January 2026

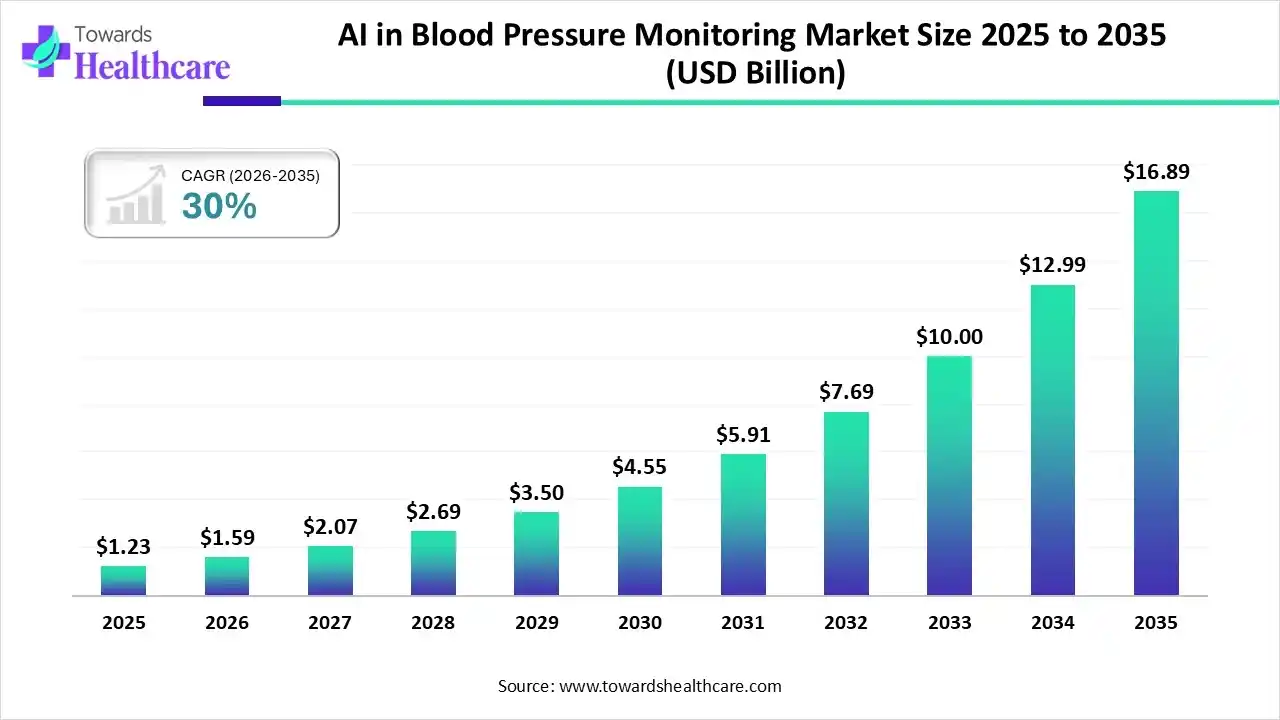

The global AI in blood pressure monitoring market size was estimated at USD 1.23 billion in 2025 and is predicted to increase from USD 1.59 billion in 2026 to approximately USD 16.89 billion by 2035, expanding at a CAGR of 30% from 2026 to 2035.

The AI in blood pressure monitoring market is experiencing robust growth, driven by the growing geriatric population and the increasing need for regular monitoring. Artificial intelligence (AI) enables patients and healthcare professionals to monitor blood pressure and other vital parameters in real time. Advances in medical technologies have led to the development of innovative medical devices. The growing demand for personalized treatment also contributes to market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.59 Billion |

