February 2026

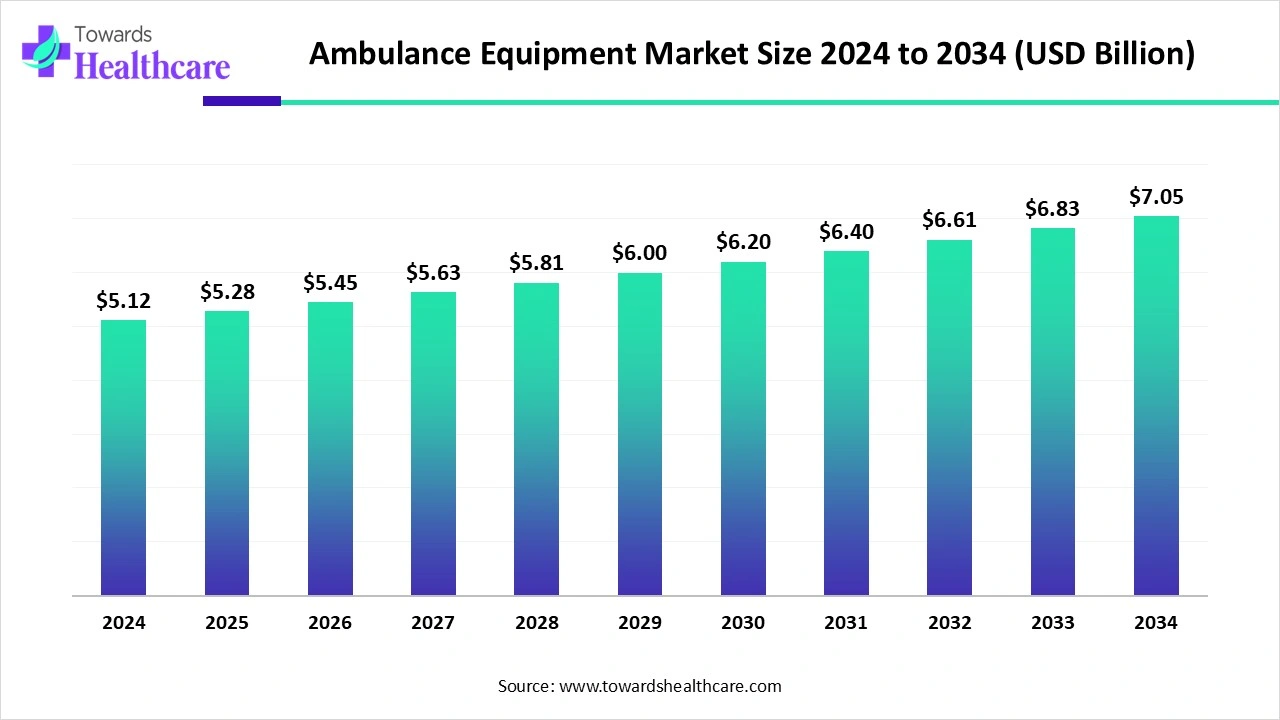

The global ambulance equipment market size is calculated at US$ 5.12 billion in 2024, grew to US$ 5.28 billion in 2025, and is projected to reach around US$ 7.05 billion by 2034. The market is expanding at a CAGR of 3.24% between 2025 and 2034.

The ambulance equipment market is accelerated by its immense potential in patient handling, medical transport, patient monitoring, and patient care. These advancements in various equipment include stretchers, first-aid, immobilization, oxygen delivery, airway management, suction, and diagnostics. This market revolves around specialized ambulances like air ambulances, neonatal ambulances, and 5G premium ICU ambulances. The emergency services are provided for cardiac support, a ventilator, medications, fluids, connectivity, and data.

