February 2026

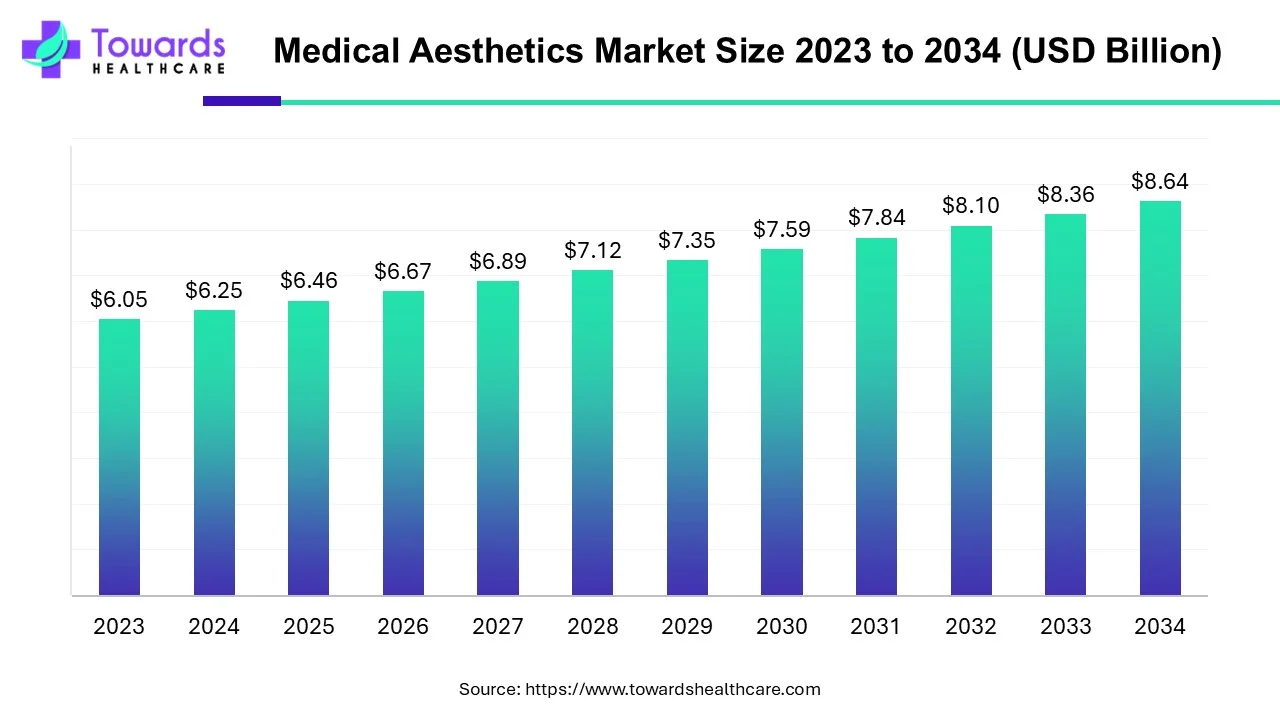

The global medical aesthetics market size was valued at more than USD 6.46 billion in 2025 and is expected to reach more than USD 8.93 billion by 2035, expanding at a CAGR of 3.29% during the forecast period 2026 to 2035. The rising incidences of surgeries, technological advancements, and growing public awareness drive the market.

| Metric | Details |

| Market Size in 2026 | USD 6.67 Billion |

| Projected Market Size in 2035 | USD 8.93 Billion |

| CAGR (2026 - 2035) | 3.29% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By End-User and By Region |

| Top Key Players | Merz Pharma, Anika Therapeutics, Inc., Johnson & Johnson Services, Inc., AbbVie, Lumenis, Solta Medical, Syneron Candela, Alma Lasers, Hologic, Cutera, Inc. |

Artificial intelligence (AI) has immense potential in the market owing to enhanced patient care and better treatment outcomes. The growing use of social media and virtual interactions increases the demand for medical aesthetics. AI can be used to design personalized solutions based on patient’s needs through advanced diagnostics and realistic simulations. AI and machine learning (ML) can analyze extensive datasets and provide objective insights for selecting suitable cosmetic procedures. It can also predict the outcome of the aesthetic procedure, allowing patients and physicians to make more informed decisions. Hence, integrating AI with human expertise can guide an individual’s journey towards self-enhancement with empathy and precision.

