February 2026

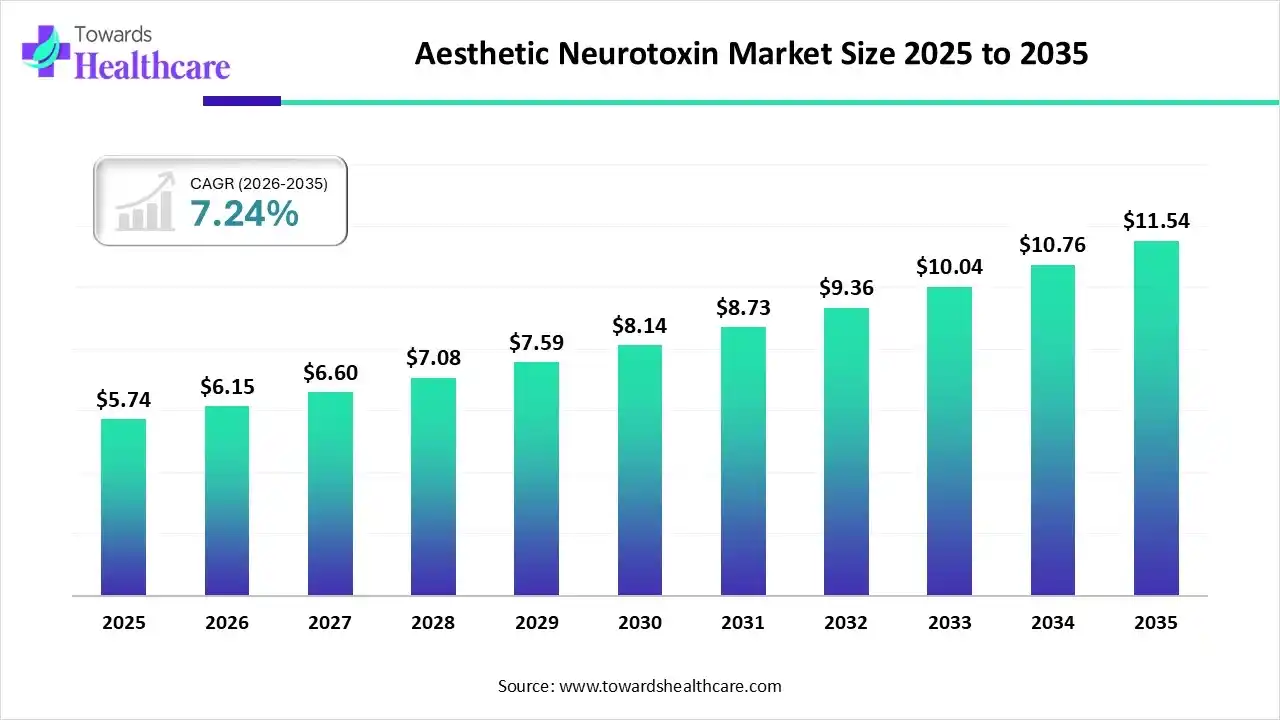

The global aesthetic neurotoxin market size was estimated at USD 5.74 billion in 2025 and is predicted to increase from USD 6.15 billion in 2026 to approximately USD 11.54 billion by 2035, expanding at a CAGR of 7.24% from 2026 to 2035.

The worldwide rising geriatric population is widely looking for anti-aging solutions, while the young population (20s & 30S) is immensely following social media-raised beauty standards, which fosters demand for these products. Moreover, many aesthetic clinics are conducting trials for developing novel modified/advanced formulations, with effective delivery, and novelty in combination therapies.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.15 Billion |

| Projected Market Size in 2035 | USD 11.54 Billion |

| CAGR (2026 - 2035) | 7.24% |

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Application, By Treatment Area, By End-User/Provider Type, By Region |

| Top Key Players | AbbVie, Merz Pharma, Ipsen Pharma, Hugel Inc., Revance Therapeutics, Evolus, Galderma, Medytox, Daewoong, Lumenis |

The global aesthetic neurotoxin market includes injectable neurotoxin products used predominantly for cosmetic applications to reduce the appearance of facial wrinkles and fine lines, and for select therapeutic indications in aesthetics such as facial contouring, hyperhidrosis (excessive sweating), and masseter reduction. Market growth is driven by rising demand for minimally invasive cosmetic procedures, increasing social acceptance of aesthetic treatments, expansion of product portfolios, innovations in formulation and delivery, and growing disposable incomes.