| Table | Scope |

| Market Size in 2025 | USD 5.28 Billion |

| Projected Market Size in 2034 | USD 7.05 Billion |

| CAGR (2025 - 2034) | 3.24% |

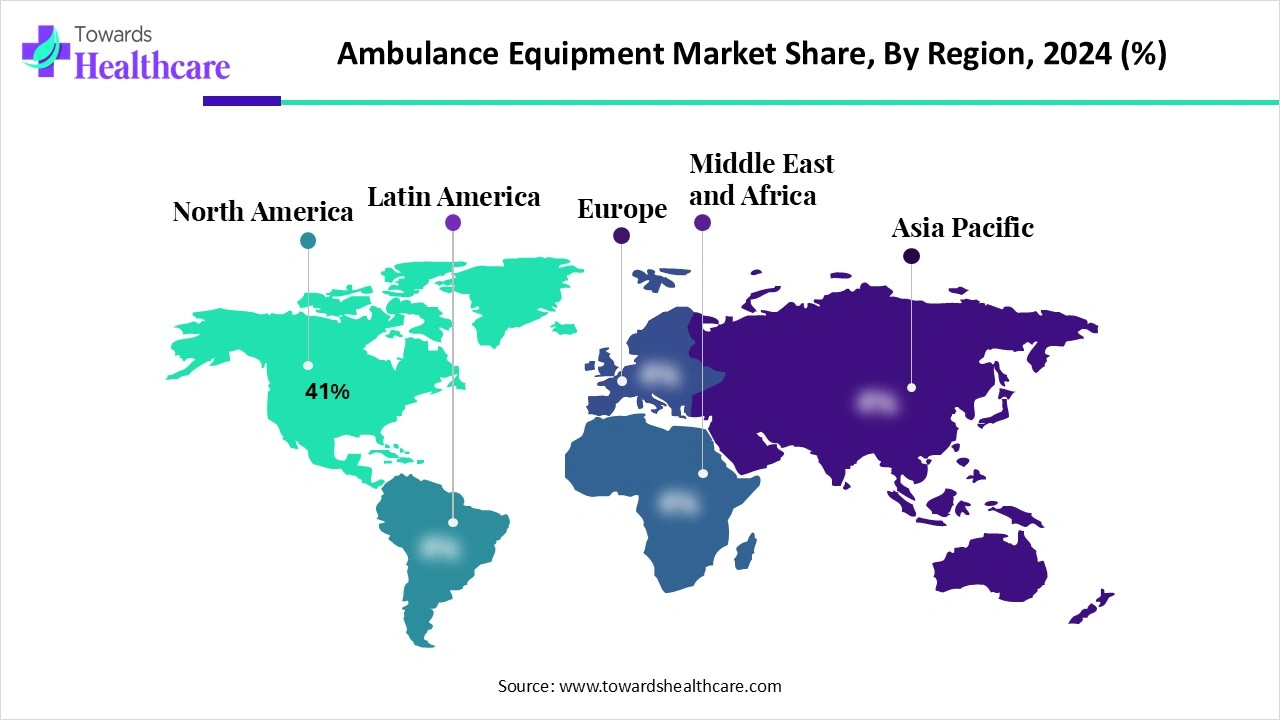

| Leading Region | North America 41% |

| Market Segmentation | By Equipment Type, By Vehicle Type, By Application, By End User, By Region |

| Top Key Players | Stryker Corporation, Ferno-Washington, Inc., Hill-Rom Holdings (Baxter International), Medtronic plc, Philips Healthcare, GE HealthCare, Smiths Medical (ICU Medical), Zoll Medical Corporation (Asahi Kasei Group), Mindray Medical International, Drägerwerk AG & Co. KGaA, Schiller AG, Allied Healthcare Products Inc., Ambu A/S, Medline Industries, Weinmann Emergency Medical Technology, Getinge AB, Nihon Kohden Corporation, Hamilton Medical, Laerdal Medical, Cardinal Health |

The ambulance equipment market includes a wide range of medical devices, life-support systems, and patient-handling tools used in ambulances to provide emergency medical care and transportation. This includes equipment for resuscitation, monitoring, infection control, diagnostic support, and patient transfer. Demand is driven by increasing emergency cases (road accidents, cardiac arrests, trauma), rising geriatric population, growing investments in emergency medical services (EMS), and technological advancements such as portable monitoring systems and telemedicine-enabled ambulances.