An increase in the adoption of Robot-based surgery helps in reducing cost as well as provide open procedures treatments.

Medical aesthetics are procedures used to improve cosmetic appearances. It is a fusion of healthcare and beauty, and it contains many types of skin treatments like skin tightening, laser hair removal lip fillers, etc. People doing aesthetic procedures from ancient days for beautiful looks. In Ancient times Egypt people used milk and honey baths for beauty now they switch on aesthetic procedures to help people to achieve the look they want including medical aesthetics. Medical aesthetics has a huge demand worldwide for energy-based, minimally invasive procedures for skin tightening, wrinkle reduction, face contouring, and skin rejuvenation.

The expansion of the market for aesthetic devices is anticipated to be constrained by the high cost of aesthetic surgery procedures and the negative effects of the devices used in those procedures. The market for medical aesthetics is driven by expanding public awareness and medical aesthetic devices are used to treat impairments associated with a person’s aesthetic appearance or to enhance the same. In addition, these devices (particularly implants) rectify the malformations caused due to accidents, trauma, and other congenital disorders. The medical aesthetics devices market is driven by an increase in technological advancements, high demand for minimally invasive & non-invasive reconstruction surgeries, a rise in the incidence of congenital face & tooth deformities, and growth in awareness for aesthetic appearance.

However, this growth is limited due to the high costs of treatment, low reimbursements, and risk of malfunctions associated with implants. The growth of the medical tourism industry, the emergence of tourism medical spas, and the adoption of aesthetic procedures are on the verge to enhance physical appearance and provide several opportunities for key market players.

Government regulation affects several aspects of the medical aesthetic market. For instance. The latest regulations on MDs in the EU are the Medical Devices Regulation (MDR), Regulation 2017/745, published on 5 April 2017, and entered into force on 25 May 2017. The regulation, to reshape and improve essential health and safety practices and guidelines, has widened the scope not only of aesthetic products but also non-medical devices.

The market for medical aesthetics is driven by expanding public awareness, medical aesthetic devices are used to treat impairments associated with a person’s aesthetic appearance or to enhance the same. In addition, these devices (particularly implants) rectify the malformations caused due to accidents, trauma, and other congenital disorders. The medical aesthetics devices market is driven by an increase in technological advancements, high demand for minimally invasive & non-invasive reconstruction surgeries, a rise in the incidence of congenital face & tooth deformities, and growth in awareness for aesthetic appearance.

However, this growth is limited due to the high costs of treatment, low reimbursements, and risk of malfunctions associated with implants. The growth of the medical tourism industry, the emergence of tourism medical spas, and the adoption of aesthetic procedures are on the verge to enhance physical appearance and provide several opportunities for key market players.

In the past decade, there has been a significant increase in the preference for minimally invasive and non-invasive aesthetic procedures over traditional surgical procedures. Minimally invasive/nonsurgical alternatives offer various advantages over traditional surgical procedures, such as less pain, reduced scarring, and quicker recovery. These procedures are also more economical than traditional surgical procedures. As per the International Society of Aesthetic Plastic Surgery (ISAPS), there was an overall increase of 5.4% in the number of plastic and cosmetic procedures between 2017 and 2018. In addition to this, the prices of dermal fillers, botulinum toxins, and skin care products tend to go up, mostly, as the companies raise the prices. However, in countries, like the United States, there are certain reward programs one can sign up for, to help lower the price. Moreover, presently, many physicians are offering promotions during the year, which prove to be useful to lower the price.

The non-invasive type of segment is dominating segment in the market. This segment dominated because recently, there has been an increasing trend of the shift of patients from more complicated, time-consuming invasive procedures to minimally invasive and non-invasive procedures for aesthetic applications. Aesthetic lasers offer effective non-invasive methods of body contouring, fat reduction, and other cosmetic procedures.

Therefore, the adoption of aesthetic lasers is increasing, and this trend is expected to continue throughout the forecast period. In the past decade, there has been a significant increase in the preference for minimally invasive and non-invasive aesthetic procedures over traditional surgical procedures. Minimally invasive/nonsurgical alternatives offer various advantages over traditional surgical procedures, such as less pain, reduced scarring, and quicker recovery. These procedures are also more economical than traditional surgical procedures.

