February 2026

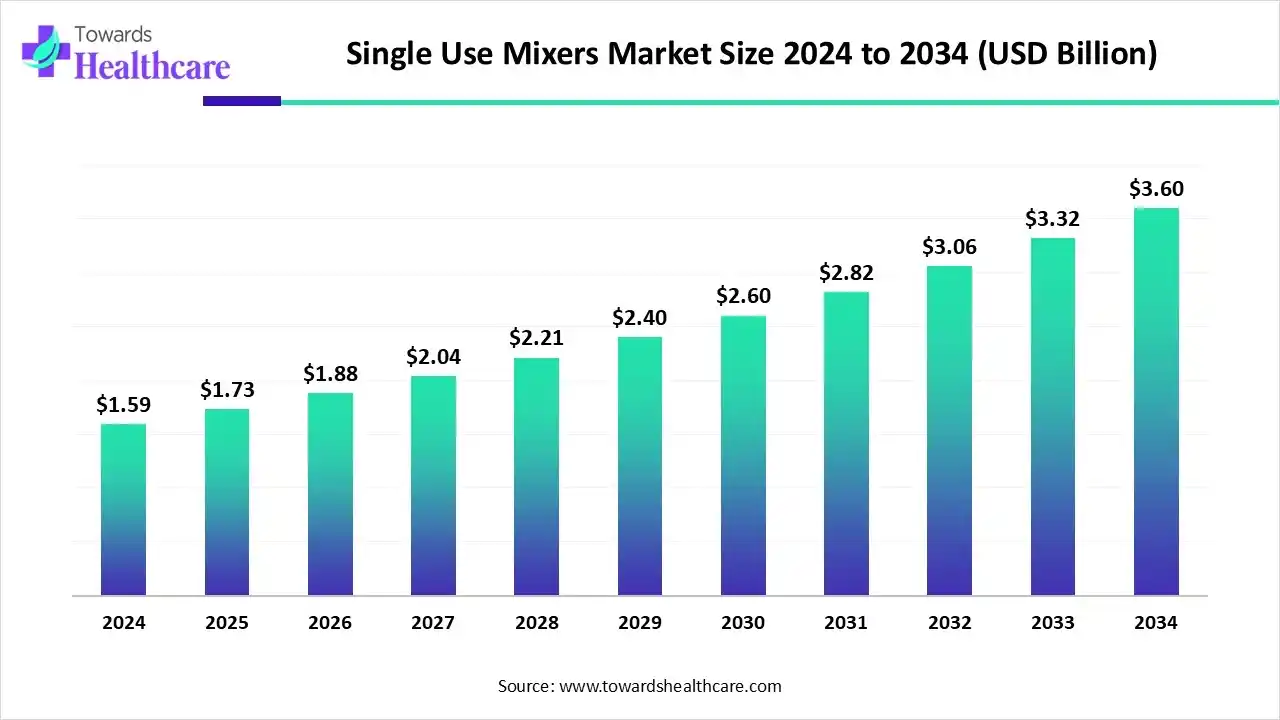

The global single-use mixers market size is calculated at USD 1.73 billion in 2025, grew to USD 1.88 billion in 2026, and is projected to reach around USD 3.6 billion by 2034. The market is expanding at a CAGR of 8.54% between 2024 and 2034.

The single-use mixers market is primarily driven by the need to streamline manufacturing processes and the increasing development of biologics. Single-use mixers are cost-effective and reduce the manufacturing timelines. Government bodies support the adoption of single-use mixers in labs and manufacturing sites by providing funding. Artificial intelligence (AI) introduces automation in mixers, enhancing efficiency and precision. Continuous improvements in design and automation of single-use mixers present future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 1.73 Billion |