Geographic expansion is supported by increasing awareness and accessibility of aesthetic procedures worldwide. Neurotoxins block neuromuscular transmission by inhibiting acetylcholine release, resulting in temporary muscle relaxation. Products are administered by trained medical professionals in dermatology clinics, cosmetic surgery centers, medspas, and aesthetic practices.

Nowadays, global clinics are increasingly adopting software, such as Modiface (led by L'Oréal) and Crisalix, which assist in analysing high-resolution facial scans to develop dynamic 3D models. On the other hand, ML algorithms are supporting the study of substantial patient data, like genetic information, skin type, and medical history, for leveraging wider tailored neurotoxin regimens. The latest software solutions include the AMI 2025 conference (like Zenoti), which uses predictive analytics to automate clinic workflows and customise the entire patient journey.

The current significant trend is fostering the use of smaller doses in strategic spots for softer results, which further improves skin texture and controls oil.

Firms are stepping towards the combination of neurotoxins with fillers, lasers, or skin boosters for holistic rejuvenation, which directs texture, pores, and lines simultaneously.

Day by day, the globe is leveraging research activities to evolve neurotoxins with a longer duration of action (up to 6 months or more) to lower injection frequency and boost patient convenience.

Researchers are working to raise the use of aesthetic procedures in the mid- and lower face, neck, and particular procedures, such as mesobotox for skin elasticity, keloid or hypertrophic scar treatment, and facial asymmetry correction.

Why did the Botulinum Toxin Type A Segment Lead the Market in 2025?

In 2025, the botulinum toxin type A segment captured nearly 85% share of the aesthetic neurotoxin market. It has versatile applications in frown lines, crow's feet, forehead wrinkles, and medically for diverse conditions. Whereas, recently, the FDA approved Letybo (letibotulinumtoxinA), a high-purity Korean neurotoxin, which is used to treat moderate to severe glabellar lines (frown lines). A newly invented BoNT-A product called MBA-P01 has demonstrated efficiency and safety comparable to OnabotulinumtoxinA in Phase III clinical trials.

Advanced/Modified Formulations

The advanced/modified formulations segment will expand at an approximate12–14% CAGR. Increased patient and provider demand for longer-lasting effects, rapid onset, optimized safety, and expanded convenience are fueling the prospective transformations. In this era, RelabotulinumtoxinA (Relfydess) created by Galderma, is the first and only ready-to-use liquid neuromodulator, which omits the requirement for reconstitution with saline. Additionally, researchers are shifting towards needle-free, topical neurotoxin serums that use peptides or nanoemulsion-based delivery systems.

Which Application Dominated the Aesthetic Neurotoxin Market in 2025?

The glabellar lines segment held nearly 45% share of the market in 2025. Major drivers are reduced downtime of botulinum toxin injections, raising awareness, novel product innovations (ready-to-use toxins), and a rigorous preference for treatments in medspas.

In April 2025, AbbVie submitted a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) for trenibotulinumtoxinE (TrenibotE) for the treatment of moderate to severe glabellar lines.

Jaw & Masseter Contouring

Moreover, the jaw & masseter contouring segment will register the fastest growth at approximately 14–16% CAGR. Specifically in Asia-Pacific, a broad or square jawline is often assumed to be less desirable, and a V-shaped or oval face is preferred, which fuels greater demand for masseter contouring procedures. For this, Dysport (abobotulinumtoxinA) is commonly used for masseter hypertrophy, according to studies in 2024 and 2025, which continue with evaluation of its efficacy dosages (e.g., 90-150U total) and injection protocols.

