February 2026

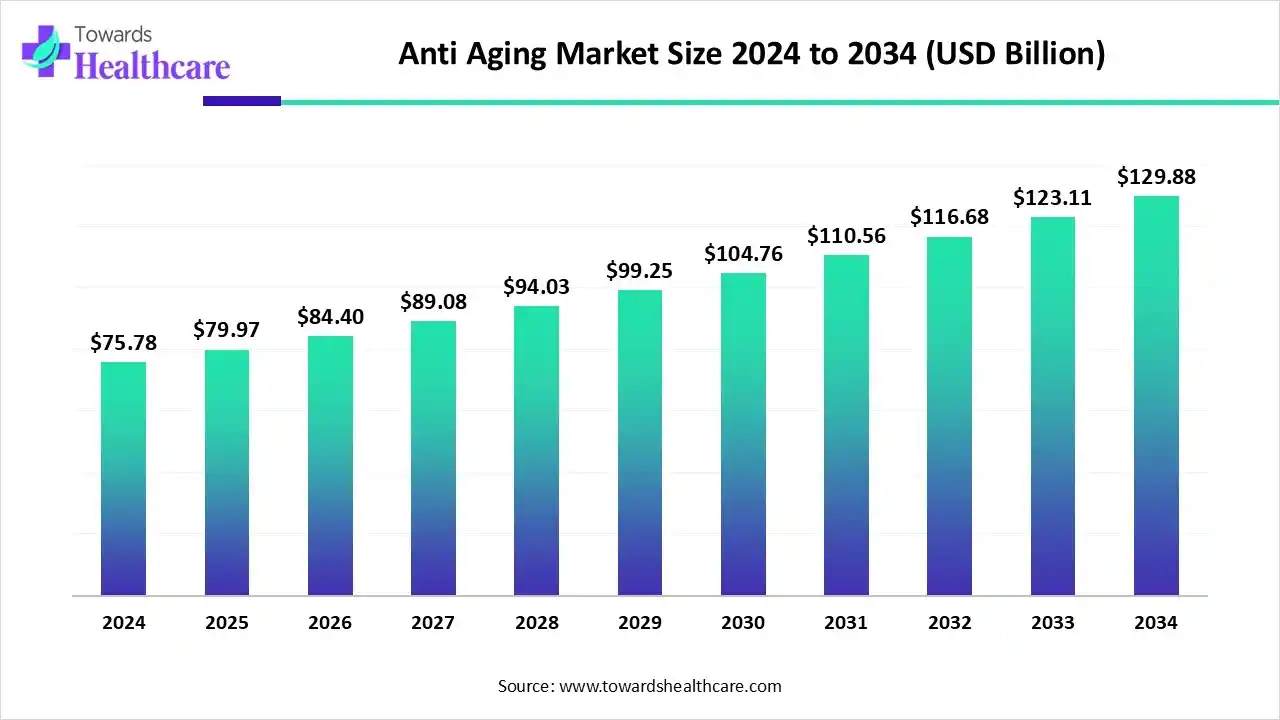

The global anti-aging market size was estimated at US$ 79.98 billion in 2025, projected to increase to US$ 84.41 billion in 2026 and reach US$ 137.13 billion by 2035, showing a healthy CAGR of 5.54% across the forecast years.

The anti-aging market is witnessing strong growth as consumers increasingly prioritize self-care, longevity, and aesthetic enhancement. Innovations in biotechnology, natural ingredients, and minimally invasive procedures are attracting a wider audience. Rising awareness about preventive skincare, combined with trends in lifestyle management and holistic health, is boosting demand. The market is also benefiting from expanding global access to professional treatments and cosmetic services, as well as the growing influence of social media and digital marketing in shaping consumer preferences.