Based on type, the invasive segment is predicted to witness significant growth in the market over the forecast period. The commonly performed invasive medical aesthetic procedures include breast implants, gluteal implants, facial surgery, liposuction, and cosmetic gynecology. Although non-invasive procedures have numerous advantages, the lack of availability of certain procedures to perform non-invasively promotes the segment’s growth. Additionally, invasive surgeries have long lasting or permanent effects.

Based on applications, the market has been Acne Scars Removal, Lip Augmentation, Wrinkle Removal, Rhinoplasty, and Others. The acne scar removal segment contributed the biggest revenue share of the market in 2024. This is due to the growing incidence of acne scars and the availability of cost-effective treatment. Acne scars can be treated using over-the-counter medications and some minimally invasive and non-invasive procedures. Technological advancements, such as laser technology, provide superior benefits to patients and diminish the appearance of scars. Moreover, other treatment modalities include dermal fillers, platelet-rich plasma, microdermabrasion, and radiofrequency, depending on the type of severity.

Based on applications, the lip augmentation segment will gain a significant share of the market over the studied period. Lip augmentation adds volume to the thinning lips, creating a more youthful appearance. The different types of lip augmentation include lip fillers, implants, fat transfers, and lip lifts. It was one of the most widely performed cosmetic surgeries in 2023, accounting for 0.9 million surgeries, an increase of 29% from the previous year. The growing public awareness and technological advancements fuel the segment’s growth.

Based on end users, the market has been segmented into hospitals & clinics, beauty centers, and home care. According to this segment. The Hospitals & clinics segment was the highest contributor to the global medical aesthetics market. Followed by beauty centers and spas. Hospitals and clinics provide facilities for a variety of cosmetic procedures that include breast augmentation, breast reduction, facelift, eyelid surgery, rhinoplasty, liposuction, breast lift, tummy tuck, body lift, hair transplant, laser resurfacing, laser hair removal, reconstructive surgeries, and hand surgery. Due to the popularity of cosmetic procedures, hospitals & clinics have installed the latest technologically advanced devices and products to provide effective, yet minimally invasive cosmetic reconstruction methods. This has enabled hospitals to provide almost all types of cosmetic procedures for patients. This will contribute to the growth of the segment over the forecasting period at the global level.

The life cycle for medical aesthetics has been analyzed for regions such as North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. In 2022, North America held the largest share of the global medical aesthetics market, a trend that is expected to continue throughout the forecast period. Advanced healthcare infrastructure, adoption of cosmetic procedures, increasing prevalence of skin disorders, and the presence of board-certified and skilled cosmetic surgeons in the region are some of the major factors contributing to the growth of the aesthetic medicine market in this region. There is a vast growth of aesthetic procedures by facial injectables in Canada. These procedures are being performed in non-clinical organizations like shopping malls, beauty salons, or day spas, as well. Owing to this, the regulations of the Canadian Association of Medical Spas & Aesthetic Surgeons (CAMAS) must be adhered to ensure safety.

U.S. Market Trends

The U.S. holds the largest share in the global medical aesthetics market, driven by high procedure volumes consist of both surgical and non-surgical treatments, an aging population, growing awareness, and strong healthcare infrastructure. As the U.S. is a leader in the development and adoption of innovative technologies in medical aesthetics, coupled with it also has a robust healthcare infrastructure with a strong network of clinics, hospitals, and medical spas, which facilitates access to aesthetic treatments by contributing to the market expansion.

Asia-Pacific is projected to expand rapidly in the medical aesthetics market in the coming years. The rising number of surgeries, increasing adoption of advanced technologies, and growing medical tourism sector drive the market. Japan, China, India, and South Korea are among the top ten countries performing the highest number of surgical procedures in 2023. The market is also driven by increasing awareness of plastic surgeries and other surgeries.

Favorable government policies and initiatives support medical aesthetics in Asia-Pacific. The South Korean government supported medical tourism by streamlining visa applications for foreign patients and implementing policies to protect and develop the medical beauty industry. The rising disposable incomes in middle- and high-income groups in Asia-Pacific countries increase the spending on medical aesthetics. Several foreigners visit Asia-Pacific for their aesthetic surgeries due to affordable costs and premium quality treatment.