How did the Upper Face Segment Dominate the Market in 2025?

In 2025, the upper face segment held an approximate 50% share of the aesthetic neurotoxin market. This mainly targets glabellar lines (frown lines), forehead wrinkles, and crow's feet, for which Botox, Dysport, and Xeomin are the prominent choices employed. Whereas, younger patients, i.e., 20s and 30s, prefer small, strategic doses (termed as "baby Botox" or "microtox") to prevent wrinkles from forming, with maintenance of natural facial movement.

Lower Face & Neck

During 2026-2035, the lower face & neck segment is estimated to expand at nearly 13–15% CAGR. Firstly, the rising geriatric population is looking for solutions to highlight visible signs of ageing, especially neck and jawline laxity, for which neurotoxins can help manage. The latest non-surgical technique is the Nefertiti Lift, which emphasizes defining the jawline and neck contours by injecting neurotoxin into the platysma muscle, which pulls the lower face downward, and assist to alleviate sagging skin (jowls) and vertical neck bands.

What Made the Medical Spas (Medspas) Segment Dominant in the Market in 2025?

In the aesthetic neurotoxin market, the medical spas (Medspas) segment captured nearly 40–45% revenue share in 2025. It is primarily driven by a rise in social media ("selfie culture"), a geriatric population (Millennials/Baby Boomers), influencer marketing, and technological breakthroughs. They specifically access the procedures, including Botox, fillers, chemical peels, laser therapy, and microneedling for deeper skin rejuvenation than regular spas.