| Table | Scope |

| Market Size in 2026 | USD 84.41 Billion |

| Projected Market Size in 2035 | USD 137.13 Billion |

| CAGR (2026 - 2035) | 5.54% |

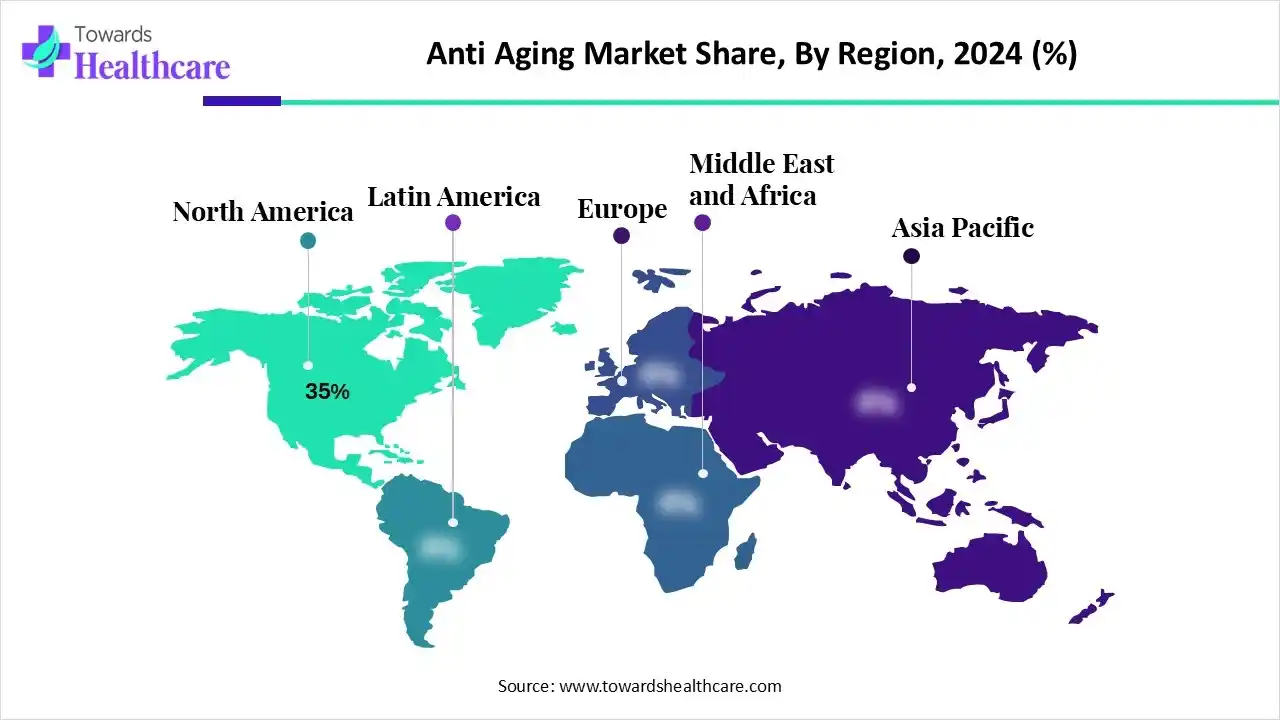

| Leading Region | North America by 35% |

| Market Segmentation | By Product / Solution Type, By Injectables, By Demographic / Age Group, By End User, By Region |

| Top Key Players | L’Oréal Group, Estée Lauder Companies, Procter & Gamble (P&G), Shiseido Co. Ltd., Unilever, Beiersdorf AG, Allergan Aesthetics (AbbVie) – Botox, Juvederm, Ipsen Pharma – botulinum toxins, Revance Therapeutics – Daxxify, RHA fillers, Evolus Inc. – Jeuveau botulinum toxin, Merz Aesthetics – Radiesse, Belotero, Medytox – botulinum-based products, Cynosure, Cutera, Bausch Health Companies – Solta Medical, Candela Medical, Sisley Paris, Amorepacific Group, Natura & Co, Hims & Hers / Nutrafol |

Anti-aging refers to products, treatments, and practices aimed at slowing, preventing, or reversing the signs of aging. It focuses on maintaining youthful appearance, health, and vitality. The anti-aging market is important as it supports the rising demand for longevity and holistic health solutions. It fosters the development of innovative therapies, minimally invasive procedures, and functional products that promote vitality and delay aging effects.

By catering to diverse consumers' needs, from skincare to nutritional supplements, the market enhances lifestyle quality and preventive health. Its growth also drives investments in research, technology, and service delivery, positioning anti-aging as a dynamic and influential segment in positioning anti aging as a dynamic and influential segment in the wellness and beauty industry.