A new development funding contributes to expanding healthcare services through the initiatives of the Department of Health. For instance, in October 2024, the Minister for Health, Stephen Donnelly, announced the €8 million investment for the national ambulance service in the 2025 budget.

The investments and funding in healthcare aim to advance emergency medical services for the global population. For instance, in November 2024, the SA Ambulance Service experienced a massive expansion to deliver brand new ambulance stations and provide more staff for emergency medical care for South Australians through a $311.2 million investment.

Artificial intelligence is crucial in optimizing emergency medical responses, diagnostic support, and remote monitoring. The improved allocation of emergency resources and reduction of patient mortality are driven by the adoption of telemedicine, predictive models, and AI-driven triage systems.

What are the Major Drifts in the Ambulance Equipment Market?

The connected and smart ambulances, telemedicine, AI, and wearable health technology have transformed ambulances into mobile intensive care units. Advancements in equipment include point-of-care diagnostics, automated patient handling, advanced life support equipment, and portability.

What are the Potential Challenges in the Ambulance Equipment Market?

There are financial and operational challenges, which include rising operational costs, budget issues, and supply chain volatility. Sometimes, there is a shortage of skilled personnel, staff burnout, and high costs of training.

What is the Future of the Ambulance Equipment Market?

The favorable opportunities revolve around technologies and connectivity, which include integrated telemedicine, 5G-enabled devices, wireless vital sign monitoring, etc. There are exciting innovations in specialized equipment, including advanced patient handling systems, burn care equipment, and specialized pediatric and neonatal tools.

The patient handling equipment segment dominated the market in 2024, owing to the exciting advantages such as improved patient safety, patient comfort, and enhanced mobility. This equipment maintains dignity in patient care and improves patient outcomes. It reduces the risk of injury and supports an aging workforce.

The diagnostic & monitoring equipment segment is expected to grow at the fastest CAGR in the market during the forecast period due to its integral part in providing accurate data for diagnosis and enabling early disease detection. It supports personalized medicine approaches and speeds up patient care. It can better manage chronic diseases and ensure patient safety.

The ground ambulances segment dominated the market in 2024, owing to their primary roles in emergency response, transportation, and non-emergency medical transportation. They provide immediate care and enable scheduled transfers and inter-facility transfers. They are popular due to greater accessibility, cost-effectiveness, and continuity of care.

The air ambulances segment is expected to grow at the fastest CAGR in the market during the forecast period due to their major driving performance in emergency response and access to remote areas. They facilitate specialized hospital transfers and advanced medical care during transit. They are ideal solutions for the rapid medical transport of injured or critically ill patients.

The emergency care segment dominated the market in 2024, owing to the critical assistance of ambulance equipment for life support in the form of defibrillators, oxygen therapy systems, suction units, and intravenous equipment. Certain equipment, like patient monitors, electrocardiogram (ECG) machines, pulse oximeters, and glucometers, helps in patient assessment and monitoring. The equipment for trauma and stabilization includes first-aid, trauma kits, burn kits, etc., which also provide immediate patient care.

The neonatal & pediatric care segment is expected to grow at the fastest CAGR in the market during the forecast period due to the pivotal role of ambulance equipment like transport incubator and radiant warmer for temperature regulation in neonatal care. The market is expanding with equipment like a cardiac monitor with pediatric capabilities and a portable ventilator, which provide advanced life support in pediatric care. The laboratory equipment is specialized with safety features, seamless transport, power backup, and gas supplies, essential for neonatal & pediatric care.

The emergency medical services (EMS) providers segment dominated the market in 2024, owing to their key role in immediate response, emergency medical care, communication, and coordination. They are expanding their positions beyond traditional ways of action by serving more in mental and behavioral health and community paramedicine. They contribute to disaster management and public health surveillance.