| Projected Market Size in 2035 | USD 16.89 Billion |

| CAGR (2026 - 2035) | 30% |

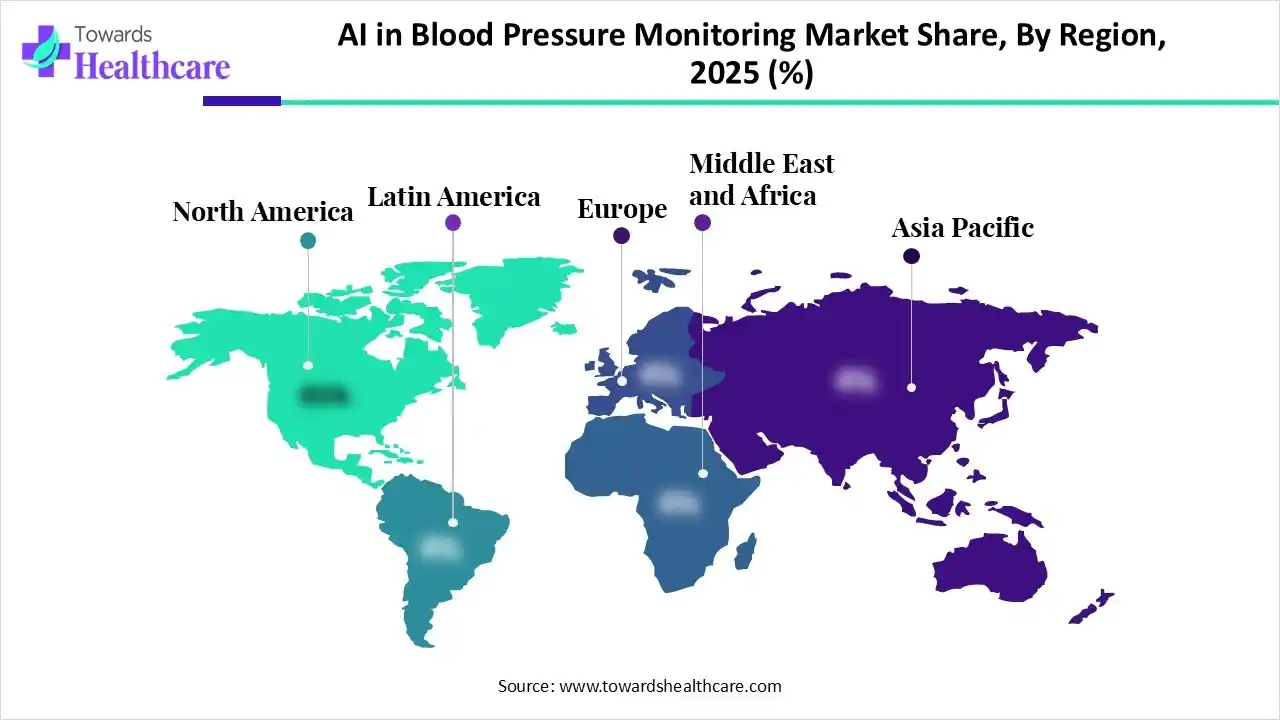

| Leading Region | North America |

| Market Segmentation | By Device Type, By Technology, By Delivery Mode, By Application, By End-Use, By Region |

| Top Key Players | Binah.ai, Omron Healthcare, Shen AI, Lifelight.AI, Hilo Group GmbH, Becton, Dickinson and Company, Tenovi, Artificialy |

The AI in blood pressure monitoring market refers to the development, testing, and distribution of AI-based monitors for measuring blood pressure. AI and machine learning (ML) play a vital role in enhancing blood pressure measurement, assessing risks, and facilitating personalized treatment. They can help detect patterns and predict future health risks, making devices smarter and more effective than traditional ones. AI algorithms can detect inconsistencies or anomalies in the data, ensuring the readings are reliable and accurate.

