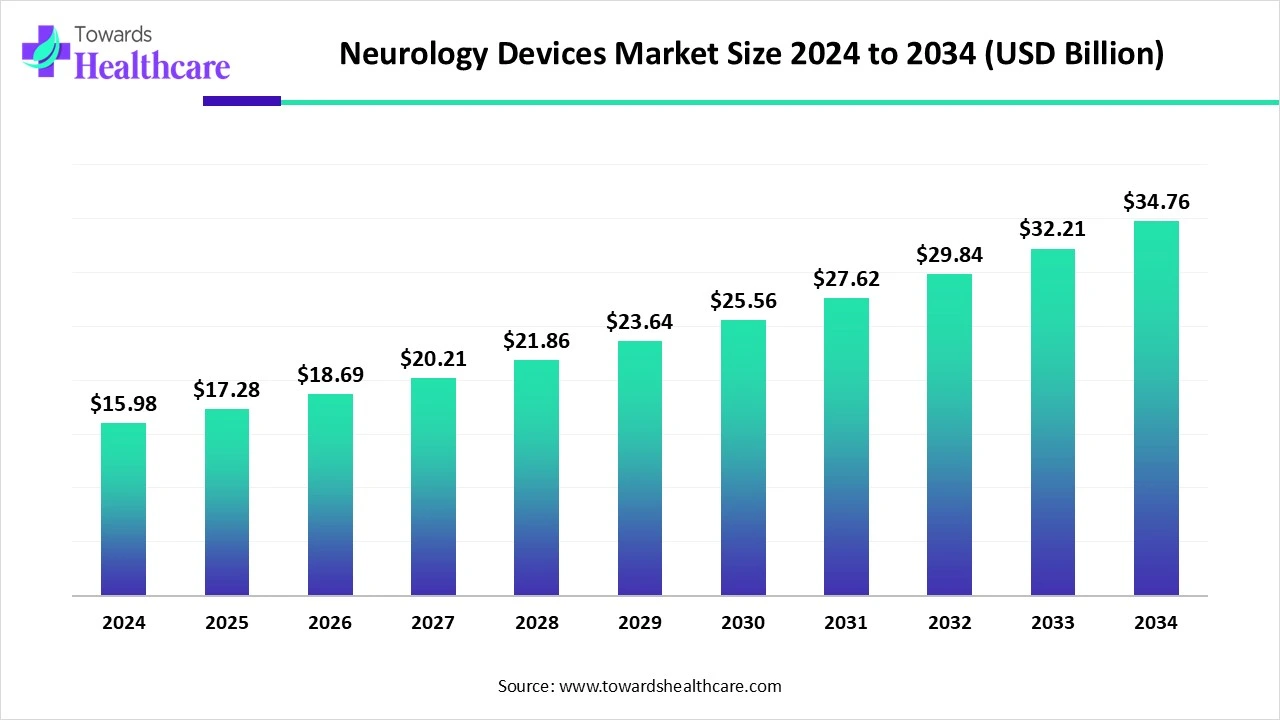

The global neurology devices market size is calculated at USD 15.98 billion in 2024, grew to USD 17.28 billion in 2025, and is projected to reach around USD 34.76 billion by 2034. The market is expanding at a CAGR of 8.14% between 2025 and 2034.

The neurology devices market is primarily driven by the rising prevalence of central and peripheral nervous system disorders. Government organizations launch initiatives to create awareness of the screening and early disease diagnosis among the general public. Prominent players collaborate to access advanced technologies and develop innovative devices. The future looks promising, with the advent of wearable devices and artificial intelligence (AI)-based devices.

