February 2026

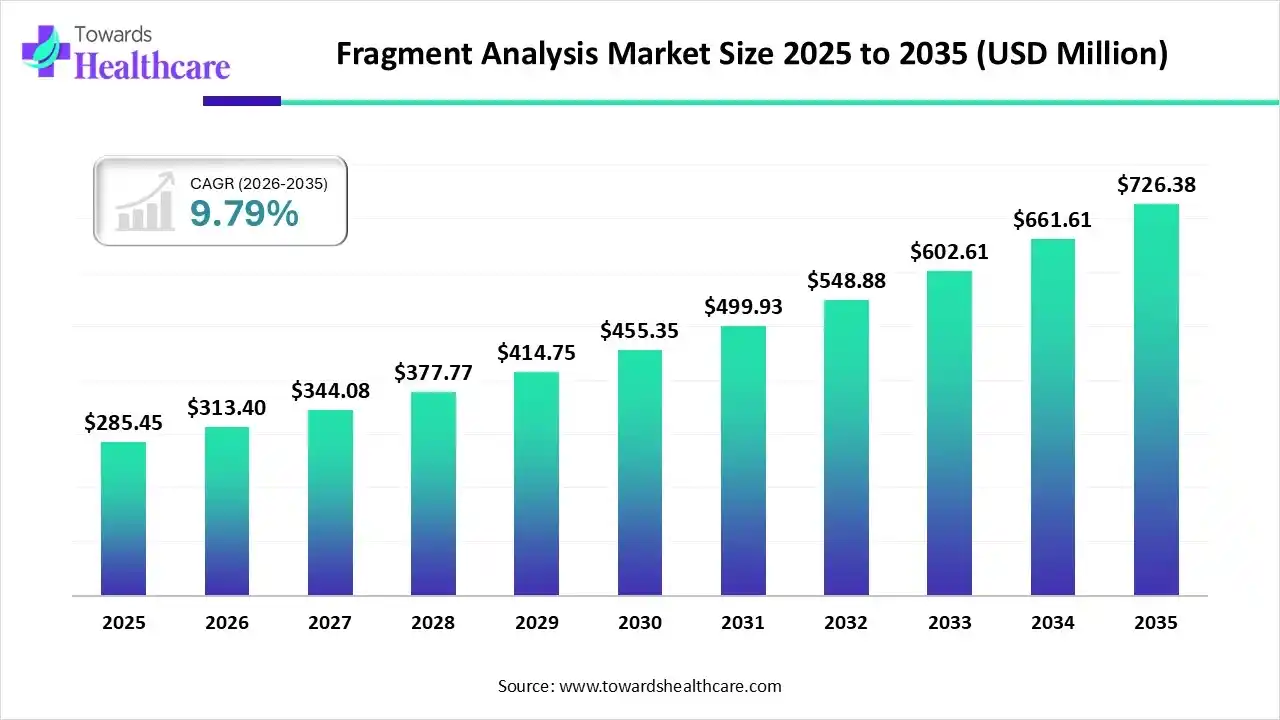

The global fragment analysis market size was estimated at USD 285.45 million in 2025 and is predicted to increase from USD 313.4 million in 2026 to approximately USD 726.38 million by 2035, expanding at a CAGR of 9.79% from 2026 to 2035.