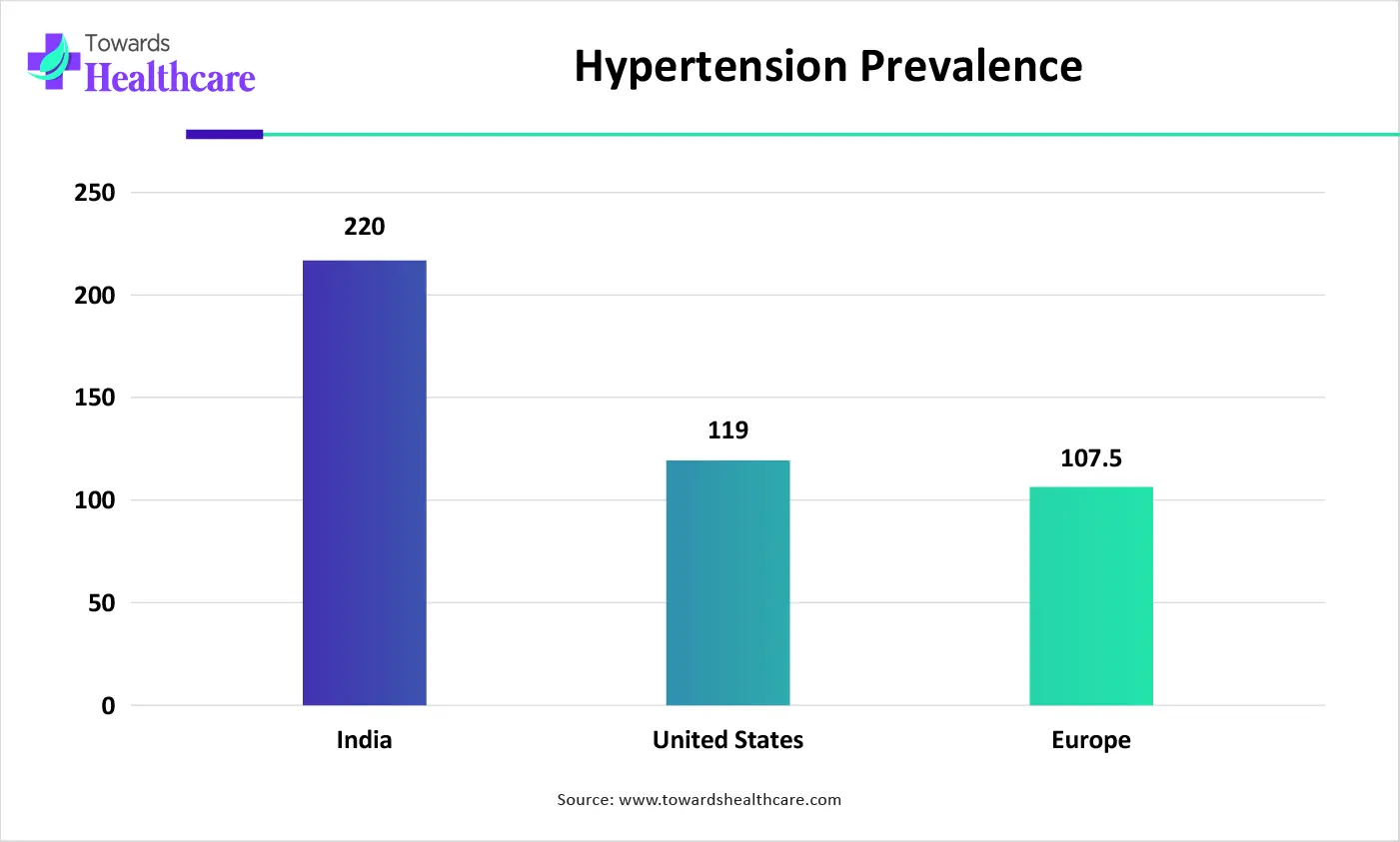

The rising prevalence of hypertension necessitates regular monitoring of blood pressure. In 2024, approximately 1.4 billion people aged 30-79 years were estimated to have hypertension.

The growing demand for early diagnosis of cardiovascular diseases encourages patients to measure their blood pressure regularly.

Government organizations launch initiatives to support the use of AI-based medical devices for various diseases.

Advanced sensors are used to design cuffless monitors and wireless smartphone-enabled monitors.

The growing geriatric population potentiates the chances of chronic disease prevalence, necessitating the use of AI-based monitors.