| Metric | Details |

| Market Size in 2025 | USD 17.28 Billion |

| Projected Market Size in 2034 | USD 34.76 Billion |

| CAGR (2025 - 2034) | 8.14% |

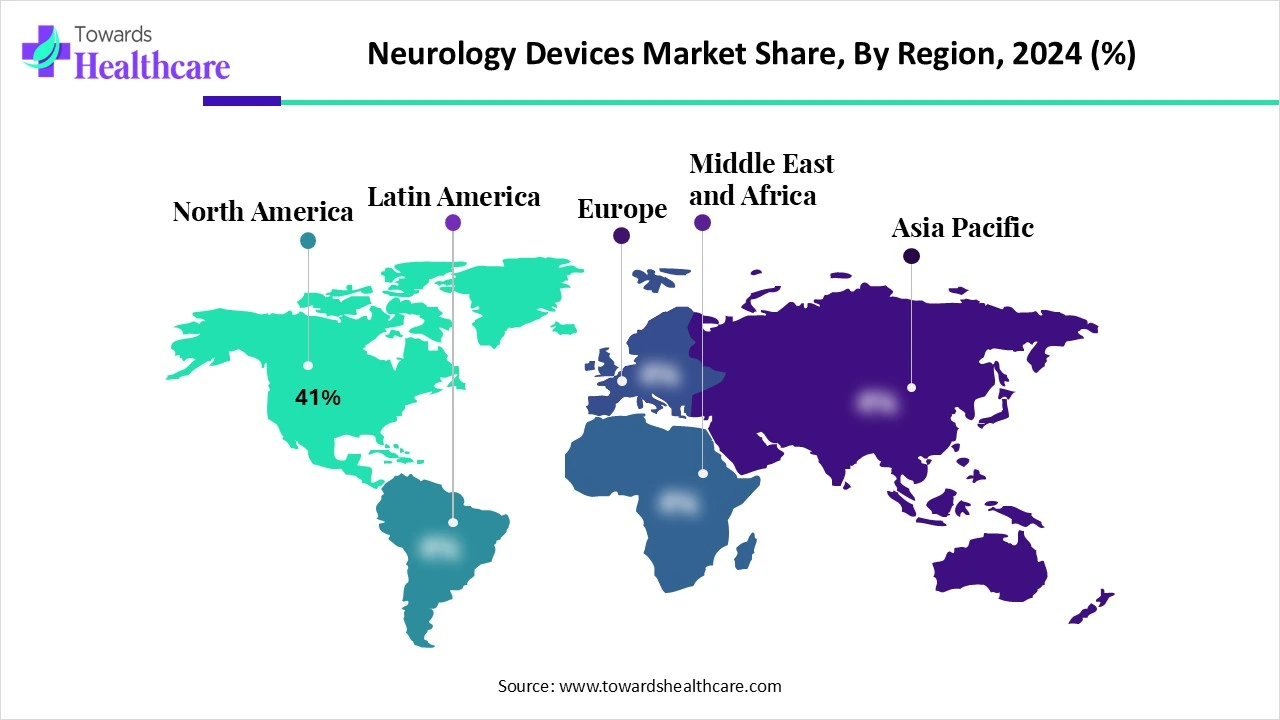

| Leading Region | North America share 41% |

| Market Segmentation | By Product Type, By Application, By Technology, By End-User, By Region |

| Top Key Players | Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Stryker Corporation, Penumbra, Inc., NeuroPace, Inc., Natus Medical Incorporated, LivaNova PLC, Zimmer Biomet, Integra LifeSciences, Raumedic AG, NeuroSigma, Inc., GE HealthCare, Philips Healthcare, Johnson & Johnson (DePuy Synthes), Synapse Biomedical Inc., BrainsGate Ltd., NeuroOne Medical Technologies, Hologic, Inc. (Neurological biopsy systems), Katalyst (wearable neuro-stimulation) |

The neurology devices market includes medical devices and technologies used for diagnosing, monitoring, and treating disorders of the central and peripheral nervous systems. These disorders include epilepsy, Parkinson’s disease, Alzheimer’s disease, stroke, multiple sclerosis, and neuropathic pain. Neurology devices cover a wide spectrum, ranging from neurostimulation and neuromodulation devices to neuroimaging systems, intracranial pressure monitors, and surgical navigation platforms.