Japan Market Trends

There were about 2,016 cosmetic surgery clinics in Japan in 2023, an increase of 43.6% compared to 2020. Japan conducted the third-highest number of plastic surgery procedures in 2024. Approximately 380,000 plastic surgery procedures were performed in Japan in 2024.

South Korea Market Trends

It is estimated that South Korea is home to 132 medical aesthetics clinics. The International Society of Aesthetic Plastic Surgery (ISAPS) reported that there are 2,808 surgeons in South Korea, contributing 4.8% of the total surgeons globally.

Europe is a notable region in the medical aesthetics market due to an increasing aging population, advanced healthcare systems, and a growing trend towards non-surgical cosmetic procedures. The market is driven by both growing demand for cosmetic treatments among older populations and a younger segment proactively planning measures. Germany is a leading market in Europe with a robust healthcare system, high disposable income, and a strong demand for cosmetic procedures.

Germany Market Trends

The medical aesthetics market of Germany is experiencing substantial growth driven by a rising demand for both invasive and non-invasive procedures, particularly non-invasive procedures like injectables, along with rising awareness and acceptance of aesthetic treatments are driving demand. It also contains global players like AbbVie, Cynosure, and Evolus Inc., which play a crucial role in market expansion.

Latin America is expected to grow at a notable CAGR in the foreseeable future. The rapidly expanding medical tourism and cosmetic sectors, increasing investments, and favorable government support drive the market. Countries like Mexico and Brazil are ideal locations for cosmetic surgeries for global patients. The growing demand for minimally invasive surgeries propels the market.

Mexico Market Trends

The favorable geographical location and the availability of affordable treatment encourage Americans and other foreigners to visit Mexico for cosmetic surgeries. Mexico ranks second as a health tourism destination after Thailand. It received over 1.2 million foreign patients per year over 10 years.

The Middle East & Africa are considered to be a significantly growing area, due to the rising adoption of advanced technologies and increasing awareness of enhanced skin care. Government bodies launch initiatives to promote the medical aesthetics field and provide funding. Foreign companies establish their facilities in the region owing to the high patient population and rising affluence.

UAE Market Trends

Aesthetics International, Skin111, and Derma Institute provide advanced medical aesthetic treatment in Dubai, UAE. The UAE conducts the third-highest number of cosmetic surgeries in the MEA region after Saudi Arabia and Egypt. The increasing prevalence of skin disorders also potentiates the demand for medical aesthetics. It is estimated that the prevalence of atopic dermatitis in the UAE is approximately 16.7%.