Which Device Type Segment Dominated the AI in Blood Pressure Monitoring Market?

The wearable devices segment held a dominant position in the market in 2024, due to the increasing awareness of advanced wearable devices and the growing demand for fitness tracking and health. Wearable devices offer a non-invasive approach to monitoring blood pressure continuously and in real time. They are available in various forms, including smartwatches, bands, and rings. These devices can also monitor heart rate, oxygen saturation, and respiratory rate, providing a complete understanding of a patient’s health.

Cuffless Solutions

The cuffless solutions segment is expected to grow at the fastest CAGR in the market during the forecast period. Cuffless solutions overcome several challenges faced by cuff-based devices, such as high cost and limited scalability. These devices enable long-term monitoring to support enhanced blood pressure management. Ongoing efforts are made to improve their validity and utility in healthcare settings. Most cuffless devices are based on PPG via a light sensor that assesses blood volume changes.

Why Did the Machine Learning Segment Dominate the AI in Blood Pressure Monitoring Market?

The machine learning segment held the largest revenue share of the market in 2024, due to the ability to analyze large amounts of data and early prediction of potential cardiovascular disease. The different types of ML algorithms include artificial neural networks (ANNs), support vector machines (SVMs), Gaussian Composite Regression, and process regression. ML algorithms can integrate diverse data sources like lifestyle factors and genetics to better understand hypertension risk.

Computer Vision Techniques

The computer vision techniques segment is expected to grow with the highest CAGR in the market during the studied years. Scientists are leveraging computer vision (CV) techniques to enable non-contact blood pressure monitoring through video-based methods. The growing adoption of smartphones and video-based capturing devices boosts the segment’s growth. CV-based devices reduce the risk of infection and are robust to diverse demographic scenarios.

How the On-Device AI Segment Dominated the AI in Blood Pressure Monitoring Market?

The on-device AI segment contributed the biggest revenue share of the market in 2024, due to the need for complete control over health data. AI algorithms are integrated into blood pressure monitors, facilitating real-time monitoring. On-device AI provides enhanced security and enables accurate health monitoring without internet connectivity. It also facilitates digital display in portable blood pressure monitors, eliminating the need for skilled professionals to interpret the data.

Cloud-based AI

The cloud-based AI segment is expected to expand rapidly in the market in the coming years. Cloud-based AI is widely preferred due to its high scalability and flexibility. It can store large amounts of patient data, allowing healthcare professionals to provide appropriate intervention based on patient history. Both providers and patients can access data from anywhere and at any time, reducing geographical barriers.

Which Application Segment Led the AI in Blood Pressure Monitoring Market?

The hypertension management segment led the market in 2024, due to the rising prevalence of hypertension and favorable government initiatives. The WHO reported that cardiovascular diseases, including hypertension, are projected to cost approximately $3.7 trillion to low- and middle-income countries from 2011 to 2025, necessitating their prevention, early detection, and treatment. Countries like Bangladesh, the Philippines, and the Republic of Korea have made significant progress by integrating hypertension care into universal health coverage.

Remote Patient Monitoring

The remote patient monitoring segment is expected to witness the fastest growth in the market over the forecast period. The growing demand for telehealth and increasing healthcare expenditure augment the segment’s growth. AI-based blood pressure monitoring provides real-time data to providers, enabling them to make effective clinical decisions. It eliminates the need for patients to visit a doctor, saving them time and costs.

What Made Hospitals & Acute Care Segment the Dominant Segment in the AI in Blood Pressure Monitoring Market?

The hospitals & acute care segment accounted for the highest revenue share of the market in 2024, due to favorable infrastructure and the increasing number of patient visits. Patients mostly prefer hospitals & acute care facilities for hypertension management due to the presence of skilled professionals who provide multidisciplinary expertise. Hospitals & acute care facilities have the suitable capital investment to adopt innovative blood pressure monitoring tools.