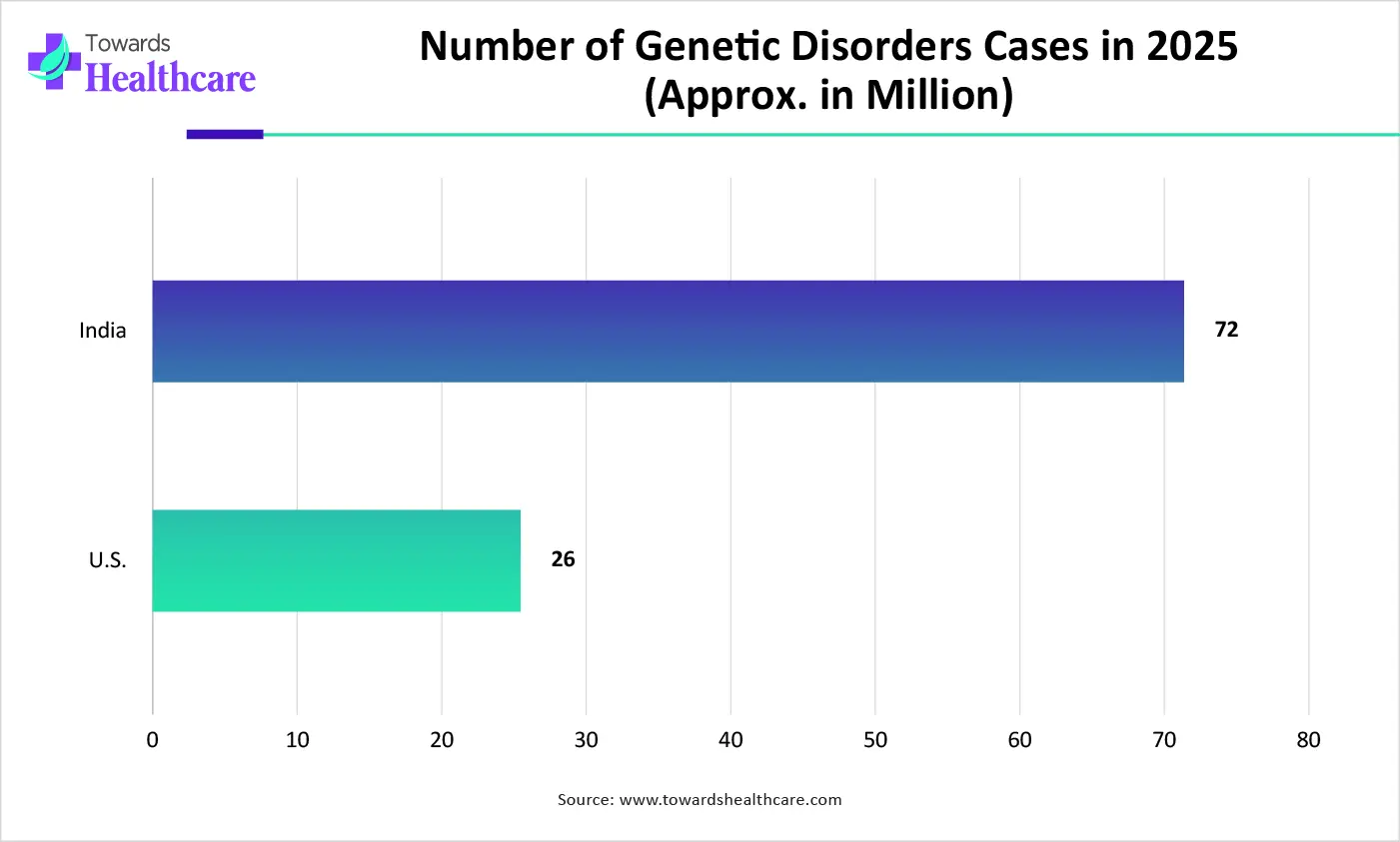

The growing instances of various cancers & genetic disorders are increasingly demanding a rapid, advanced genetic and cancer testing solution. This further promotes sophisticated molecular diagnostics, which supports facilitating precision medicine in cancer and other rare conditions.

Mainly, the fragment analysis market covers a high-throughput, PCR-based genetic technique, which explores the detection of the precise size and quantity of DNA fragments employing capillary electrophoresis. Moreover, the overall market growth is driven by breakthroughs in capillary electrophoresis, an increase in genetic disease cases, and a rise in cancer cases. Whereas, the latest guidelines for Fragment Dispersity Index (FDI) analysis were merged to reflect chromatin accessibility. Also, the FDI-oncology model has demonstrated strong clinical potential for early cancer detection by finding major cancer genes through cfDNA patterns.

Continuous efforts from researchers include the rollout of a Python-based pipeline utilizing XGBoost classifiers, which supports the analysis of fluorescence intensity data to determine trisomies (13, 18, 21) in prenatal screening. Alongside certain AI solutions, especially Variational Autoencoders (VAEs), reinforcement learning (RL), and SE (3)-equivariant models are currently applied to grow, merge, and link fragments into robust drug candidates.

Many laboratories of this era are highly using automated data-analysis software, such as GeneMarker and ChimeRMarker, to manage vast data and enhance reproducibility and speed.

Day by day, the market is fostering developments in microsatellite instability (MSI) testing, MLPA for copy number variation, & chimerism monitoring for transplant studies.