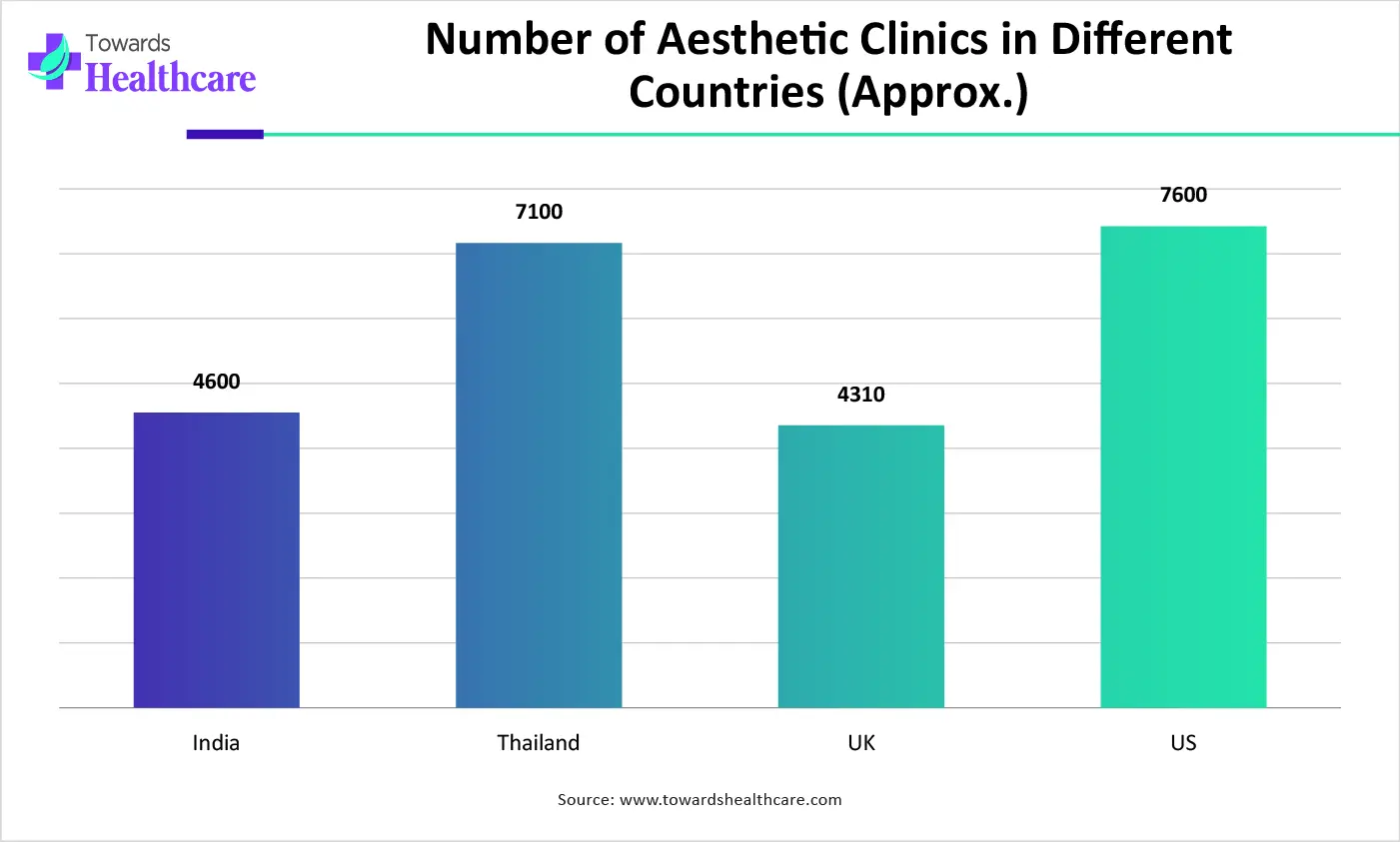

Aesthetic Clinics

The aesthetic clinics segment is predicted to expand at a nearly 12–14% CAGR. This mainly comprises specialty dermatology clinics, which facilitate a variety of non-invasive treatments, minimal downtime, and personalized wellness. Nowadays, they are also widely adopting AI for facial mapping, 3D imaging, and precision injection strategies to customize treatments for individual patients' unique facial anatomy and desired outcomes.