| Projected Market Size in 2034 | USD 3.6 Billion |

| CAGR (2024 - 2034) | 8.54% |

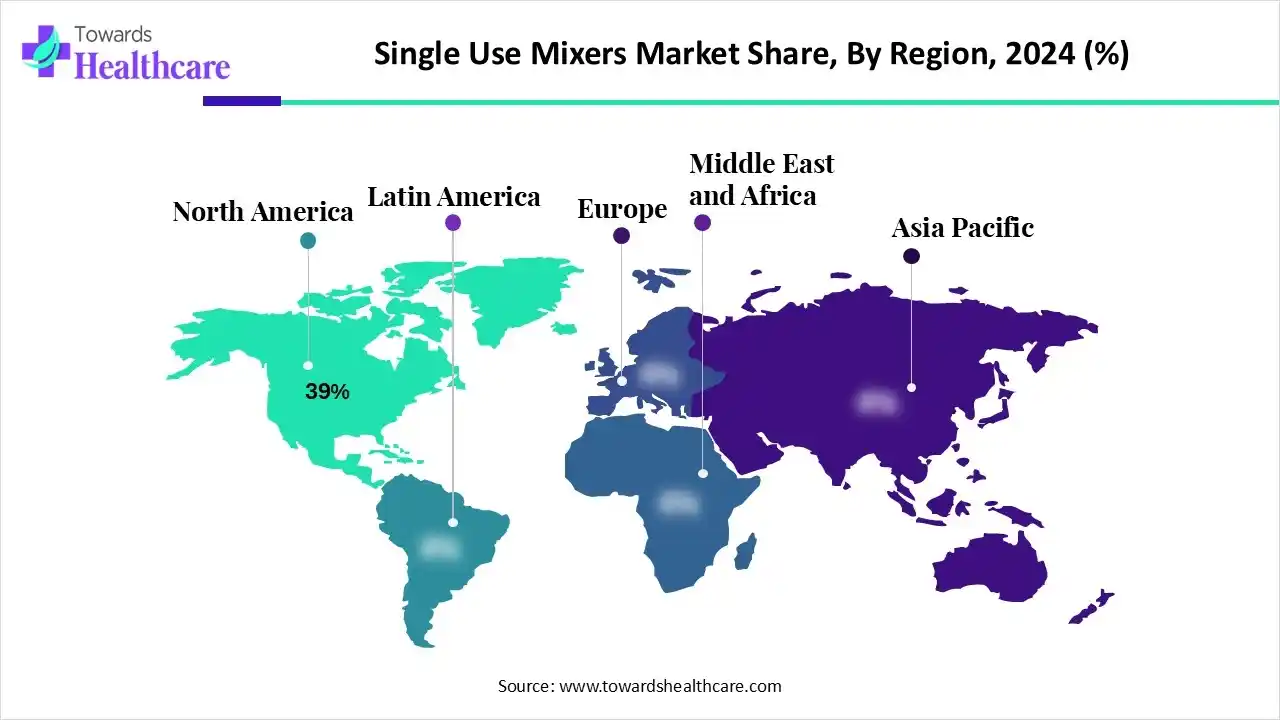

| Leading Region | North America by 39% |

| Market Segmentation | By Product Type, By Mixing Capacity/Volume Range, By Application, By Mixing Technology, By Region |

| Top Key Players | Sartorius AG, Thermo Fisher Scientific, Inc., Eppendorf AG, Saint-Gobain Performance Plastics, PBS Biotech, Inc., Meissner Filtration Products, Inc., Agilitech, DrM Life Science (Dr. Müller AG), Novasep Holding S.A.S., FlexBiosys Inc. |

The single-use mixers market is experiencing robust growth, driven by growing demand for biopharmaceuticals, the increasing need for sterile biomanufacturing processes, and technological innovations in single-use mixers. It comprises disposable mixing systems, components, and accessories used for the preparation, blending, and homogenization of liquids in biopharmaceutical and bioprocessing applications.

These systems replace traditional stainless-steel mixers with pre-sterilized, single-use polymeric assemblies, minimizing cleaning validation, cross-contamination risk, and downtime. They are critical in biologics production, vaccines, cell & gene therapies, and buffer/media preparation, enabling rapid changeovers, scalable production, and compliance with cGMP and PAT guidelines.

AI and machine learning (ML) algorithms can help researchers and manufacturers to design innovative single-use mixers based on specific product requirements. This offers an ergonomic and efficient use experience for biomanufacturing applications. AI and ML introduce automation in single-use mixers, enhancing their efficiency, accuracy, precision, and reproducibility. They can also monitor real-time conditions of the system, allowing manufacturers to control biomanufacturing specifications.

Thermo Fisher Scientific offers the HyPerforma Mixer Touchscreen Console that can enhance upstream and downstream processes by offering advanced sensor monitoring and user-defined automated mixing recipes.

Which Product Type Segment Dominated the Single-Use Mixers Market?