In the future, the key firms will implement the application of this analysis in pathogen sub-typing, animal breeding, and validating CRISPR-Cas9 genome editing.

| Key Elements | Scope |

| Market Size in 2026 | USD 313.4 Million |

| Projected Market Size in 2035 | USD 726.38 Million |

| CAGR (2026 - 2035) | 9.79% |

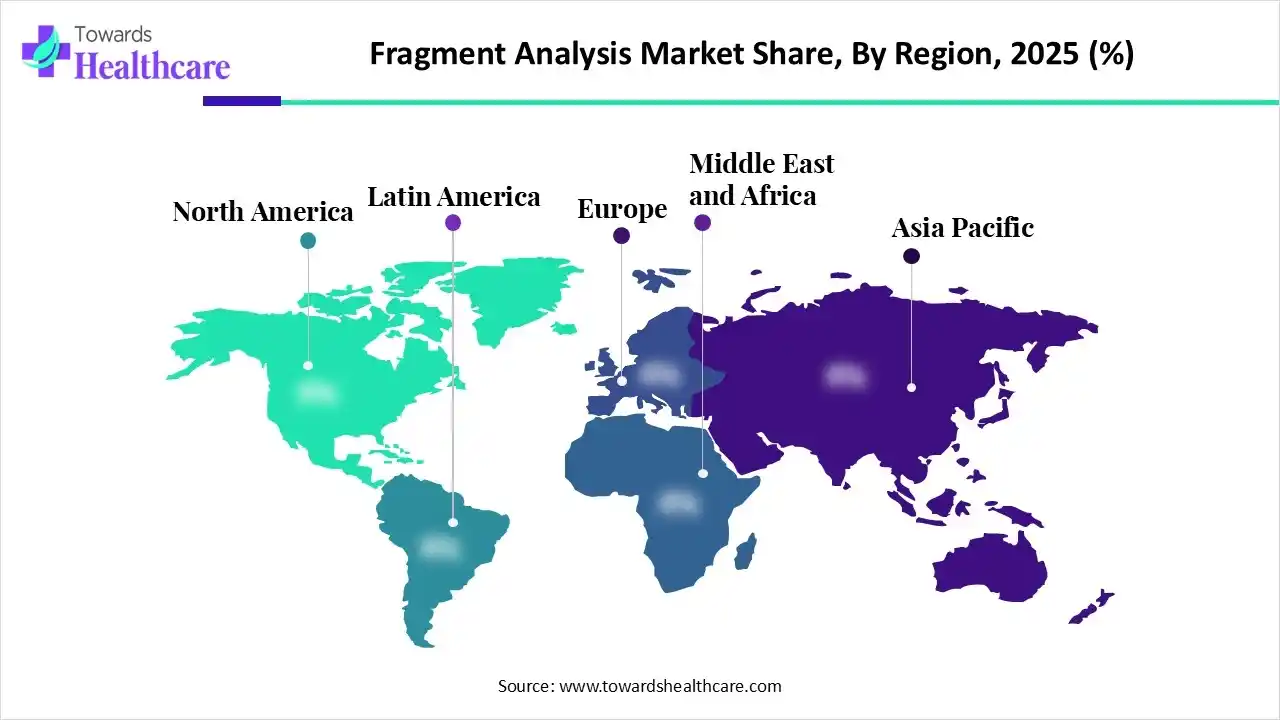

| Leading Region | North America |

| Market Segmentation | By Product & Service, By Technology, By Application, By End Use, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Agilent Technologies, Genetika Science, Promega Corporation, Eurofins Genomics, SoftGenetics |

Why did the Reagents & Consumables Segment Lead the Market in 2025?

In 2025, the reagents & consumables segment held the biggest share of the fragment analysis market. This is primarily propelled by a huge demand for extensive PCR primers, fluorescent dyes, enzymes, and specialized kits. Alongside, companies are widely leveraging STR genotyping and Microsatellite Instability (MSI) assessment. The globe is stepping towards the progression of multiplexing capability with novel 8-color Dye Sets for enabling more loci to be assessed in a single capillary electrophoresis injection.

Services

The services segment will expand rapidly. This encompasses outsourcing analysis and diverse products used in applications, particularly forensics, diagnostics, and research. Researchers are emphasizing oncology testing, genetic disorder detection, and microsatellite instability (MSI) using capillary electrophoresis. Companies are promoting specialized libraries, like covalent fragments, RNA-targeted fragments, and natural product-like fragments, to boost hit success rates.

Which Technology Dominated the Fragment Analysis Market in 2025?

The capillary electrophoresis segment was dominant in the market in 2025. This technology facilitates greater resolution, rapid run times, increased sensitivity, and escalated multiplexing capabilities, which finally strengthen laboratory workflow efficiency. The market is putting efforts into developing compact, affordable, self-built CE-LIF systems that can separate PCR products for pathogen detection.

DNA Sequencing

The DNA sequencing segment will witness the fastest growth. Globally rising adoption of next-generation sequencing and higher demand for precision medicine & diagnostics are driving the DNA sequencing progression. The latest advances comprise Oxford Nanopore and PacBio SMRT sequencing & offer superior, longer reads, with enhanced resolution of complex structural variants and repetitive sequences.