AI can impact the market by accelerating research and development of novel ingredients and therapies. Machine learning algorithms can analyze large datasets to identify trends, predict product effectiveness, and optimize clinical trials. AI-powered devices, such as smart skin analyzers, help track aging signs over time and guide treatment adjustments. Additionally, AI enhances marketing strategies by predicting consumer preferences and personalizing recommendations, ultimately improving product adoption, customer satisfaction, and overall market growth.

Rising Consumer Focus on Health and Appearance

The increasing emphasis on personal grooming and self-care is propelling the anti-aging market, as consumers actively seek products and treatments that support a youthful appearance. Awareness of aging signs and preventive measures motivates individuals to invest in skincare, supplements, and to consider invasive procedures. This growing consumer inclination encourages brands to innovate and offer targeted, effective solutions, expanding product adoption and driving overall market growth across diverse demographics.

For Instance,

High Product and Treatment Costs

The high costs of anti-aging products and treatments restrain market growth because many consumers view advanced skincare, serums, and cosmetic procedures as luxury items. This limits their use to the affluent population, reducing overall adoption rates. Additionally, ongoing expenses for maintenance treatments, professional consultations, and specialized equipment can discourage repeated purchases. Even with increasing awareness of anti-aging benefits, price sensitivity in key markets slows widespread uptake, making cost a significant barrier to market expansion.

Development of Personalized Anti-Aging Solutions

Personalized anti-aging solutions offer a future opportunity as they allow brands to address individual consumer needs more precisely, improving treatment outcomes and user satisfaction. By leveraging technologies like genetic testing, AI-driven skin analysis, and data-based lifestyle assessments, companies can create customized skincare regimens and supplements. This approach not only increases consumer engagement and repeat purchases but also opens new revenue streams, especially among tech-savvy and health-conscious customers, driving growth and innovation in the anti-aging market.

For Instance,

The topical products segment led the market with the revenue shares of 38% in 2024 as consumers increasingly prefer care options that deliver visible results without medical intervention. Advances in dermatology allowed the development of multifunctional formulations combining hydration, sun protection, and anti-aging actives in a single product. Rising interest in clean-label, natural, and scientifically backed ingredients also fueled trust and adoption. Moreover, the growing influence of social media and endorsements by skincare professionals further accelerated demand for topical solutions over other product types.

The injectables segment is projected to grow rapidly as consumers seek personalized aesthetic treatments tailored to specific facial areas, such as lips, under-eyes, or jawlines, which promote natural collagen production and enhance outcomes beyond temporary fixes. Additionally, expanding the availability of trained professionals in dermatology and aesthetic clinics, along with increasing awareness through digital platforms, is making these procedures more accessible and desirable, driving faster adoption compared to traditional anti-aging solutions.

The 40-59 years segment dominated the anti-aging market with the revenue shares of 45% in 2024, as people in this age range increasingly prioritized maintaining a youthful appearance for professional and social confidence. Many in this group are influenced by lifestyle trends and media, encouraging the adoption of an advanced skincare routine and treatment. Moreover, they represent a key target for brand launching specialized anti-aging lines, as this demographic actively seeks solutions that balance effectiveness with safety, further strengthening their role as the leading consumer base.

The 20-39 years segment is set to grow quickly as this group shows strong interest in personalized and tech-driven skincare solutions. Many in this demographic are early adopters of AI-powered apps, virtual skin consultations, and DNA-based products that promise tailored results. Their openness to experimenting with new brands and treatments, along with growing demand for clean-label and sustainable formulation, fuels faster adoption. This tech-savvy, health-conscious generation is reshaping the market, creating long-term opportunities for innovative anti-aging solutions.

The offline/retail segment led the market with the revenue shares of 52% in 2024 as brands increasingly leveraged digital channels to launch exclusive anti-aging product lines and limited-edition collections. Growing trust in secure online payment systems and the rise of mobile shopping apps made purchases seamless, especially for younger demographics. Additionally, the partnership between beauty brands and major e-commerce giants expanded product accessibility worldwide. Virtual skin consultation and personalized product suggestion on retail sites further encouraged customers to shop online, driving higher adoption.