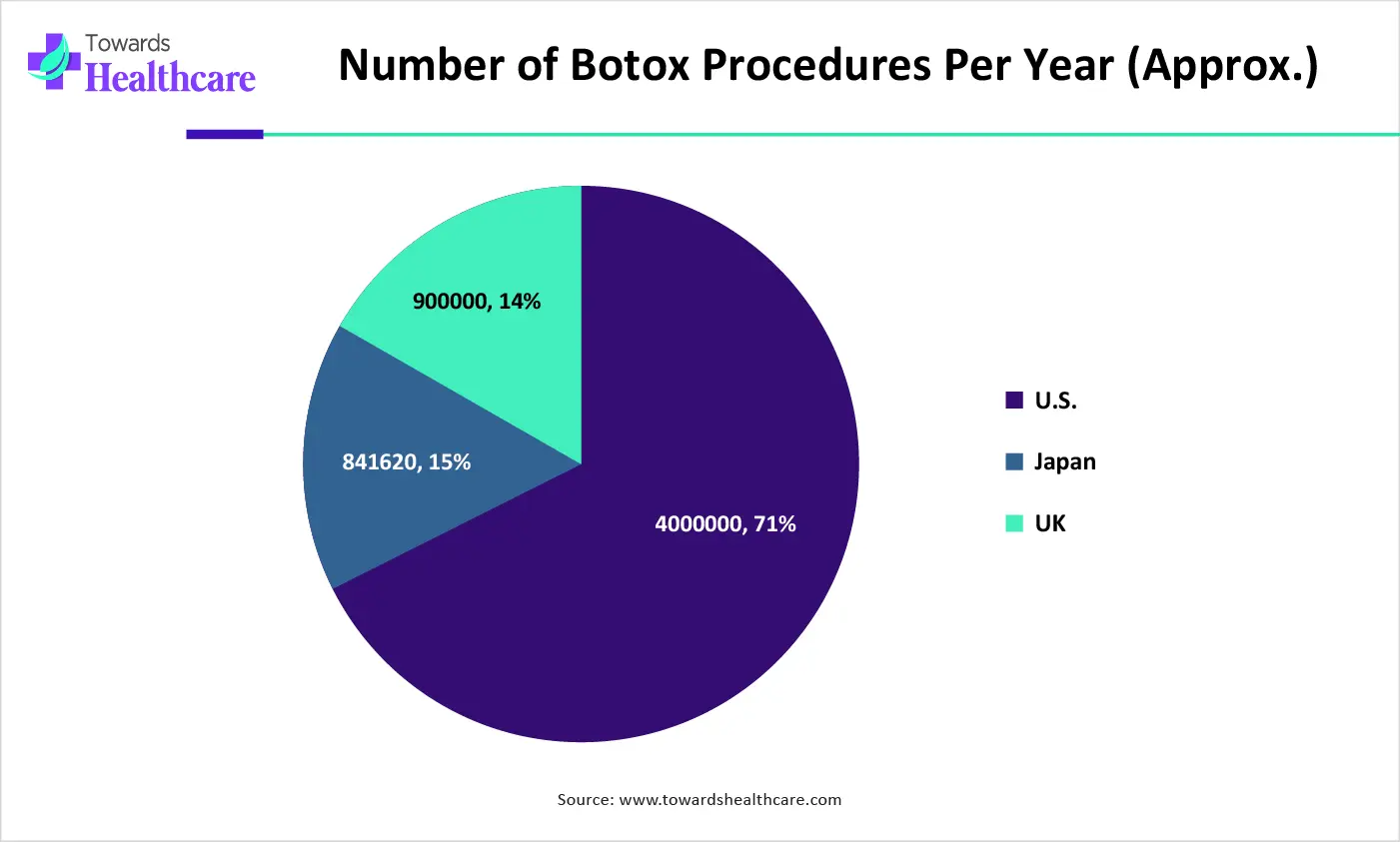

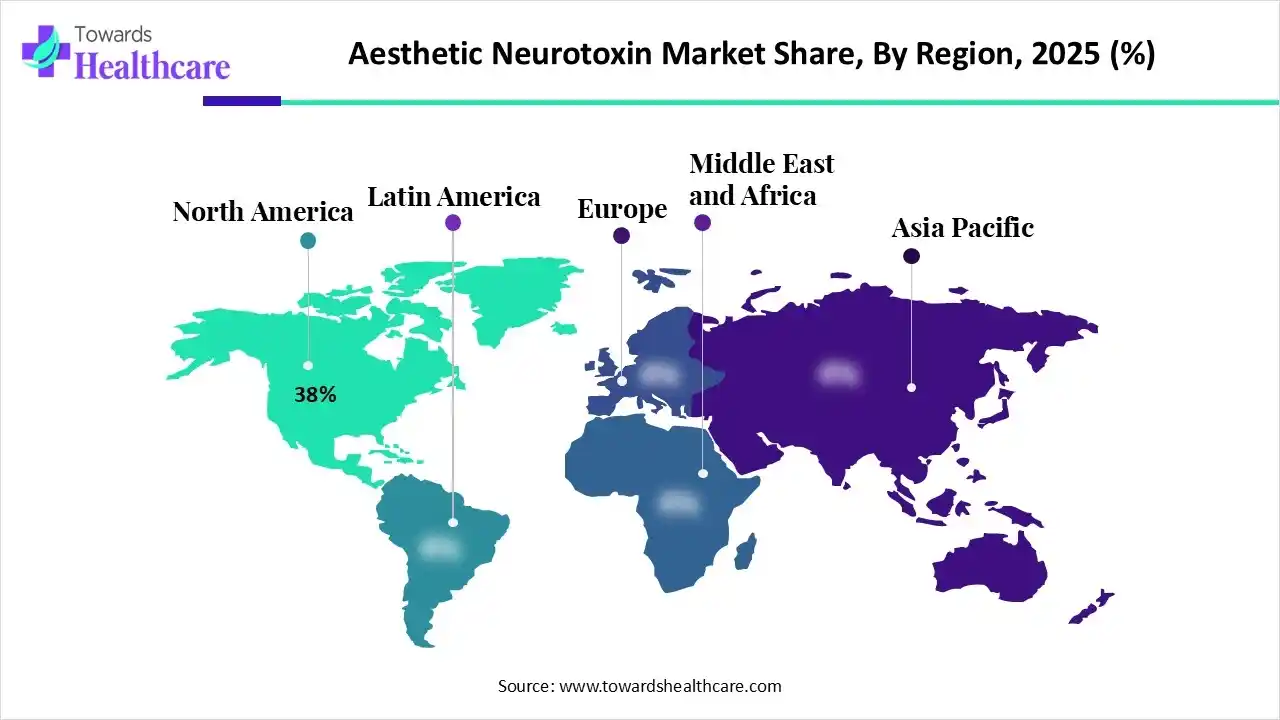

By capturing nearly 38% share, North America led the market in 2025. The increasing ageing population is seeking anti-aging solutions, with expanded aesthetic consciousness, like prejuvenation, and the dual use of neurotoxins for both cosmetic and therapeutic (migraines, spasticity) necessities has propelled its dominance.

For instance,

Whereas, the aesthetic neurotoxin market in the U.S. is broadly promoting and approving the latest and more efficacious long-lasting formulations, combination therapies to resolve the rising concerns among diverse populations & regions.

At approximately 15–17% CAGR, the Asia Pacific will expand fastest, due to the accelerating economic progression, mainly in China, India, and Southeast Asia. Alongside, the region has been experiencing a huge rise in social media platforms, which amplifies the desirable beauty standard for youthful looks, normalizing aesthetic procedures.

For instance,

However, South Korea has been stepping into innovative achievements, such as Hugel’s Letybo, which is receiving FDA approval & global traction, and Daewoong introducing Nabota in emerging markets.

Europe will expand significantly in the aesthetic neurotoxin market due to growing and extensive efforts towards non-invasive solutions in medical aesthetics, like Botox. Many companies are immensely bolstering into Europe, such as recently HYDRINITY Accelerated Skin Science collaborated with the UK/Ireland partners to contact more dermatologists and surgeons.

The UK market is described by stringent regulations, i.e., mandatory in-person consultations, a crackdown on unlicensed products, which are associated with botulism outbreaks, and trends towards tailored treatments.