How did the Genotyping & Polymorphism Analysis Segment Lead the Market in 2025?

In 2025, the genotyping & polymorphism analysis segment led with a major share of the fragment analysis market. A prominent driver is a huge rise in genetic disorders, which fuels substantial investment in and demand for sophisticated genotyping solutions. Researchers established a novel technique that connects fluorescent dyes at fixed, accurate locations and locks them using light activation.

Molecular Diagnostics

Moreover, the molecular diagnostics segment will grow fastest. This is propelled by the growing need for faster infectious disease detection and immersive, tailored interventions in oncology. Ongoing advances in CE systems, such as 96-capillary, high-throughput, and benchtop systems, are also raising efficiency. The market is bolstering the adoption of Fragile X syndrome, Cystic Fibrosis panels, and Trisomy testing in accelerating genetic illnesses.

Which End Use Dominated the Fragment Analysis Market in 2025?

The academic & research institutes segment led the market in 2025. Their expansion is spurred by active government funding in genomics and molecular biology, primarily for genomic research & functional genomics. Also, they are shifting towards fragment-based drug discovery for early-stage drug discovery. They are increasingly leveraging fragment analysis in the validation of CRISPR efficiency by identifying insertion/deletion (indel) fragment sizes.

Hospitals & Diagnostic Laboratories

In the coming era, the hospitals & diagnostic laboratories segment is predicted to expand rapidly. The worldwide booming cancer cases are demanding specialized, high-resolution diagnostic tools. However, Japanese researchers evolved miniaturized electrophoresis-based chips for quicker RNA fragment analysis in oncology, i.e., under 10 minutes. The widespread use of automated CE- and sequencing-based workflows in clinical provisions, like for cell line authentication and CRISPR-Cas9 validation, is also impacting.

North America captured the biggest share of the fragment analysis market in 2025, due to the raised demand for microsatellite instability (MSI) testing in cancer & increased investments in R&D. Additionally, this year strengthened identification of small, low-molecular-weight fragments as substantial for oncology and immunology in this region.

U.S. Market Trends

The U.S. was a major contributor to the fragment analysis market, as it has explored innovative fragment libraries with greater 3D character (sp3-rich) for extensive fit into protein binding pockets.

Asia Pacific will register rapid expansion in the future, with the increasing developments in genomics, like next-generation sequencing (NGS) and CRISPR-based reinforcement. Besides this, China & India are fostering investment in pharmaceutical R&D by expanding CROs. Specifically, China is focusing on prenatal testing, oncology genotyping, and, mainly, forensic STR profiling.

India Market Trends

Whereas India is broadly executing Multiplex Ligation-dependent Probe Amplification (MLPA) to find copy number alterations, and for detecting cancer-related gene mutations. Alongside, Haryana's forensic labs explored the Trakea Portal, digitizing the workflow to allow real-time tracking and quicker reporting of DNA analysis.

Europe will expand notably in the market, as it is experiencing faster growth in Assisted Reproductive Technologies (ART), particularly Preimplantation Genetic Testing (PGT) and prenatal aneuploidy detection, which demands fragment analysis services.

Germany Market Trends

However, Fragment-Based Drug Discovery (FBDD) is reinforced by structural biology institutions in Germany, like EU-OPENSCREEN, Leibniz Institute for Molecular Pharmacology - FMP, to target "undruggable" proteins.

| Company | Description |

| Thermo Fisher Scientific, Inc. | A firm provides its Applied Biosystems & Invitrogen brands of fragment analysis. |

| Danaher | This specialises in capillary electrophoresis (CE), mass spectrometry (MS), and automated software. |

| Agilent Technologies | It usually explores automated, high-throughput fragment analysis solutions based on parallel capillary electrophoresis (CE). |

| NimaGen | This facilitates a comprehensive portfolio of high-quality reagents and consumables for fragment analysis. |

| Genetika Science | It provides comprehensive DNA fragment analysis services and, in certain areas, distributes related synthesis products. |

| Promega Corporation | This focuses on capillary electrophoresis (CE) instrumentation, specializedSTR (short tandem repeat) kits, and analysis software. |

| LGC | A company offers various products and services for molecular biology |

| Eurofins Genomics | This implements comprehensive fragment analysis (FA) and Fragment Length Analysis (FLA) services. |

| MCLAB | It offers a variety of products and services for fragment analysis and genetic profiling. |

| SoftGenetics | This facilitates advanced, biologist-friendly software for fragment analysis, mainly through its GeneMarker & ChimerMarker applications. |

By Product & Service

By Technology

By Application

By End Use

By Region

February 2026

February 2026

February 2026

February 2026