The online/retail segment is expected to grow at the highest rate during the forecast period as consumers increasingly prefer home delivery and contactless shopping for anti-aging products. The availability of niche and international brands online, along with easy return policies, boosted consumer confidence. Digital marketing, influencer collaboration, and targeted promotion on social media platforms further drove traffic and sales. Additionally, online channels allowed brands to offer educational content and virtual consultations, helping customers make informed choices, which reinforced the segment's leading position in the market.

The individual consumers segment led the market with a revenue share of 70% in 2024, as more people preferred taking charge of their personal care routine. Growing interest in self-directed treatments, such as at-home serums, masks, and supplements, fueled direct purchases. Social media influence, product reviews, and targeted marketing encourage experimentation and brand loyalty among consumers. The ease of accessing diverse products through e-commerce and retail outlets further empowered individuals, making them the primary drivers of market revenue compared to institutional or professional end-users.

The dermatology clinics & medspas segment is projected to grow rapidly as consumers increasingly prefer expert-led, targeted anti-aging solutions for faster and more reliable results. The rising popularity of combination treatments, such as PRP therapy with fillers, and access to advanced equipment in clinics and medspas, enhances treatment effectiveness. Additionally, lifestyle-conscious younger adults and affluent consumers are opting for preventive aesthetic care, driving frequent visits. The growing emphasis on professional, customized services positions this segment for the fastest CAGR during the forecast period.

North America led the market, with a revenue of approximately 35% as consumers increasingly prioritize appearance, wellness, and preventive skincare. High penetration of dermatology clinics, medspas, and aesthetic centers, along with easy access to premium products, fueled adoption. The region also benefits from strong marketing, celebrity endorsements, and digital platforms that influence consumer choices. Growing interest in personalized and technologically advanced anti-aging solutions, combined with early adoption of innovations by both consumers and healthcare providers, reinforced North America’s dominance in the global market.