The consumables & accessories segment held a dominant presence in the market in 2024, with a revenue of approximately 55% due to their easy availability and cost-effectiveness. Key players offer preconfigured and customizable consumables and accessories for their mixing systems, eliminating the need for manufacturers to purchase the entire equipment.

The mixing bags sub-segment held the largest revenue share, due to the need for small-scale compounding and mixing. 2D and 3D mixing bags are used for robust mixing of powders and liquids from discovery to commercial scale.

The mixing systems segment is expected to grow at the fastest CAGR in the market during the forecast period, due to advances in mixing systems and the need for consistency throughout the mixtures. Mixing systems lead to process efficiency, leading to higher production and reduced costs.

The top-entry mixers sub-segment is expected to grow rapidly. Top-entry mixers are more sustainable due to lower energy consumption. They require 3 to 5 times less energy than side-entry mixers. They have reduced maintenance and high mixing efficiency.

How the 500 L-1000 L Segment Dominated the Single-Use Mixers Market?

The 500 L-1000 L segment contributed the biggest revenue share of the market in 2024, with a revenue of approximately 35% due to the need for large-scale production of biologics. Single-use mixers with 500 L to 1000 L capacities are widely used for scaling up upstream and downstream processes after pilot scale. Mid-scale production bridges the gap between pilot scale and commercial scale, ensuring consistent manufacture of experimental formulations.

1000 L

The 1000 L segment is expected to grow with the highest CAGR in the market during the studied years. 1000 L mixers are predominantly used in commercial-scale manufacturing to produce large quantities of biologics. This enables manufacturers to deliver the products, fulfilling patients’ needs.

100 L-500 L

The 100 L-500 L segment is expected to grow in the coming years, due to the growing need for pilot-scale production to investigate and optimize product and process. Pilot scale provides valuable insights into product and process development on a larger scale. It helps identify any potential issues that may arise during mass production.

Why Did the Buffer Preparation Segment Dominate the Single-Use Mixers Market?

The buffer preparation segment held a major revenue share of approximately 38% of the market in 2024, due to the ability of buffers to maintain and optimize a stable pH throughout the manufacturing process. Single-use mixers are specifically designed to enable the mixing of media, buffers, and other process liquids, facilitating optimal performance. Buffer solutions are particularly essential for activities like enzymatic reactions, cell cultures, and protein purifications.

Product Mixing & Final Formulation

The product mixing & final formulation segment is expected to expand rapidly in the market in the coming years. Single-use mixers are essential for mixing and preparing the final formulation of biologics. They offer a flexible and sterile system for preparing final products. The risk of cross-contamination also reduces with single-use mixers.

Intermediate Processing

The intermediate processing segment is expected to grow in the upcoming years. Intermediate processing is a critical step in the chemical pathway that leads to the production of API. Intermediate processing includes harvest and clarification steps and concentration/dilution of protein solutions.

What Made Mechanical Agitation the Dominant Segment in the Single-Use Mixers Market?

The mechanical agitation segment led the market in 2024, due to high-intensity mixing and customized speed control ability. Mechanical agitation refers to devices, like mixers and agitators, to achieve uniformity and desired reactions. It allows the formation of stable formulations, such as suspensions and emulsions, as well as appropriate heat transfer in the system.

Magnetic Stirring Systems

The magnetic stirring systems segment is expected to witness the fastest growth in the market over the forecast period. The demand for magnetic stirring systems is increasing, as they provide contact-free mixing, avoiding equipment contamination. In addition, magnetic systems possess a lesser chance of rusting or corrosion.

Rocking Motion/Wave-Type

The rocking motion/wave-type segment is expected to grow in the coming years. Wave-type mixing uses a rocking platform to oscillate a disposable bag, thereby creating waves in the fluid for mixing and gas transfer. These waves are generated through an electric system and impose lower stress values in the liquid medium during agitation.

North America dominated the market with approximately 39% share in 2024. The region has a strong presence of biopharmaceutical and biotech companies that are strongly dedicated to producing innovative biologics. Favorable regulatory support and the increasing adoption of advanced technologies foster market growth. The availability of state-of-the-art research and development facilities also propels the market.

Key players, such as Thermo Fisher Scientific, Meissner Corporation, and Cytiva Life Sciences, provide high-quality and customized single-use mixers in the U.S. The U.S. is home to more than 3,028 biotech companies as of 2024, representing an increase of 4.2% from 2023. The U.S. government is committed to growing the bioeconomy by investing $46 billion in public and private sector biomanufacturing.