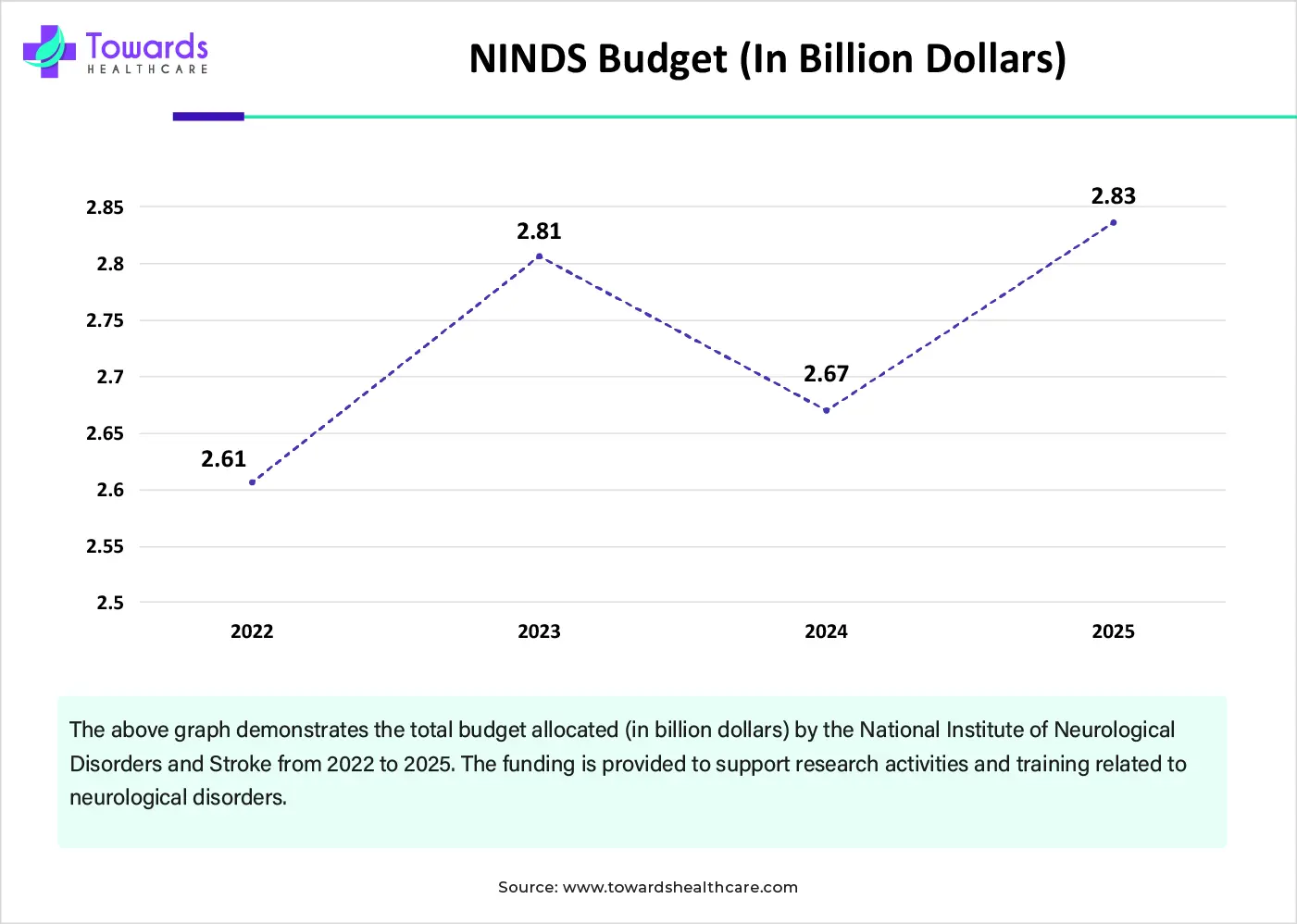

The market is driven by the increasing prevalence of neurological diseases, an aging population, growing demand for minimally invasive neurological surgeries, and the rise of wearable and AI-integrated brain-monitoring solutions. The rapidly expanding medical devices sector and advancements in medical technology boost the market. The burgeoning demand for point-of-care diagnostics and increasing funding are contributing to market growth.

AI plays a crucial role in neurology devices by improving the functionality of prevention, diagnosis, and treatment of neurological disorders. Integrating AI in neurology devices enhances the efficiency and precision of devices. The advent of AI-based sensors and wearable devices enables real-time monitoring of patients’ vital signs, allowing healthcare professionals to make effective and personalized clinical decisions. Wearable devices provide unprecedented access to personal health information and allow patients to participate in decision-making. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and suggest patient outcomes.