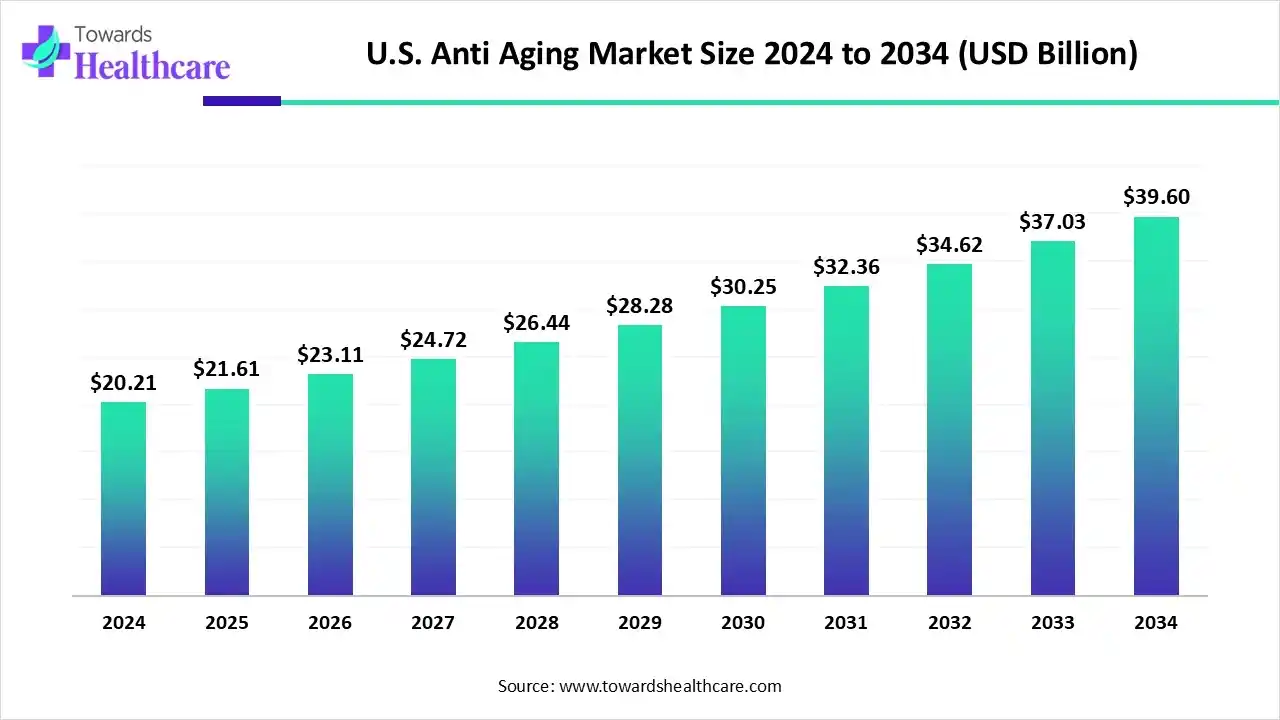

The U.S. market is expanding as consumers seek effective solutions to delay visible signs of aging and maintain confidence. Innovations in personalized skincare, injectables, and non-invasive treatments attract a broad audience. Rising interest in natural and scientifically backed products, combined with growing e-commerce adoption and virtual consultations, makes anti-aging solutions more accessible. Additionally, lifestyle trends emphasizing self-care and preventive health further drive demand, supporting steady market growth across diverse demographics.

The U.S. anti-aging market is valued at approximately $20.21 billion in 2024 and is expected to grow to $21.61 billion in 2025. Looking ahead, the market is projected to reach around $39.6 billion by 2034, growing at a CAGR of 6.95% between 2025 and 2034.

The Canadian market is growing as more consumers focus on preventive skincare and maintaining a youthful look. Increasing demand for innovative treatments, such as laser therapies, injectables, and customized skincare solutions, is fueling growth. Rising health and beauty awareness, combined with wider availability of professional clinics and digital platforms for product education, enables easier access. Lifestyle trends emphasizing wellness and appearance, along with growing disposable incomes, further contribute to the expansion of the market across Canada.

Asia-Pacific is projected to grow rapidly in the market as consumers increasingly prioritize youthfulness and preventive care. The region benefits from a rising middle class, growing exposure to global beauty trends, and increasing availability of premium and innovative products. Expanding digital platforms and social media influence drive awareness and adoption, while local brands tailor solutions to regional preferences. Additionally, improving healthcare infrastructure and the popularity of aesthetic clinics and medspas support faster market expansion compared to other regions.

Clinical Trial- Clinical trials in the anti-aging field mainly target age-related conditions and biological markers, since aging is not classified as a disease by the FDA. Key research areas include mTOR pathway modulation, senolytics to eliminate senescent cells, NAD+ precursors, and metformin, aiming to address issues like frailty, metabolic disorders, and skin aging. These studies focus on slowing or mitigating age-related changes rather than reversing aging itself.

Packaging and Serialization- Packaging and serialization in anti-aging products help prevent counterfeiting and ensure consumer safety by giving each item a unique identifier that can be tracked throughout the supply chain. Methods include QR codes, tamper-evident seals, holograms, secure printing, and blockchain authentication. These measures verify product authenticity, deter fake products, and enable efficient tracking, protecting both brands and consumers while maintaining trust in the market.

Patient Support and Services- Patient support in anti-aging involves consulting specialists, such as dermatologists, to select appropriate treatments. It includes access to options like injectables, lasers, topical products, and surgeries, along with guidance on daily skincare routines and non-invasive maintenance. Medical and aesthetic clinics often provide ongoing advice and monitoring to ensure optimal results, helping patients effectively manage aging concerns while maintaining skin health.

In April 2024, Beiersdorf announced a breakthrough in understanding the skin’s glycation process after nearly ten years of research. The team identified an active ingredient that combats sugar-induced skin aging and wrinkle formation. While sugar’s role in diseases like obesity and diabetes is well-known, its impact on skin has been less recognized. Dr. Gitta Neufang, Corporate SVP of R&D, highlighted Beiersdorf’s pioneering work on Q10, noting the company made the skin’s own Q10 available as an active ingredient for the first time, advancing innovations in anti-aging skincare.

By Product / Solution Type

By Injectables

By Demographic / Age Group

By Distribution Channel

By End User

By Region

February 2026

February 2026

February 2026

February 2026