Asia-Pacific is expected to host the fastest-growing market in the coming years. Countries like China, India, and Japan have well-established biomanufacturing infrastructures and an affordable workforce, encouraging foreign investors to set up their manufacturing facilities in these countries. Government and private organizations provide funding for the adoption of single-use technologies for large-scale biologics production. The growing geriatric population necessitates manufacturers to fulfill unmet patient needs, favoring large-scale production of biologics.

China has been emerging as a global biotech hub for several decades by expanding biomanufacturing capacity and attracting venture capital investments. The Chinese biotech sector attracted approximately CNY 20 billion (EUR 2.6 billion) in public funding in 2023. China’s innovation capabilities have surpassed Europe in most biotech areas, and the U.S. in some. According to a recent BIO survey, 79% of 124 global biopharma companies have at least one contract or product with a China-based CDMO/CMO.

Europe is expected to grow at a considerable CAGR in the market in the upcoming period. Favorable government support for the development and manufacturing of biologics boosts the market. Government and private institutions conduct seminars and workshops to share the latest updates about innovative biomanufacturing technologies. Advancements in digital monitoring and sustainable materials also contribute to market growth.

Germany hosted the 5th BIOTECH Conference 2025 – Single-Use Technologies for Bio-Based Applications to focus on areas such as bioprocess development and manufacture with single-use technology and process analytical technologies for single-use devices. Companies like Sartorius AG and Merck Group, headquartered in Germany, provide single-use mixers to global biotech companies.

South America is considered to be a significantly growing area in the single-use mixers market. The burgeoning biopharma sector and the growing demand for personalized medicines potentiate the need for single-use mixers. Manufacturers are aware of the benefits of single-use mixers over traditional mixers. Efforts are made to strengthen policy and regulatory frameworks to encourage innovation and safe adoption of new biotechnologies.

Brazil’s single-use mixers market is thriving, fueled by expanding biopharma manufacturing, sustainability initiatives, and flexible production demands. Local biotech investments and government-backed healthcare modernization accelerate adoption across research and production facilities.

The UAE is rapidly embracing single-use mixers, driven by its vision for advanced healthcare, biotech innovation, and clean manufacturing. Strategic partnerships and smart facility expansions strengthen its regional bioprocessing capabilities.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The increasing number of biotech startups and venture capital investments in the region facilitates the development and use of single-use mixers. Government organizations launch initiatives to support the indigenous development of biologics. Countries like the UAE, South Africa, and Saudi Arabia are actively investing in R&D, biomanufacturing, and genomics.

Company Overview

A global life-science and lab-equipment supplier focused on biopharmaceutical manufacturing, including single-use systems and mixers.

Corporate Information

History and Background

Founded in 1870 as a precision instrument maker, evolved into a major bioprocess-solutions provider with strong growth in single-use technologies.

Key Milestones / Timeline

Business Overview

Key Developments and Strategic Initiatives

Competitive Positioning

SWOT Analysis:

Company Overview

A global leader in life-science tools, lab instruments, consumables, and bioprocessing equipment, including single-use mixers for upstream/downstream manufacturing.

Corporate Information

History and Background

Formed via the merger of Thermo Electron and Fisher Scientific in 2006, expanded through acquisitions, and provides a broad spectrum of life-sciences solutions; single-use mixing systems are part of its bioprocessing portfolio.

Key Milestones / Timeline

Business Overview

Key Developments and Strategic Initiatives

Competitive Positioning

SWOT Analysis:

Recent News and Updates:

| Companies | Headquarters | Product Offerings | Product Specifications |

| Sartorius AG | Germany | Flexsafe Pro Mixer | Scalable, efficient, and versatile mixing from 5 to 3000 liters |

| Merck KGaA | Darmstadt, Germany | Mobius Single-Use Mixing Systems | Delivers advanced technology for mixing pharmaceutical ingredients from intermediate to final drug products |

| Cytiva Life Sciences | United States | RTP Mixer | A portable, benchtop instrument for the rapid and efficient mixing of culture media in a sterile environment |

| Avantor, Inc. | United States | TopMixer Single-Use Open Top Mixing Systems, 240 V | Modular mixing system with a top-mounted mixer for use with drums, including a single-use liner |

By Product Type

By Mixing Capacity/Volume Range

By Application

By Mixing Technology

By Region

February 2026

February 2026

February 2026

February 2026