Neurological Disorders

The major growth factor of the neurology devices market is the rising prevalence of neurological disorders. These disorders are the major reason for illness and disability worldwide. The growing geriatric population, genetic mutations, and certain autoimmune diseases are the major causes of neurological disorders. The World Health Organization (WHO) estimates that over 1 in 3 people are affected by neurological conditions globally. It also formed the “Intersectoral global action plan on epilepsy and other neurological disorders 2022-2031” to improve prevention, early identification, treatment, and rehabilitation of neurological disorders. (Source: WHO)

High Cost

Advanced neurology devices are comparatively expensive, limiting the affordability of numerous people and healthcare professionals, especially in low- and middle-income countries. The average cost of neurology devices is estimated to be between $30,000 and $40,000.

What is the Future of the Neurology Devices Market?

The market future is promising, driven by the need for point-of-care (PoC) diagnostics and personalized treatments. Portable diagnostic devices are emerging as they provide bedside assistance or in other immediate care settings. This eliminates the need for patients to visit a laboratory or hospital setting. PoC diagnostics provide rapid and accurate diagnosis of neurological conditions, enabling healthcare professionals to make proactive decisions. Additionally, personalized treatments are delivered based on patients’ conditions. Neurological devices, such as implantable neurostimulators and wearable sensors, enable more precise and tailored interventions, based on patients’ needs and responses.

By product type, the neurostimulation devices segment held a dominant presence in the market in 2024. This segment dominated because neurostimulation devices offer a non-invasive approach and lead to reduced dependence on medication. These devices are used for a wide range of disorders, such as neuropathic pain, epilepsy, Parkinson’s disease, obsessive-compulsive disorder (OCD), and major depressive disorder (MDD). Advancements in neurostimulation devices are made to provide tailored treatments. Healthcare professionals focus on combination therapies, such as the combination of neurostimulation devices with medications or physical therapy.

By product type, the interventional neurology devices segment is expected to grow at the fastest CAGR in the market during the forecast period. Interventional neurology devices involve minimally invasive procedures with the highest level of accuracy and precision. This results in shorter recovery times and reduced pain. They are commonly used in treating aneurysms, AVMs, spinal cord disease, and stroke. They can deliver excellent image quality and 3D imaging.

By application, the Parkinson’s disease segment held the largest revenue share of the market in 2024. This is due to the rising prevalence of Parkinson’s disease (PD) and growing awareness of effective treatment. It is estimated that 1.1 million people in the U.S. are living with PD, and the number is projected to rise to 1.2 million by 2030. (Source - Parkinson Foundation) The increasing geriatric population is the biggest risk factor for PD. It affects individuals of greater than 60 years.

By application, the stroke segment is expected to grow with the highest CAGR in the market during the studied years. The World Stroke Organization: Global Stroke Fact Sheet 2025 reported that the incidence of stroke increased by 70% between 1990 and 2021. The estimated global cost of stroke is over $890 billion annually and is projected to almost double by 2050. (Source - National Library of Medicine) Advanced neurology devices play a vital role in diagnosis, treatment, and rehabilitation.

By technology, the implantable neuromodulation technology segment contributed the biggest revenue share of the market in 2024, due to the ability to stimulate the nervous system. Healthcare professionals have access to modulate nerve activity from a computer device. This enables them to provide tailored and targeted treatment based on patients’ responses. The demand for implantable neuromodulation technology is increasing due to its broad therapeutic scope and ongoing improvements in biotechnology.

By technology, the wearable neurodiagnostic devices segment is expected to expand rapidly in the market in the coming years. Advancements in AI-based sensors enable the development of wearable devices for real-time neuroimaging. Wearable neurodiagnostic devices can monitor brain activity and use it as a biomarker. They are more cost-effective and suitable for long-term monitoring. The availability of wearable devices in smartphones, smartwatches, and headbands boosts the segment’s growth.

By end-user, the hospitals segment led the global market in 2024. The segmental growth is attributed to favorable infrastructure and suitable capital investments. Patients mostly prefer hospitals as they provide state-of-the-art diagnostic, treatment, and rehabilitation services in a single place. Hospitals have skilled professionals, providing multidisciplinary expertise to patients. Additionally, favorable reimbursement policies facilitate the segment’s growth.