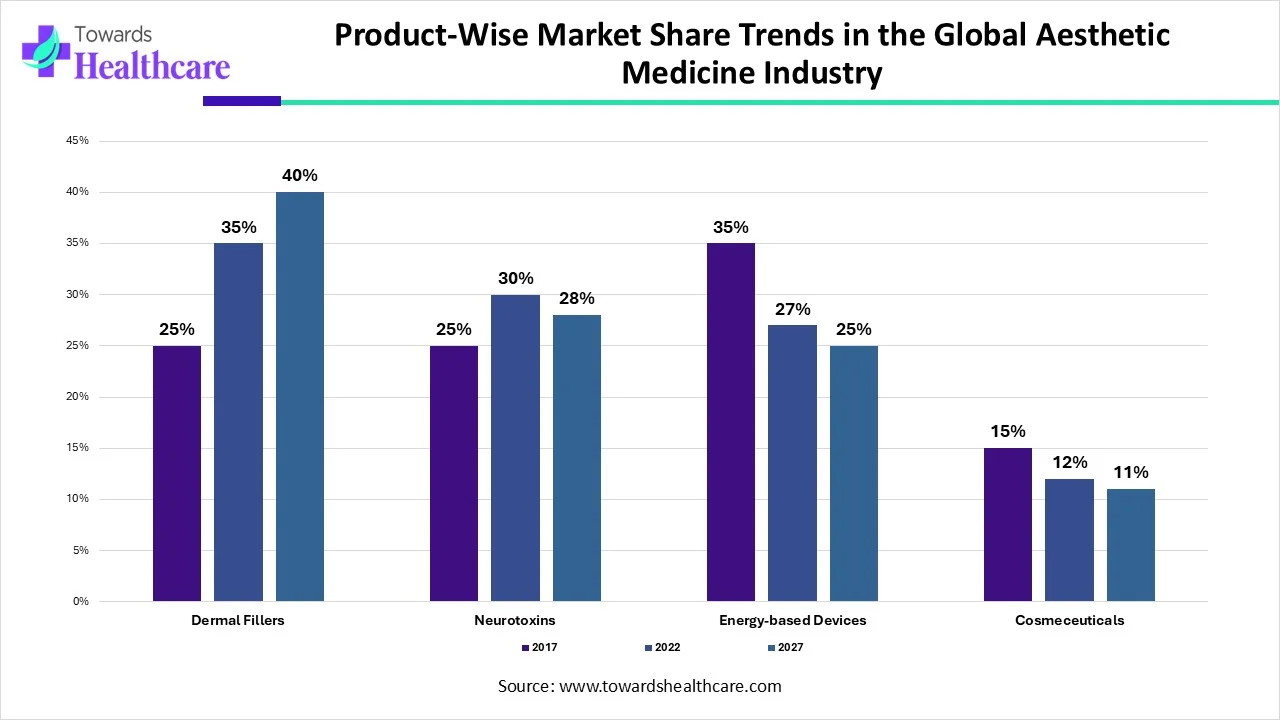

|

Year

|

Dermal Fillers | Neurotoxins | Energy-based Devices | Cosmeceuticals |

| 2017 | 25% | 25% | 35% | 15% |

| 2022 | 35% | 30% | 27% | 12% |

| 2027 | 40% | 28% | 25% |

, |

Cutera, Inc. is a global leader in dermatology and aesthetic devices that develops solutions for acne, body sculpting, skin revitalization, pigment vascular, hair removal, etc. The company generated a consolidated revenue of $32.5 million in the third quarter of 2024.

Galderma SA is an American-Swiss pharmaceutical company specializing in dermatological treatments and skin care products. The record net sales were $2.448 billion, an increase of 12.2% in the first half of 2025. The injectable aesthetics segment showed growth of 9.8%, the dermatological skincare segment had 7.7% growth, and the therapeutic dermatology segment reported 26.9% of growth.

Van Park, Cosmetic Physician & Founder, DVP, Sydney, commented in a recent Galderma Aesthetic Injector Network (GAIN) event in the Asia-Pacific region (JPAC) that aesthetics is a rapidly evolving field, impacting the practice of many cosmetic physicians in the Asia-Pacific region. He also said that such events allow physicians to deep-dive into the future trends, techniques, and products in aesthetics, and design tailored solutions for the patients, delivering the excellence that patients expect.

In June 2024, Ruud van den Handel, Co-Founder and Co-CEO of Faceland, announced its acquisition of a majority stake in market-leading Italian medical aesthetics network Juneco to enhance its presence and accelerate its expansion within the fast-growing European market. This growth plan focused on adding new clinics using Greenfield and M&A strategies to improve access to high-quality cosmetic medicine for patients.

Sam Cinkir, Founder and CEO of Este Medical Group, commented that Dubai offers an ideal environment for business growth and innovation in the healthcare sector. The launch of a new flagship clinic and the company’s investment are strategic steps to deliver advanced aesthetic treatments to both residents and medical tourists.

In October 2024, Allergan Aesthetics in collaboration with Girls, Inc. joined SkinSpirit, a medical aesthetics and skincare company, to inspire girls to be strong, smart, and bold and explore career paths in STEM.

In July 2024, Merz Aesthetics announced the US FDA approval of XEOMIN (incobotulinumtoxinA) as the first and only neurotoxin for the simultaneous treatment of upper facial lines – forehead lines, frown lines, and crow’s feet.

Merz Pharma

Johnson & Johnson Services, Inc.

AbbVie

Lumenis

Syneron Candela

Alma Lasers

Hologic

Cutera, Inc

El.En. S.p.A.

Medytox, Inc.

Fotona d.o.o

Sisram Medical

Cynosure

Galderma

Read further to see how top innovators are redefining the Medical Aesthetics Market: https://www.towardshealthcare.com/companies/medical-aesthetics-companies

By Type

Non-invasive

Invasive

By Application

Rhinoplasty

Wrinkle Removal

Lip Augmentation

Acne Scars Removal

Others

By End-User

Hospital and Clinic

Home Care

Beauty Centers

By Region

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

February 2026

February 2026

February 2026

February 2026