Home Care Settings/Patient (Consumers)

The homecare settings/patient (consumers) segment is expected to show the fastest growth over the forecast period. The growing geriatric population and the increasing demand for home-based care propel the segment’s growth. AI-based monitors can enable patients to perform their daily life activities effectively, without impacting their lifestyle. In addition, home-based care also reduces the anxiety of “white-coat syndrome”, resulting in appropriate results.

North America dominated the global market in 2024. The availability of robust healthcare infrastructure, the presence of key players, and favorable regulatory support are major factors driving market growth in North America. The increasing adoption of wearable technologies and rising investments in medical devices propel the market. Americans increasingly demand home-based care, eliminating the need to visit healthcare organizations.

According to a study, approximately 1 in 3 people in the U.S. use a wearable device, such as a smartphone or band, to track their health and fitness. Companies like Omron Healthcare, Hilo, and Becton, Dickinson and Company provide high-quality AI-based blood pressure monitors in the U.S. The Food and Drug Administration (FDA) regulates the approval of AI-based medical devices in the U.S. As of July 2025, the FDA has approved a total of 1,247 AI-based devices.

Asia-Pacific is expected to grow at the fastest CAGR in the AI in blood pressure monitoring market during the forecast period. The growing geriatric population and the rising prevalence of hypertension boost the market. Government organizations launch initiatives to encourage people to screen for and diagnose hypertension early. Increasing collaboration among key players and public-private partnerships is fostering market growth. The burgeoning healthcare sector, expanding middle-class population, and the rising disposable incomes contribute to market growth.

The World Health Organization (WHO) reported that around 270 million Chinese people suffer from hypertension, of which only 13.8% of the patients have their condition under control. The Chinese government supports hypertension prevention and control through its Healthy China 2030 initiative, thereby increasing awareness and normalizing the management, treatment, and control of hypertension.

Europe is expected to grow at a considerable CAGR in the upcoming period. The increasing demand for personalized treatment and the rapidly expanding medical device sector facilitate the development of AI-based blood pressure monitoring devices. Government bodies recommend that patients conduct timely and regular monitoring of blood pressure, thereby preventing future chronic diseases. The growing research activities and the increasing number of medical device startups bolster market growth.

The UK has the third-largest medical device market in Europe. London is home to over 3,492 medical device companies. In January 2025, the researchers from Imperial College London NHS Trust developed an AI model to predict the risk of high blood pressure to treat patients faster and reduce the risk of complications. The UK government aims to ensure that 80% of patients with hypertension are treated to target by 2029.

| Companies | Headquarters | Offerings |

| Binah.ai | Ramat Gan, Israel | It offers contactless, AI-powered, video-based blood pressure monitoring software to monitor heart rate variability, oxygen saturation, and respiration rate. |

| Omron Healthcare | Kyoto, Japan | The OMRON BP monitor uses AI to analyze blood pressure patterns and provide tailored health recommendations. |

| Shen AI | Tallinn, Estonia | Shen AI uses photoplethysmography (rPPG) and advanced AI to track over 30 health markers, including blood pressure. |

| Lifelight.AI | United Kingdom | It offers the world’s first medically certified software-only tool to measure blood pressure. |

| Hilo Group GmbH | Hainichen, Germany | It provides the Hilo Band for continuous monitoring of blood pressure in adults. |

| Hello Heart | California, United States | Hello Heart’s Nia platform helps members understand their treatments and manage side effects. |

| Becton, Dickinson and Company | New Jersey, United States | It offers a next-generation hemodynamic monitoring solution, providing clinicians with AI-driven support. |

| Tenovi | New Hampshire, United States | Tenovi Blood Pressure Monitor is a Bluetooth-enabled RPM device that automatically sends blood pressure and pulse data to the Tenovi Cloud through the Tenovi Gateway. |

| Artificialy | Switzerland | The company developed a custom AI-based wearable bracelet capable of predicting blood pressure values directly from the pulse signal. |

By Device Type

By Technology

By Delivery Mode

By Application

By End-Use

By Region

North America

South America

Europe

Eastern Europe

Asia Pacific (APAC)

Middle East and Africa (MEA)

January 2026

January 2026

January 2026

January 2026