By end-user, the ambulatory surgical centers (ASCs) segment is expected to witness the fastest growth in the market over the forecast period. ASCs perform minor surgeries and therefore do not require patients to stay overnight. They possess specialized equipment to provide personalized treatment to patients. They offer cost-effective services and prioritize patient safety. ASCs have reduced the risks of hospital-acquired infections, providing a safer setting for surgeries.

North America dominated the global market share by 41% in 2024. The presence of key players, favorable government support, and a robust healthcare infrastructure are the major growth factors for the market in North America. Government and private organizations in North American countries provide favorable reimbursement to increase accessibility and affordability of advanced treatment. A suitable regulatory landscape also results in the development and launch of new neurology devices.

Key players, such as Boston Scientific Corporation, Neuropace, Inc., and Johnson & Johnson, are the major contributors to the market in the U.S. The Centers for Disease Control and Prevention (CDC) reported that 90% of the nation’s $4.5 trillion healthcare expenditures are for people with chronic and mental health conditions. The cost of caring for people with AD was estimated to be $360 billion in 2024 and is projected to reach $1 trillion by 2050 (Source - Chronic Disease)

It is estimated that more than 10 million Canadians suffer from neurological disorders. The total cost of PD in Canada, including patients’, care partners', and direct health systems’ costs, was estimated to be $3.3 billion in 2024 and is expected to increase to $4.4 billion by 2034. (Source - Parkinson) The Government of Canada also supports the research, diagnosis, and treatment of neurological disorders by allocating $80 million in Budget 2024 over four years to the Brain Canada Foundation. (Source - Government of Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the neurology devices market during the forecast period. The rising prevalence of neurodegenerative diseases, the increasing geriatric population, and the burgeoning diagnostic sector bolster market growth. The growing investments in India, China, and Japan to develop advanced neurology centers also favor the market. The increasing number of neurology device startups and venture capital investments also contributes to market growth. People are becoming more aware of the early diagnosis of neurological disorders, propelling market growth.

Approximately 470 million people are suffering from neurological disorders in China. China is home to 108 neurology startups. The Chinese government launched a three-year campaign from 2023 to 2025 to promote the prevention and treatment of AD. Efforts are being made to raise public awareness and guide the elderly population. (Source - English)

In India, neurological disorders contribute to approximately 10% of the overall disease burden. The Indian government makes numerous efforts to address dementia in the country. It has launched the National Dementia Strategy to improve awareness, early diagnosis, and access to care & support services. Apart from this, the government trains healthcare workers, runs awareness programs, and launches research initiatives.

Europe is expected to grow at a notable CAGR in the neurology devices market in the foreseeable future. The rising adoption of advanced technologies and the burgeoning medical device sector boost market growth. The increasing healthcare expenditure and growing awareness of early disease diagnosis promote the use of neurology devices. Government organizations provide funding to conduct advanced research, leading to the development of innovative neurology devices. The recent research funding cut by the U.S. government opens opportunities for researchers in European countries.

More than 2 million people are estimated to have dementia or PD. The German Brain Council formed the “German Brain Plan – Agenda 2030” to maintain health and combat brain diseases. The major strategies of the roadmap include increasing awareness in 2022-23, pilot projects on traumatic brain injury and depression, and promotion of early diagnosis, treatment, and rehabilitation in 2024-25, implementation of research findings in clinical practice in 2026-27, and continuous expansion of project topics in 2028-29. (Source - Braincouncil)

The UK government published a report titled “The Value of Action: Mitigating the Impact of Neurological Disorders in the United Kingdom” to implement existing interventions, including preventative care, treatment, and rehabilitation, to significantly reduce the economic impact of neurological conditions. (Source - The Neurological Alliance) The government also invested £350,000 in the BPS to support neurological research and treatment.

Dr. Jin Hyuang Lee, Founder of LVIS Corporation, commented that NeuroMatch represents a transformative step towards democratizing neurological care for patients worldwide. The company aims to harness advanced technology to expedite EEG diagnostics and make these critical services accessible to all. (Source - Medical Device Network)

By Product Type

By Application

By Technology

By End-User

By Region

January 2026

December 2025

December 2025

December 2025