For instance,

| Company | Description |

| AbbVie | It prominently offers BOTOX Cosmetic (onabotulinumtoxinA), marketed through its subsidiary, Allergan Aesthetics. |

| Merz Pharma | A company explores its comprehensive aesthetic portfolio, which encompasses dermal fillers, including Belotero, Radiesse, and skin tightening devices (Ultherapy). |

| Ipsen Pharma | This specialises in different types of neurotoxin, like Dysport/ Azzalure (abobotulinumtoxinA), and a next-generation, long-acting recombinant neurotoxin candidate, IPN10200. |

| Hugel Inc. | They usually facilitate diverse injectables, such as HA fillers (Filler, volume), but Letybo is their flagship neurotoxin. |

| Revance Therapeutics | A vital company explored DAXXIFY (daxibotulinumtoxinA-lanm) for injection. |

| Evolus | This offers Jeuveau (prabotulinumtoxinA-xvfs), the first neurotoxin developed exclusively for cosmetic use. |

| Galderma | It has created and is introducing its own new, ready-to-use liquid neurotoxin called Relfydess (RelabotulinumtoxinA). |

| Medytox | A firm explores different aesthetic neurotoxin products, all based on the Clostridium botulinum toxin type A (Hall strain). |

| Daewoong | Their marketed products are Nabota (prabotulinumtoxinA) under the brand names Jeuveau in the United States and Nuceiva in Europe. |

| Lumenis | This establishes & commercialize innovative energy-based medical devices, like lasers, Intense Pulsed Light (IPL), and Radio Frequency (RF) technologies. |

By Product Type

By Application

By Treatment Area

By Region

February 2026

February 2026

February 2026

February 2026