The home healthcare & private ambulance services segment is expected to grow at the fastest CAGR in the market during the forecast period due to key functions of home healthcare in providing personalized care and delivering required therapies. The private ambulance services offer non-emergency transport and on-site medical coverage. These services lower infection risk and offer a comfortable environment to patients.

North America dominated the market share 41% in 2024, owing to the high EMS expenditure, advanced ambulance fleets, and strong infrastructure. The North American government programs took several initiatives towards integrating technologies and adopting fleet modernization, especially in the U.S. and Canada. They made efforts to improve efficiency, response times, and patient care. The federal programs and public-private partnerships revolutionized the medical equipment sector across the region. The rising investments in the Advanced Life Support (ALS) Equipment ensure robust support for innovations.

In July 2025, the Army reported its transformative efforts to fill the gaps between medical maintenance support and operational units, which include the U.S. Army Medical Materiel Agency’s Medical Maintenance Operations Division.

The Government of Canada recognized the 2024-2025 emergency management of medical services to protect people, property, and the environment. The other major rationales behind the growth of the Canadian market are community paramedicine funding, federal funding, healthcare funding, and favorable initiatives.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to rising investments in emergency care, road safety initiatives, and growing demand in India, China, and Japan. In February 2025, Nepal announced its aim to strengthen emergency care systems with the global emergency and trauma care initiative of the World Health Organization (WHO).

The major government programs of Asia and the Pacific focused on advancing and expanding ambulance services through increased funding, technology integration, and new fleets. The Asia Pacific region focuses on local production and MedTech expansion. The public hospital funding initiatives boost hospital healthcare and improve the efficiency of emergency medical services.

The National Ambulance Services (NAS) Scheme introduced by the Indian Government accounts for 15,283 Basic Life Support Units, 3,918 Patient Transport Vehicles, and 3,044 Advanced Life Support vehicles as of June 2024.

This initiative was launched by the Ministry of Health and Family Welfare as part of the National Health Mission (NHM). It aims to ensure a balanced and effective response to healthcare needs. It has reported one Advanced Life Support (ALS) ambulance for every 500,000 people and one Basic Life Support (BLS) ambulance for every 100,000 people.

China has adopted a new strategy to advance high-end medical devices by 2025 to boost industrial innovations and global competitiveness. In April 2024, China announced an action plan to upgrade industrial equipment.

China recently planned to increase its funding support for equipment upgrades and consumer goods trade-in programs.

Europe is expected to grow at a notable rate in the market in 2024. This regional growth is attributed to the strong government-backed EMS networks (U.K., Germany, France). The European Union provides funding for emergency services and has set an emergency medical teams action plan. The EU conducts national ambulance equipment programs across European countries like Italy, Germany, Poland, France, and Spain. The EU-funded programs raise the ambulance equipment and emergency medical services through improved preparedness, technologies, and fleet renewal.

The World Health Organization (WHO), in collaboration with the Government of Germany, donated 20 ambulances to Ukraine to ensure emergency care provision during medical transportation. In January 2025, Germany launched a transformative action plan for inclusive and barrier-free healthcare. In July 2025, the German Federal Ministry for Transport launched a new nationwide funding call to accelerate zero-emission technology through bus fleets by providing essential support to public transport operators across the country.

France increased hospital funding in 2025 for all facilities in the public and private sectors. It will support pediatrics, major surgical and medical procedures, transplants, etc. France focuses on sustainability, general healthcare reforms, and investments.

In May 2024, Aman Rishi, Vice President and General Manager of Stryker in India, reported his happiness after launching the customer experience center and displayed the importance of this center in the acute care and emergency care products of Stryker. He also expressed that this center aims to boost collaboration, innovation, and enhanced patient care within the Indian healthcare system.

By Equipment Type

By Vehicle Type

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026